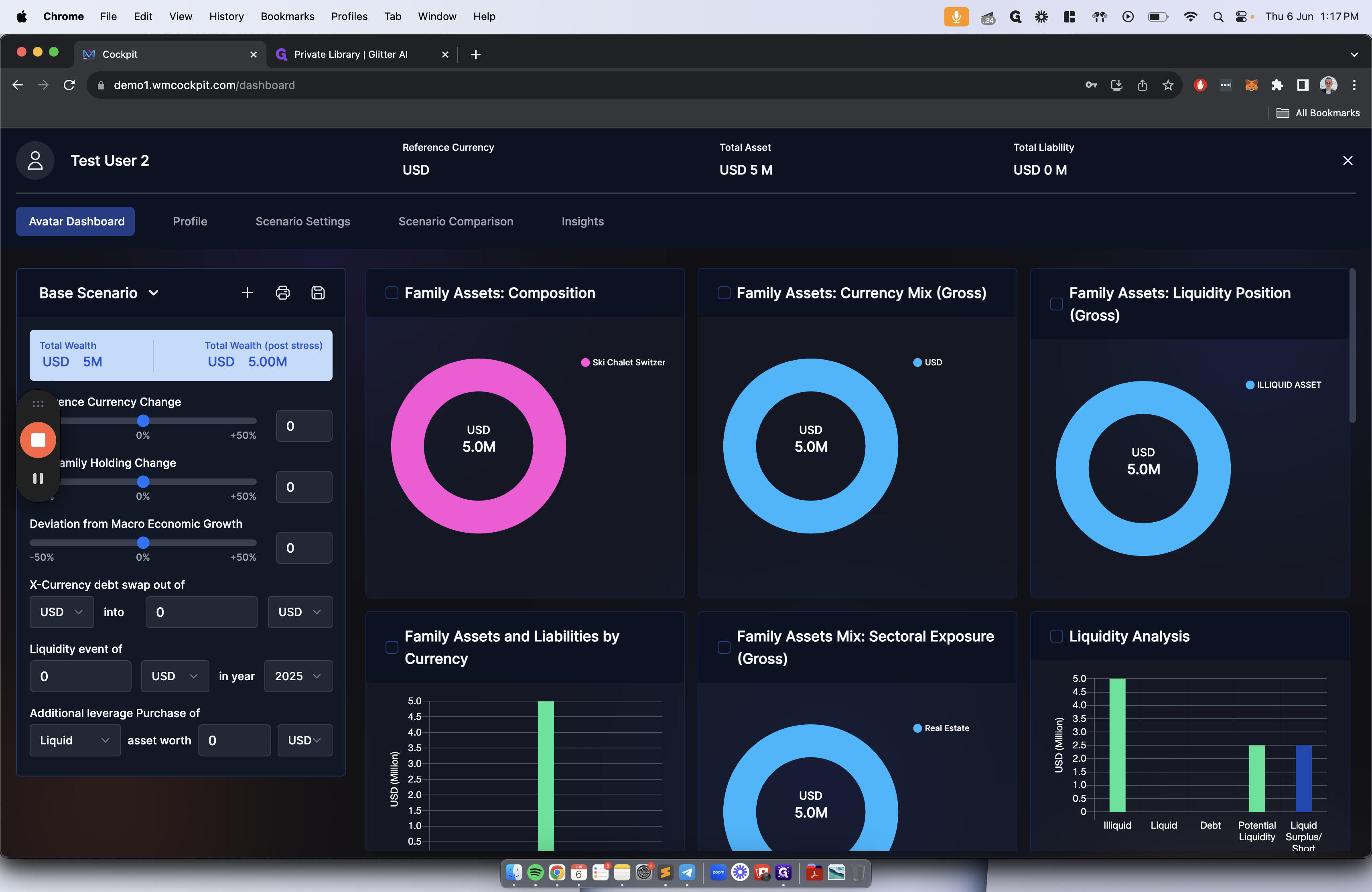

Step 4 - Avatar Dashboard, Slicing & Dicing of Data, Stress Testing & Creating Scenarios

Learn how to stress test your current estate by creating scenarios that can be compared to your existing assets. Understand and contextualize the impact of various events on your net worth.

In this guide, we'll learn how to navigate the Avatar Dashboard to analyze and compare financial scenarios effectively. By utilizing the slicing and dicing features, we can delve into the details of our assets and liabilities, stress testing various data points. Through this process, we can explore potential changes in reference currency, key family holdings, macroeconomic growth, cross-currency debt swaps, liquidity events, and leverage purchases. These inputs will be reflected on the dashboard, providing a comprehensive view of the scenario outcomes.

