Guide to Creating Member Special Assessment Invoices for Members Who Own Shares of Multiple Cabins

Learn how to efficiently create and manage member special assessment and annual capital contribution invoices, with tips on handling multiple cabin owners and ensuring accuracy.

In this guide, we'll learn how to create invoices for member special assessments and annual capital contributions using QuickBooks. These invoices are similar in process, with the main difference being the accounts receivable account used. Special assessments occur as needed, while annual capital contributions are done once a year. We'll focus on handling multiple cabin owners and ensuring accuracy in account selection, notations, and amounts. This approach aims to minimize errors and streamline the invoicing process.

Let's get started

Here's a quick guide on creating specific types of invoices. Member special assessment invoices and annual capital contribution invoices are generally created and managed in the same way. The annual capital contribution is done once a year, while special assessments are done as needed. In my 12 years here, special assessments have been rare. However, the camp is currently facing challenges, and this is the second one in a few months. I received an email from Steve today, and as mentioned, Sandy called and spoke with me, so I'm fully informed about the situation.

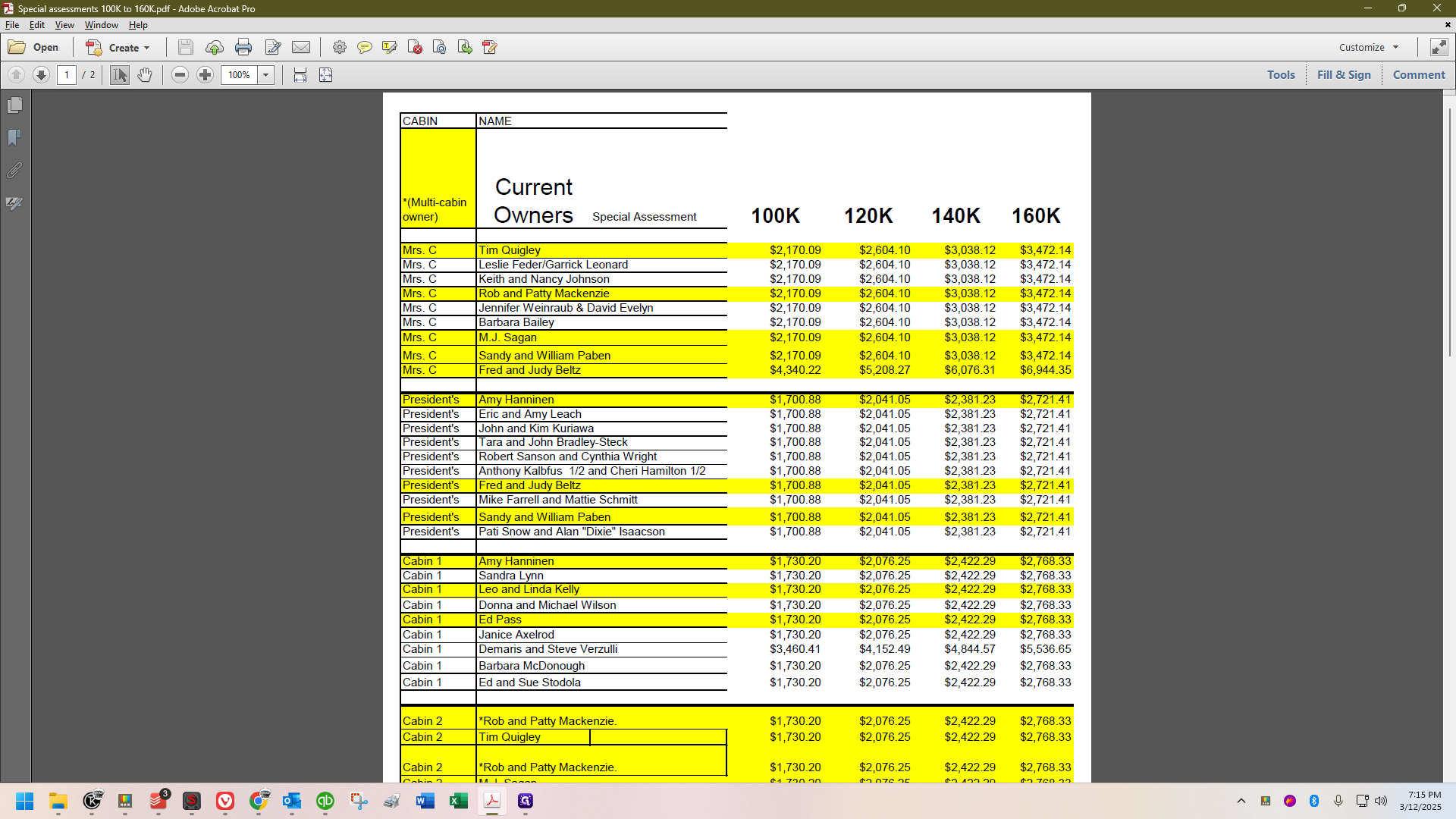

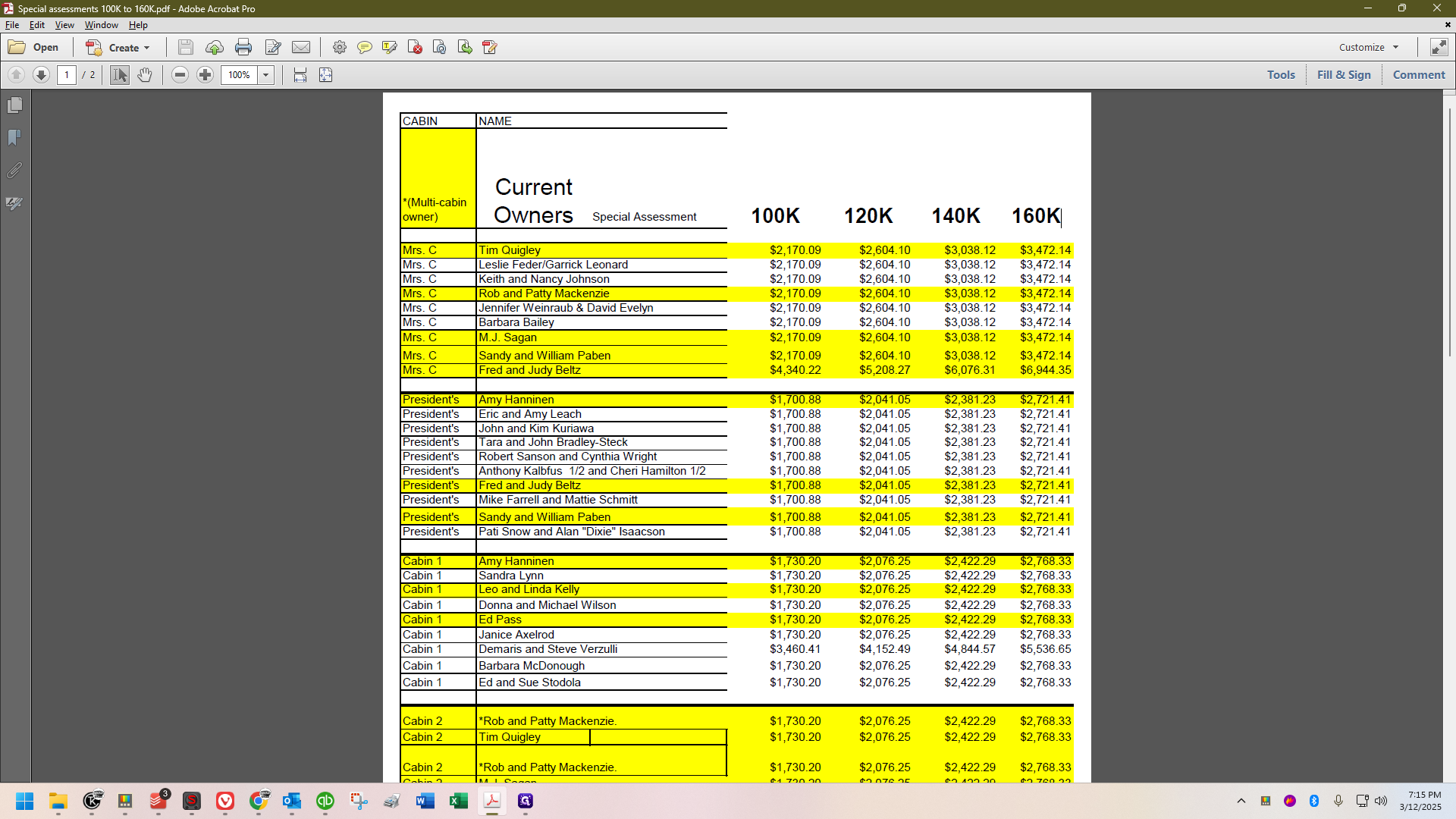

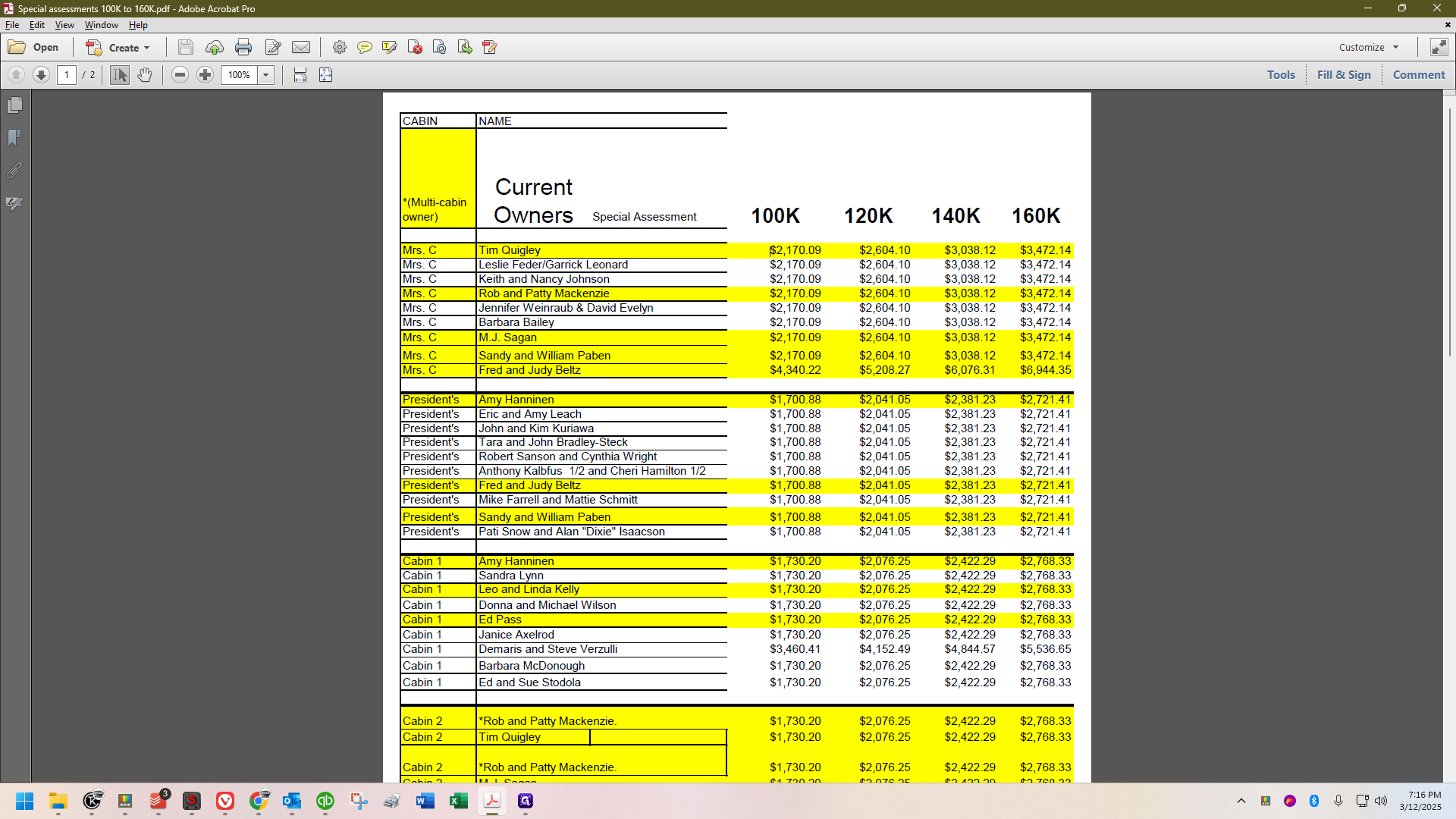

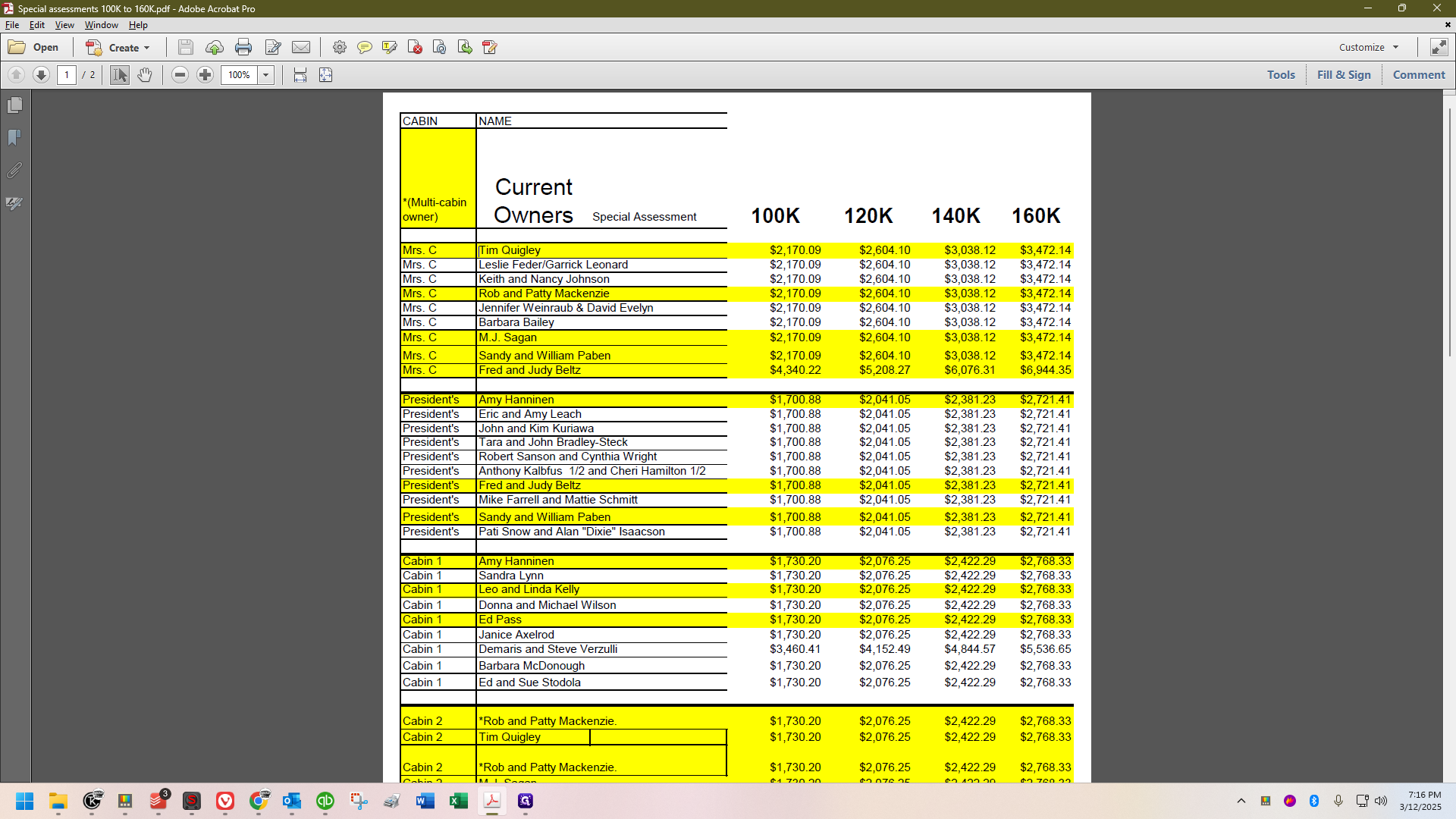

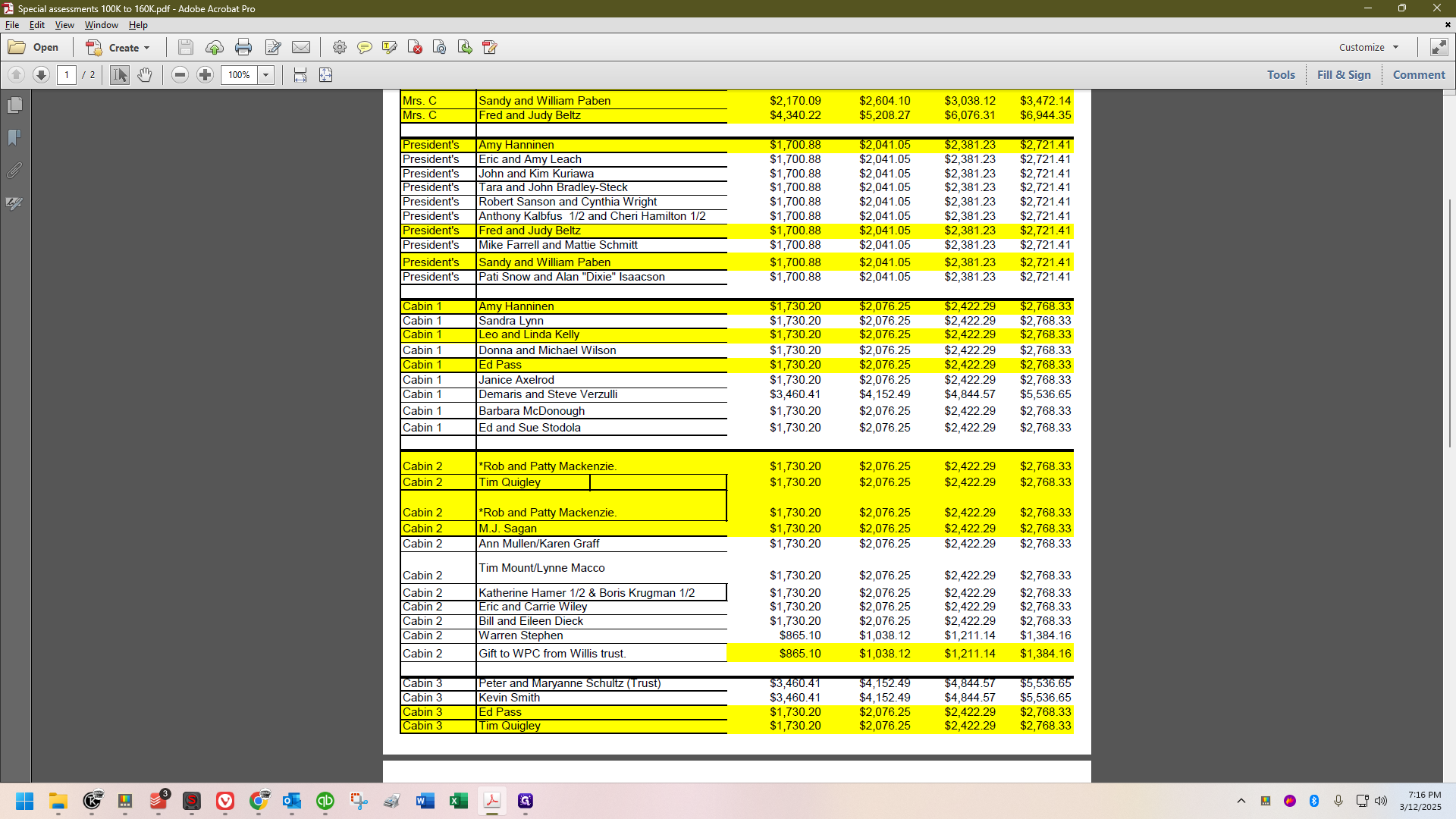

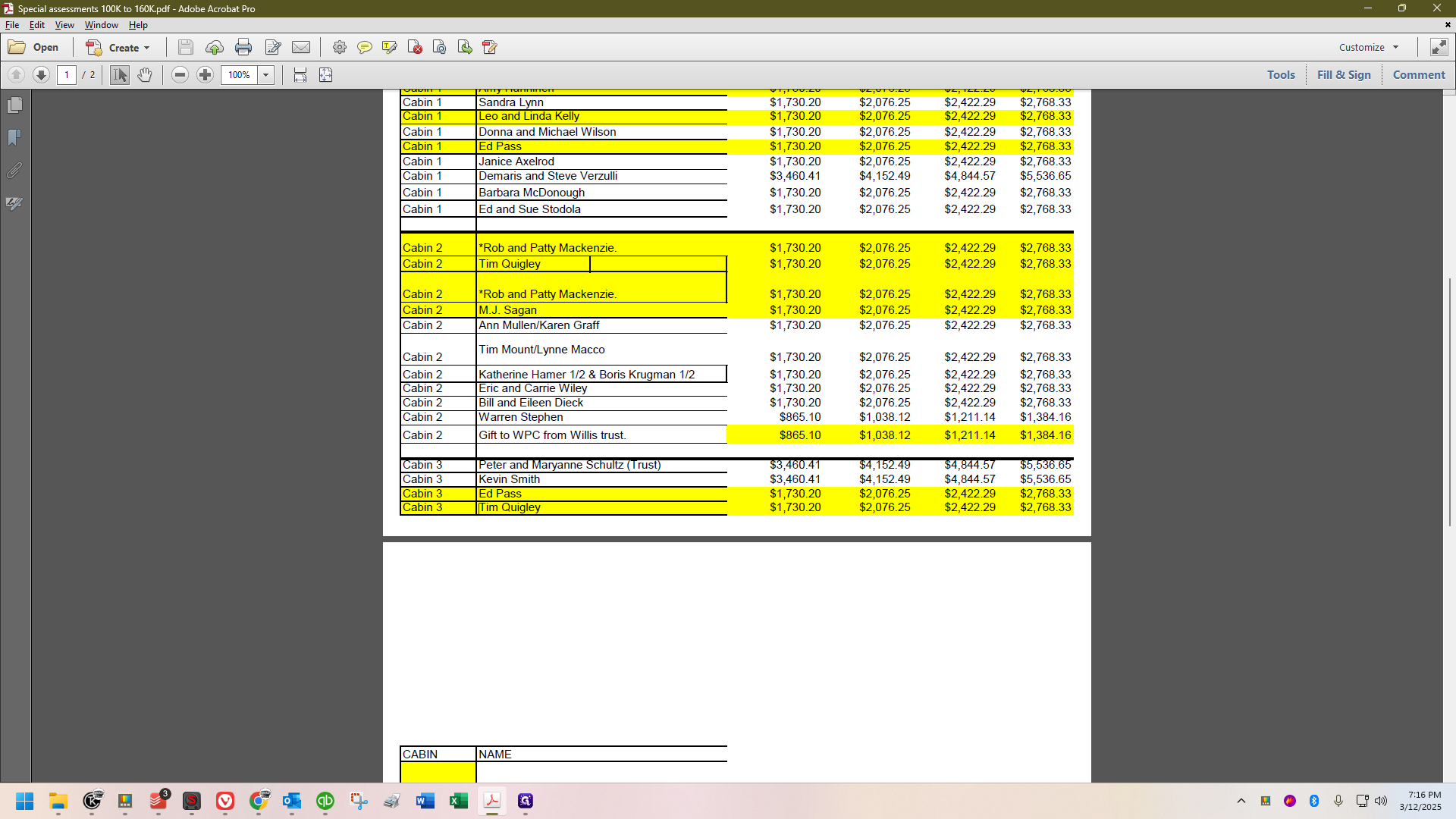

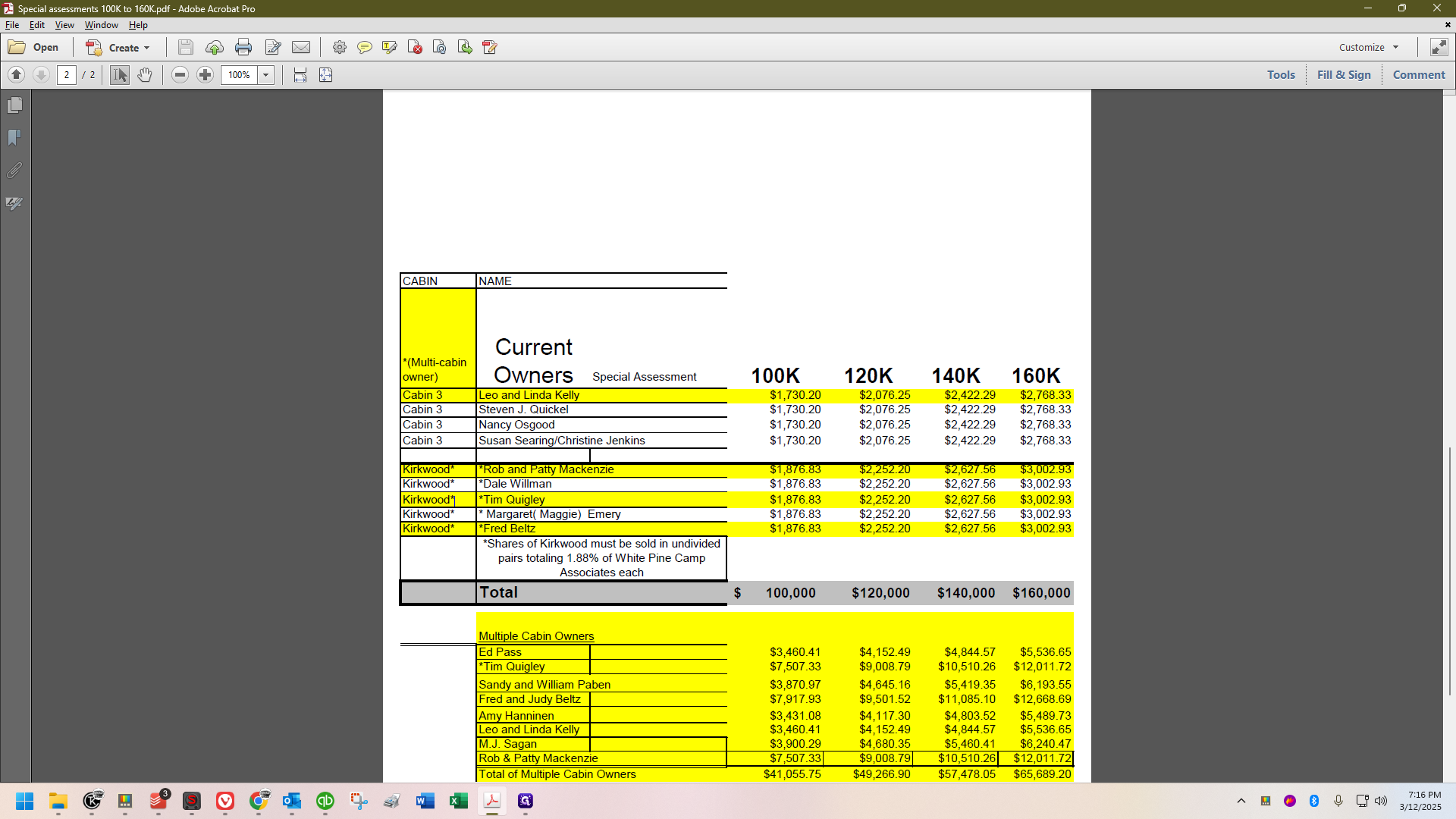

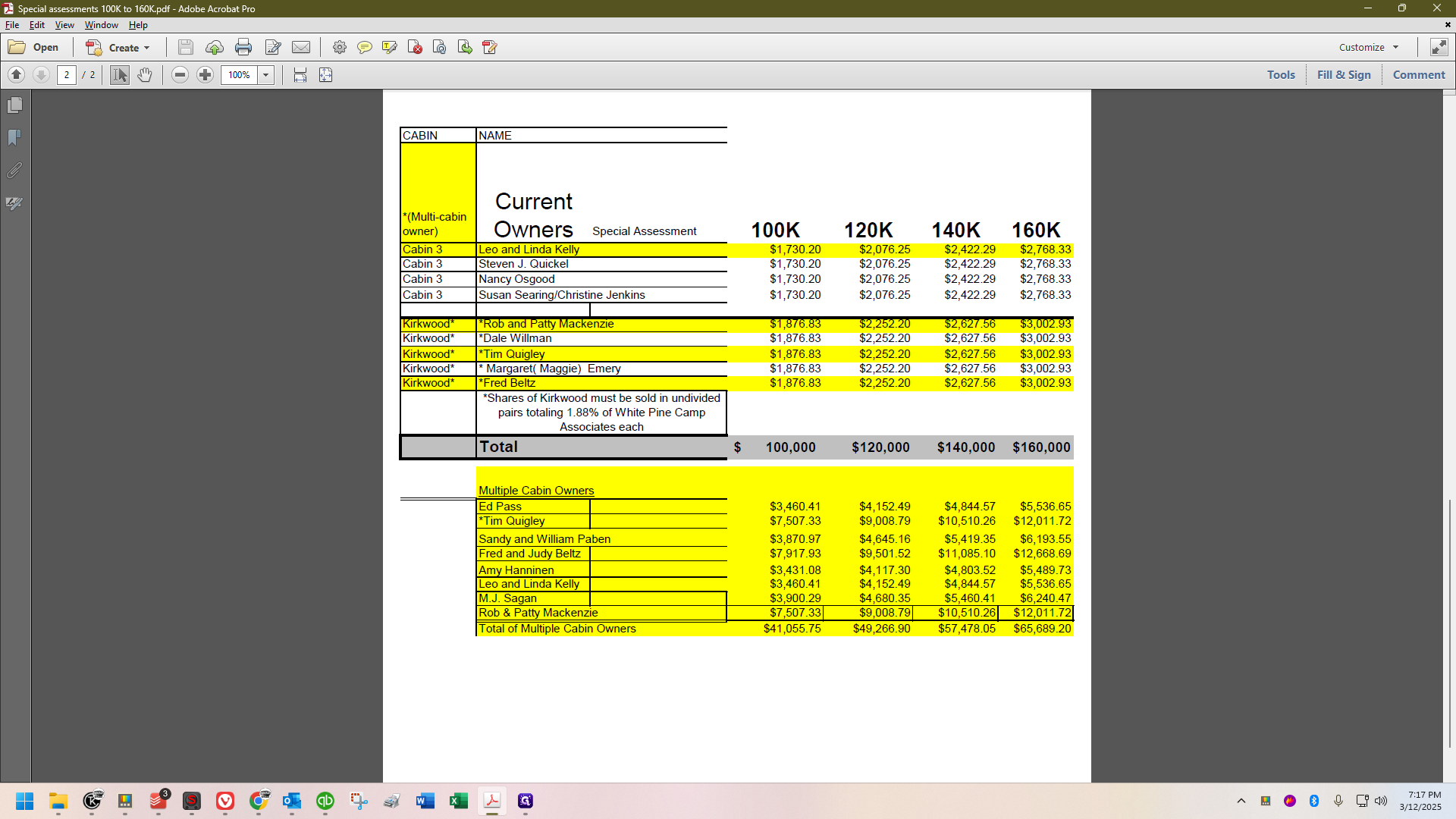

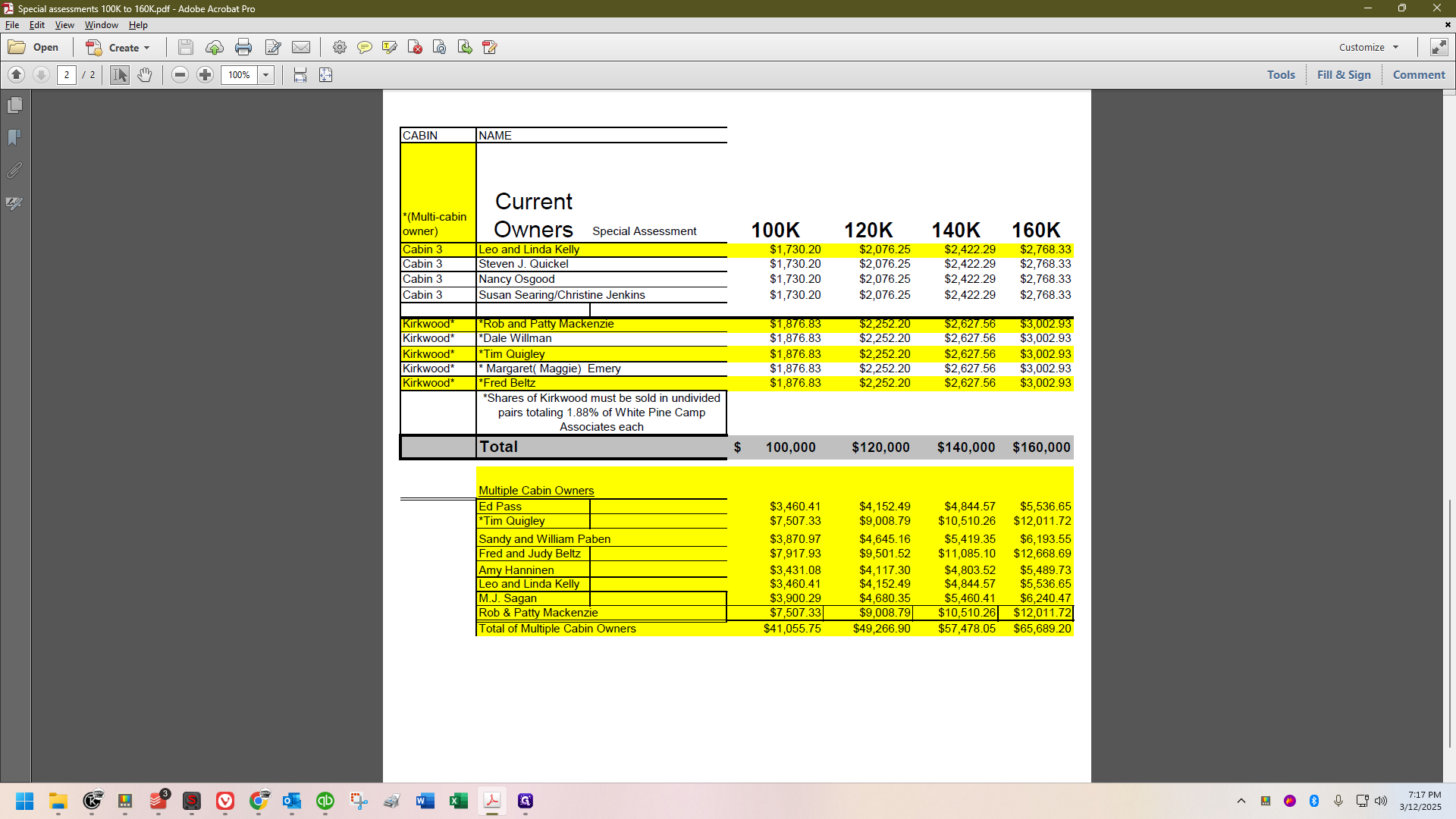

