How to Enter Salaried Employees and Set Up SSO in Payroll Systems

Learn the step-by-step process for correctly entering salaried office employees in payroll before adding SSO, including tips for using Sage and ADP, creating time cards, and ensuring accurate overtime and department allocation.

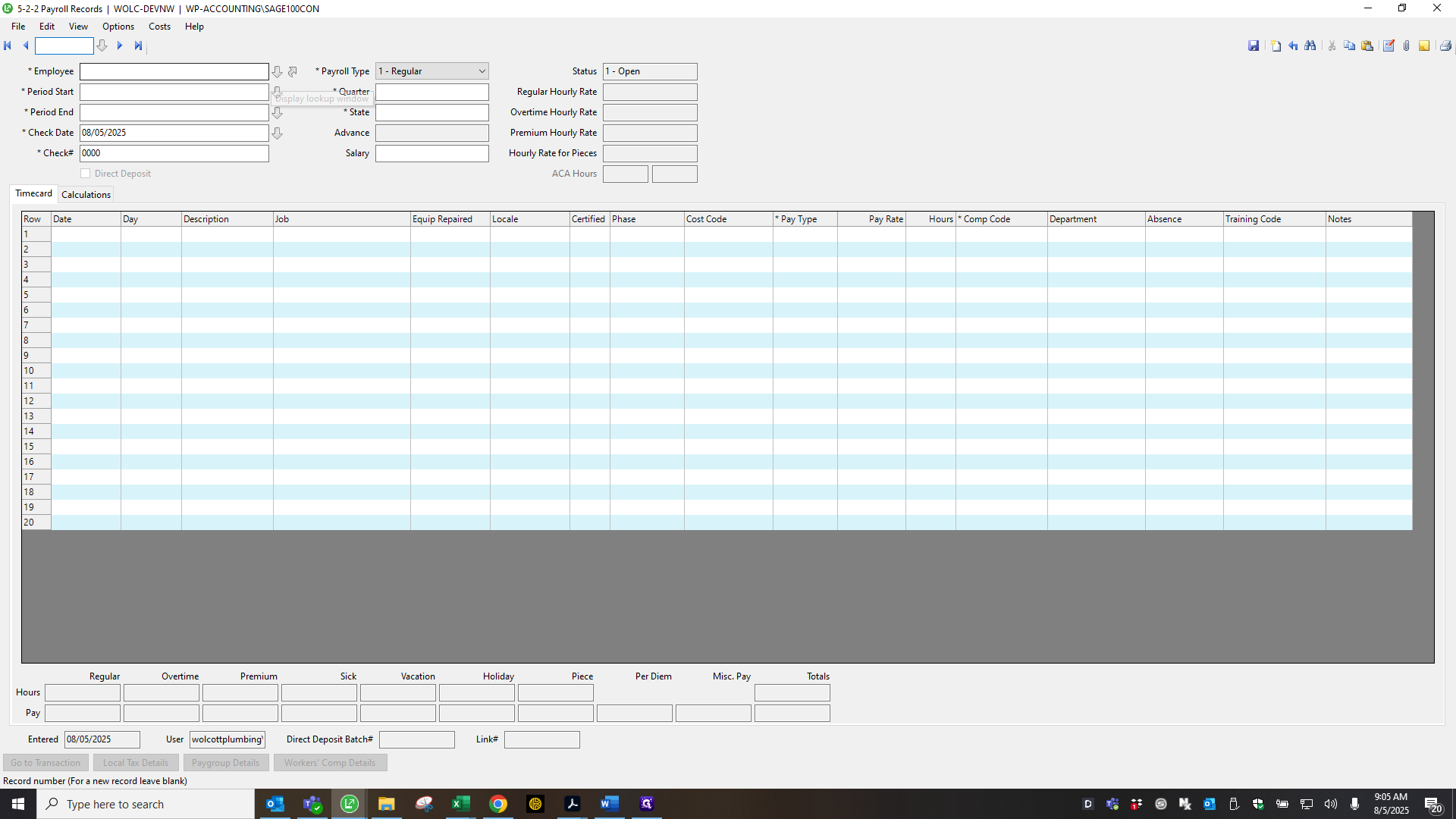

In this guide, we'll learn how to update payroll records for salaried office employees before implementing Single Sign-On (SSO) for payroll processing. The goal is to ensure that salary rates are removed and hourly rates are entered correctly in the payroll system to prevent duplicate payments. We will also cover how to create time cards, verify payroll periods, and check overtime and departmental allocations for accuracy.

Let's get started

Hello. This is for records that must be entered before adding SSO for payroll.