Analyzing Scenarios

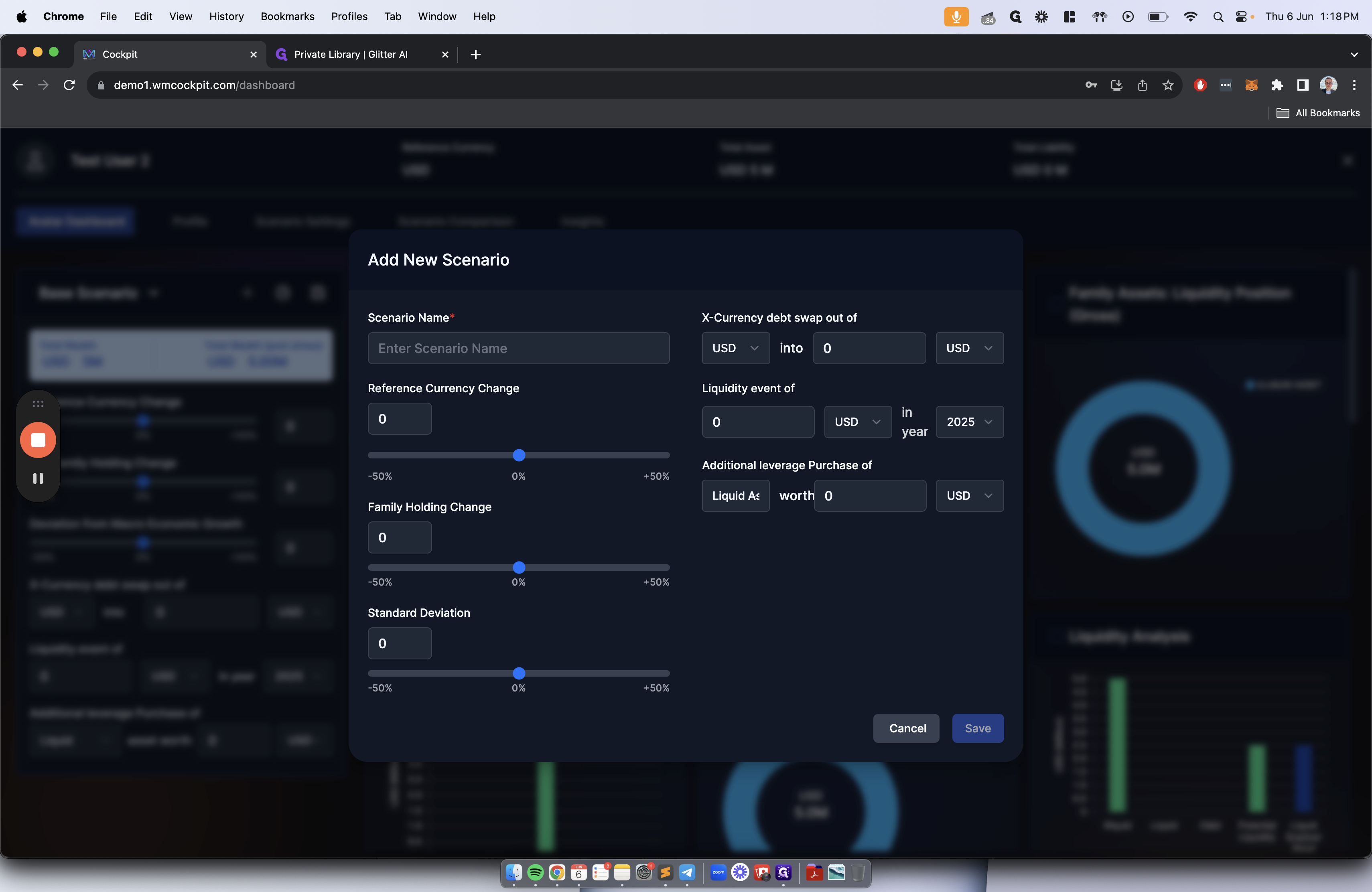

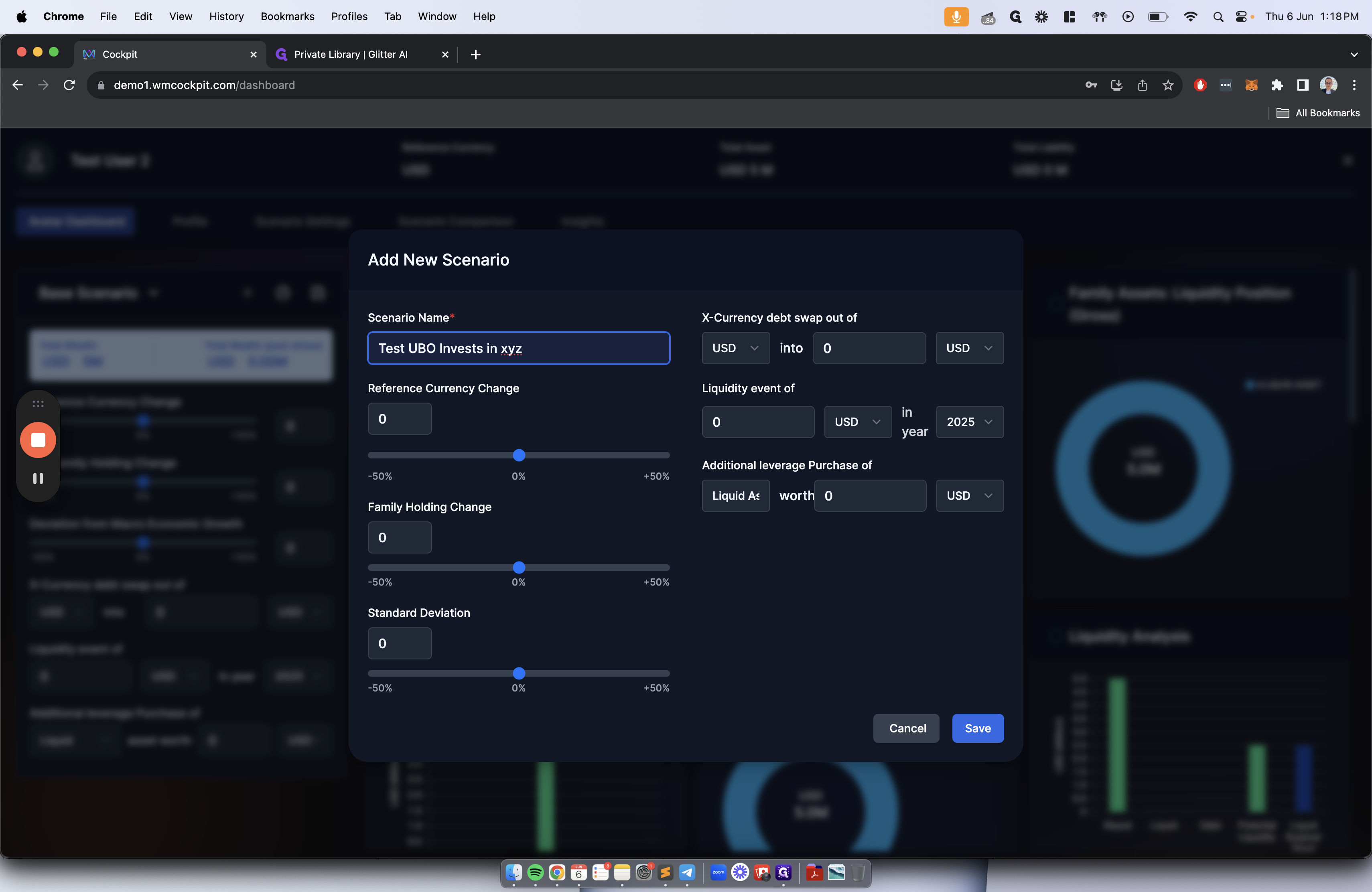

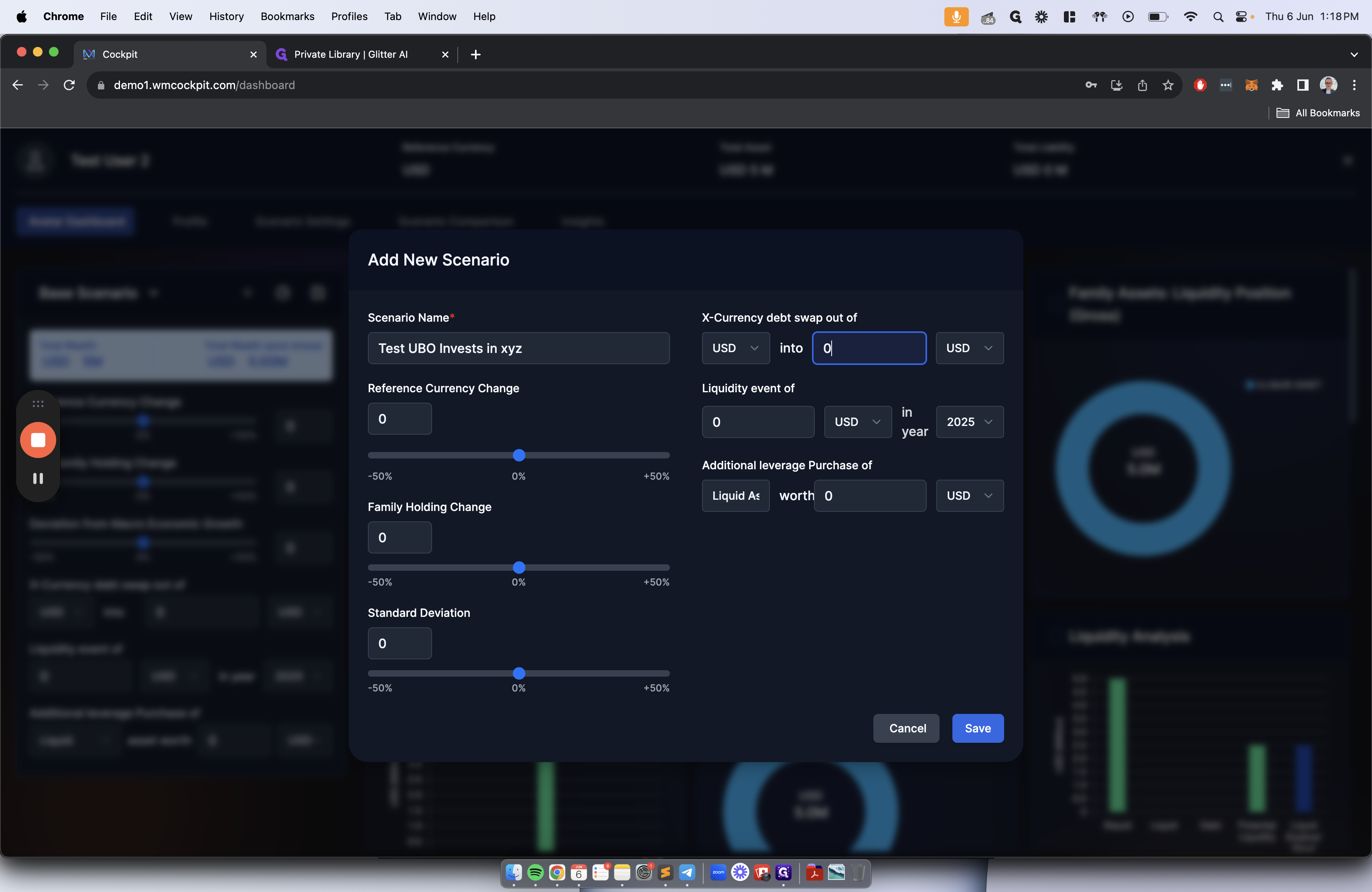

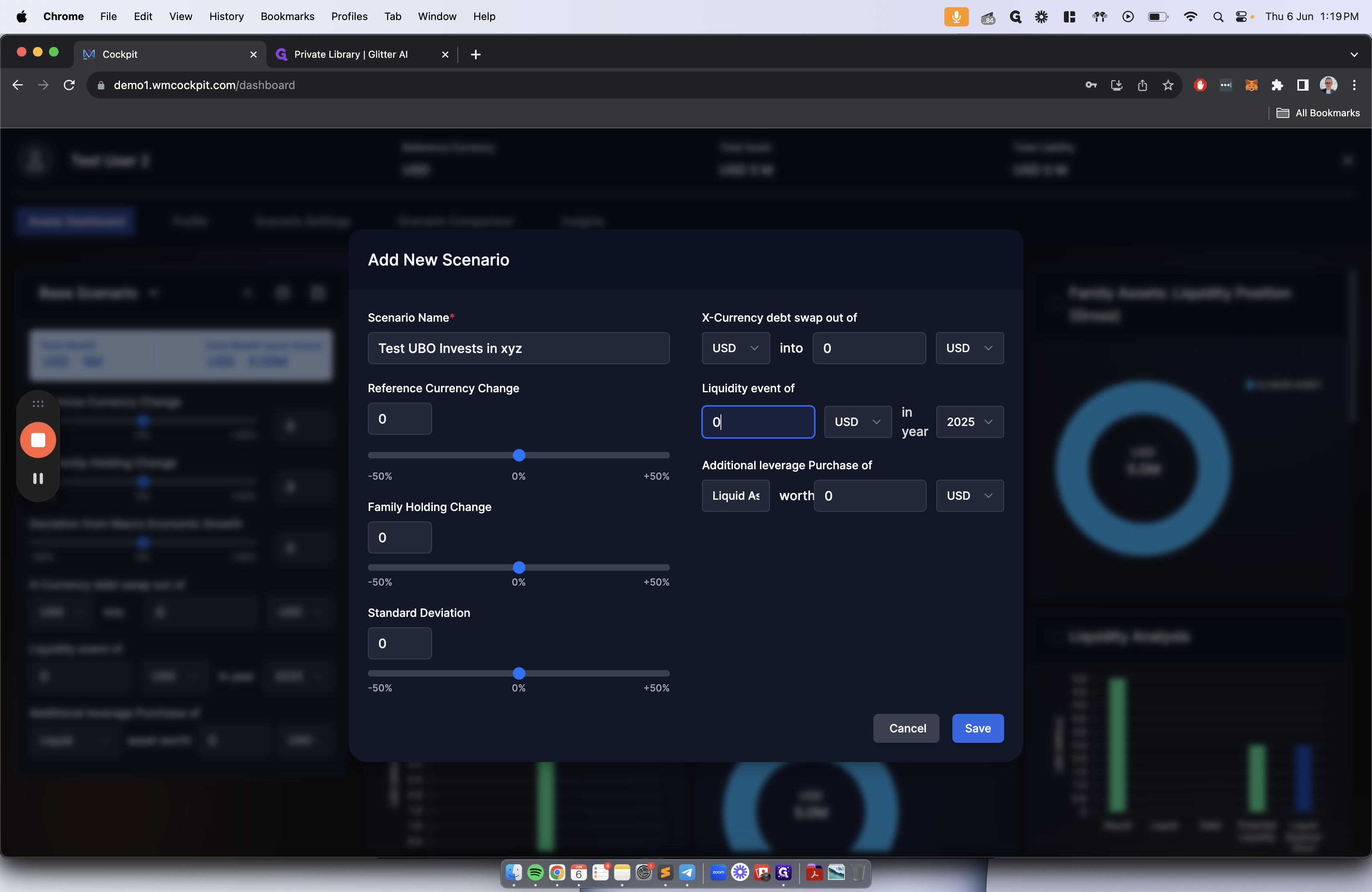

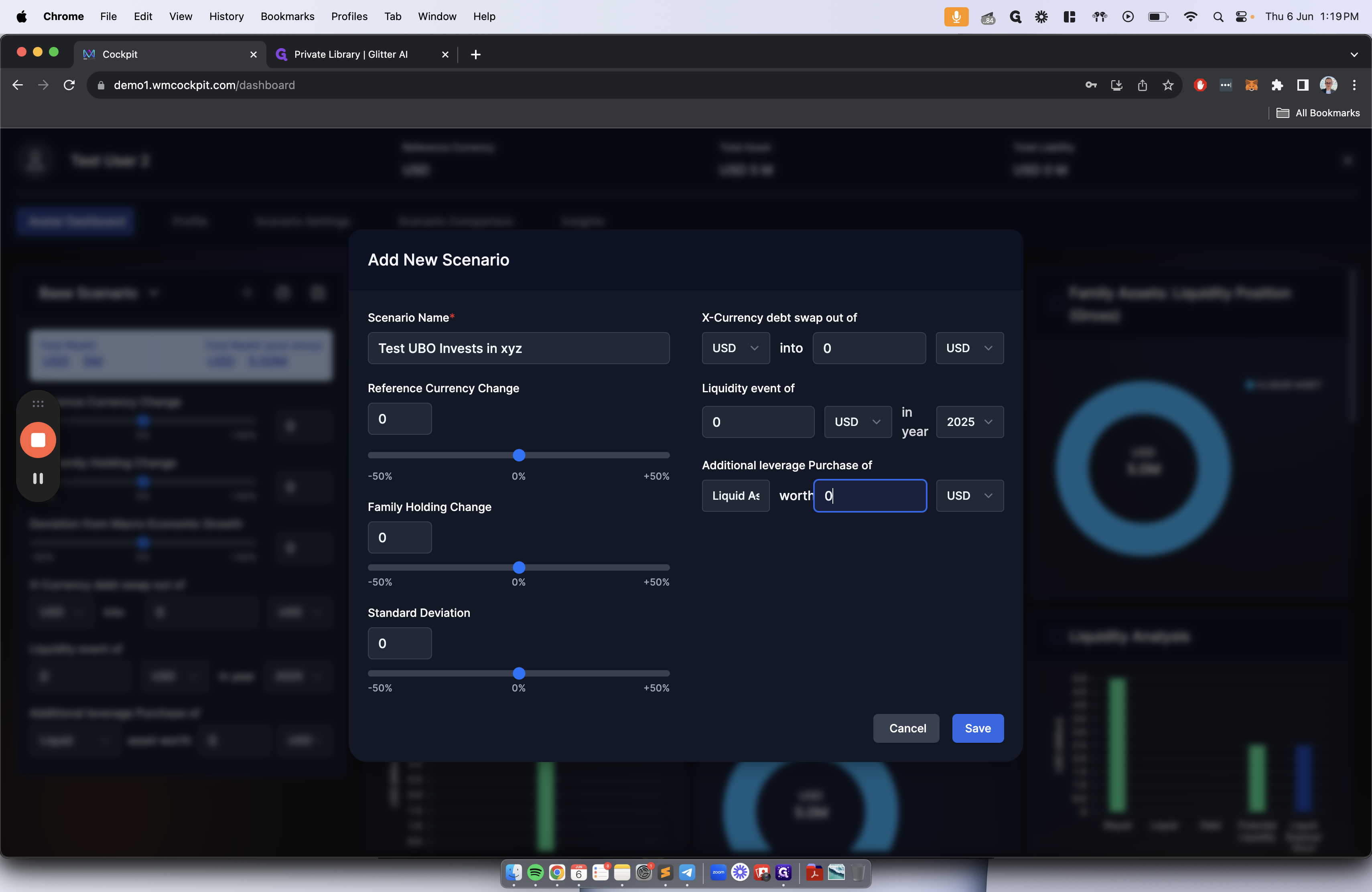

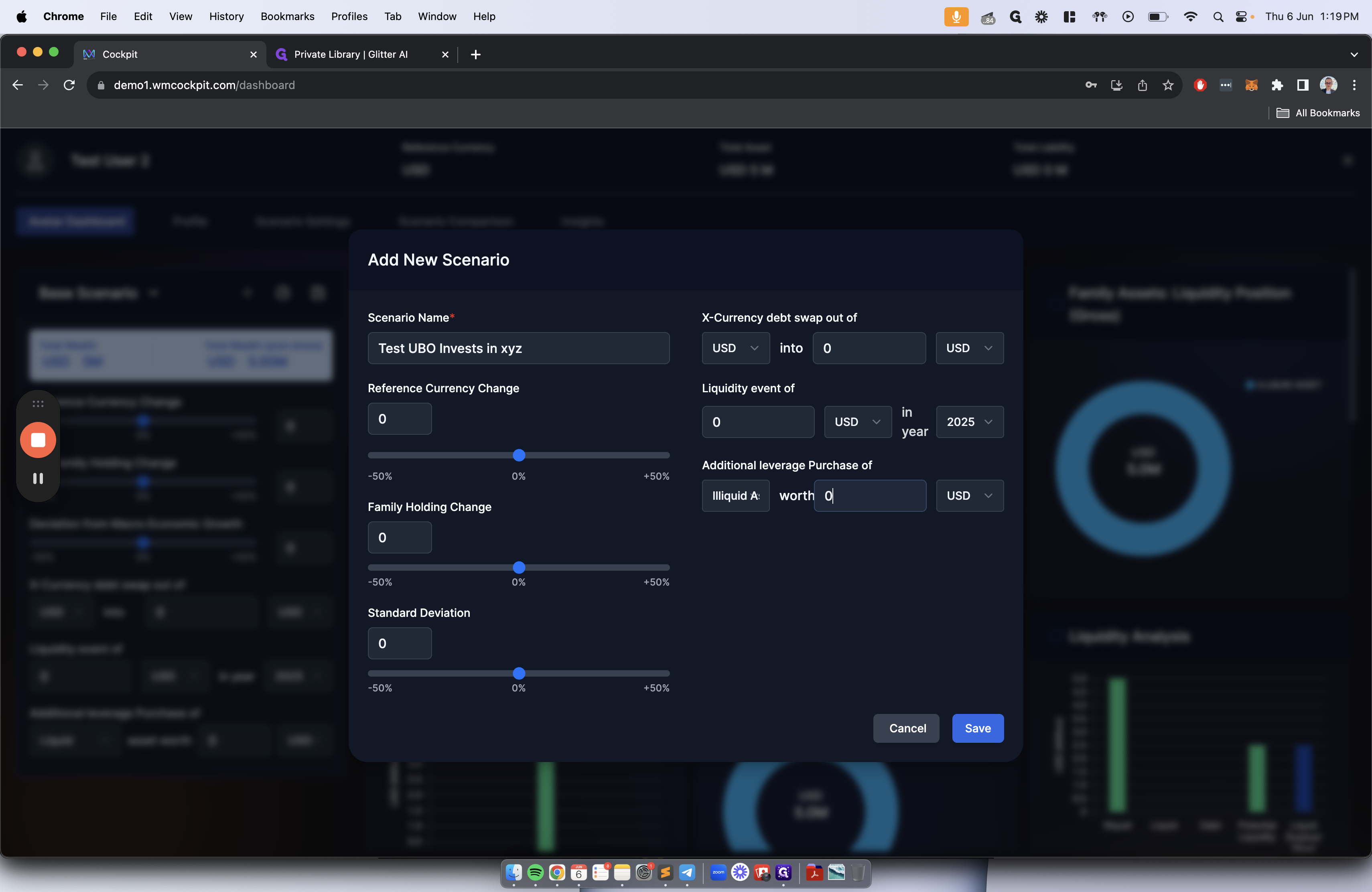

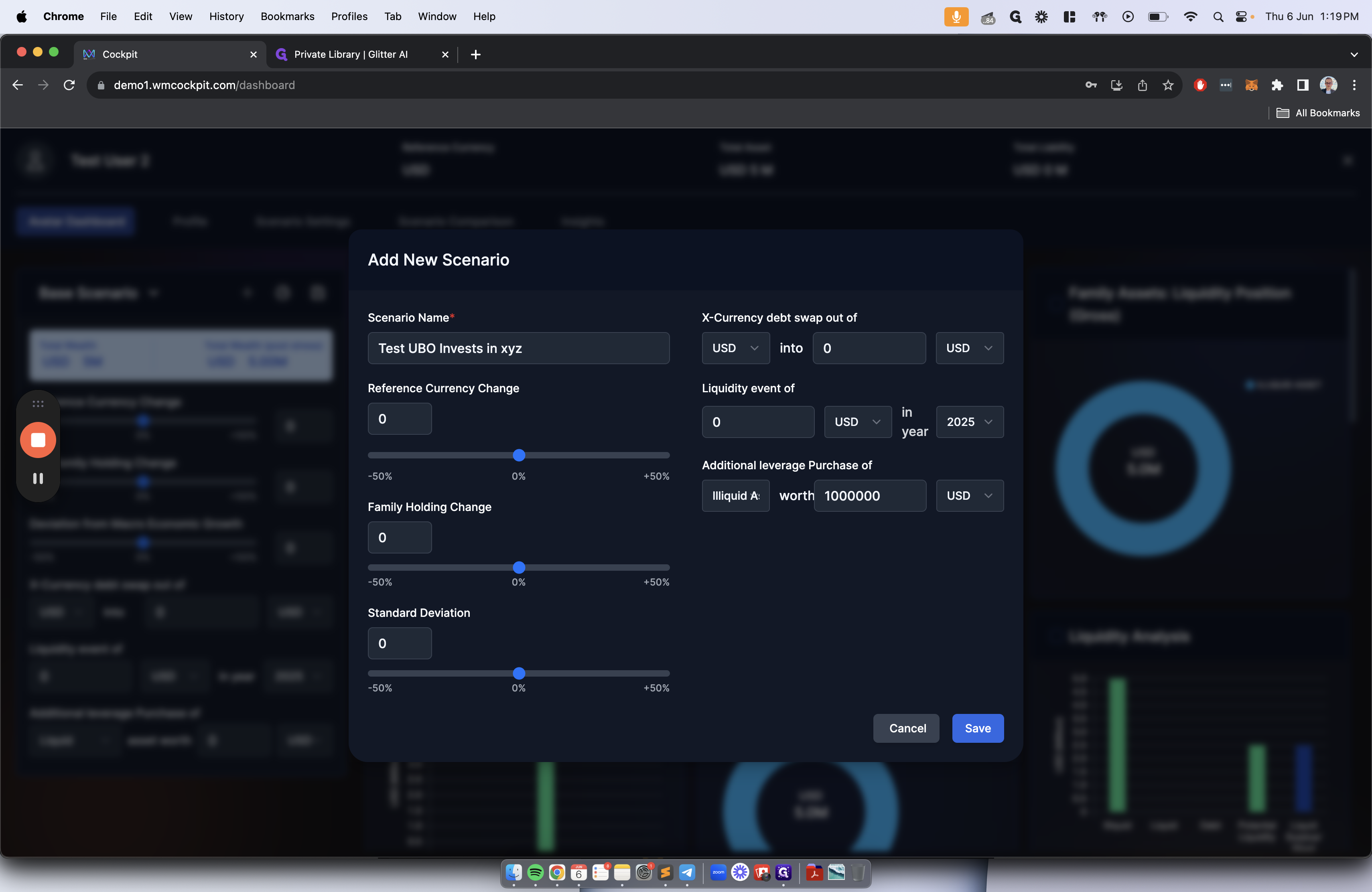