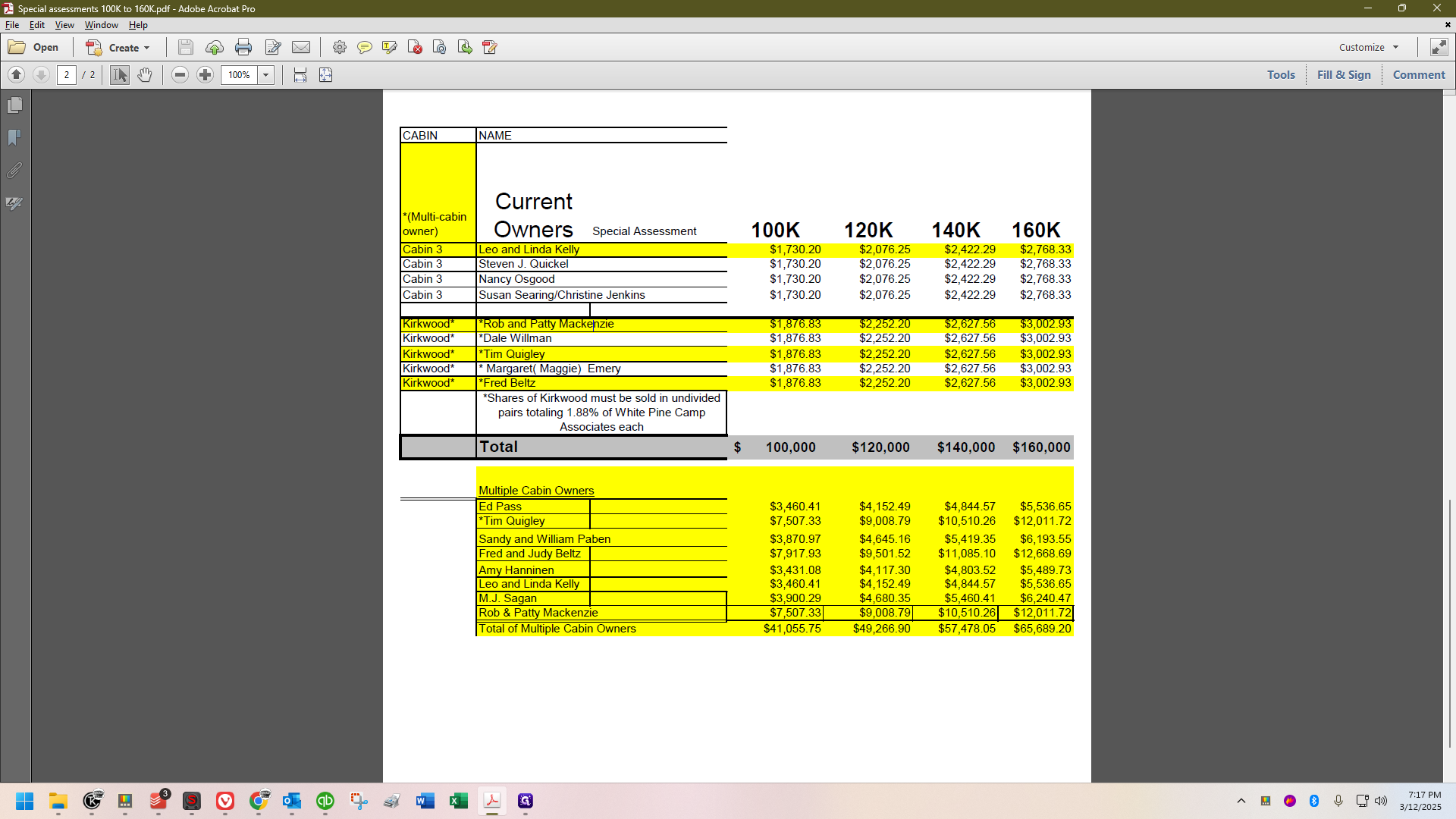

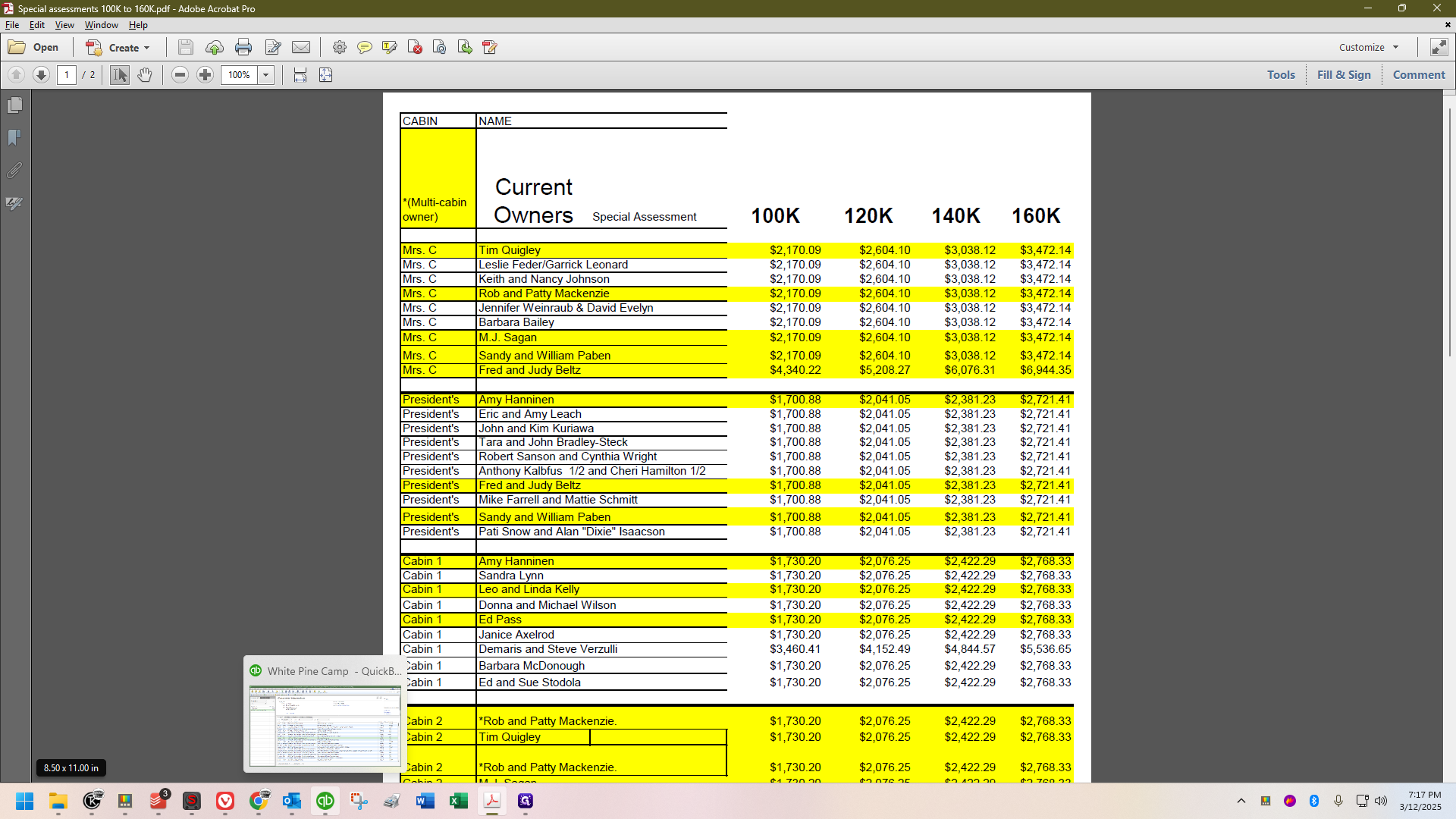

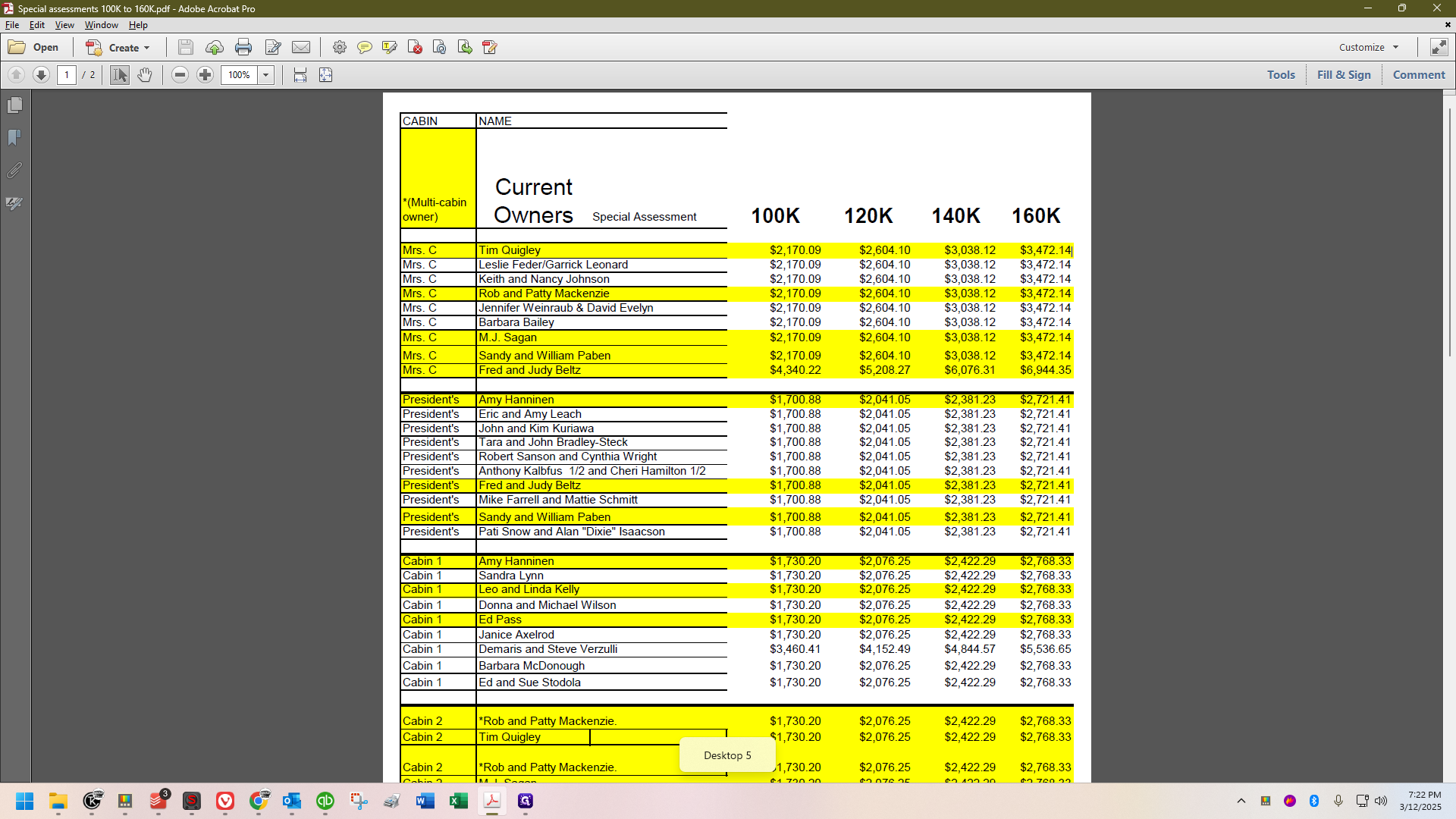

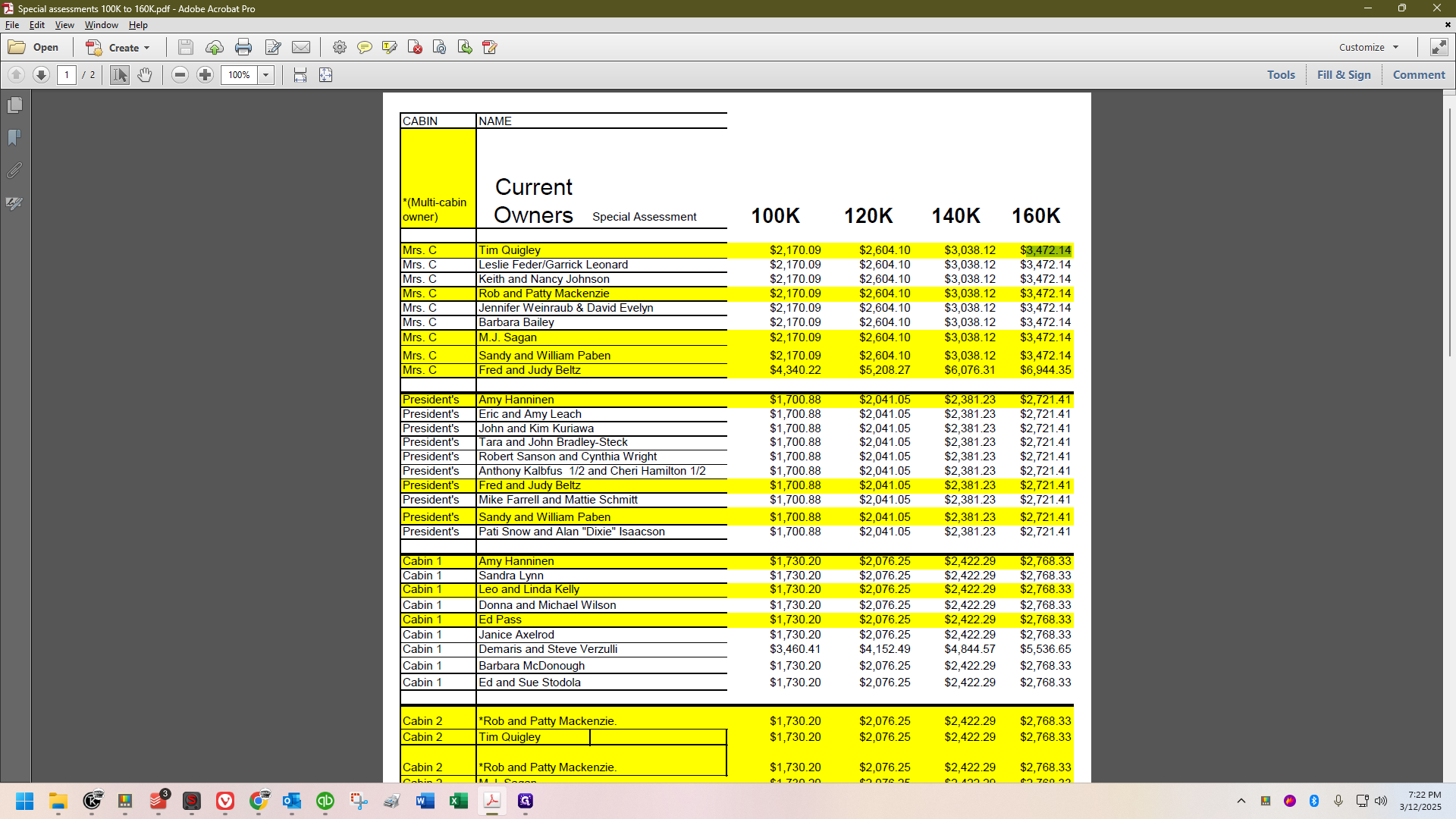

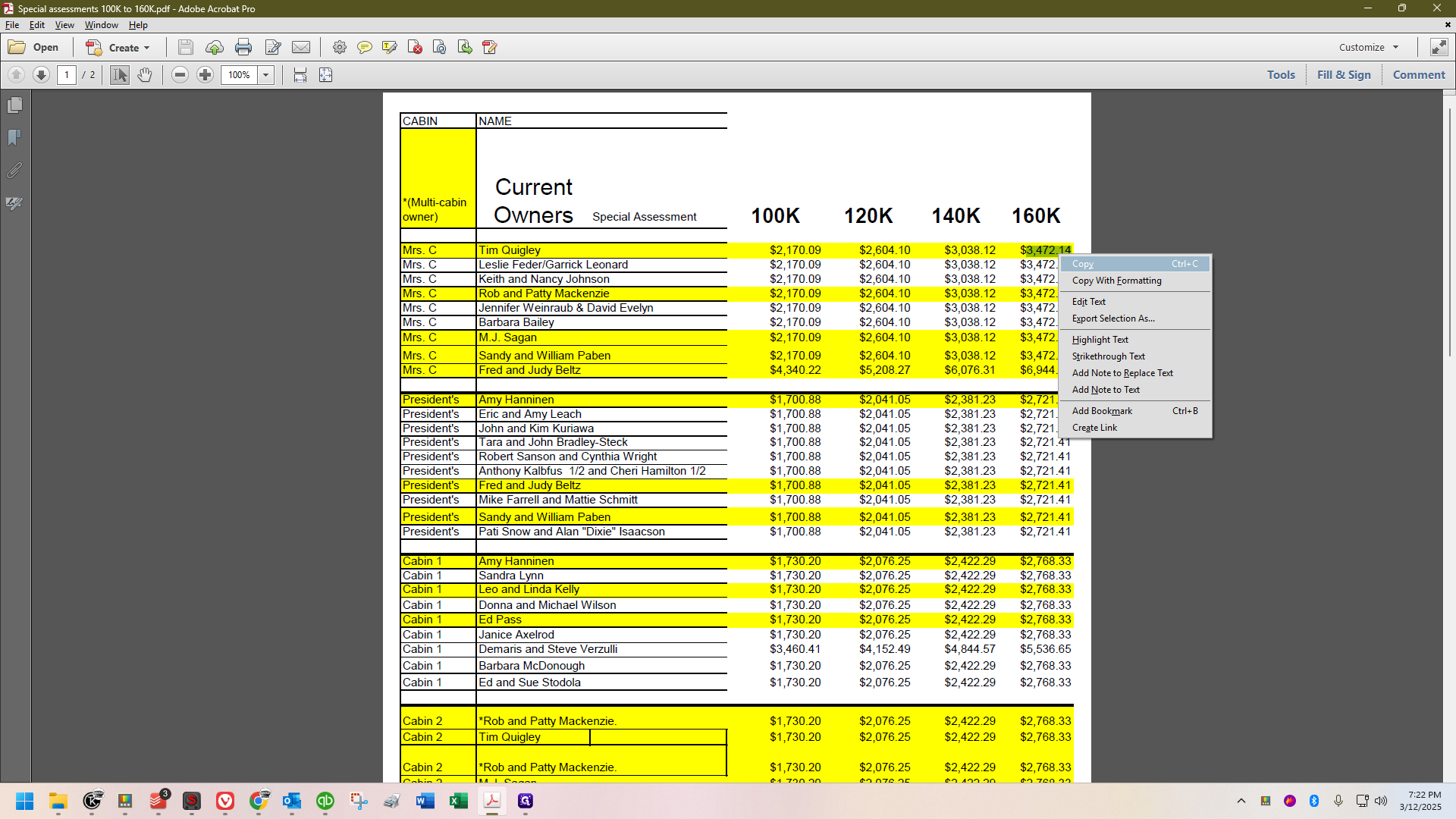

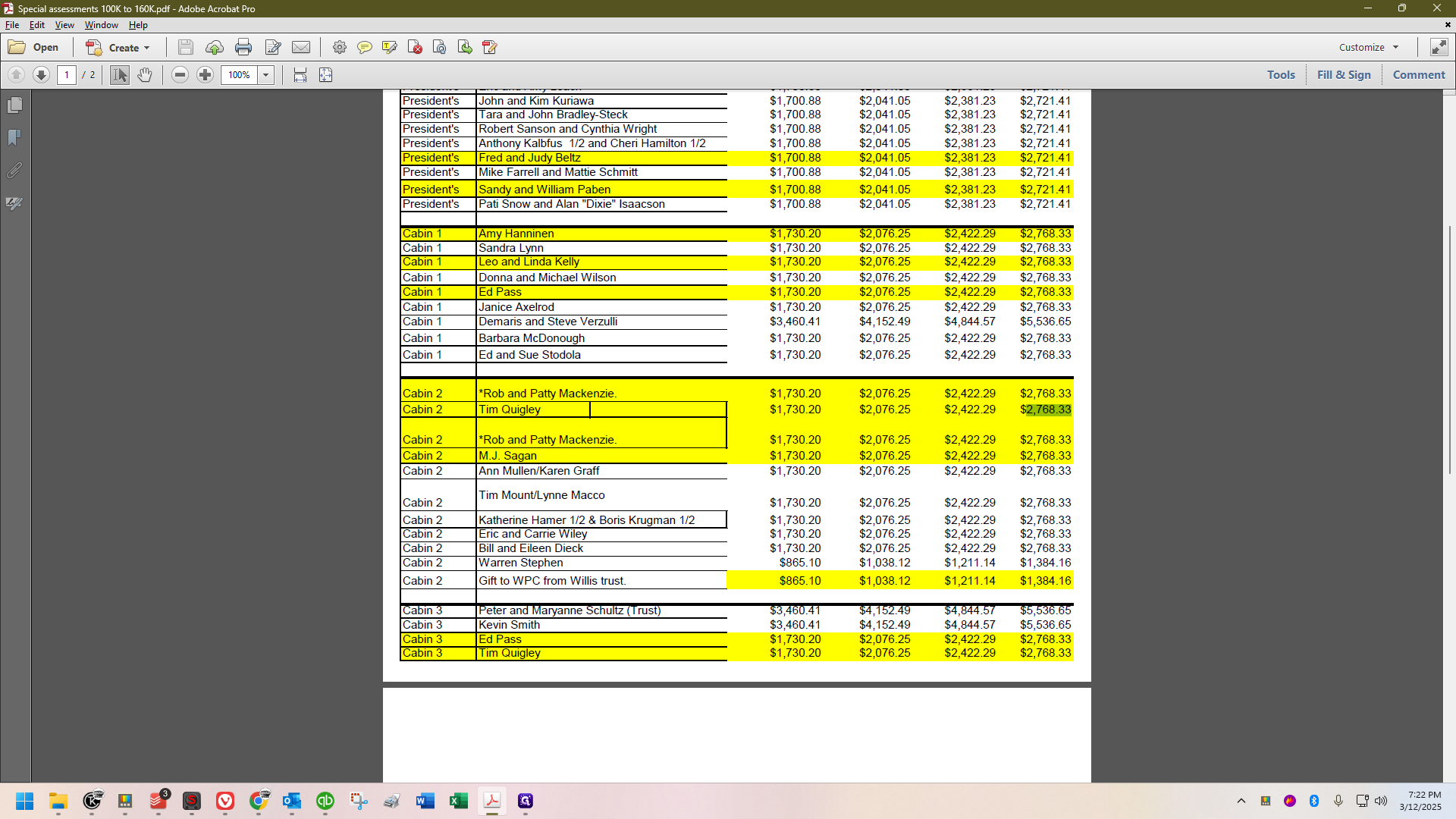

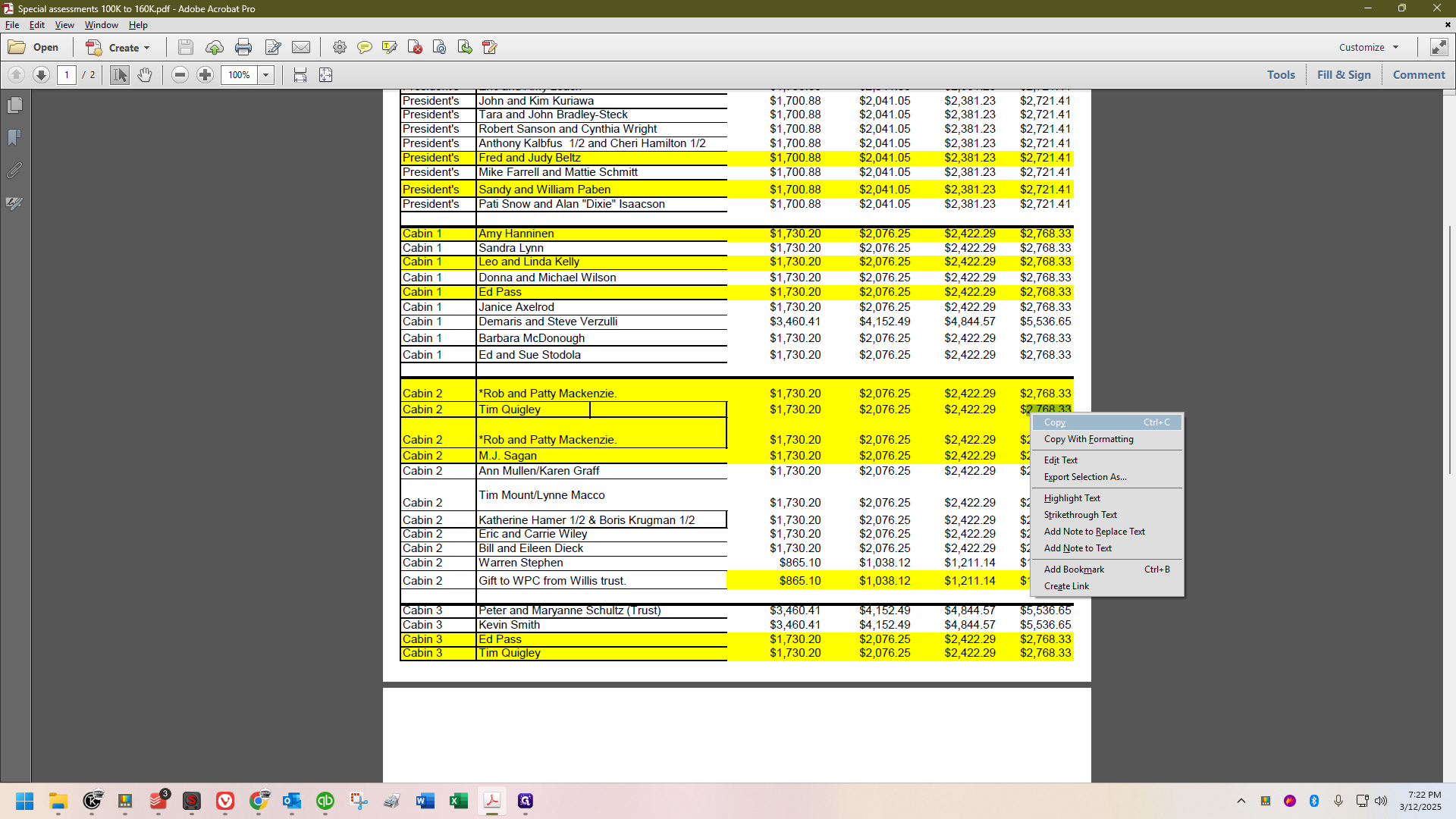

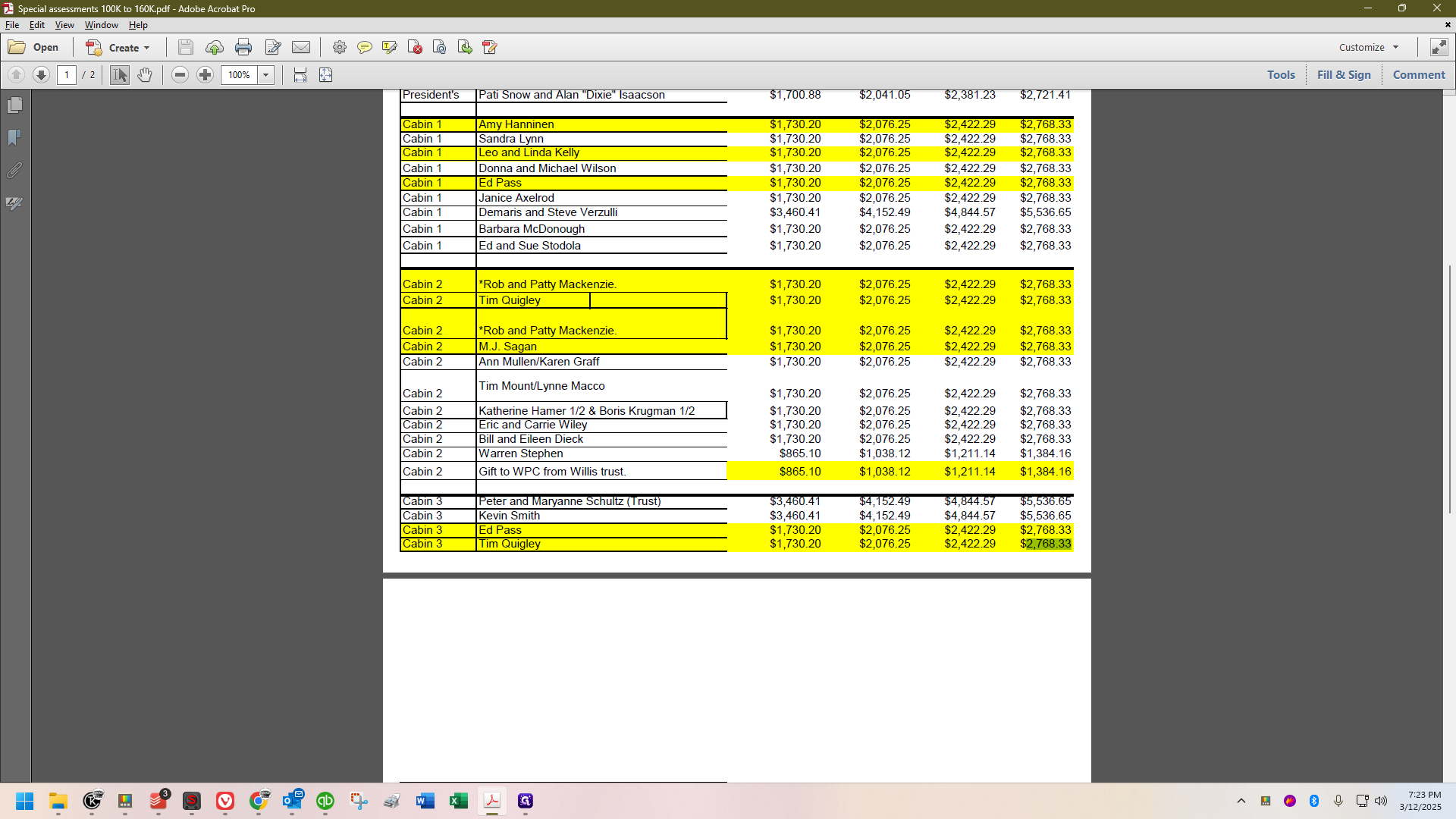

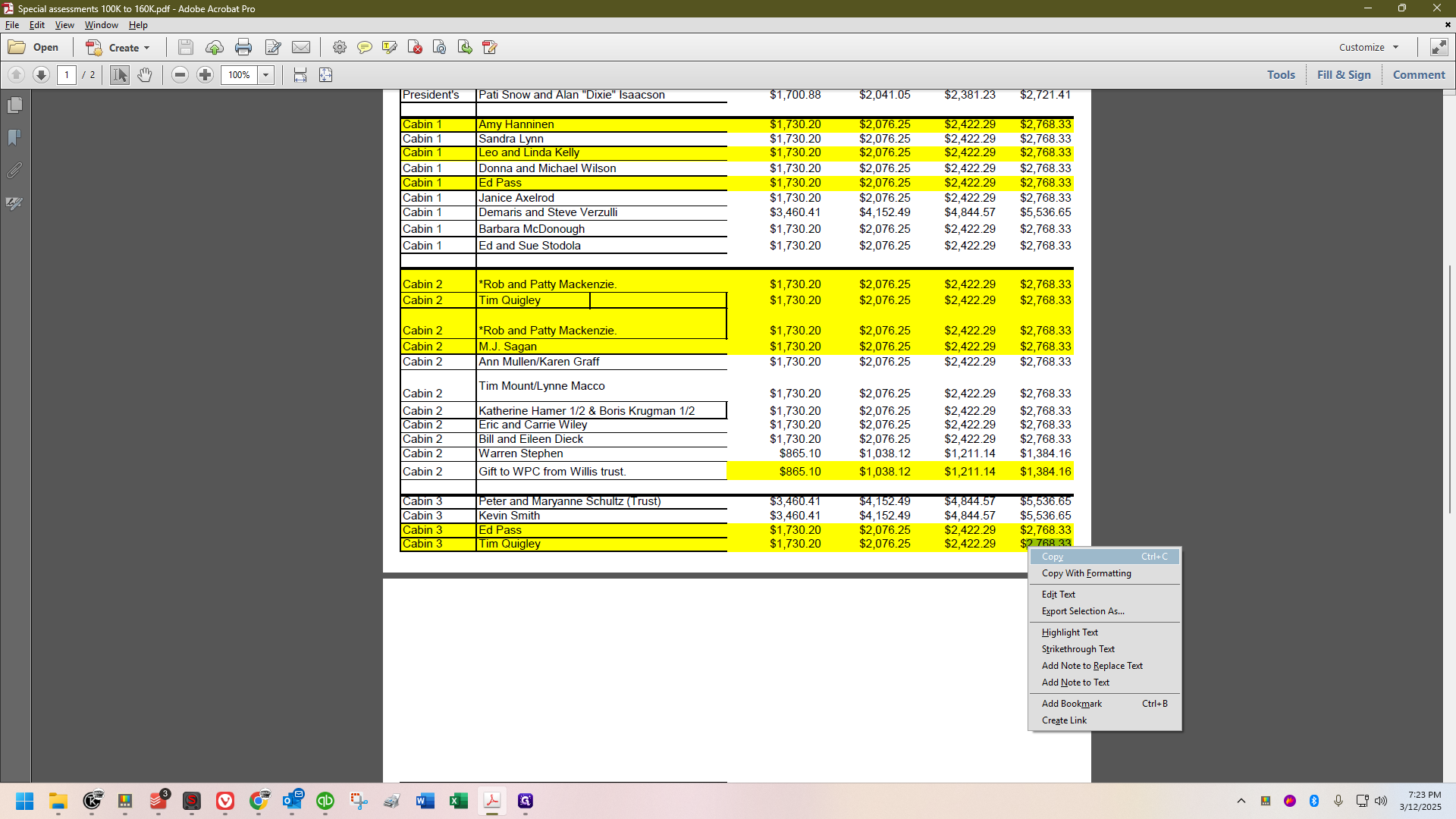

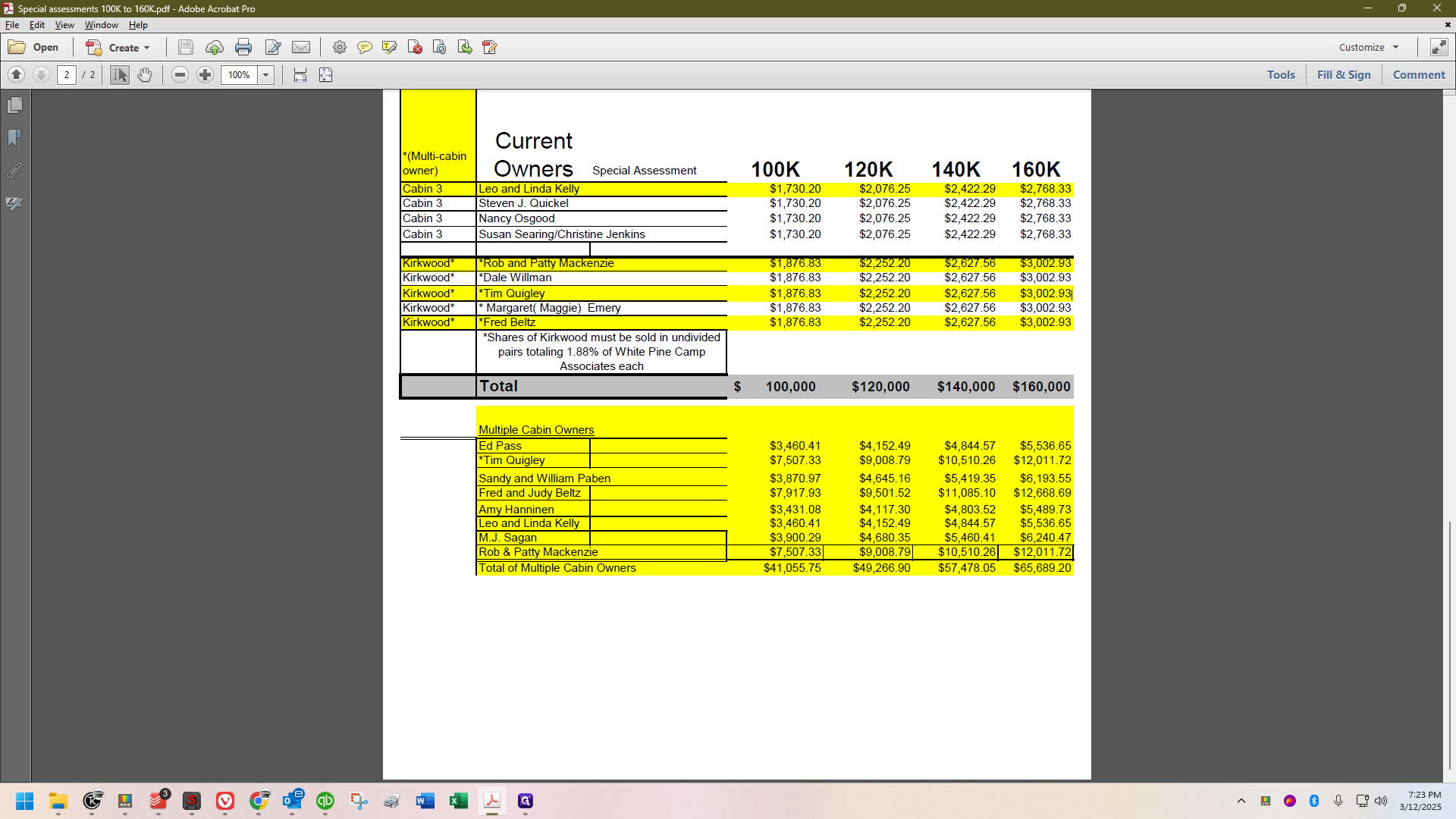

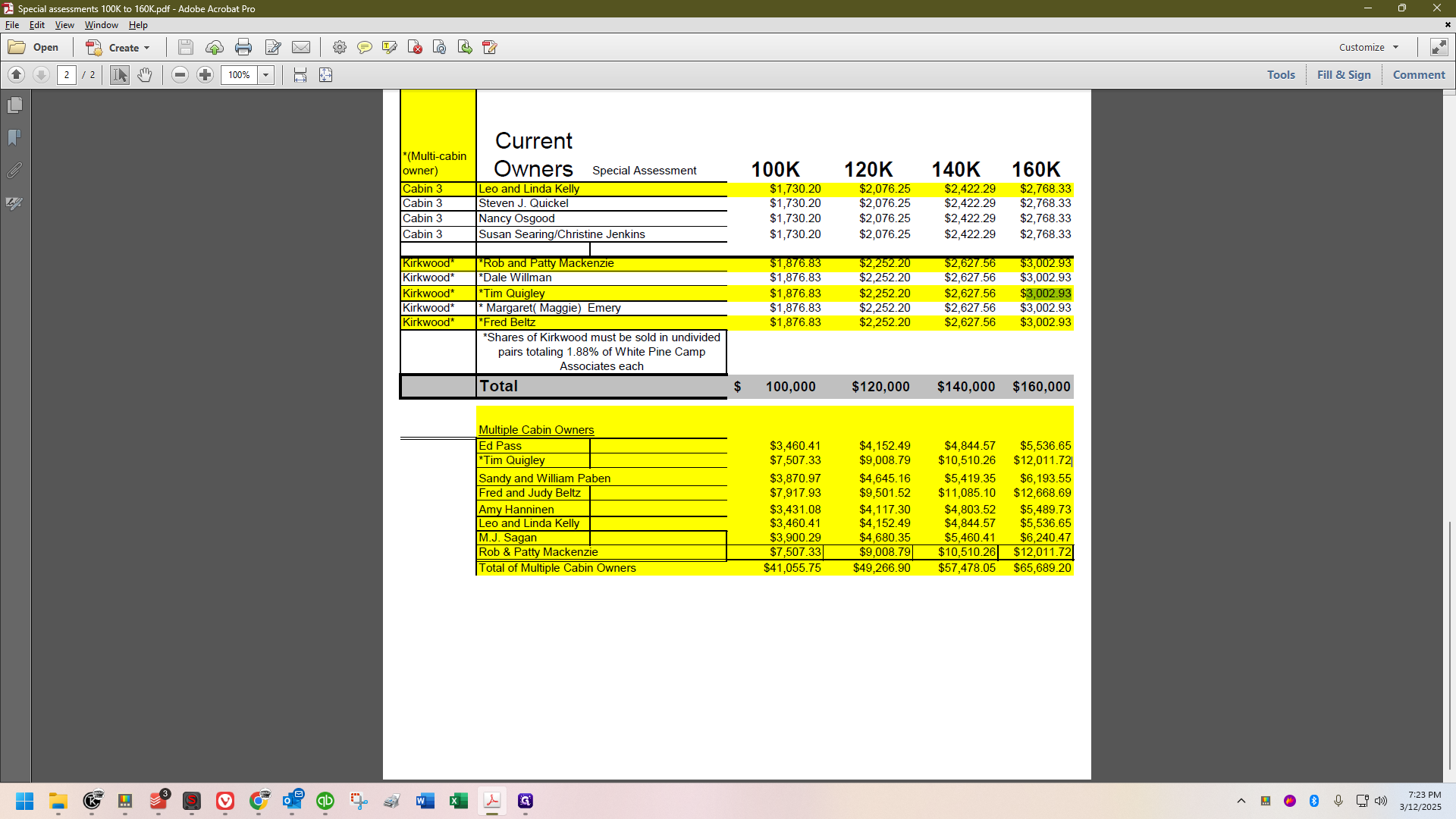

I have already downloaded the attachment. I'll display the PDF on the screen now. It shows the payments each member owes.

This is how it will work, even though this is a specific spreadsheet LMPDF form for a special assessment. The amounts of $100K, $120K, $140K, and $160K were chosen after a lengthy discussion by the steering committee to determine the necessary assessment amount.

They chose to use the $160,000 figure.

The method Steve used is the same as for every annual capital contribution, so you can apply the same principles. I'll show you how I do these quickly and efficiently, minimizing errors more than any other method I've found. If you see yellow coloring, it indicates a multiple cabin owner.

It means the owner has more than one share. For example, Quigley has a share of Mrs.

Coolidge's name is highlighted in yellow. If you scroll down, you'll find him again with a share of cabin 2.

Scroll down further, and we find him sharing cabin 3.

Additionally, he has a few shares of Kirkwood, as Kirkwood will always be in an undivided pair.

He has five shares. If you look at the bottom, you'll see the total for all the multiple cabin owners.

If there's no yellow color, it means that is the only share the person owns, or in Kirkwood's case, the only pair of shares.