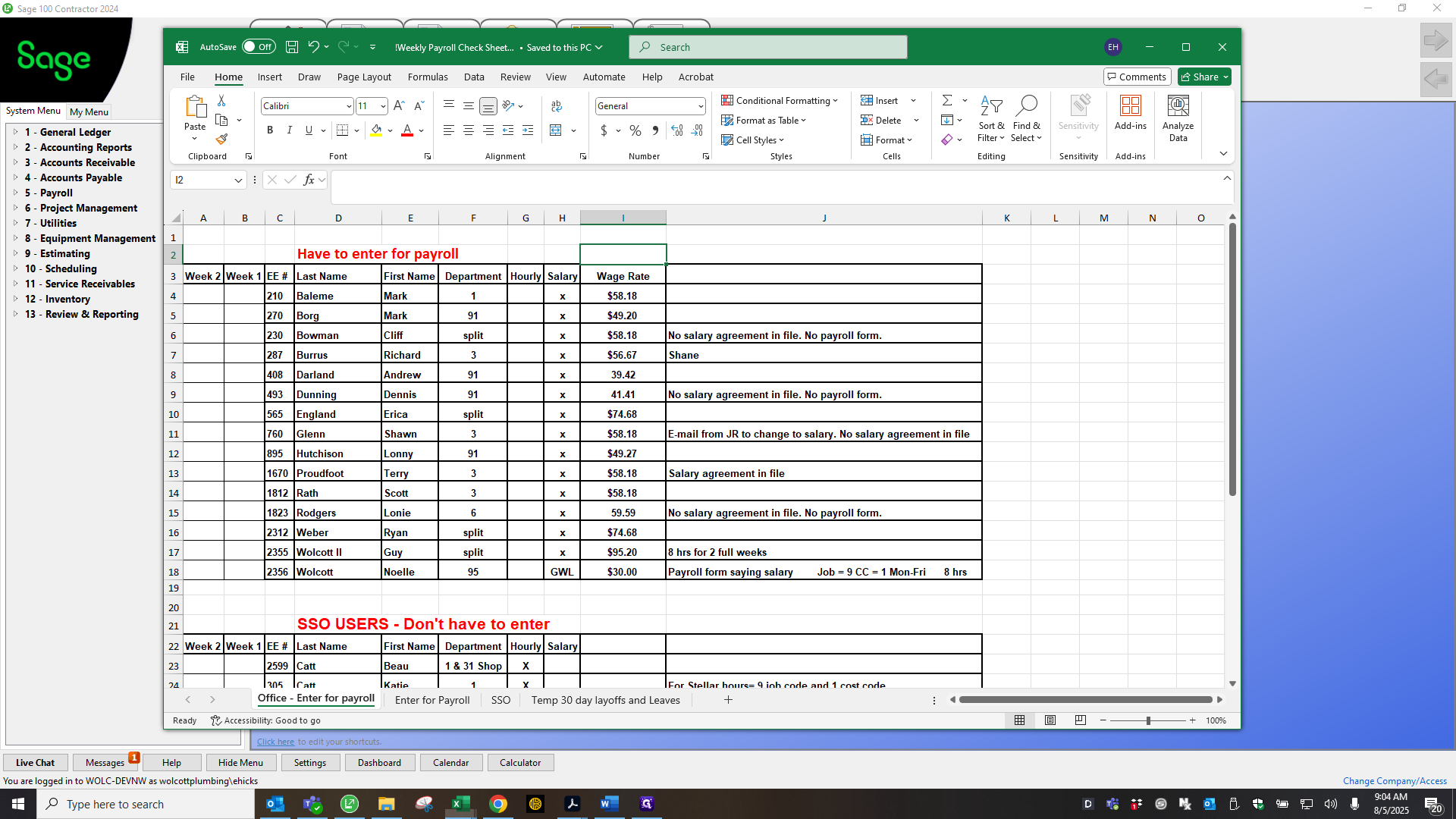

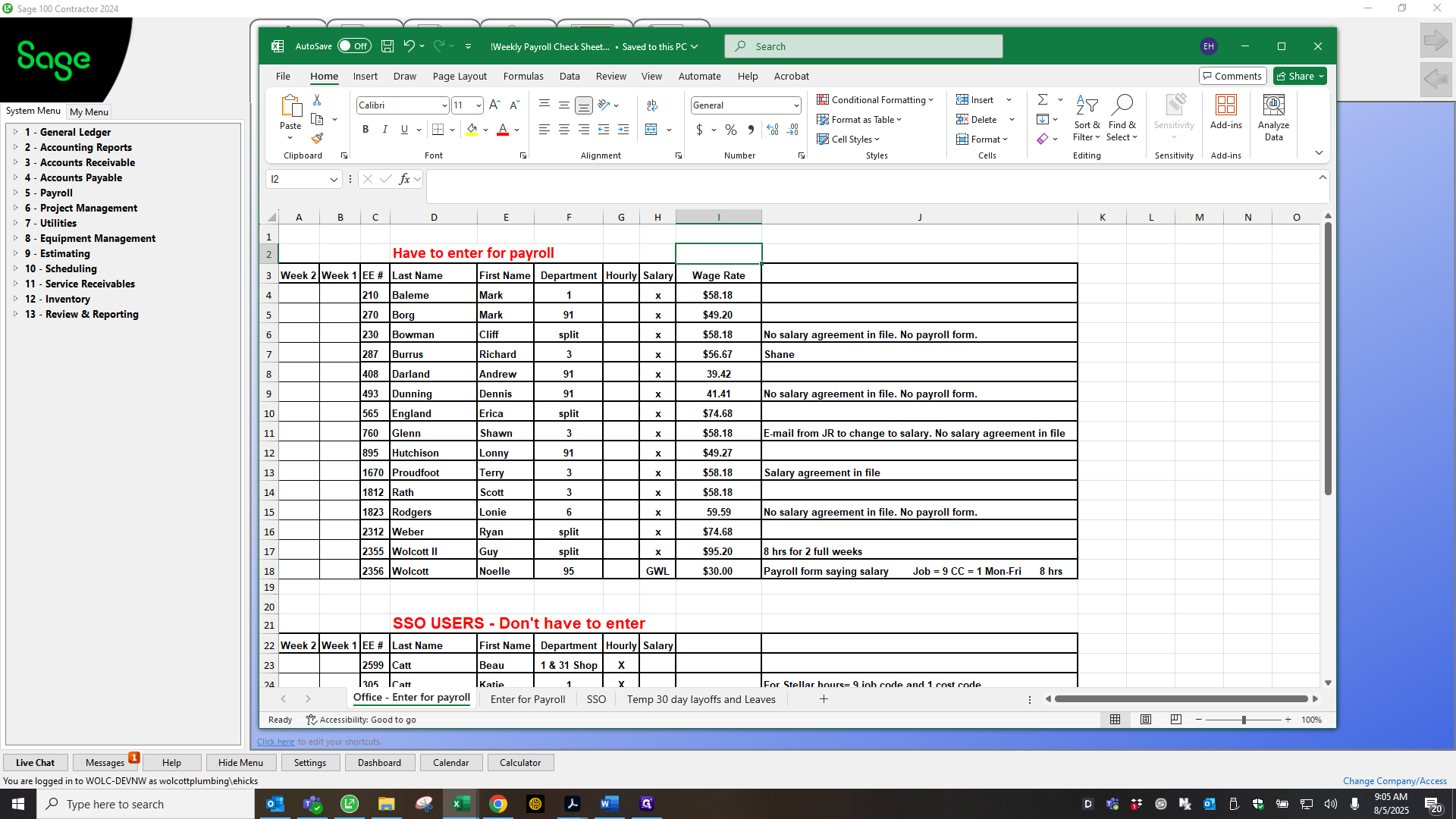

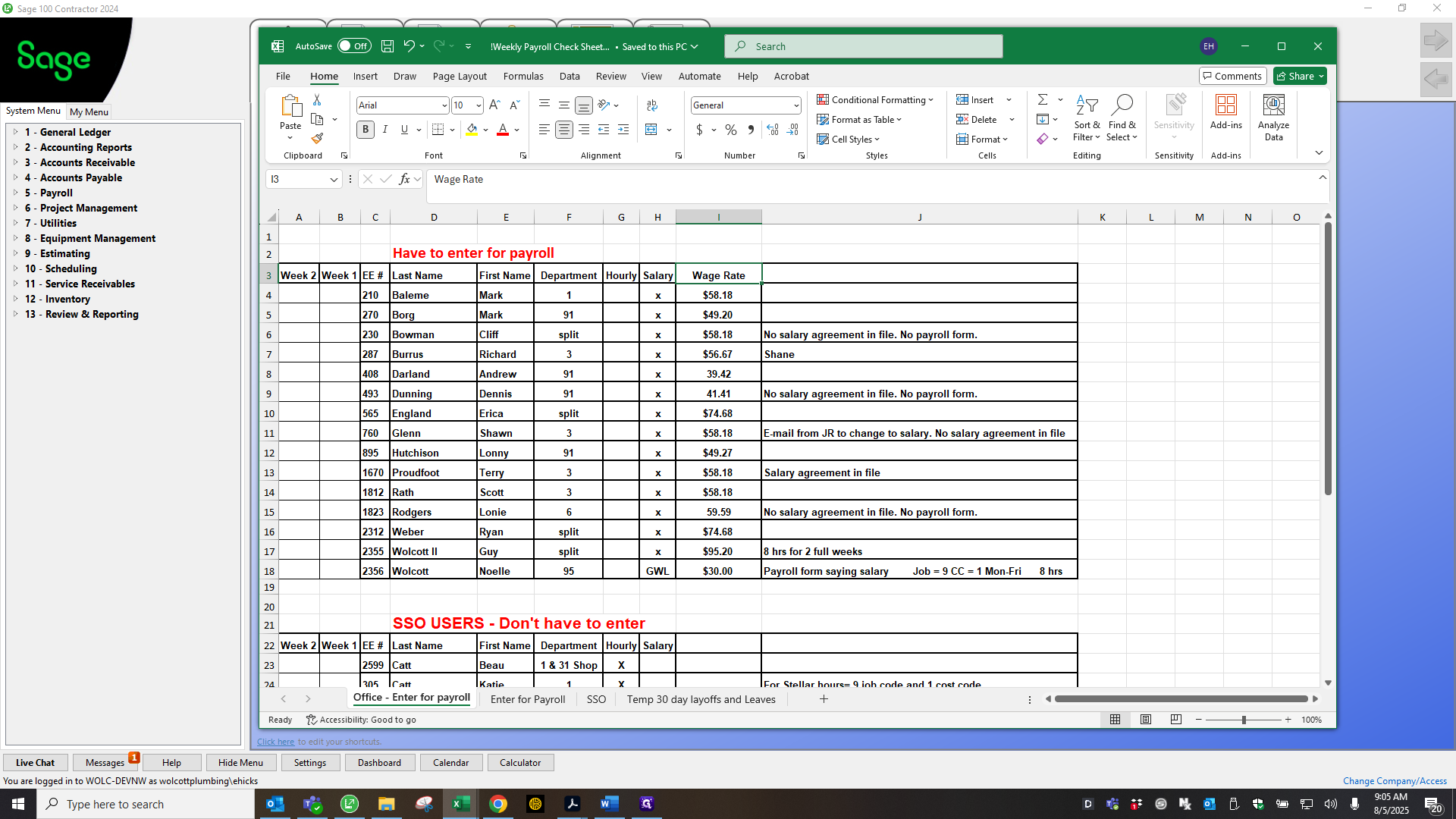

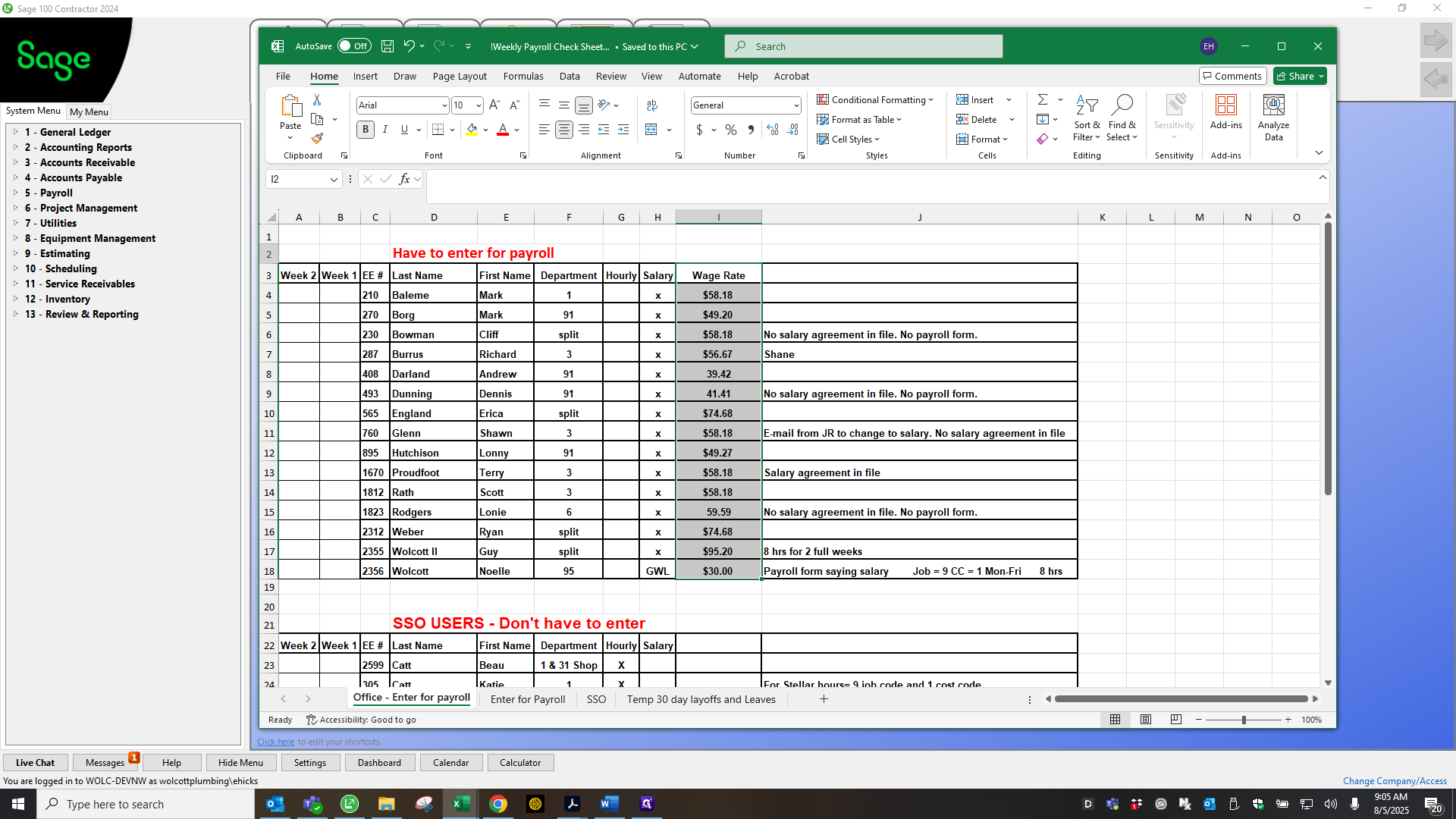

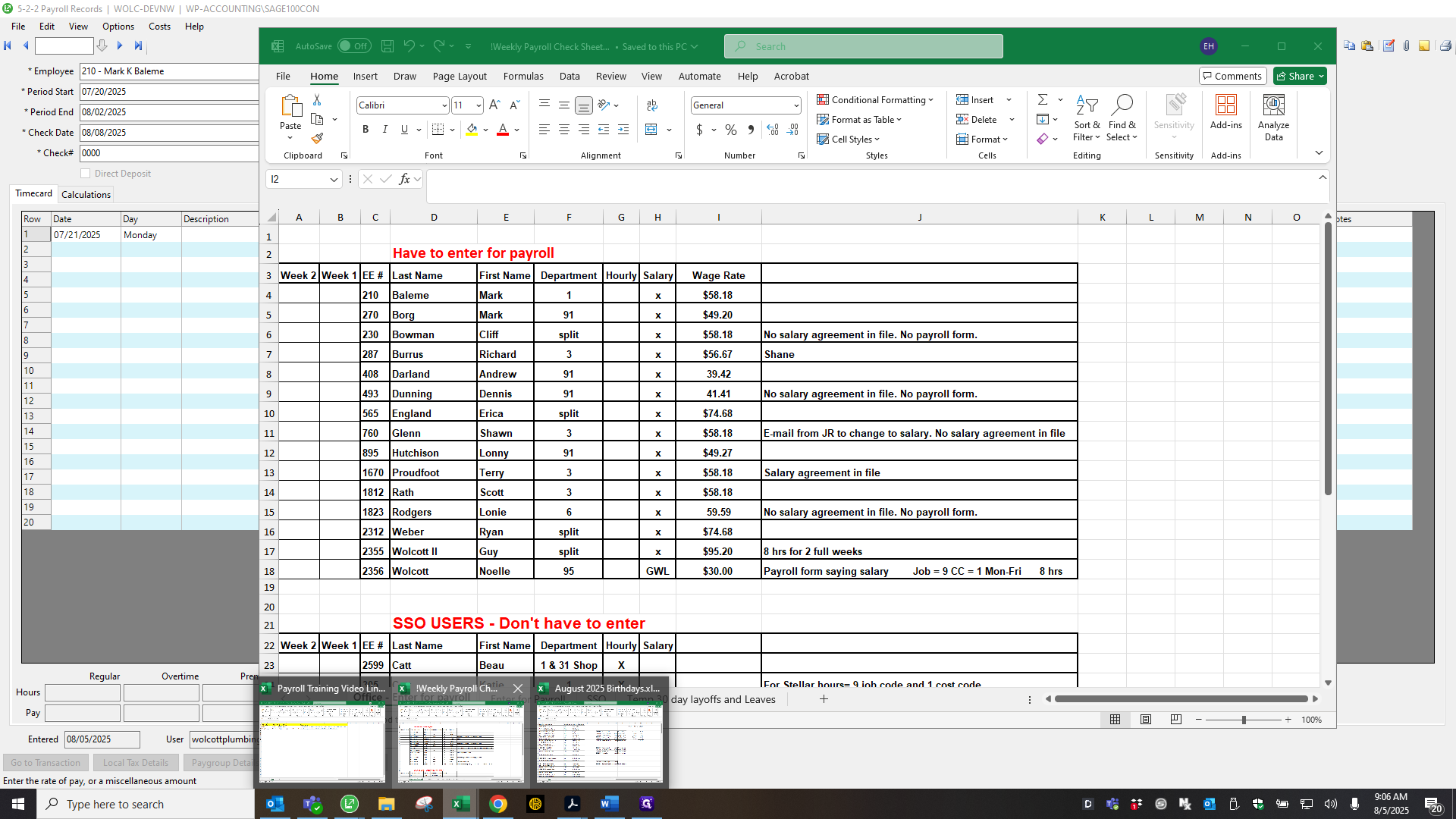

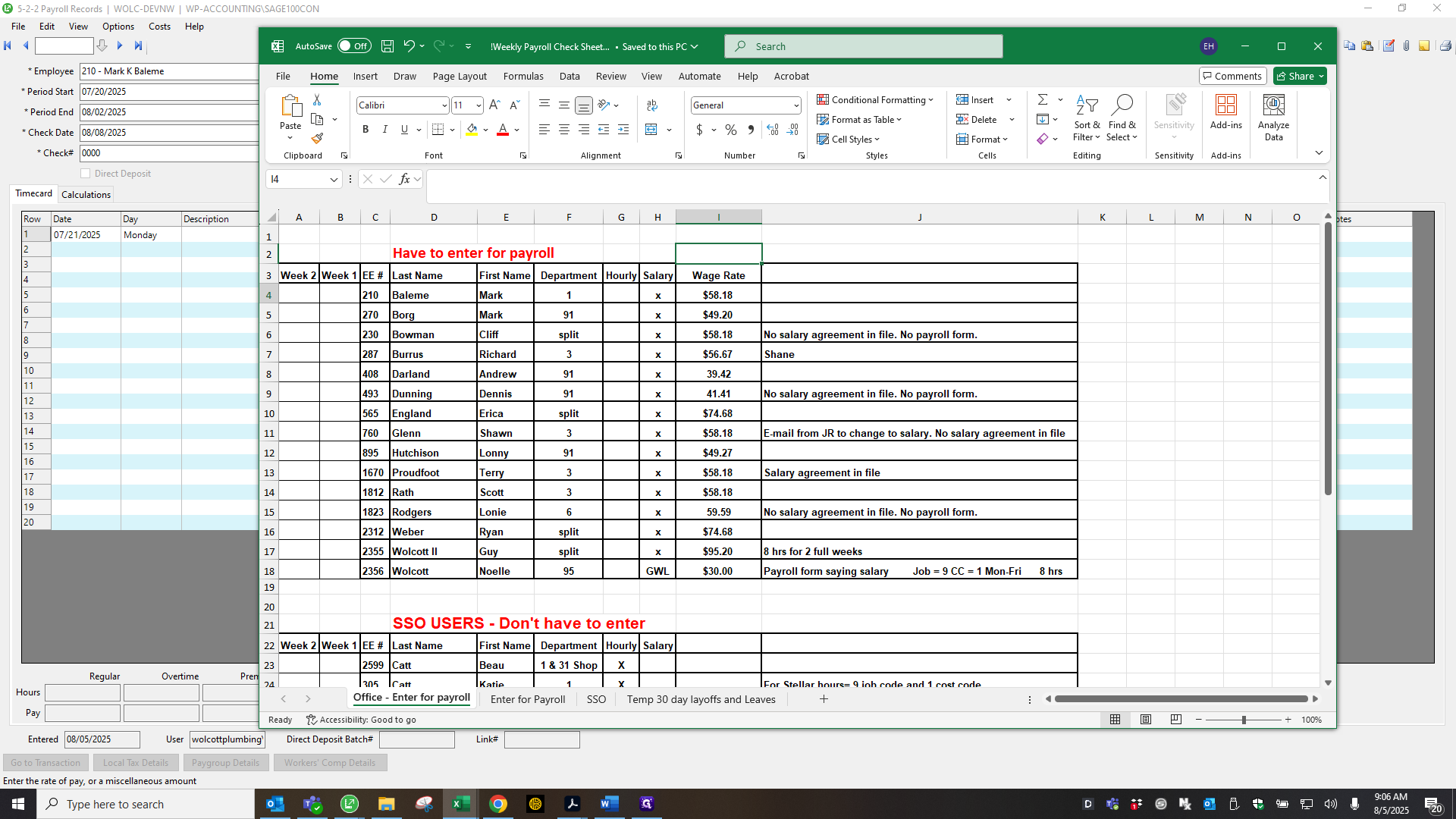

These are all the salaried office employees. Uh, the spread... We've been using the same spreadsheet for years. But use the employee record number and their wage rate. In Sage, remove the salary rate and enter the hourly rate.