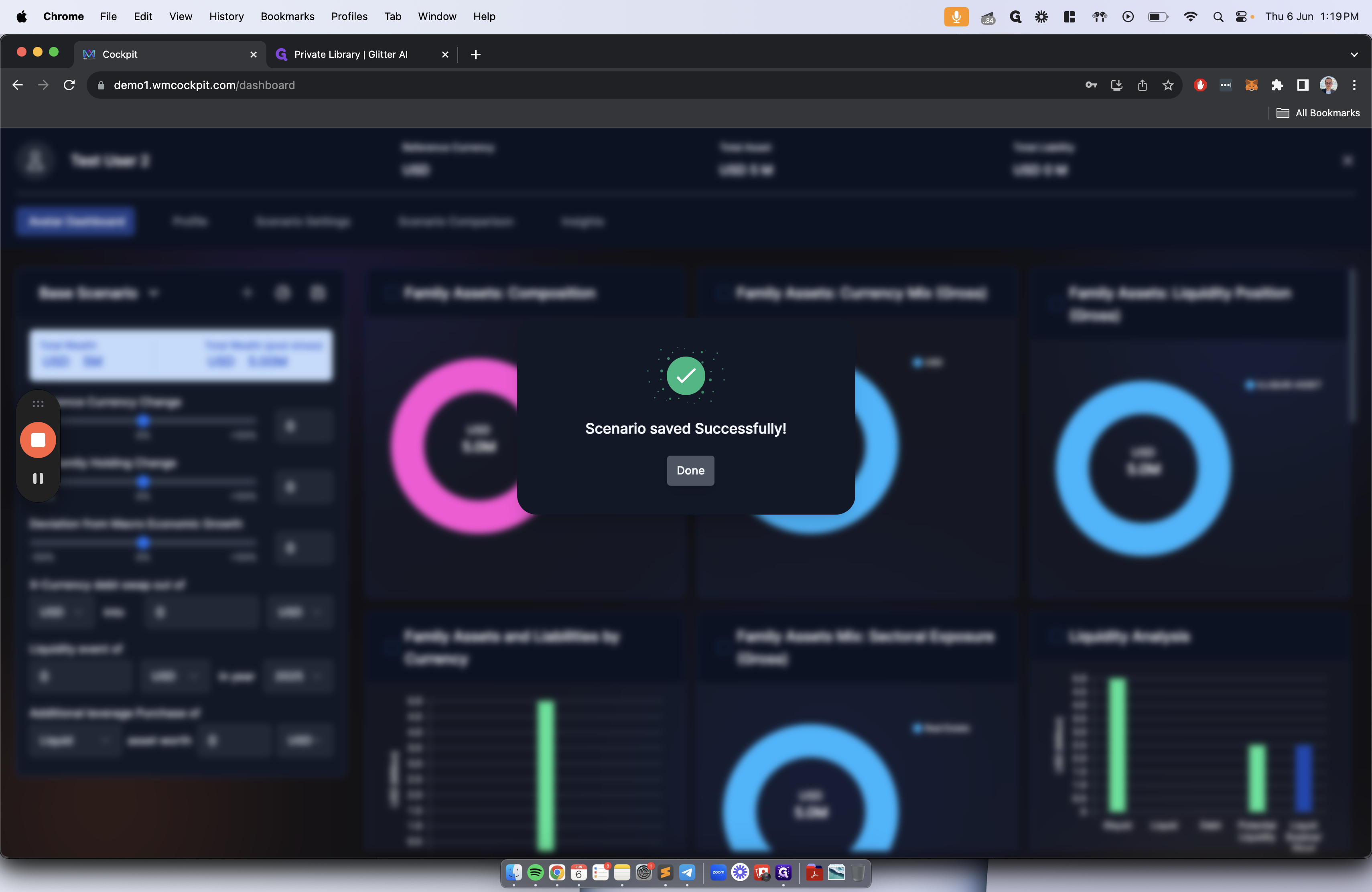

To create a new scenario and input values for investments, swaps, liquidity events, and leverage purchases, we'll use the plus button and save our scenario. This step allows us to compare different scenarios against our base case, enabling a detailed analysis of the financial implications.