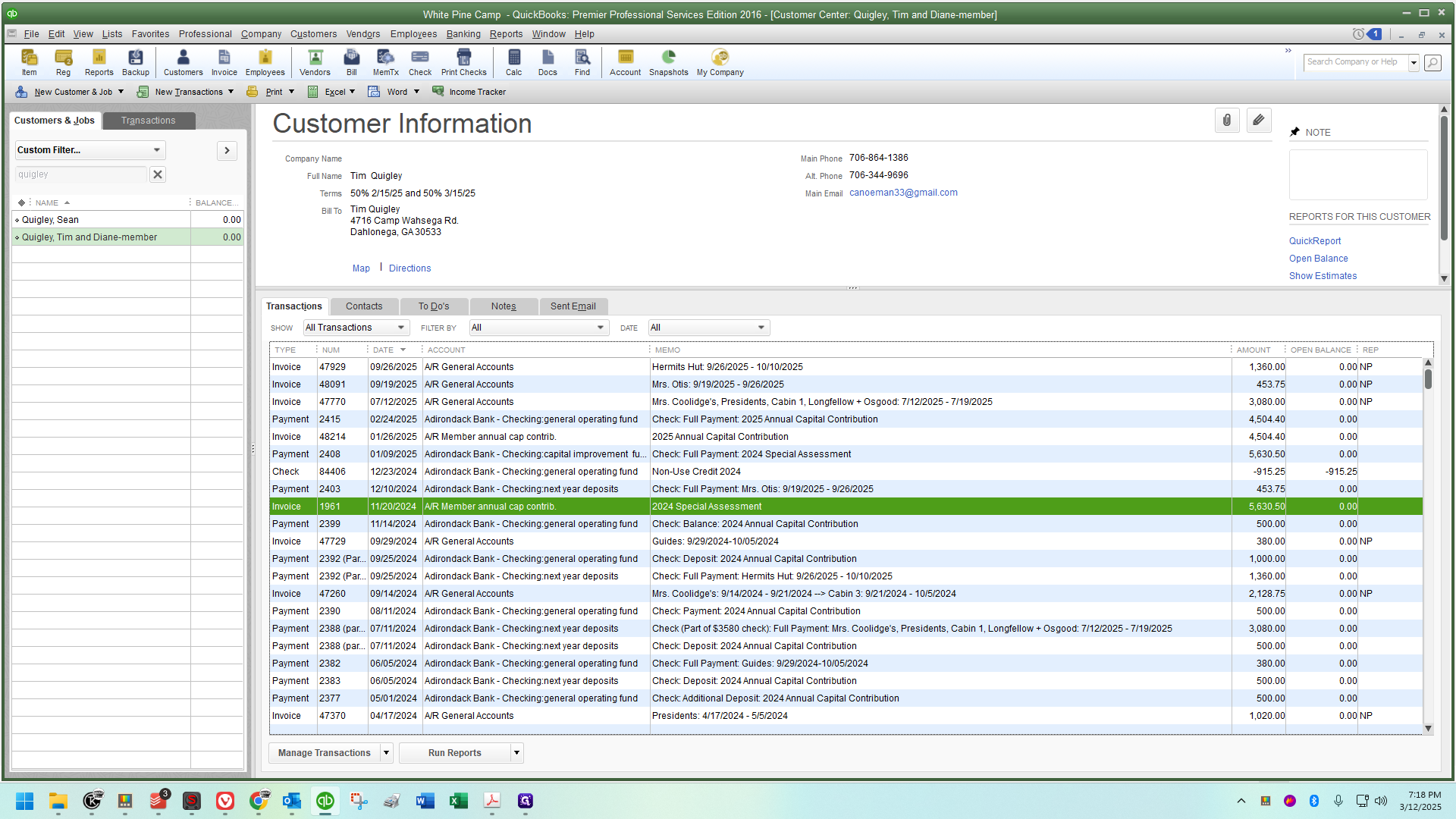

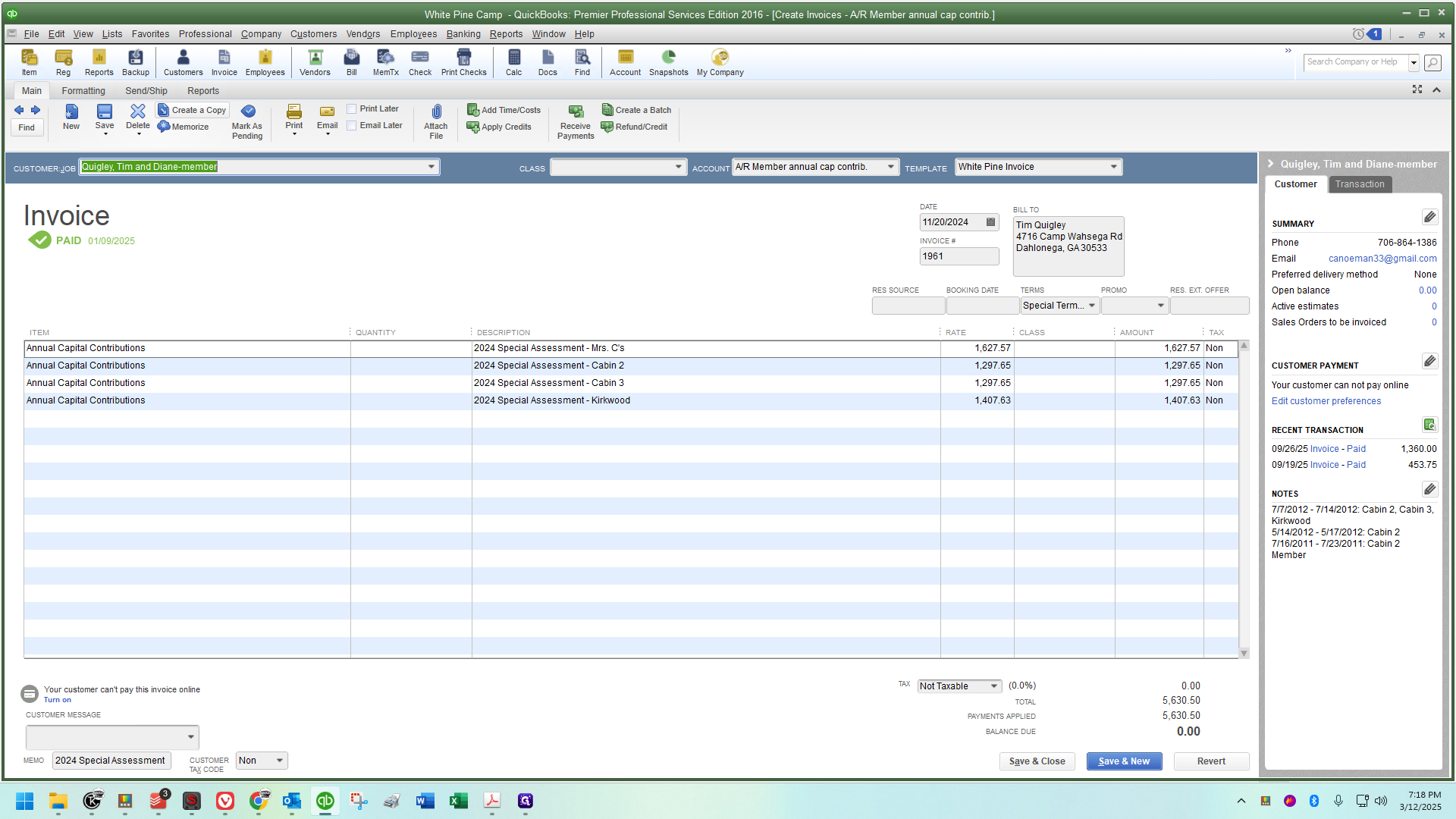

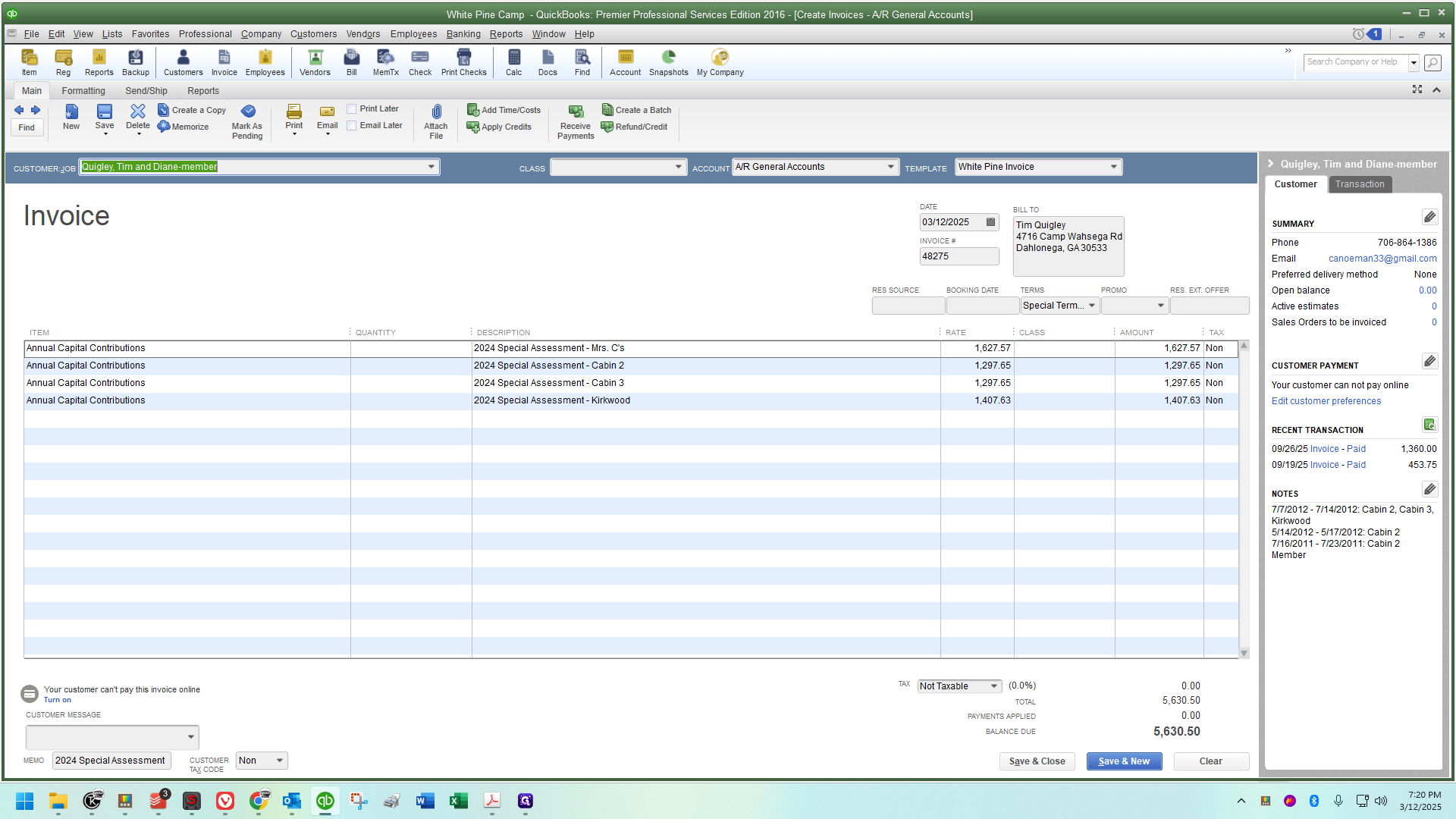

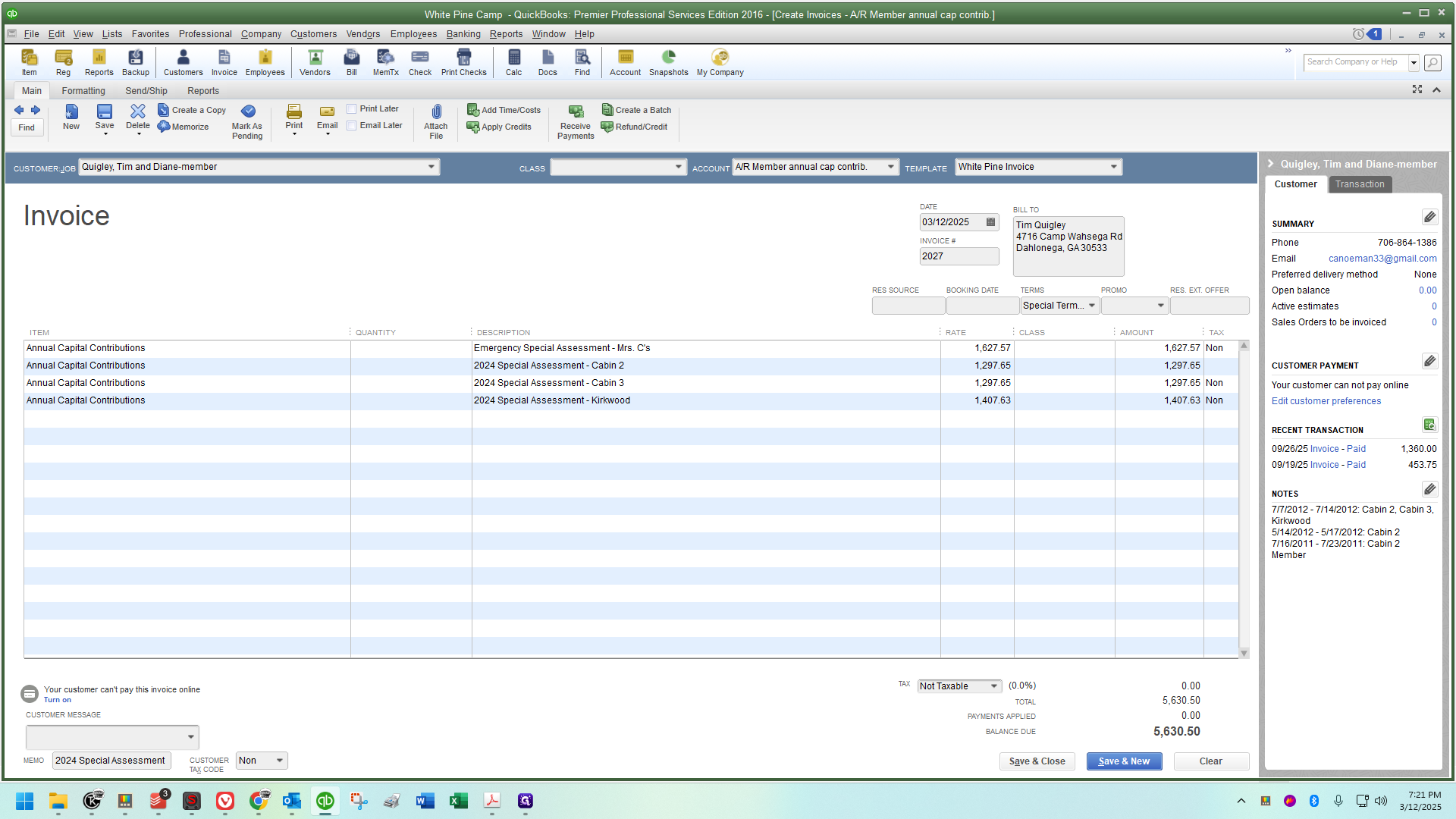

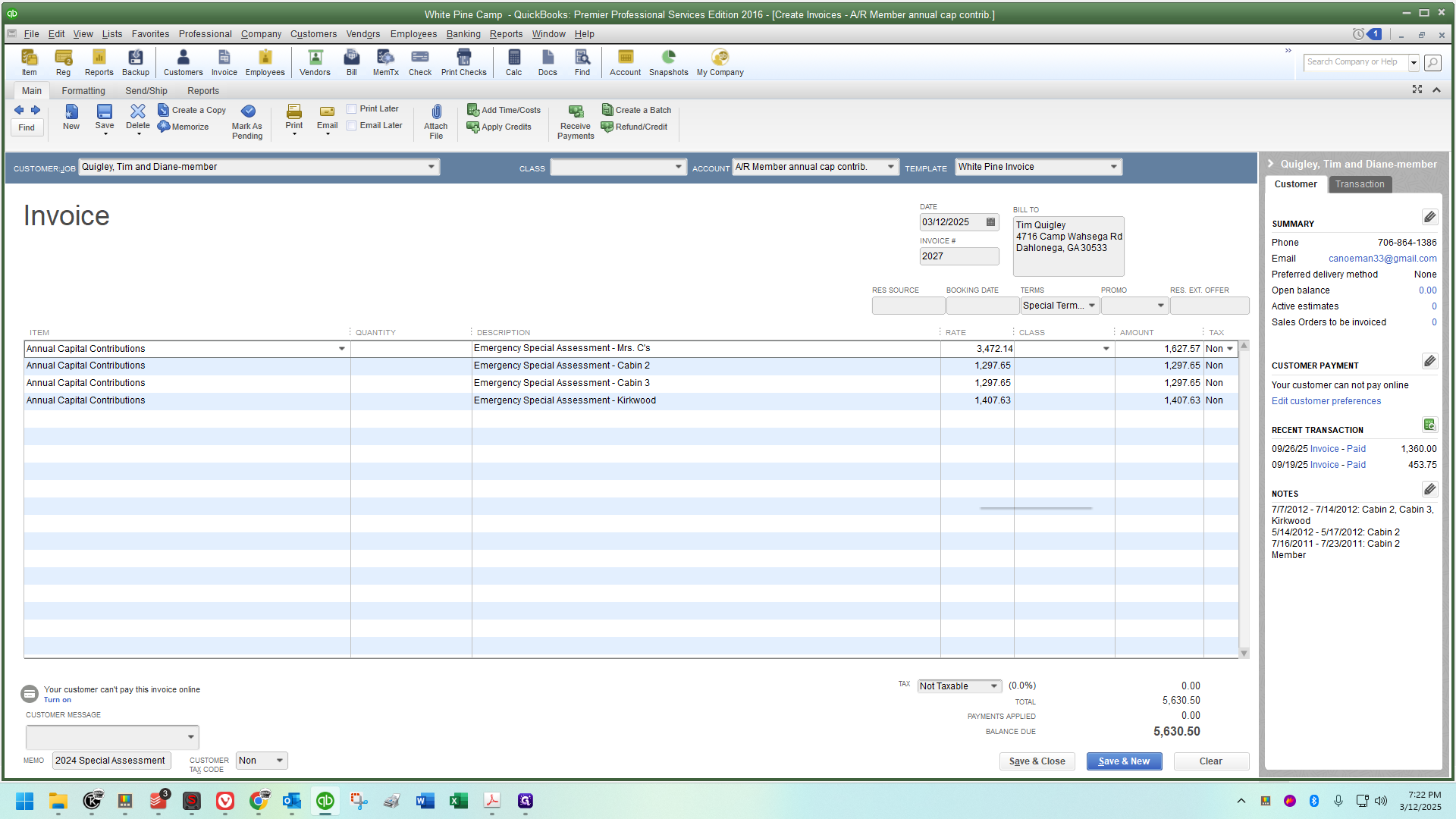

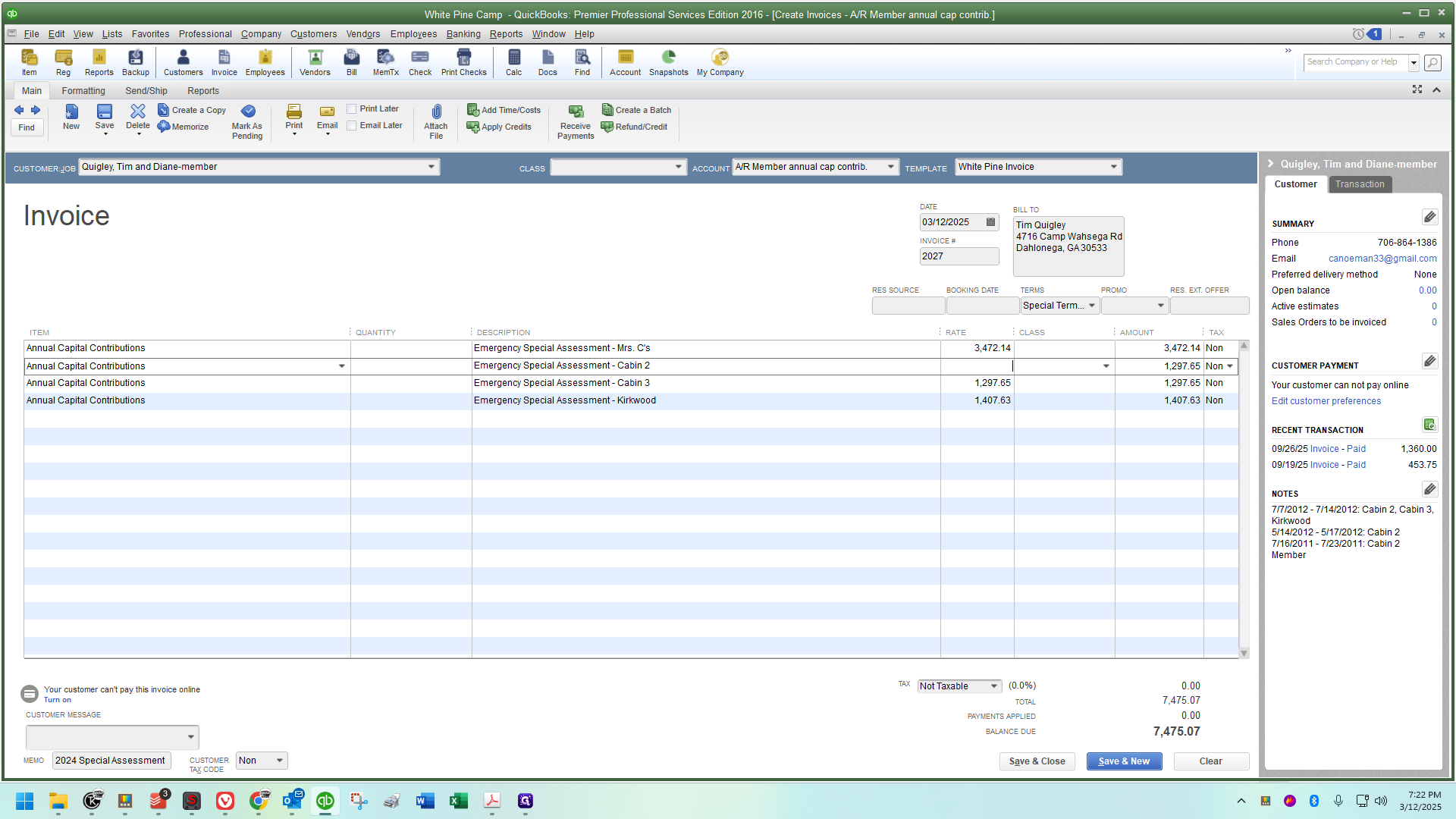

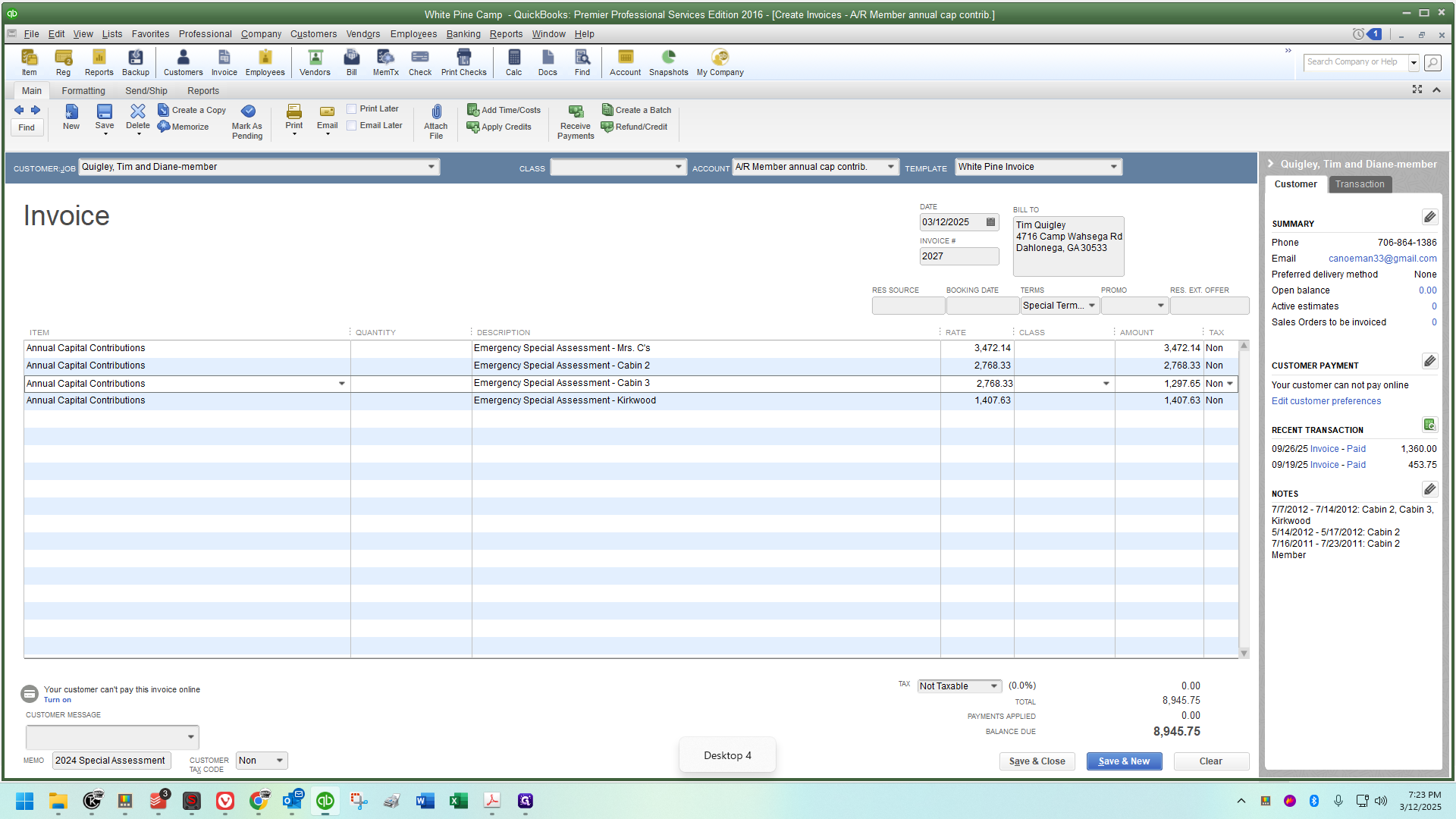

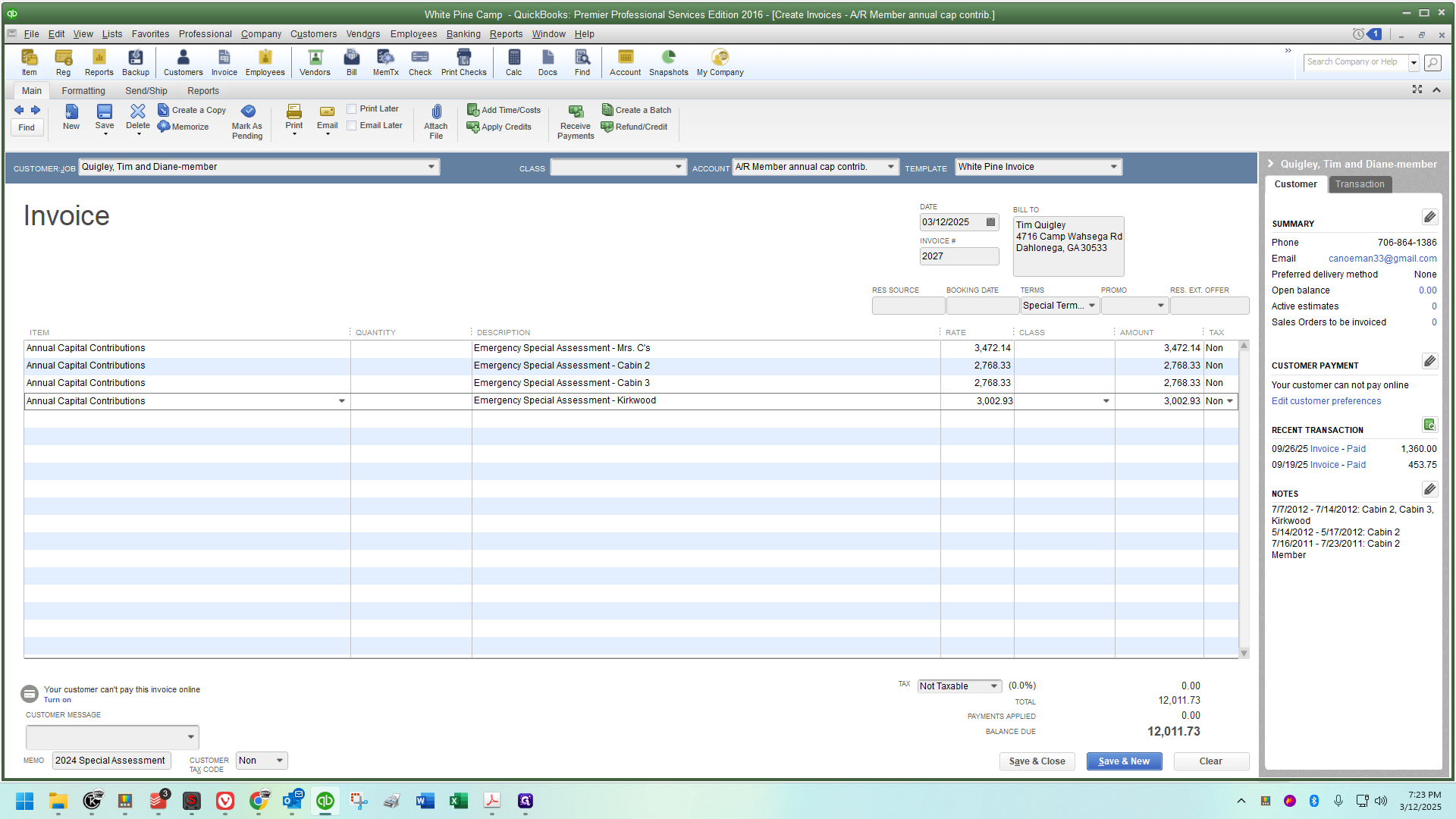

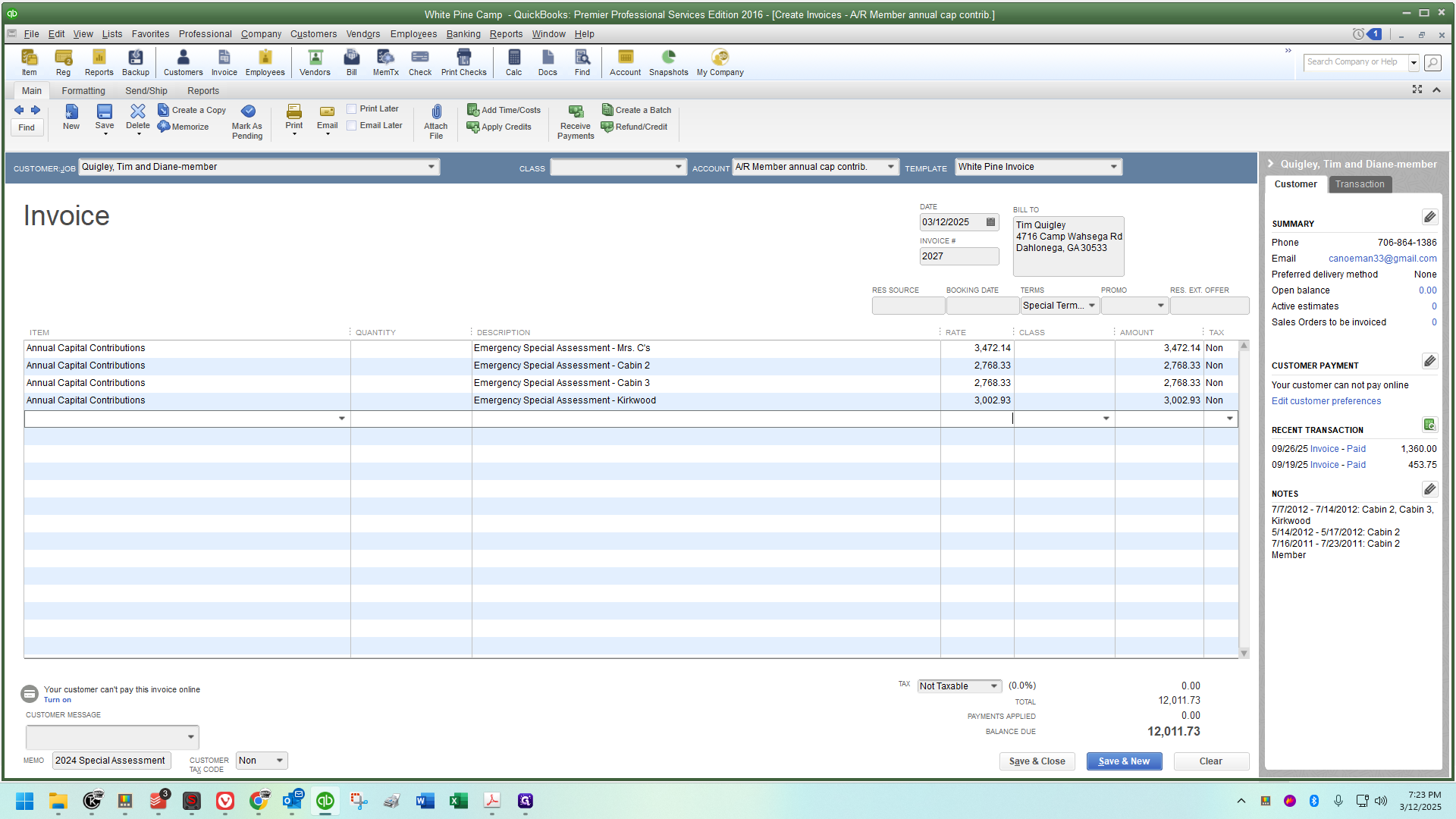

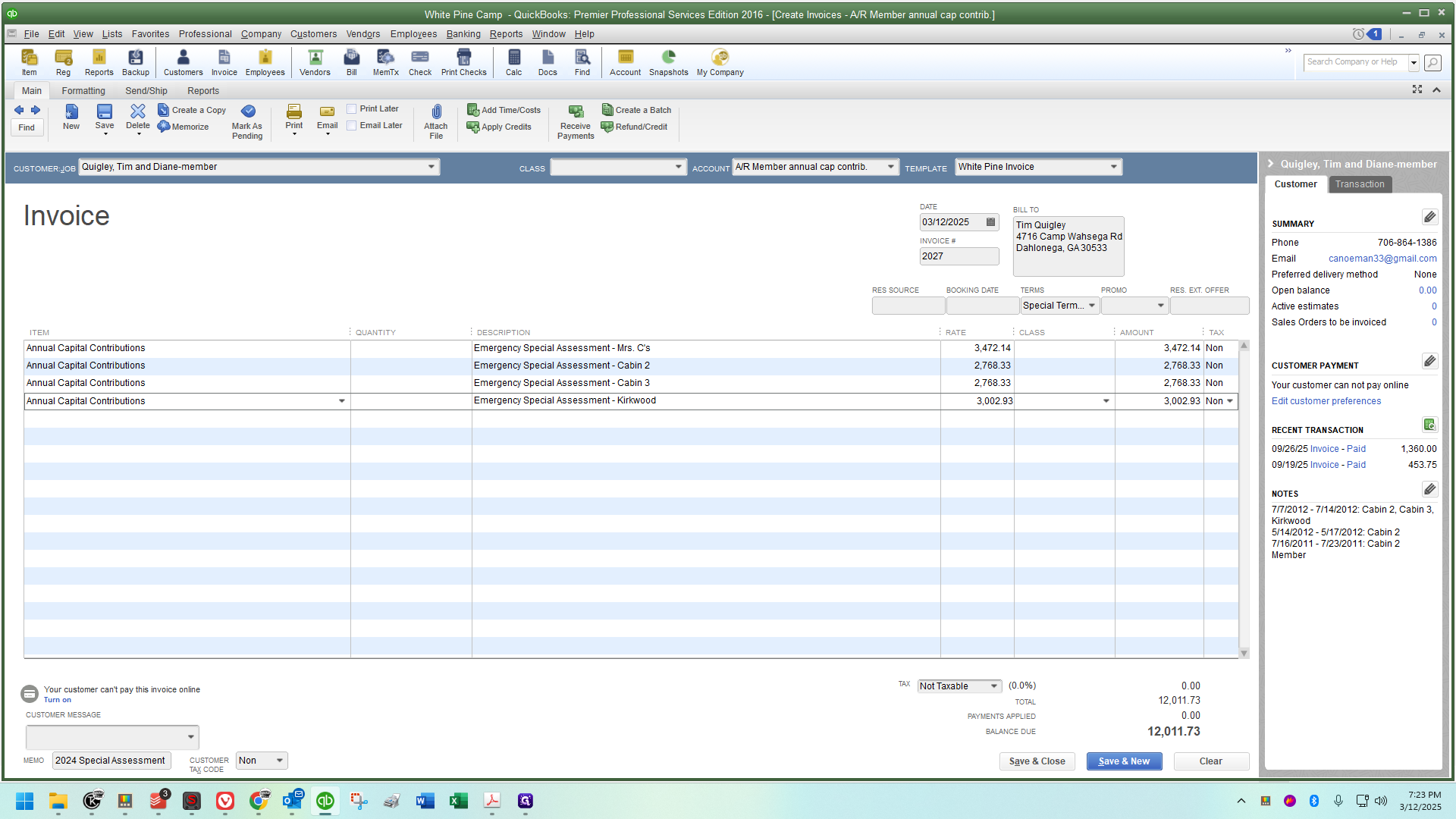

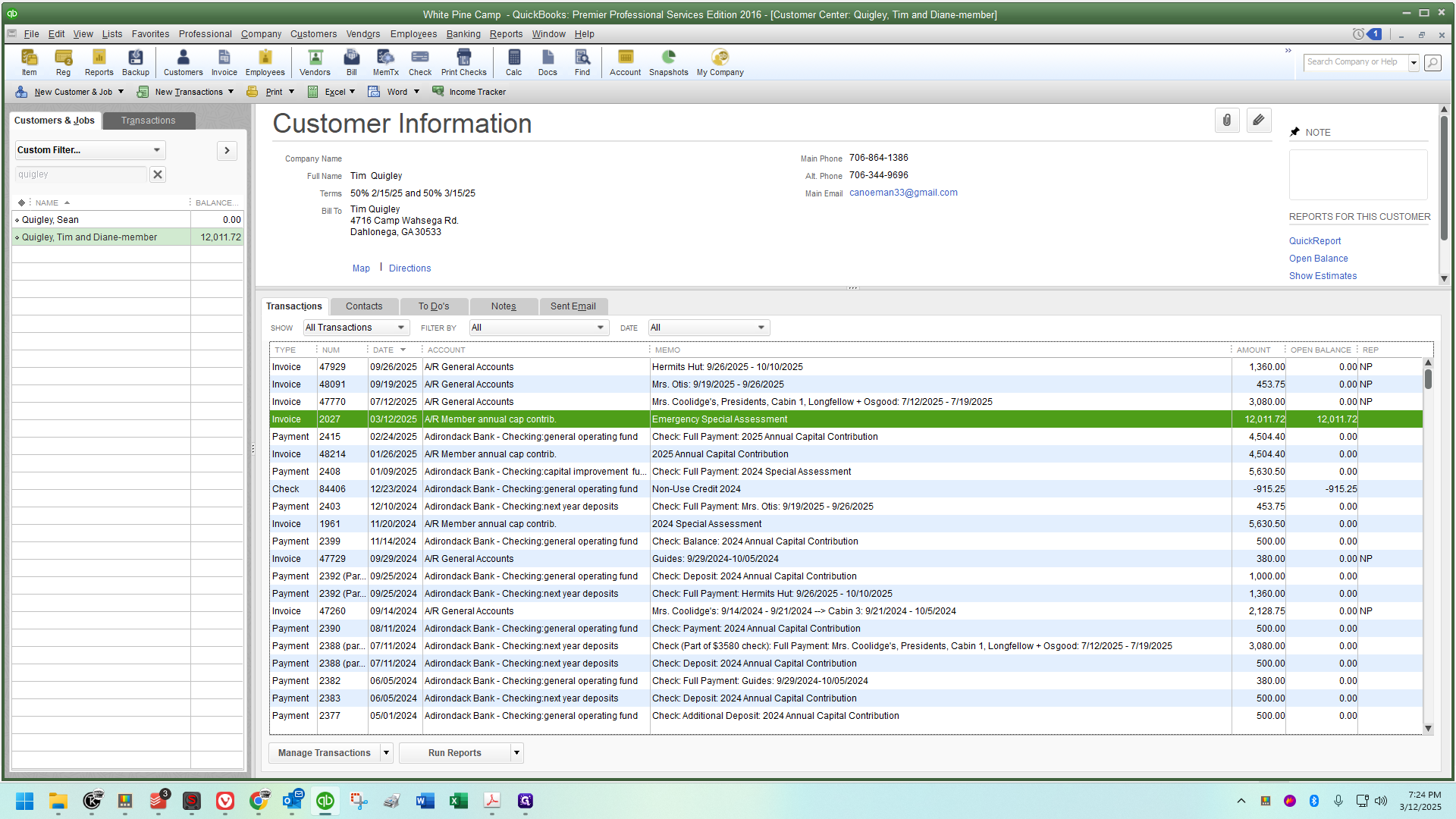

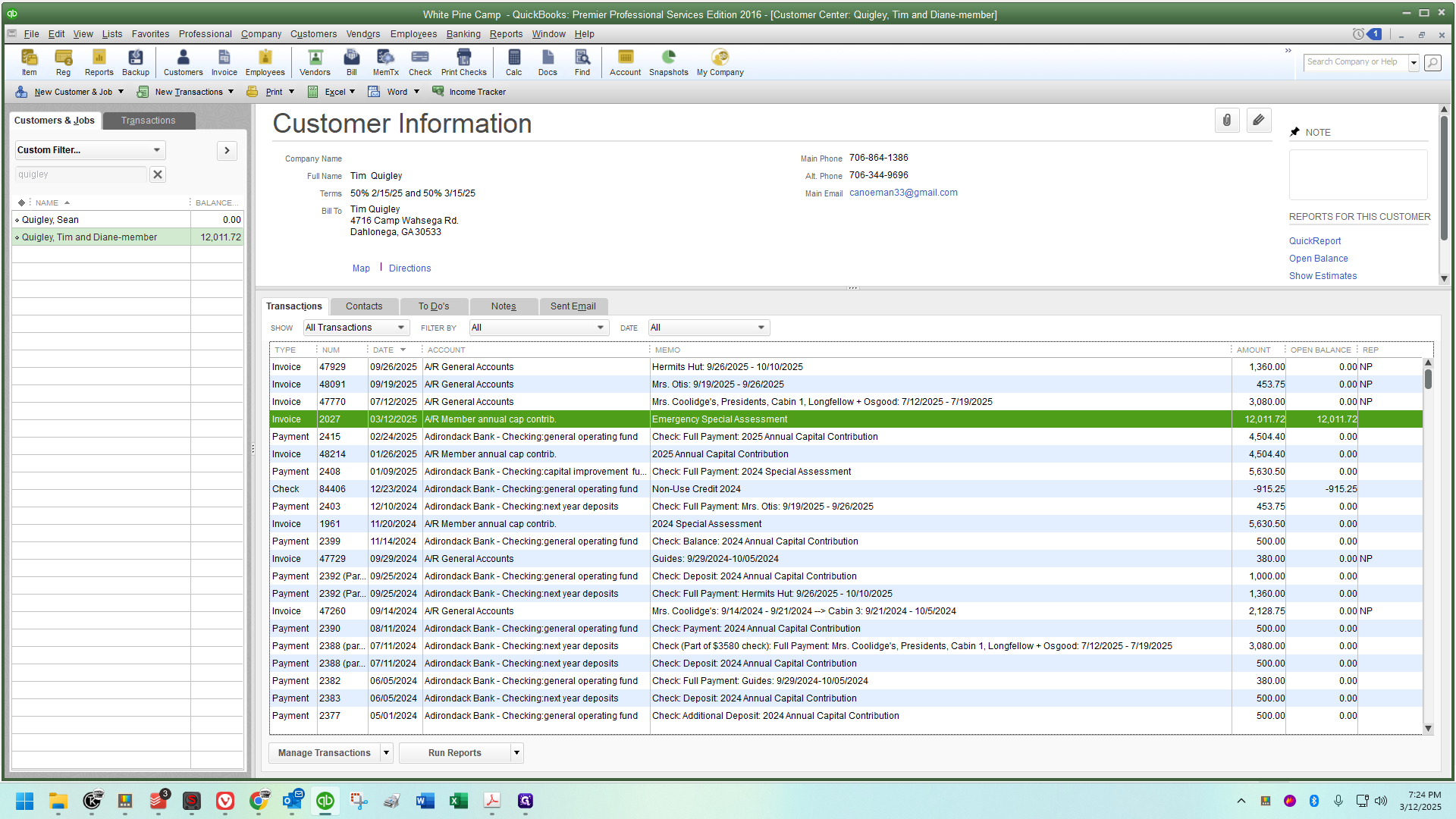

With that in mind, I like to focus on one task at the start and then move on to the rest. I'll begin with the multiple cabin owners. First, go into QuickBooks and