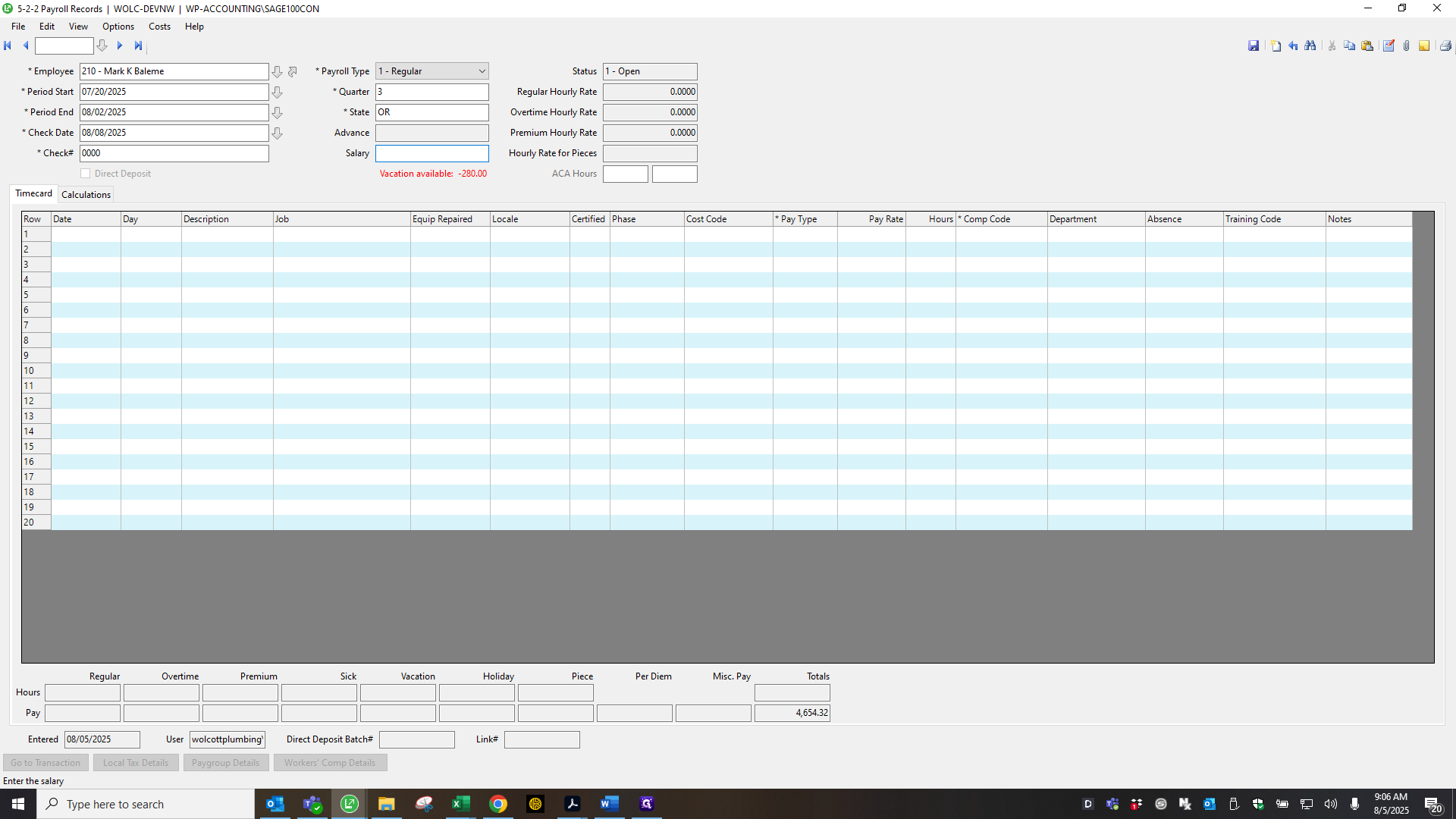

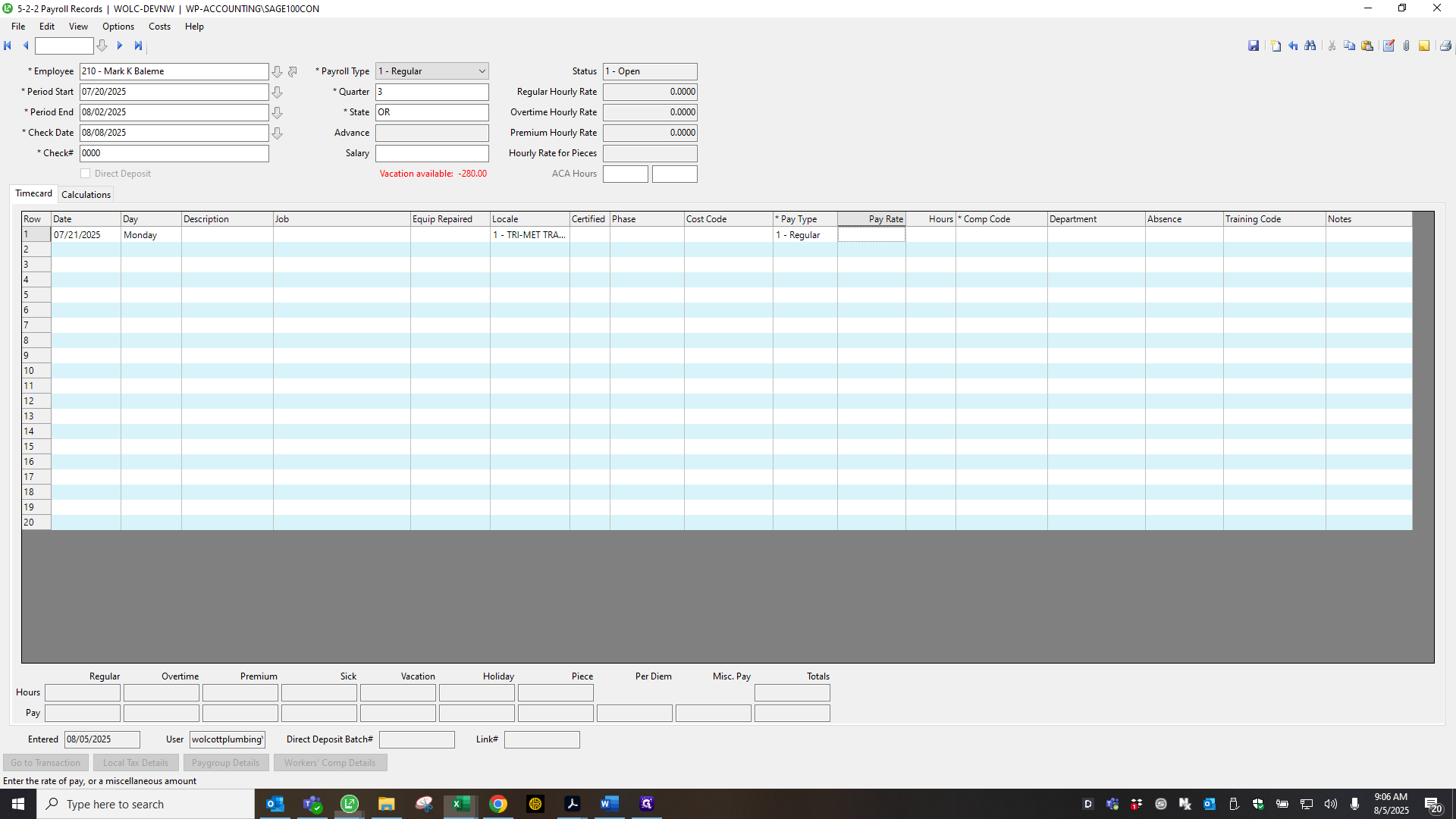

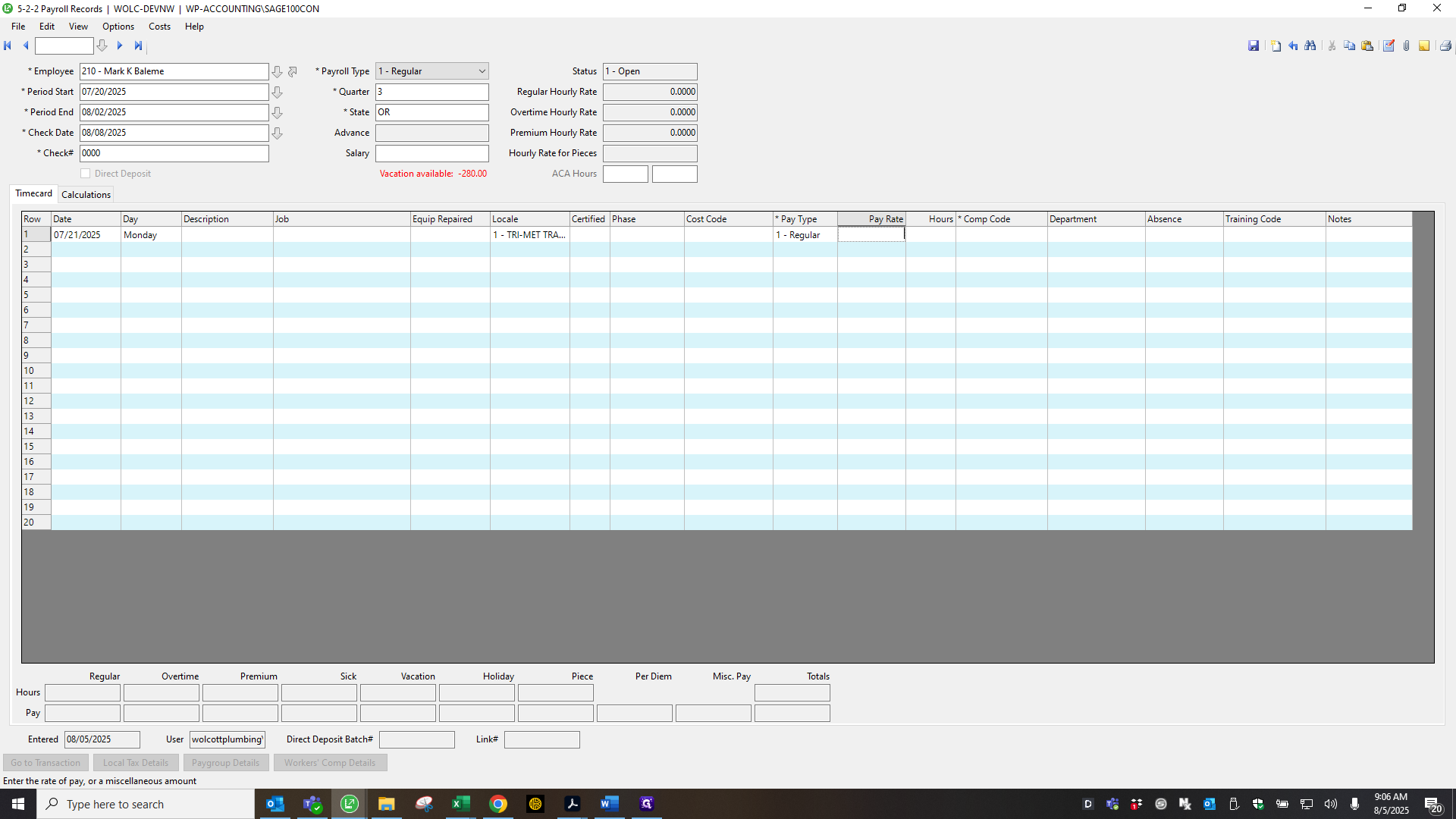

If we don't fix that, ADP will pay both of them. To save time, I will demonstrate how to correctly record a salaried employee. Let's go with Marc. Up to the pay date. You need to remove the salary amount.

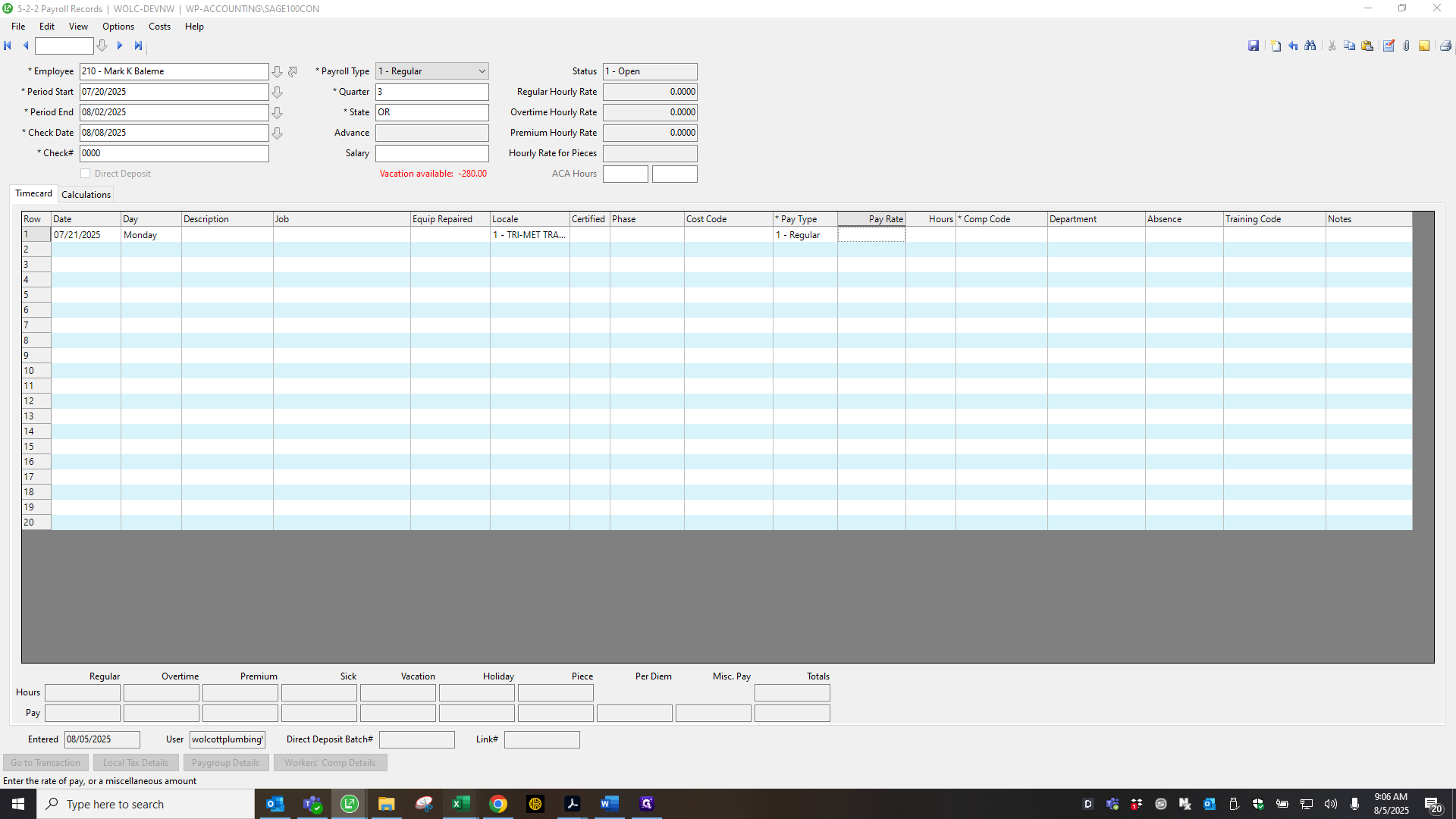

If that remains and you enter the hourly rate, ADP will pay both. Enter the day, then add the pay rate.

Excuse me.

Let me double-check that. 58.18. And this department. "" Okay, I'll pause here. Next, we'll begin with how to set up SSO.