Comparing Scenarios

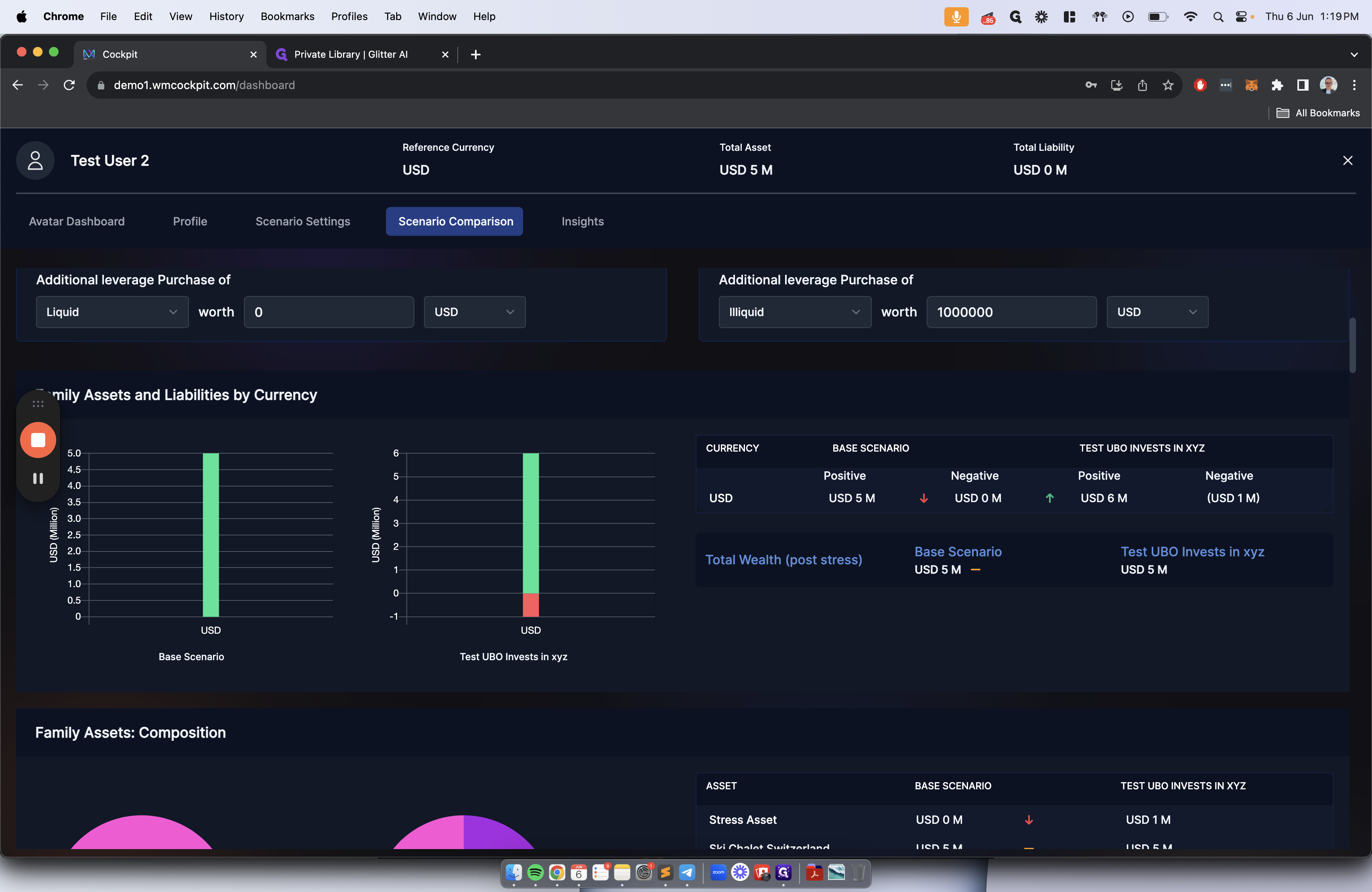

By utilizing the scenario comparison tab, we can juxtapose our base case with the newly created scenario. This comparison feature facilitates a side-by-side evaluation of metrics, aiding in decision-making and strategic planning.

Let's get started.

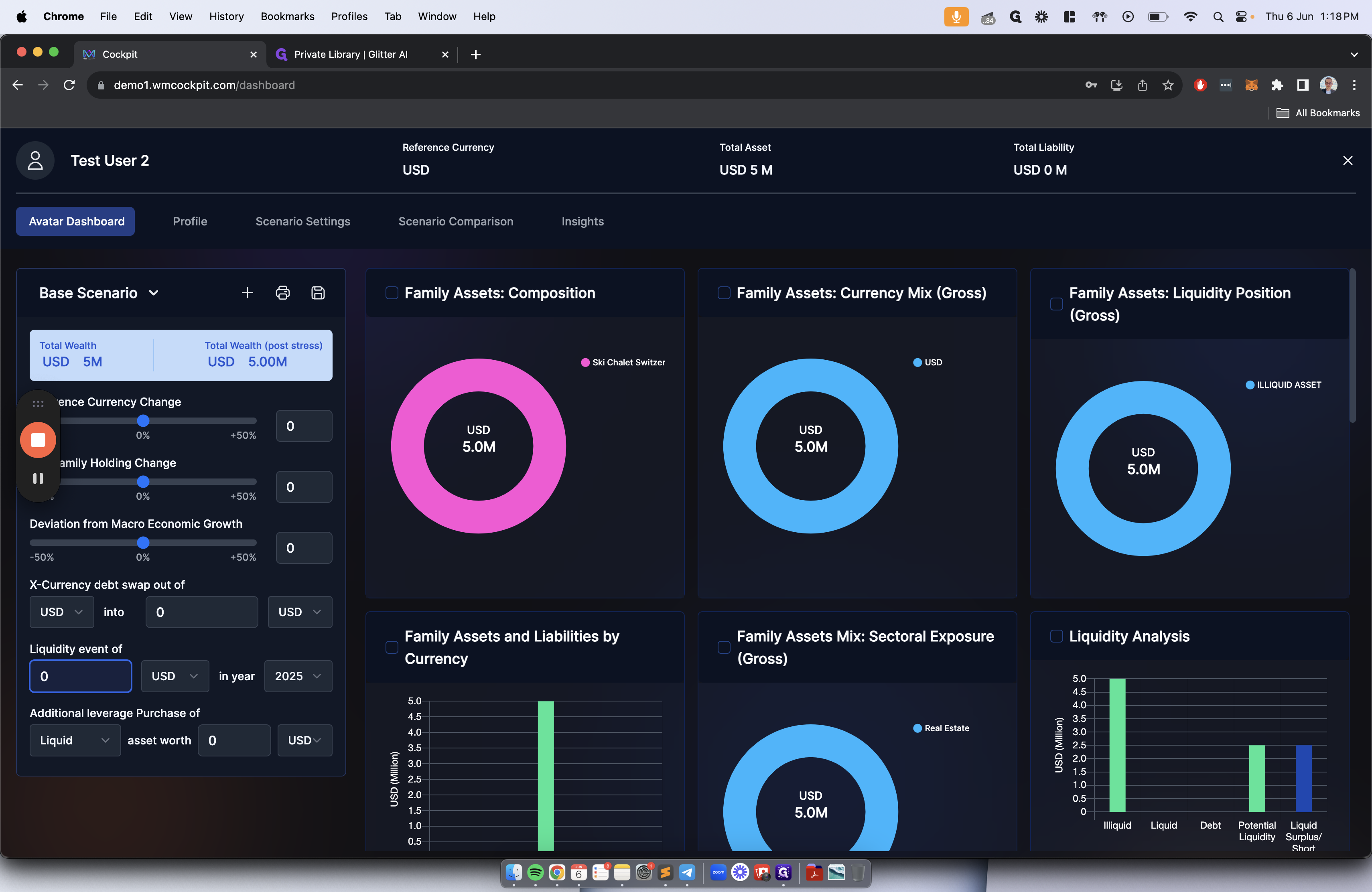

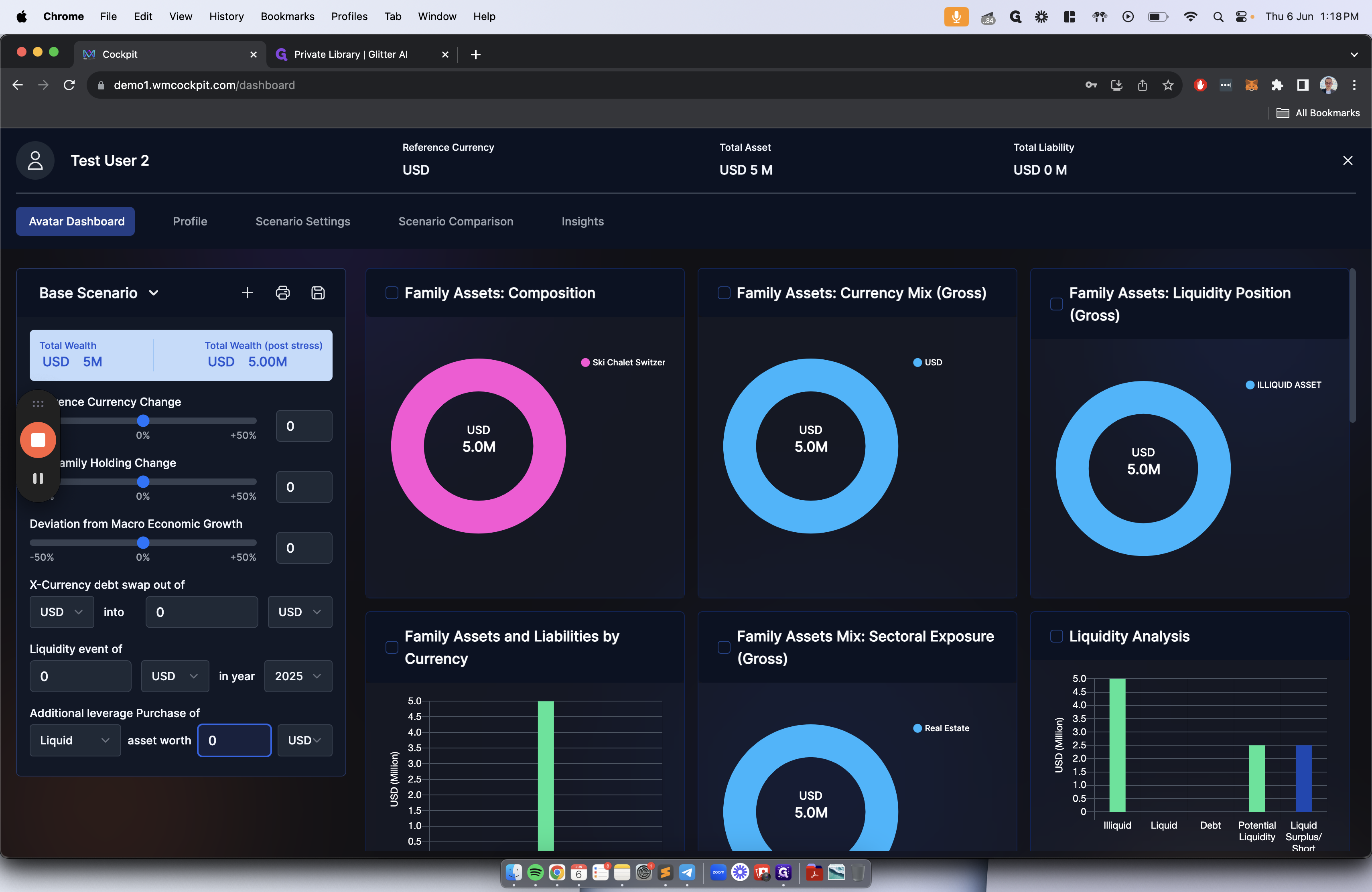

We can input the values of this investment by adding a potential cross-currency swap, a potential liquidity event, or a potential leverage purchase.