find the account of the person you're starting with. In my case, that's Tim Quigley, and I've already pulled up his account.

Last November, there was a special assessment. Additionally, at the start of each year, around this date, you will have the annual capital contribution.

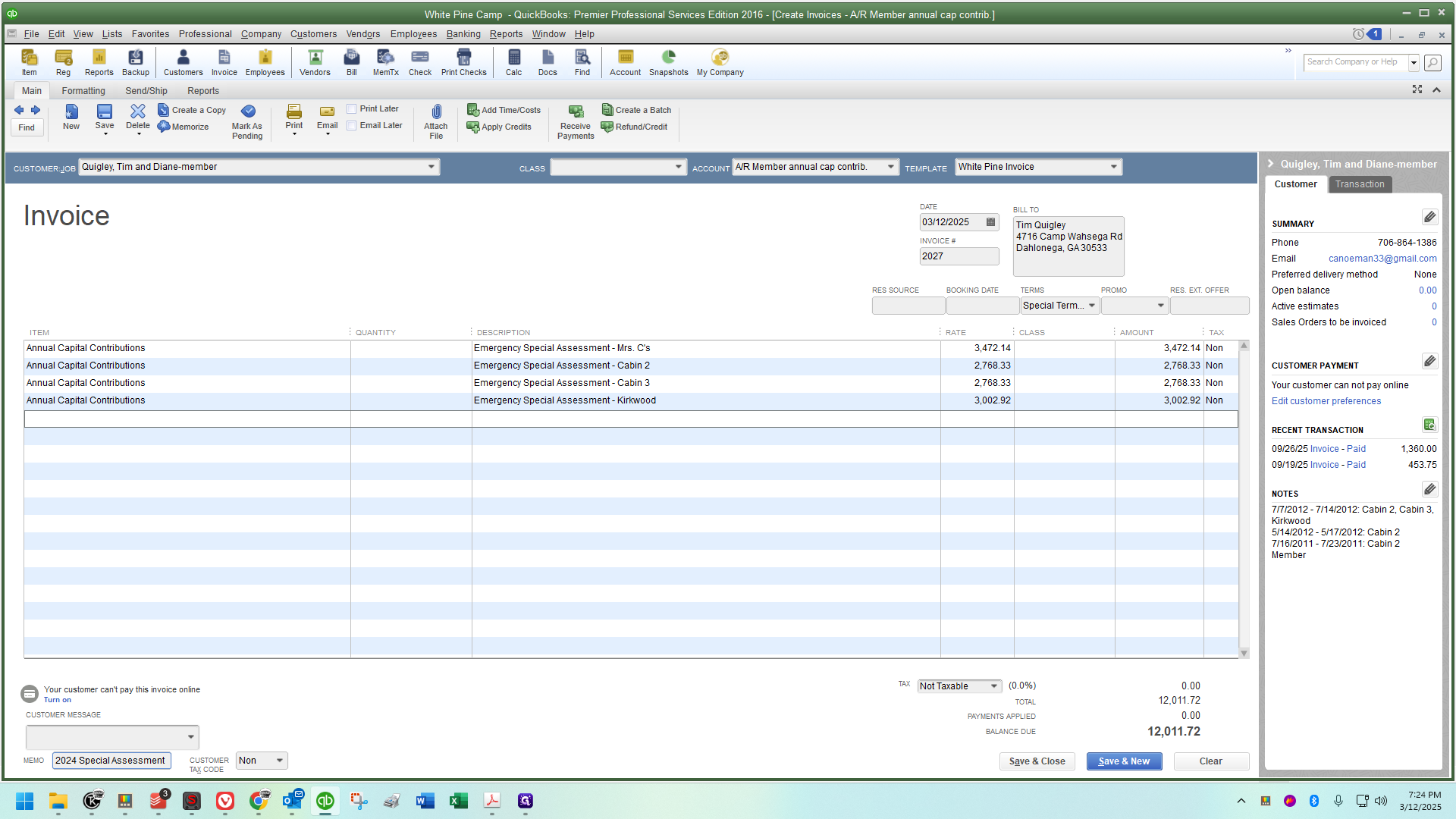

Both use the accounts receivable annual capital contribution account. This is the main difference compared to a regular invoice.

We usually ignore that field, as almost everything else is accounts receivable. However, for these invoices, we'll use the annual capital contribution. Since I have a special assessment available, I'll refer to that.