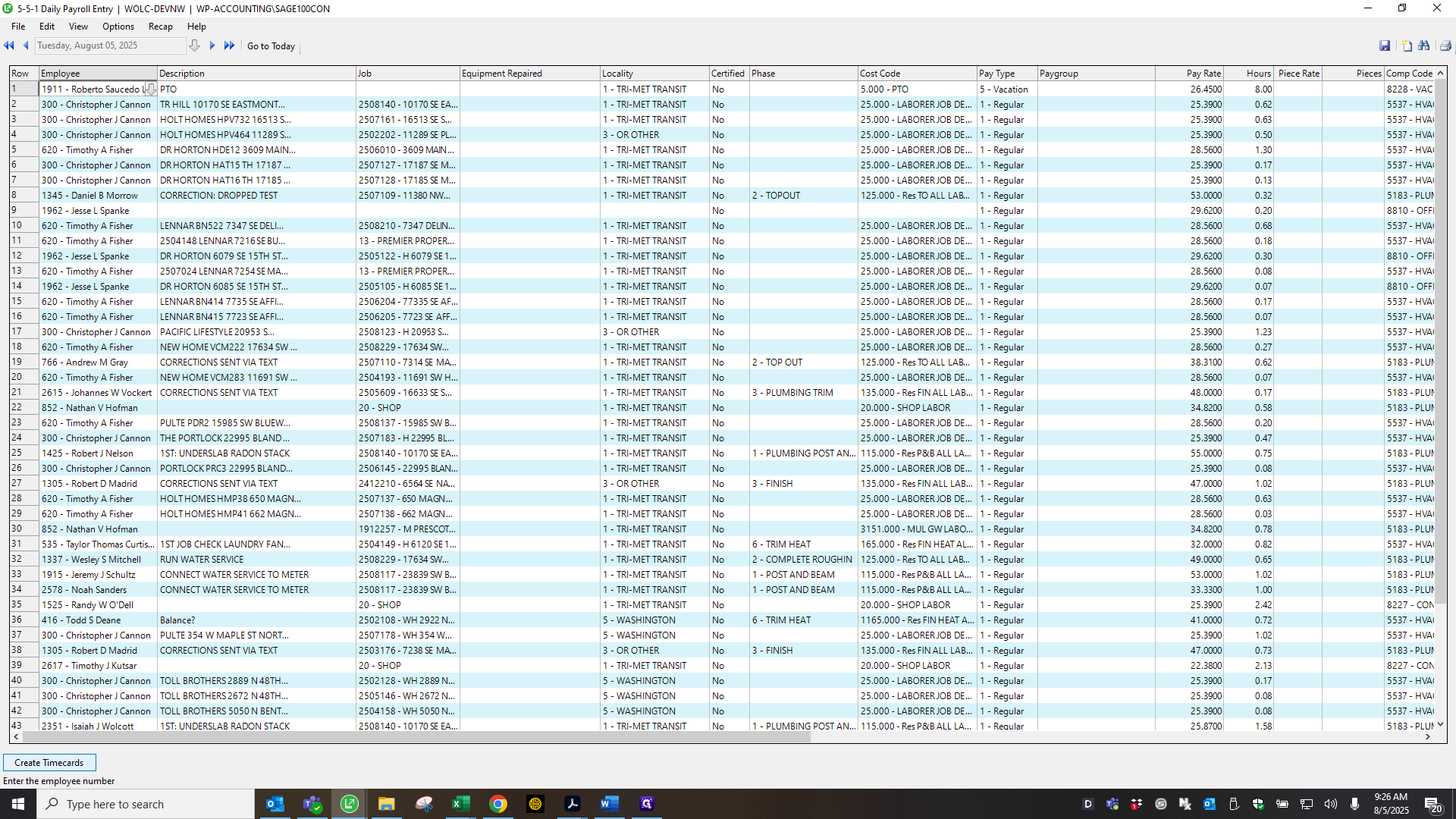

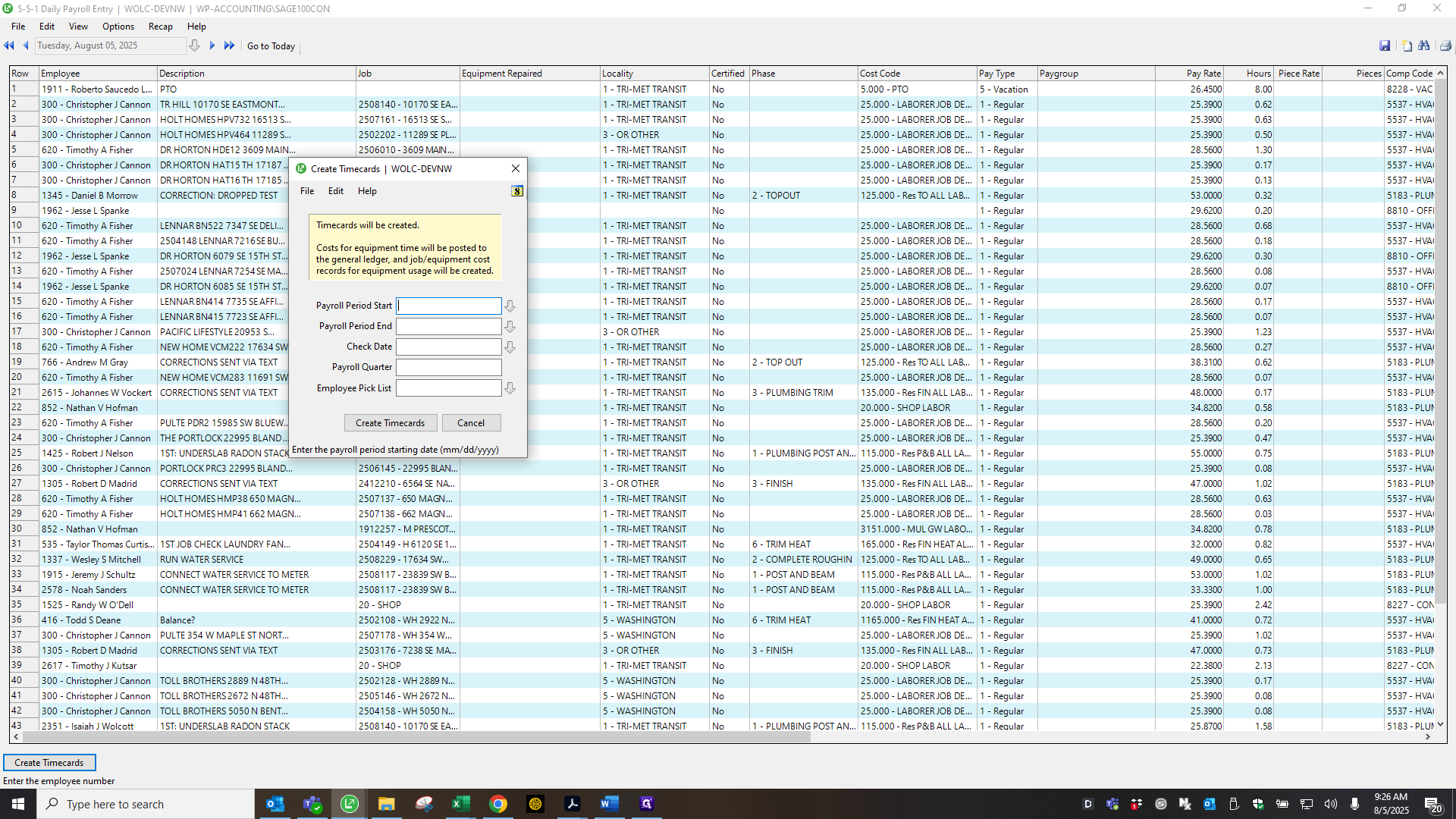

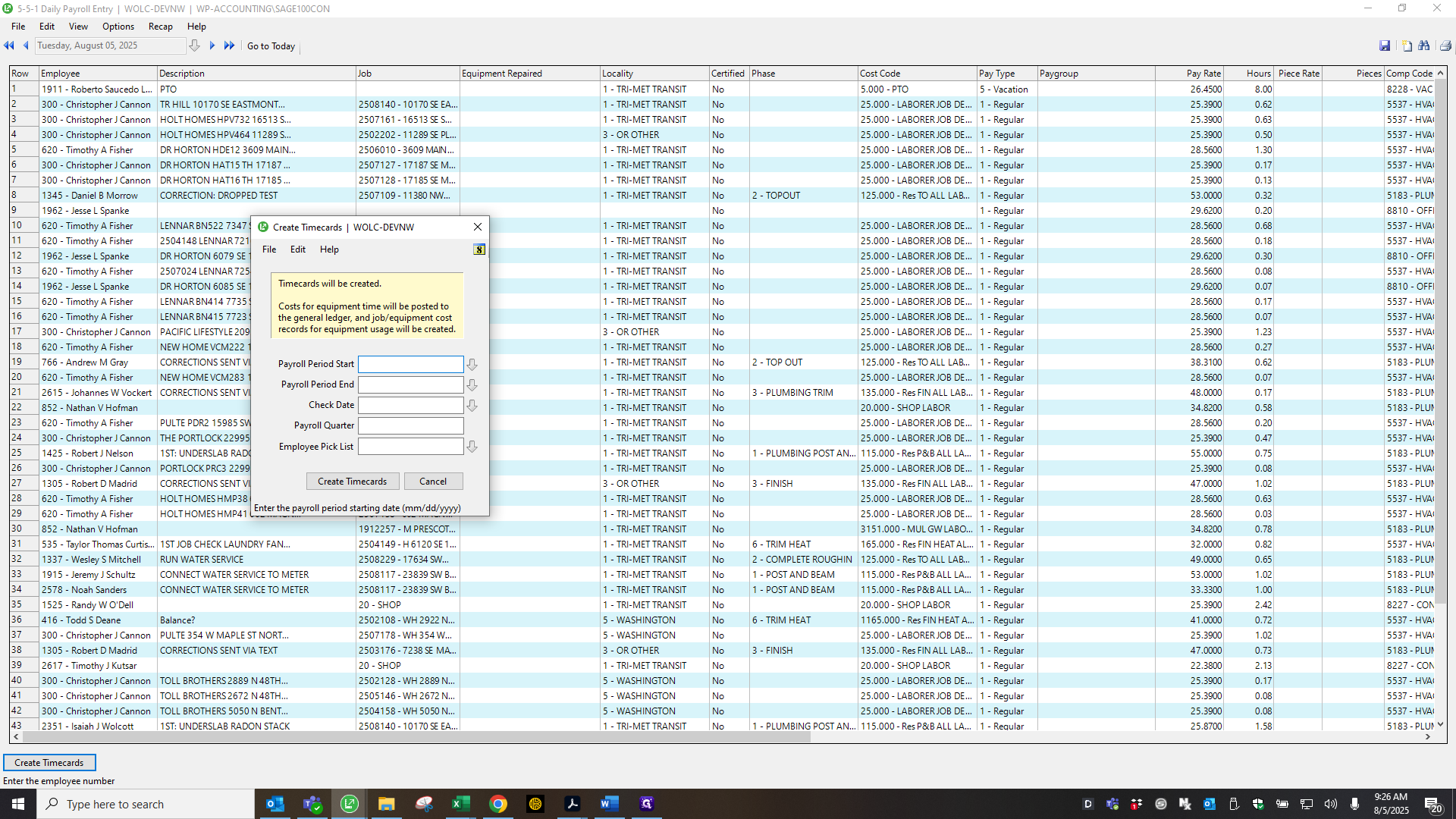

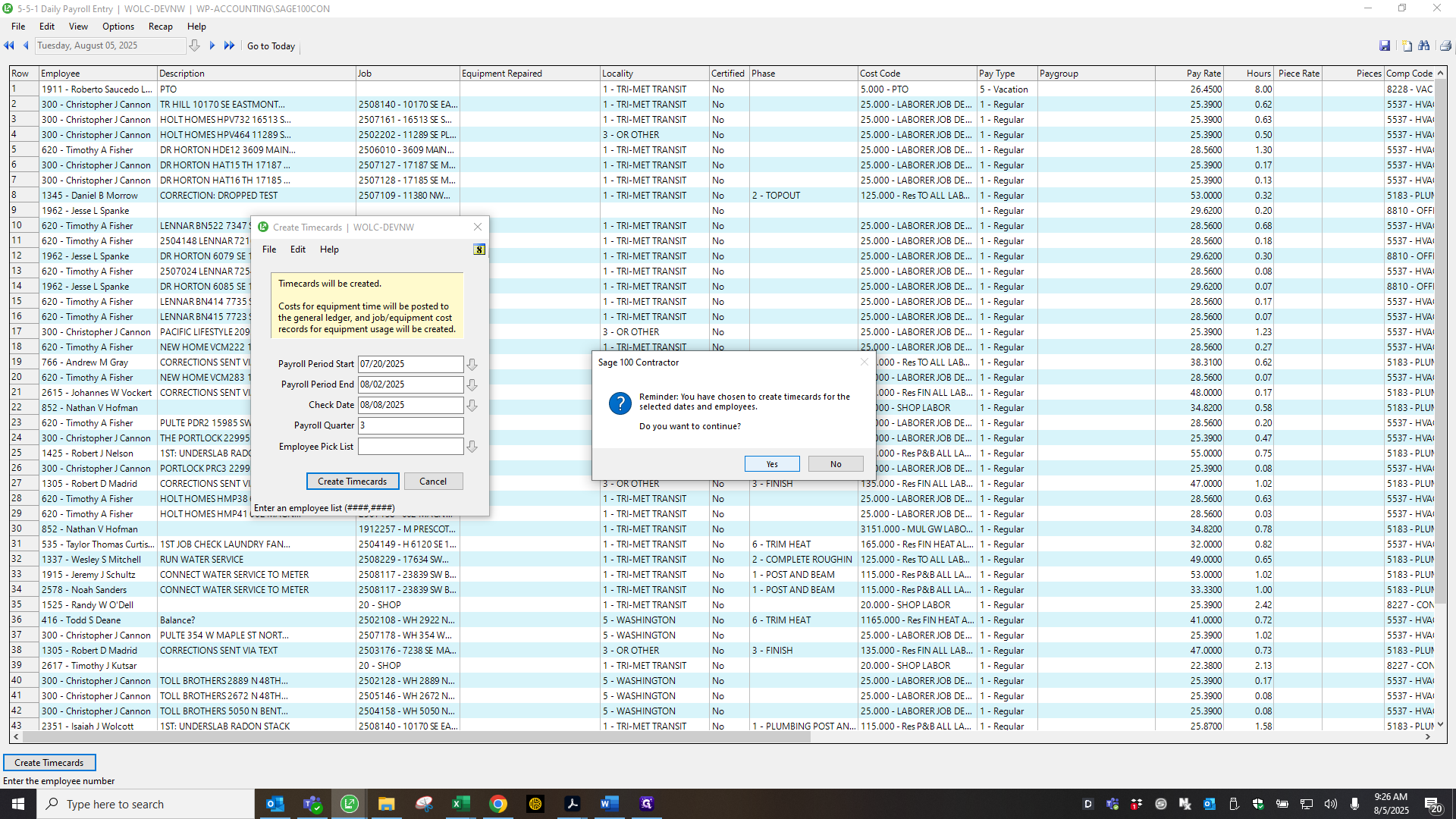

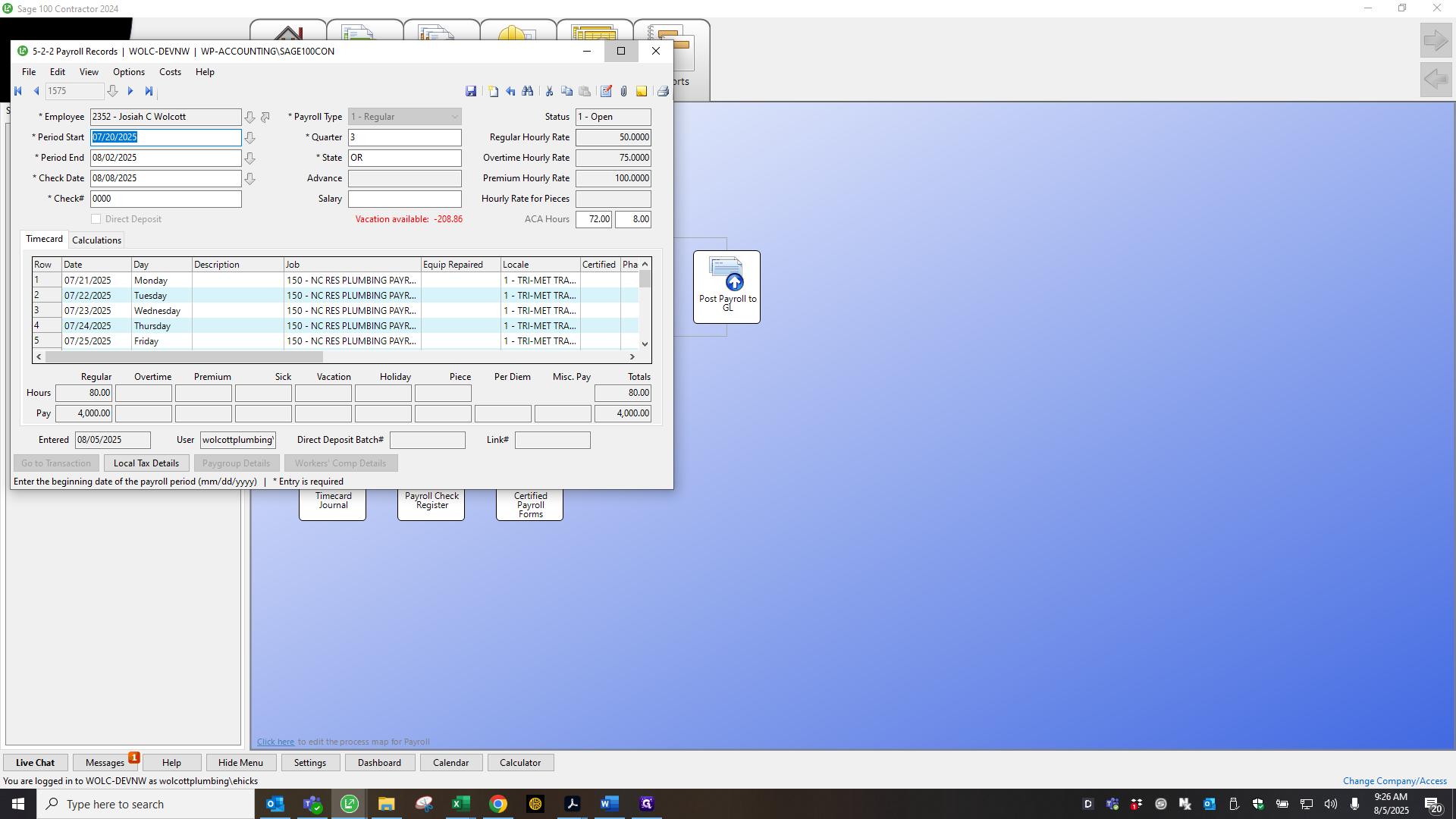

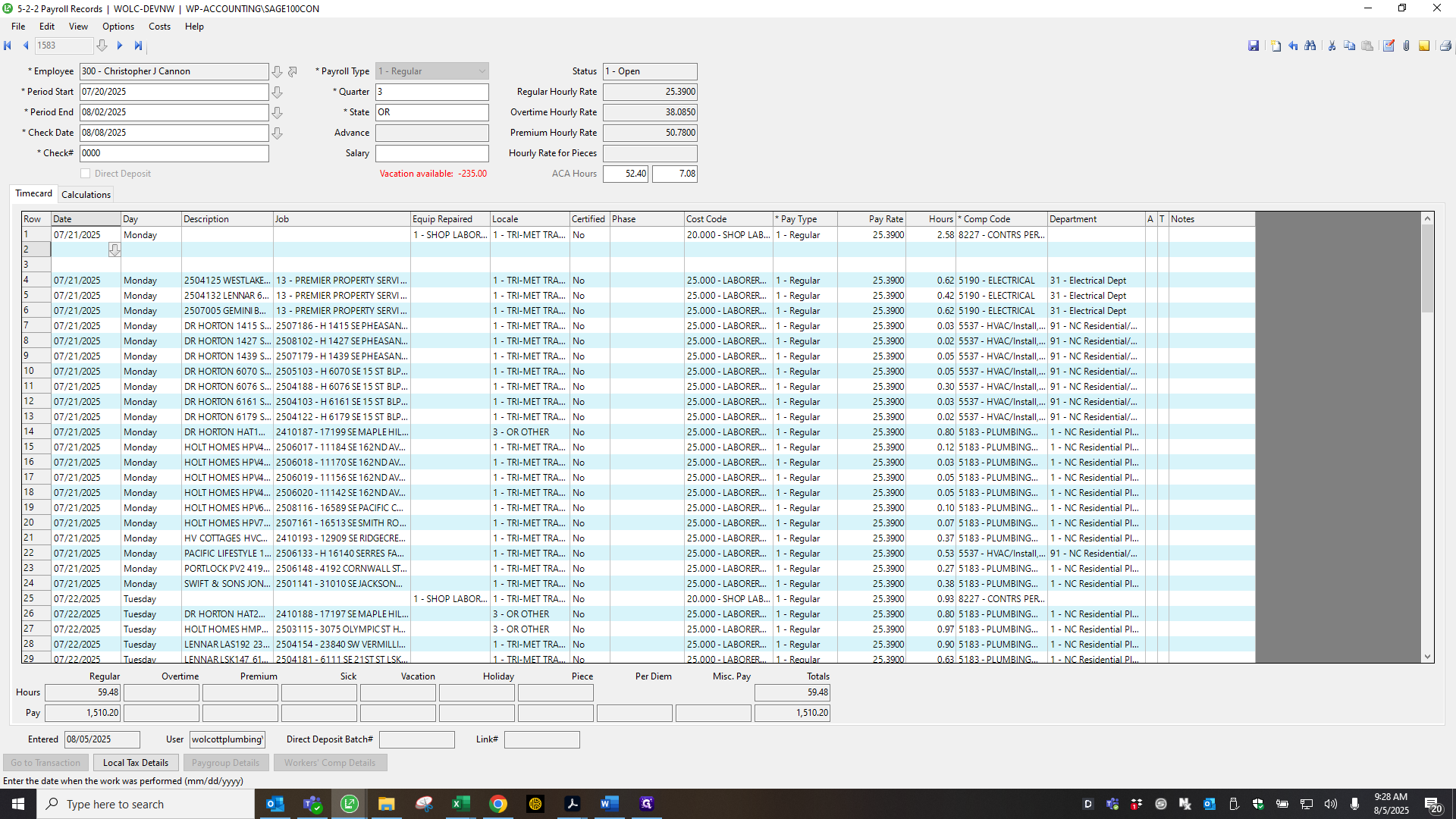

Now that all salaried employees are entered in payroll, return to the daily entry and click the Create Time Cards button.

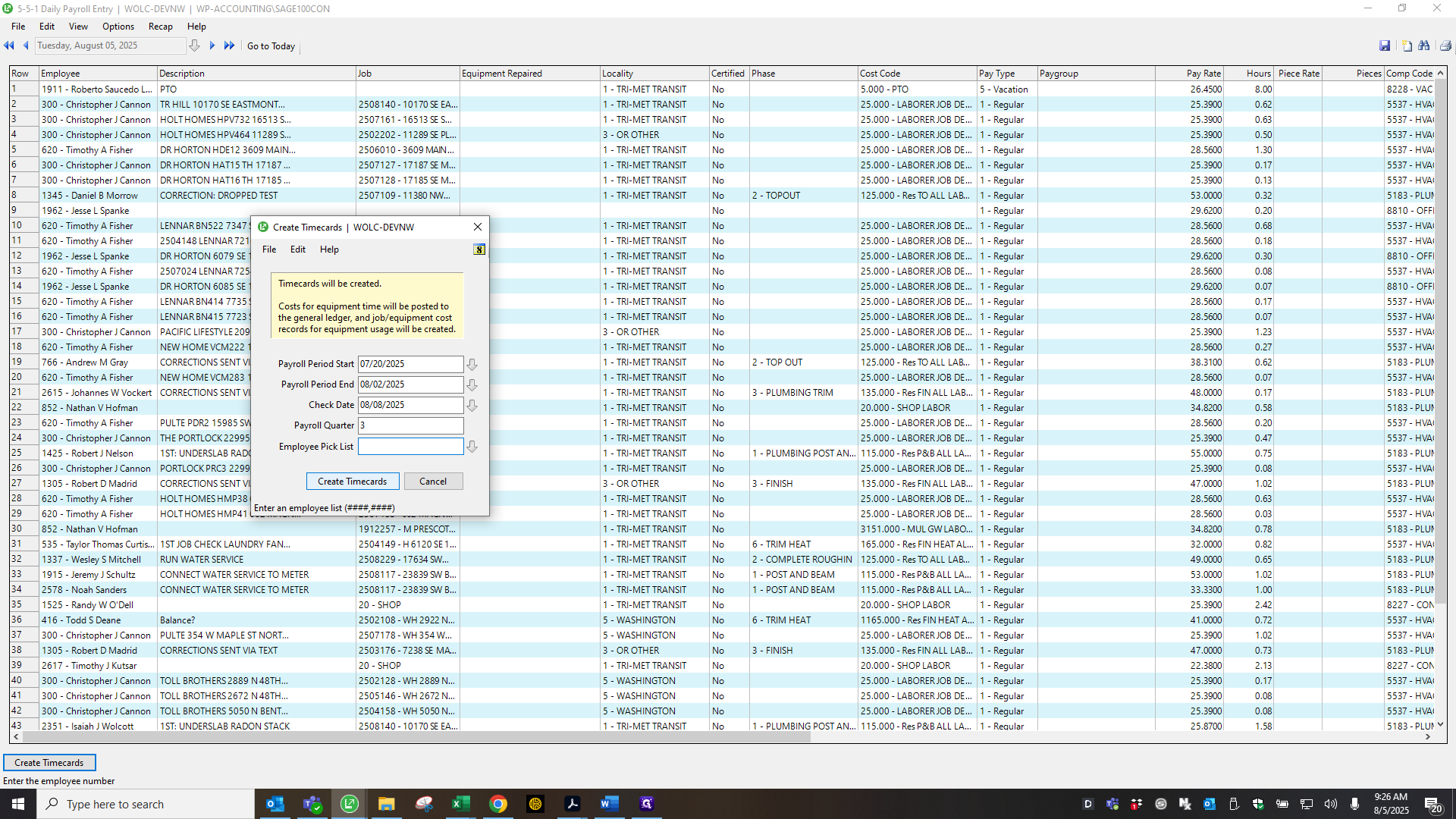

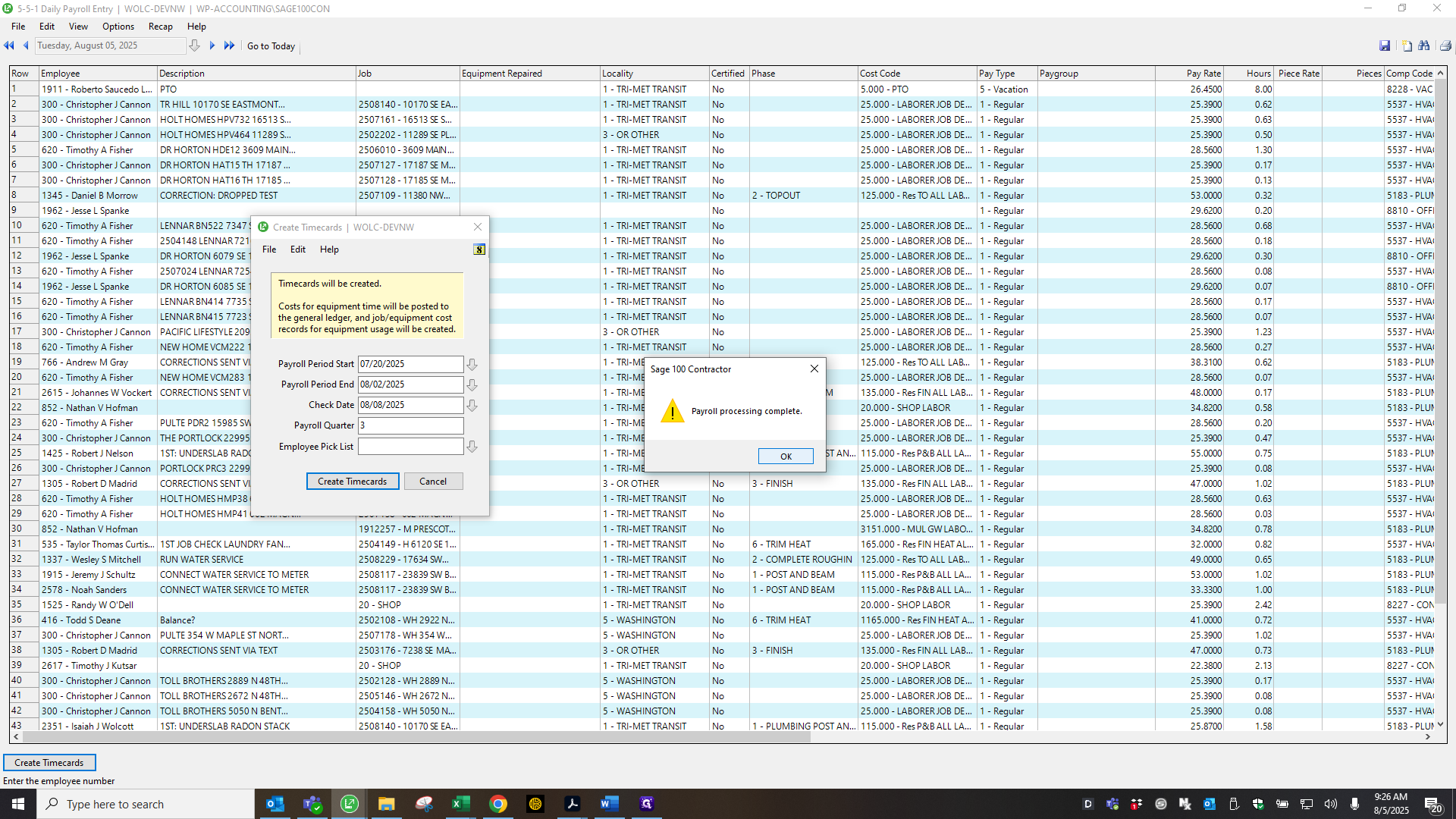

And then you... A small window will appear. Enter your payroll start date, end date, and check date. Also, make sure this period matches the check date. On 07/09/2022 and 08/08, select quarter three for the payroll quarter, then click Create Time Cards. Yes.

