How to Cross-Check Sage Payroll Register to ADP Payroll Register

Learn the detailed process of matching payroll records between ADP and Sage, including trial computations, removing discrepancies, and ensuring accurate payroll posting. Perfect for payroll professionals seeking accuracy.

In this guide, we'll learn how to cross-check payroll records between ADP and Sage to ensure all amounts match before finalizing payroll. This process helps identify any discrepancies, such as small rounding differences or missing entries, and confirms that employer contributions and taxes are accurate.

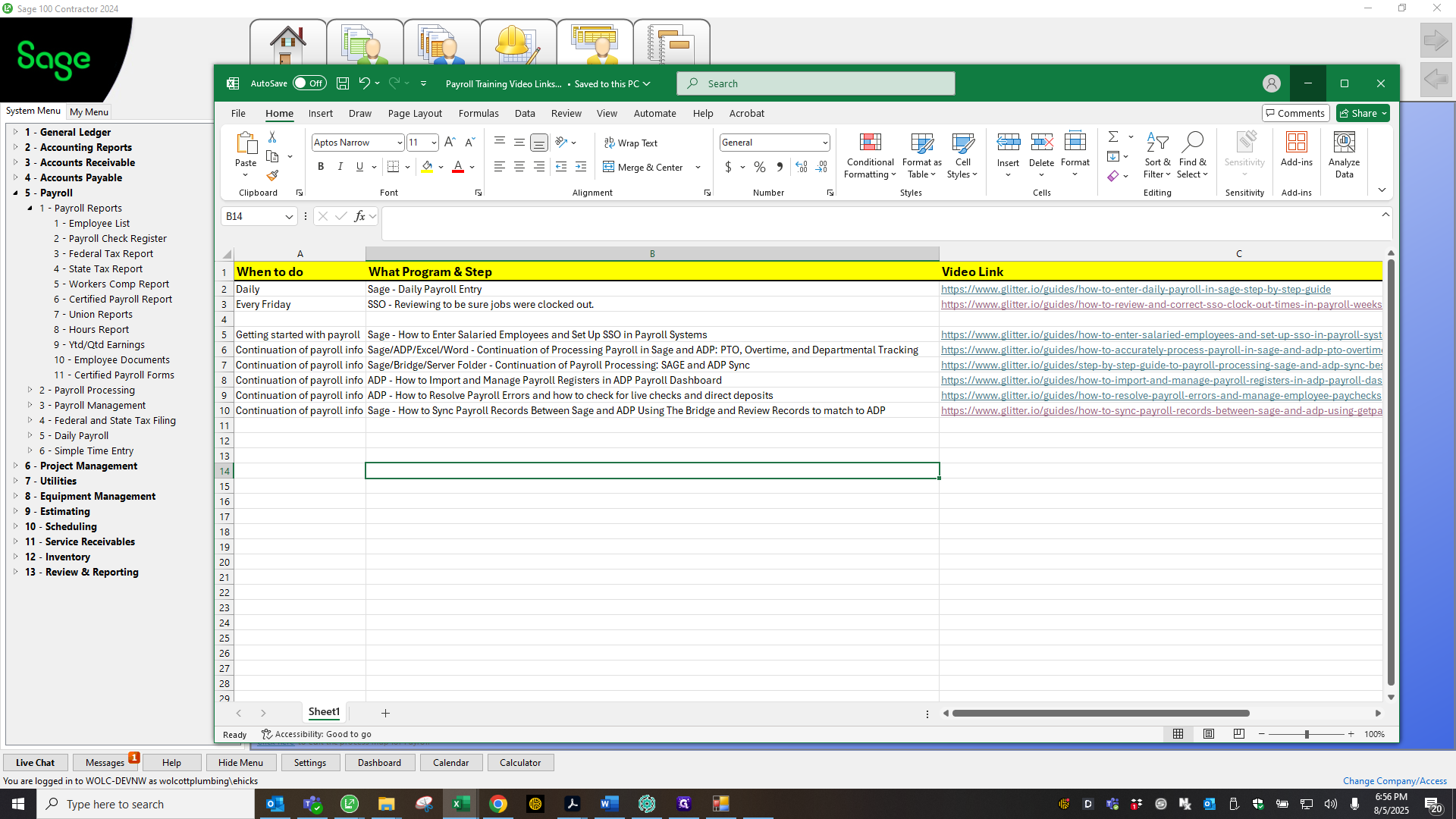

We'll also cover how to save and organize payroll registers for future reference.