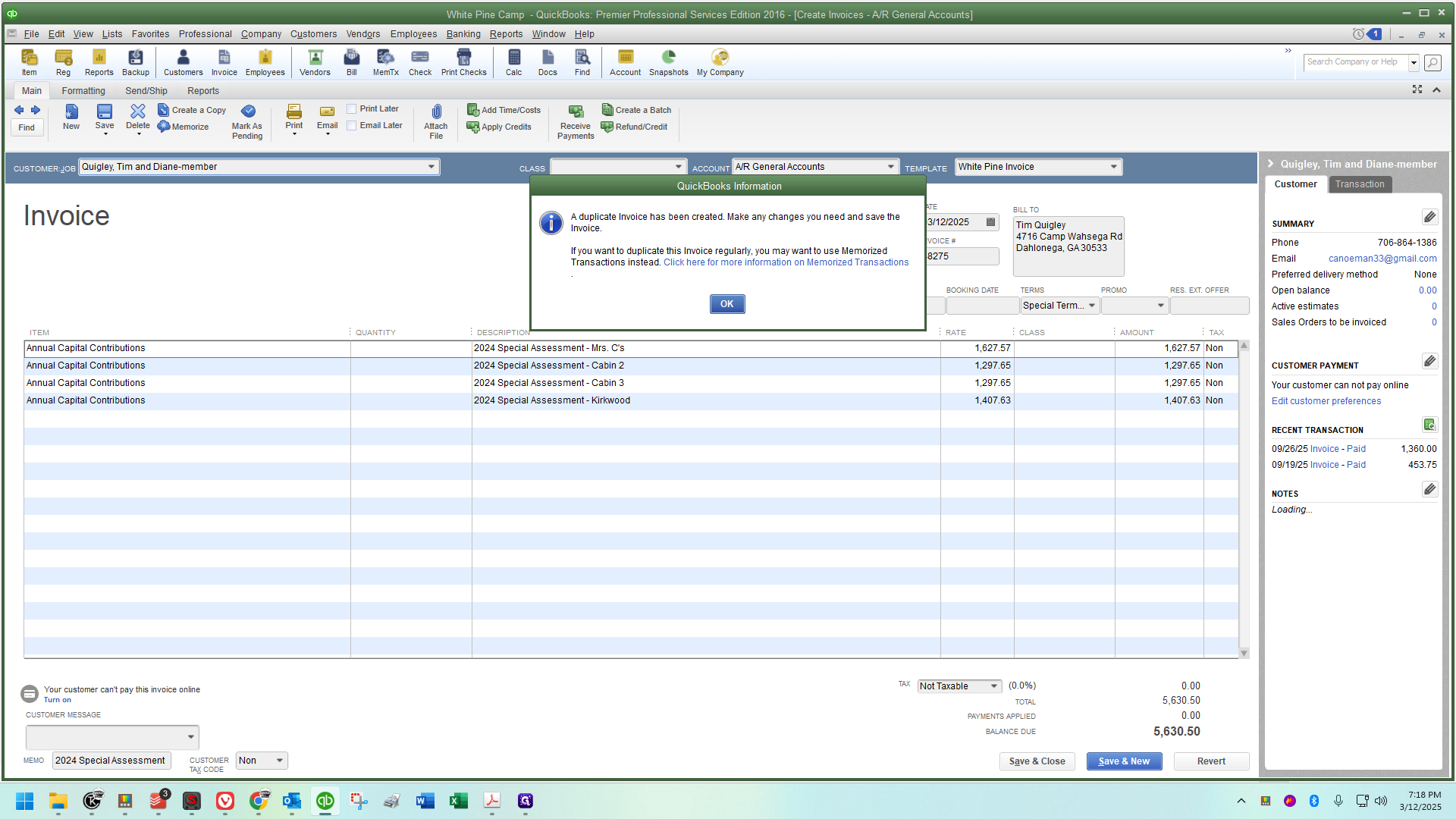

If not, I would access the capital contribution and create a copy.

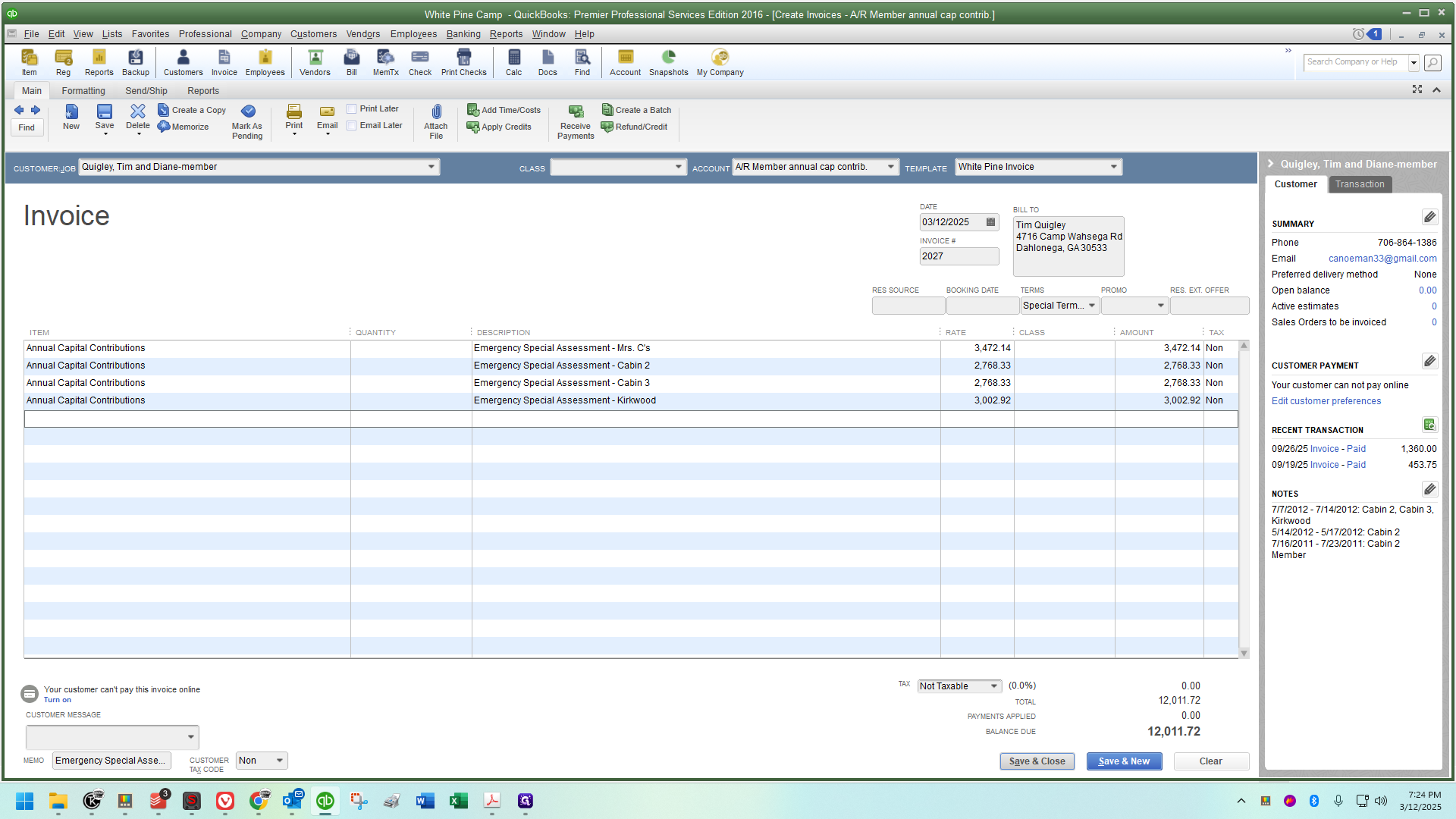

A message will confirm a duplicate has been created. Click OK. You'll know it worked if the invoice date is today's date, as copies default to the current day.

Today, I'm working on this the same day Sandy sent out the announcement about the special assessment. I'll keep today's date. You should use your own situation to determine the appropriate date. For this task, we can ignore many details like reservation source and booking date, as they are blank. The terms are special terms, and we'll leave them as they are.

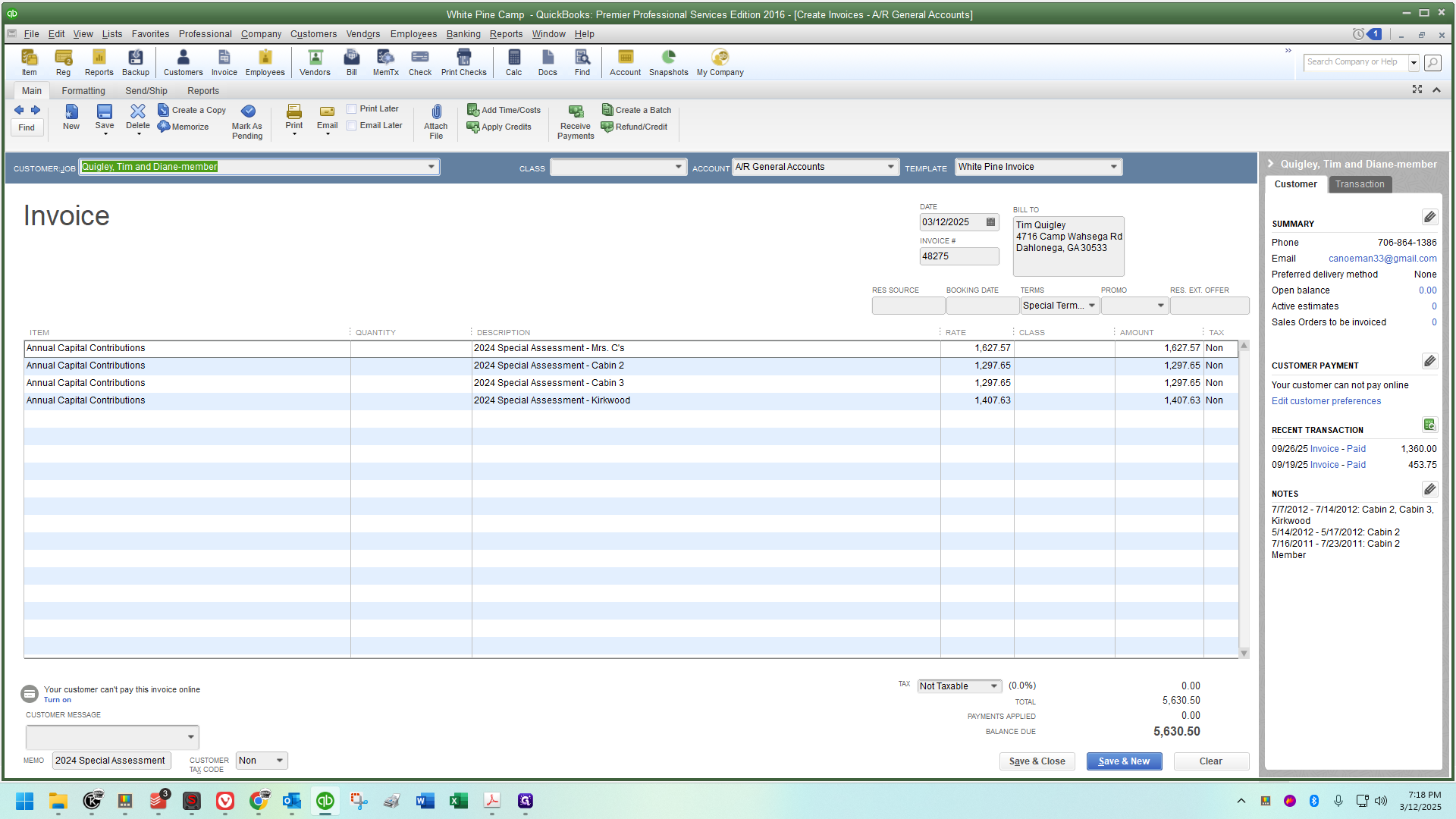

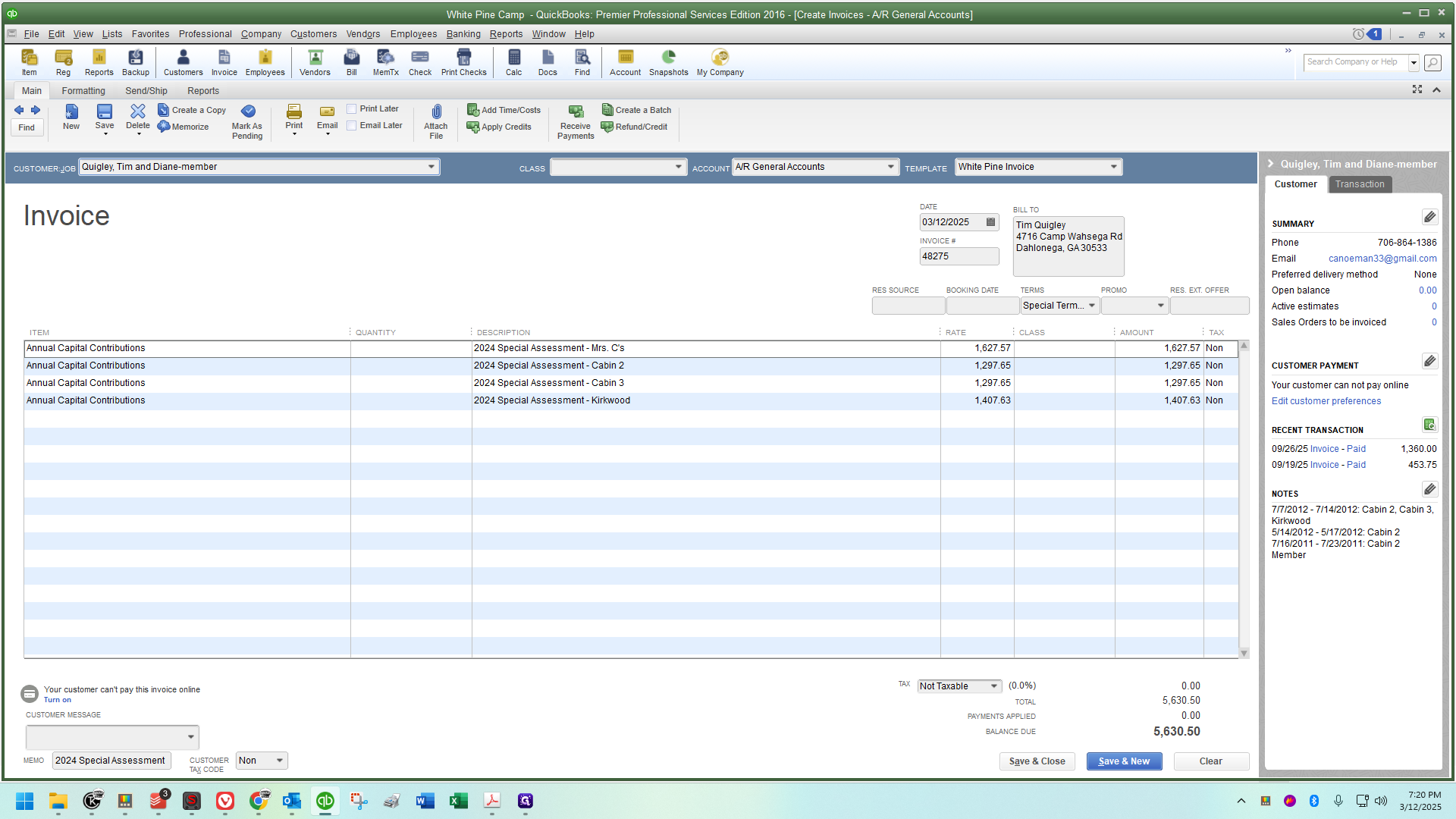

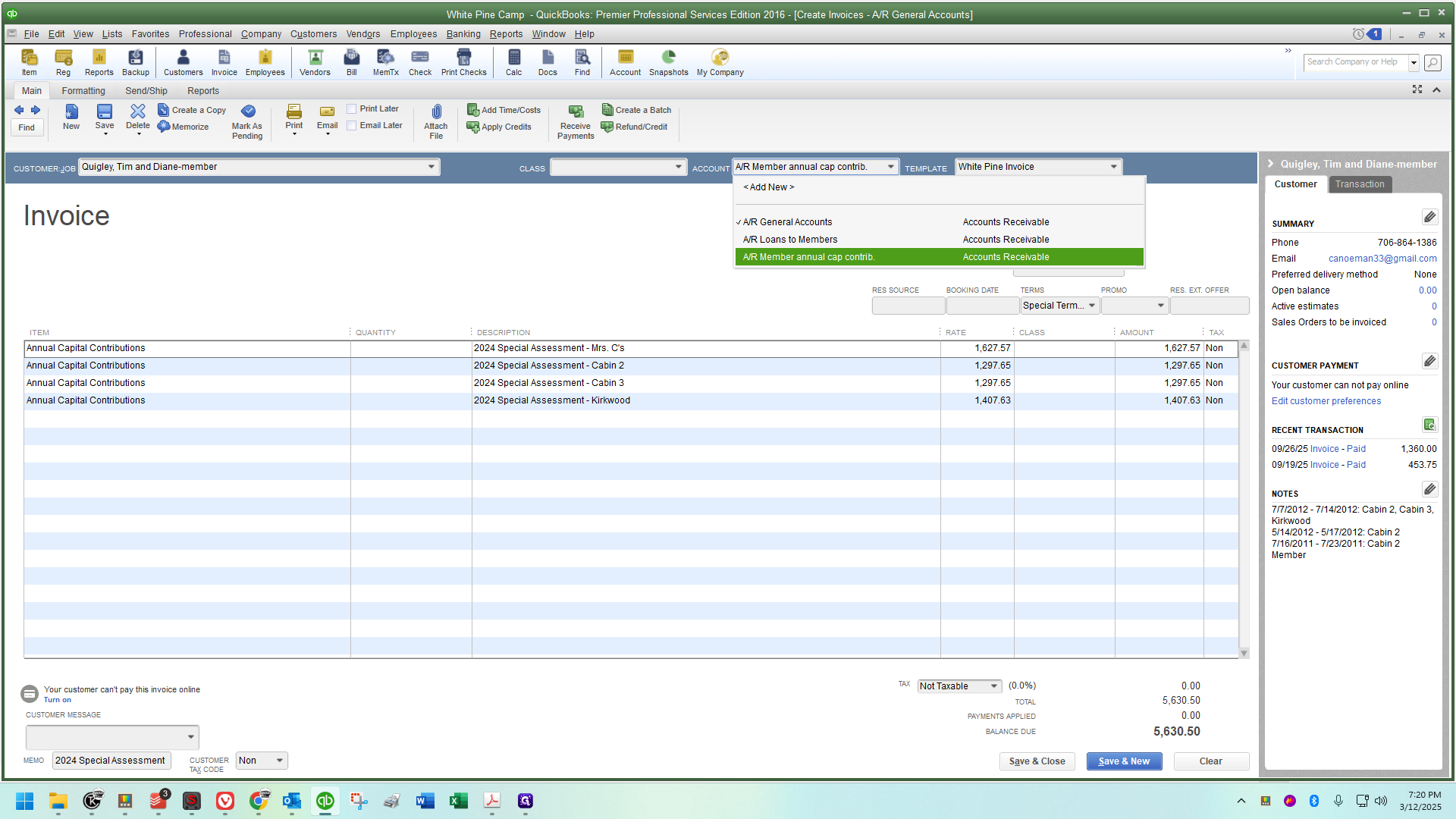

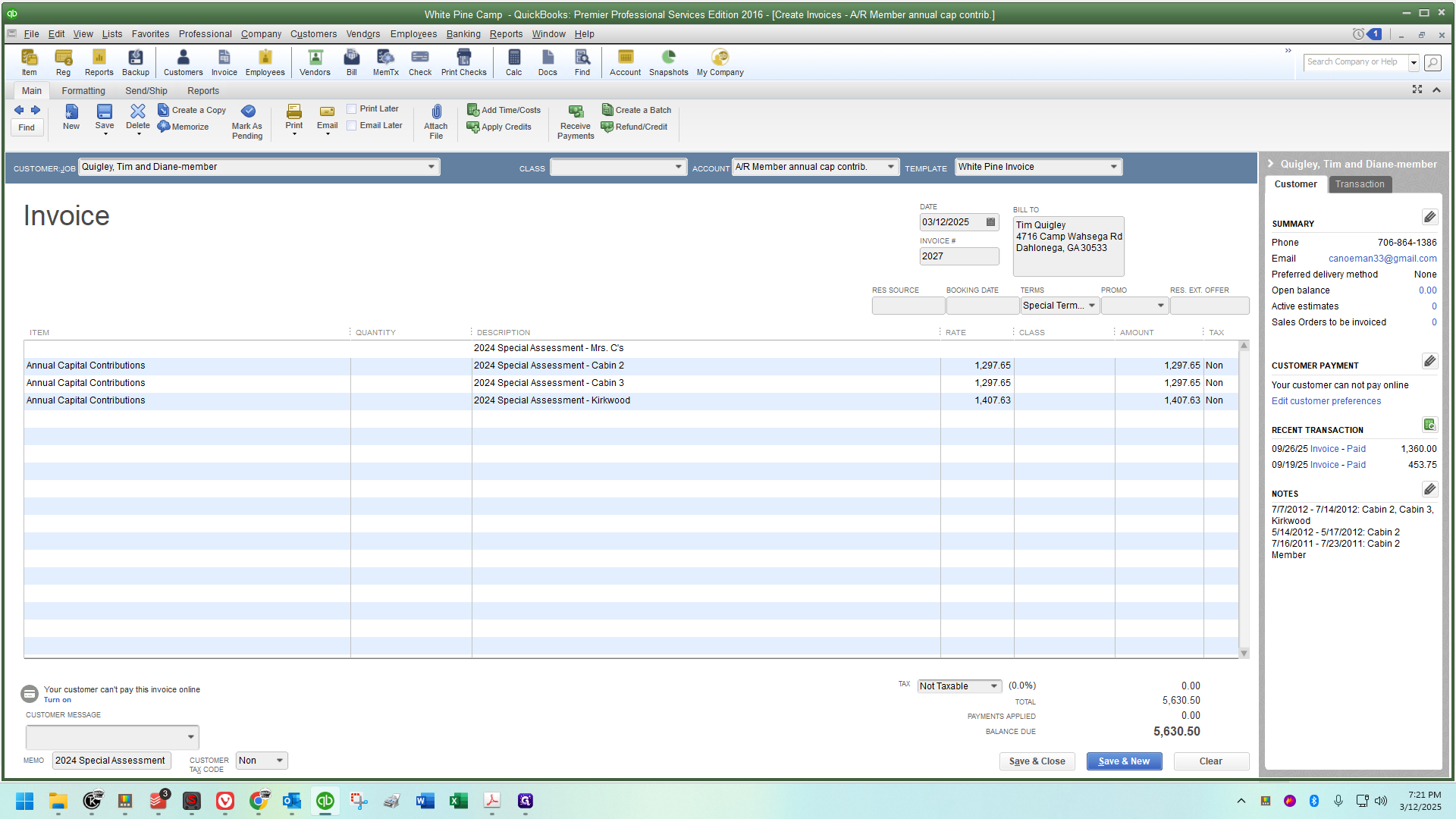

I will only change the notations and the amount of money. First, I'll ensure the account is correct. When I created the duplicate, it reverted to the general accounts, so I need to change it to the member annual capital account.