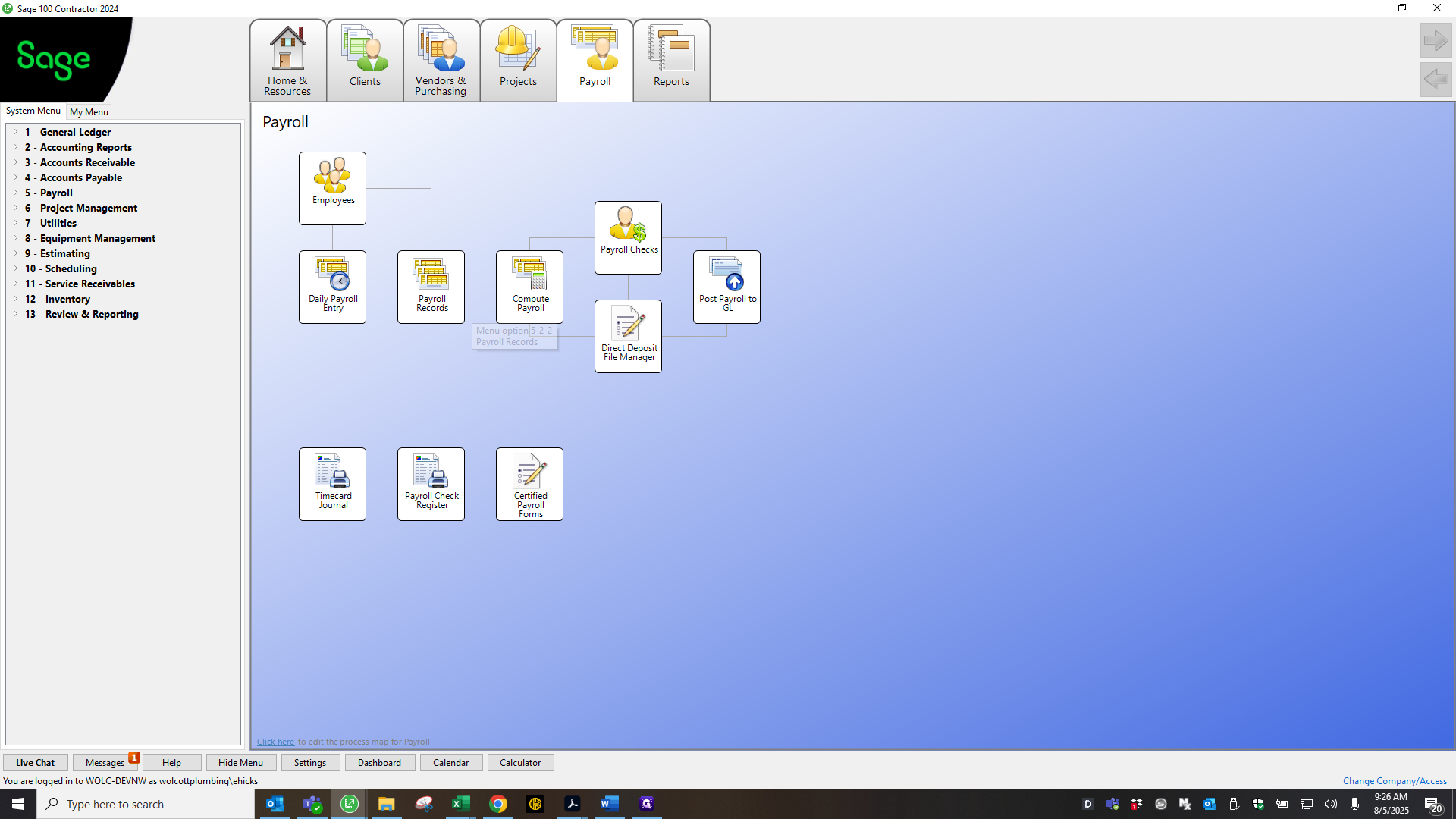

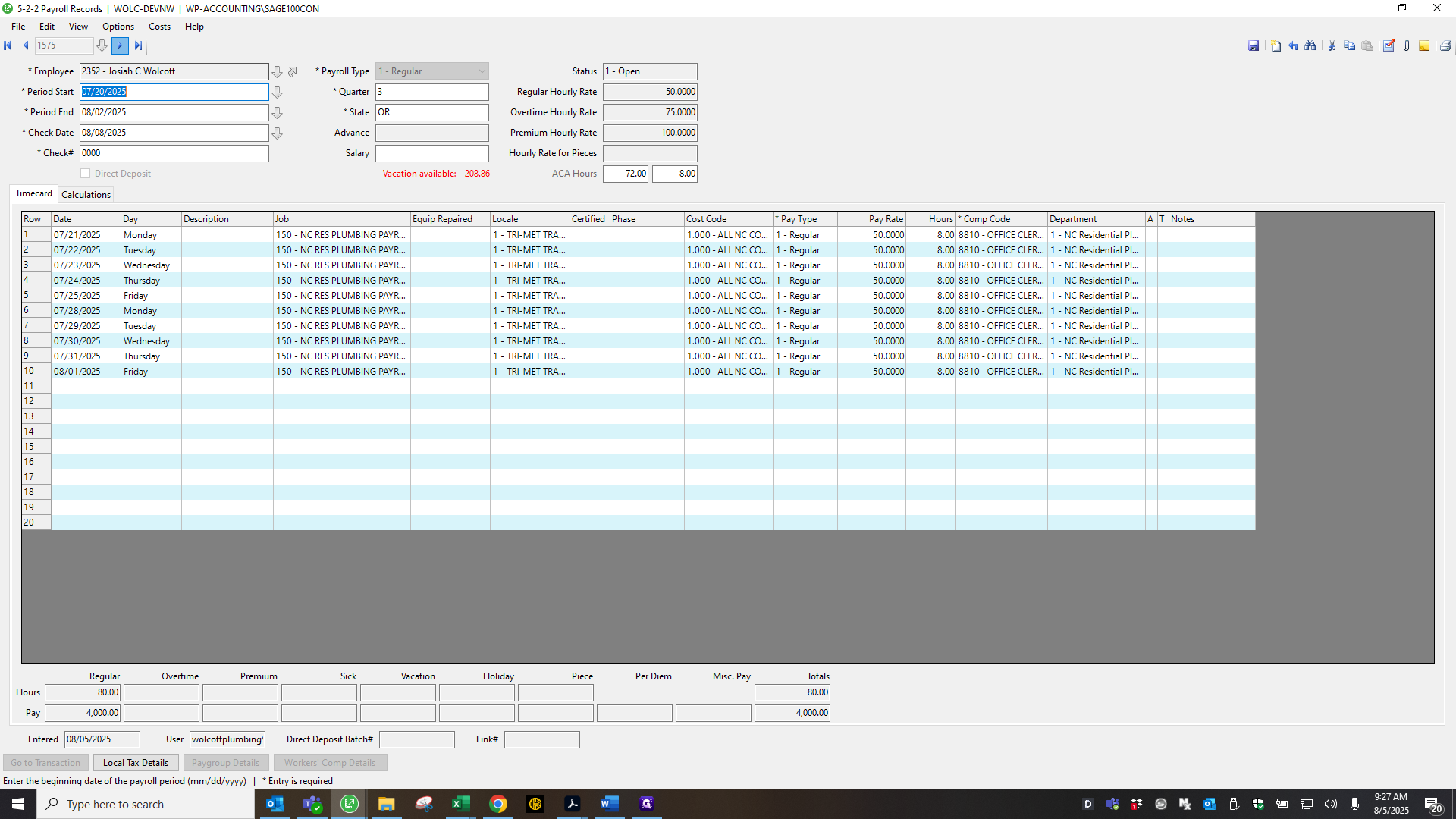

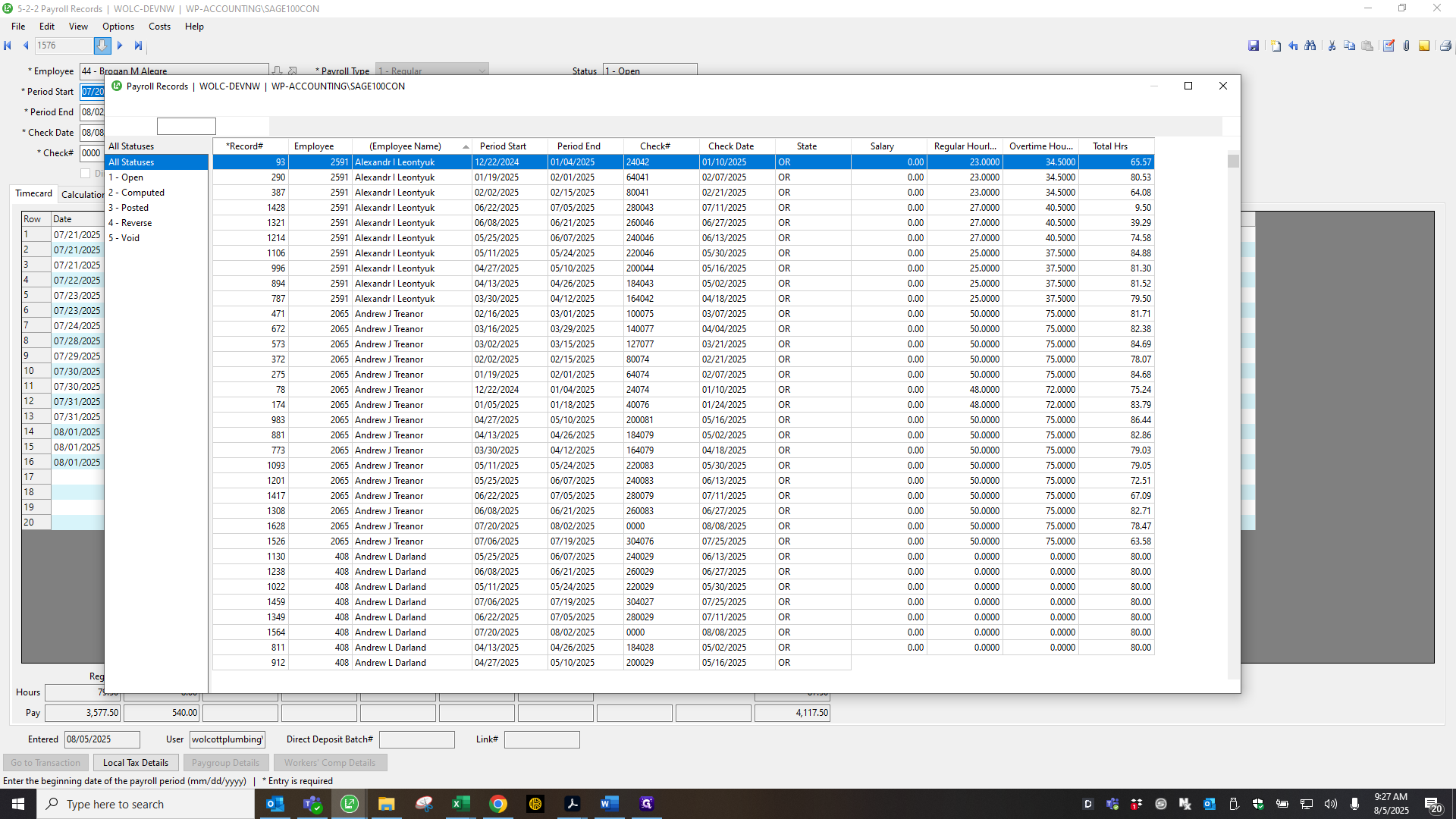

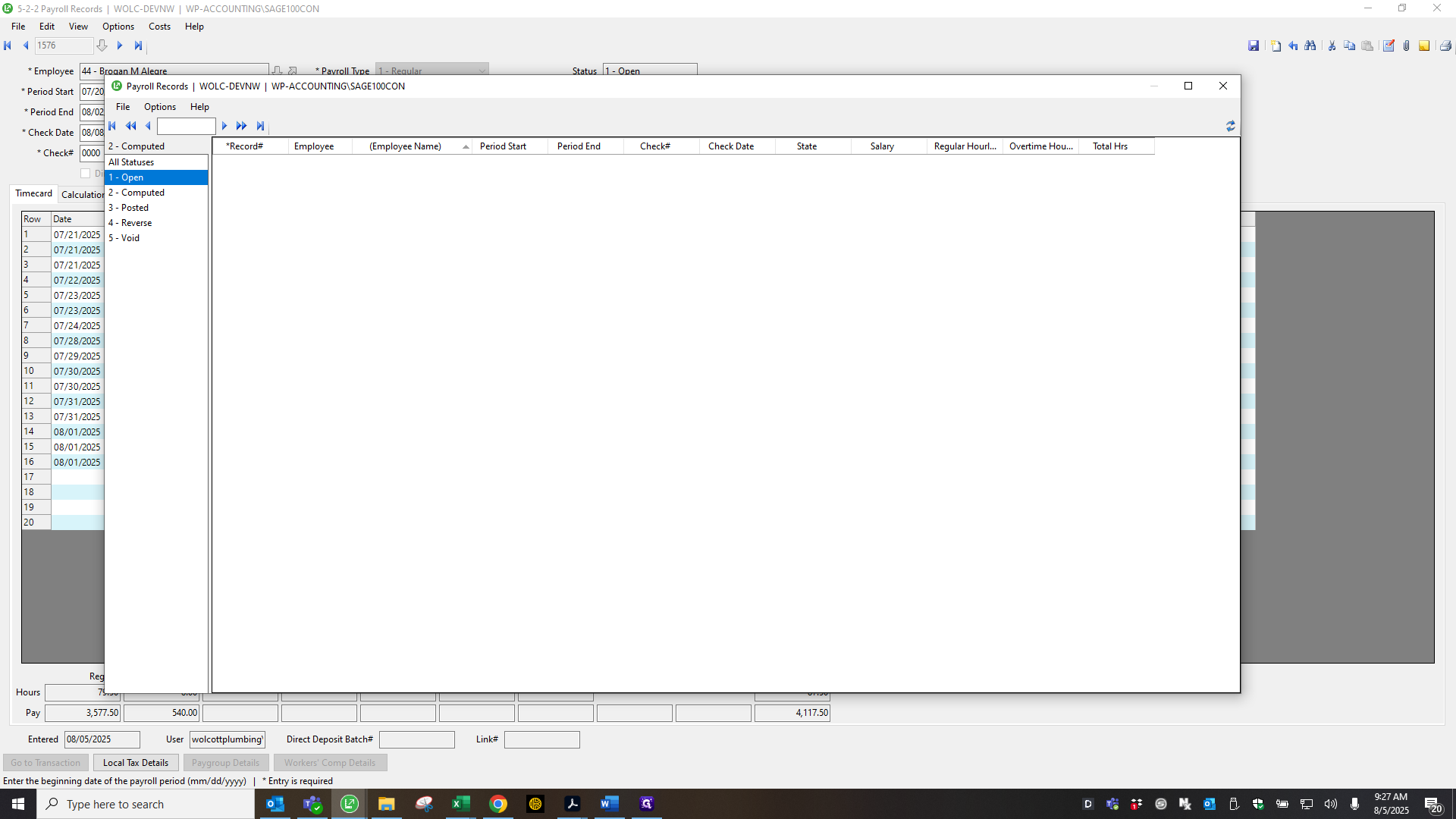

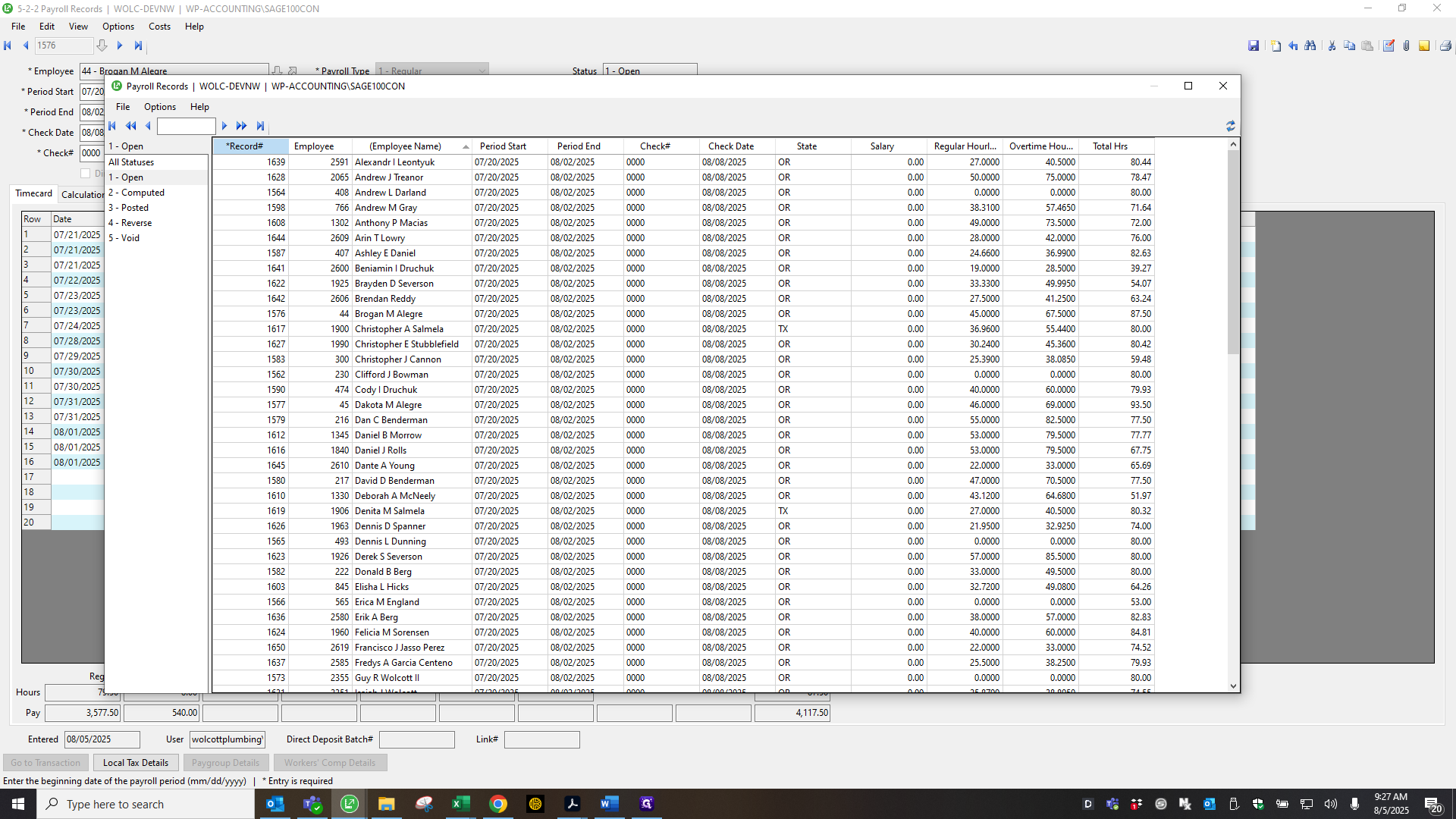

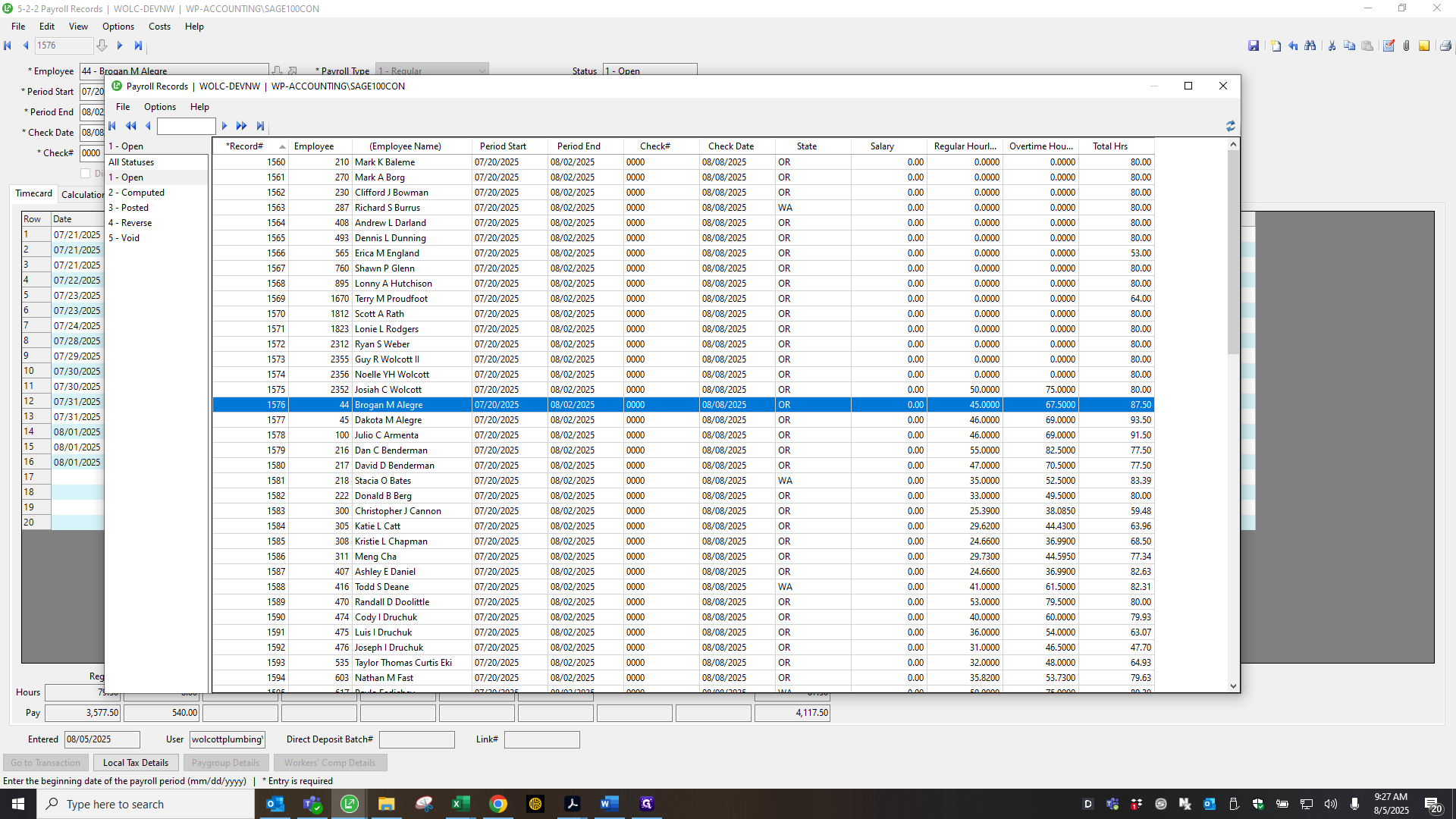

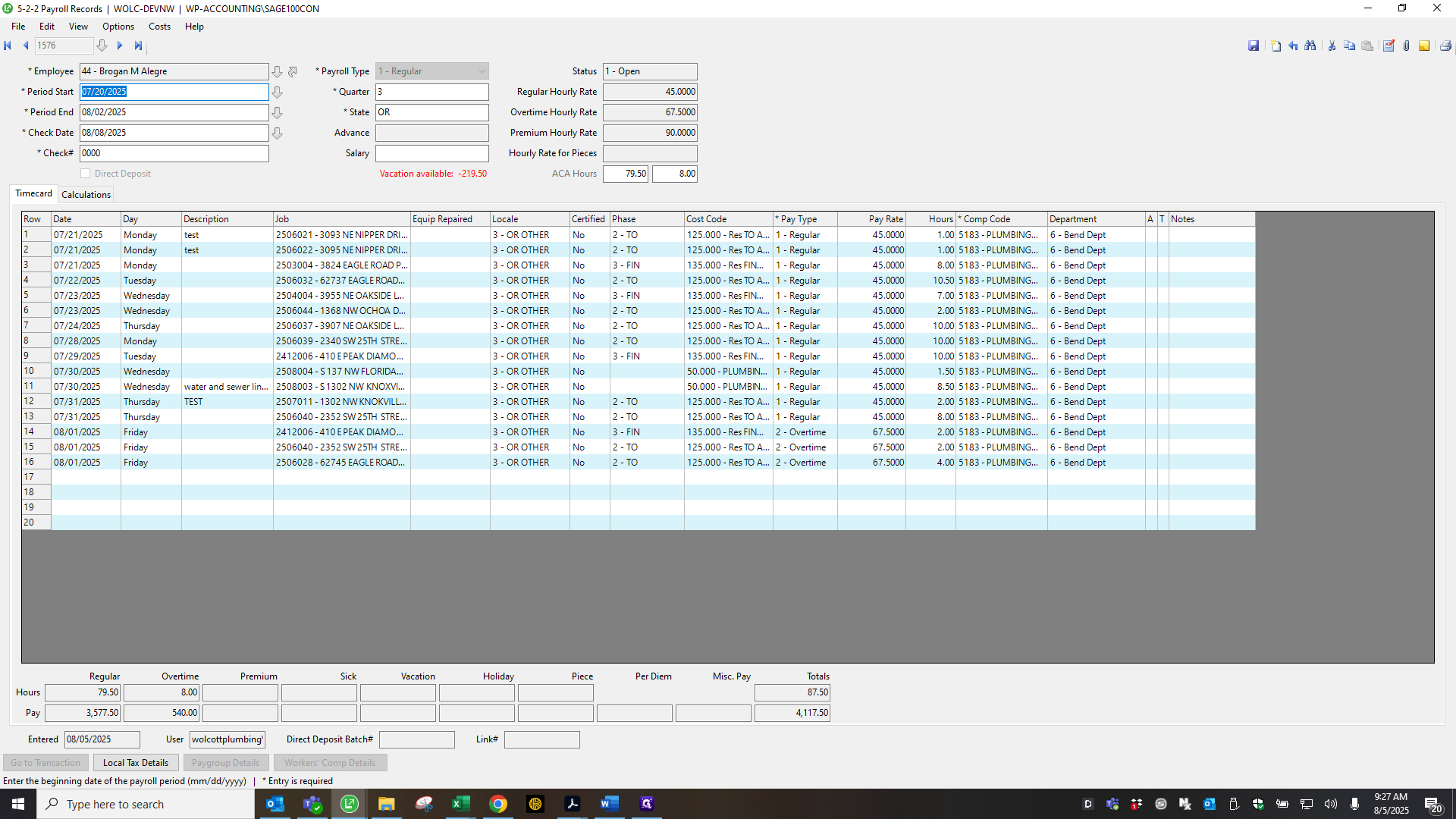