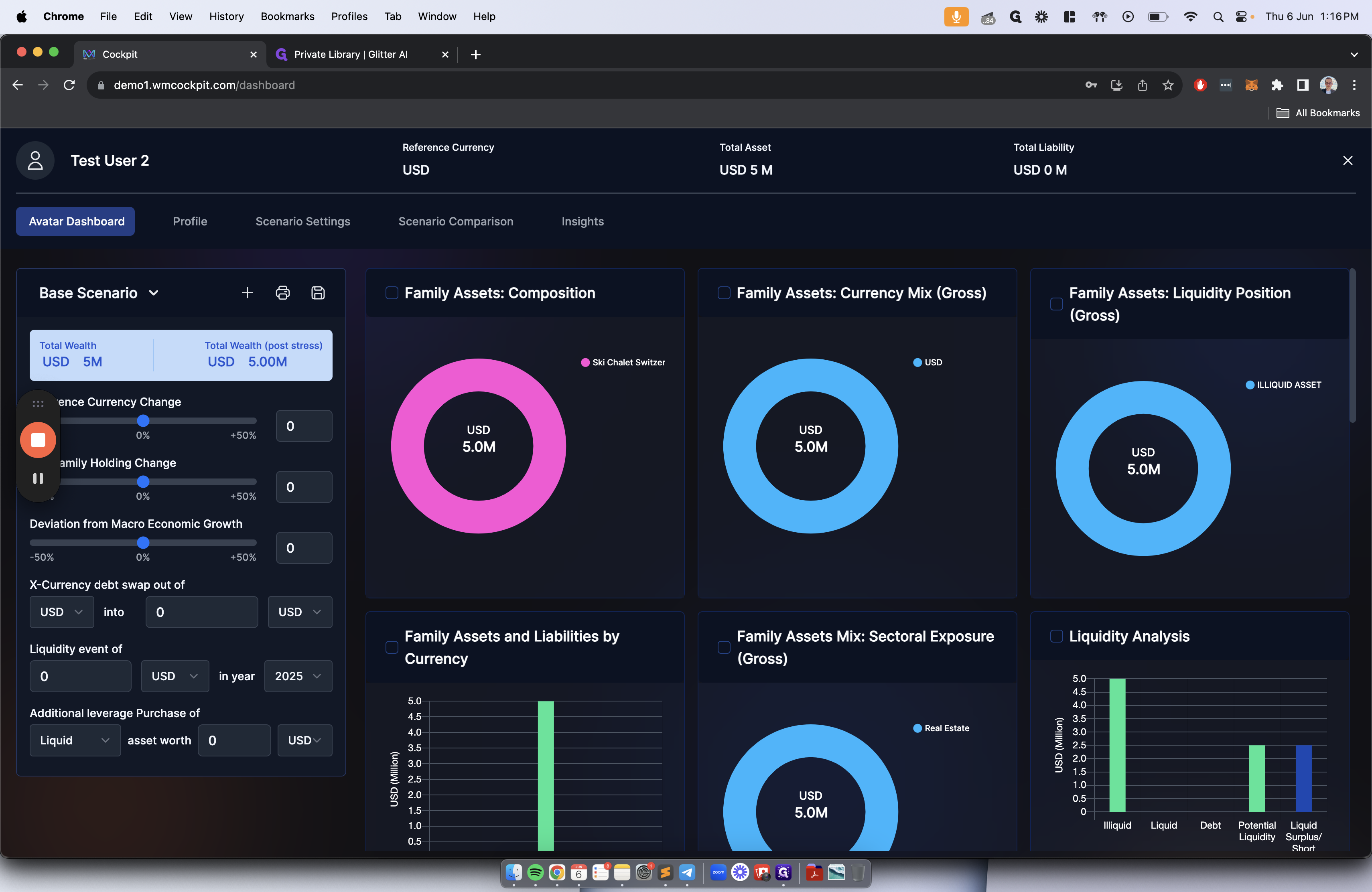

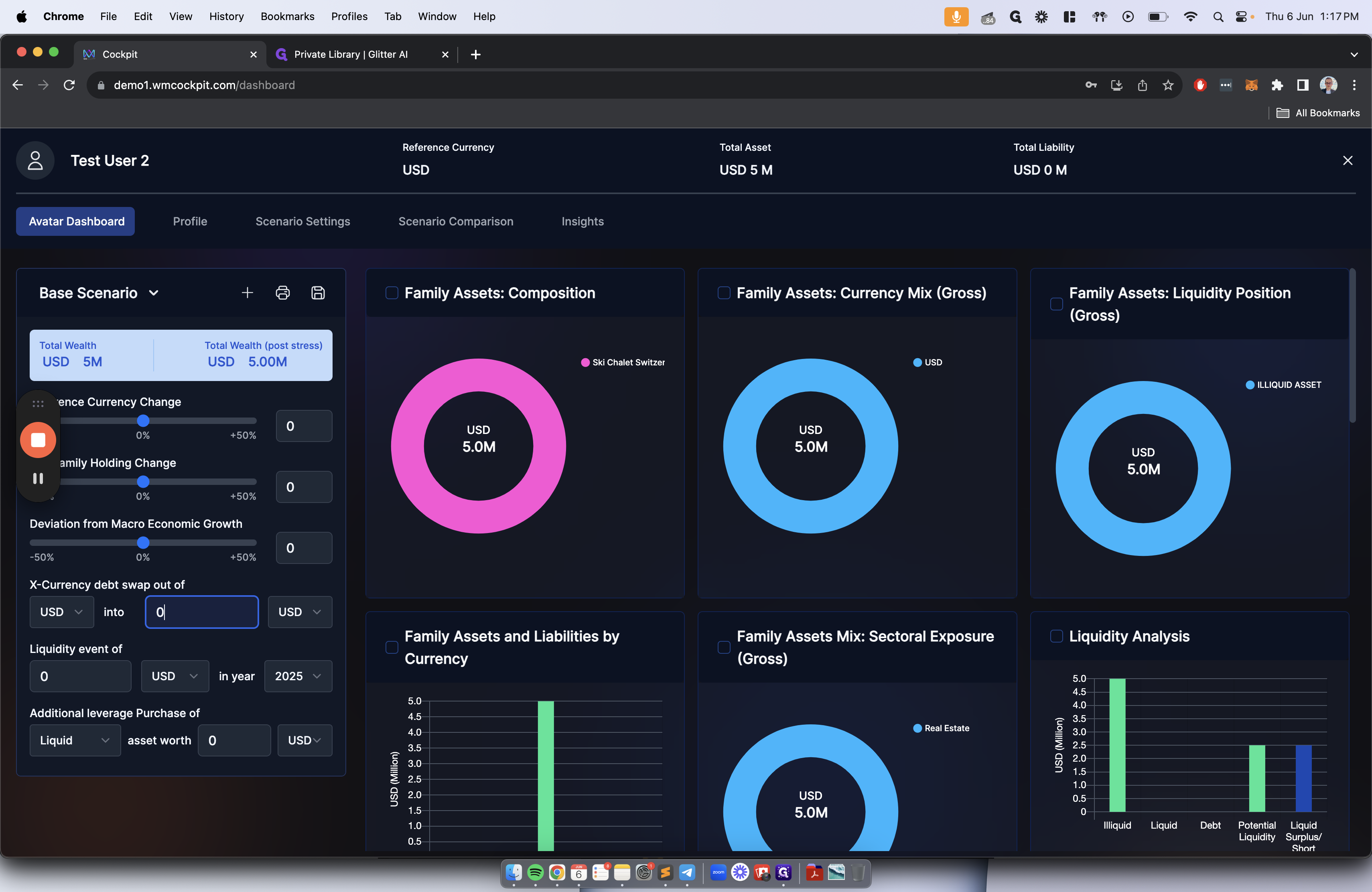

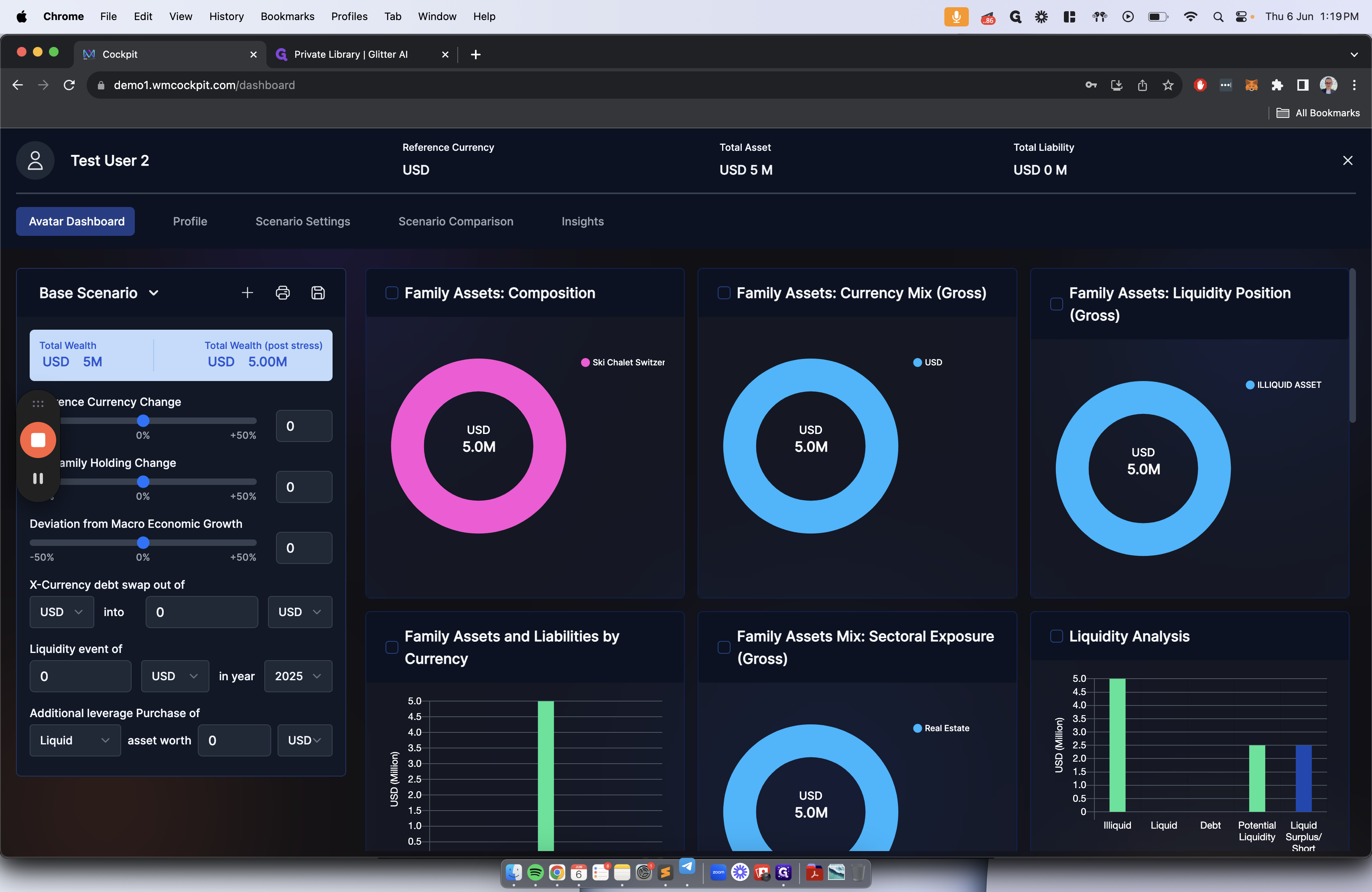

After creating the scenario setting, click on Avatar Dashboard. Here, you will see a breakdown of all the assets and liabilities you entered in the previous section.