Let's get started

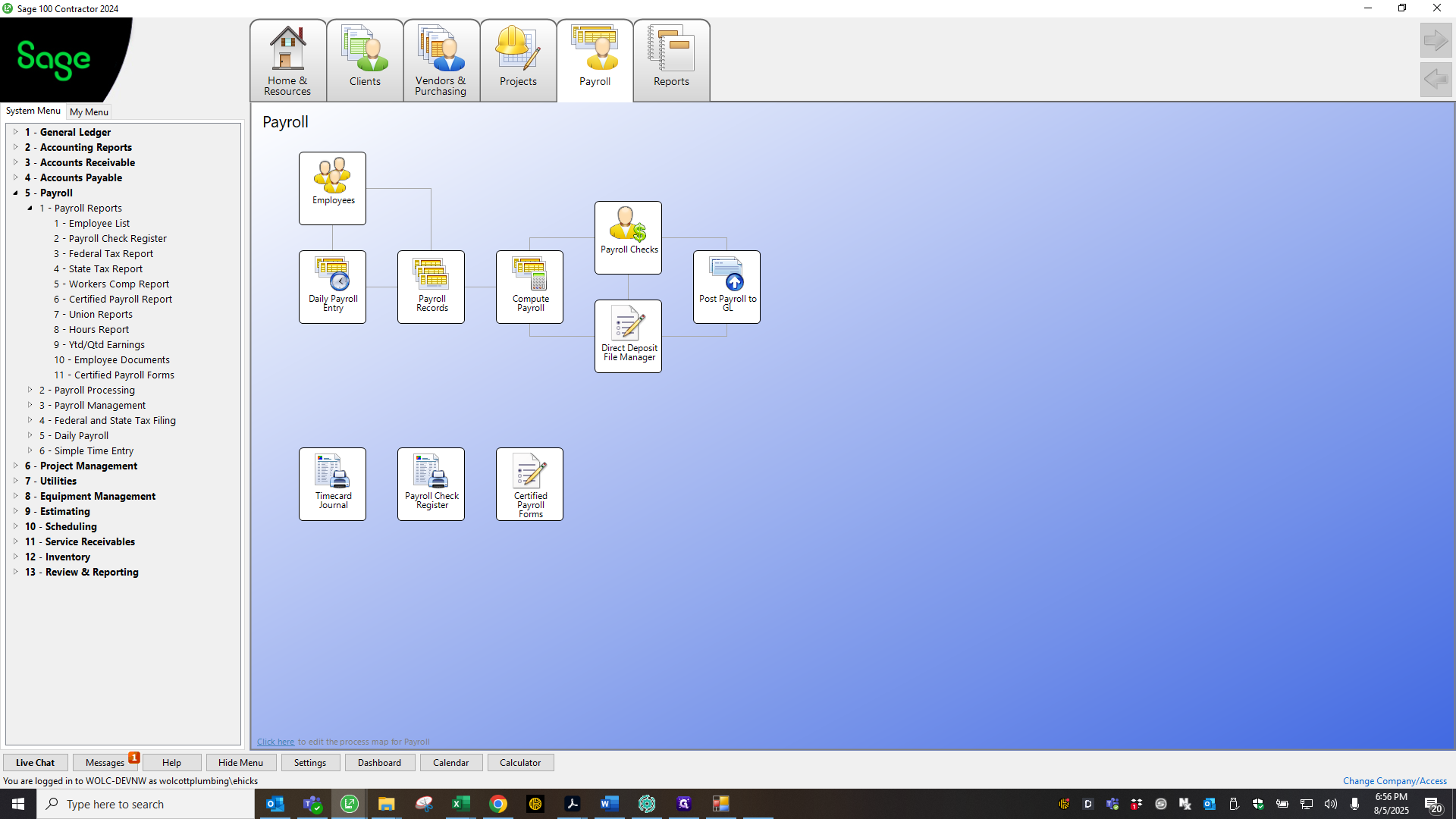

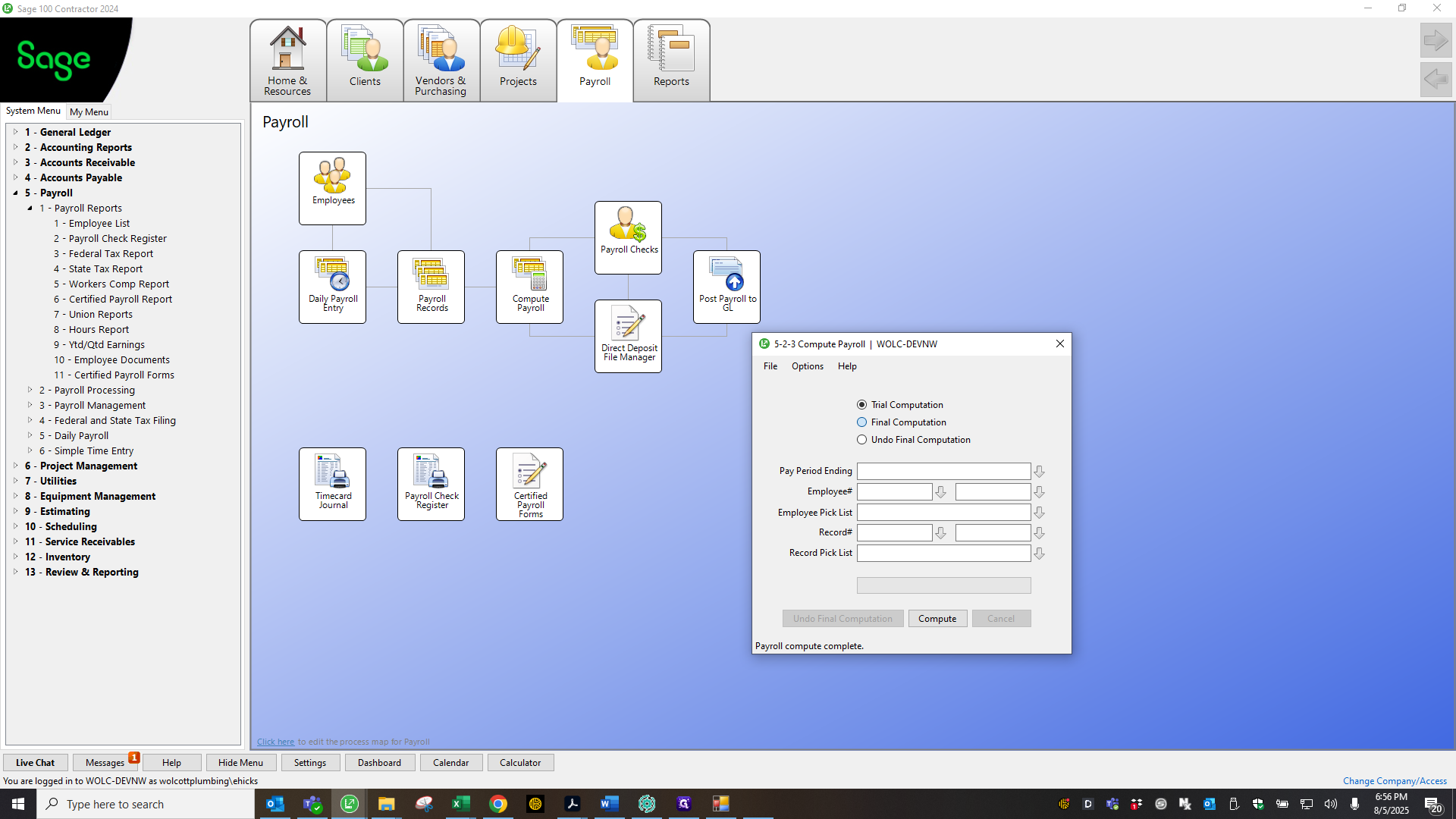

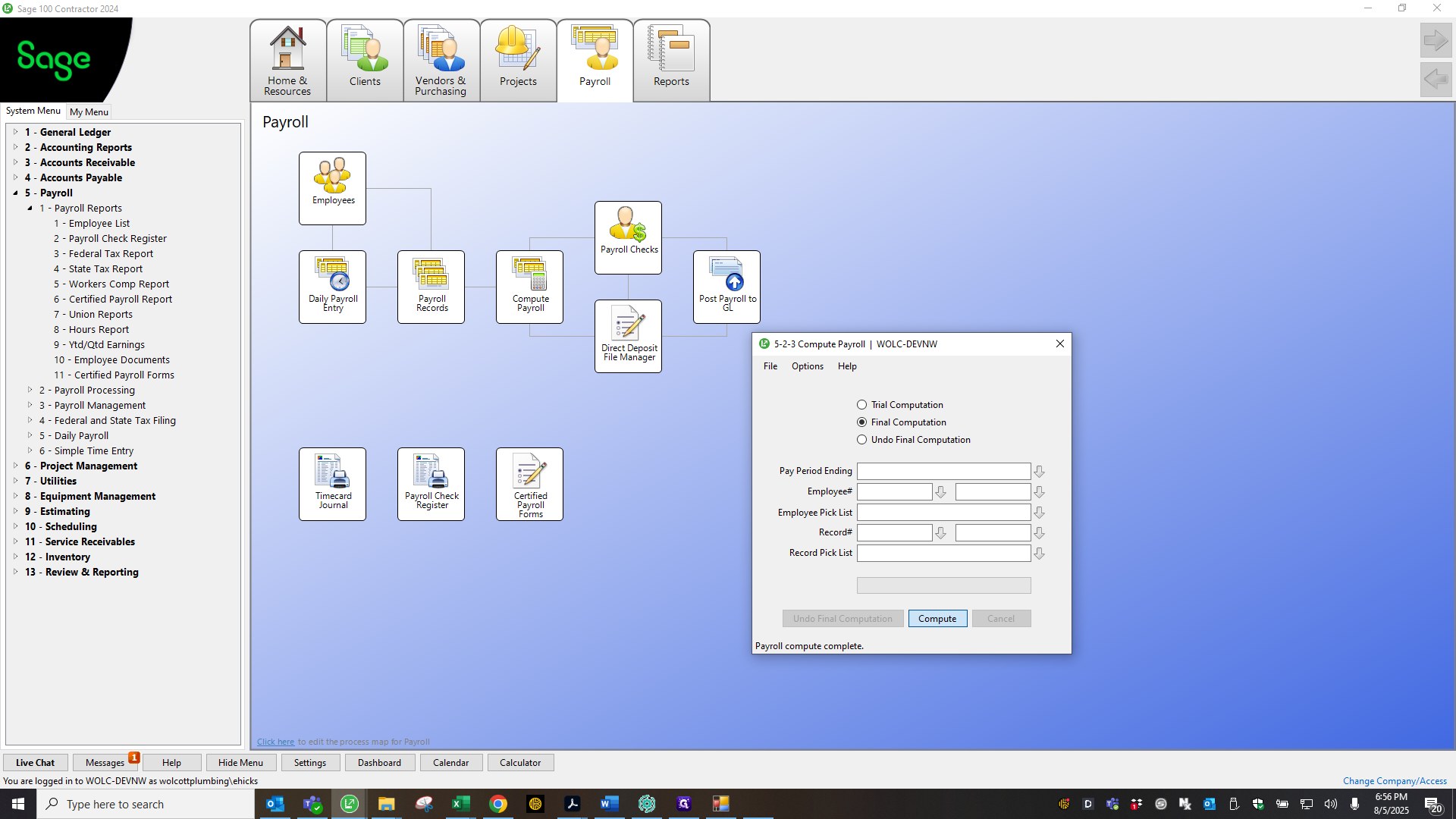

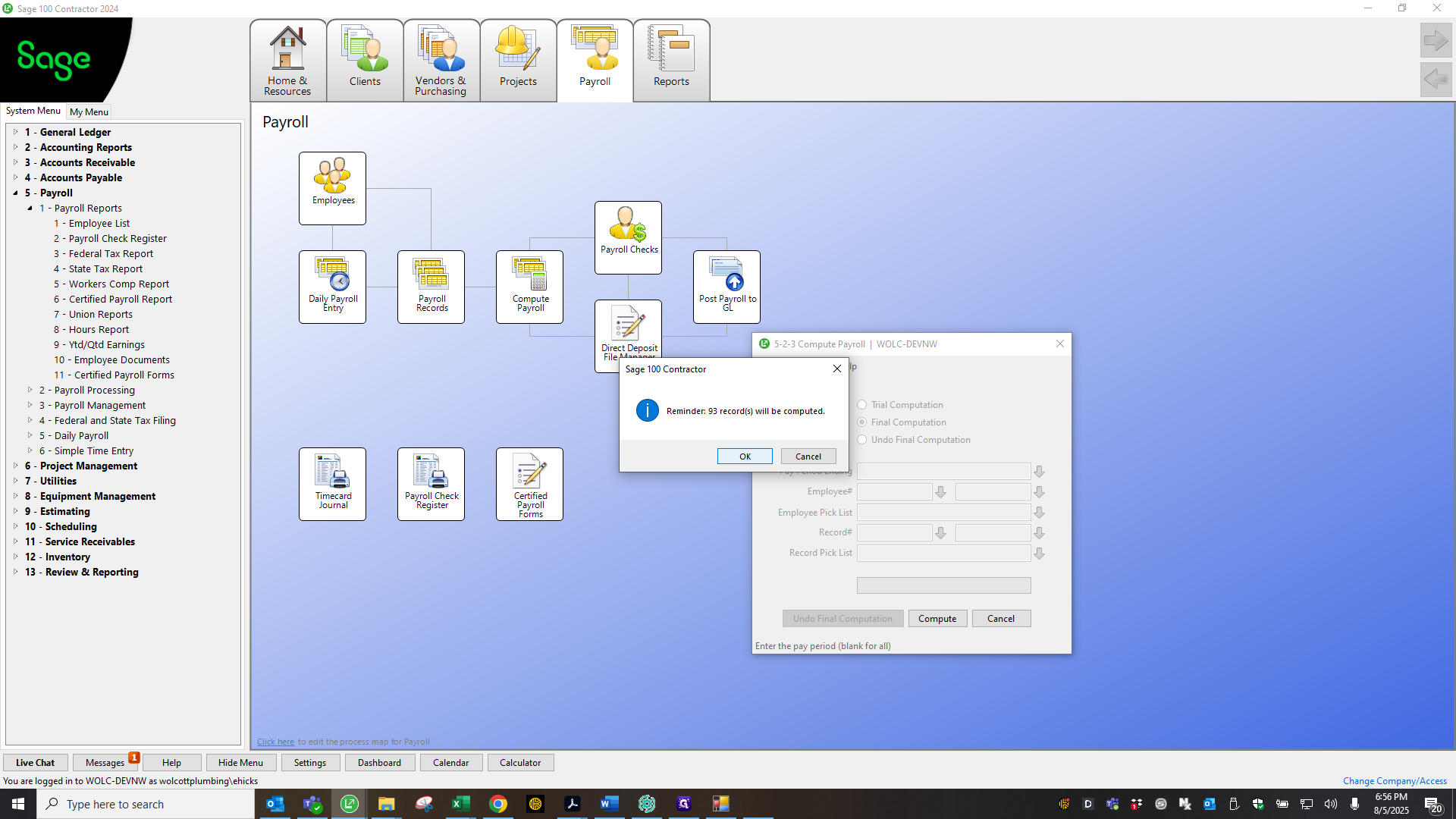

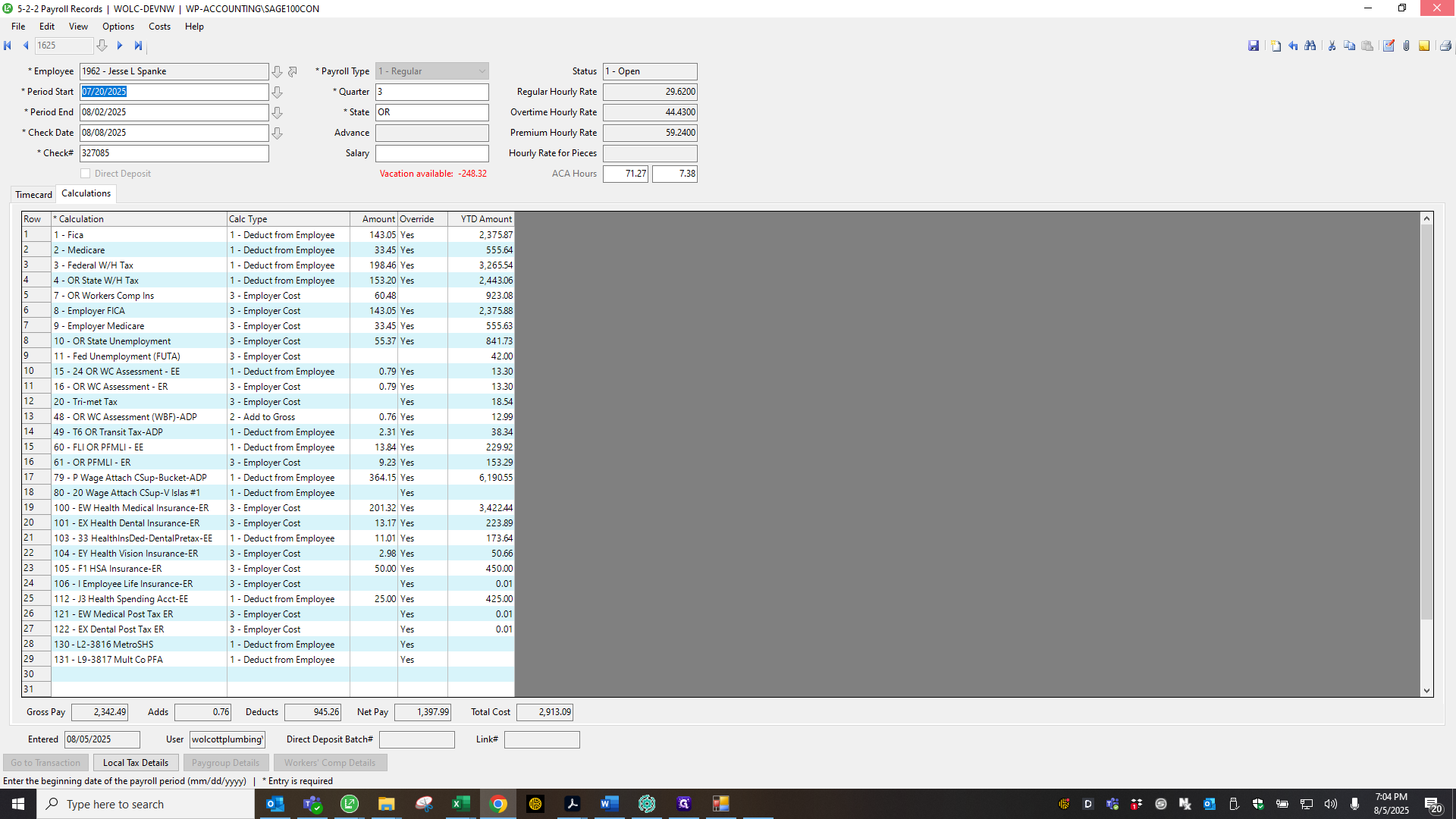

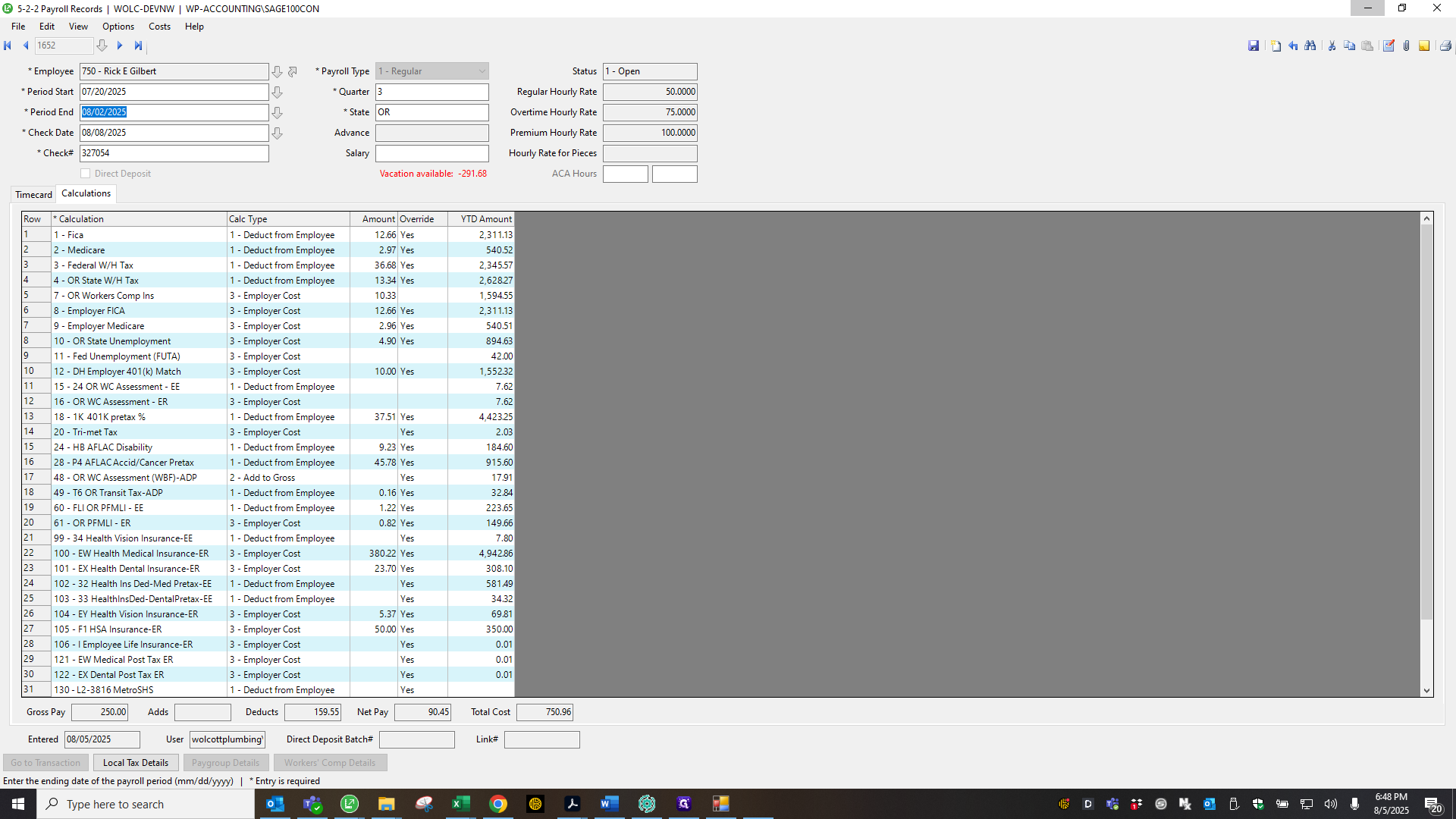

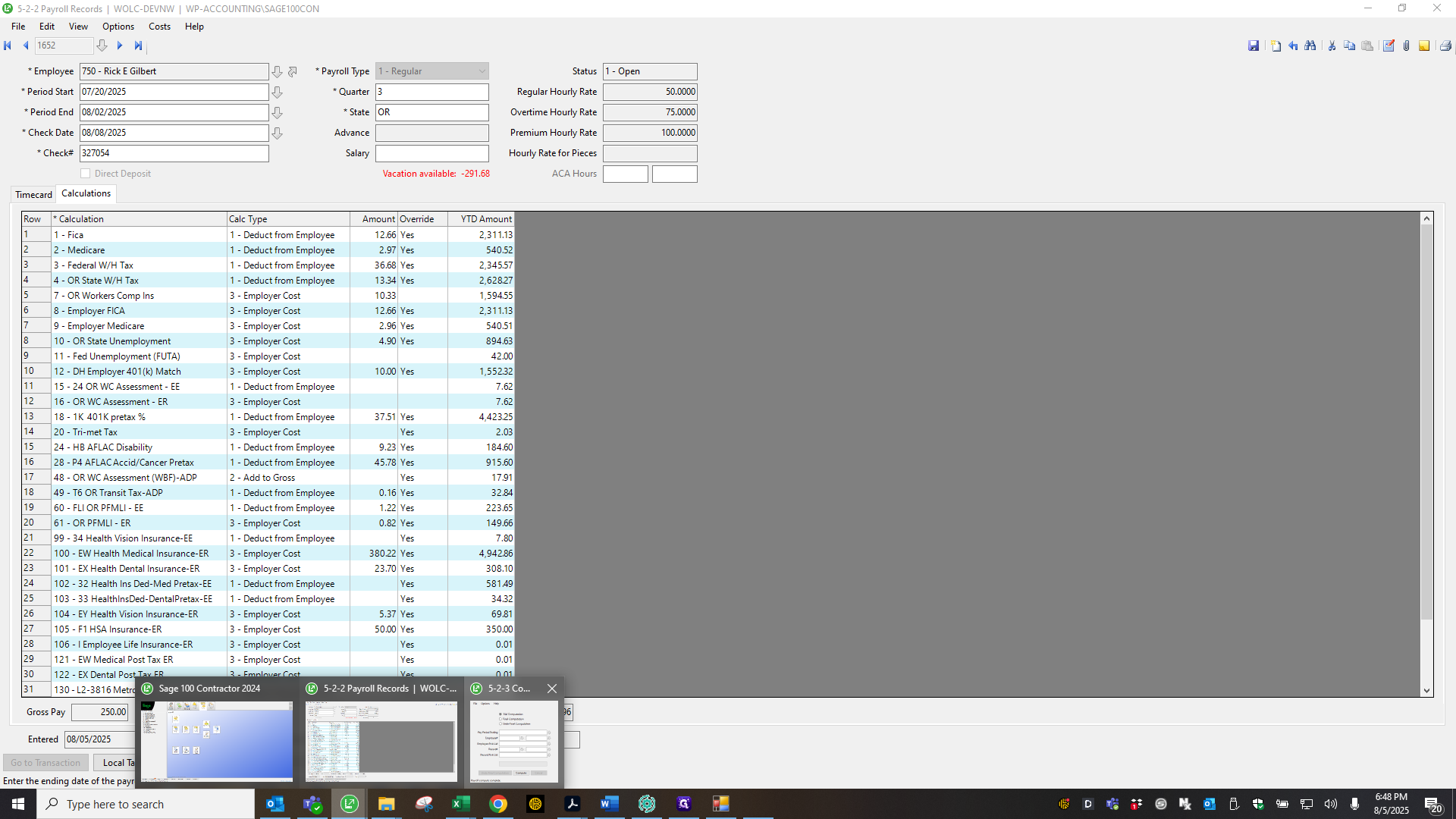

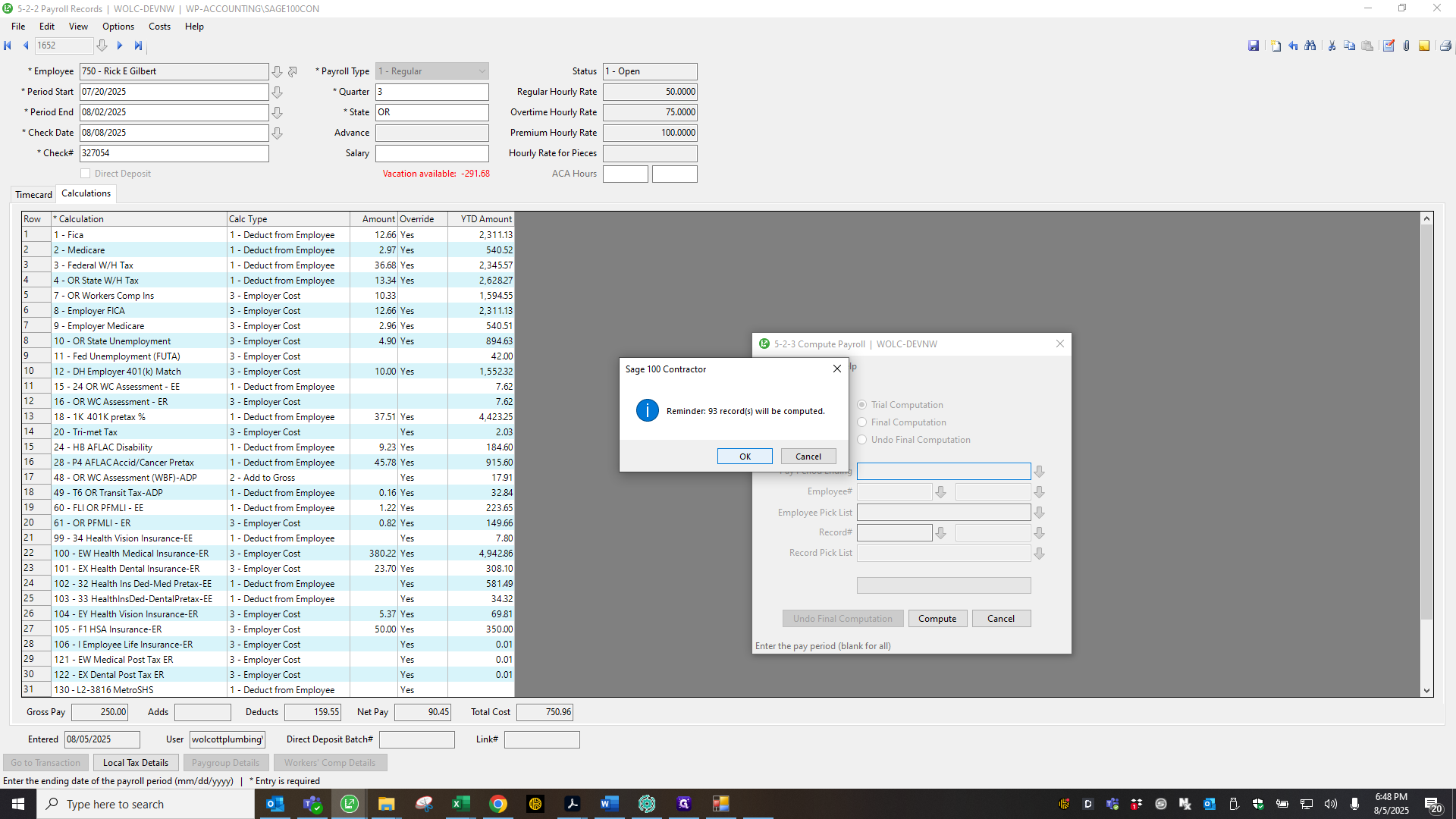

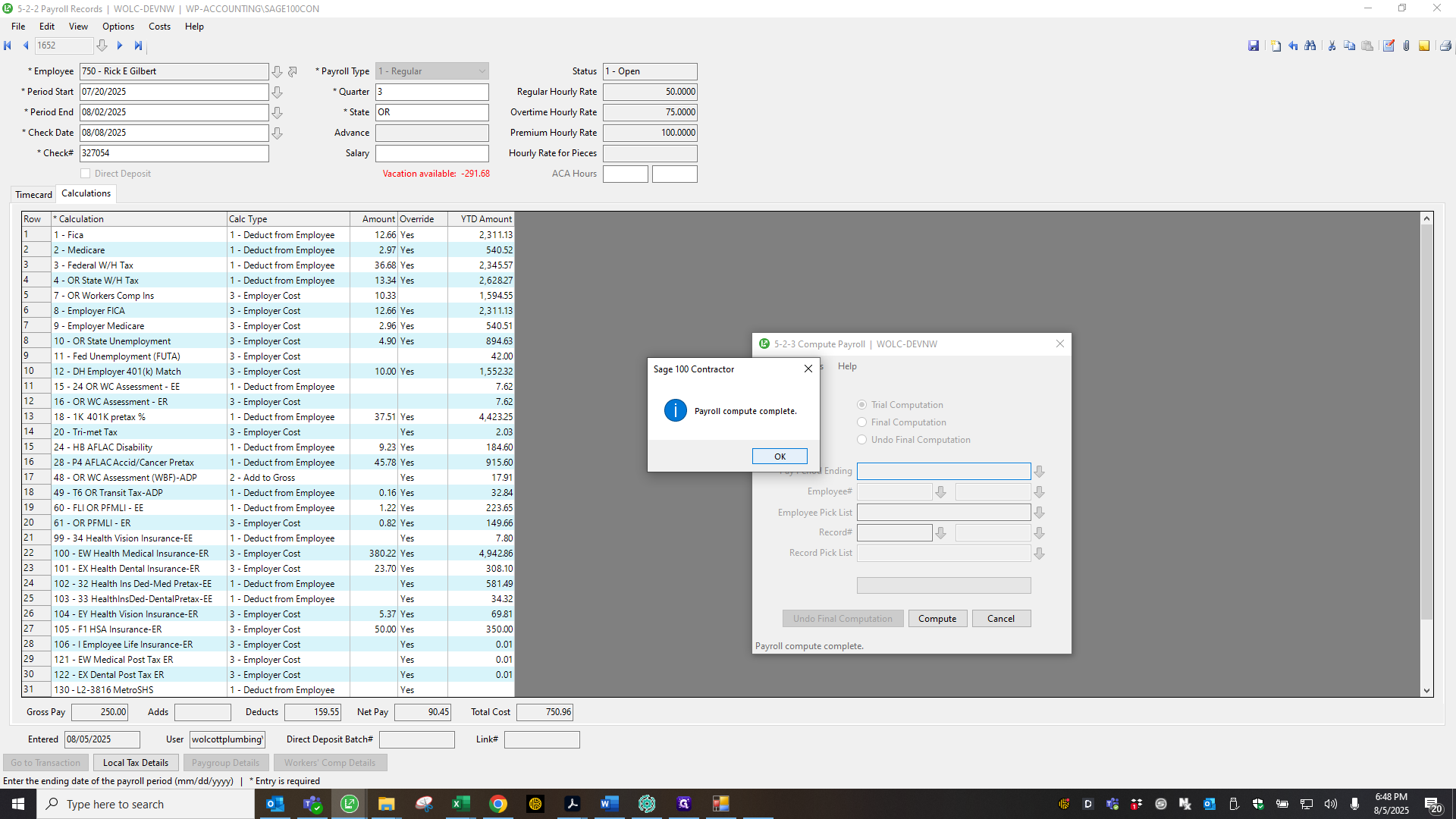

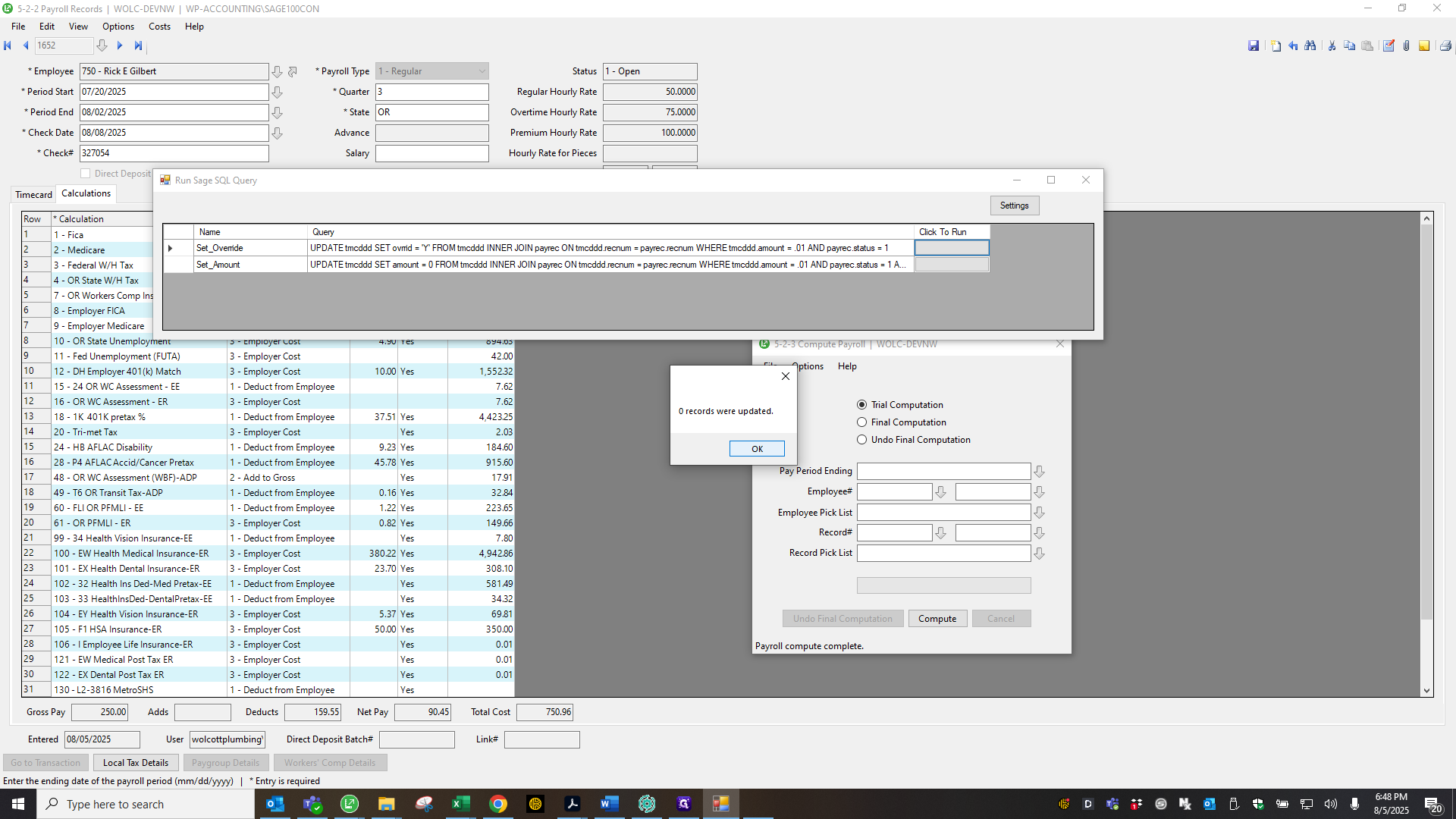

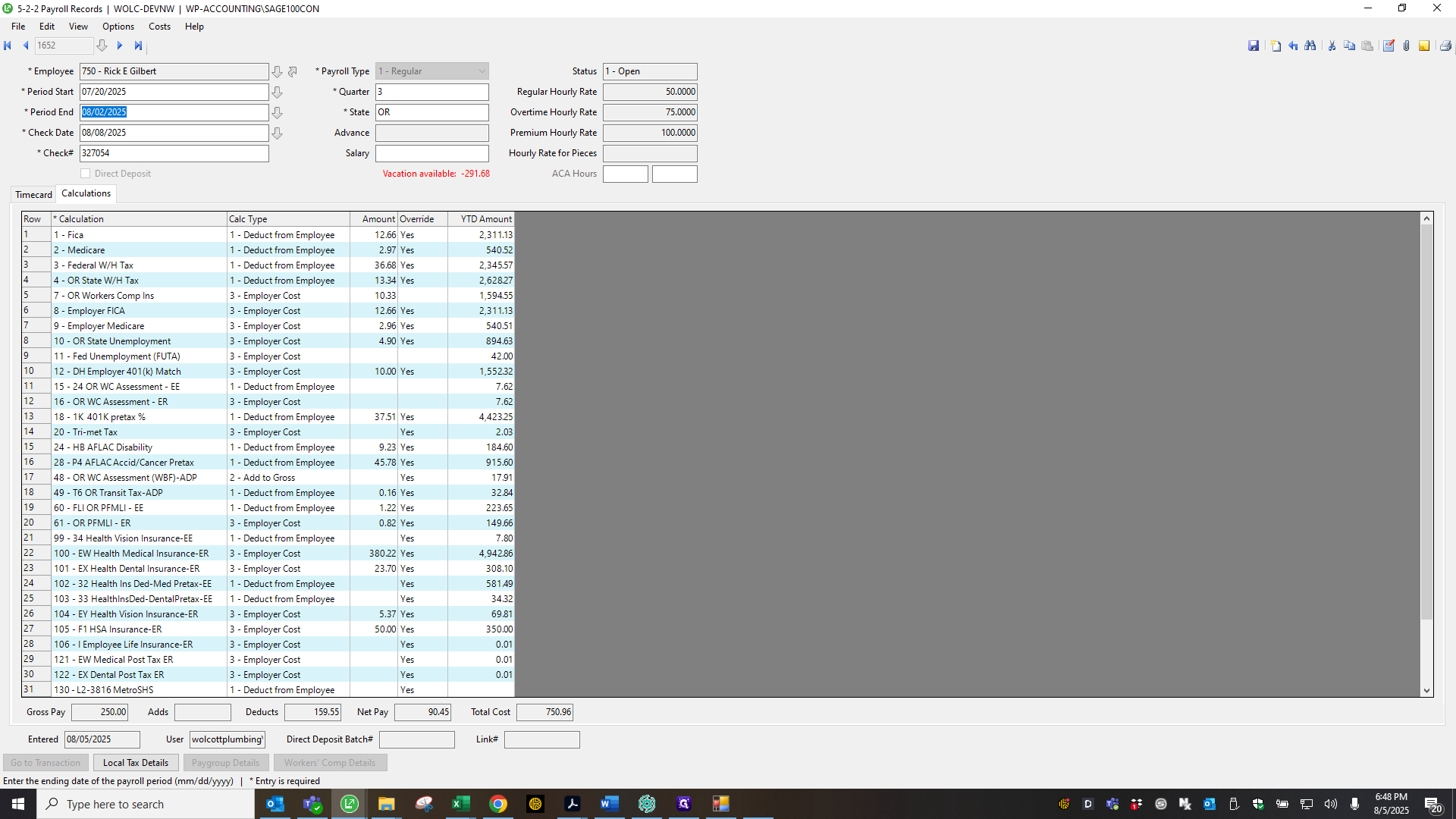

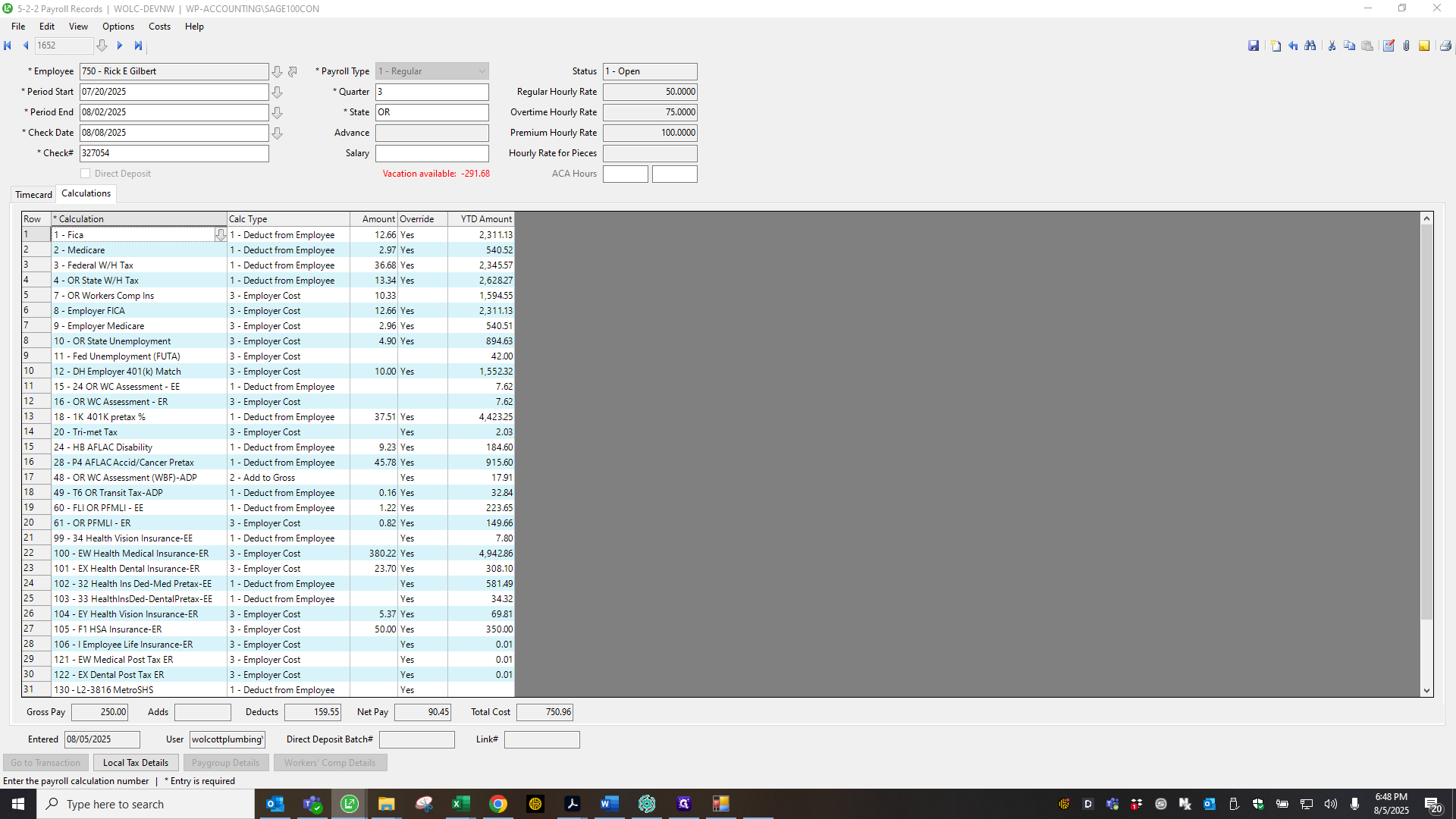

Hello. I have reviewed all the records and matched them to ADP. Now we will perform a trial computation.

Sorry.

We process those records.

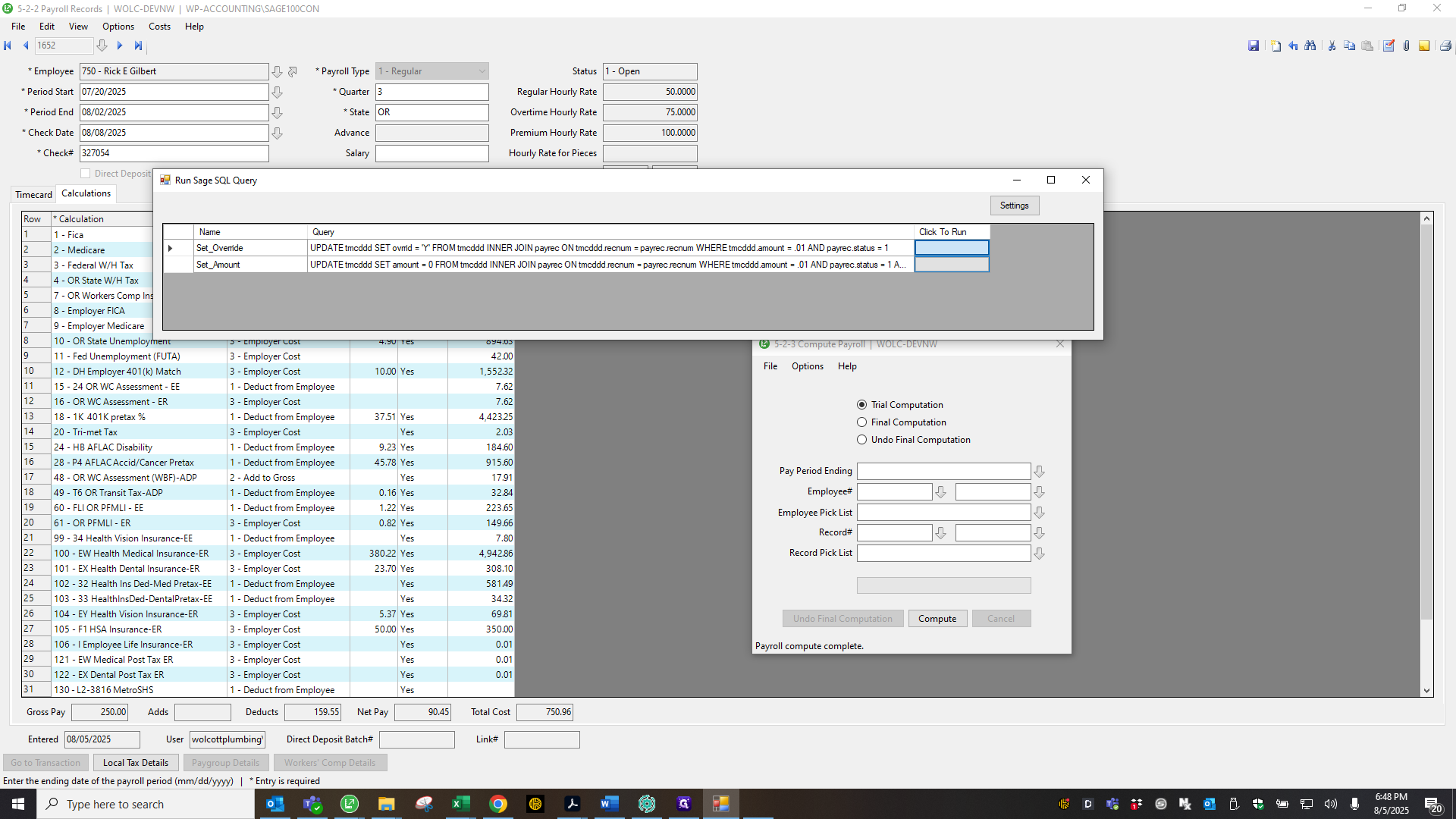

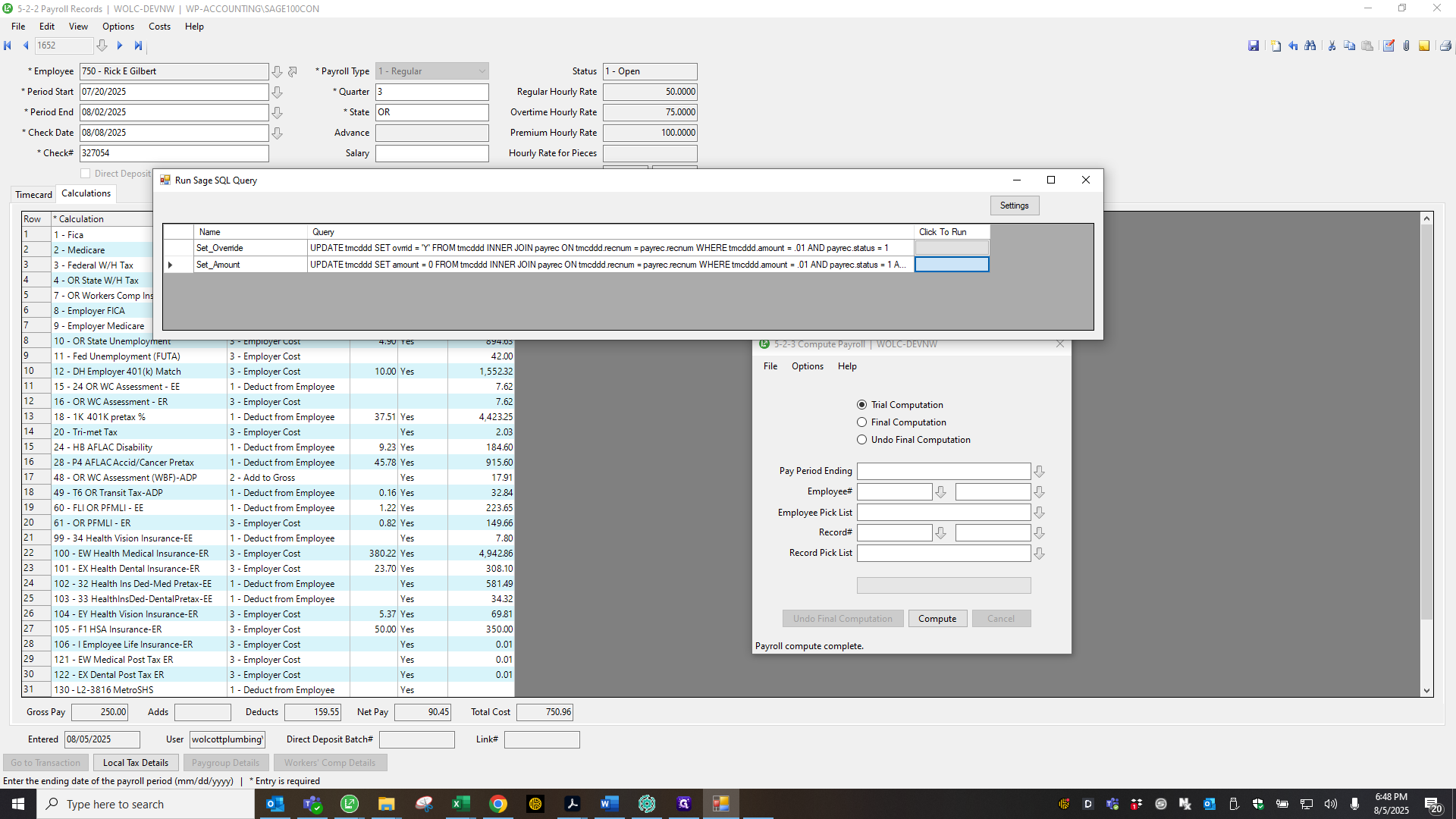

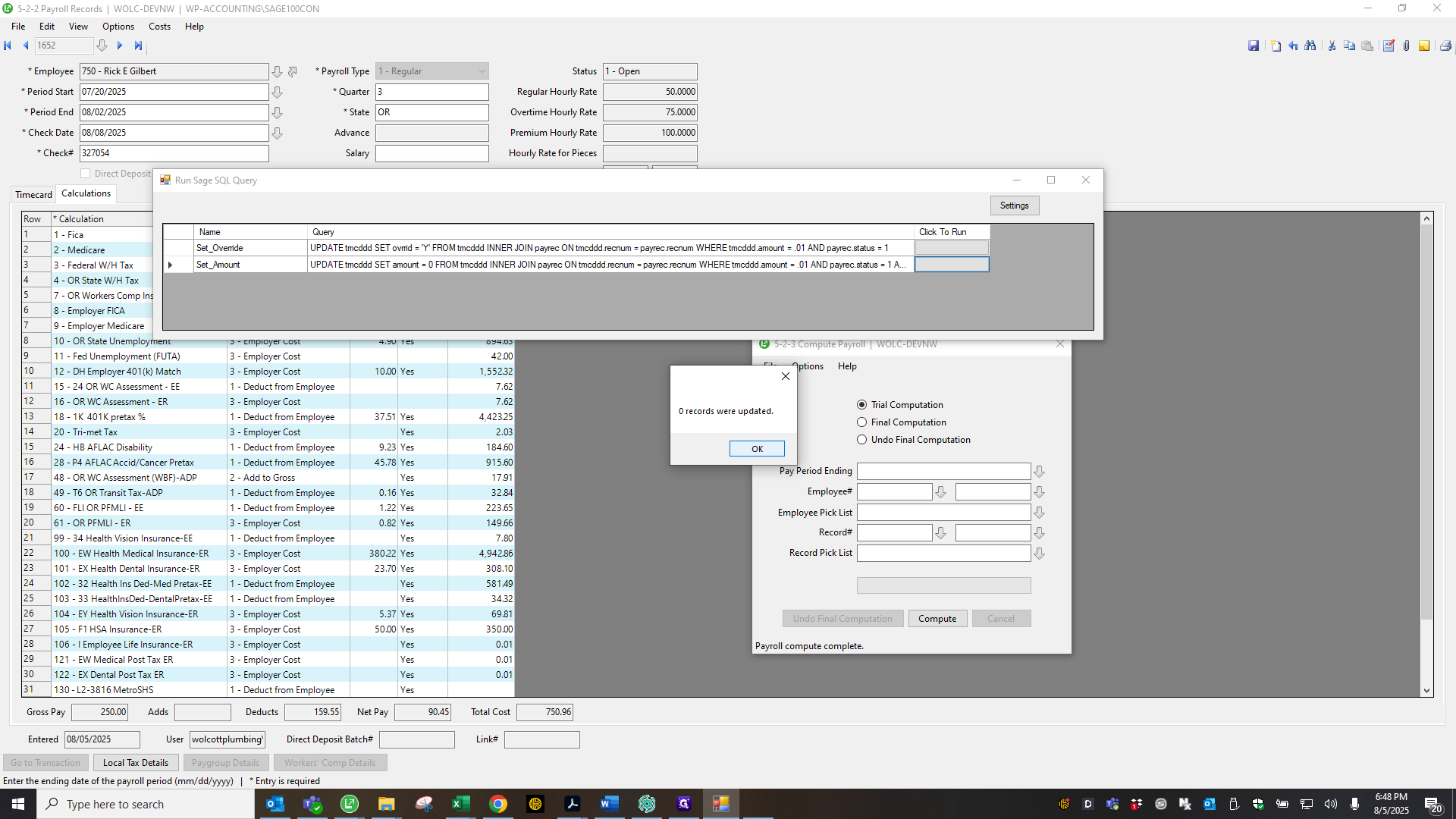

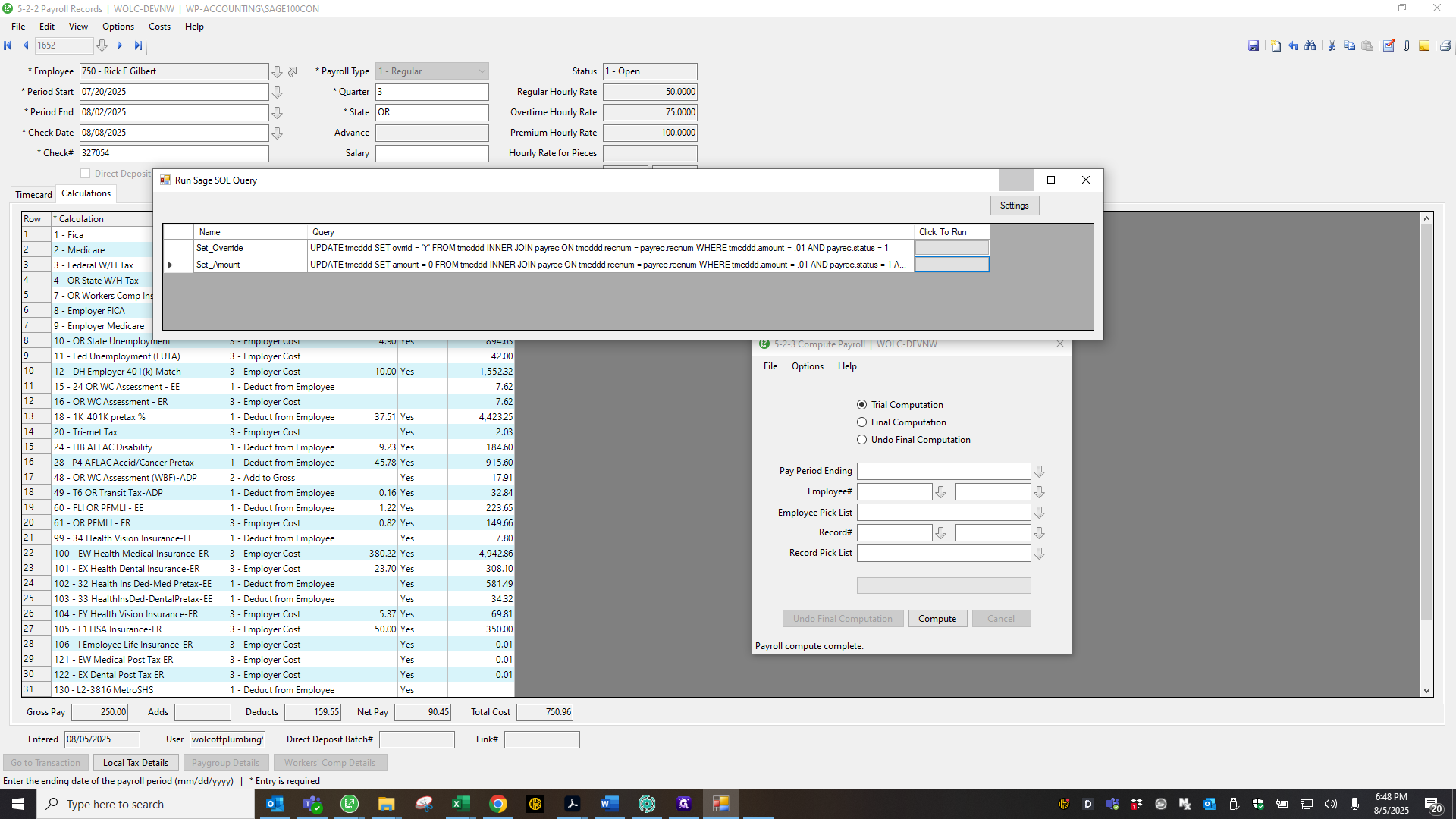

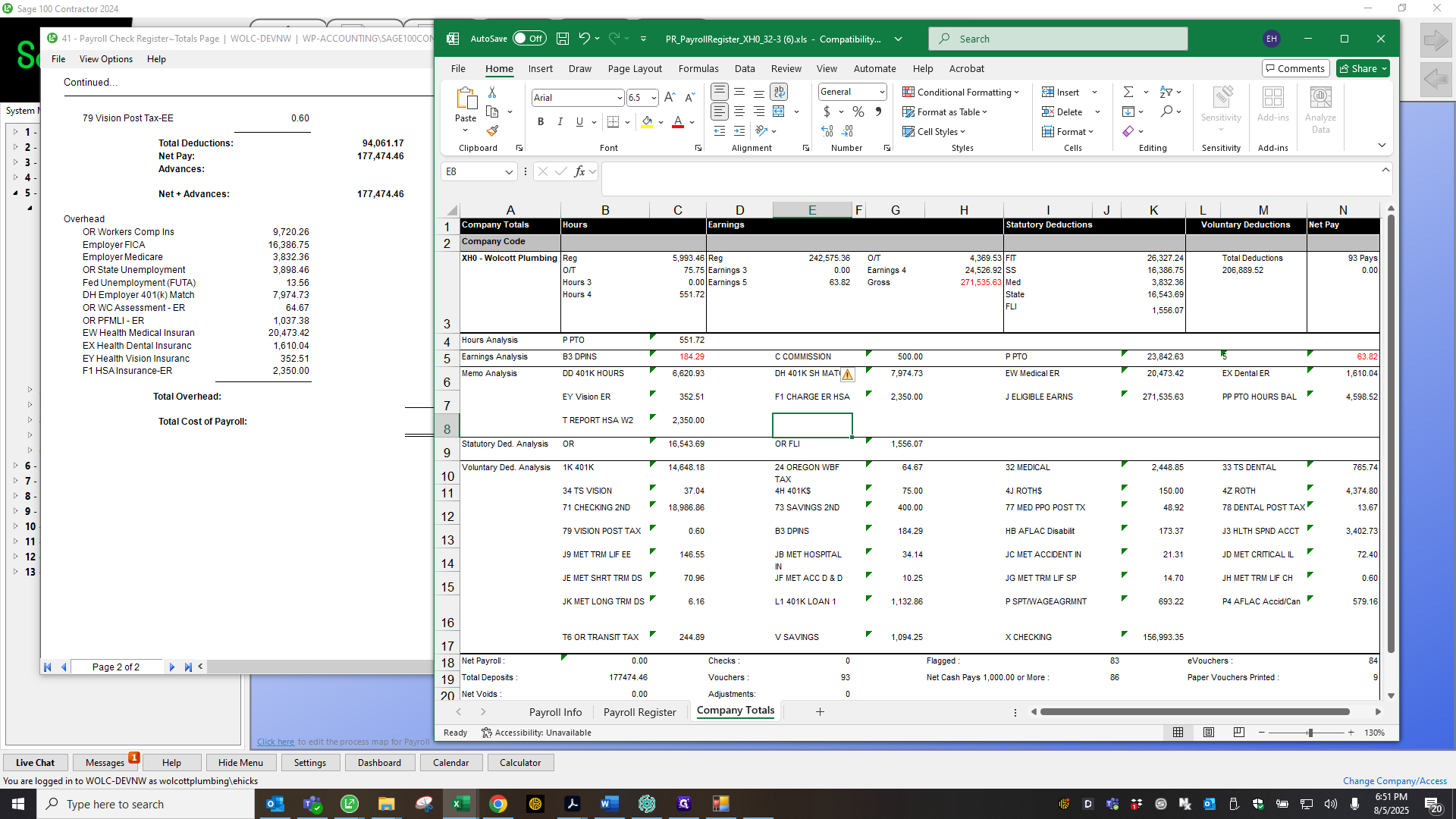

I also do a second click to remove any remaining pennies, in case something was missed or reappeared after the trial calculation.

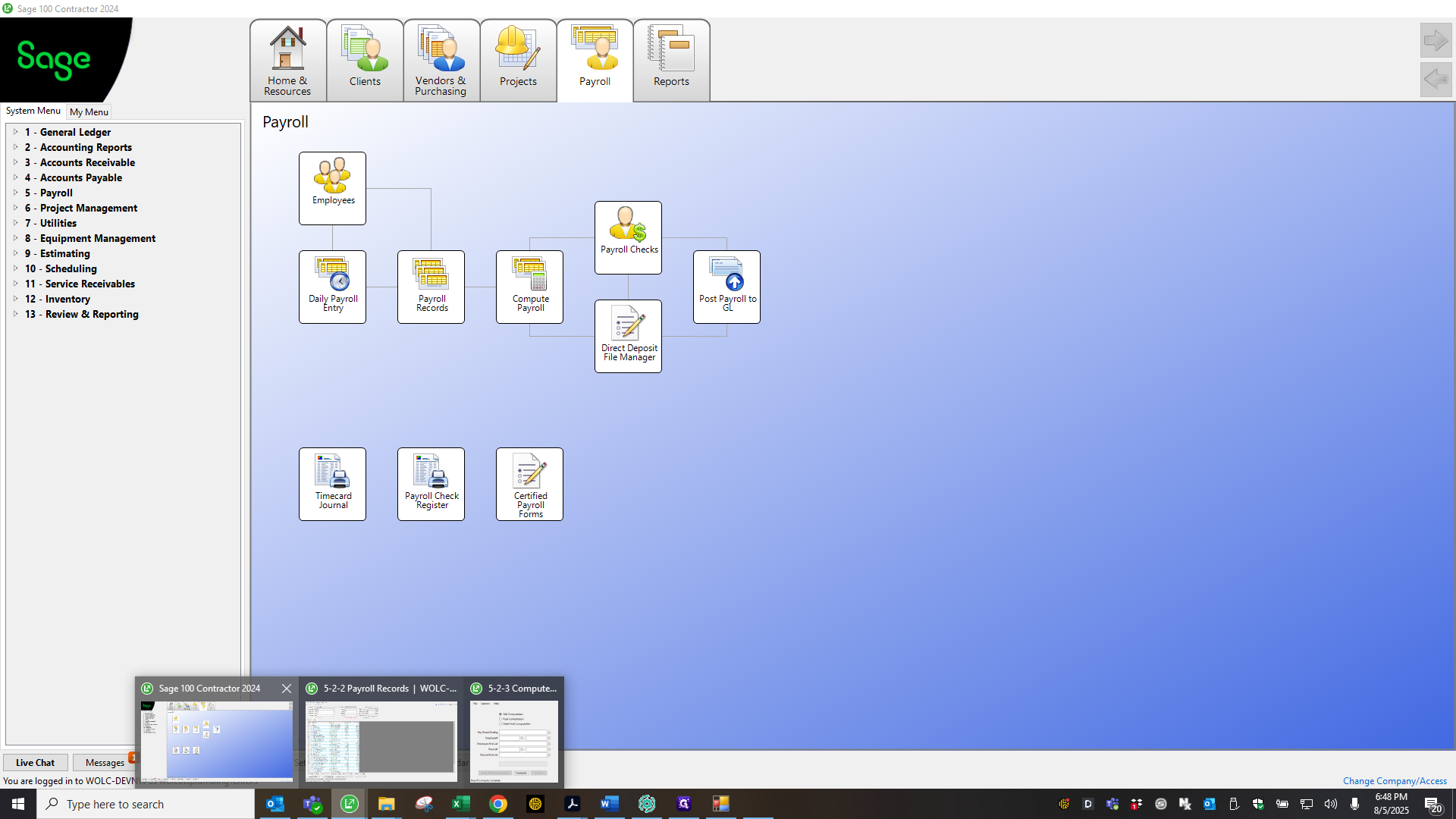

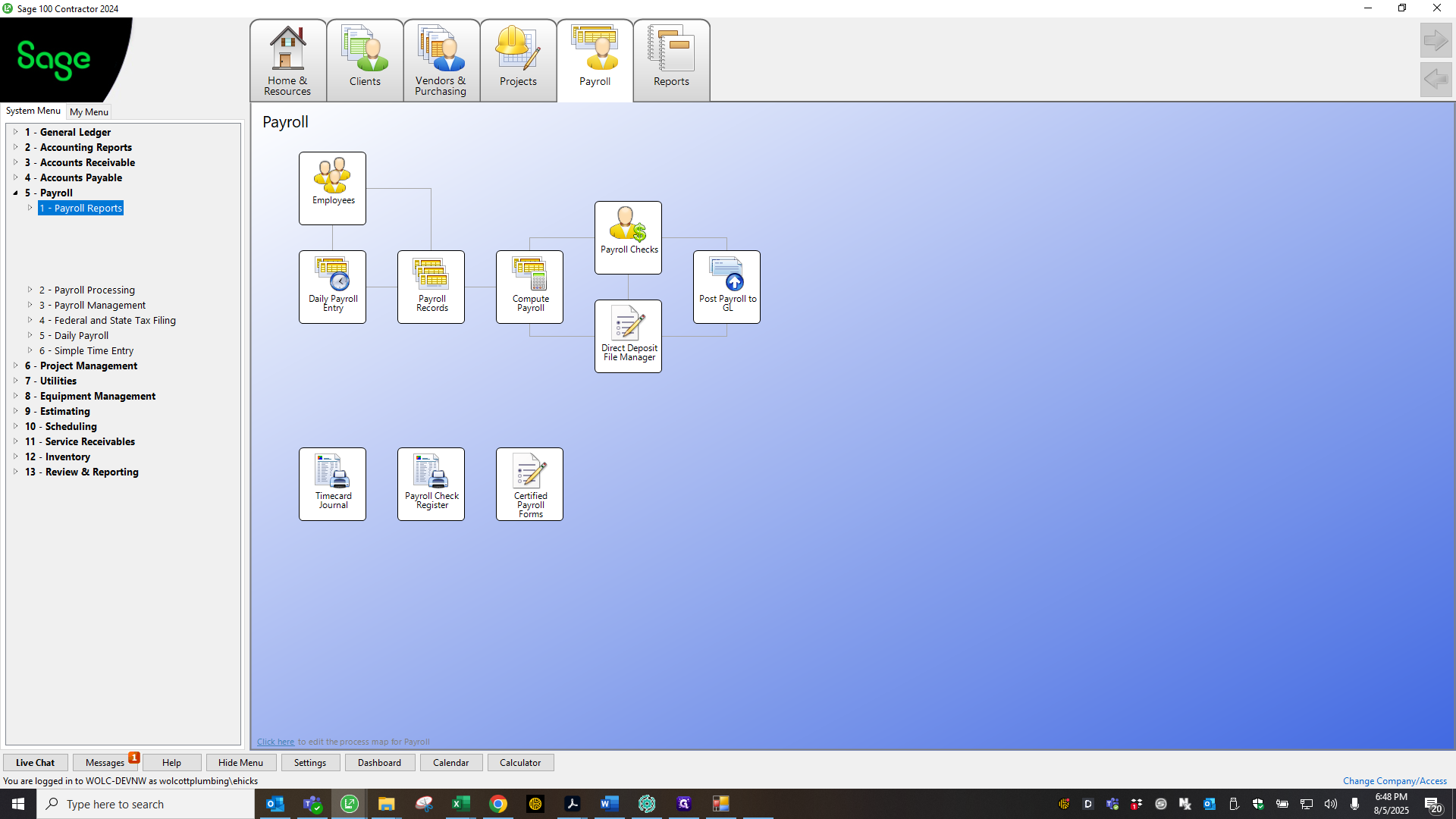

There's nothing there, so now I will go and do a...