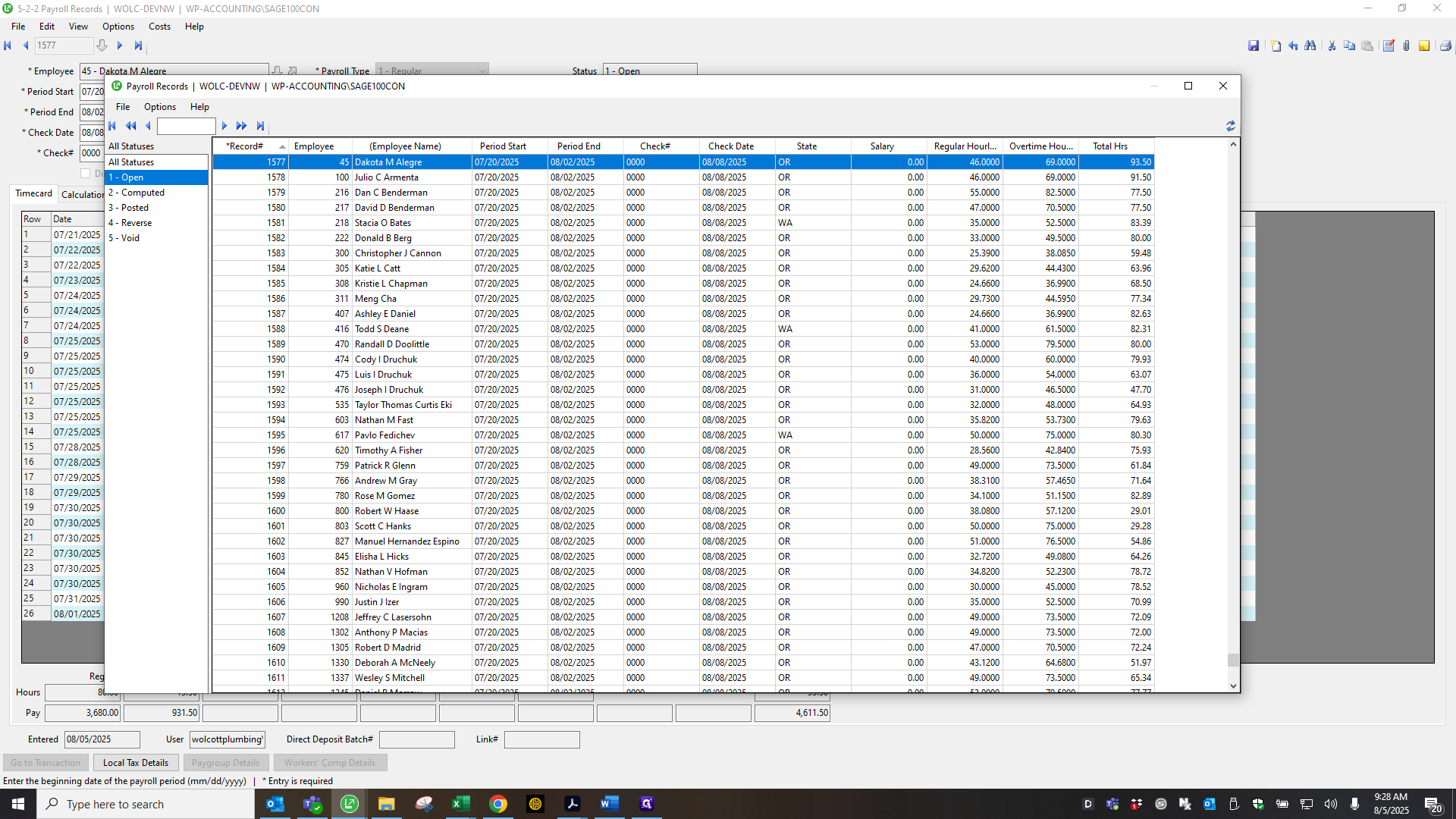

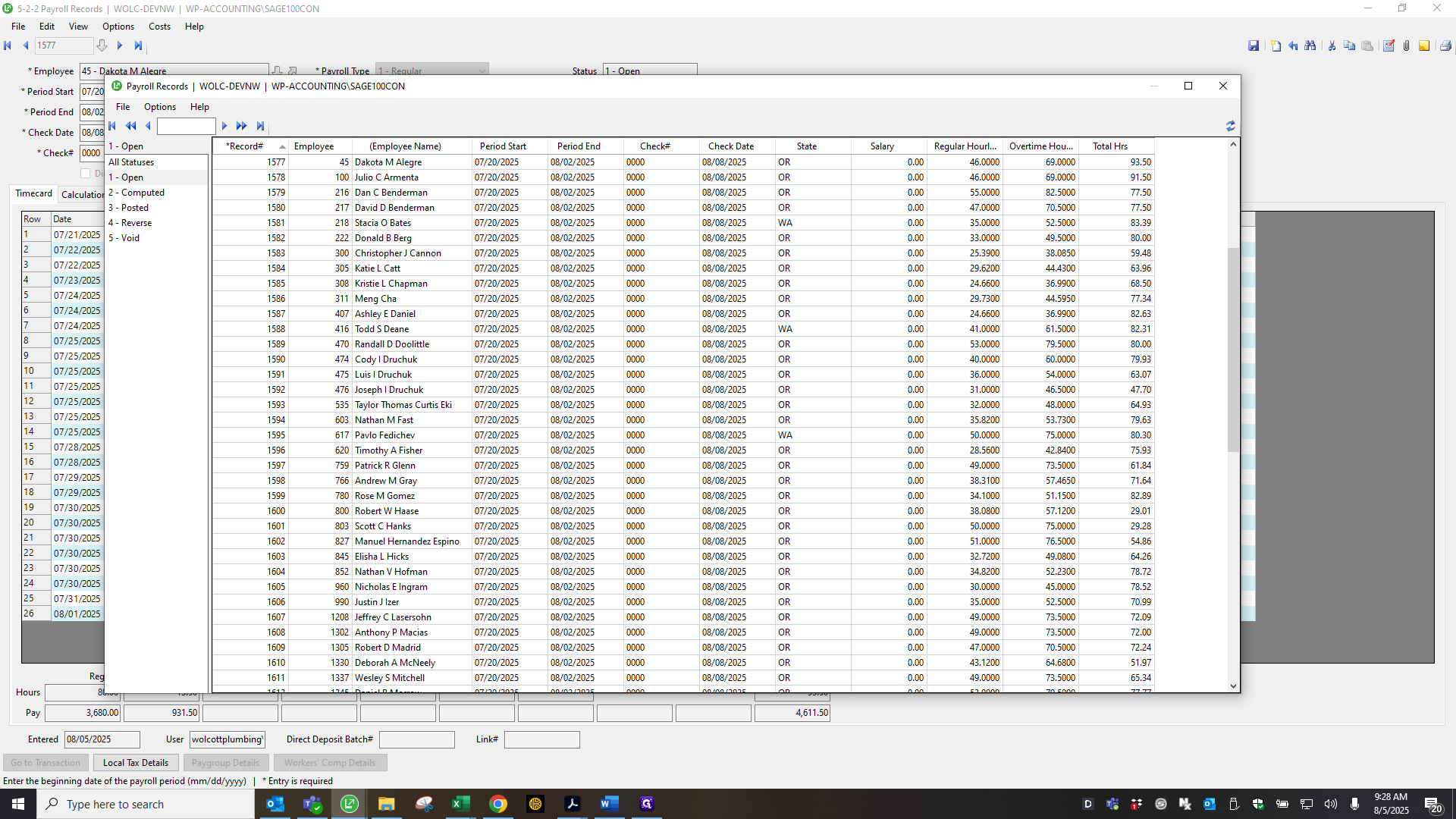

It takes a moment. Click OK, then close the daily entry. Next, return to the payroll records and click the arrow button. It will now start and display all the downloaded records from SSO. As you can see, all records are open.