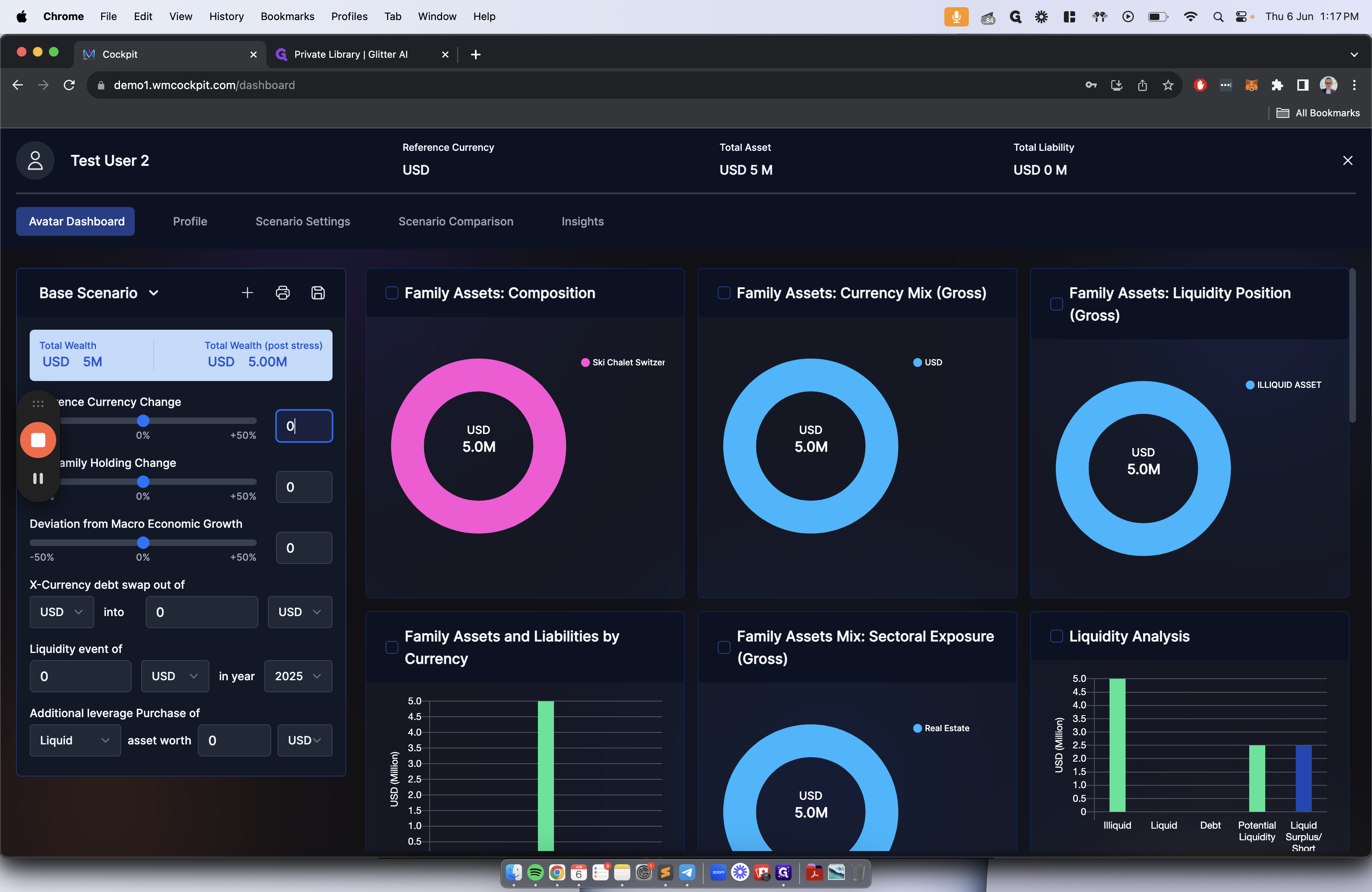

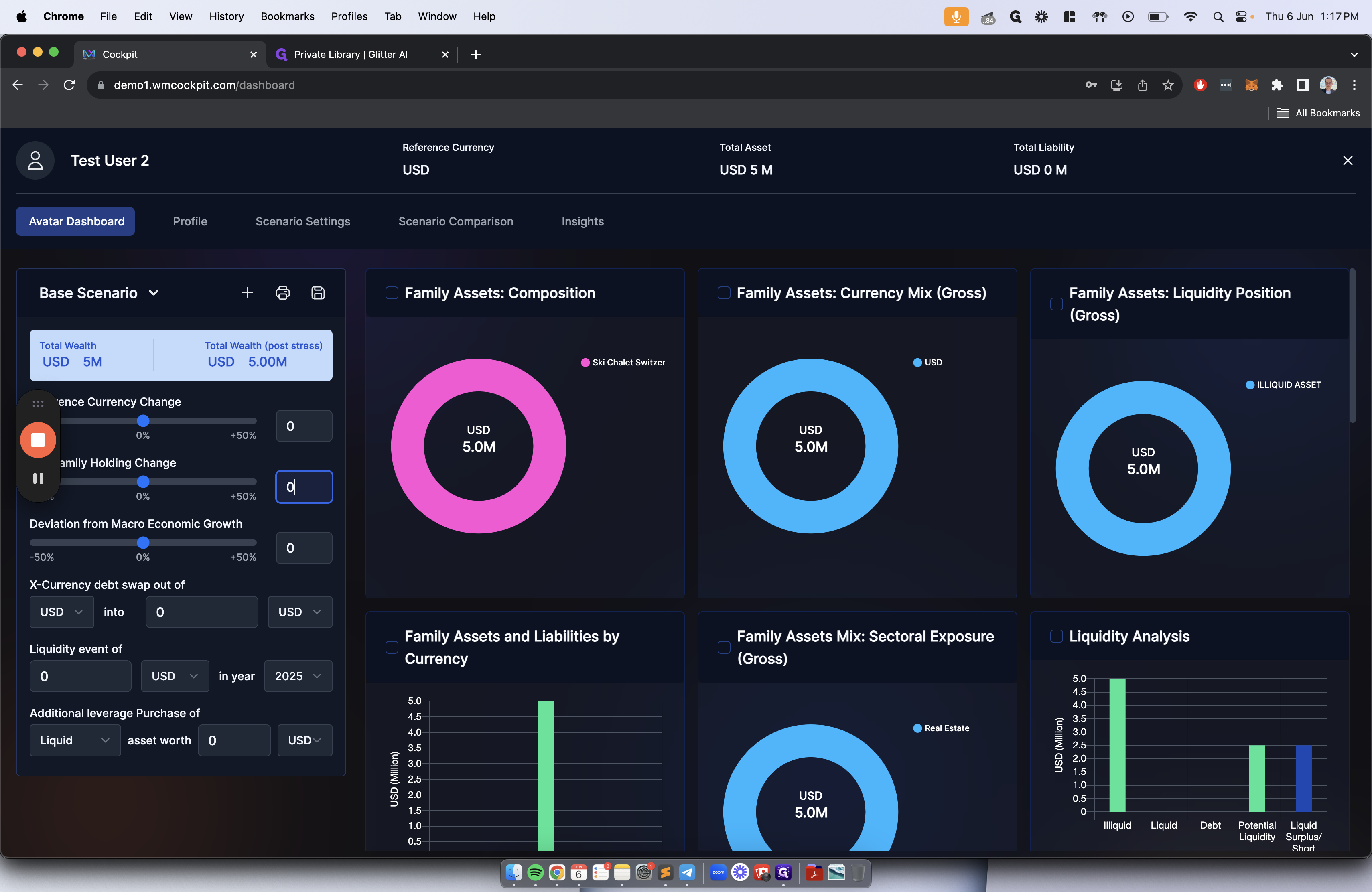

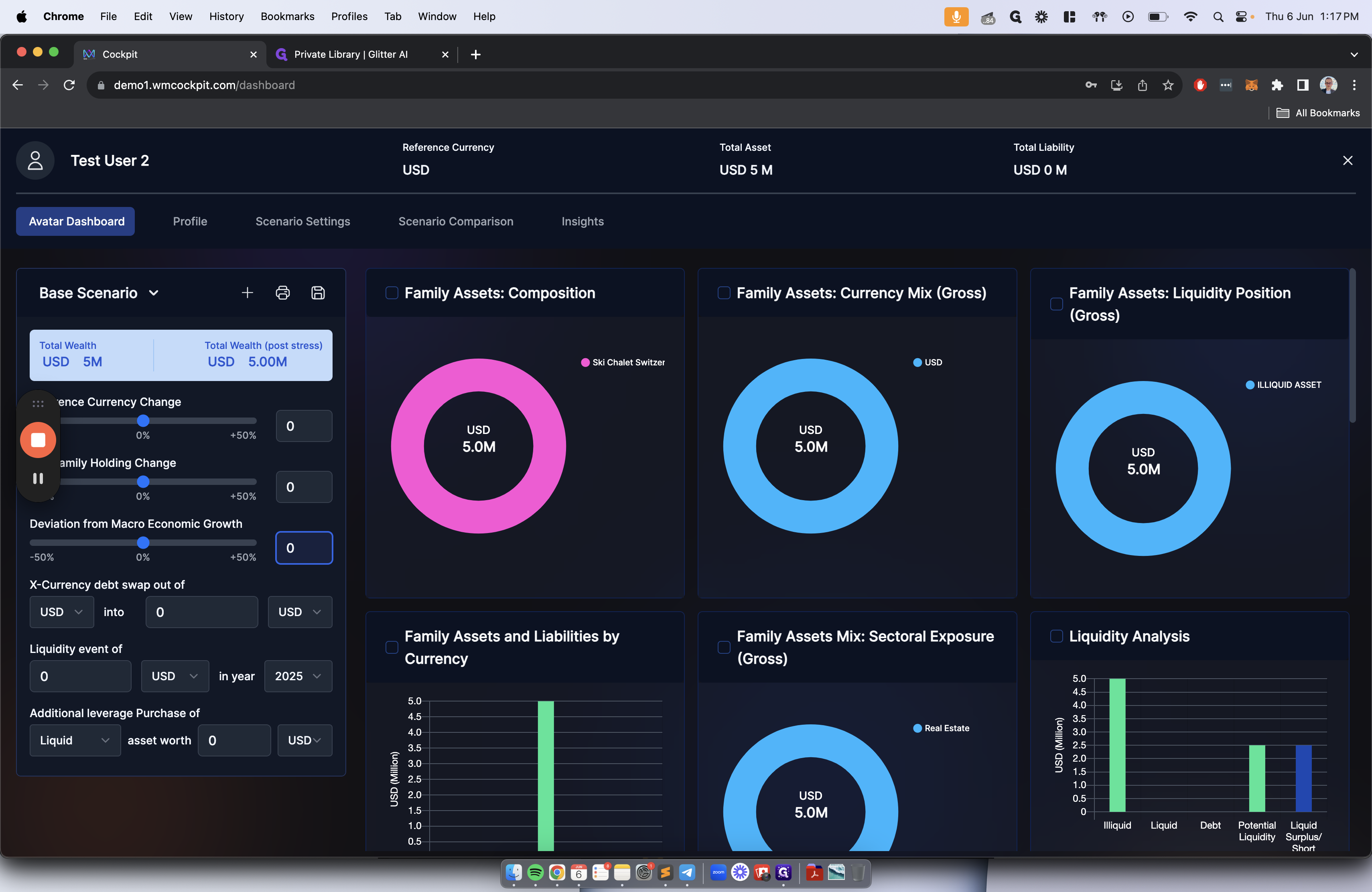

On the left-hand side, we can see the stress testing of different data points. For instance, we can stress test scenarios like changing the reference currency by inputting the number here.

Are there any changes in key family holdings? Any deviations from macroeconomic growth? Any cross-currency debt swaps? Any potential liquidity events, such as a life insurance policy payout, selling of stock or equities with future payouts, or additional leverage purchases? These inputs will be reflected on the right-hand side, showing the slicing and dicing that occurs. This will show what impact these stressed scenarios have on your entire estate and which UBOs are impacted.