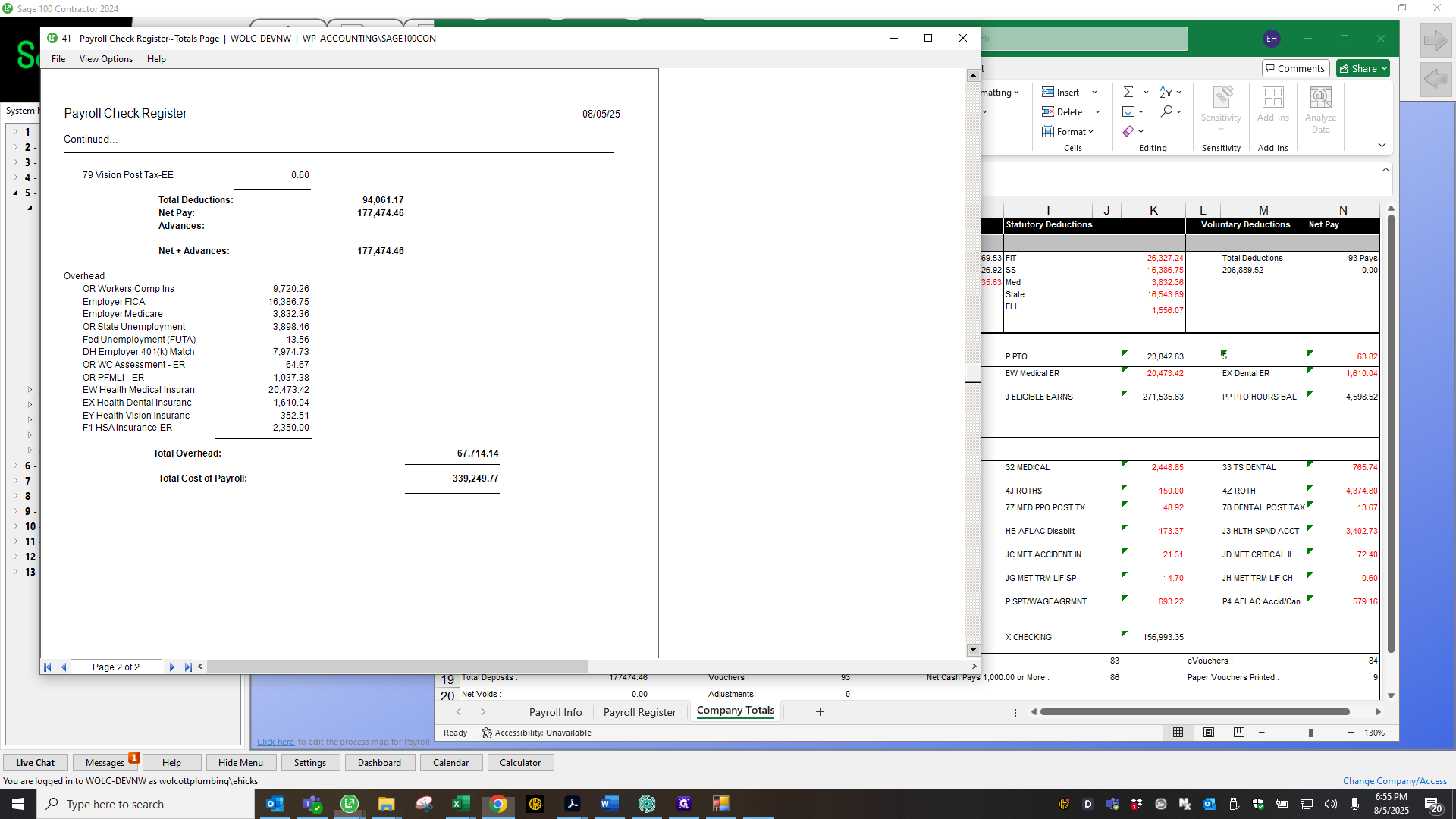

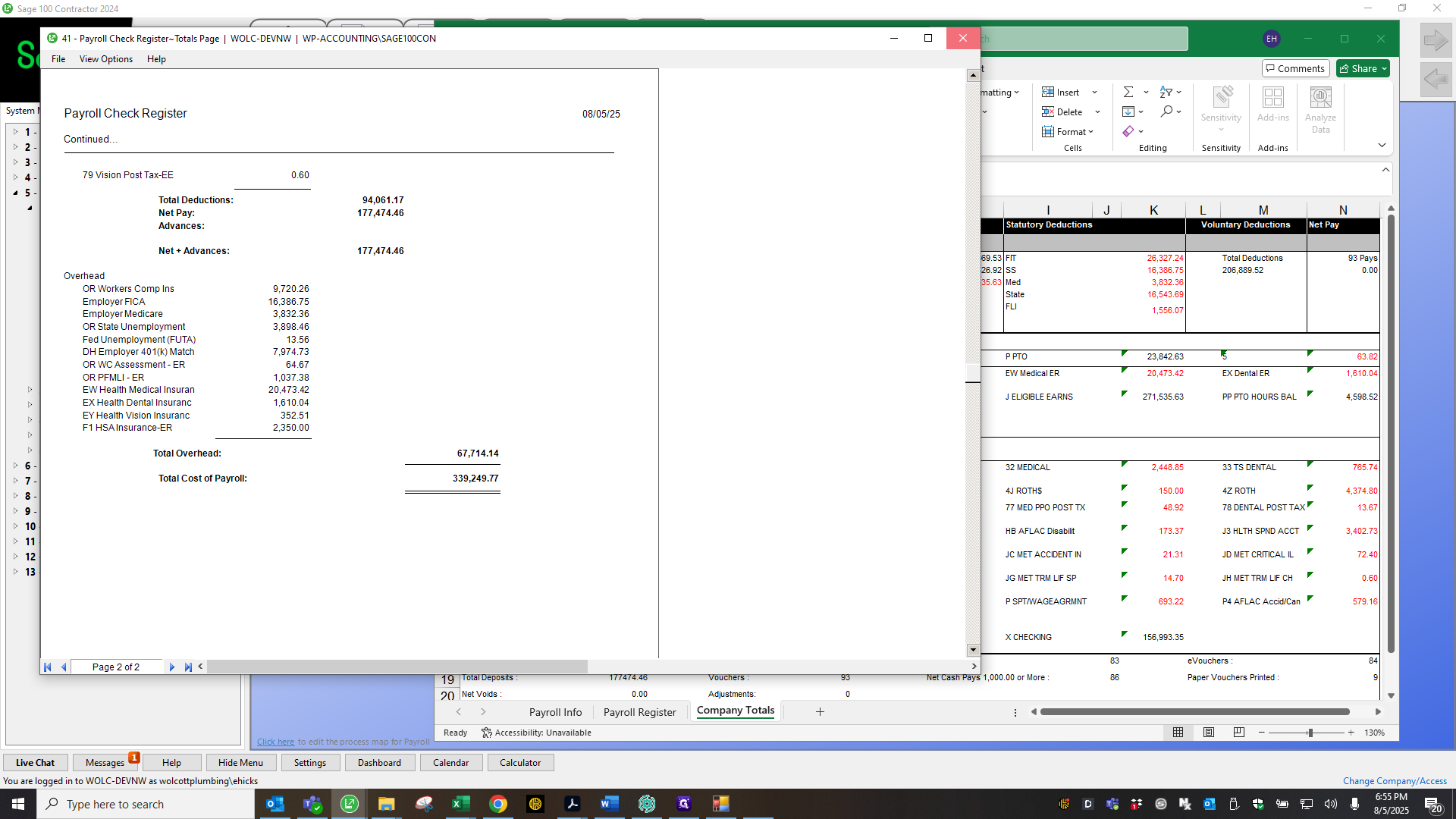

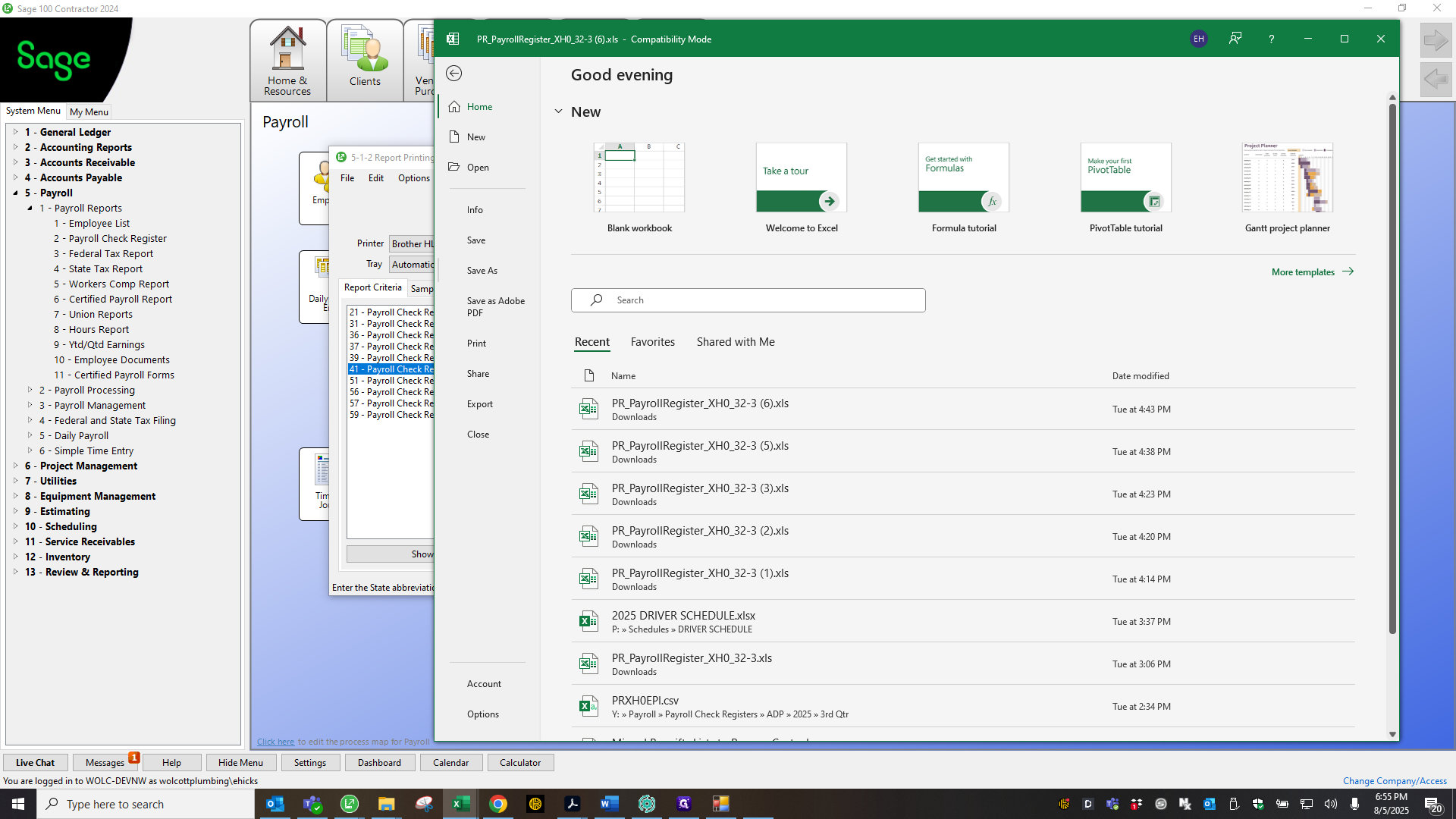

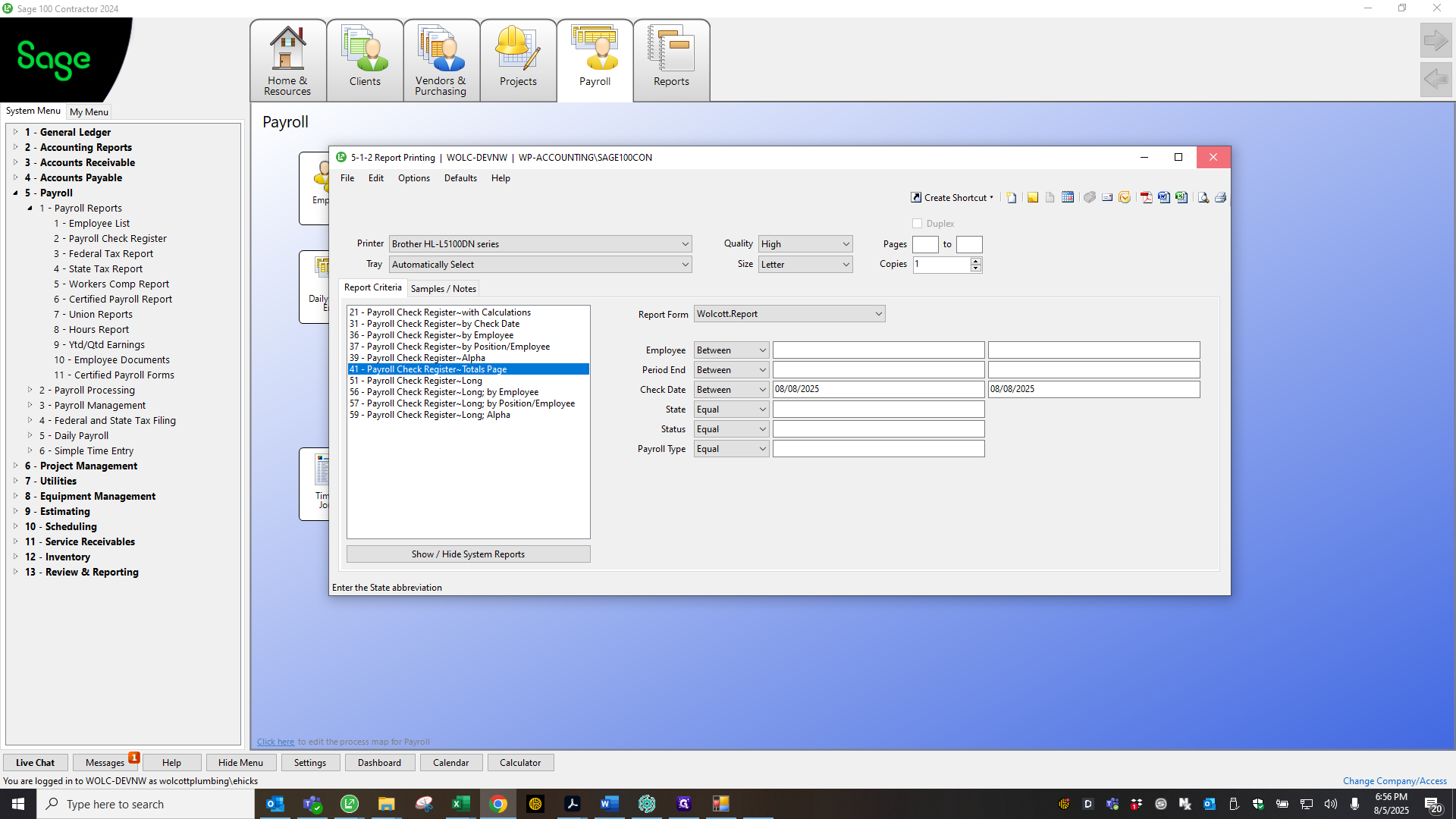

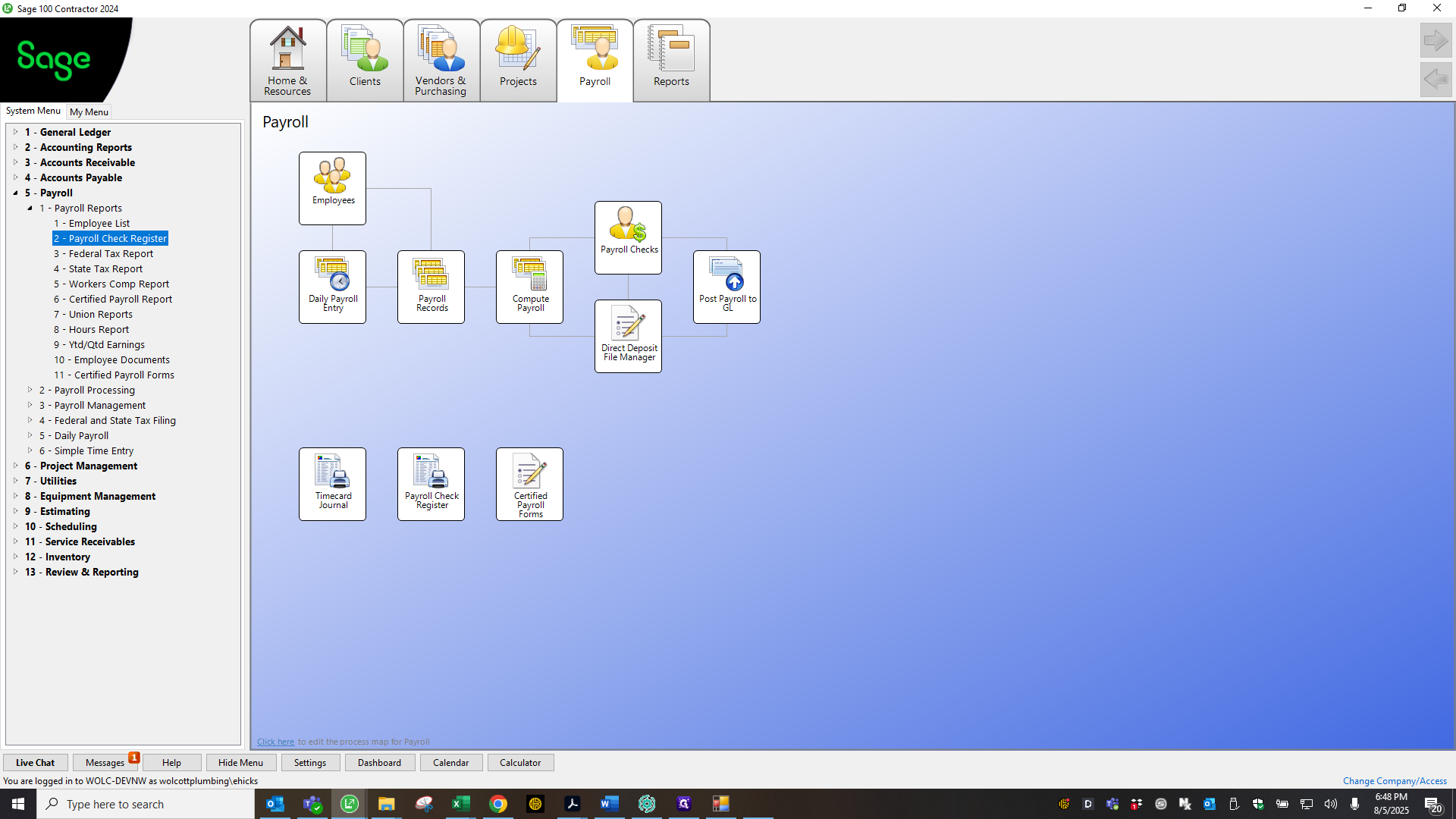

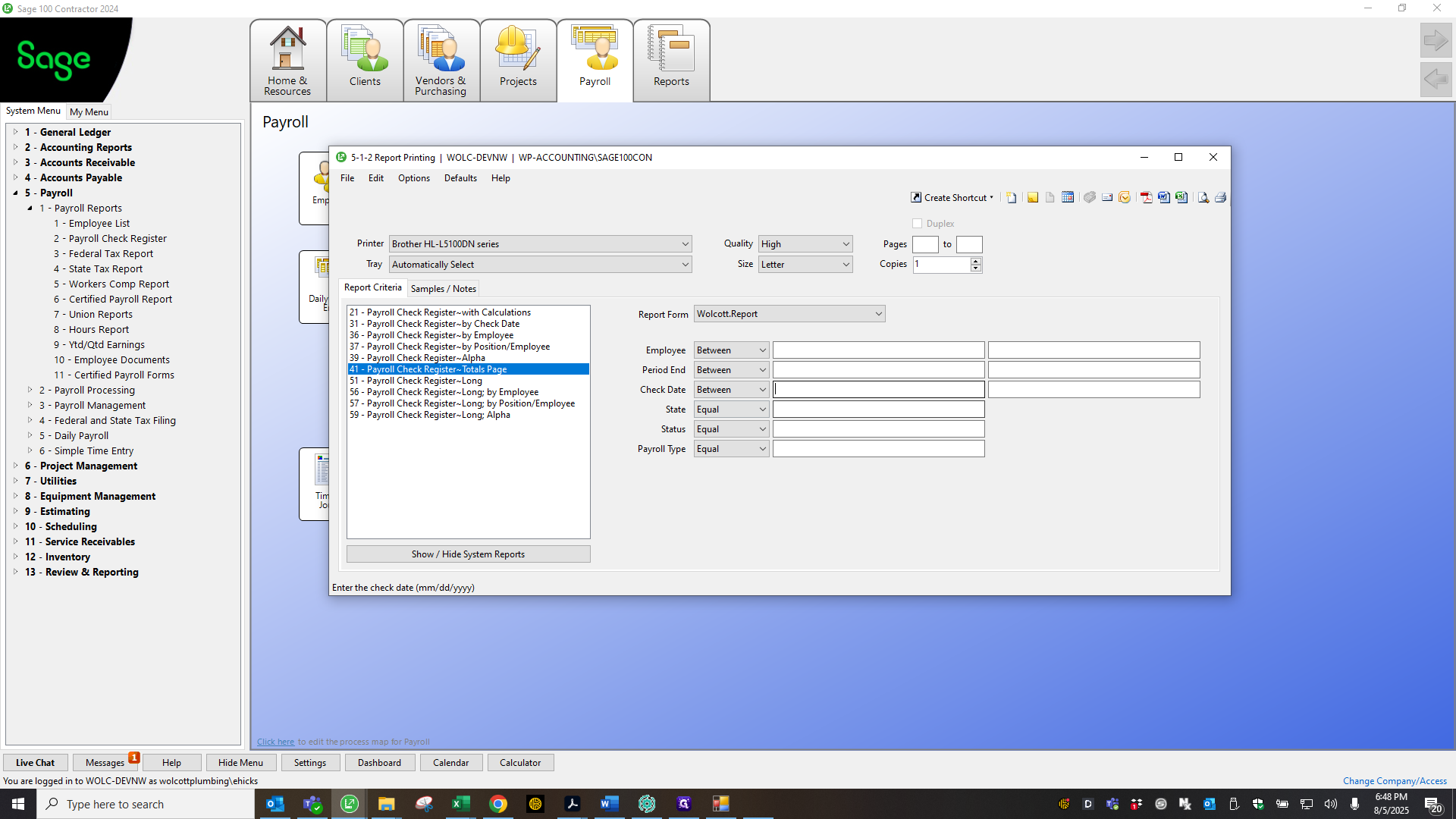

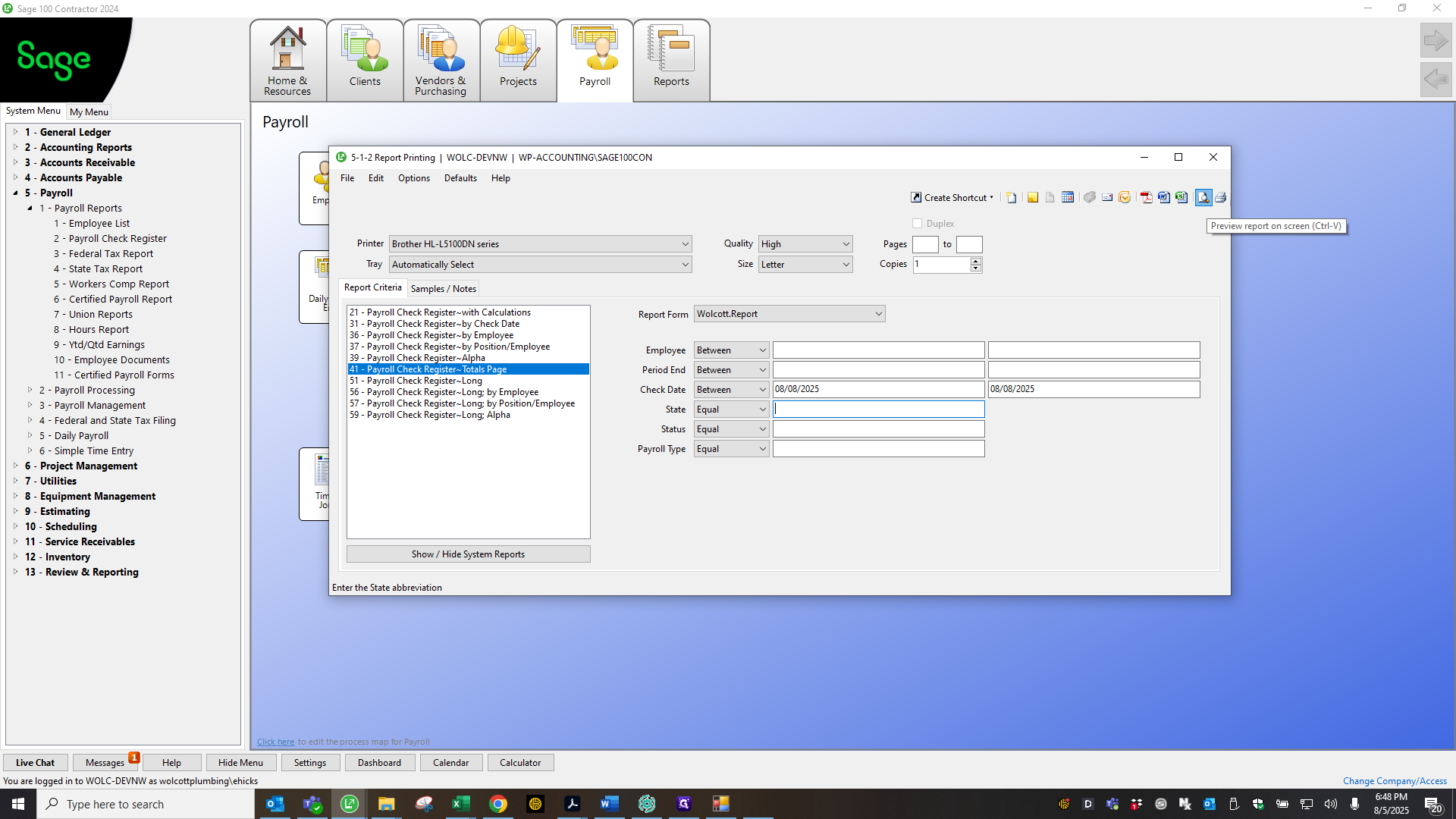

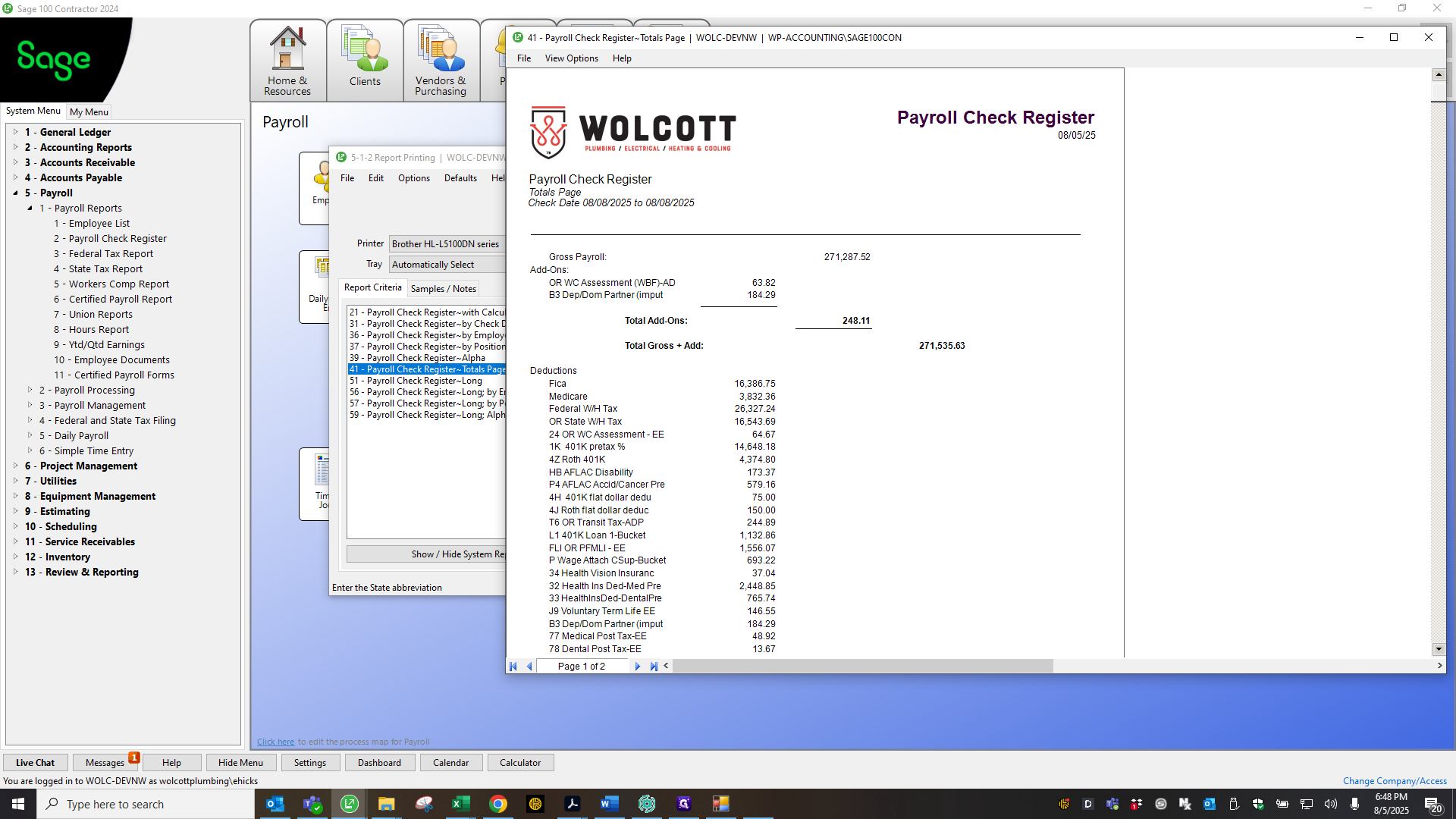

Pull a... Pull the paycheck register to match against...

Goodness.

Match against the ADP Excel register we downloaded.

Let's see if I can do that here with this one.

Great.

Okay.