That part is something we're not used to handling, and I'm glad I noticed it when I did! It's easy to overlook. The last thing you want is to be halfway through and realize you haven't been making the necessary changes. Even though we duplicated one that was already set up, QuickBooks defaults to the usual AR. For multiple cabin owners, I prefer to set the notation correctly for each line, specifying the share each line is referencing (I don't always bother with the single cabin shareholders).

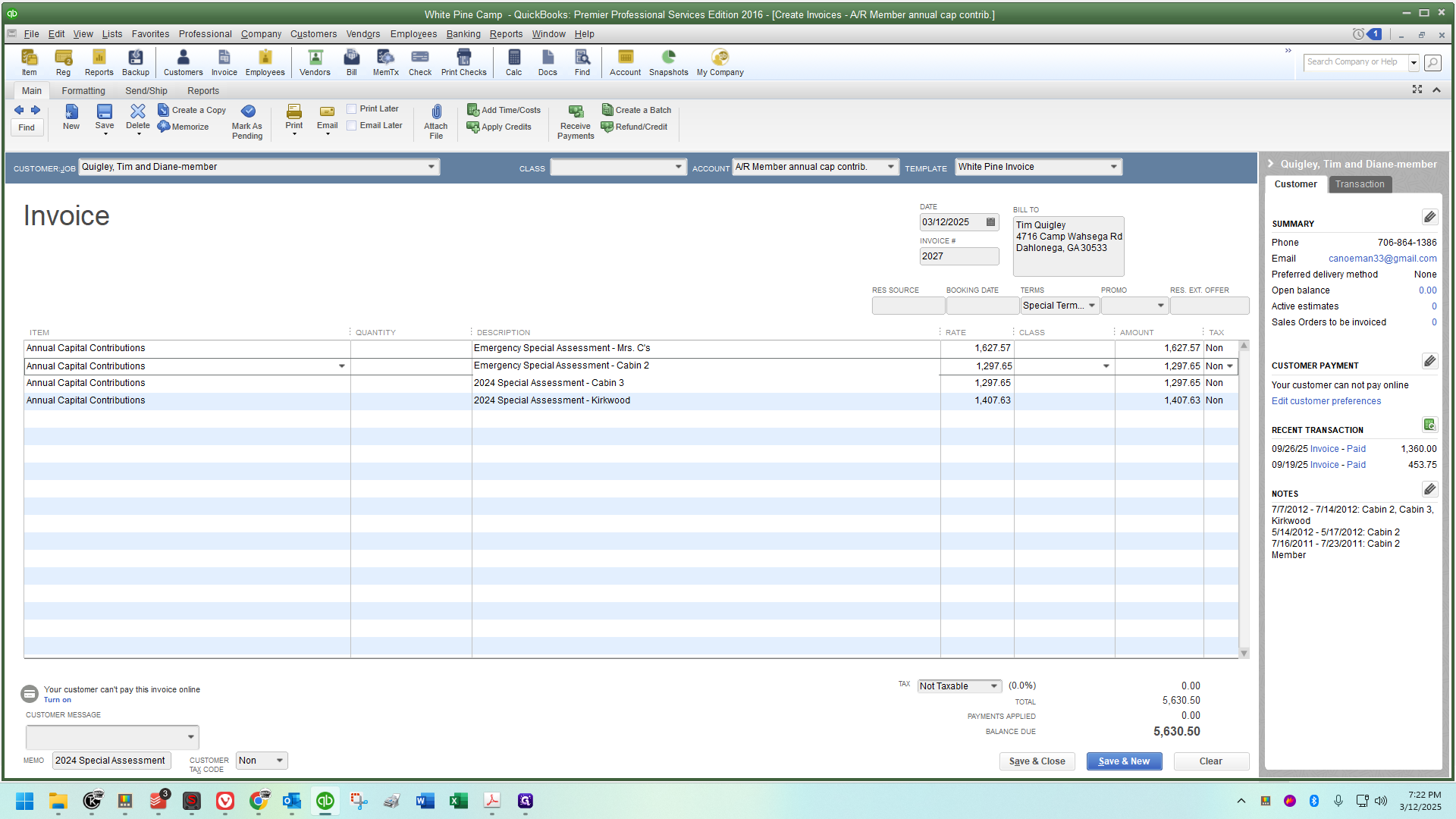

Where it says "2024 Special Assessment," click to the right of the text. This will highlight everything to the left. Press the backspace key to delete it. I have a macro set up to type "Emergency Special Assessment" automatically.

If I didn't have a macro available, I would simply copy and paste it.

You can do that on each line.

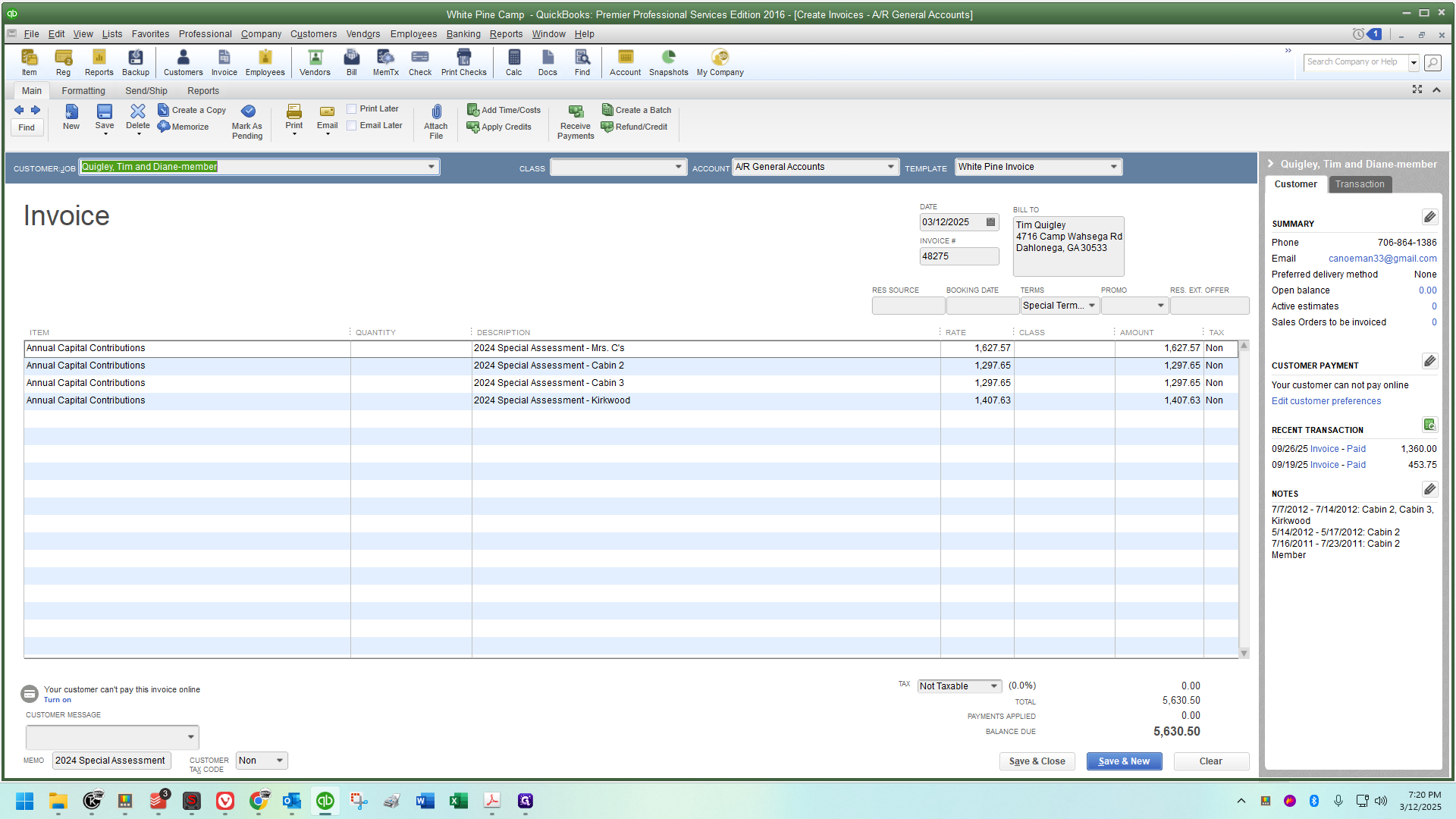

The notations are all correct. Now, I need to ensure the rate is accurate.

Refer to the PDF for the correct amount:

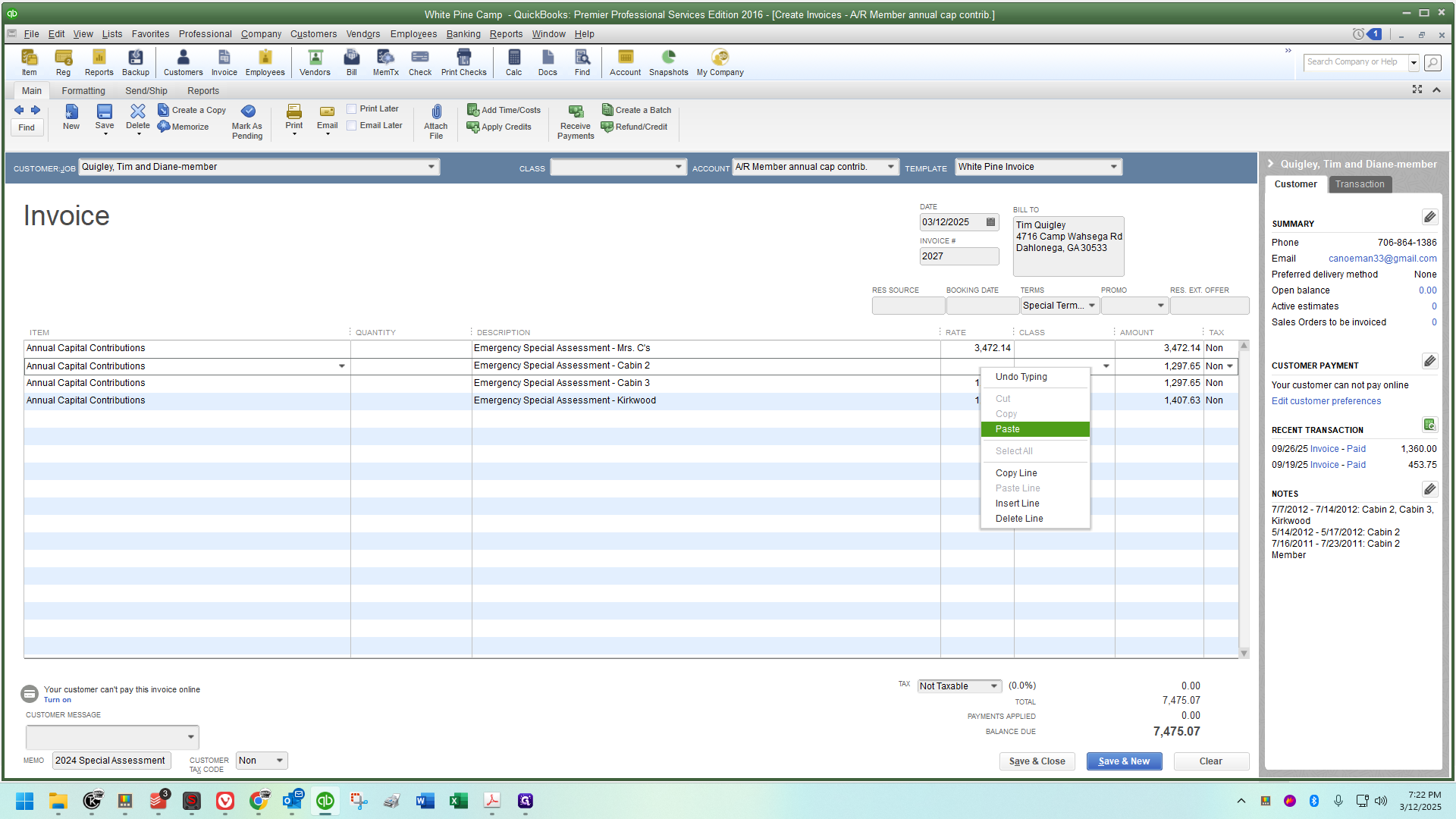

I can copy and paste to ensure I don't make any mistakes.

Go back to the invoice, then paste it.

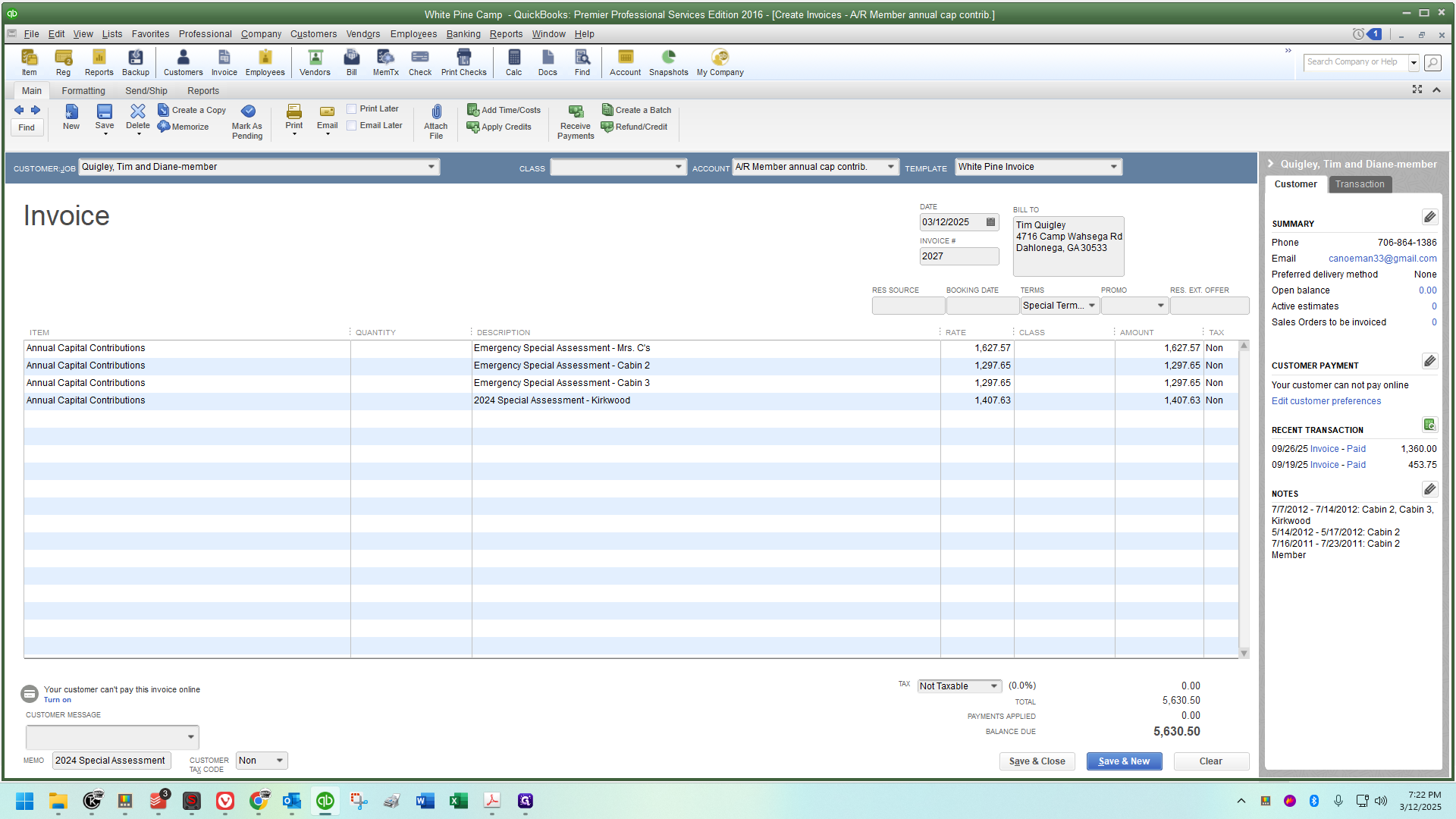

Proceed to Cabin 2.

I'll scroll down in the PDF, find the amount, copy it, and paste it.

Next up:

Out of curiosity, if I look over here, it's 12,011.72

The total at the bottom for multiple cabin owners, including Tim Quigley, is 72.

One penny too high. 👀

Quickly addressing a rounding error, I'll reduce the invoice by one penny.

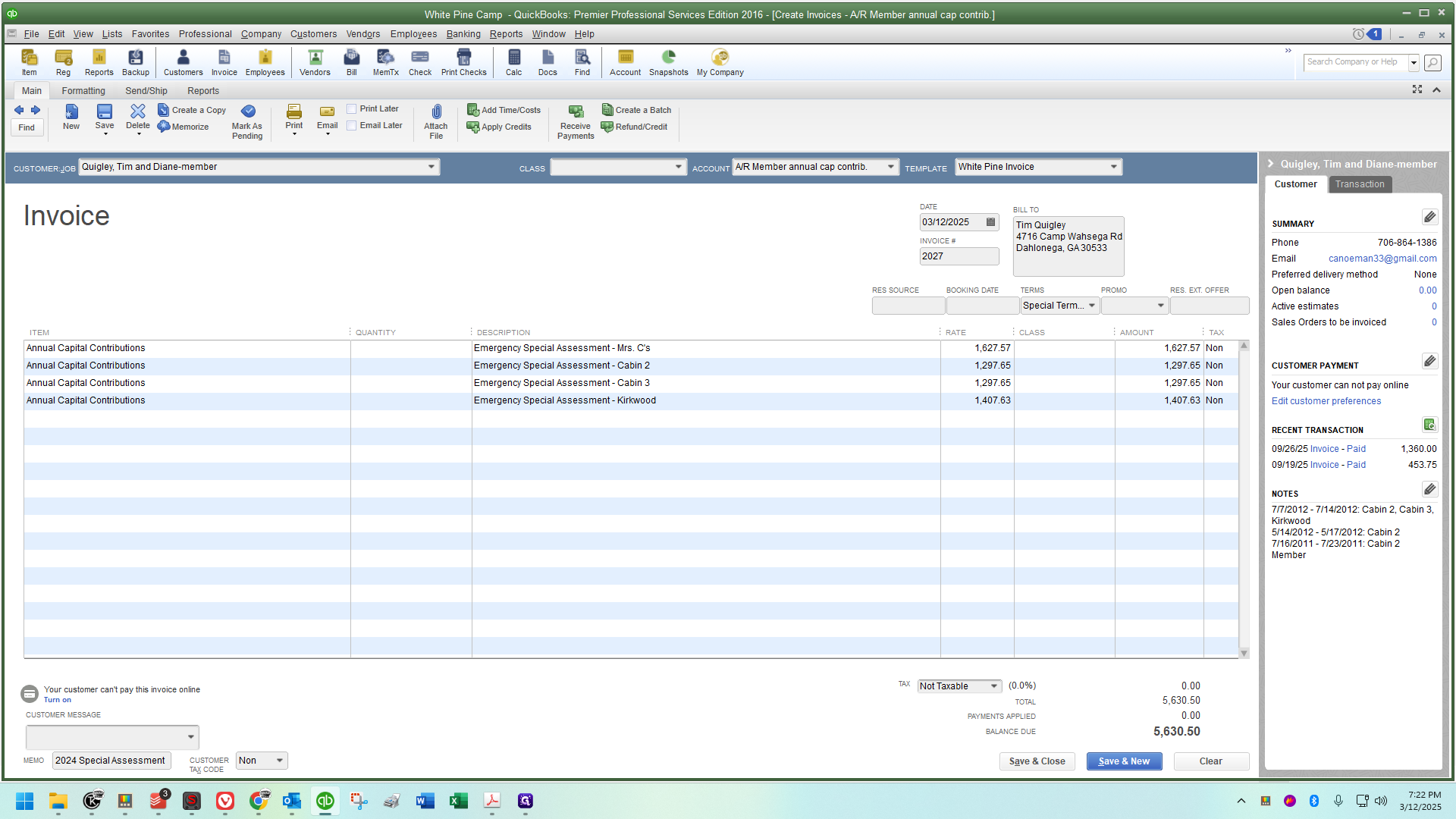

I'll highlight everything, delete it, and use my macro to type "emergency special assessment."

Then save and close.

On this screen, when I scroll up on the account, I should see a record dated 3/12/25. It should show an emergency special assessment affecting the accounts receivable member annual capital contribution account for that amount.

That's it. This is the hardest example because it involves a multiple cabin owner. I'll stop here and create a separate, more concise guide that covers a few examples quickly. I'll wait until I finish with the multiple cabin owners before doing that.

Always ensure it hits the accounts receivable account, the notation is correct, and the amount is accurate. Then you're good to go! These are super easy but we just don't do them very often, so they seem intimidating.