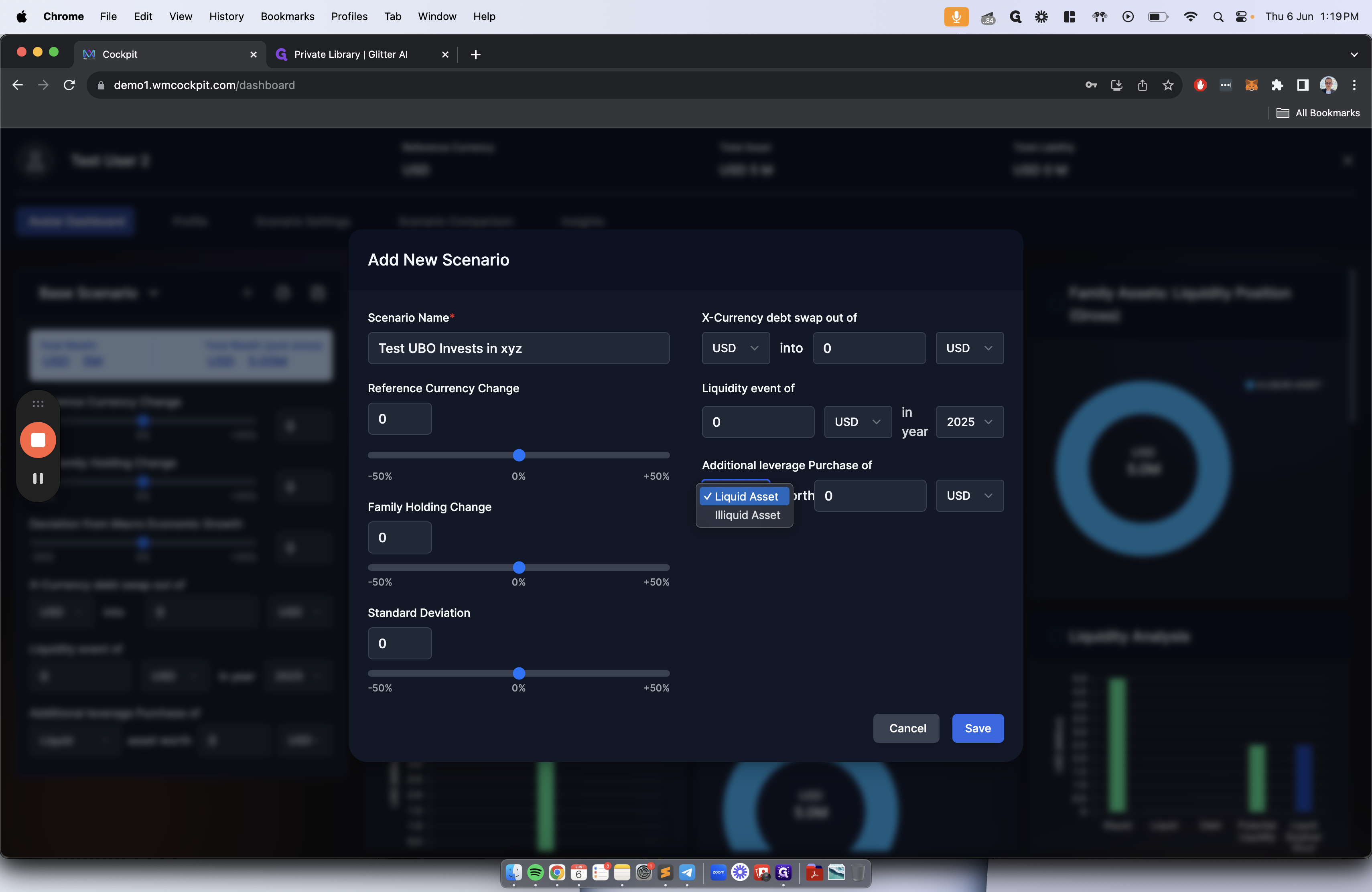

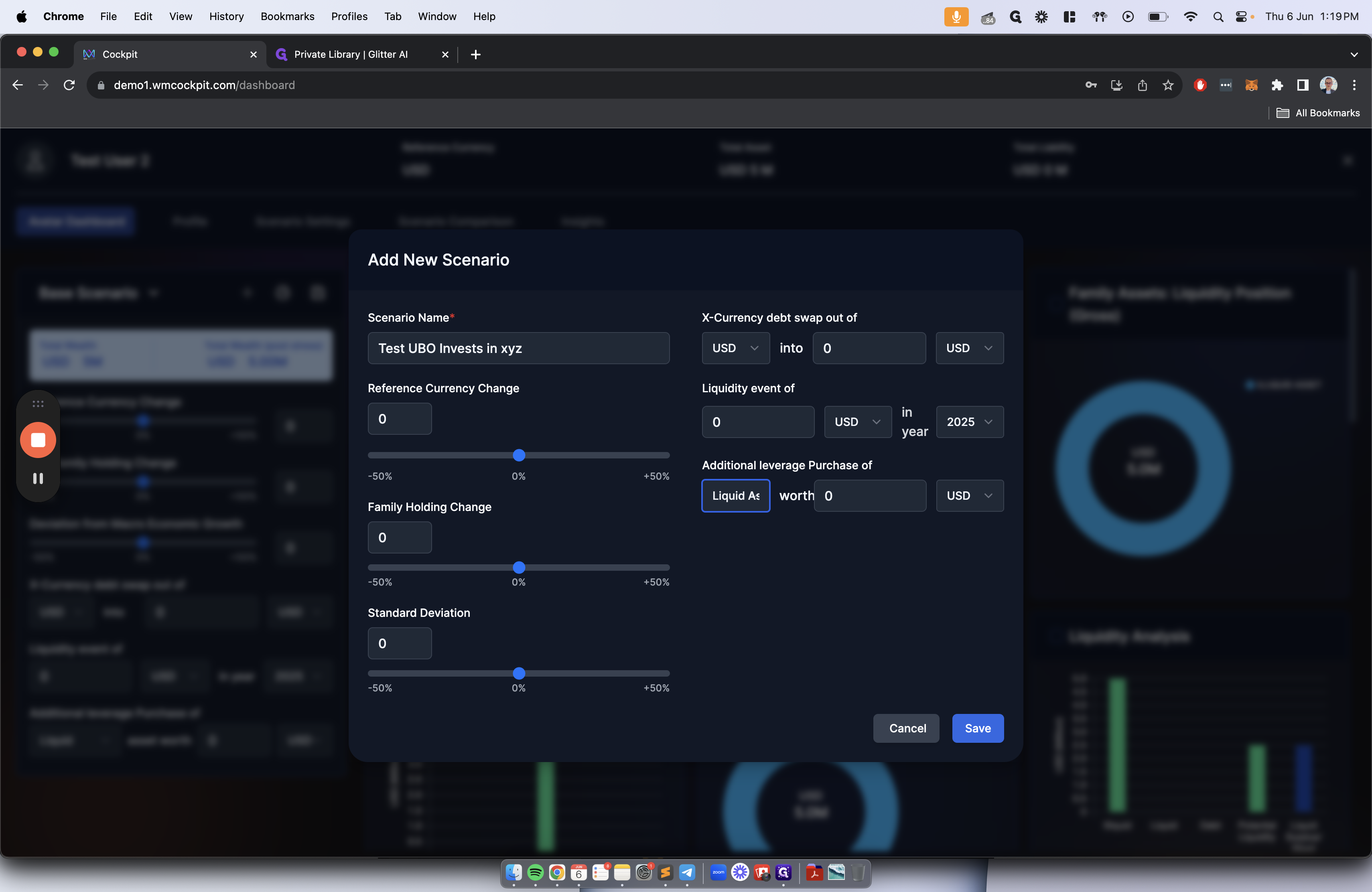

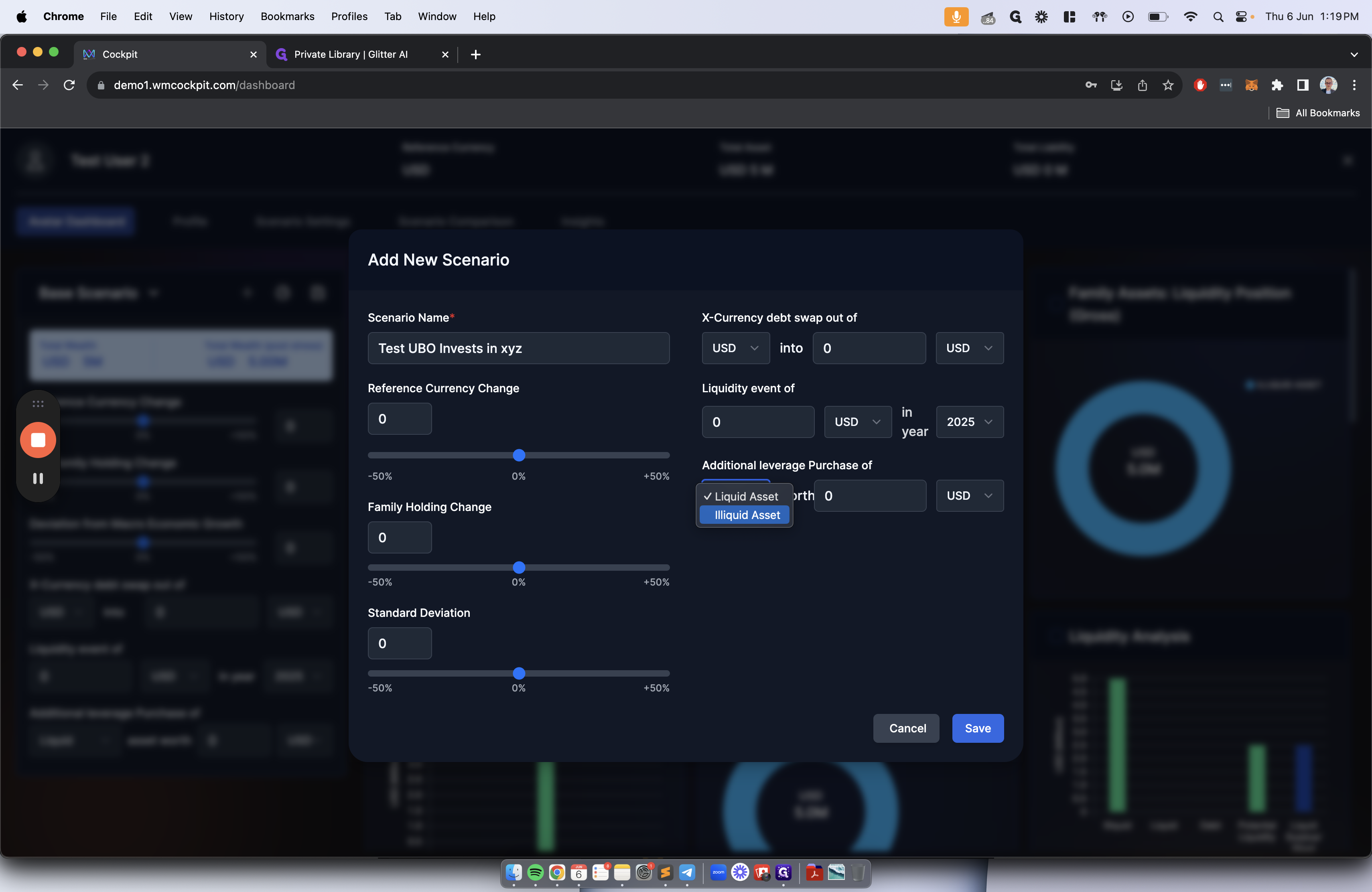

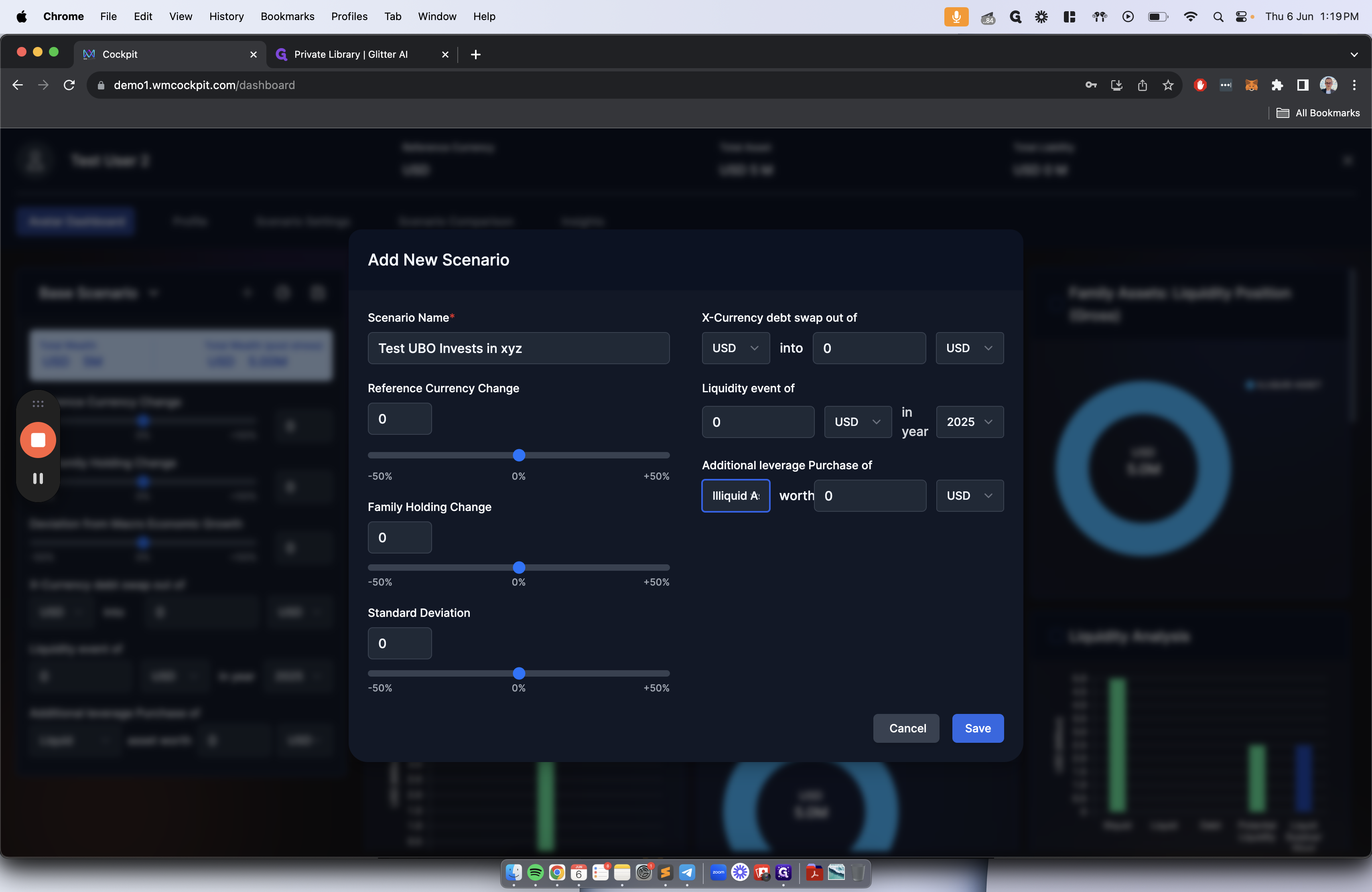

To create a scenario, you can compare it to your current base situation. Press the plus button to create a new scenario named "Test UBO invests in XYZ."

We can choose whether that is a liquid asset or an illiquid asset. Then, we can press save.