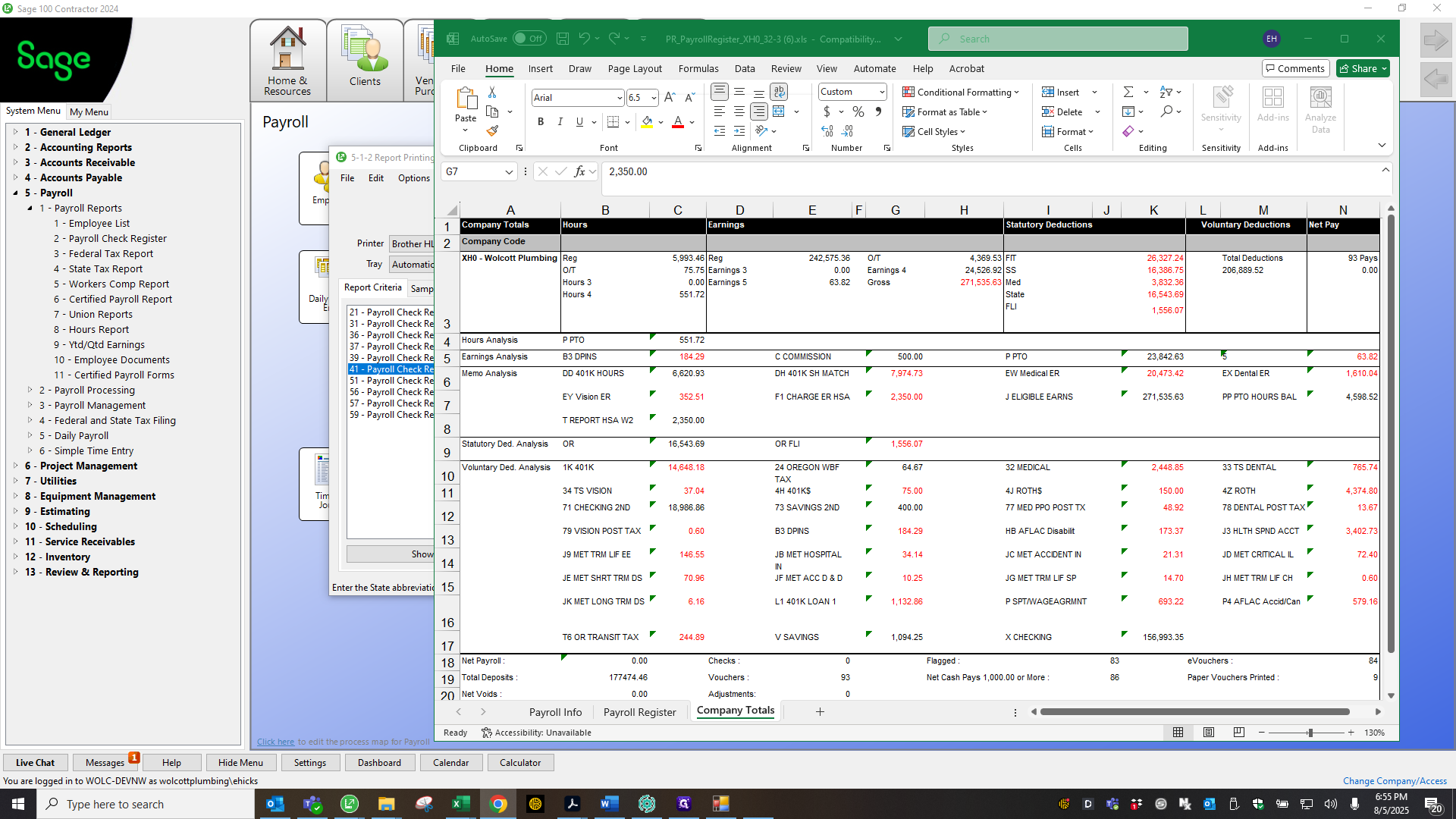

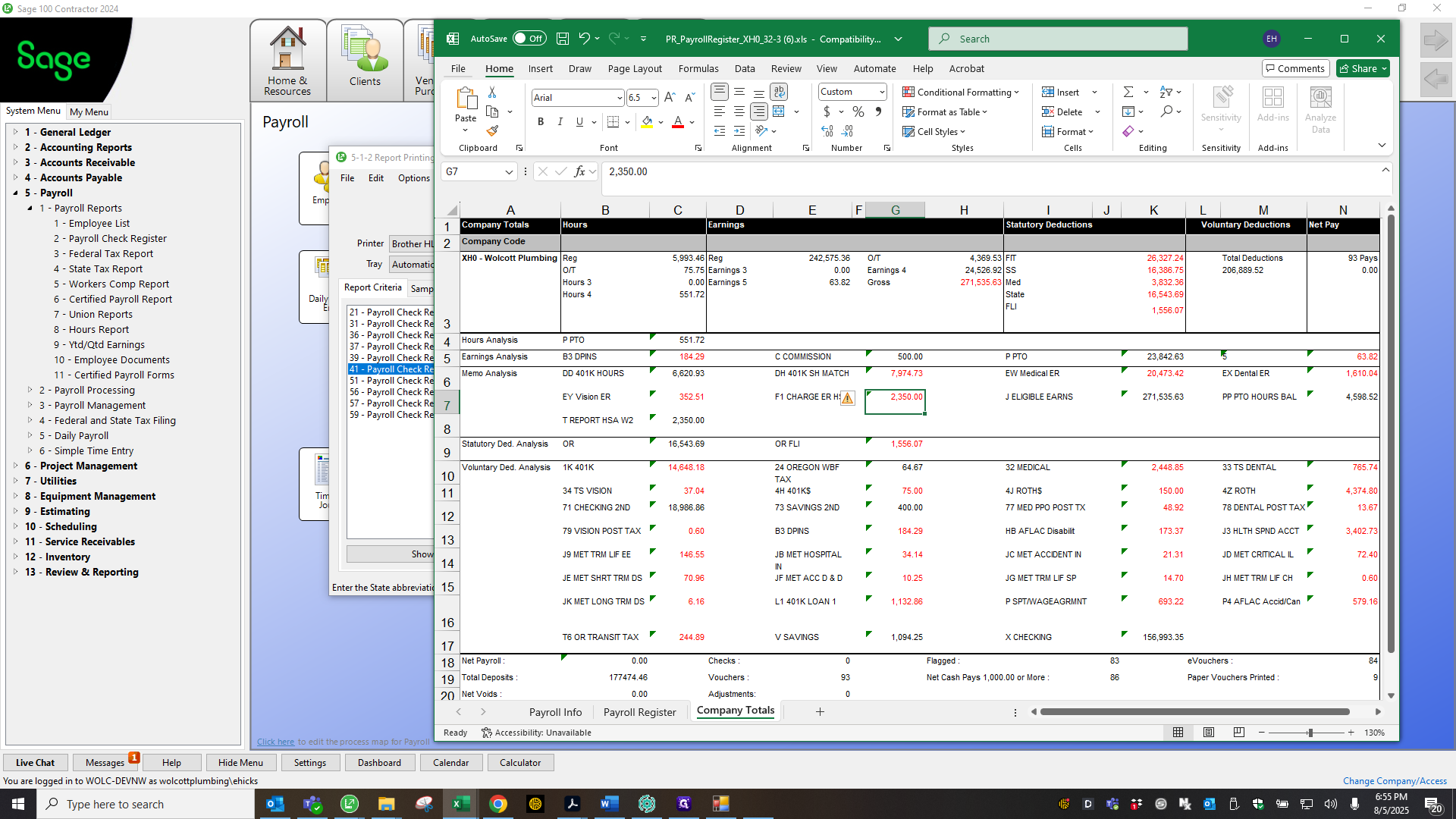

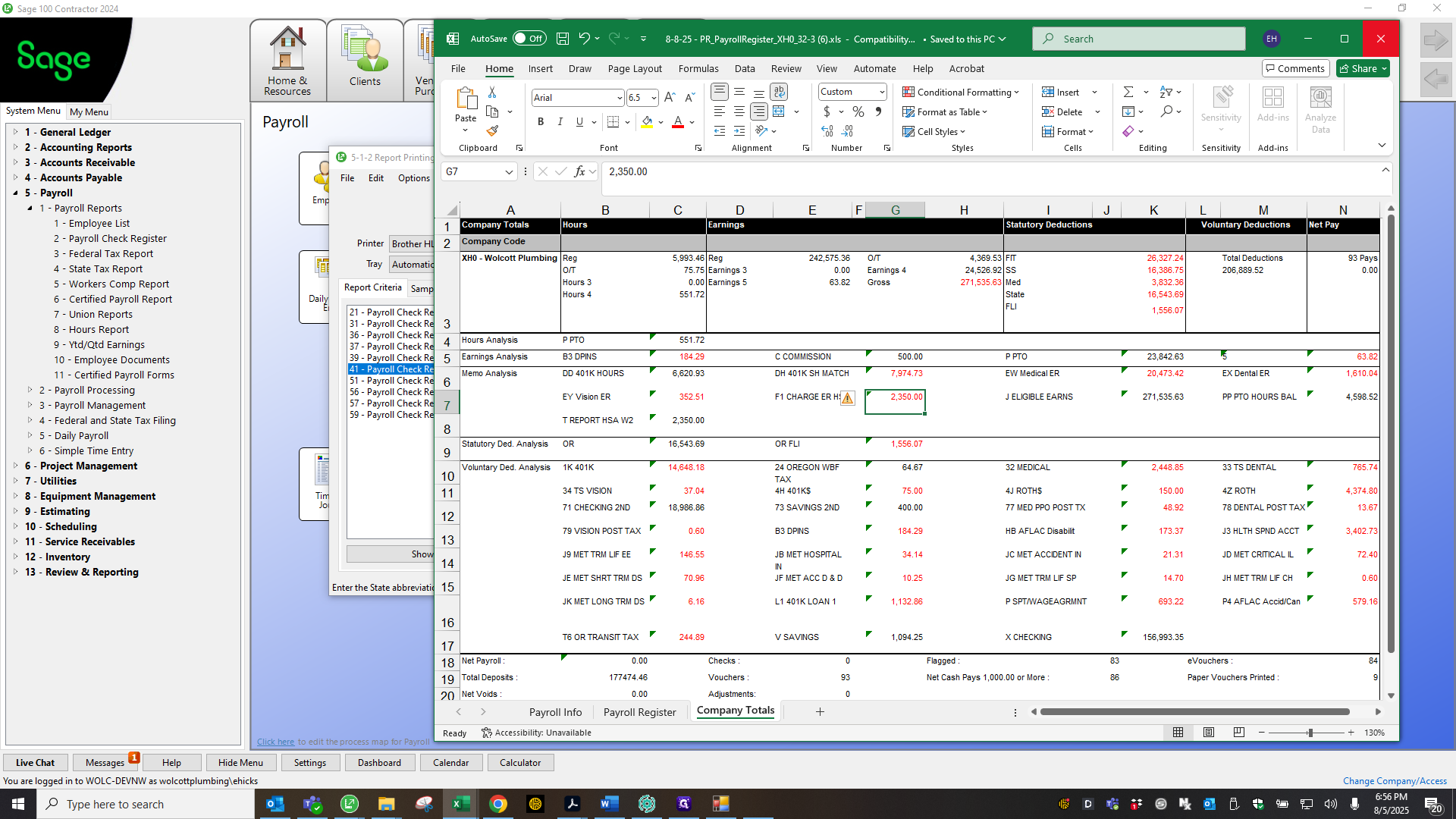

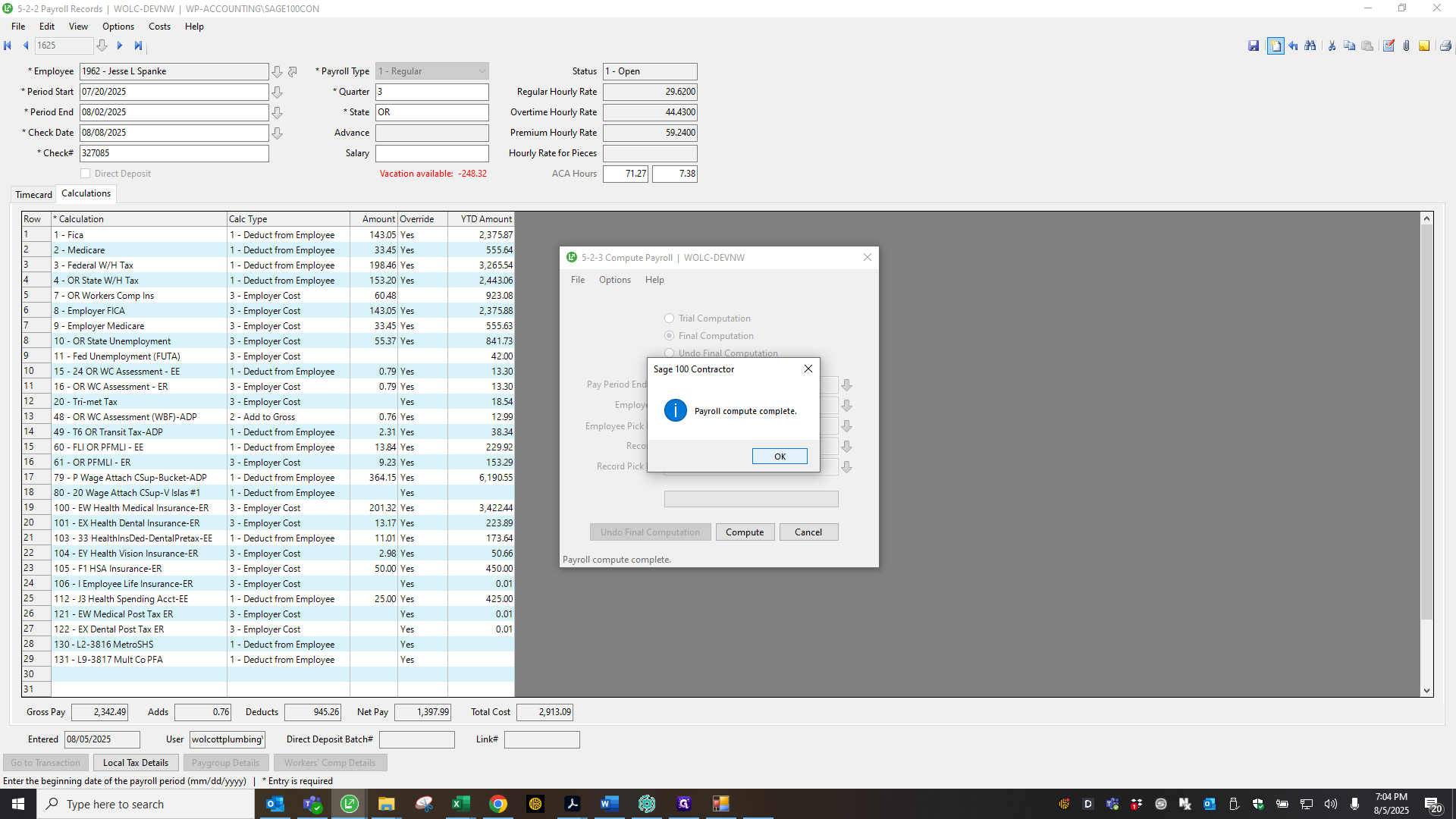

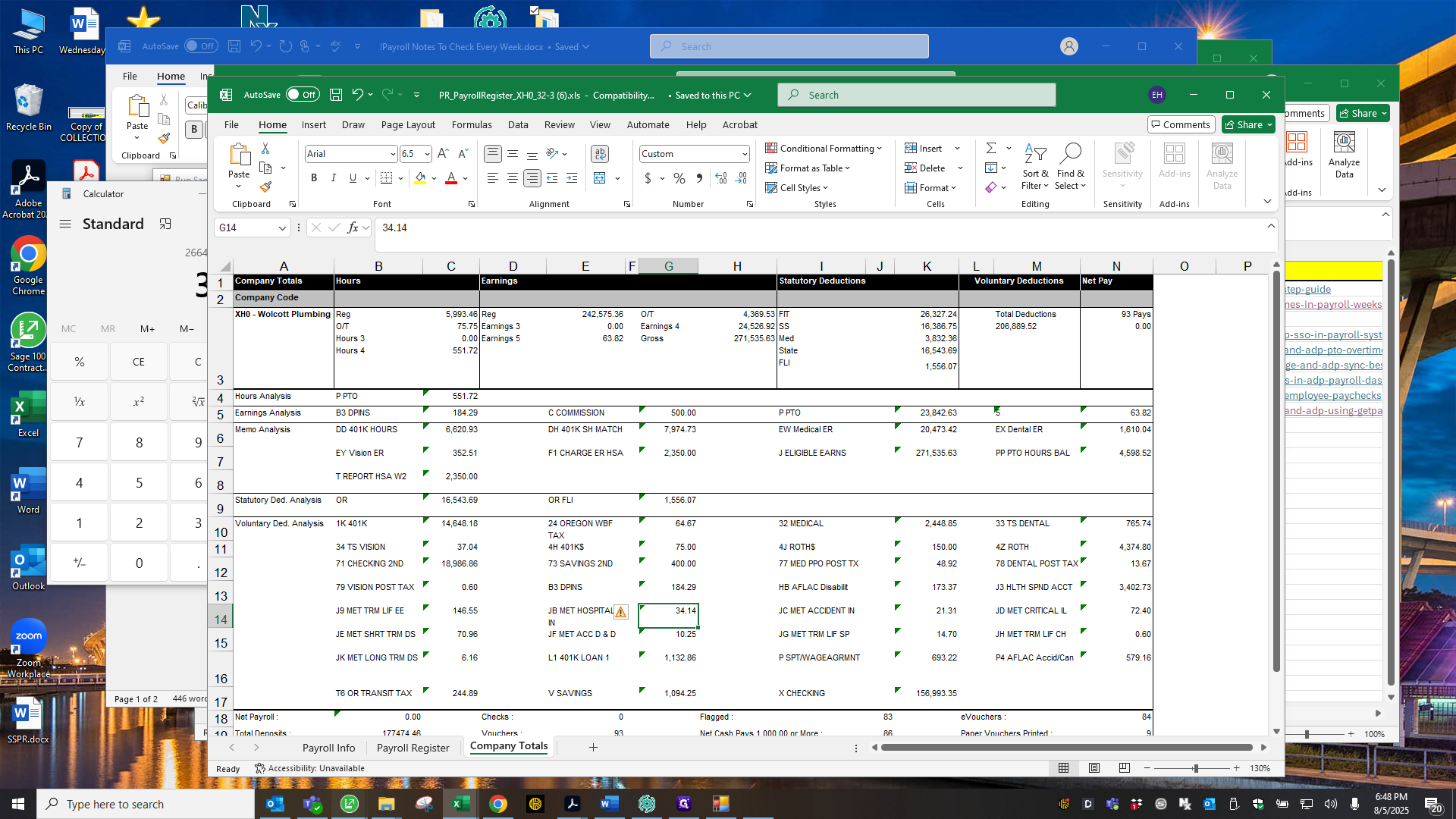

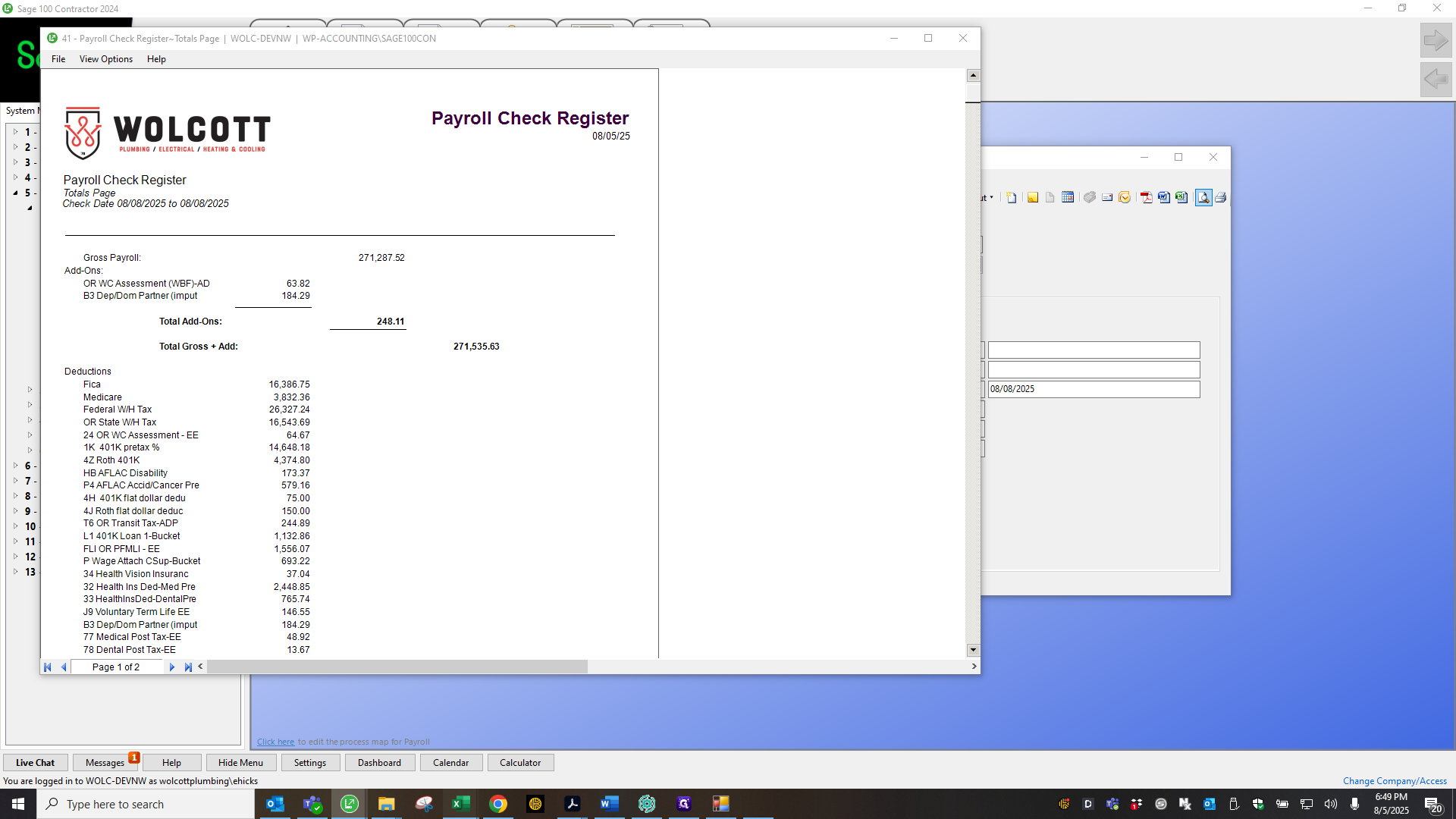

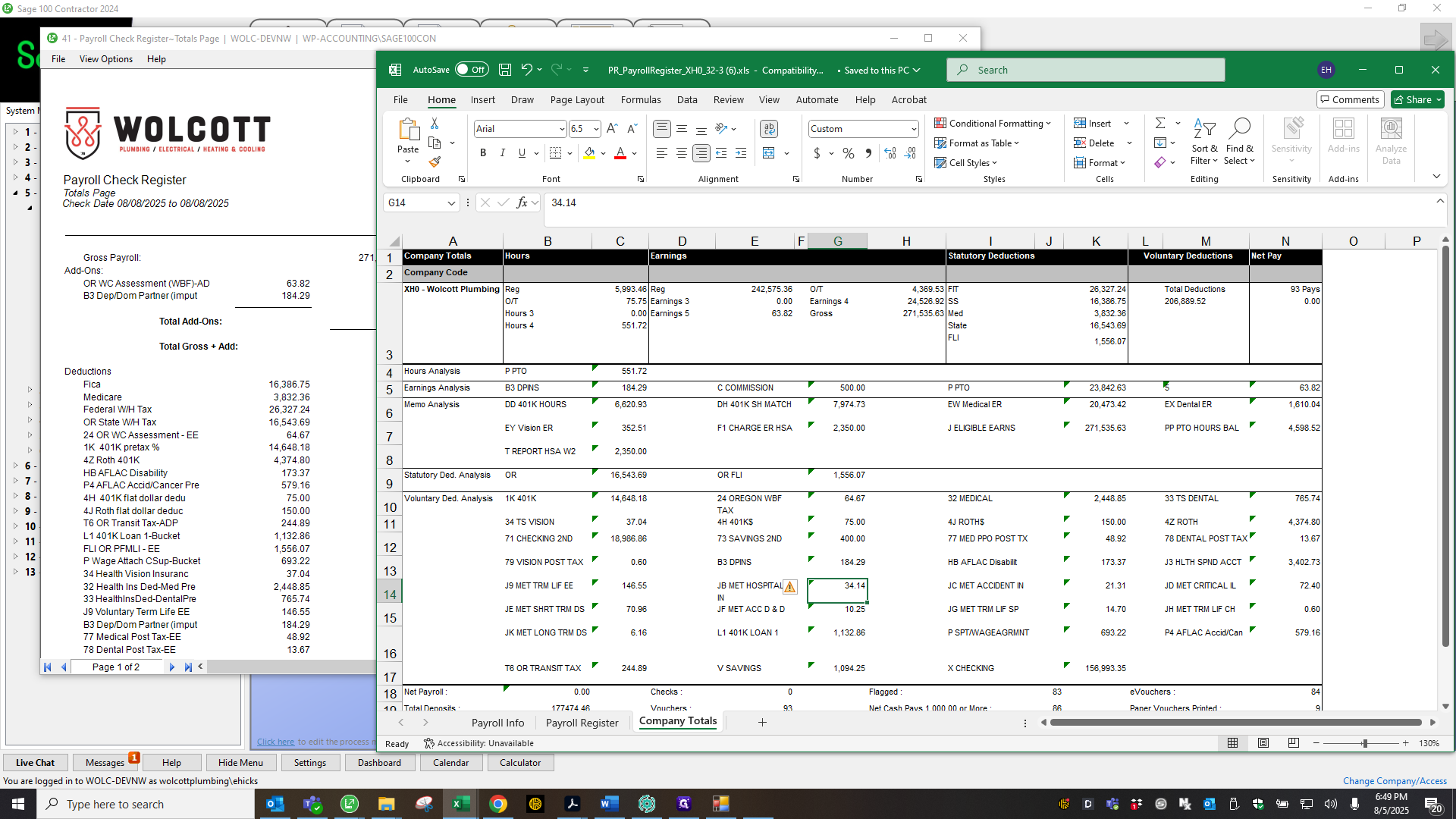

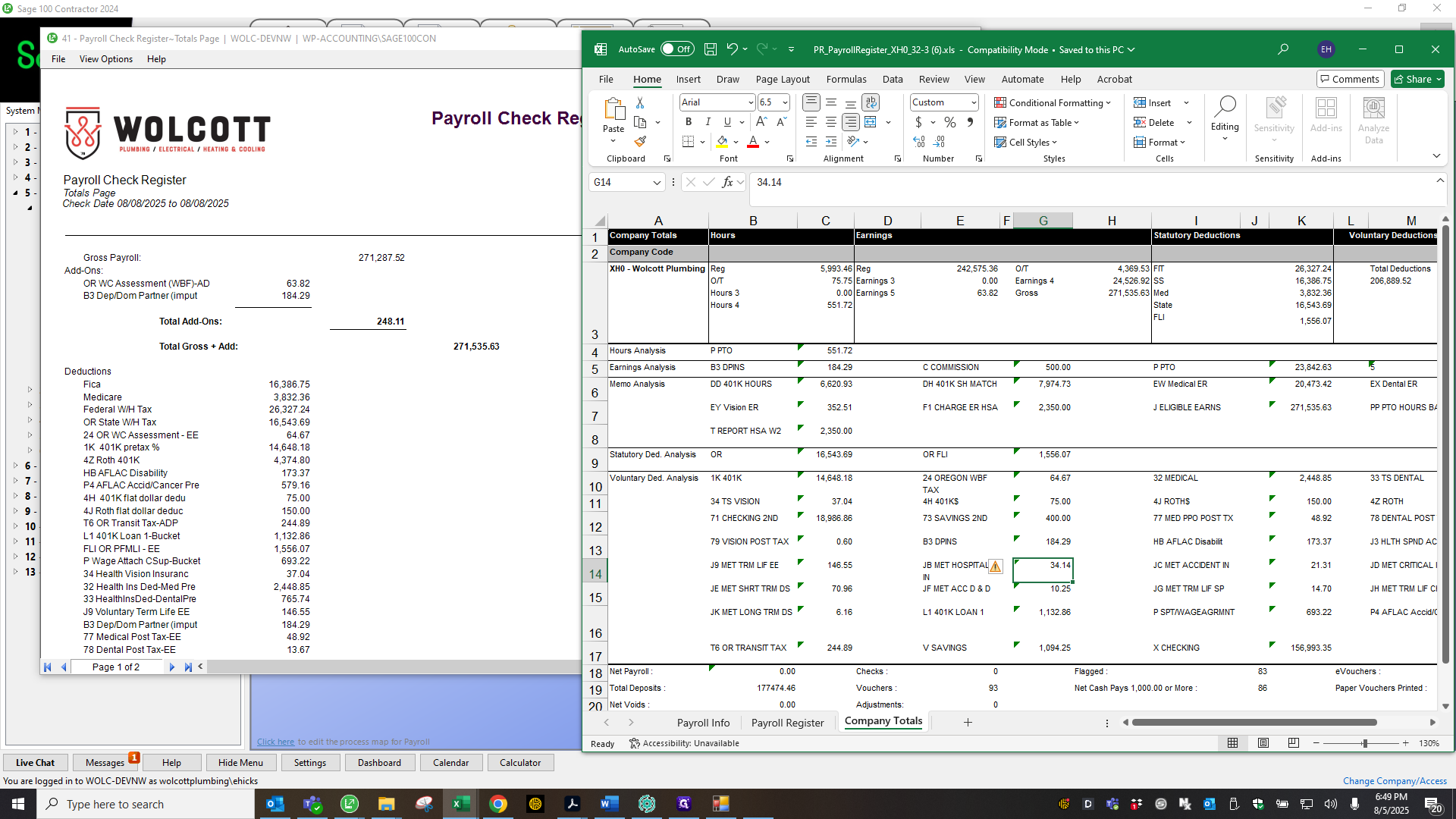

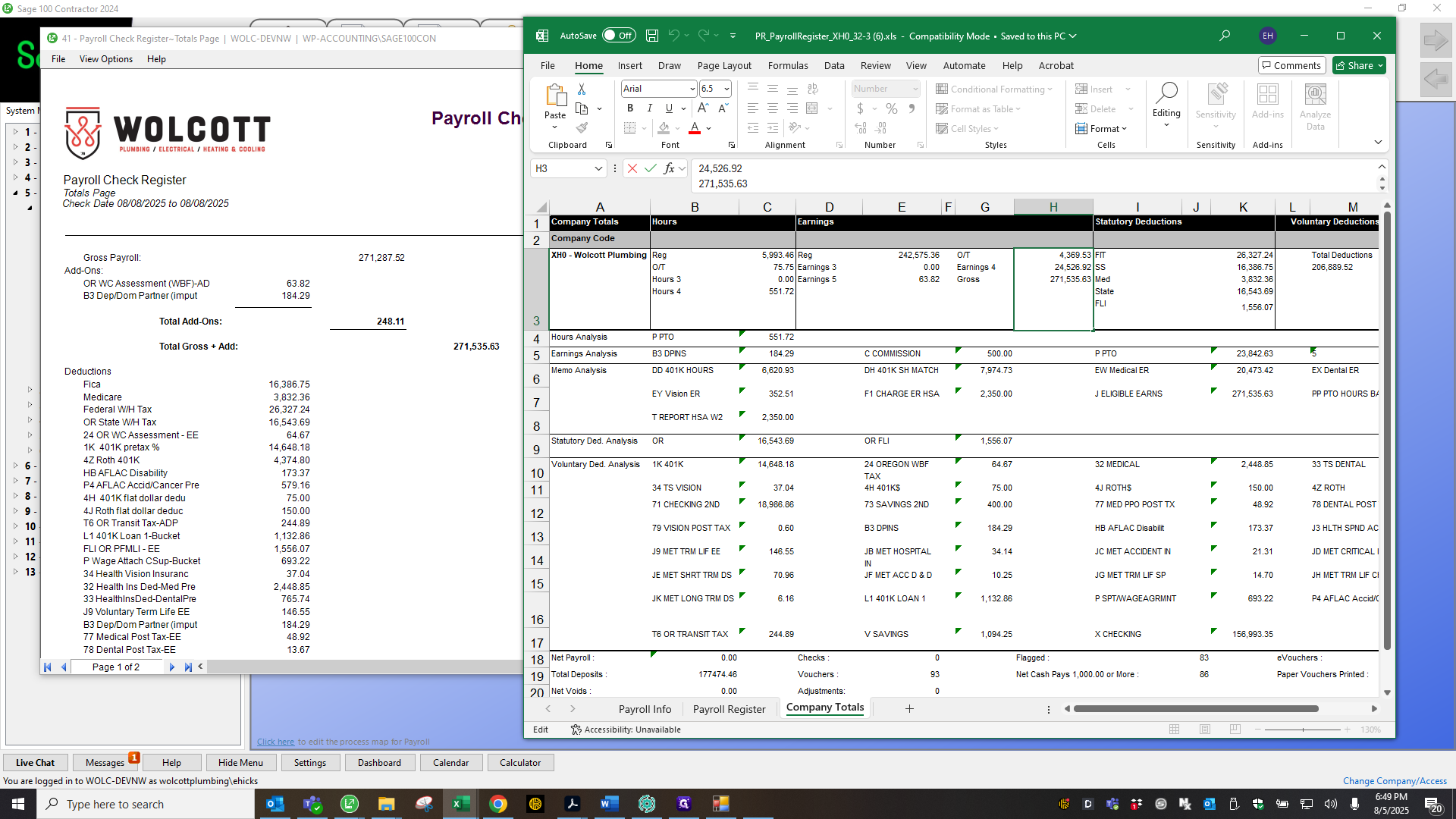

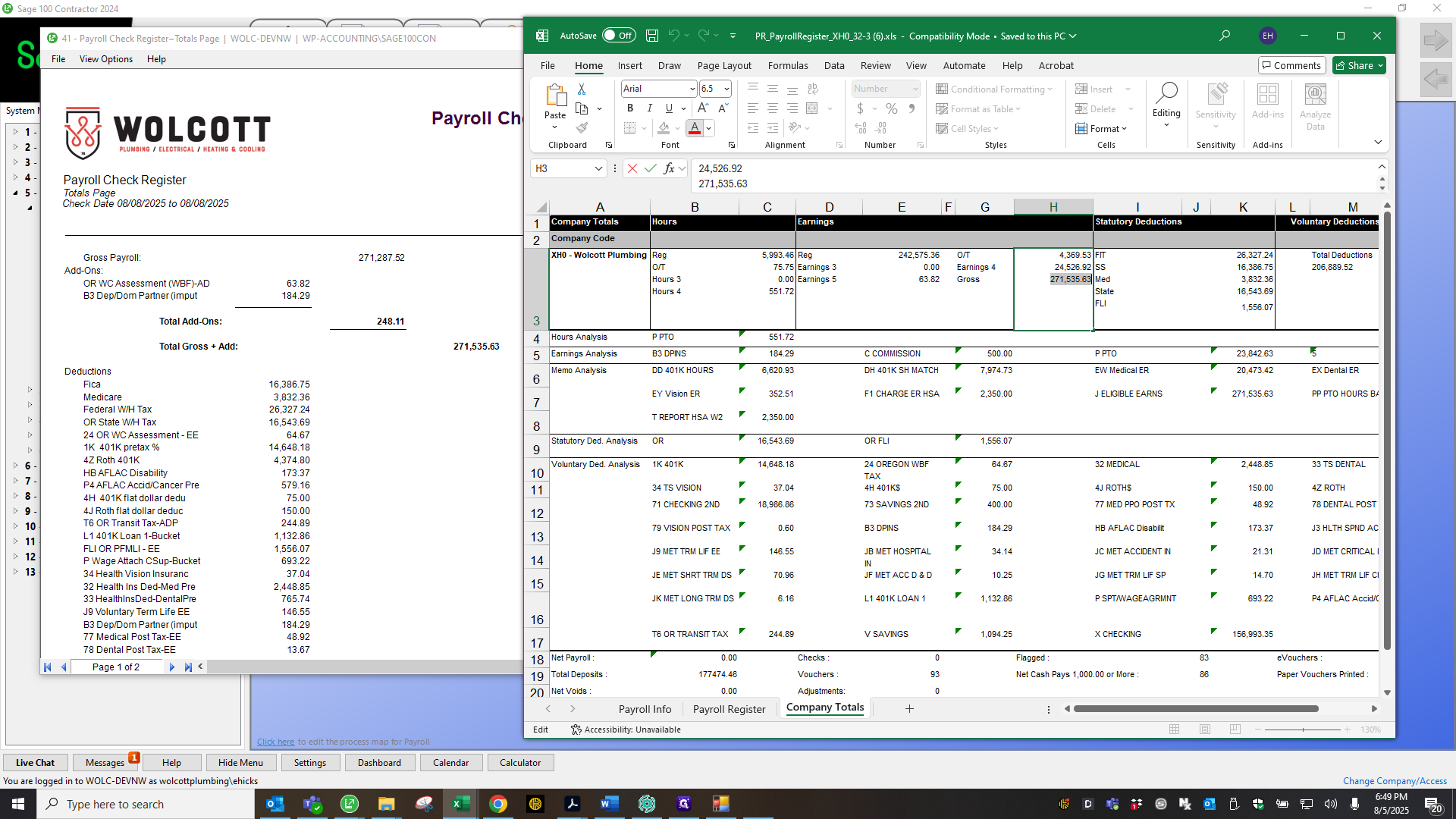

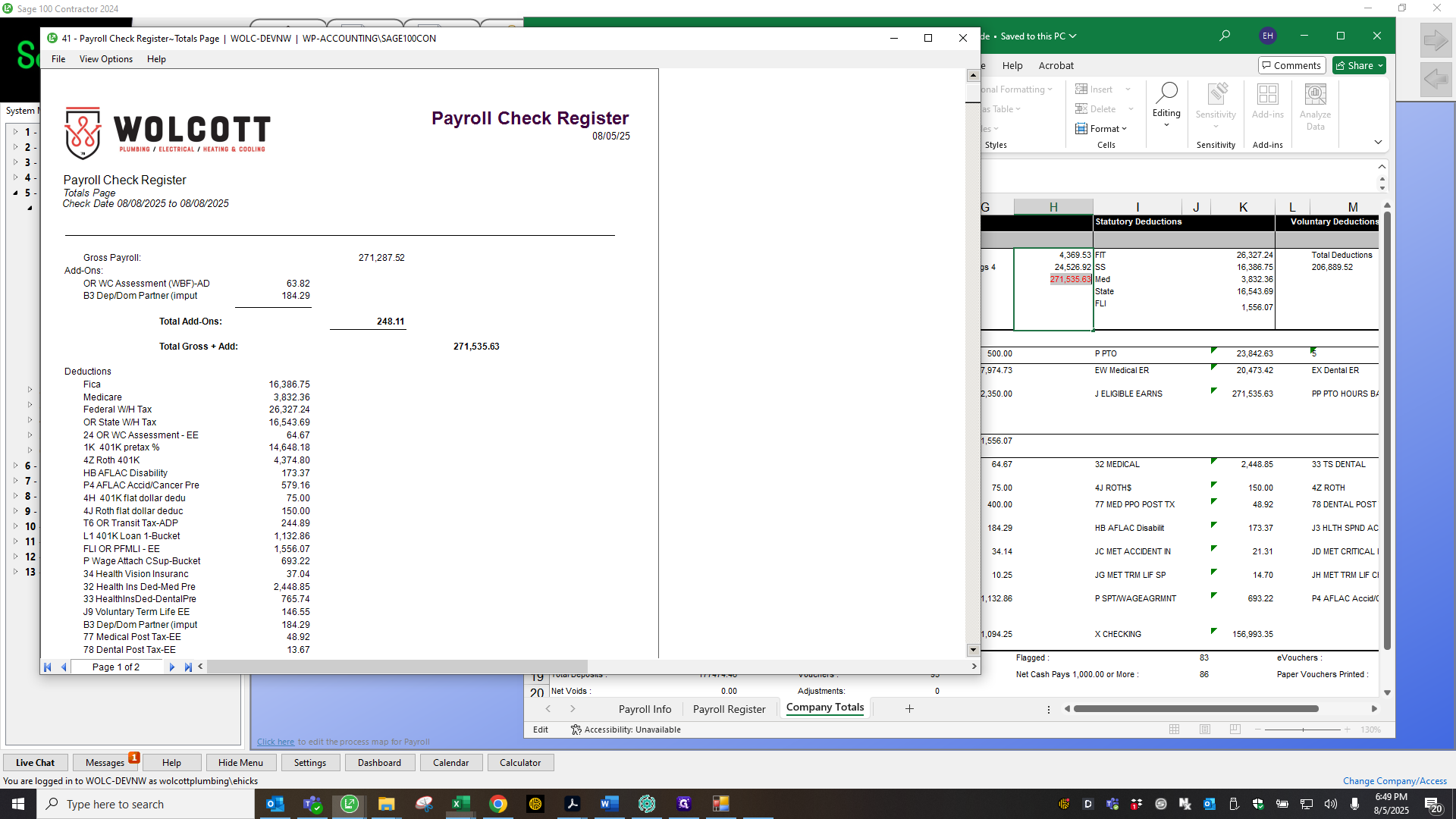

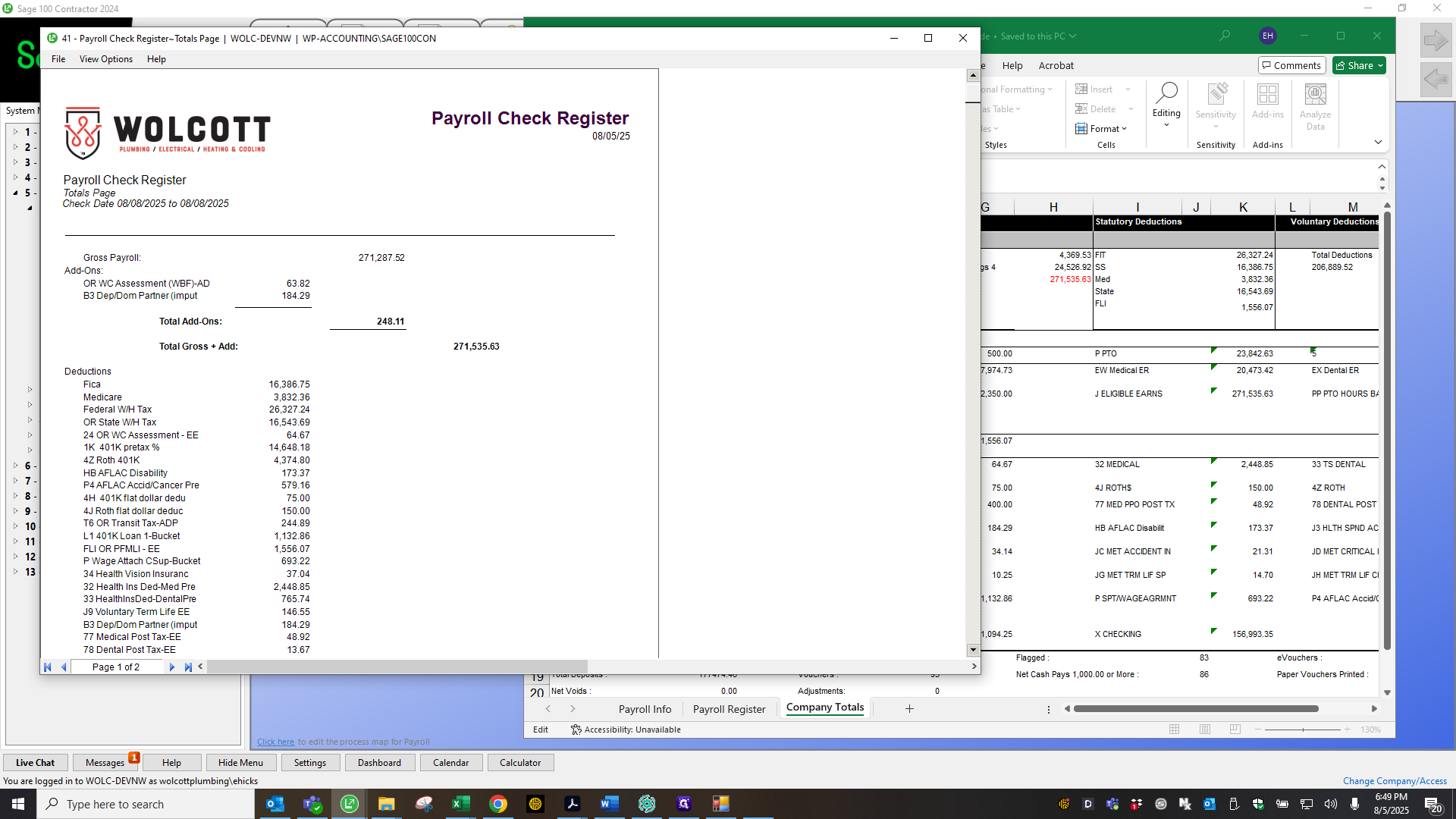

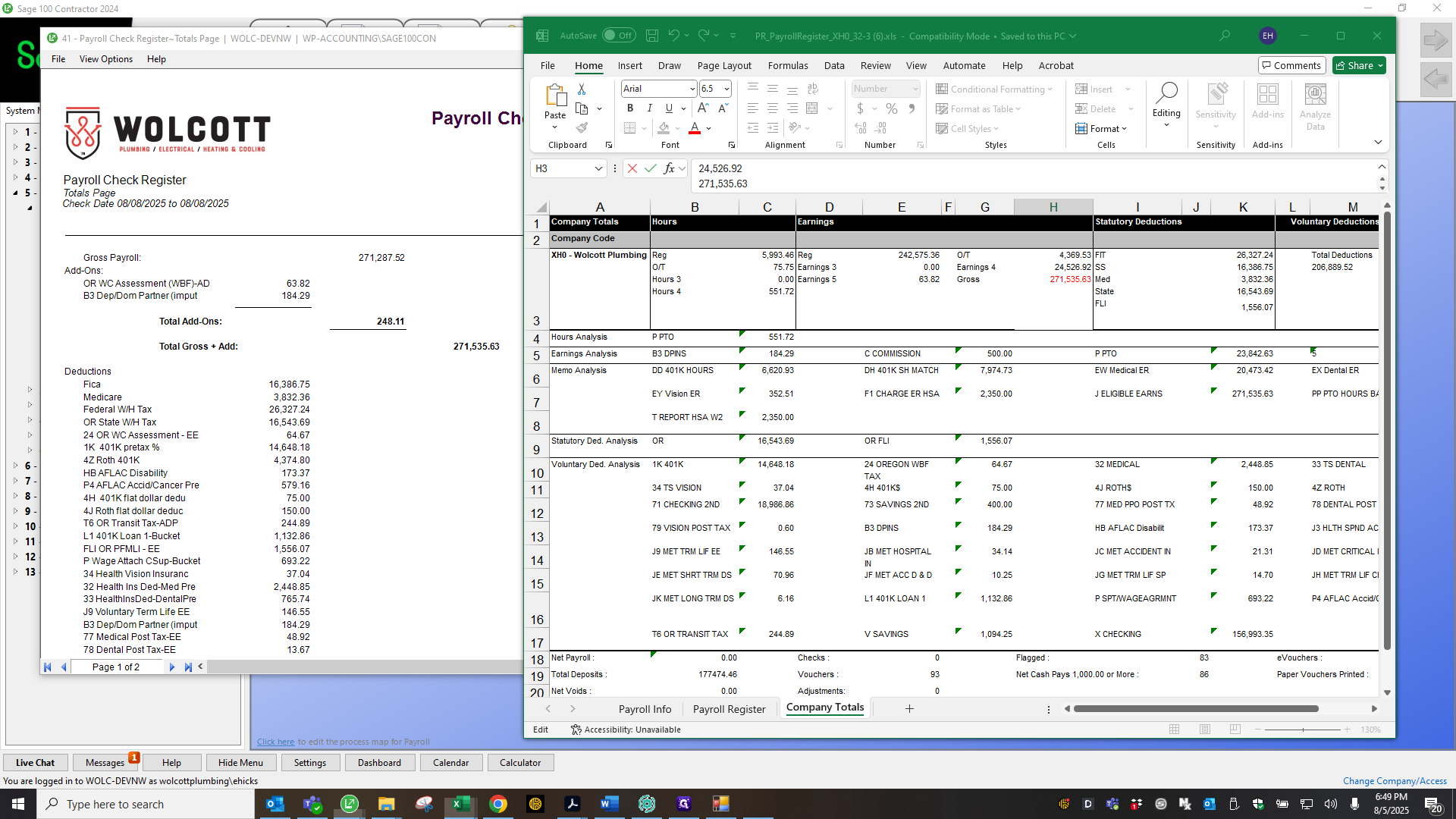

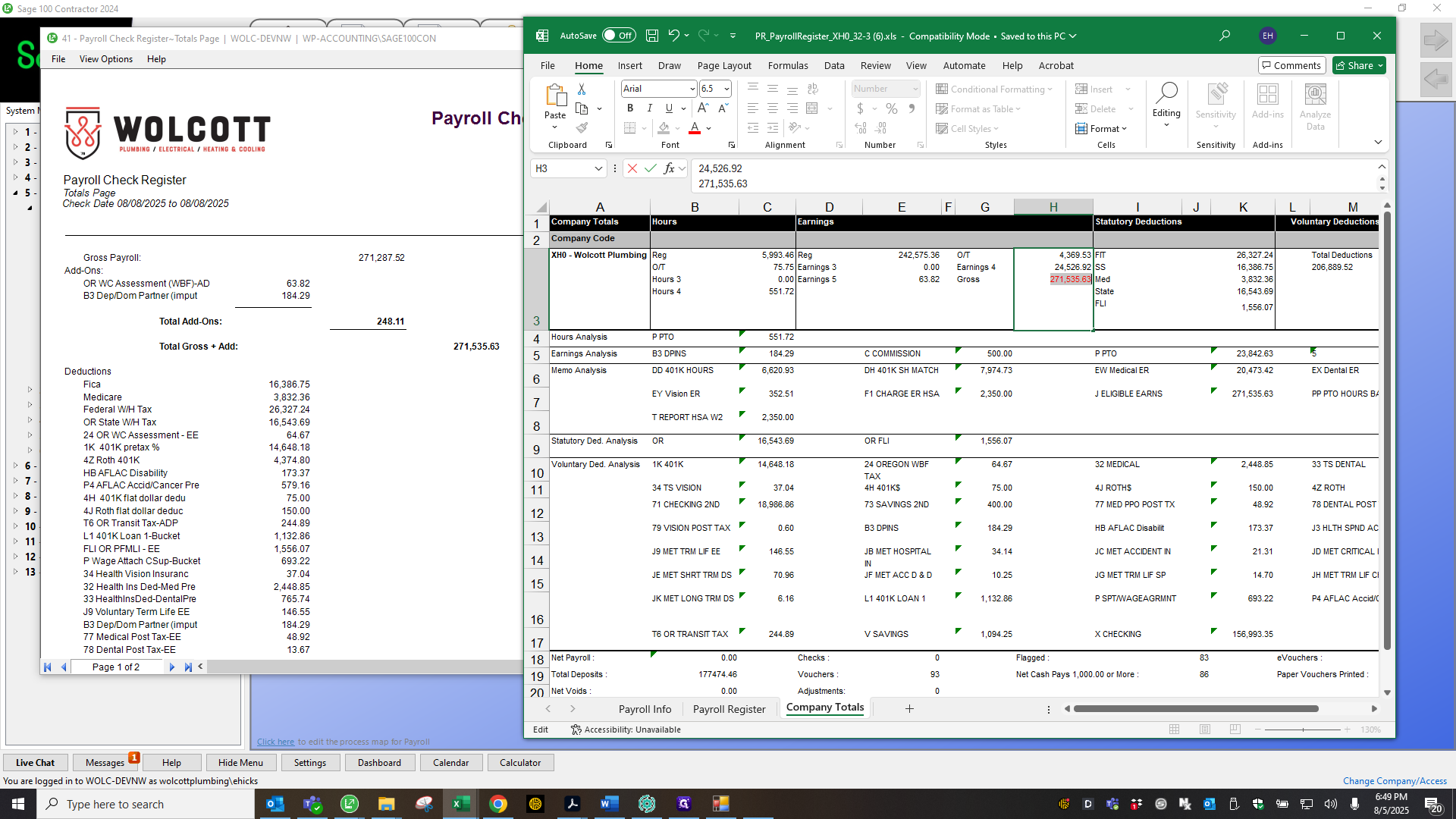

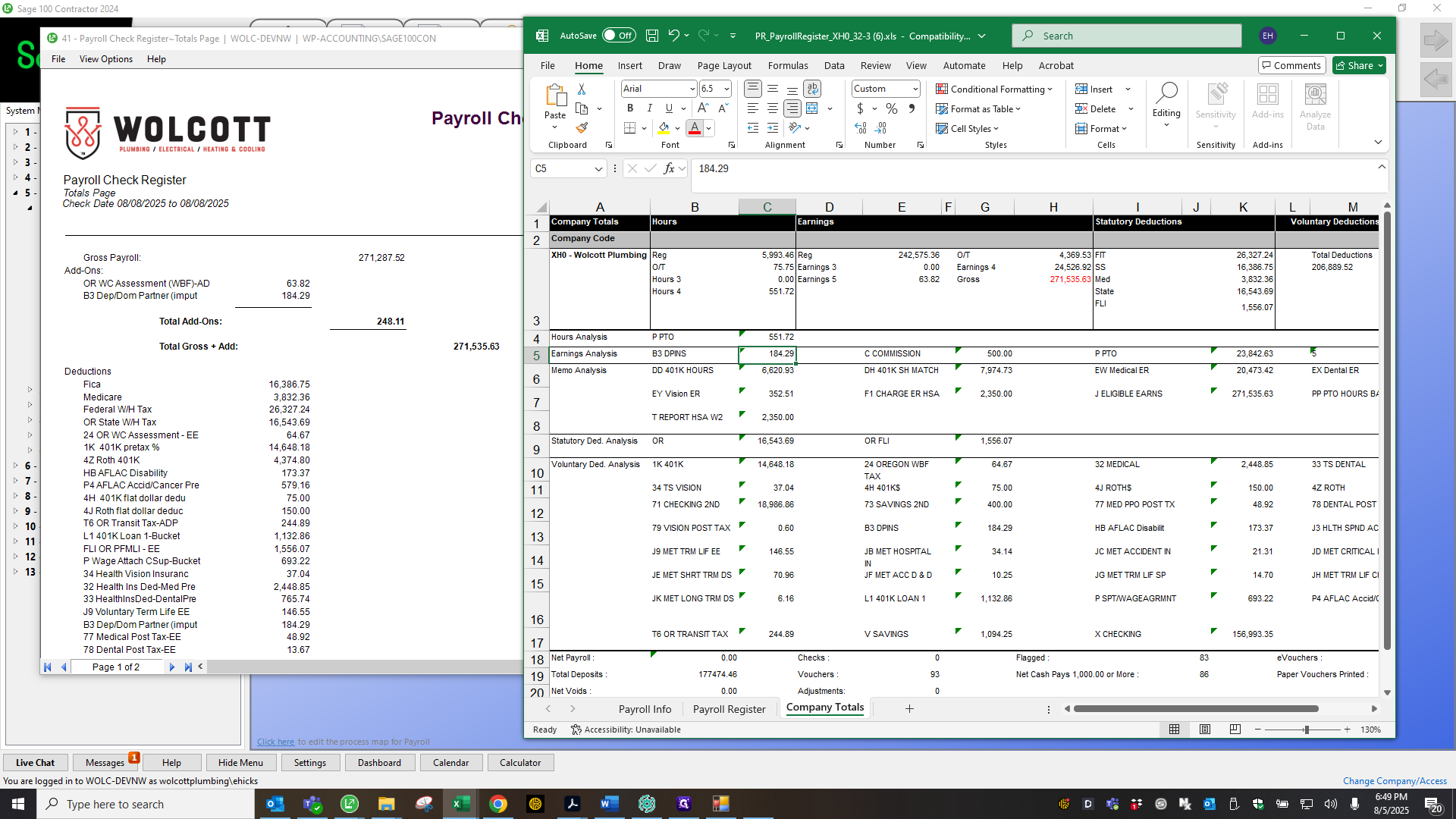

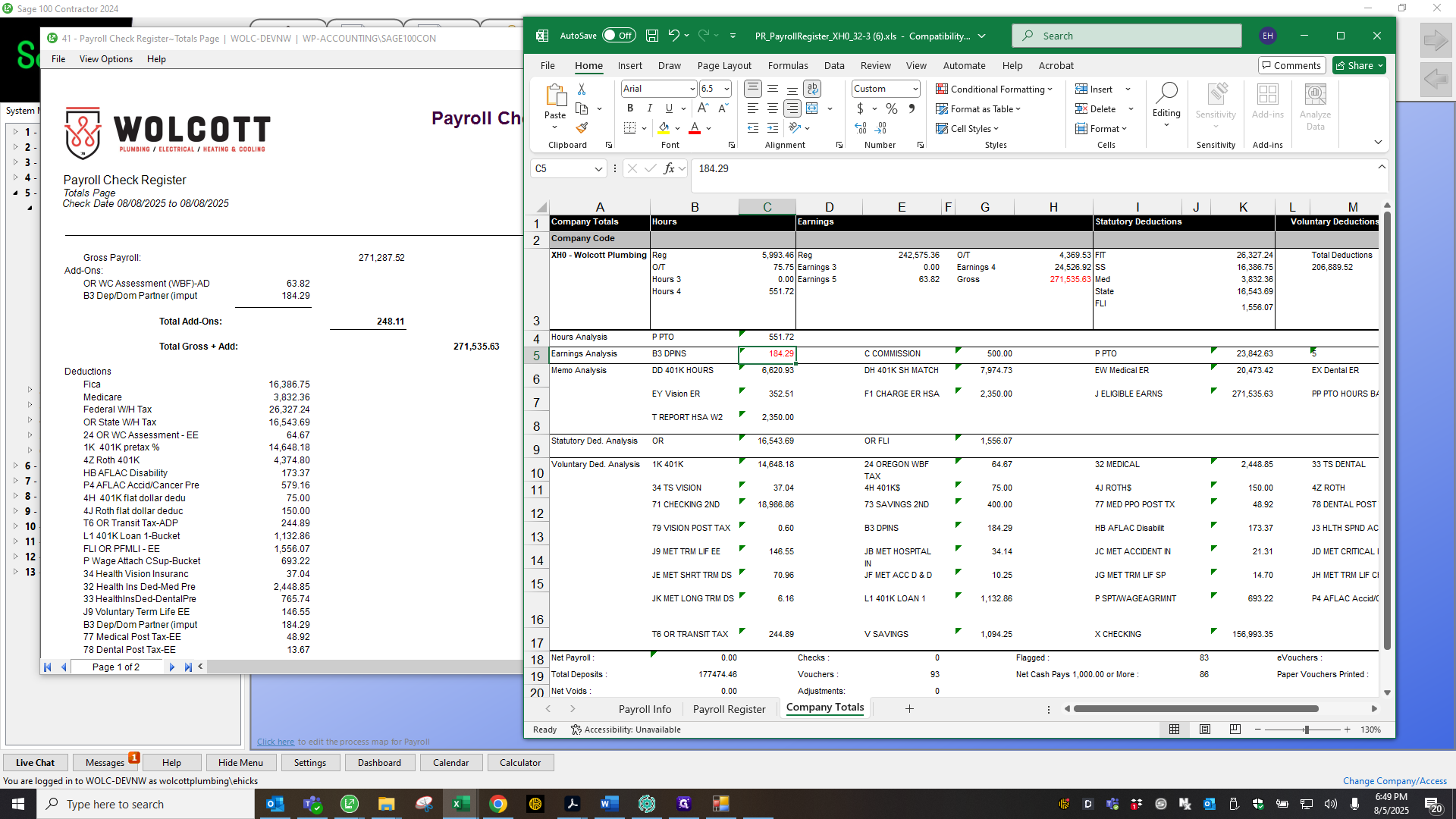