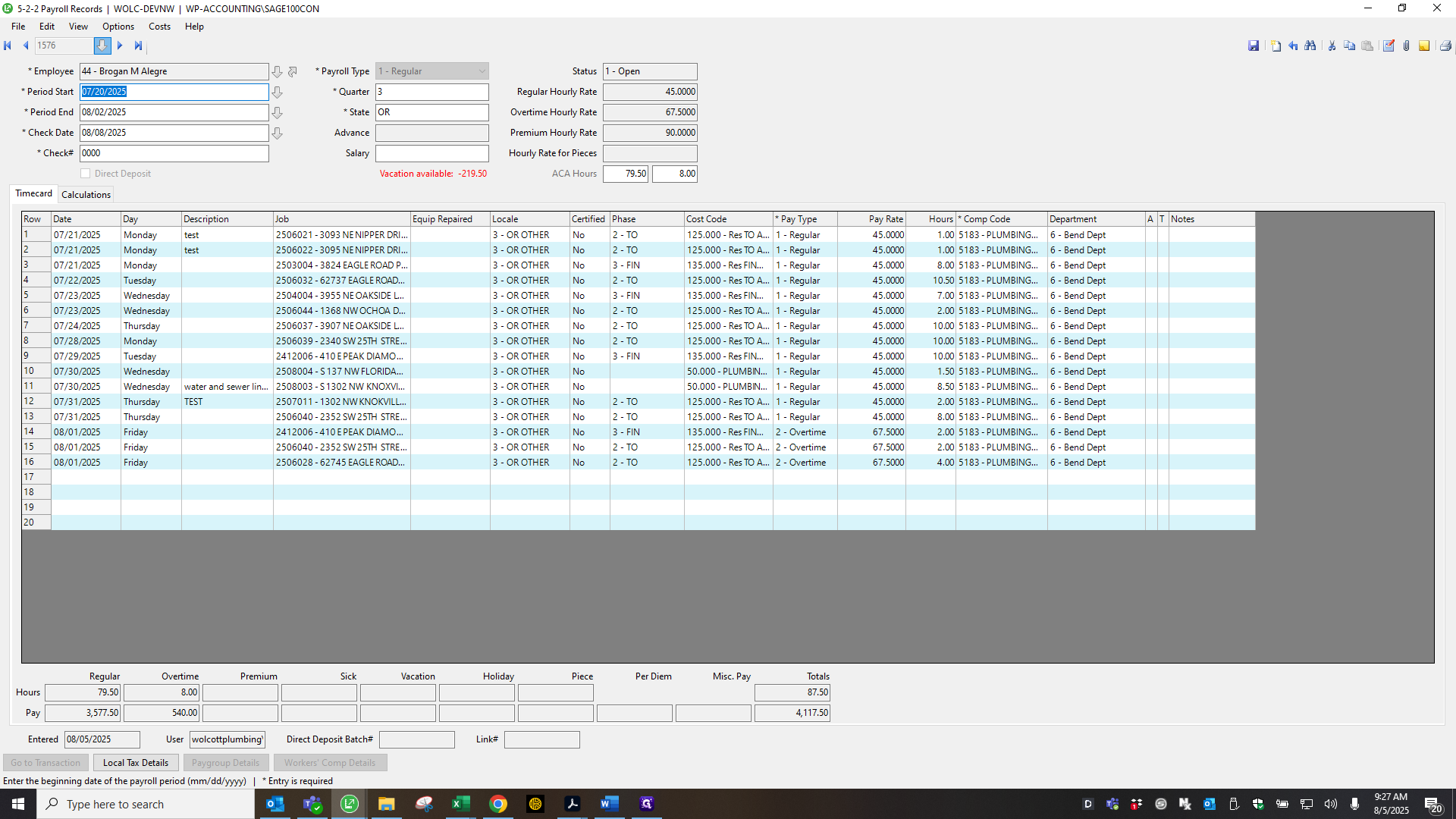

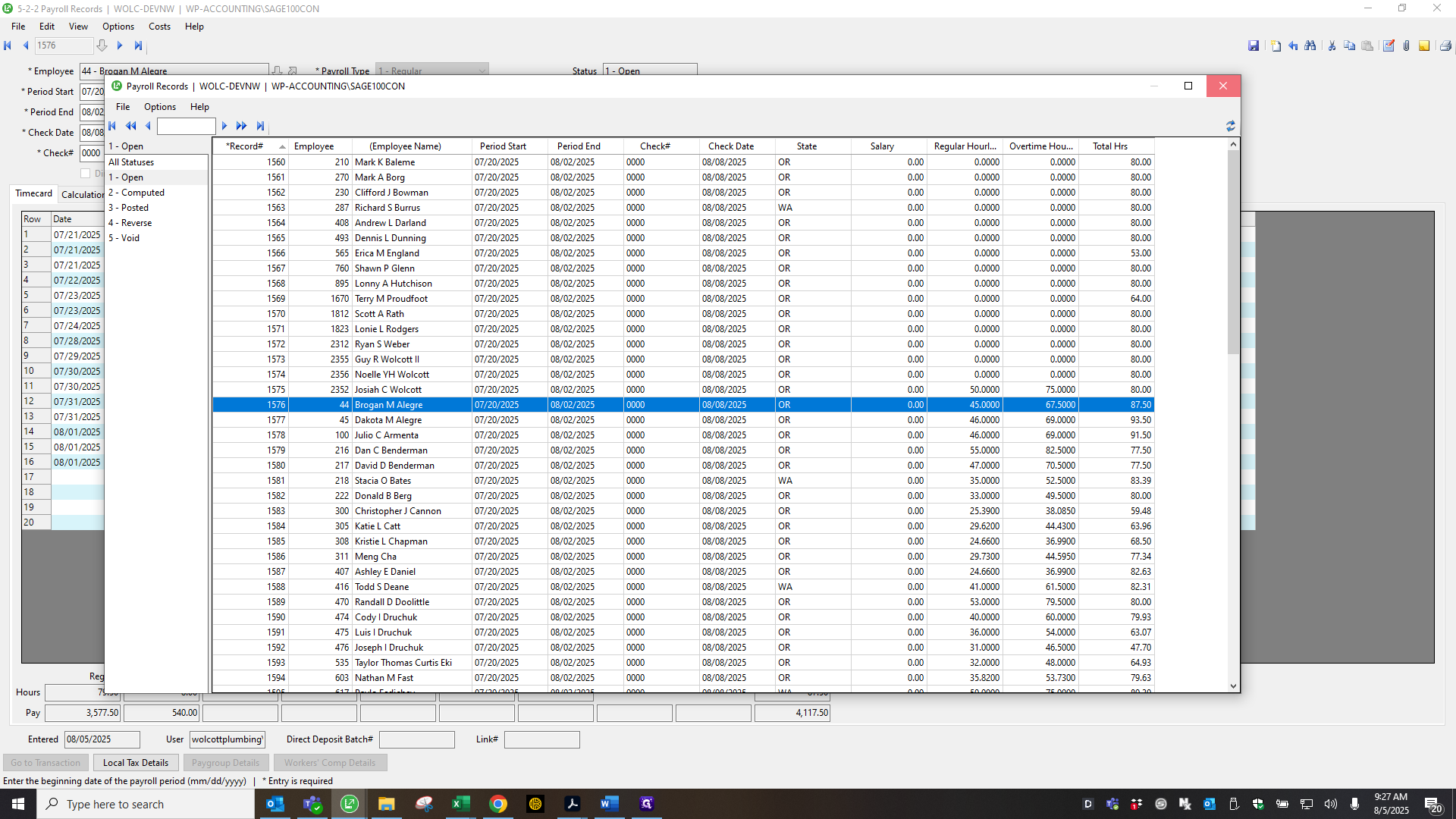

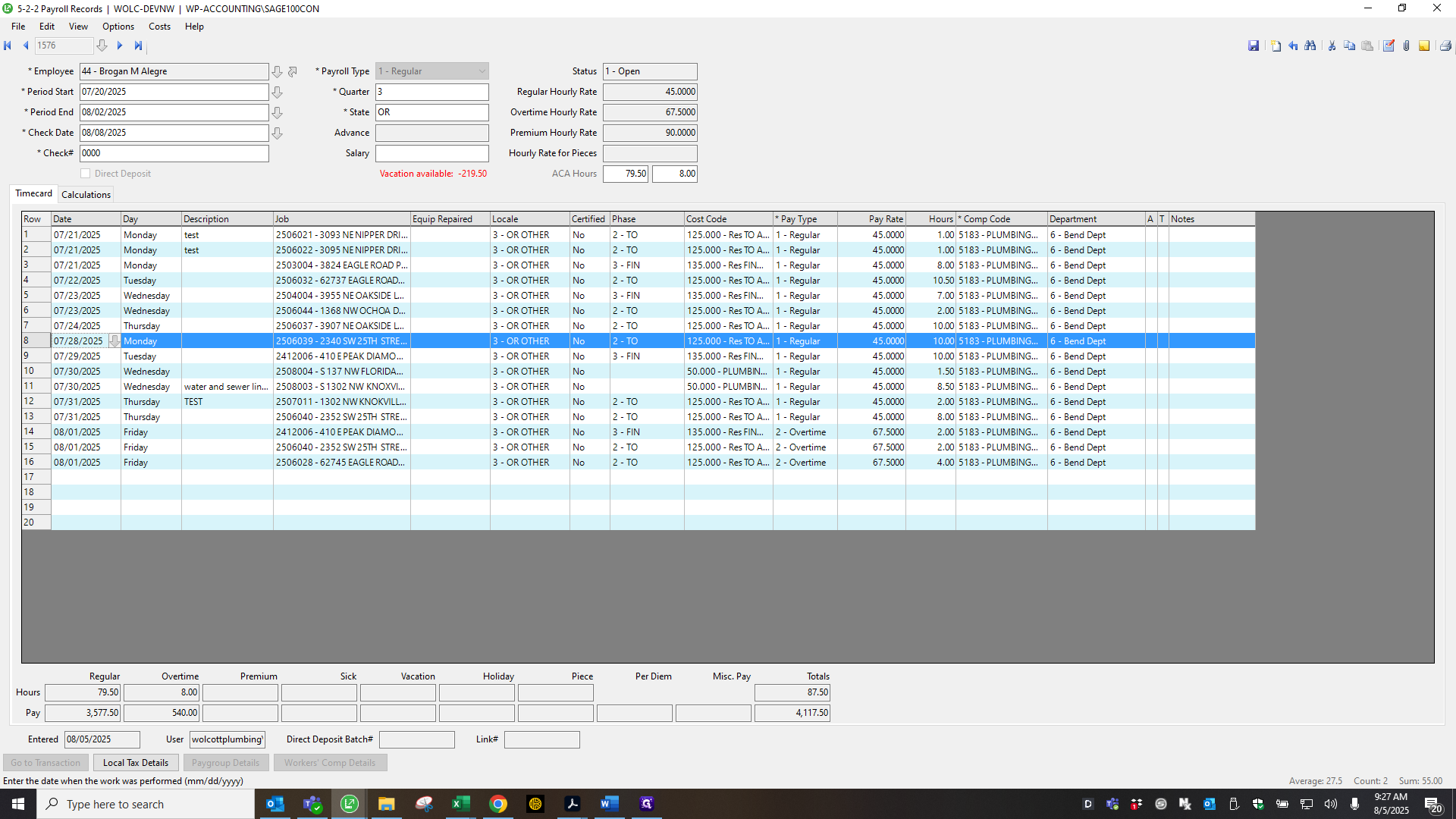

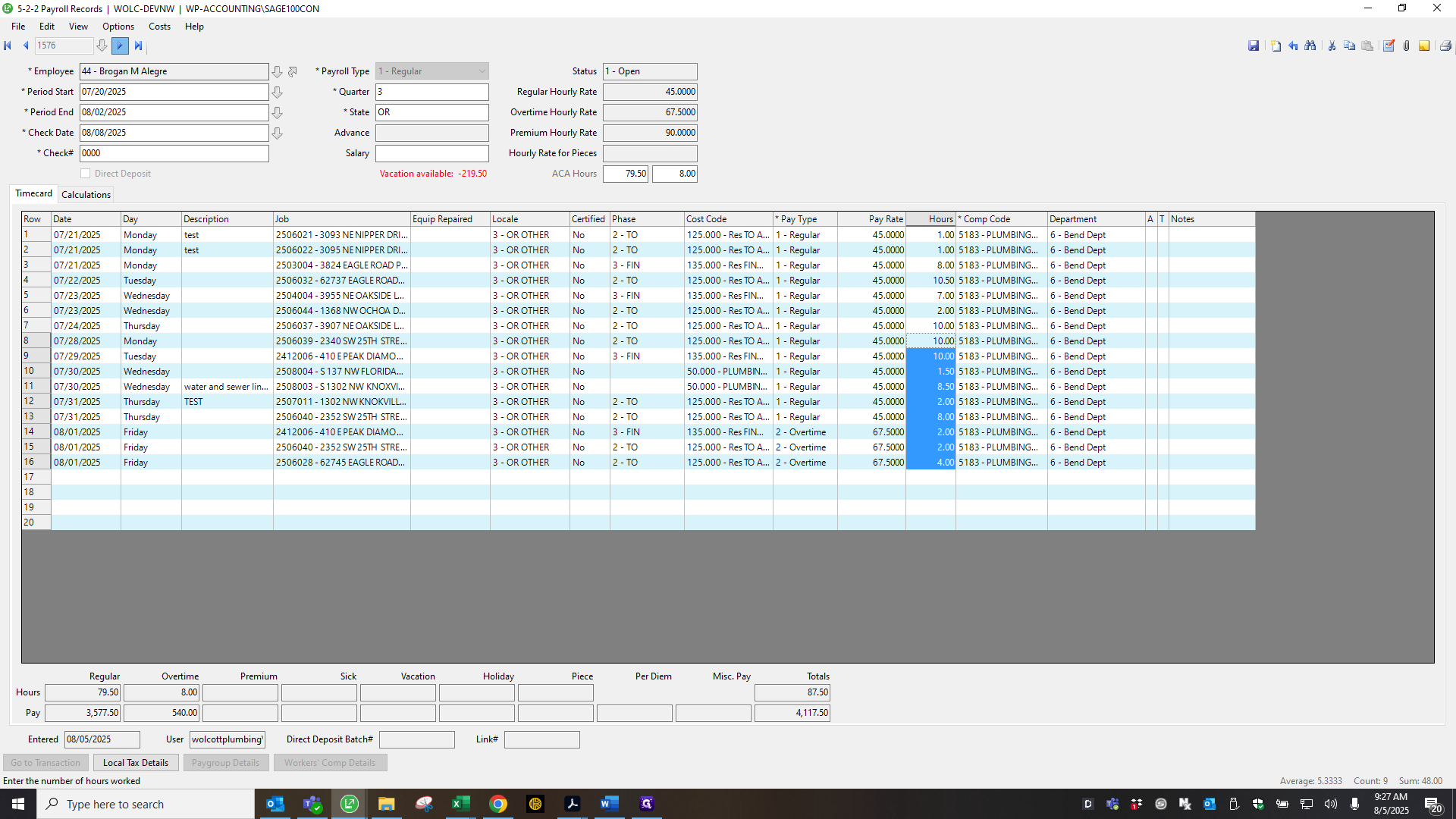

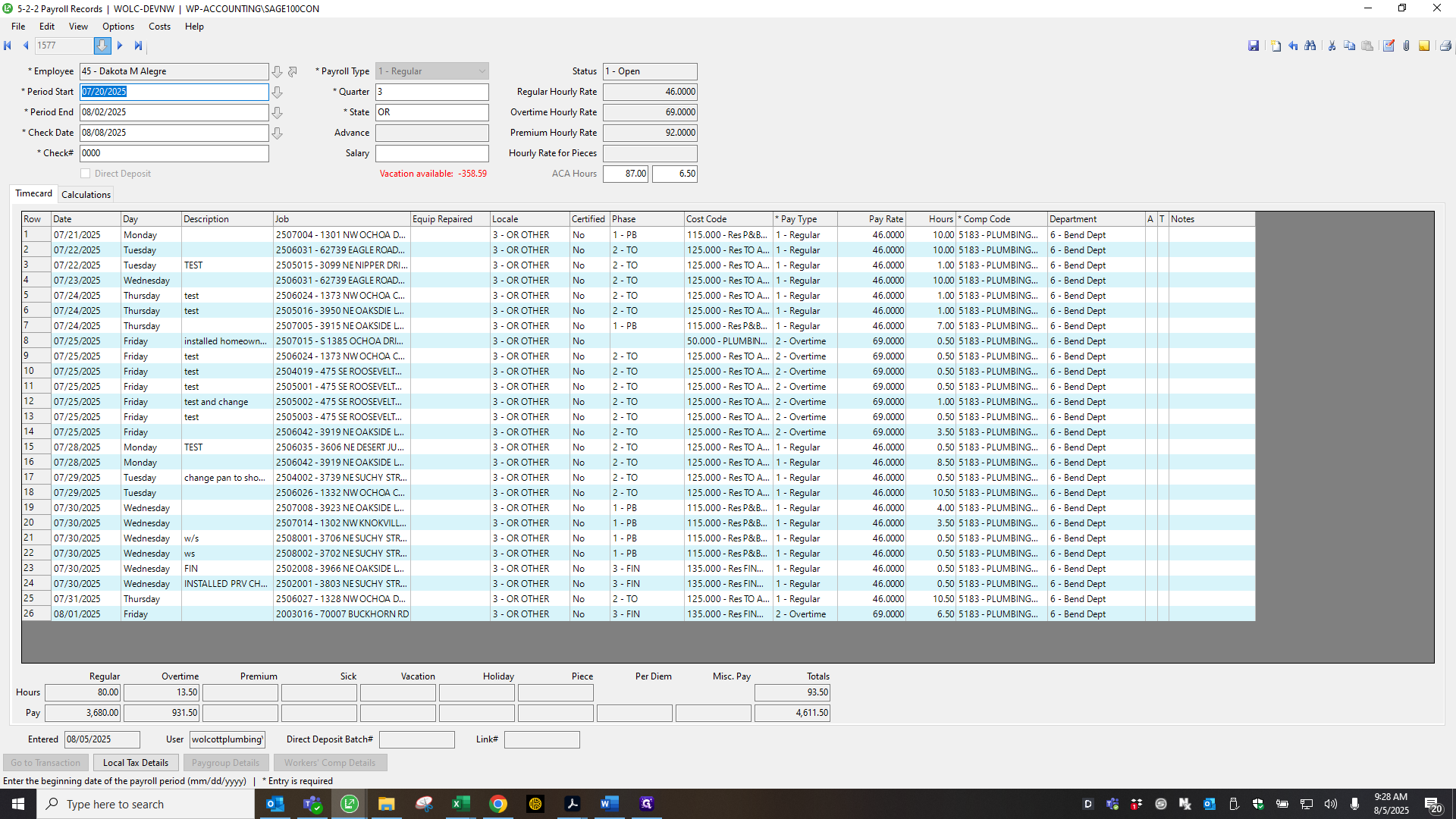

It includes everyone, starting with the salary, and then moves down through the field and office staff who use SSO. I then go through each record, triple-checking that the phases are correct. I also triple-check the overtime. Sometimes that's true... It can be tricky, and something may be off.