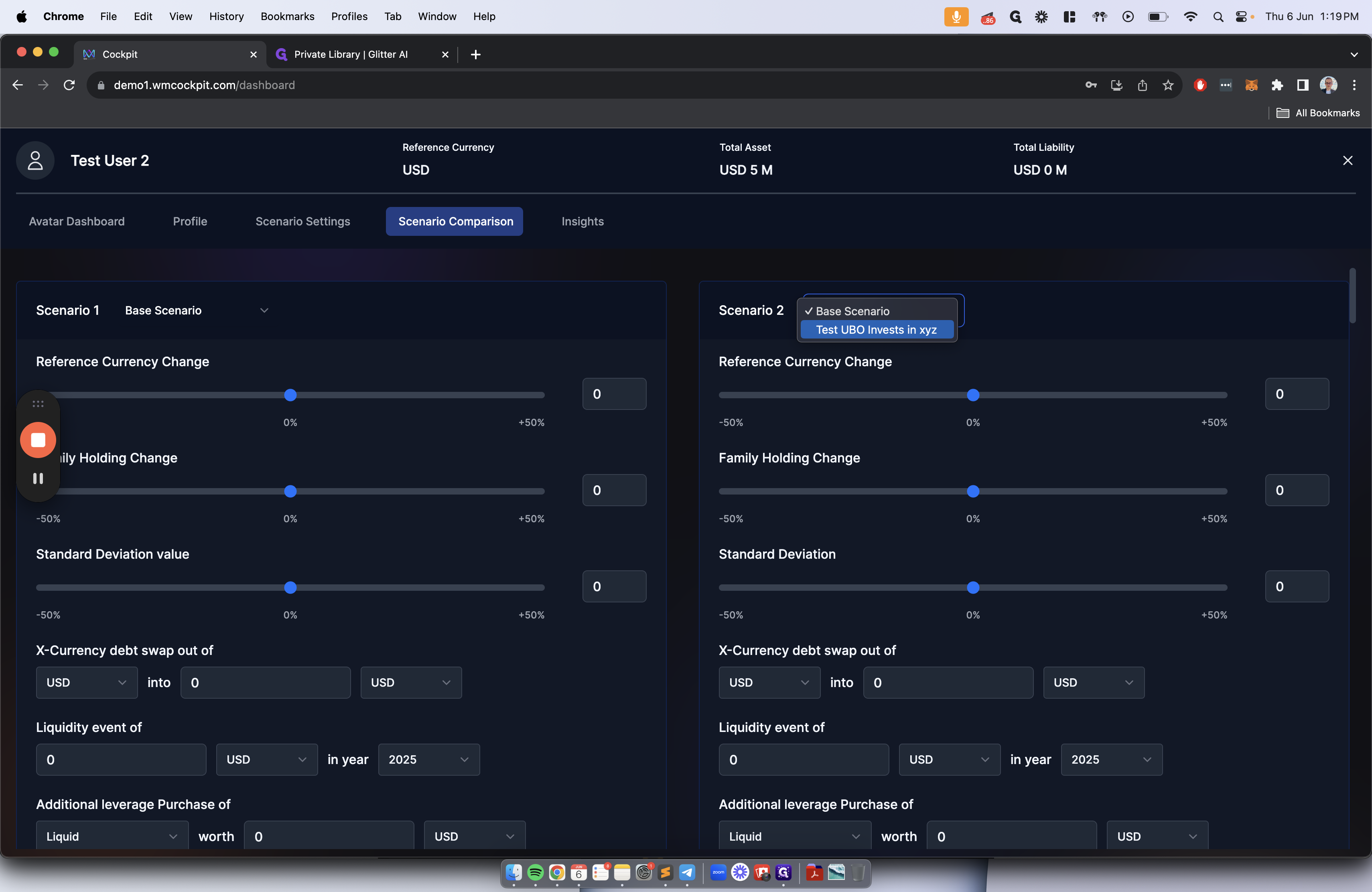

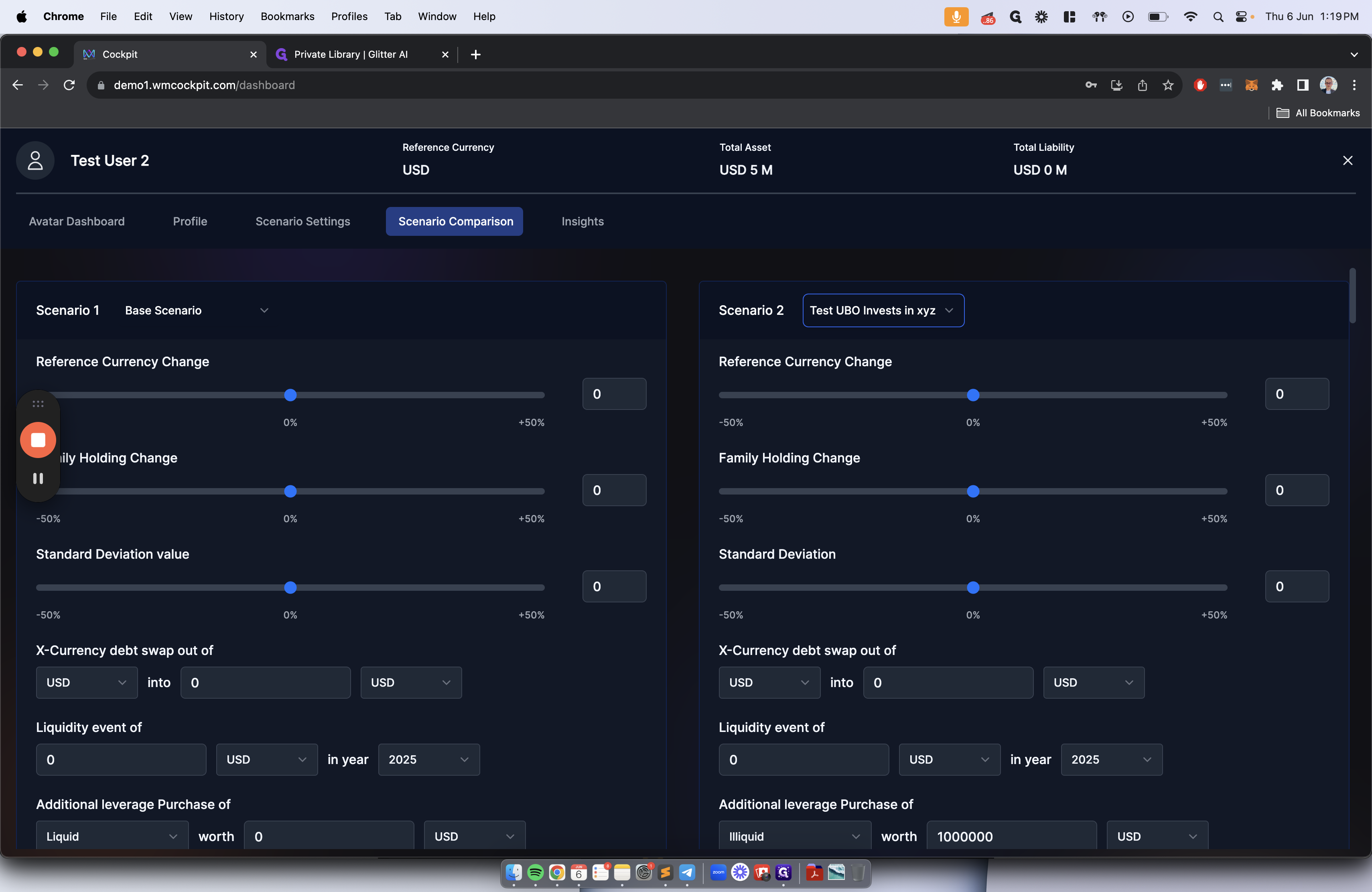

After doing that, we can press the scenario comparison tab.

The scenario comparison tab lets you compare your base case scenario with the pre-wired scenario you've chosen.

On the left, we will keep the base case the same. On the right, we will choose our test UBO investment. If we scroll down, we can compare the metrics side by side.