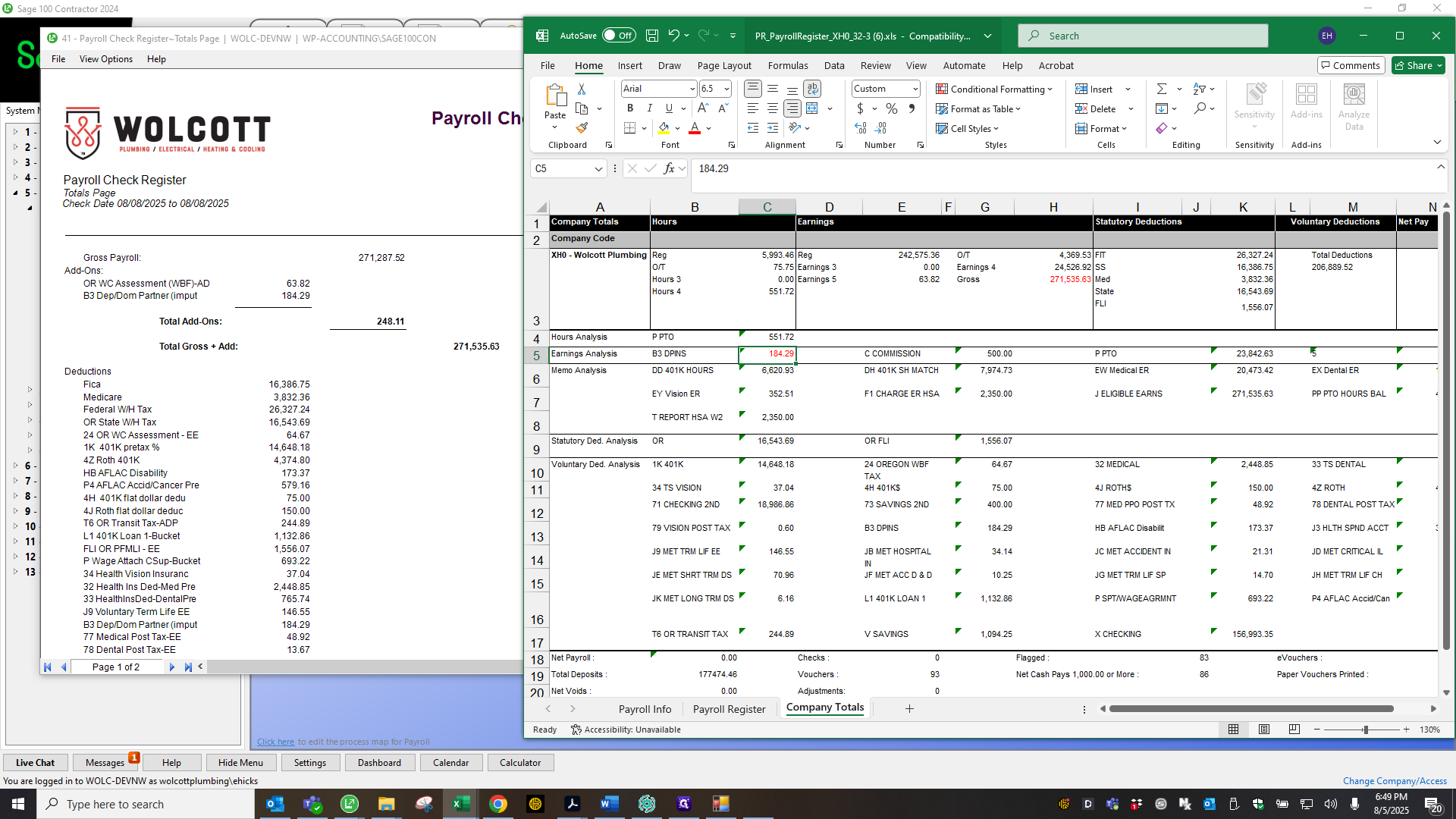

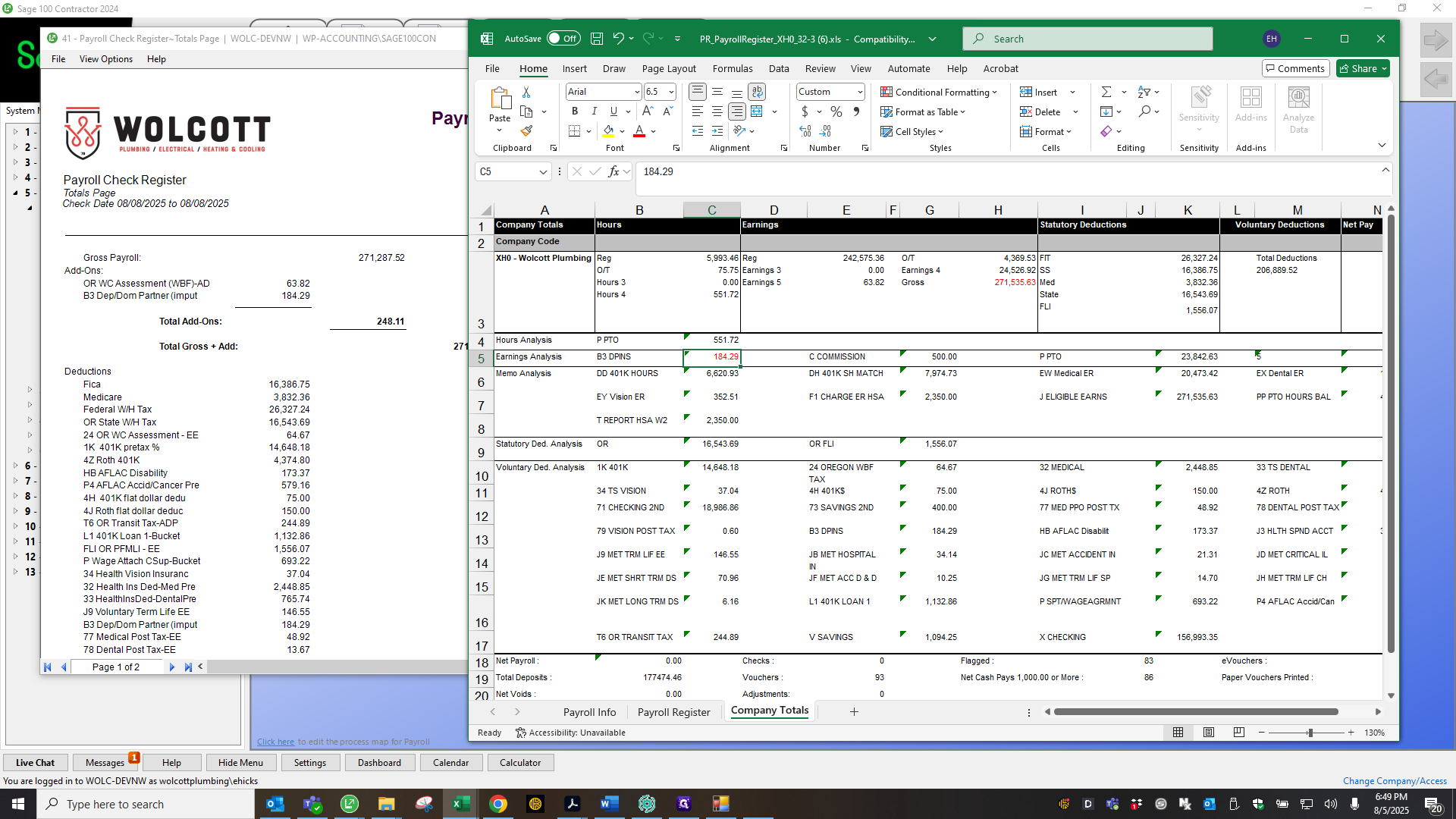

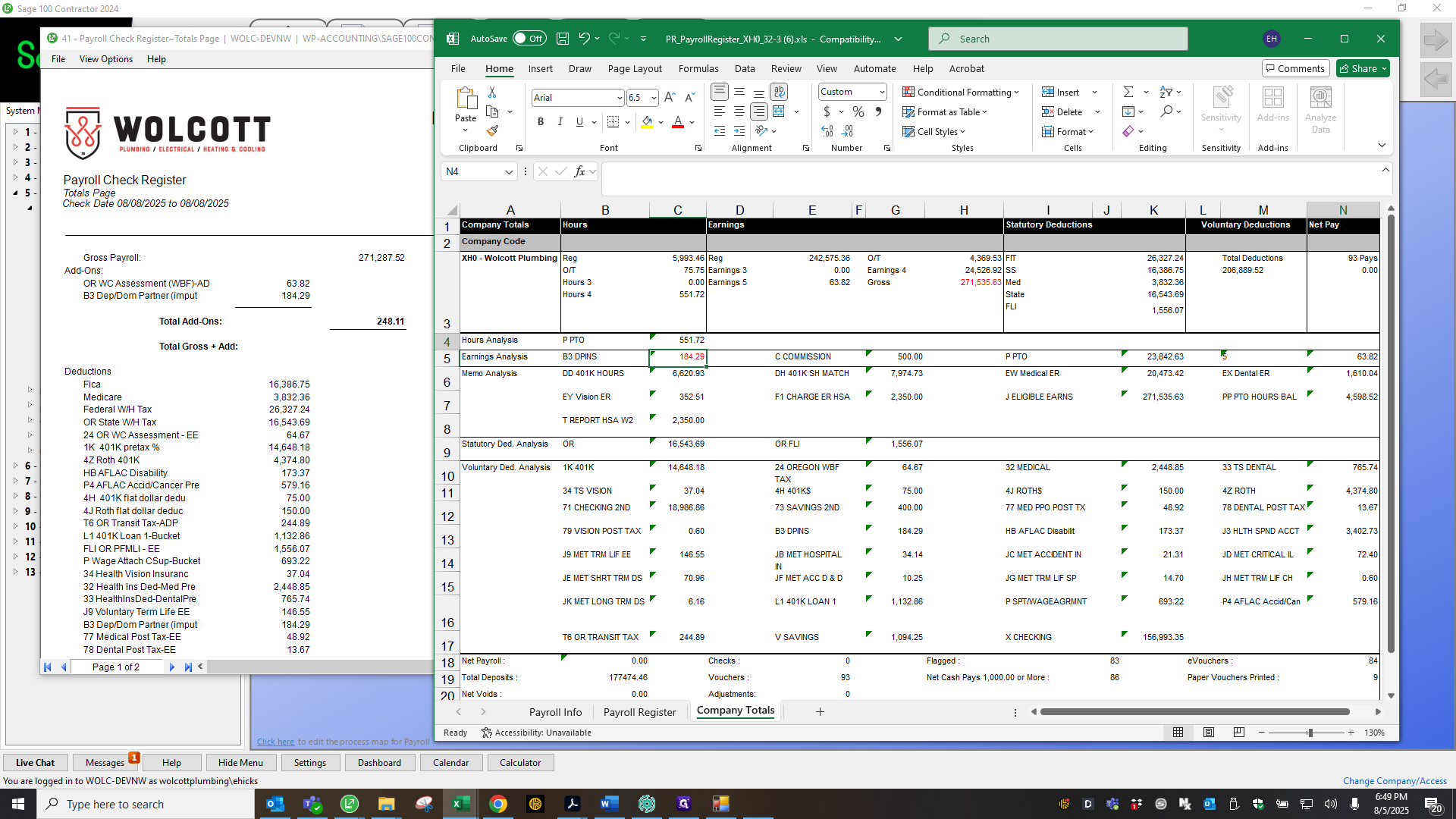

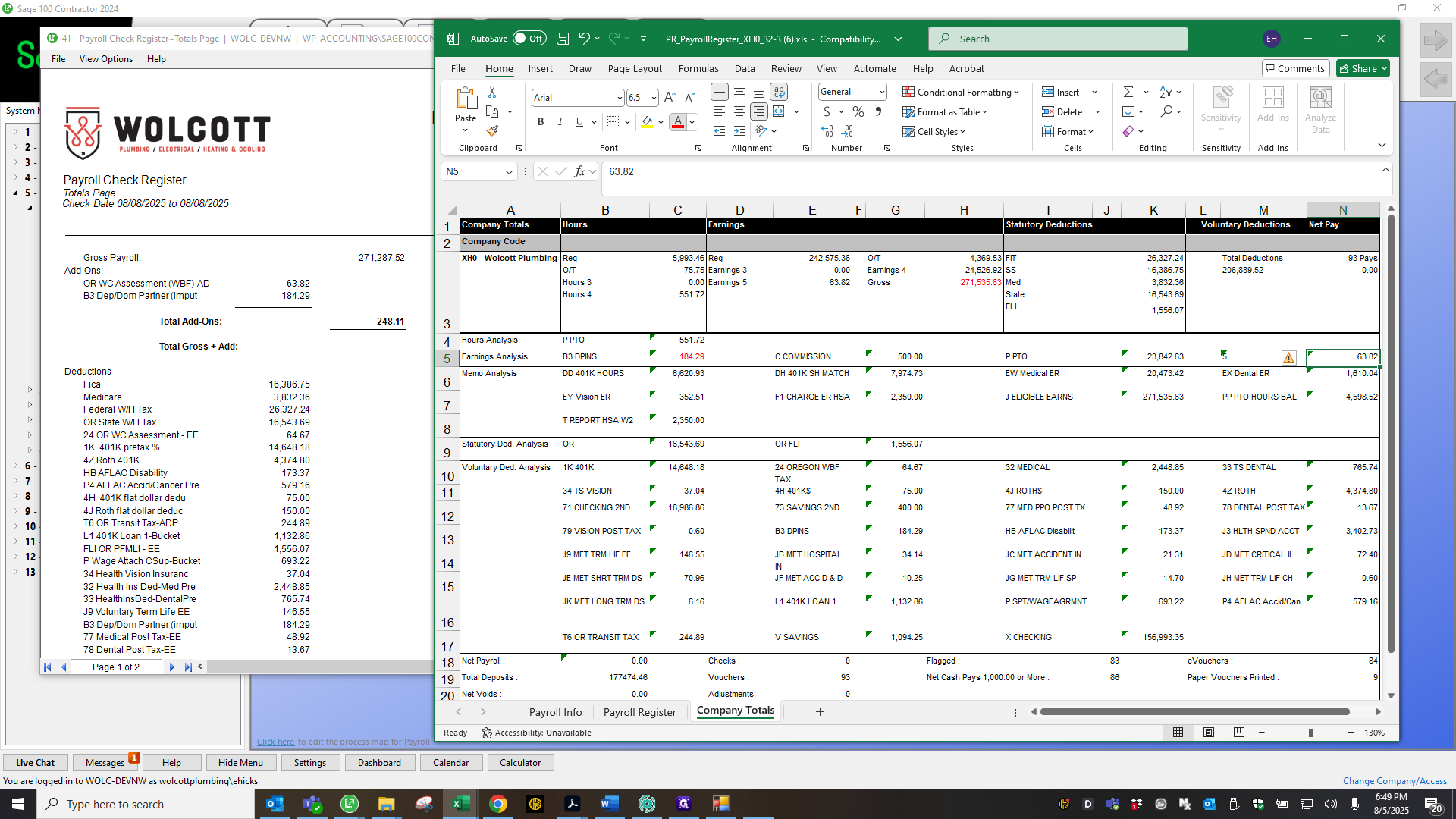

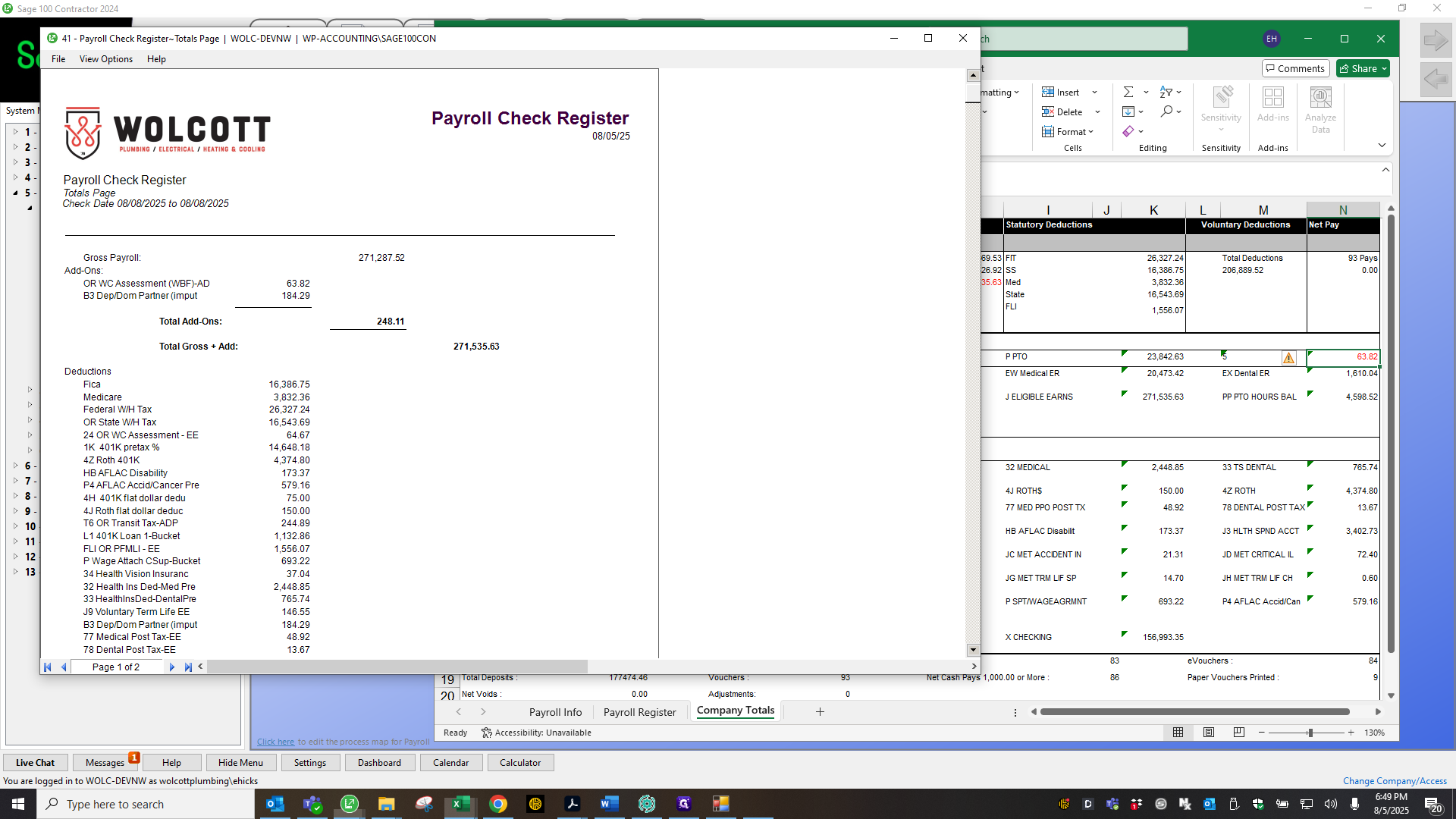

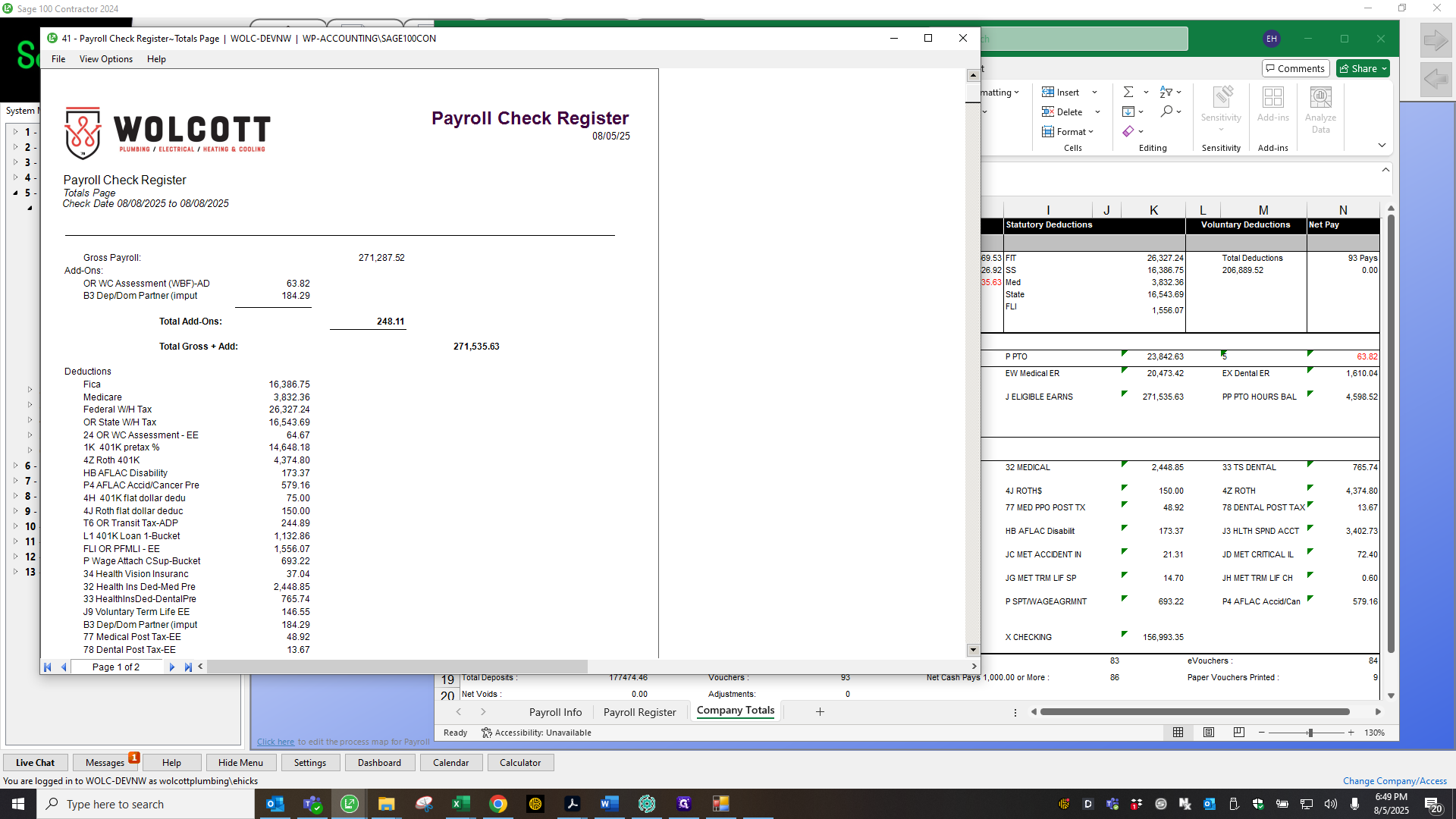

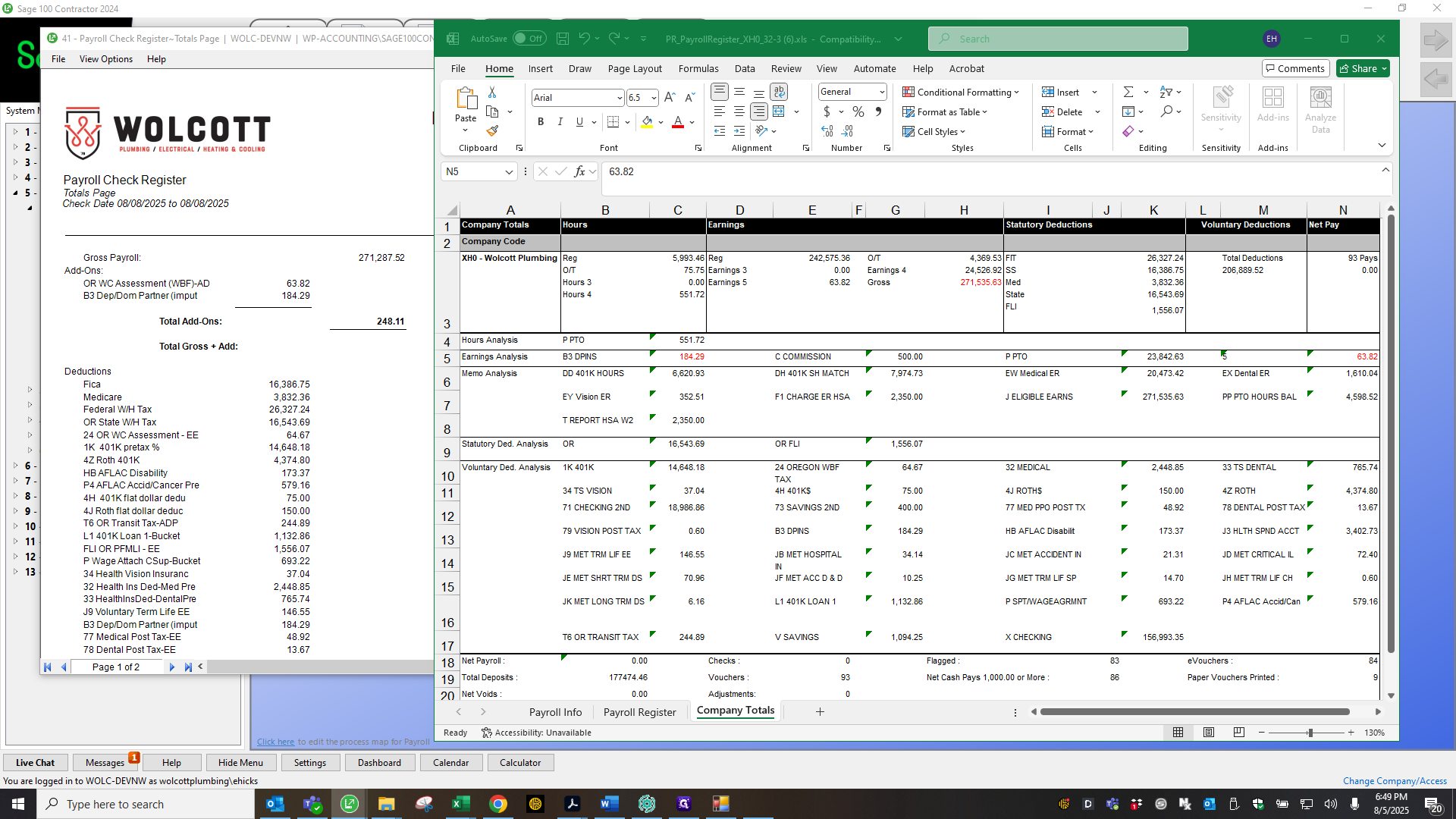

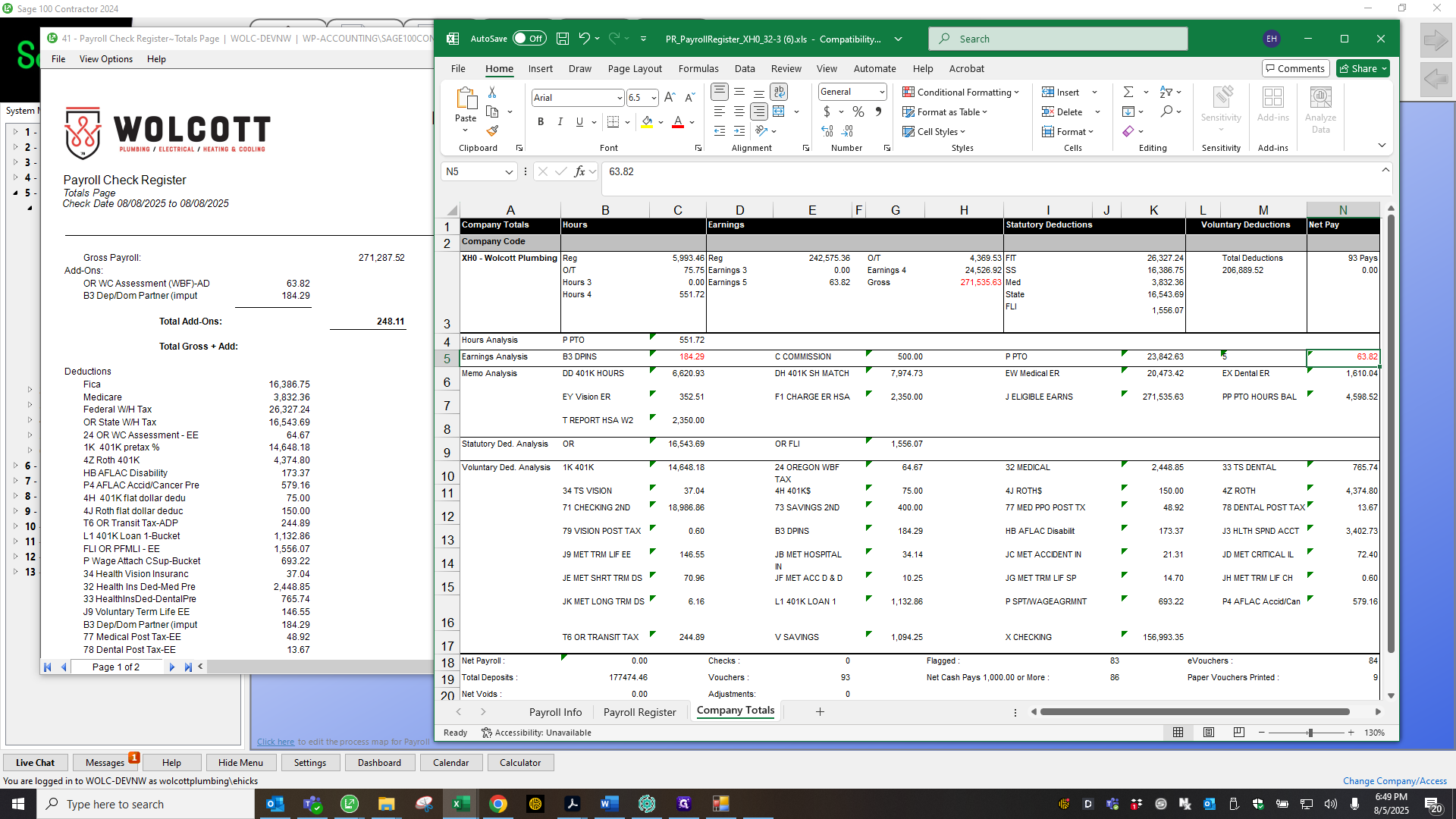

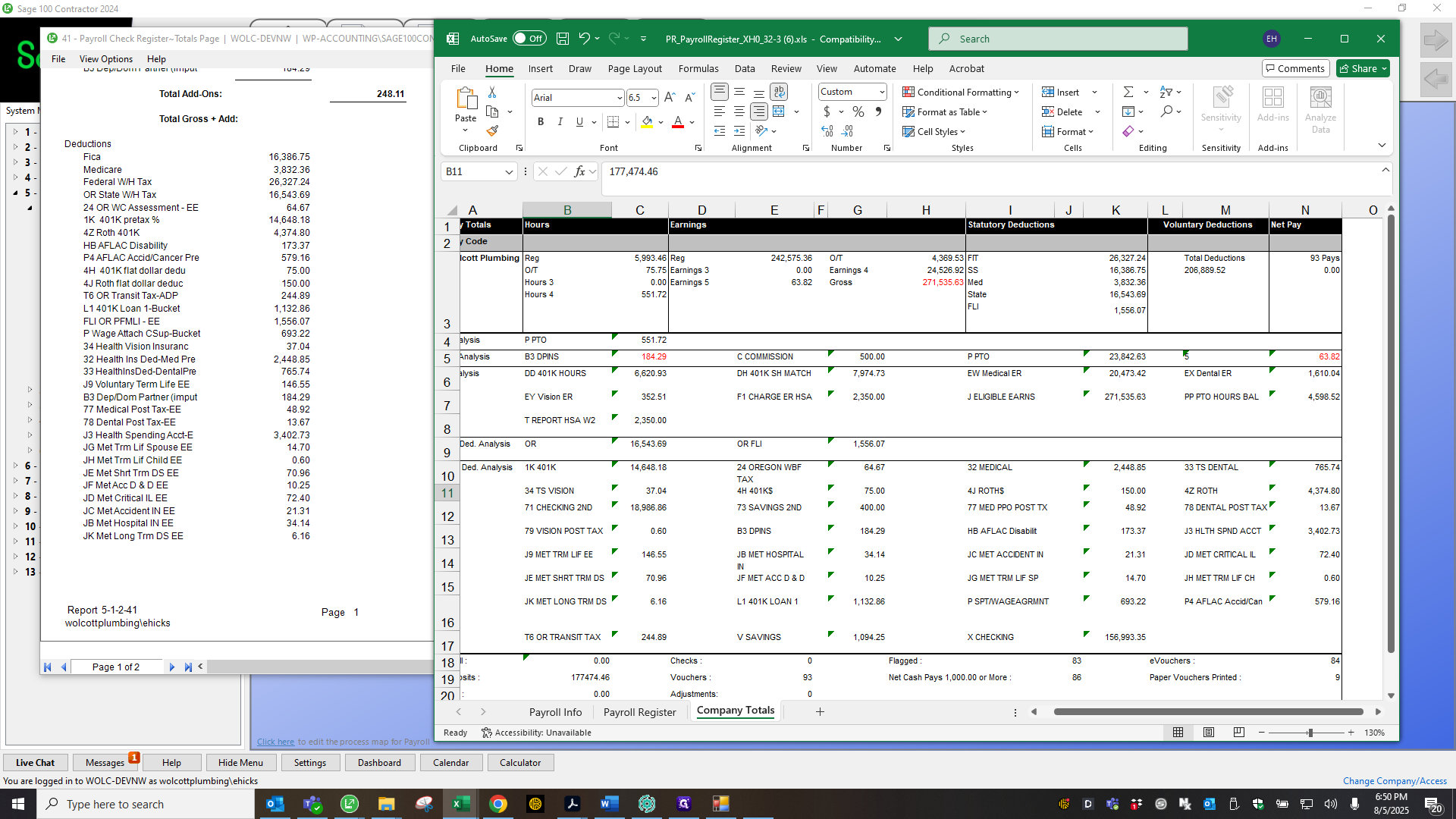

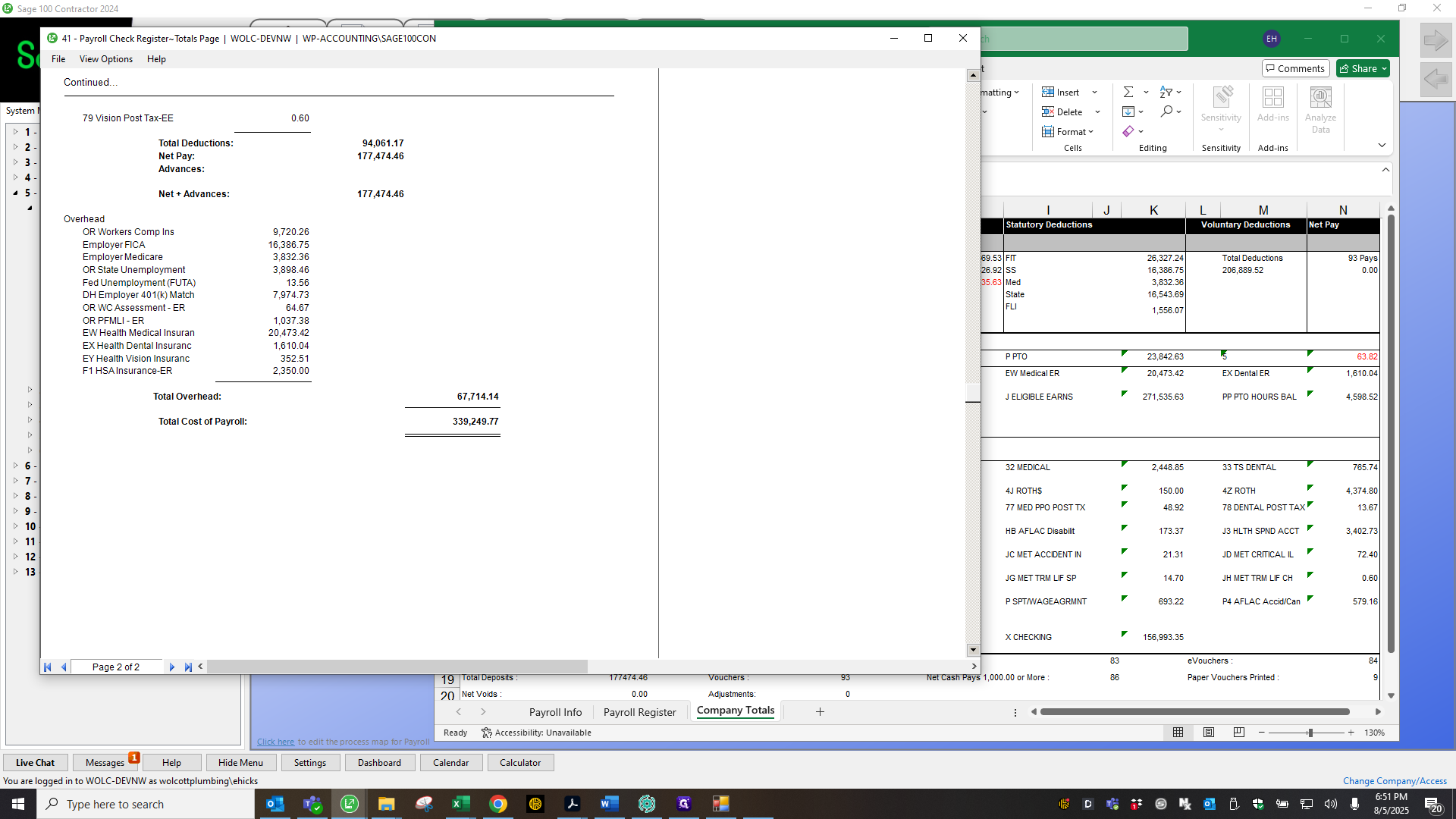

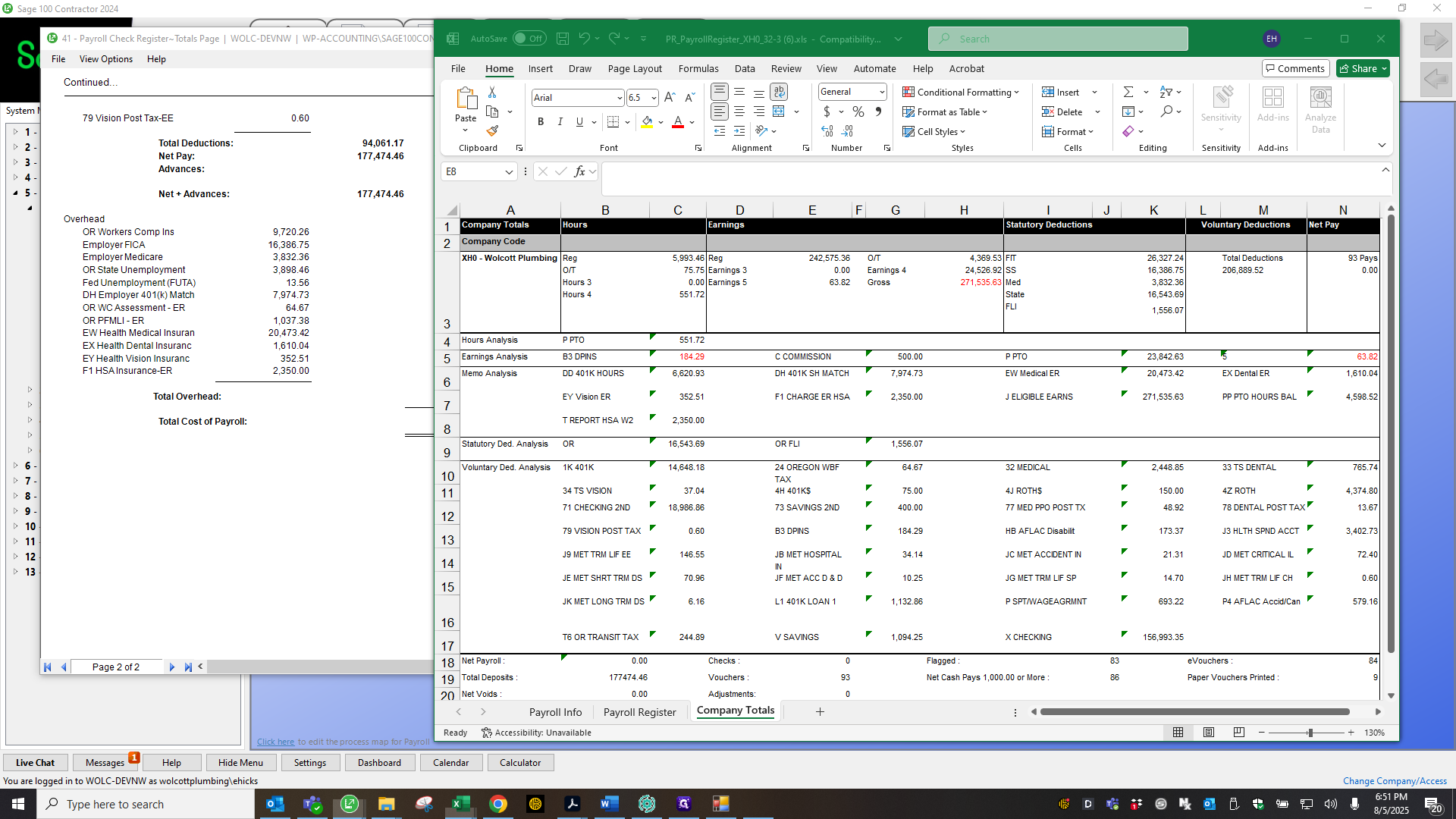

So I just go... Here's our total gross. Both amounts match, so I highlight them in red.

Here are the two: workers' compensation and benefit partner.

Those are located here, and they match.

Uh.

Expand this.

There's the 6382.

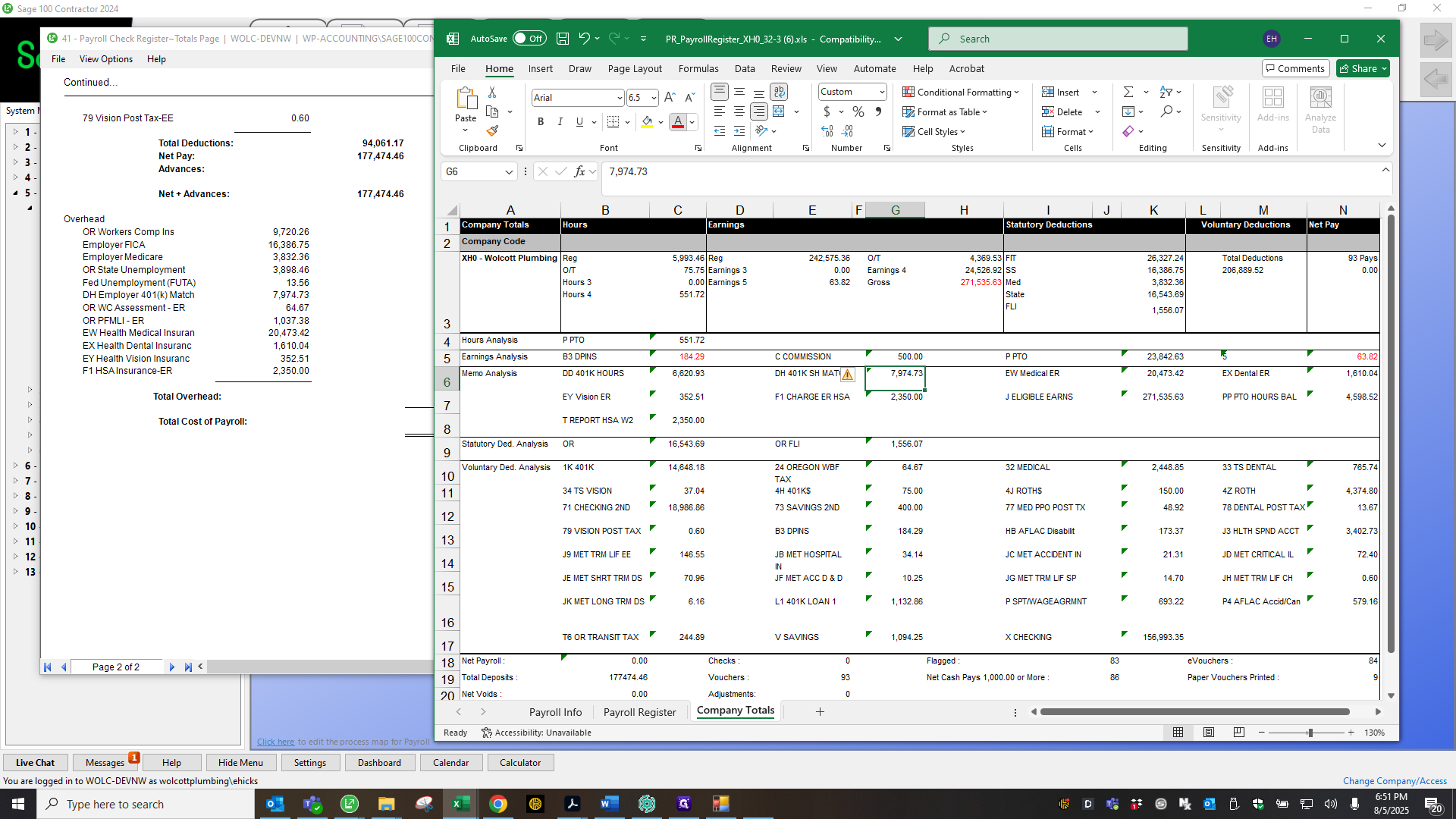

I go down the line and match.

Make sure nothing is out of place, even if it appears to bounce because of the matching net.

I still review everything to ensure all the numbers match. I do this only because that's what my brain tells me to do. What if one item is off by a penny and another item is also off by a penny, but the totals still balance?

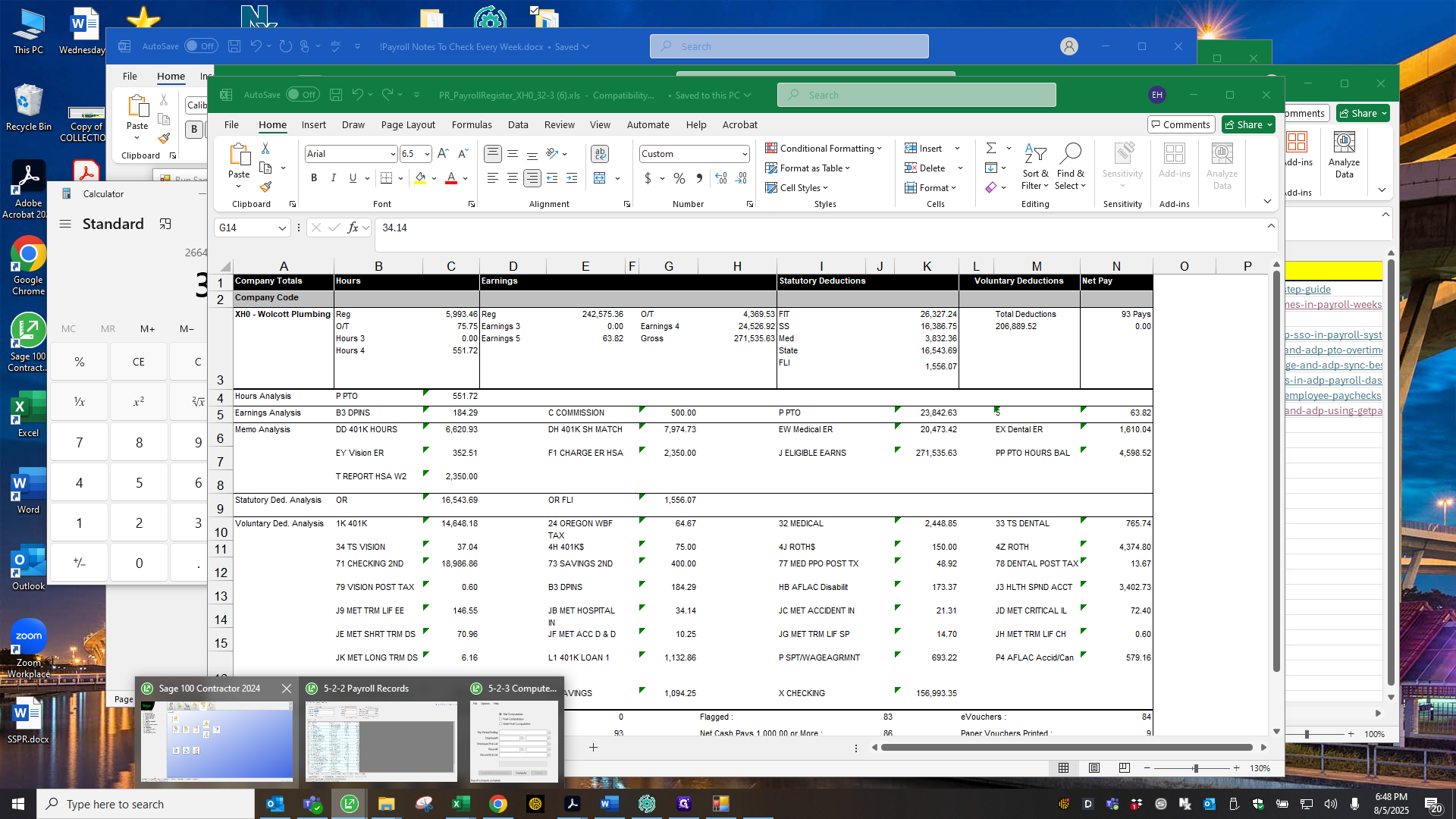

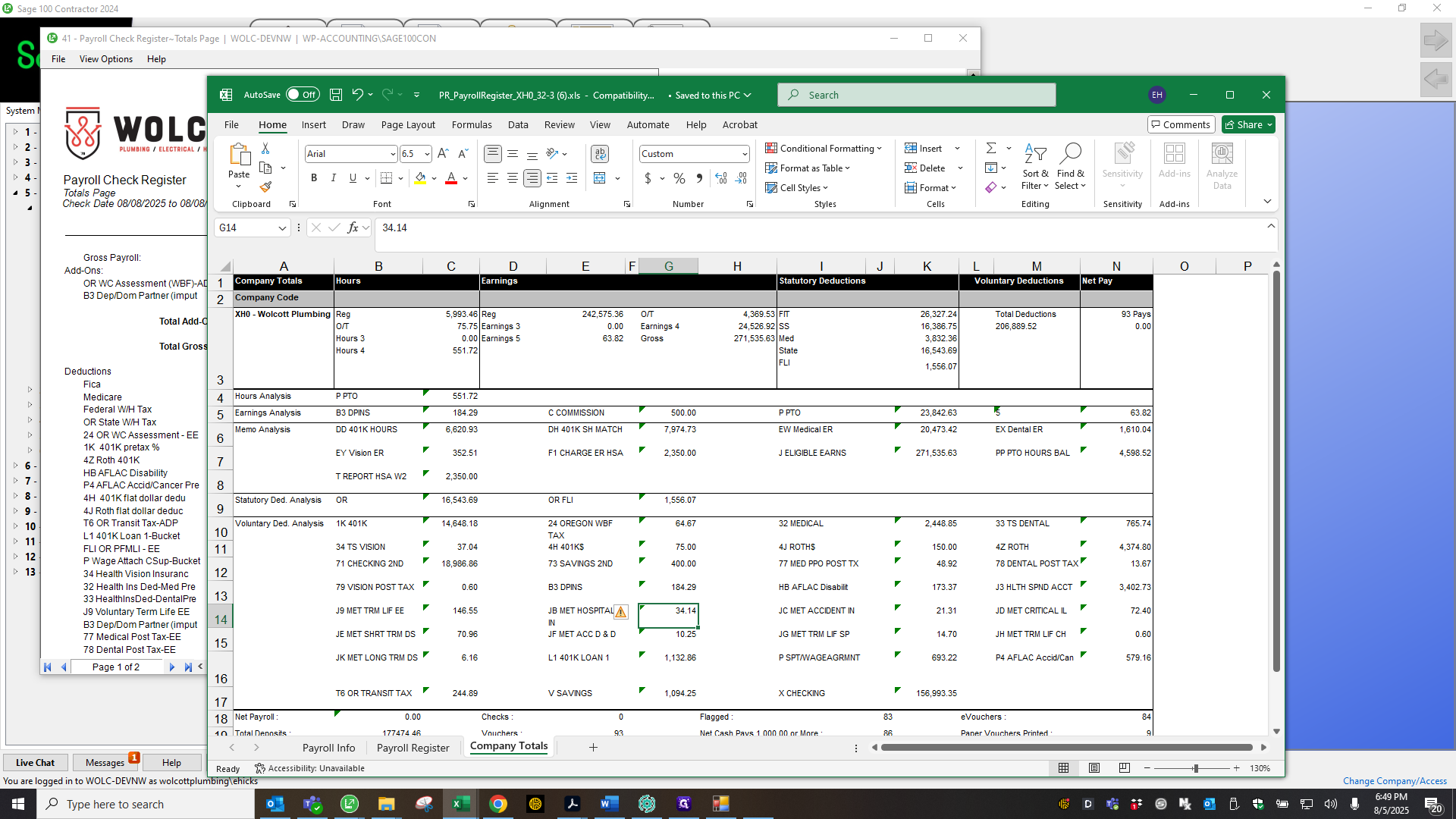

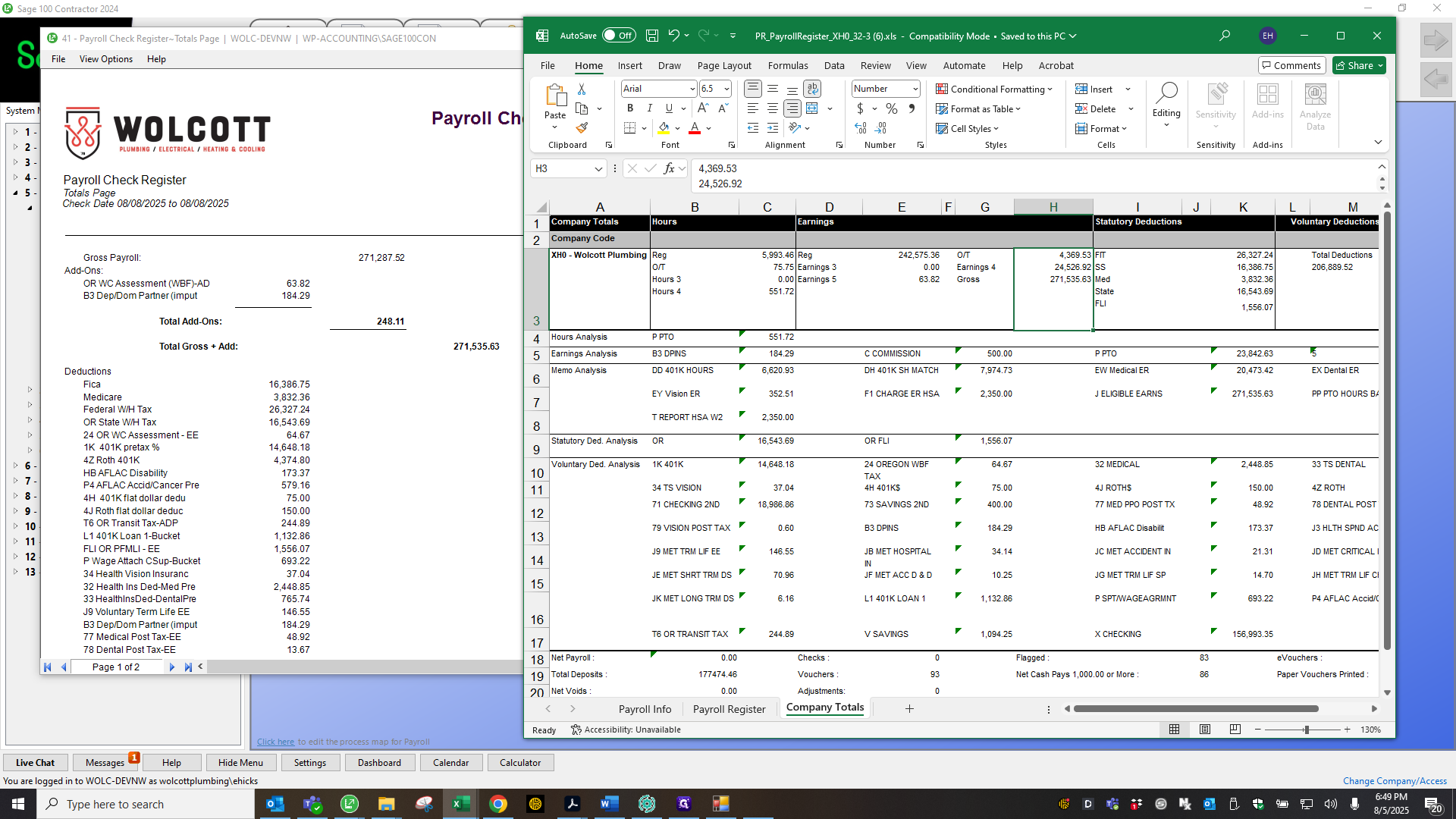

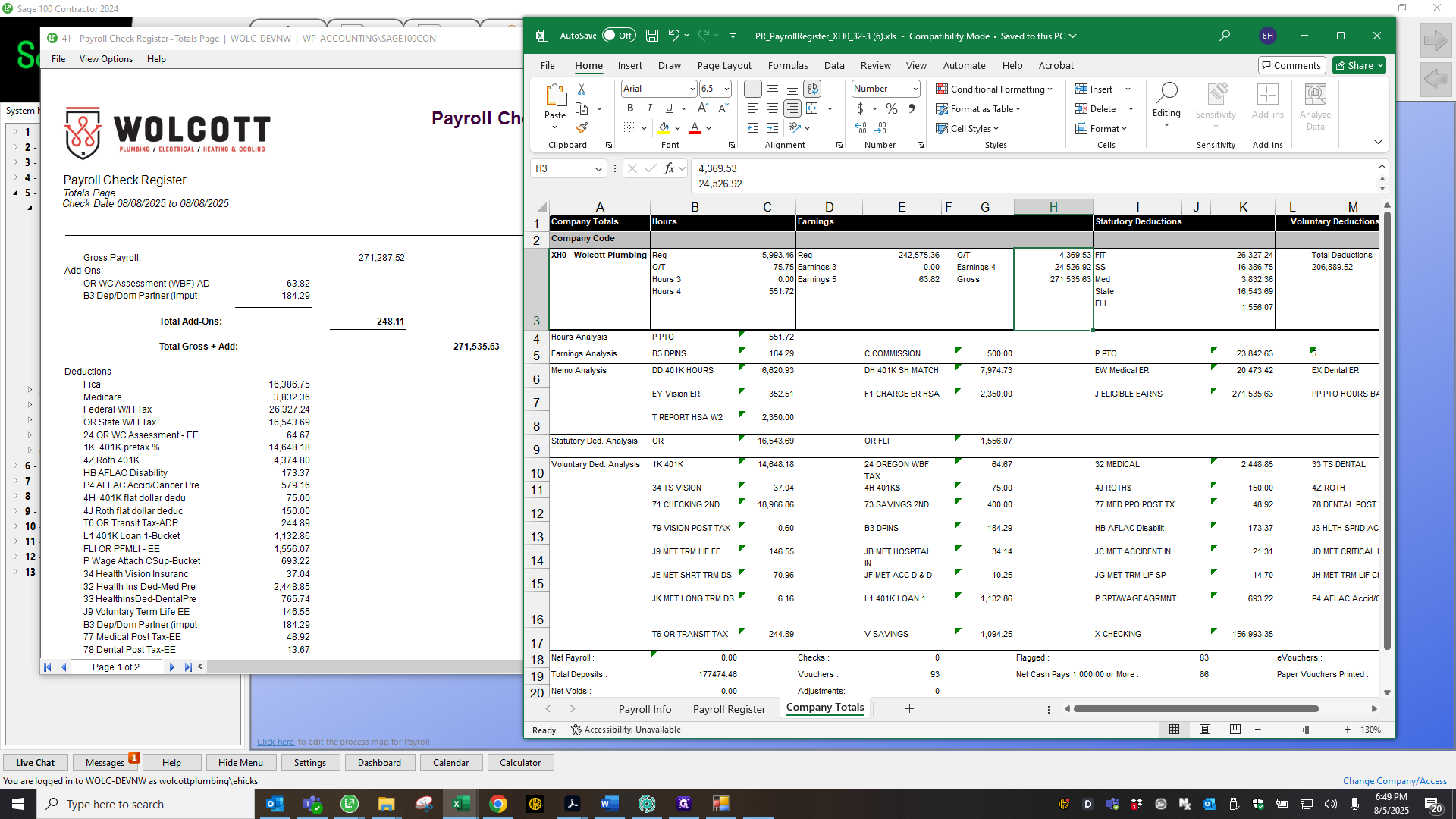

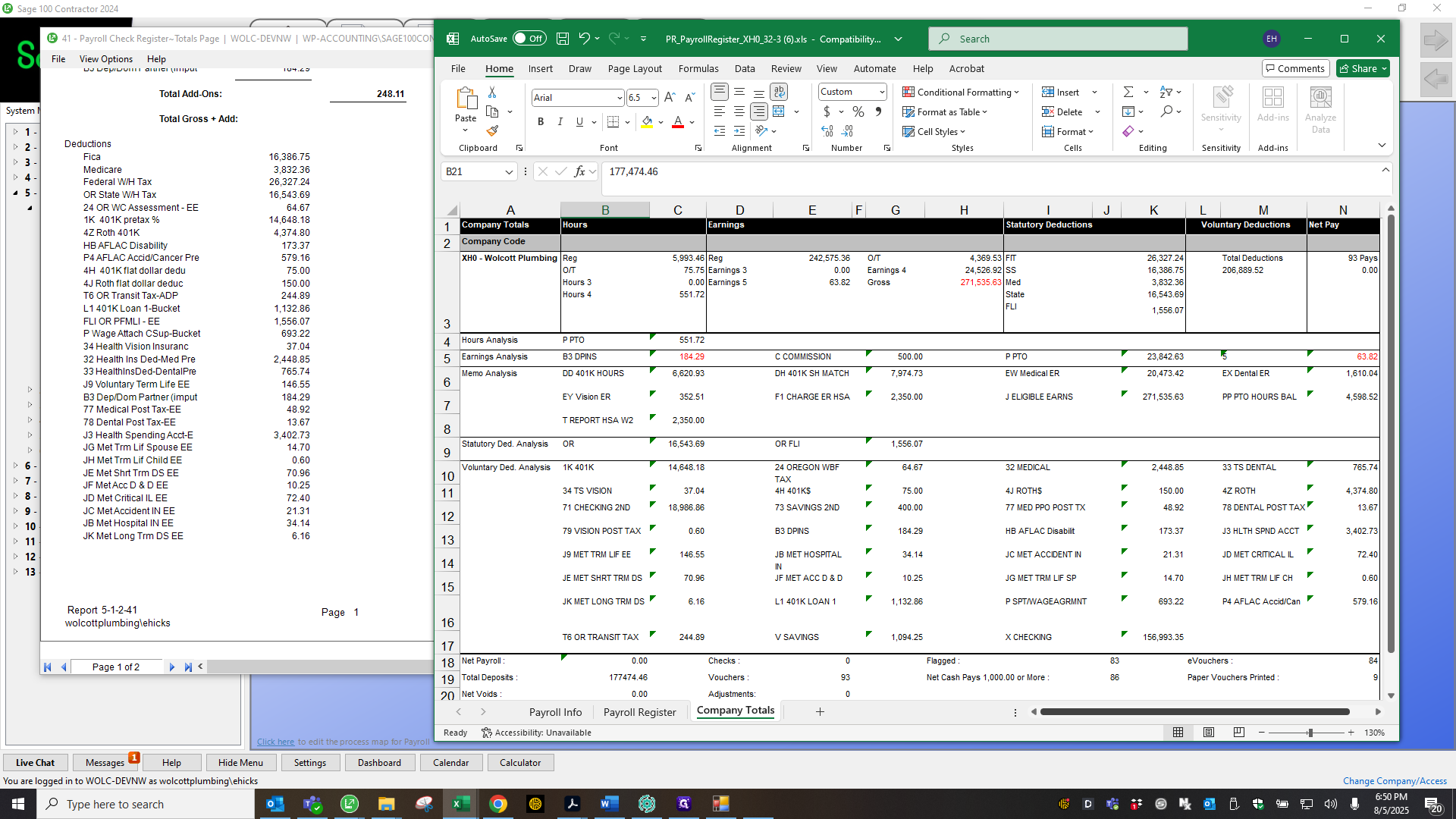

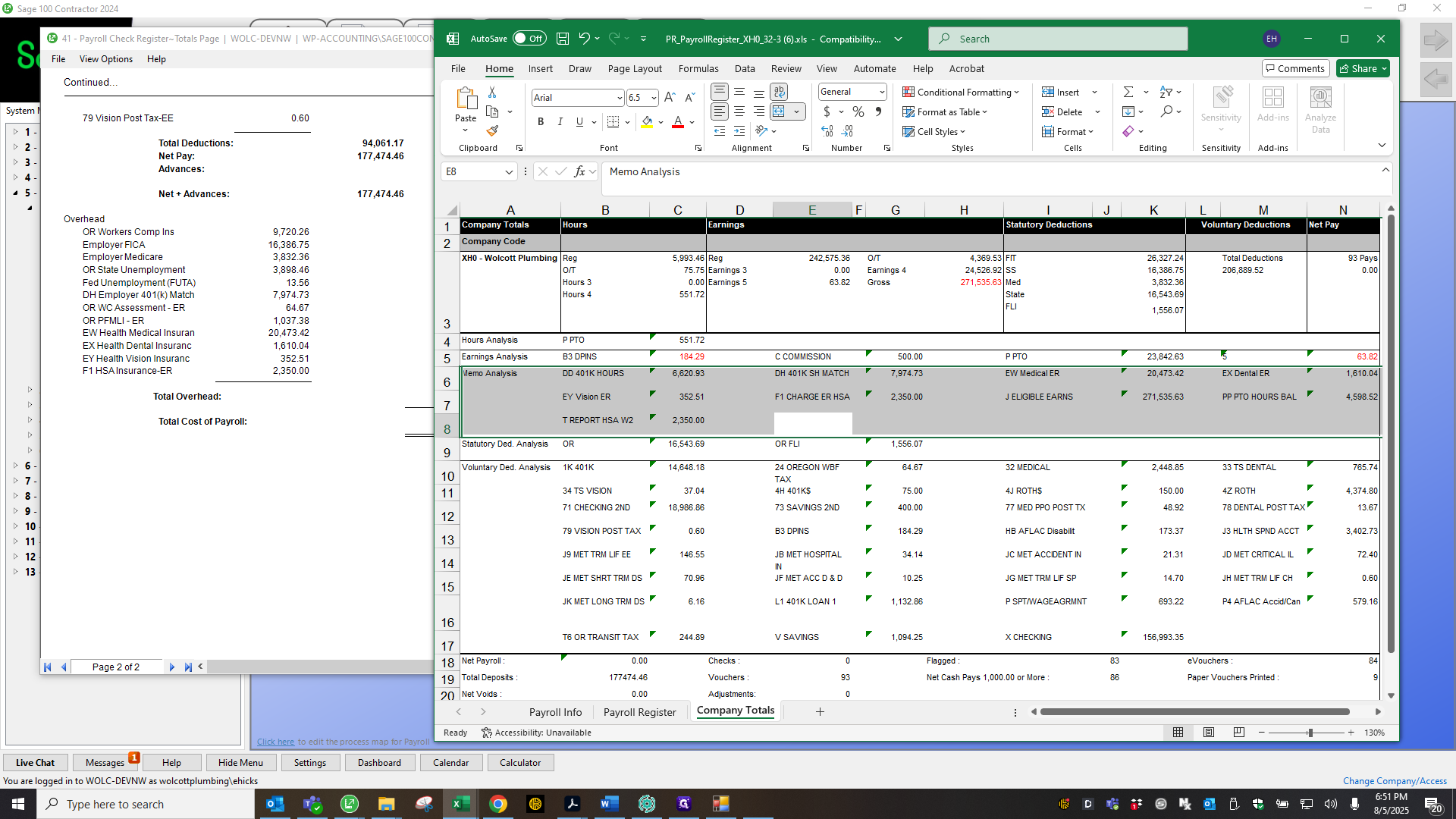

I cross-check all of these things. You’ll see in the ADP register that there is... These numbers on the Sage side match the numbers here. You can find it—34—right here.

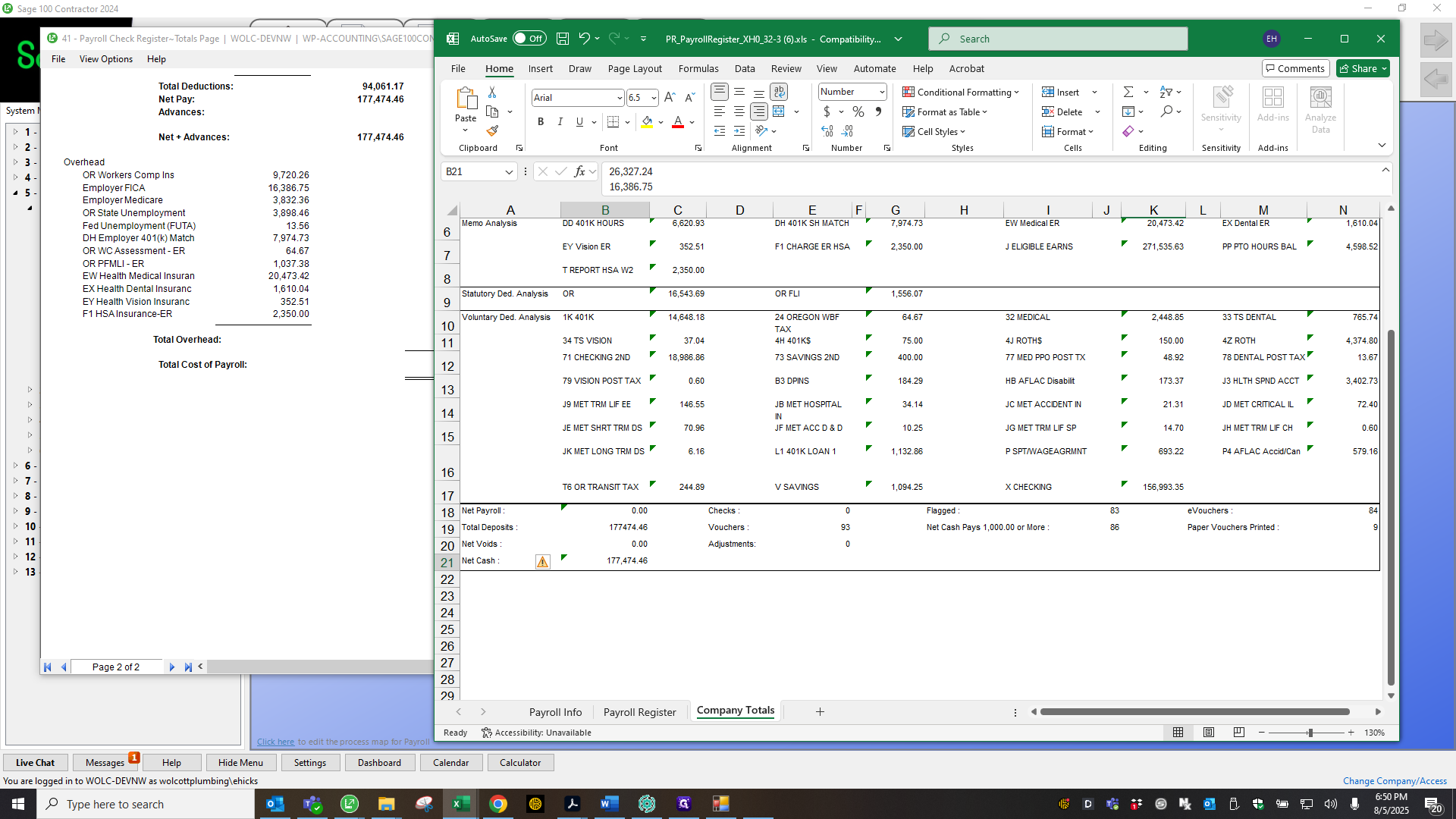

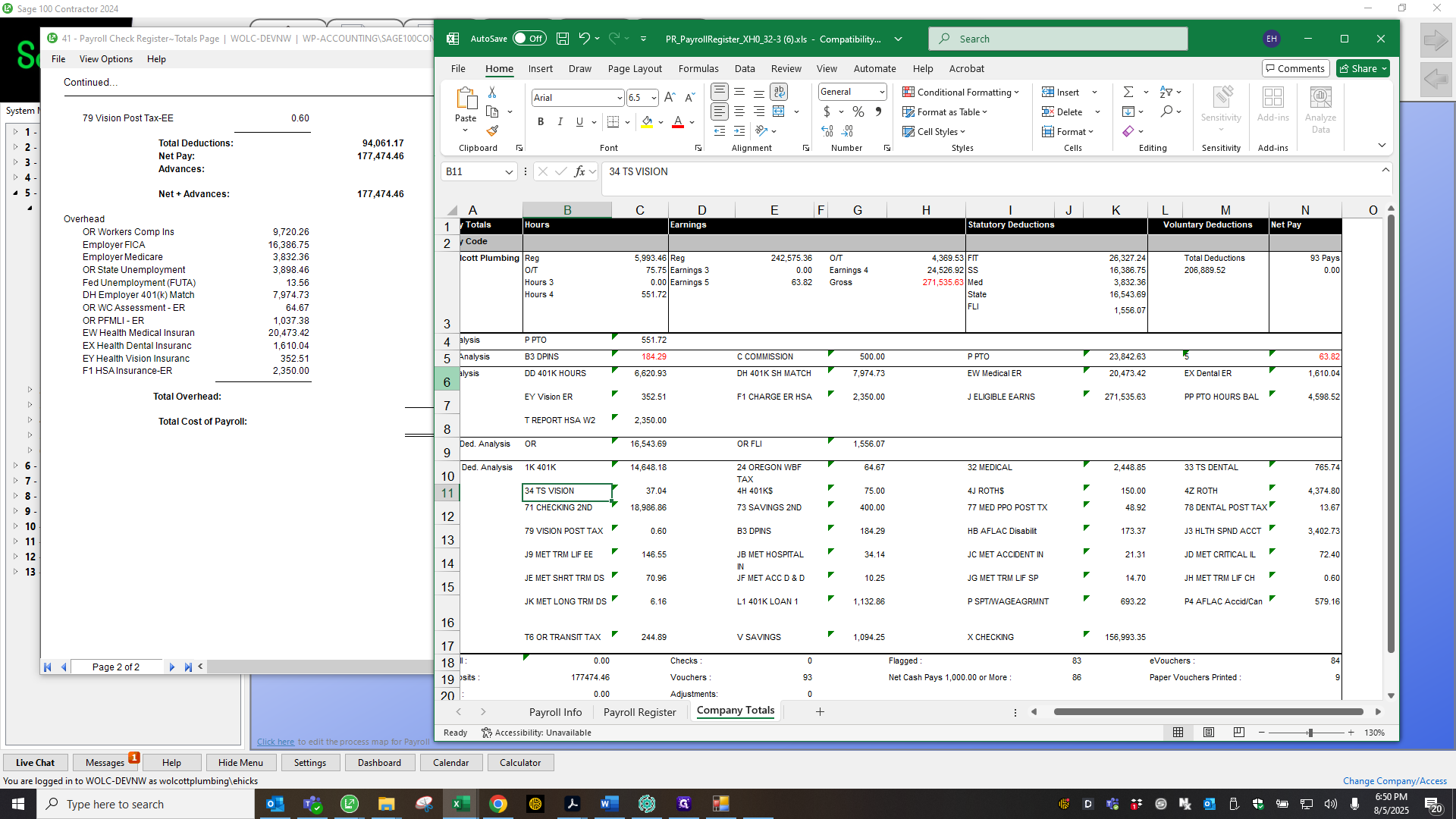

First, items are organized by number, then alphabetically by letter. I also make sure on the employer side, in this section, that all the numbers match.

Also, make sure nothing from Sage appears here. Usually, this would only be any city taxes. The TriMet tax, wills, bills, and similar items would appear there. We would then need to locate them and have them removed.

Another important step is to triple-check the employer match for your 401K. New employees should ensure this is properly cross-referenced.

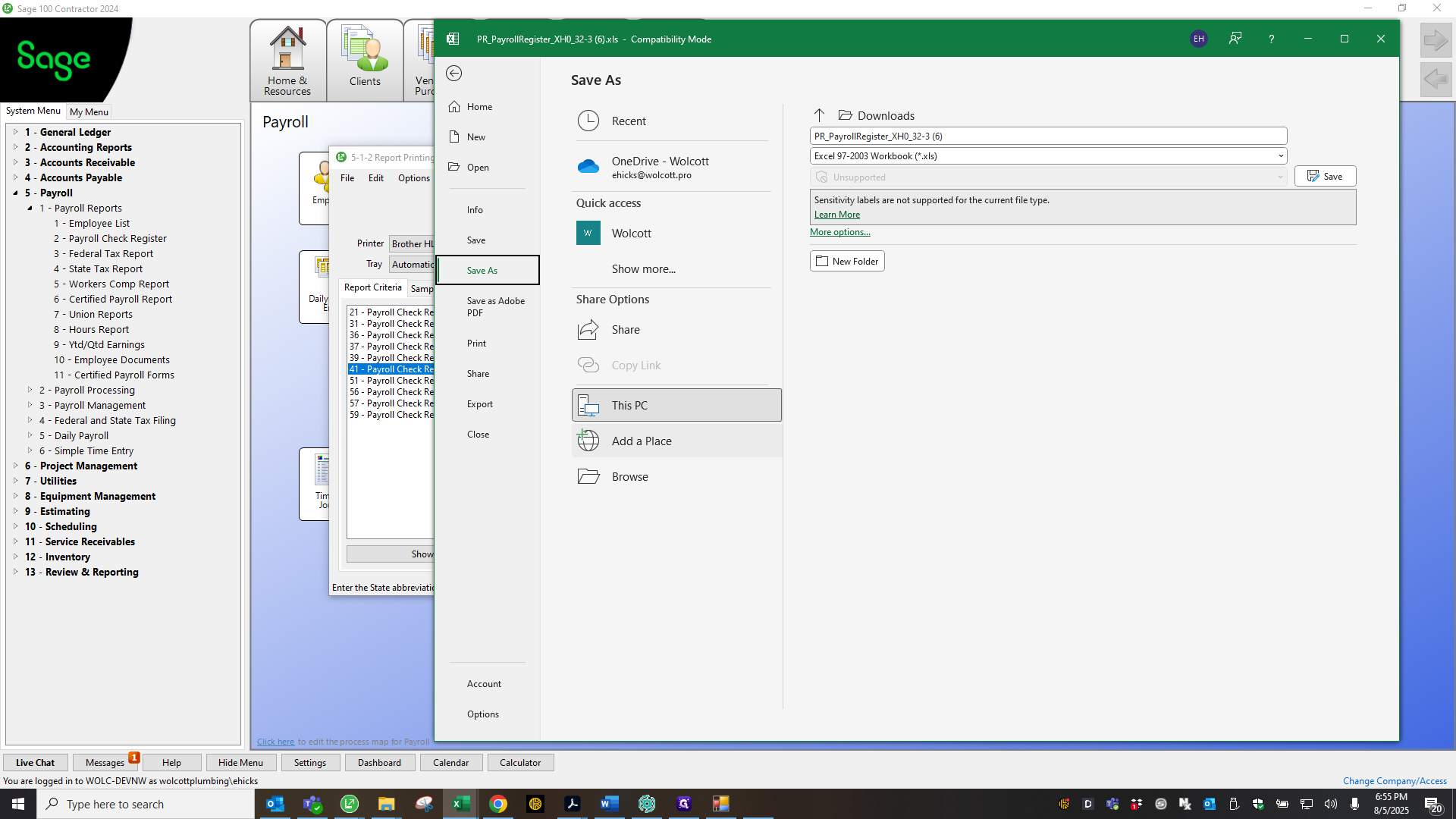

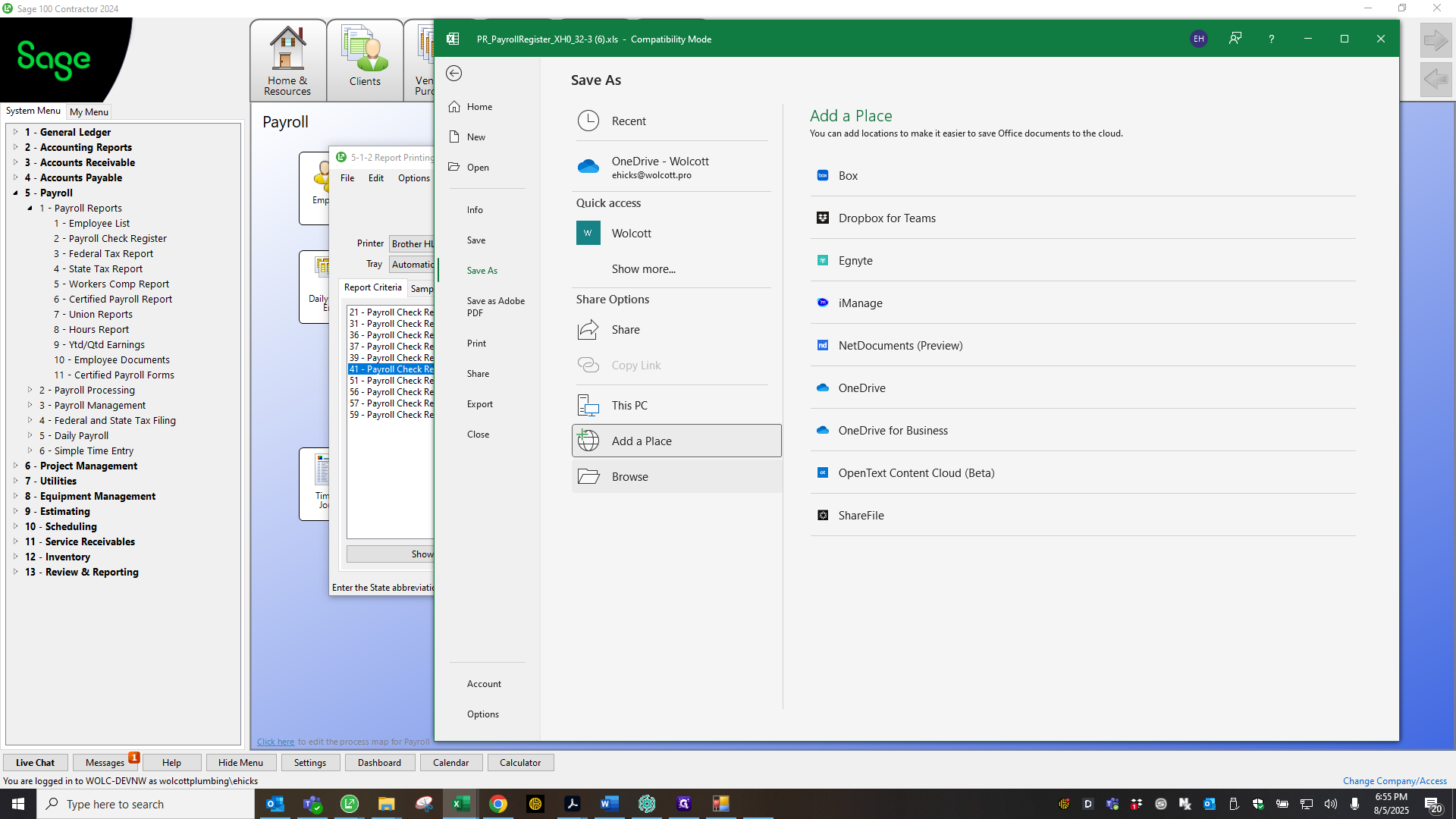

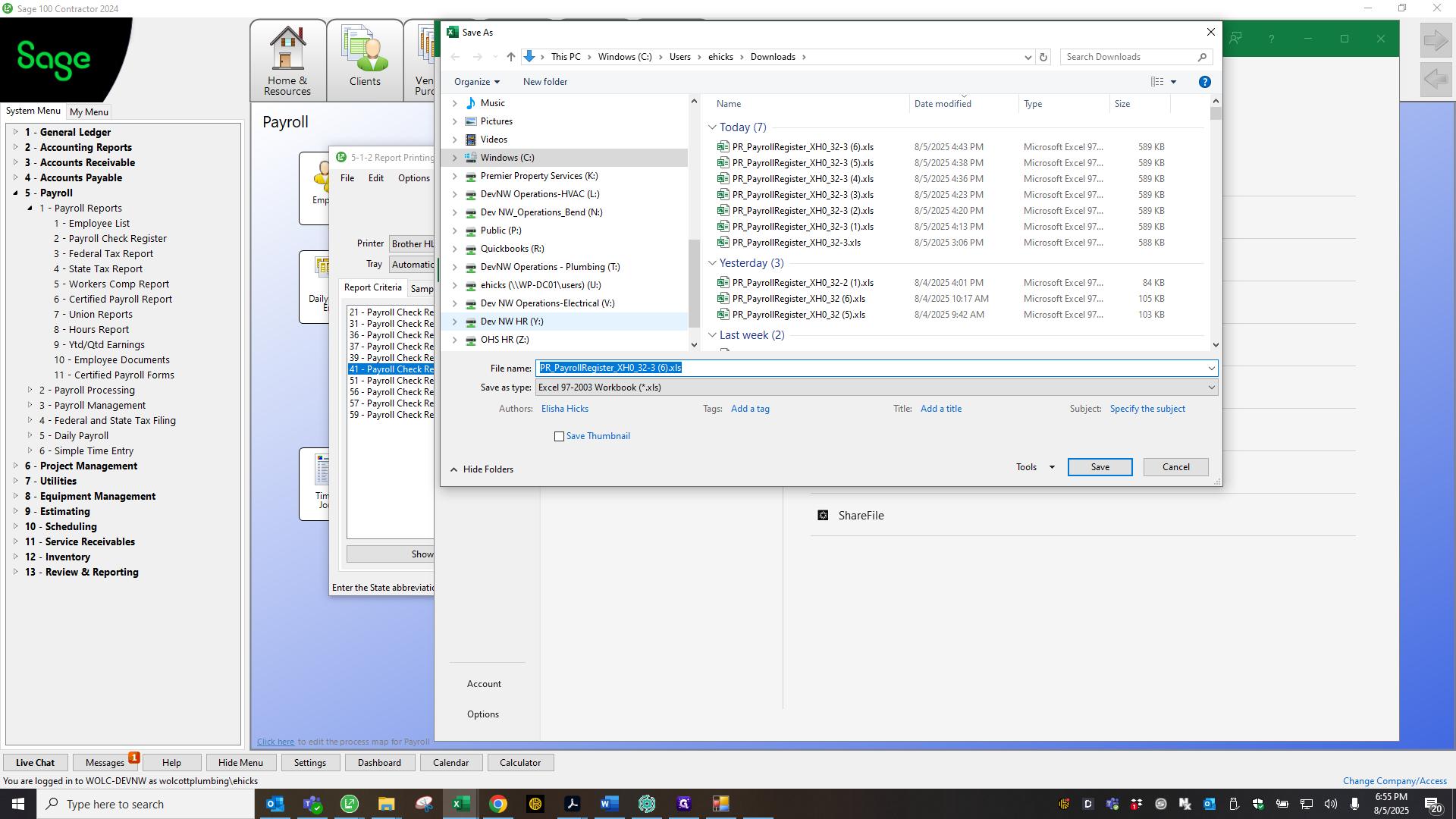

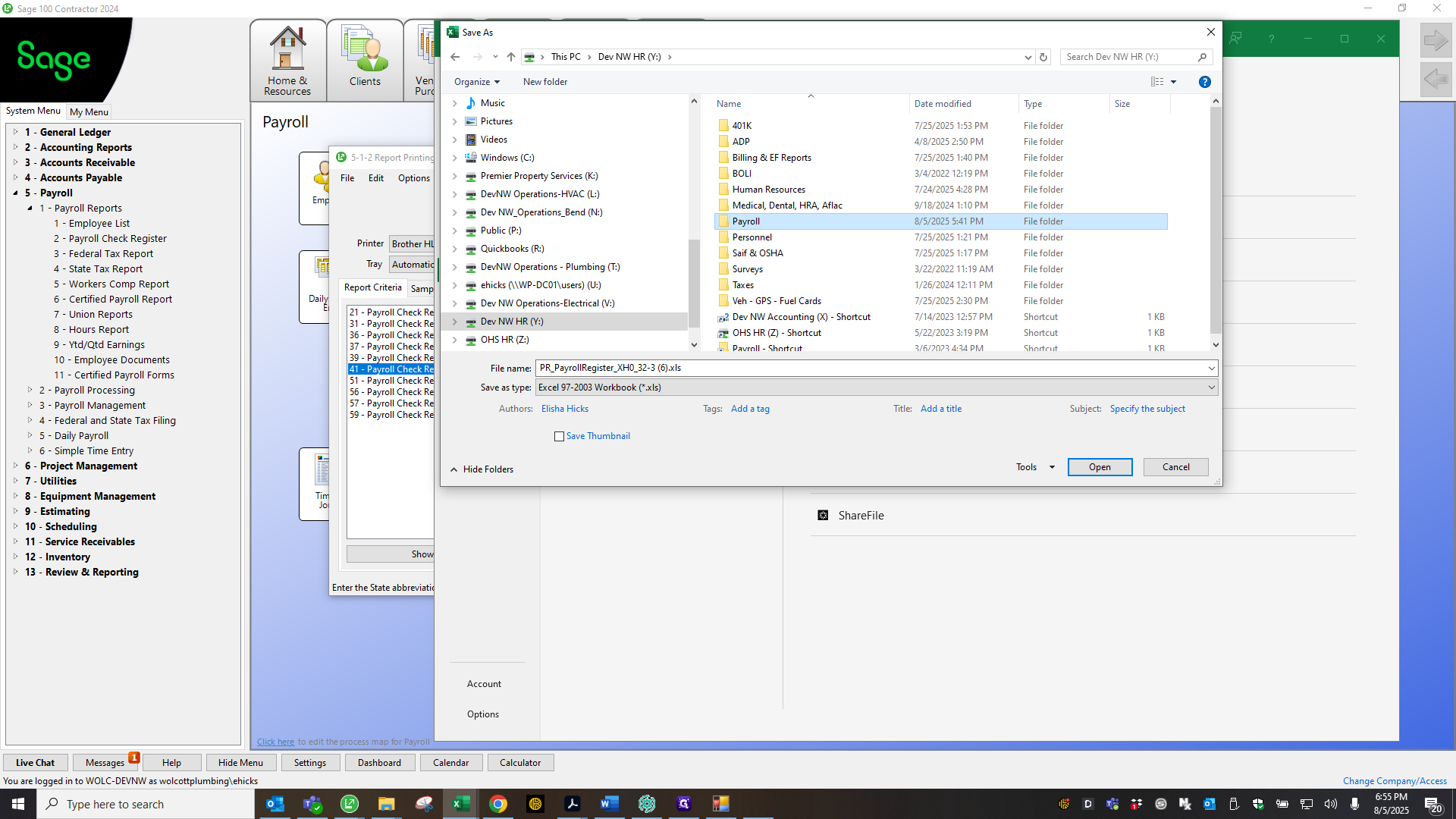

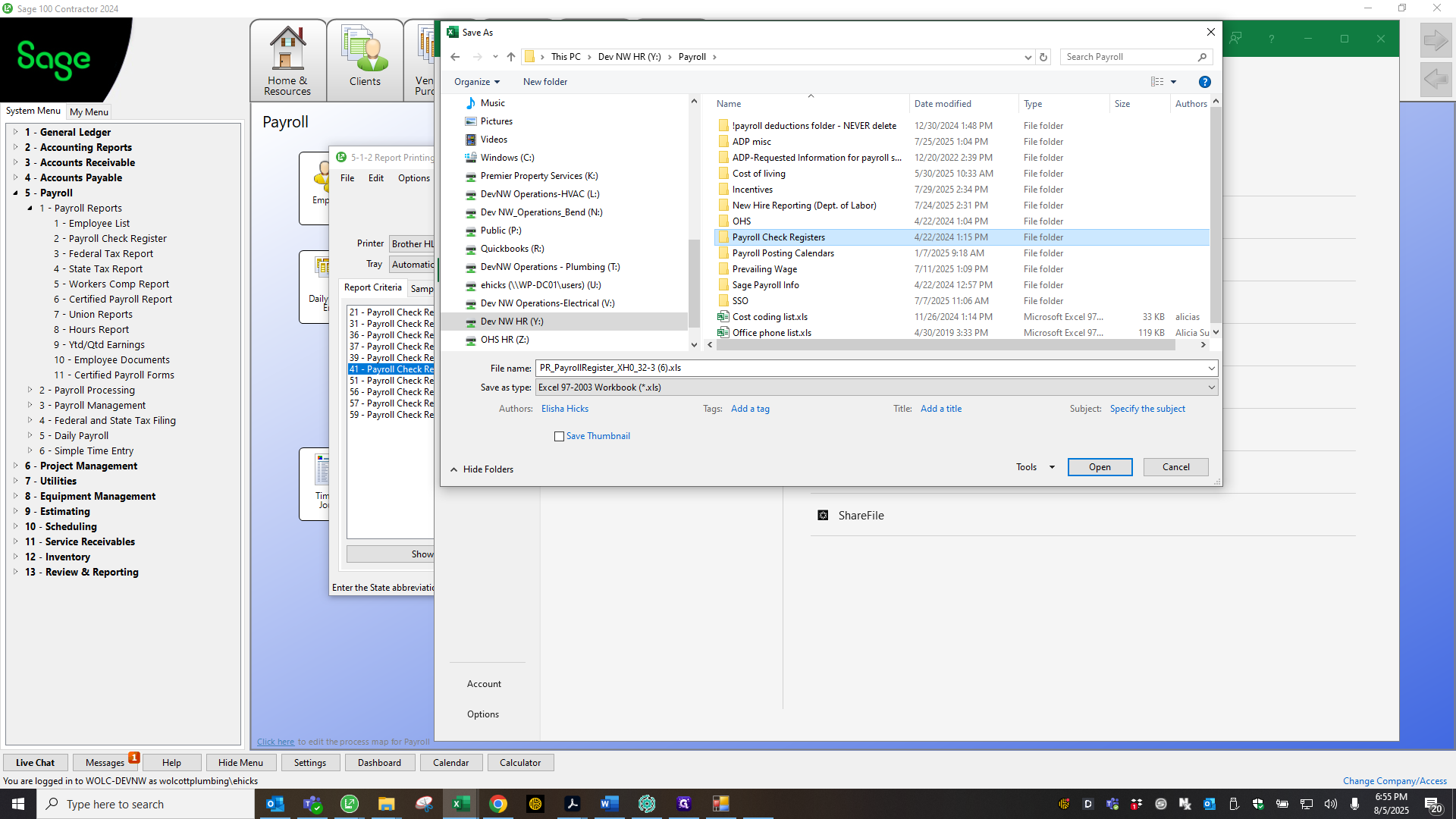

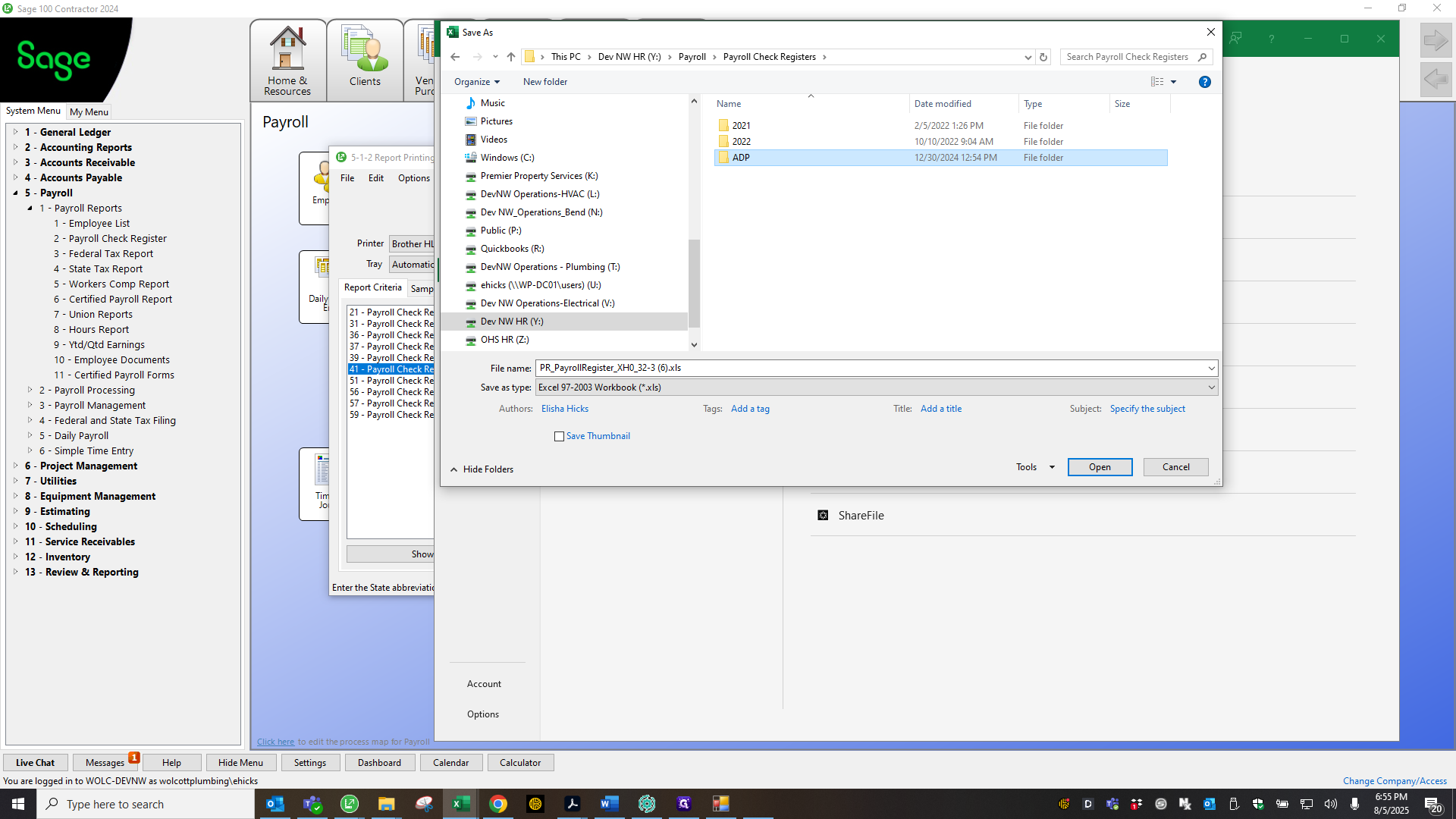

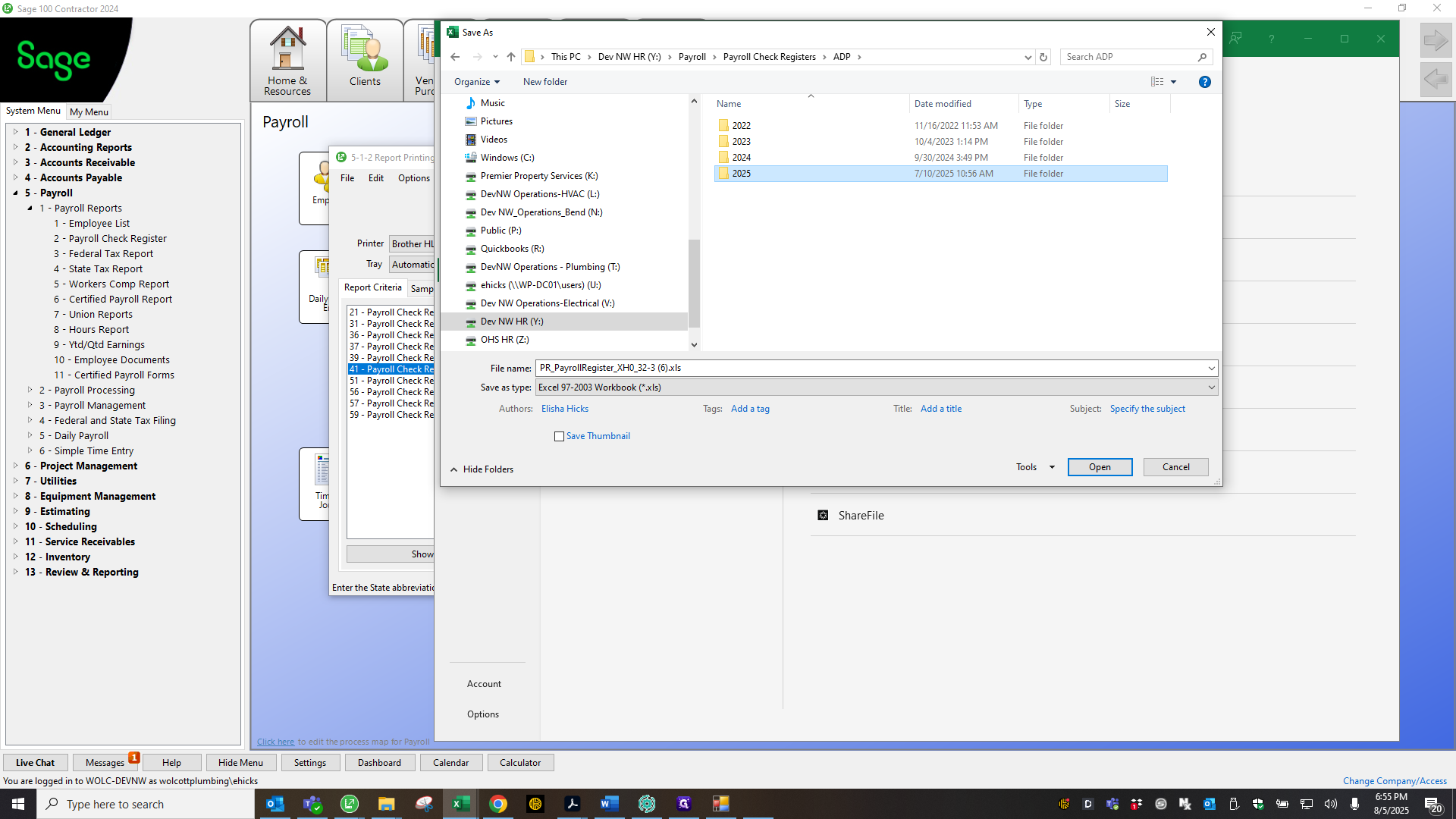

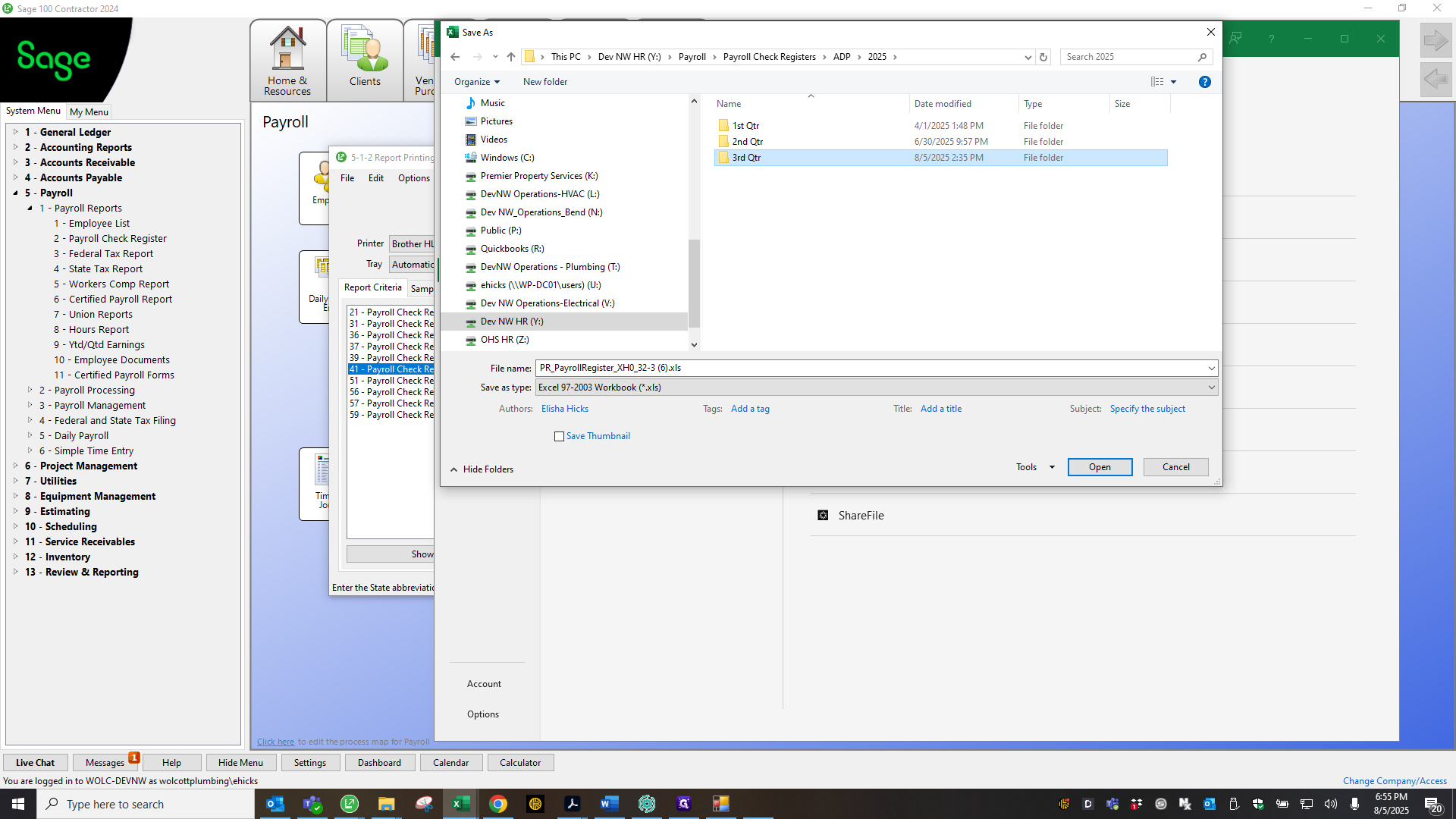

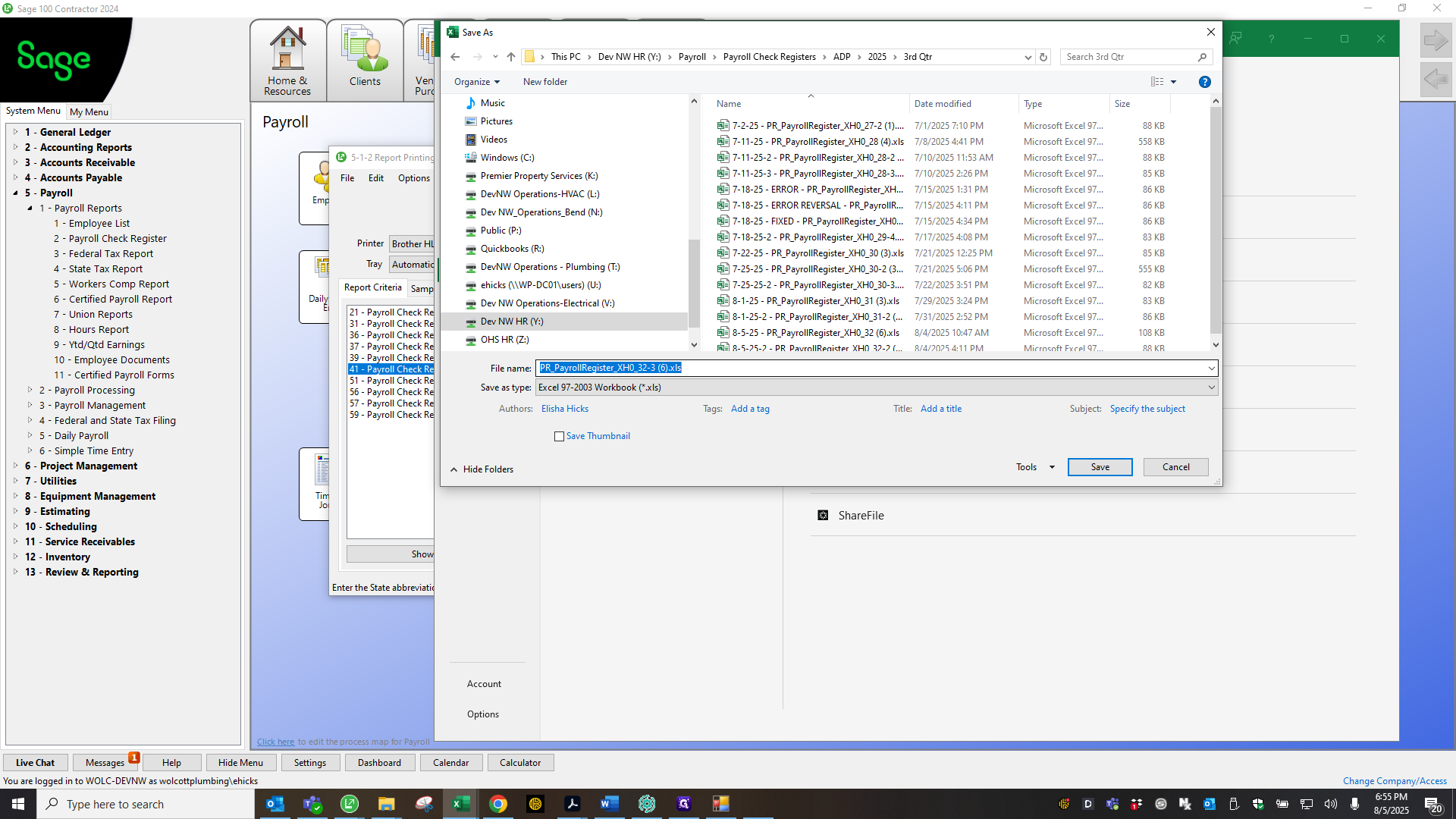

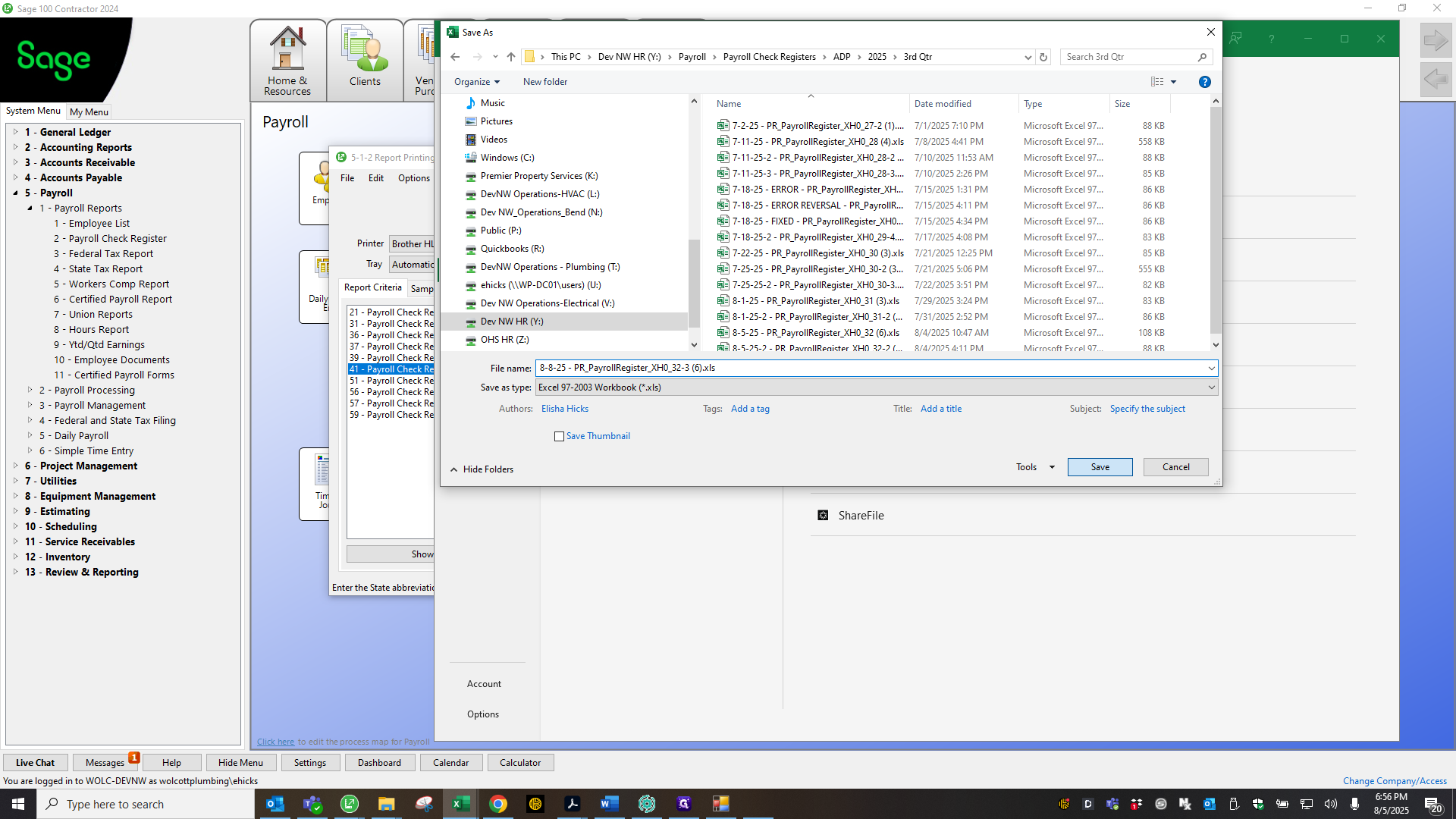

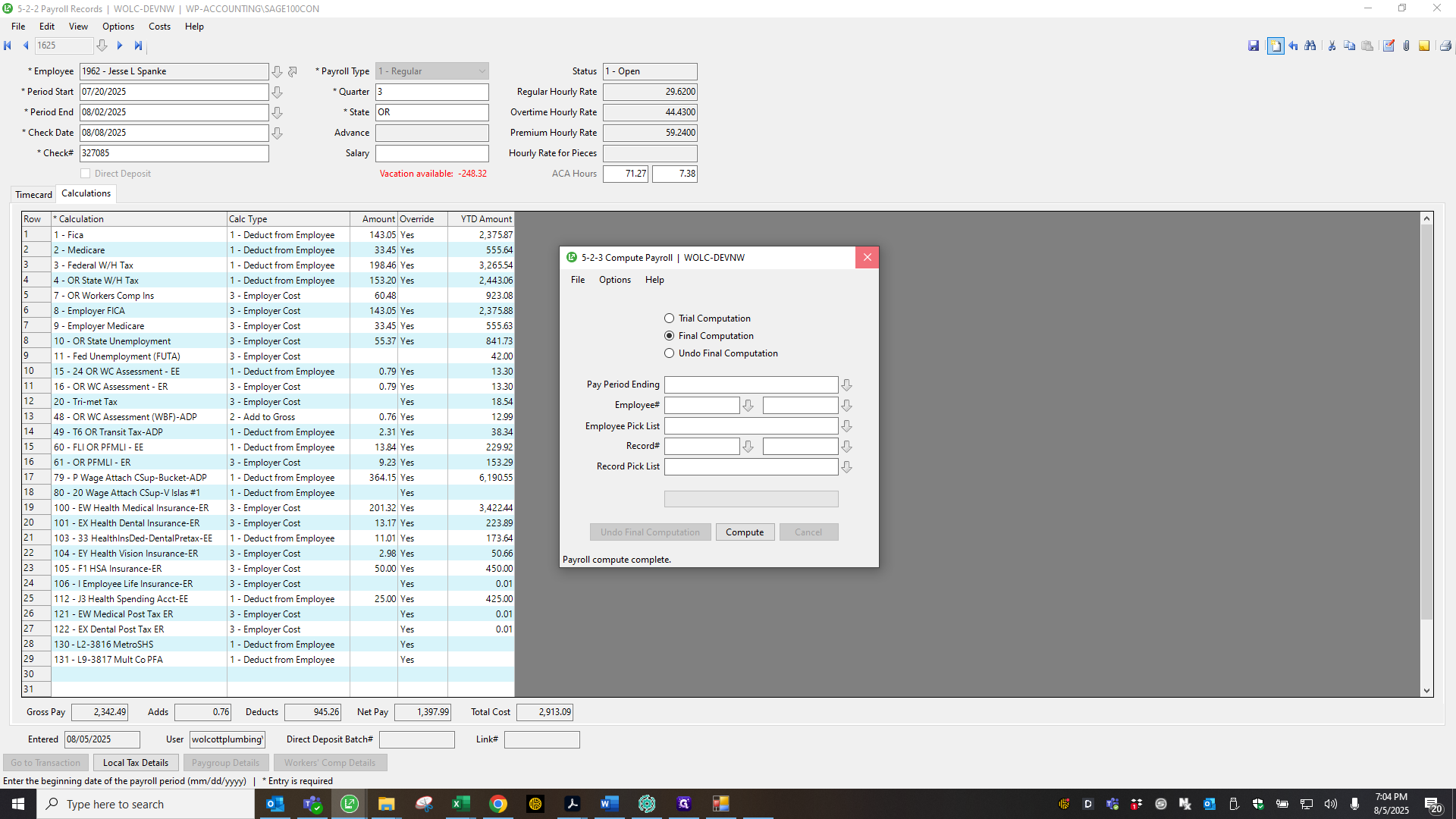

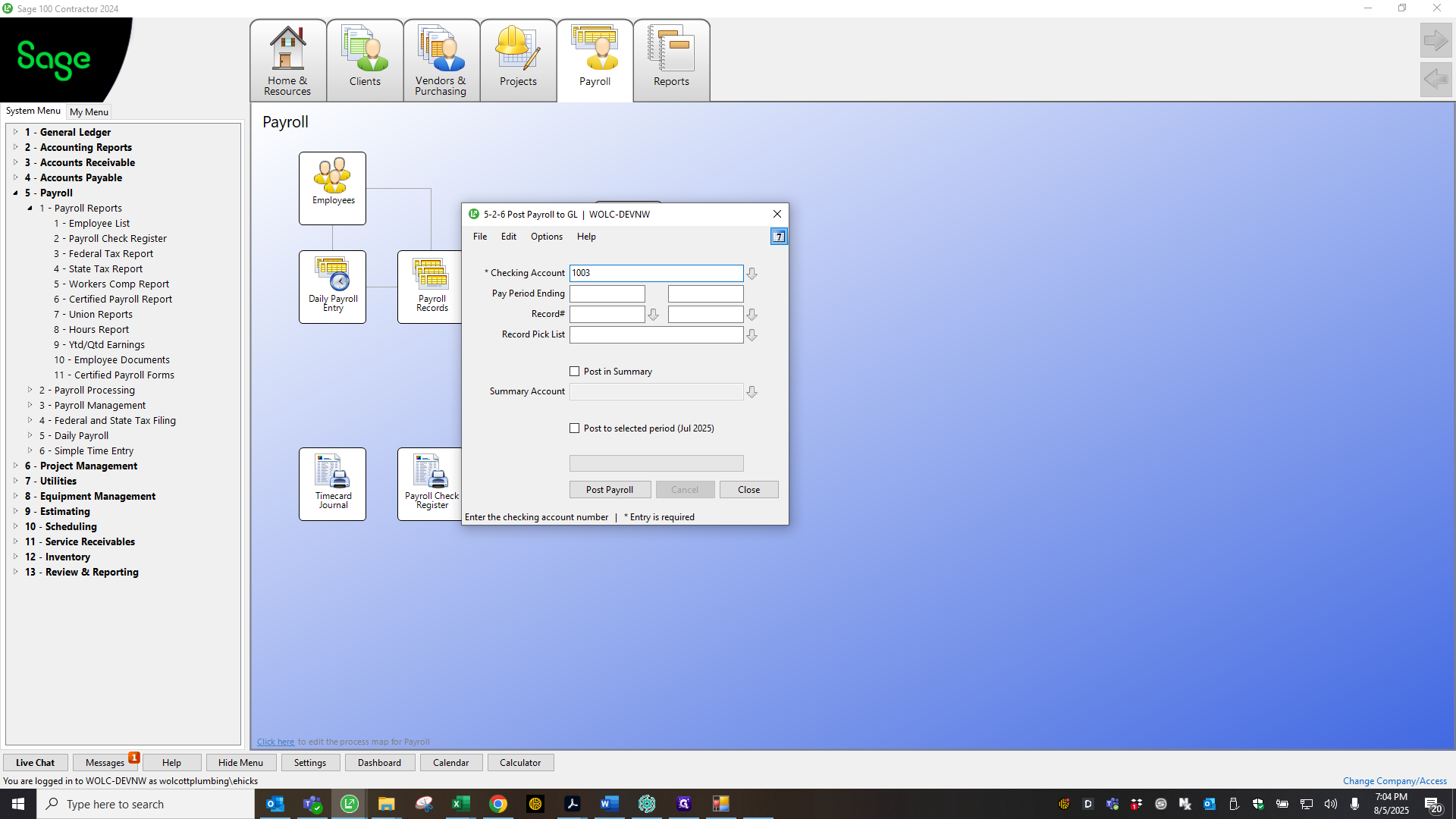

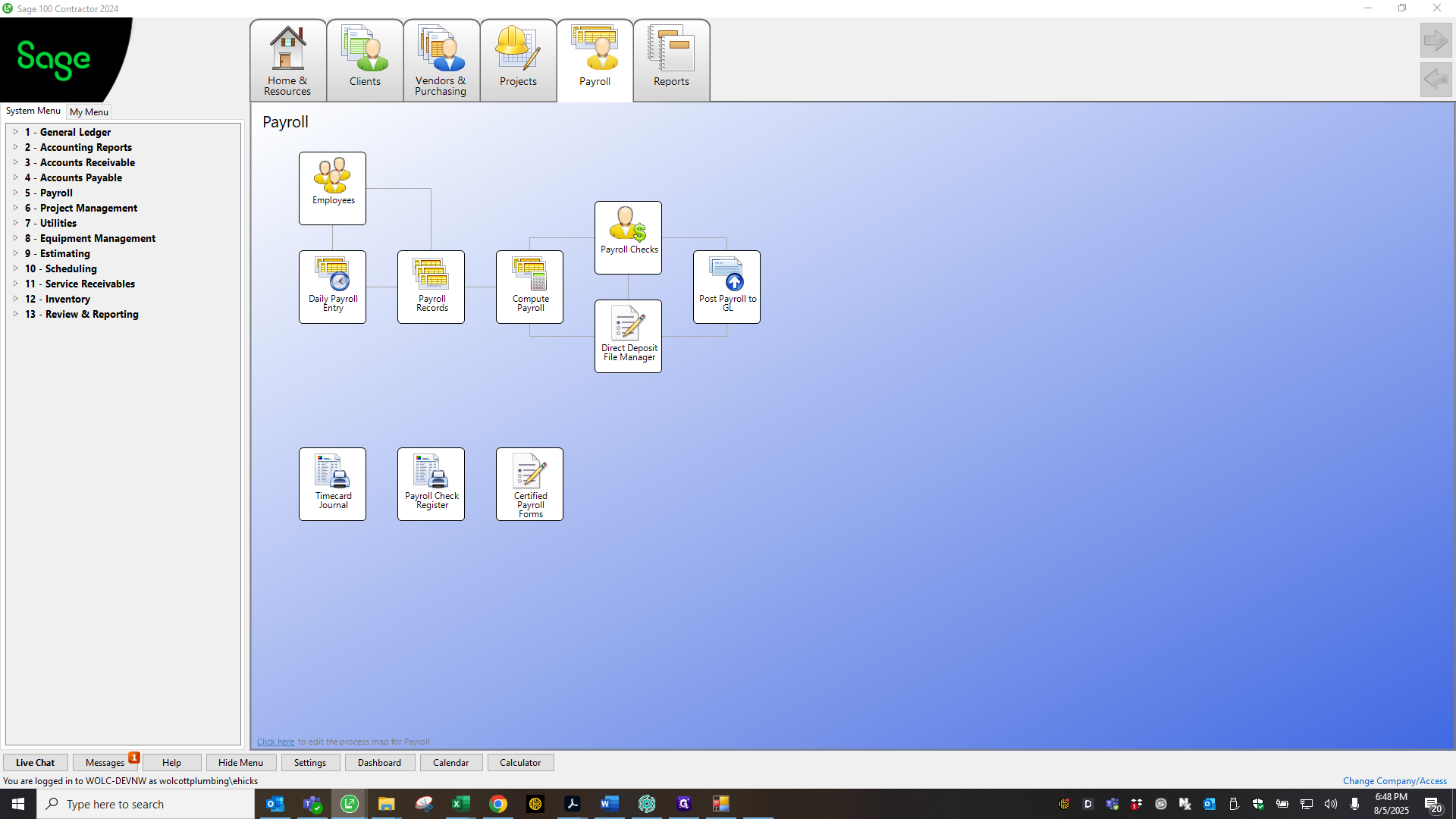

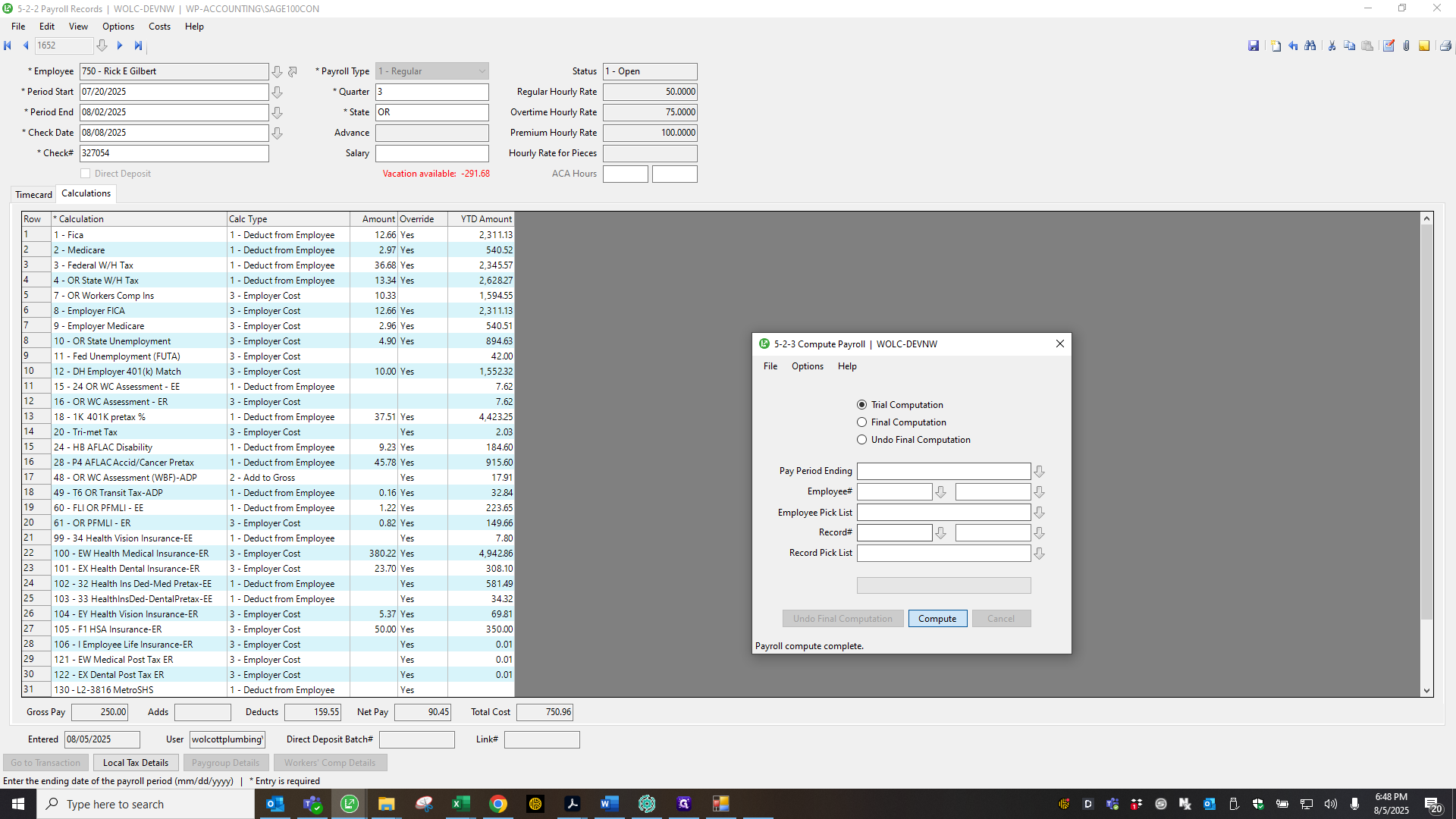

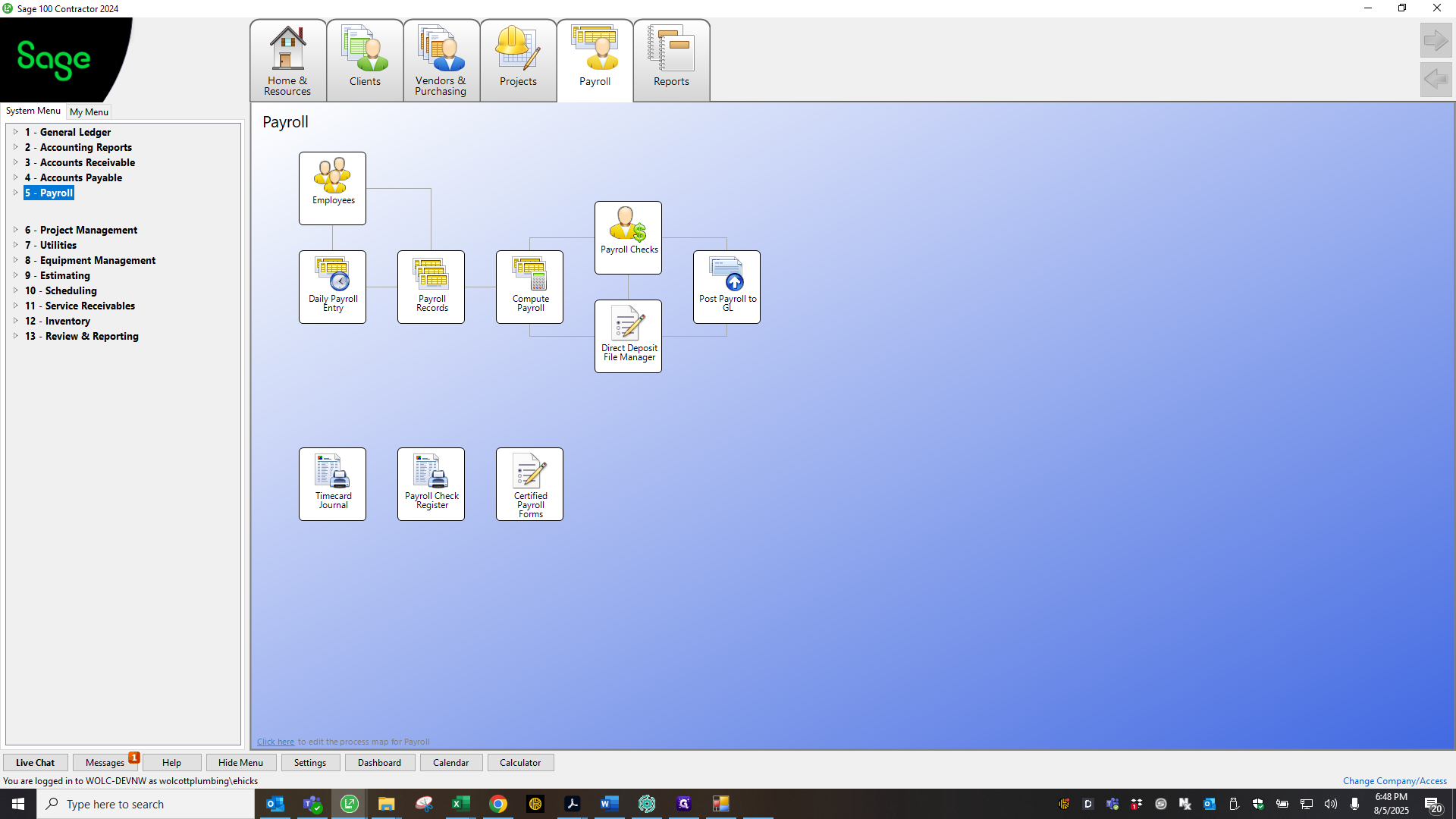

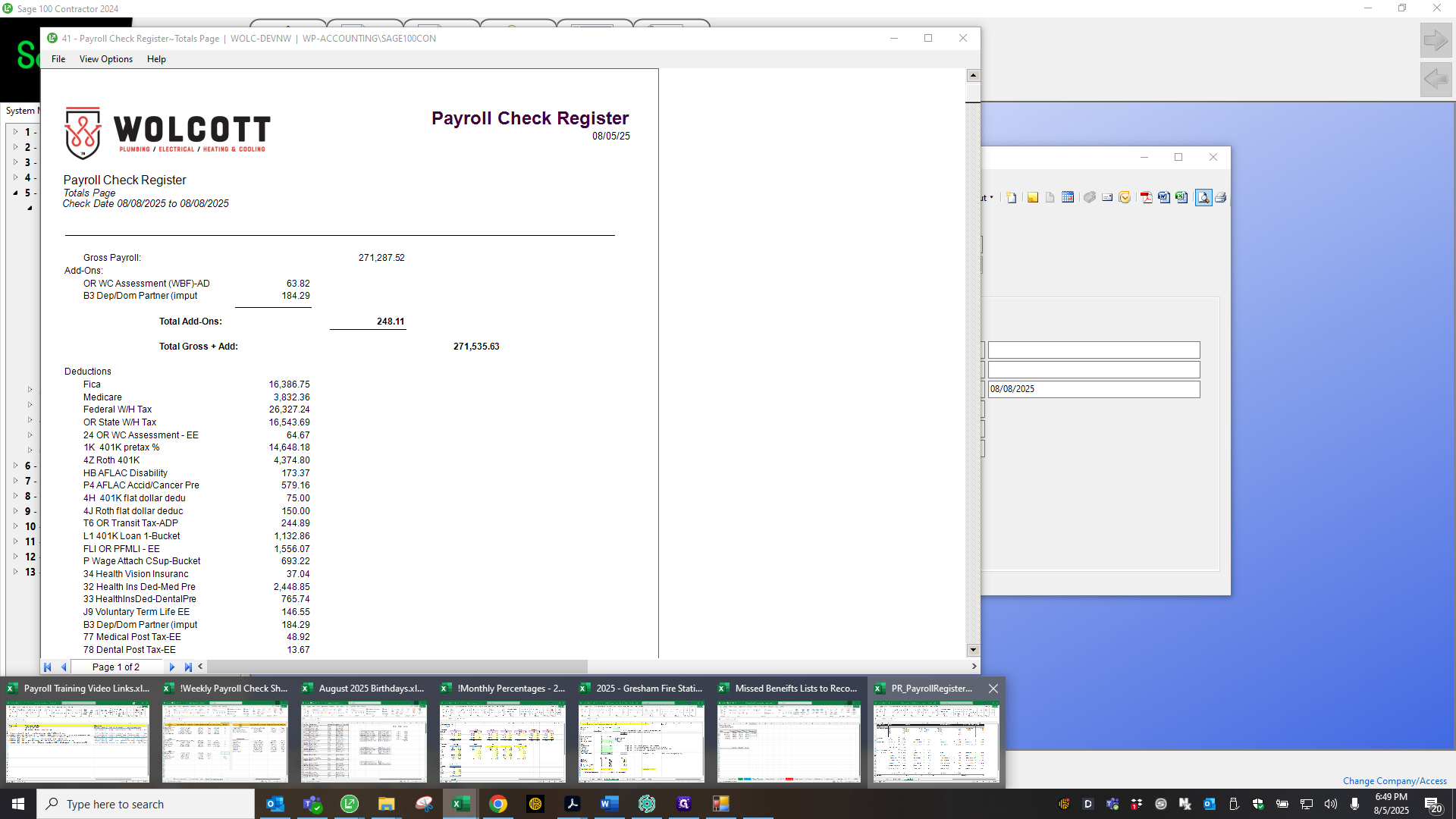

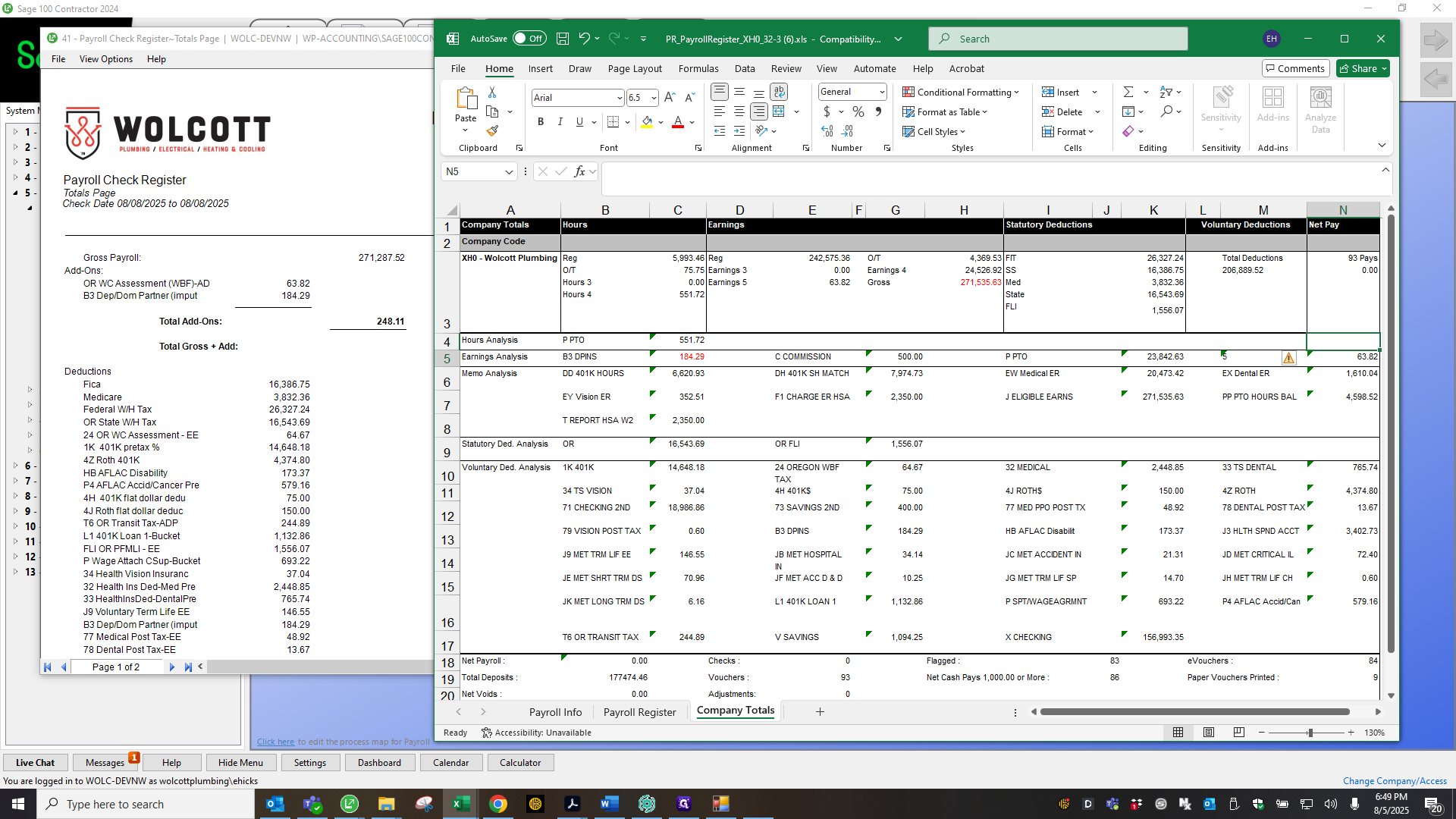

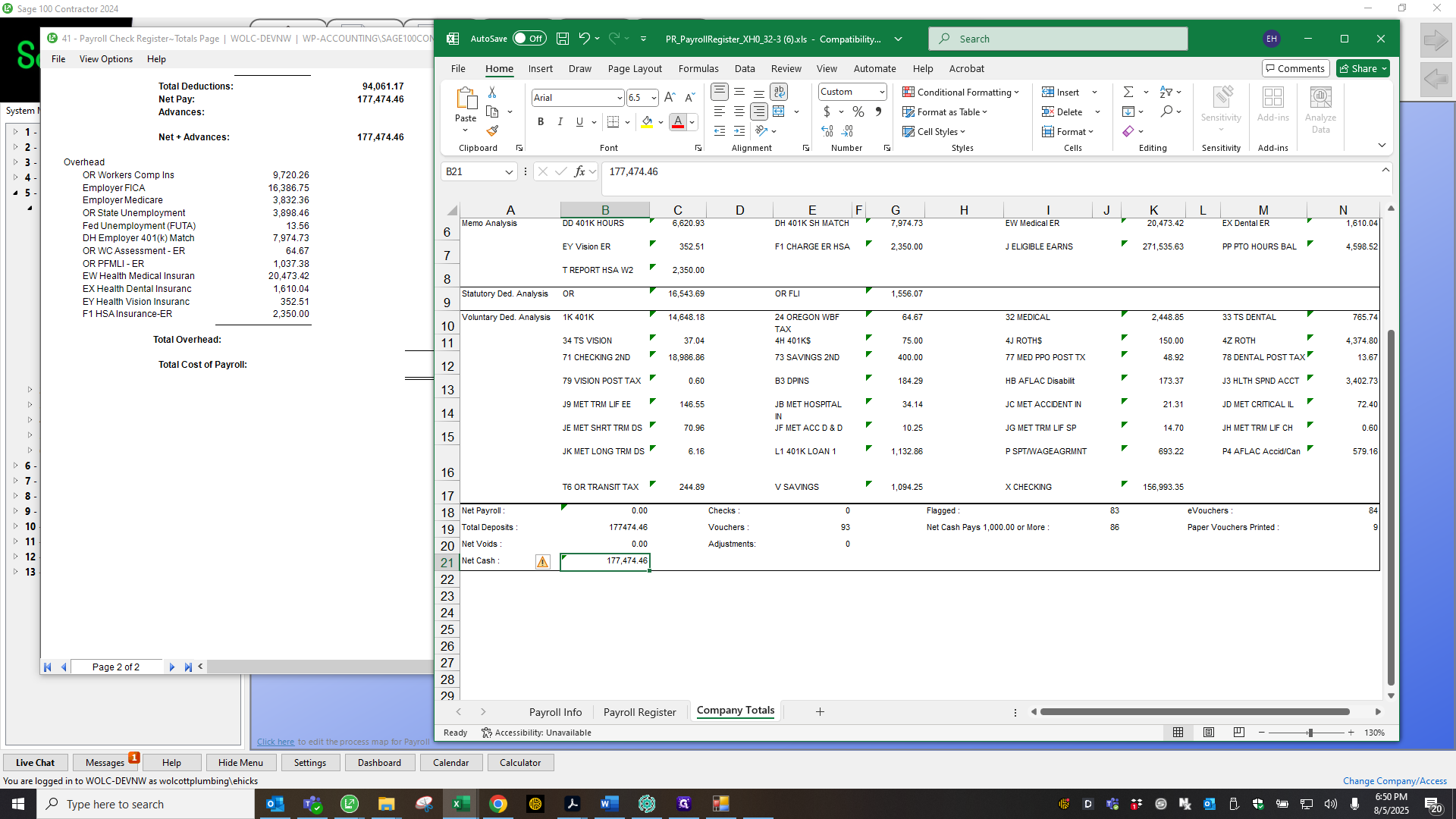

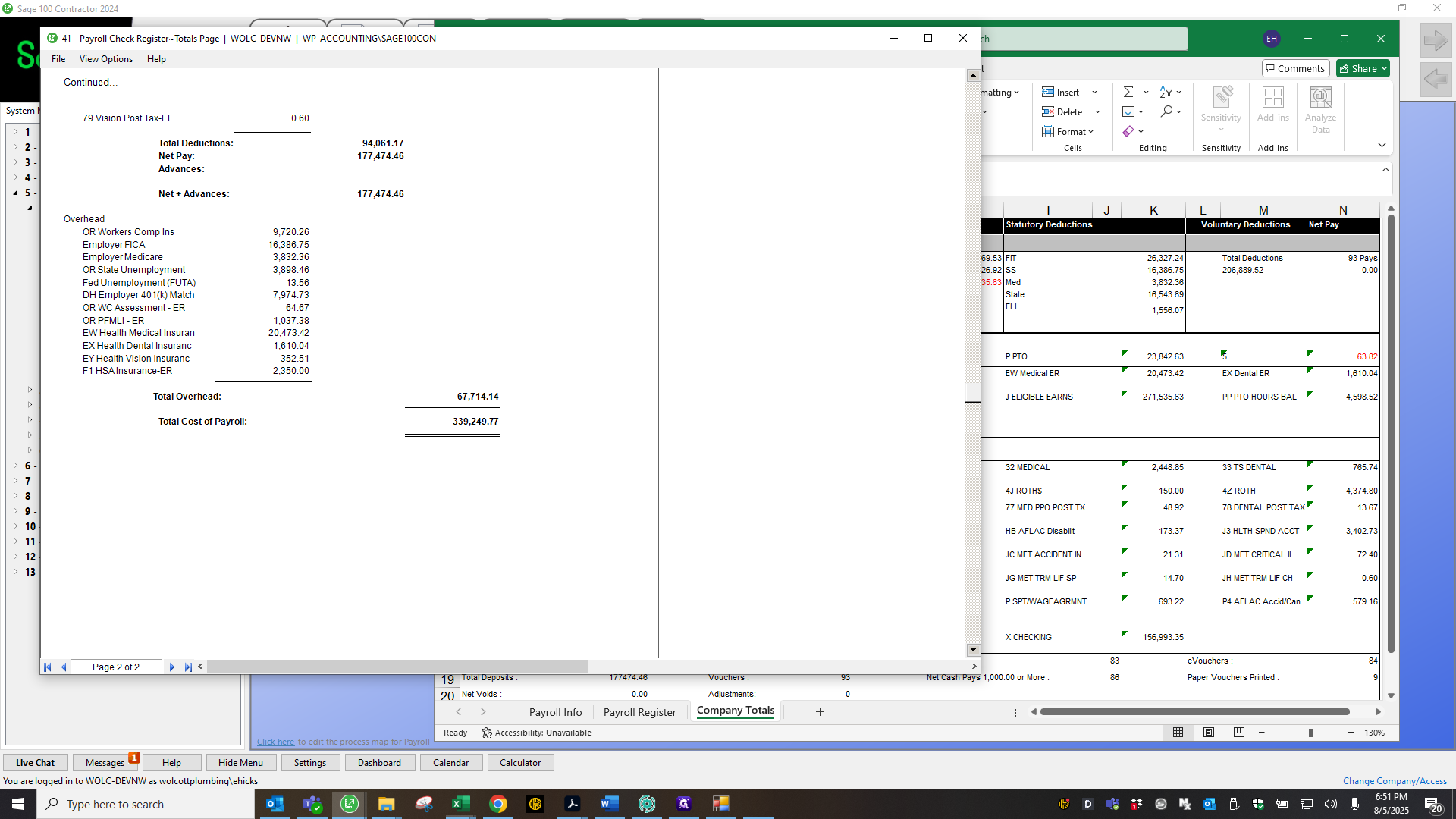

Okay. Everything matches, so I can close this and save it under the payroll check register. By year and quarter. I keep the filing as it is and add the payroll pay date in front. Save.

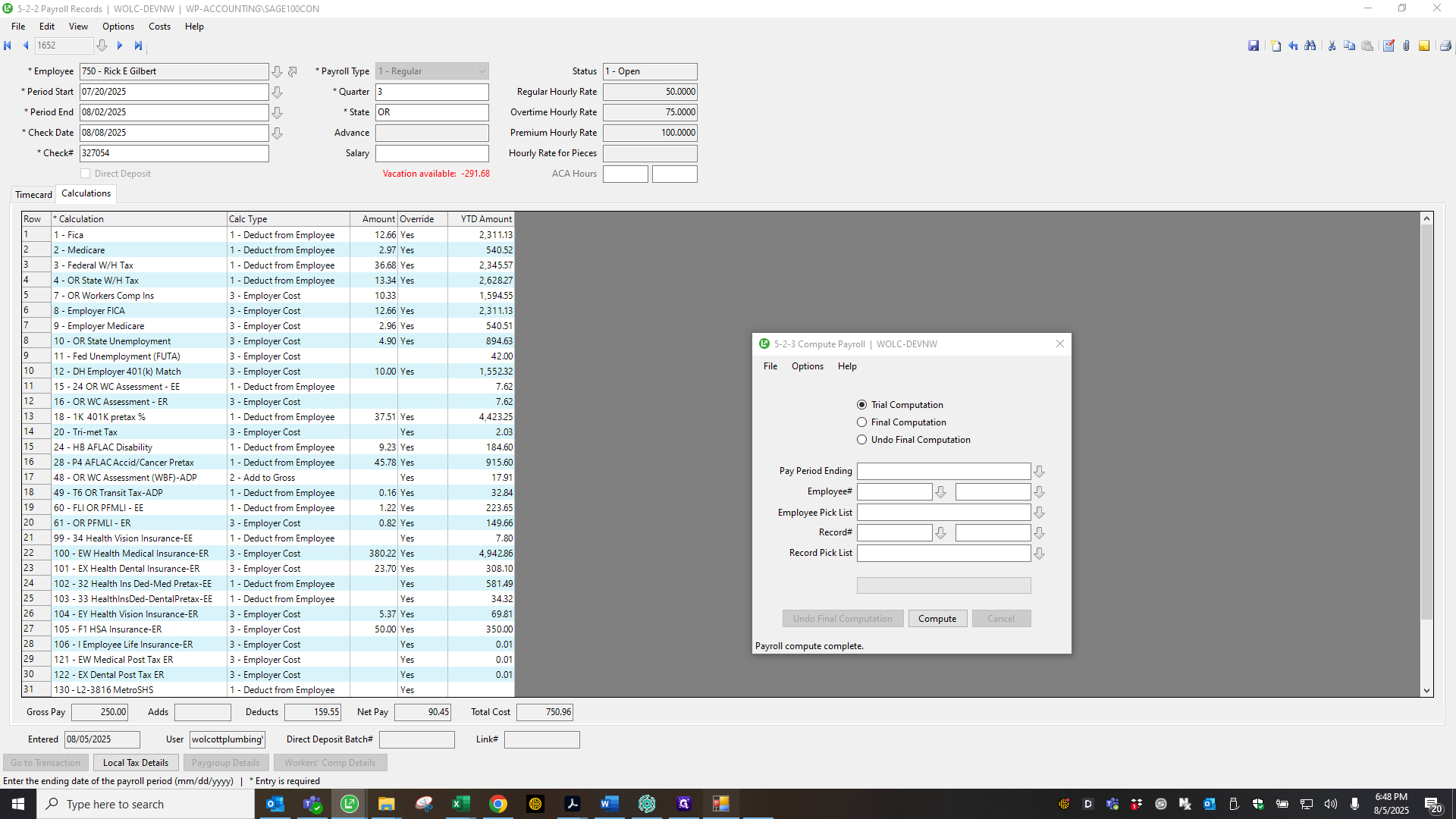

Close that. Now, perform a final calculation. Takes only a second. Finished computing. All done.

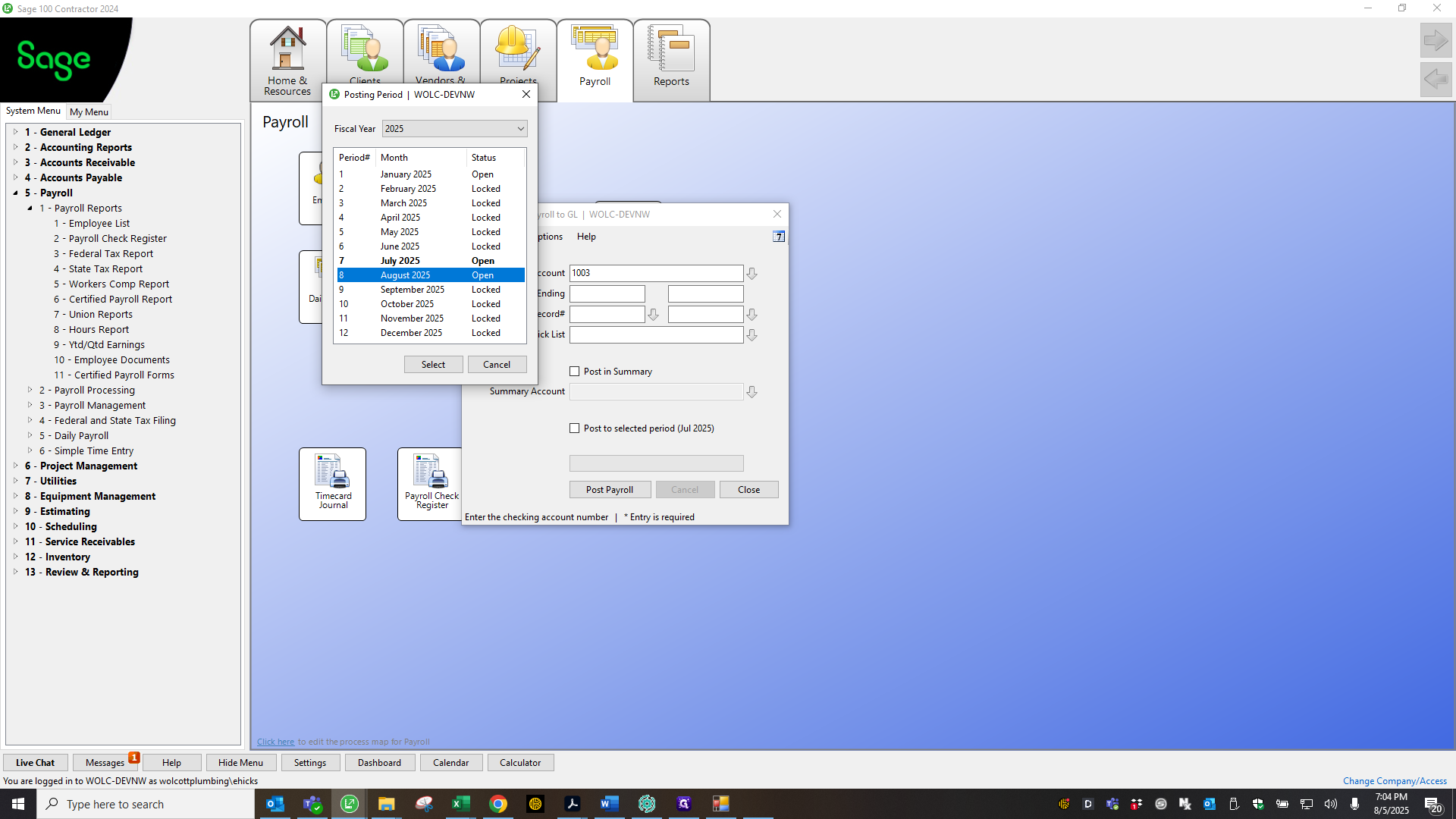

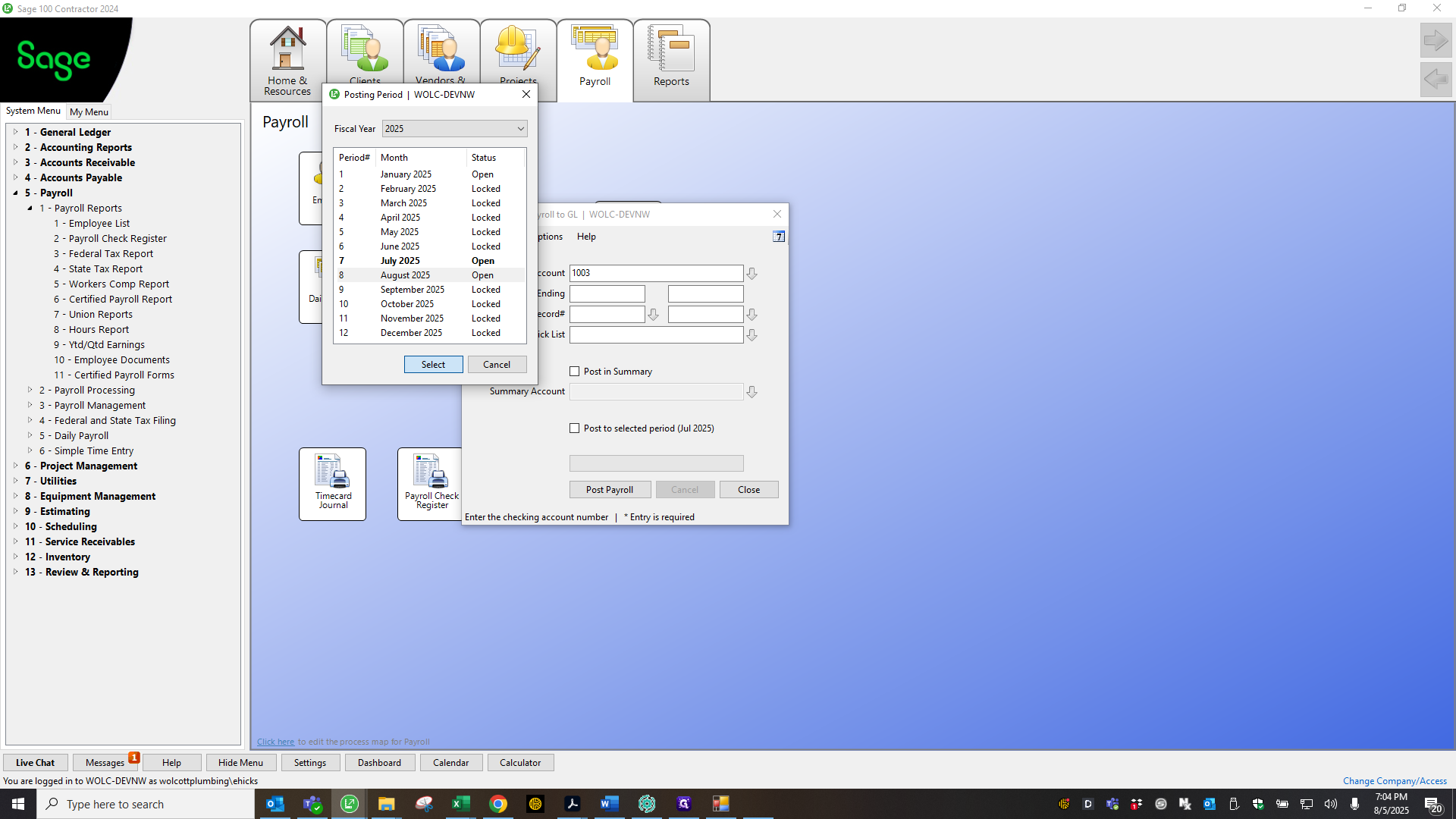

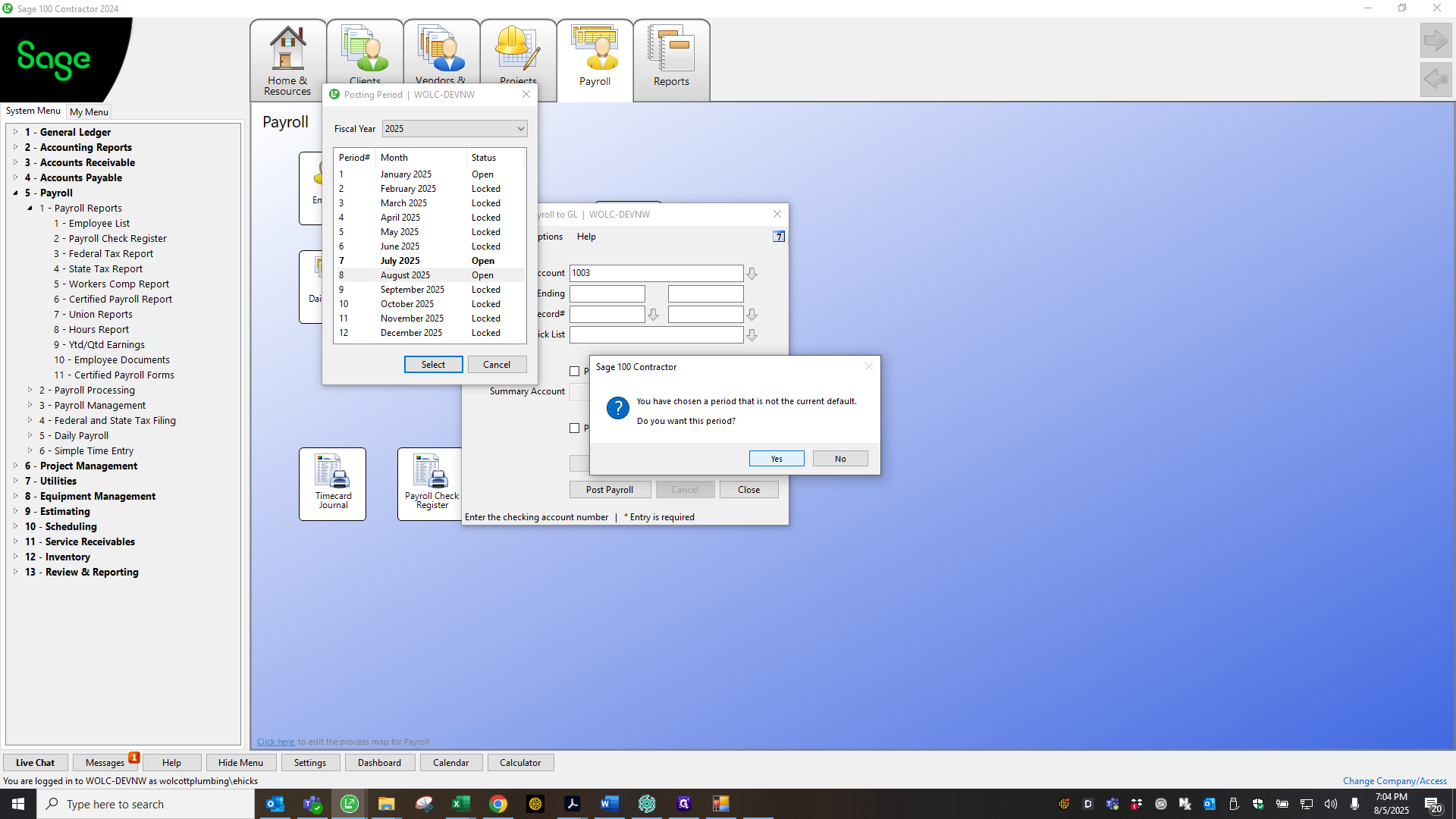

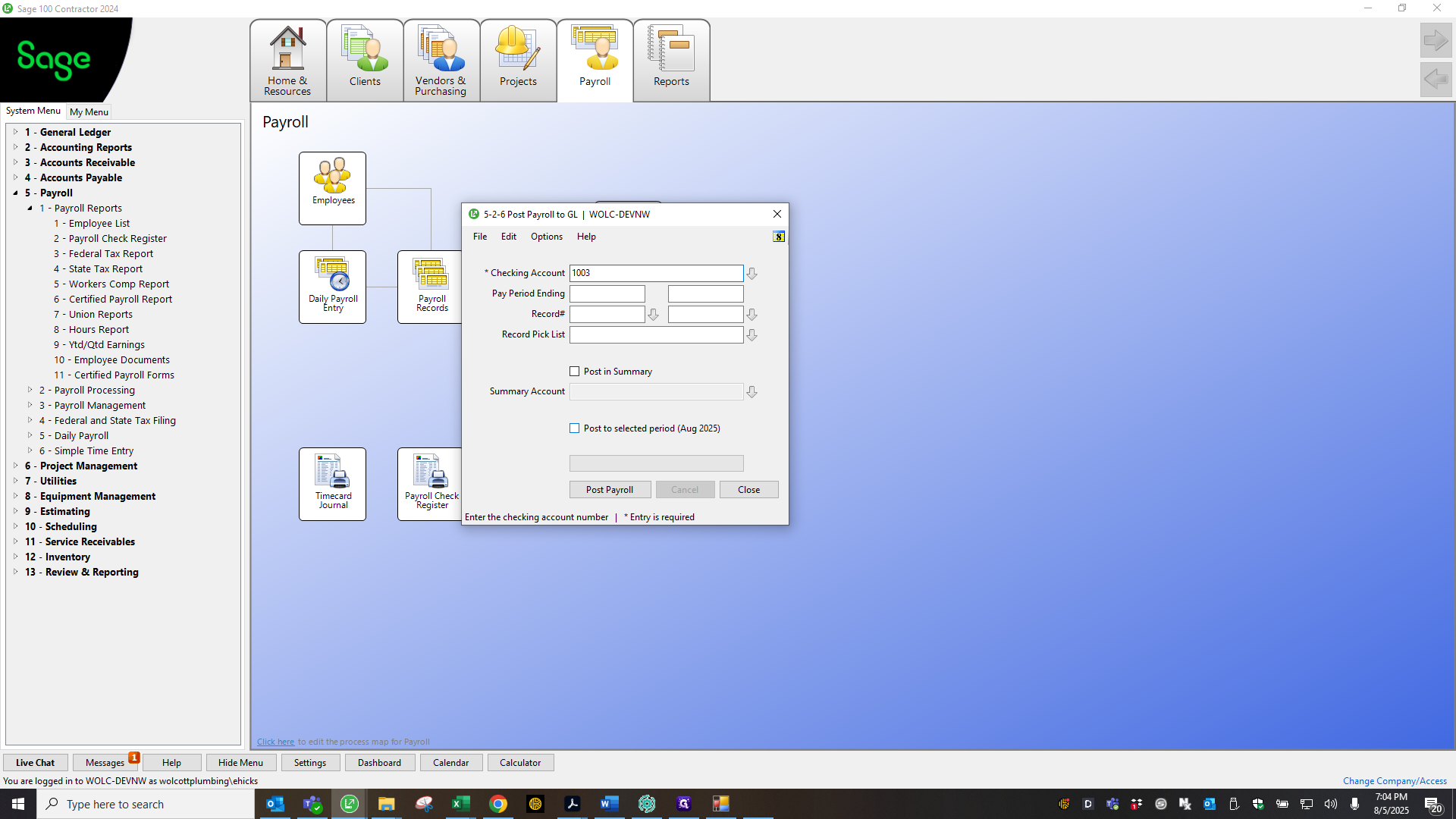

I'm going to post payroll now. 0003. Make sure to update the period here.