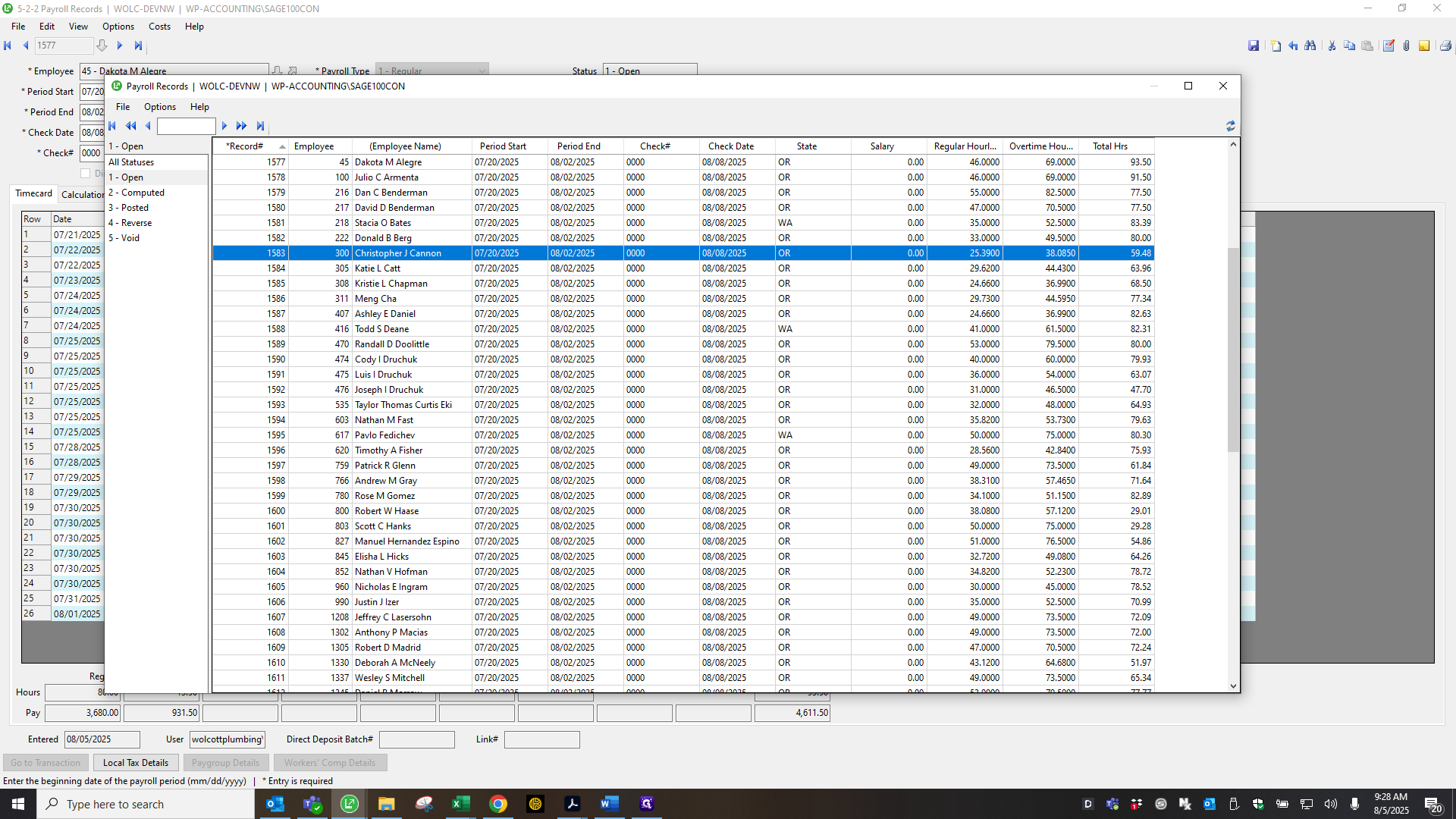

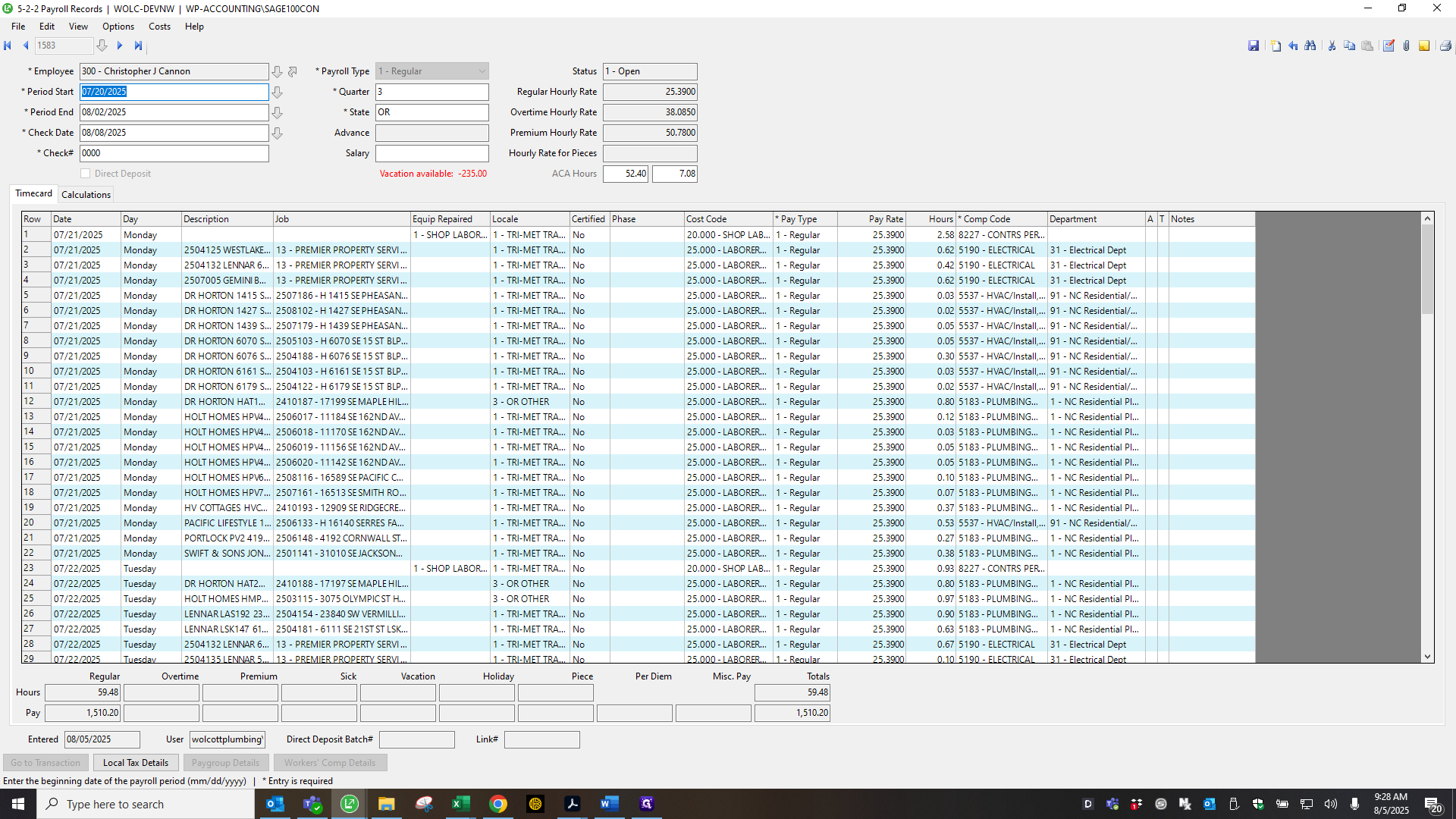

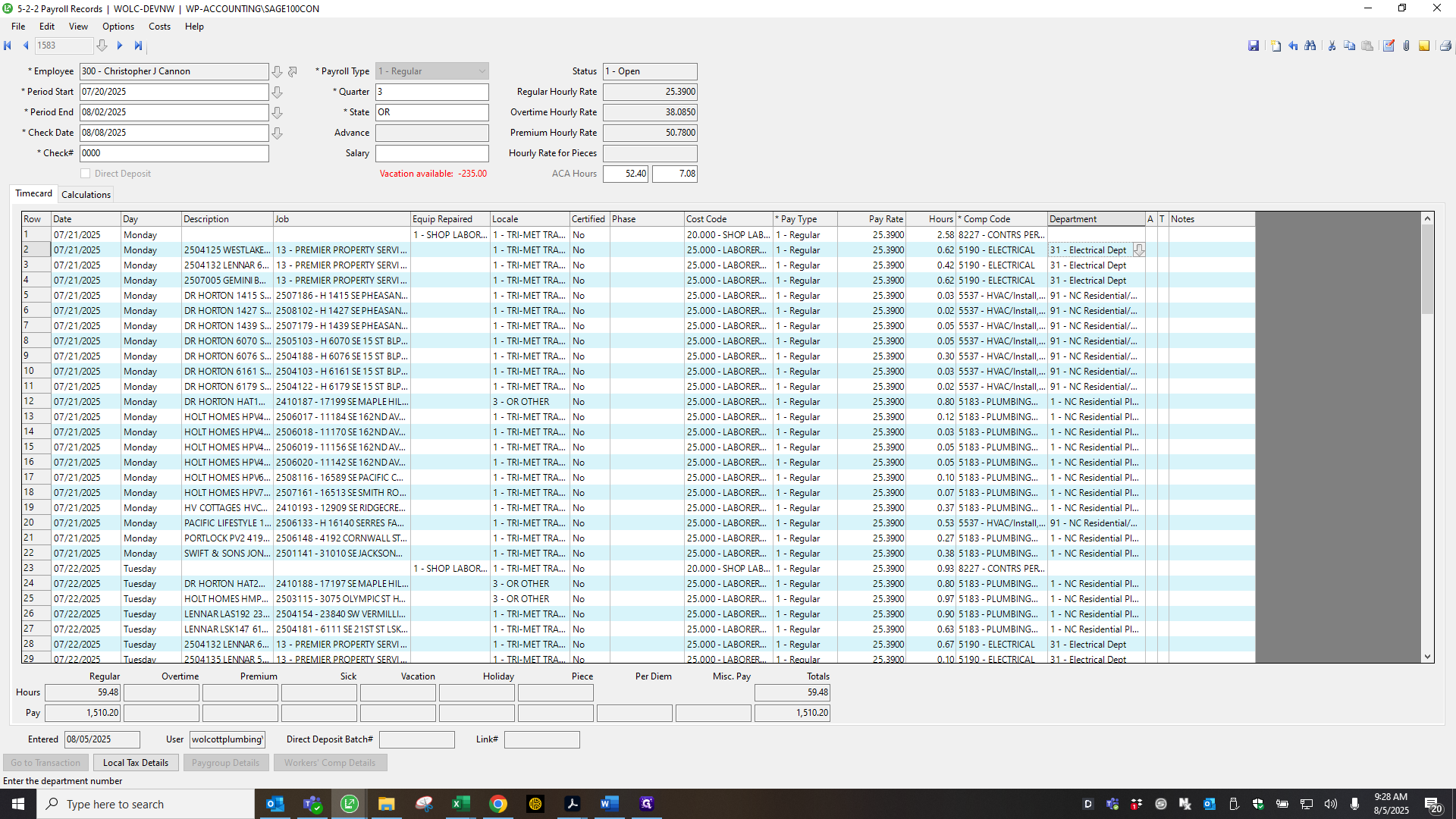

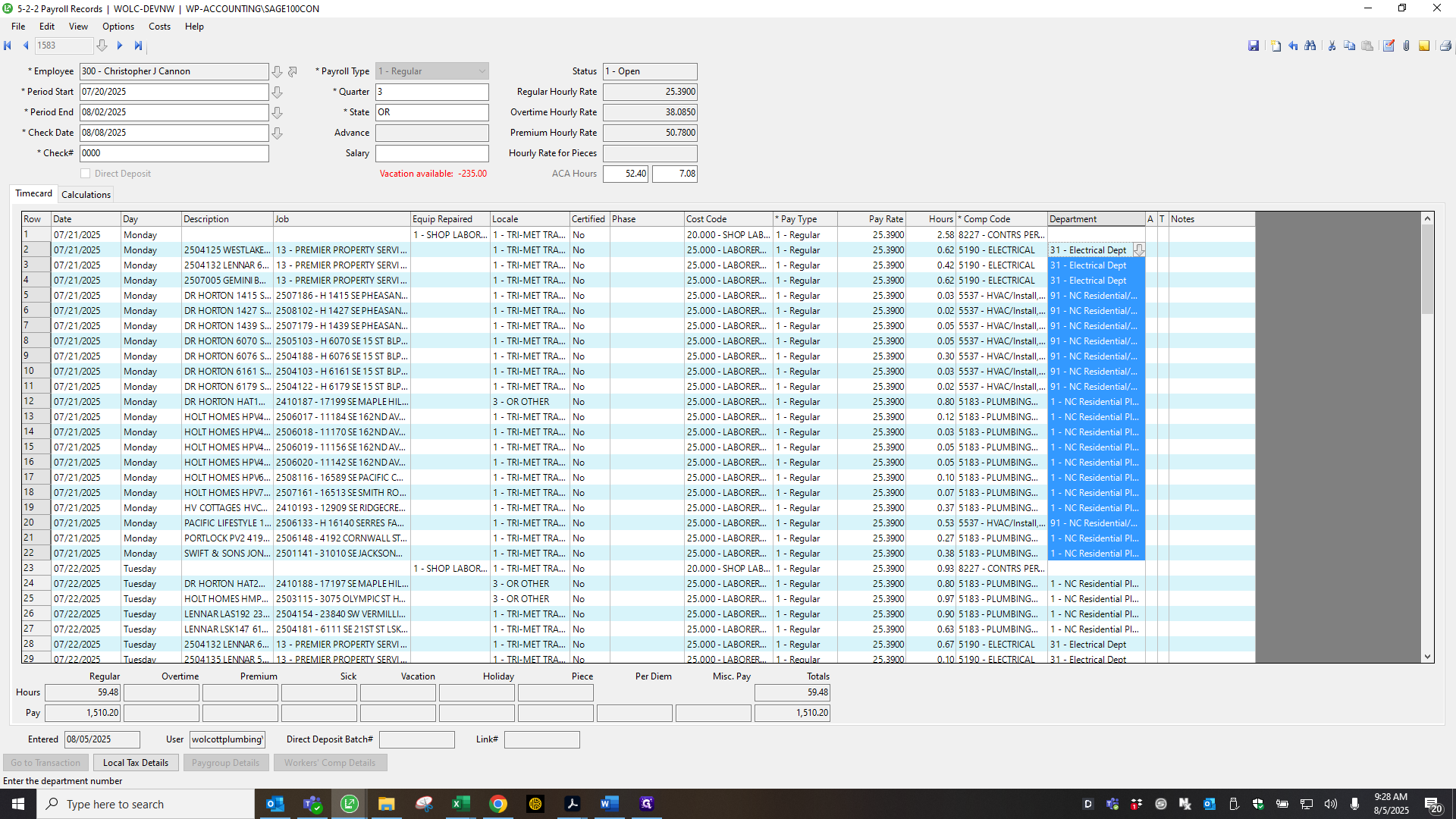

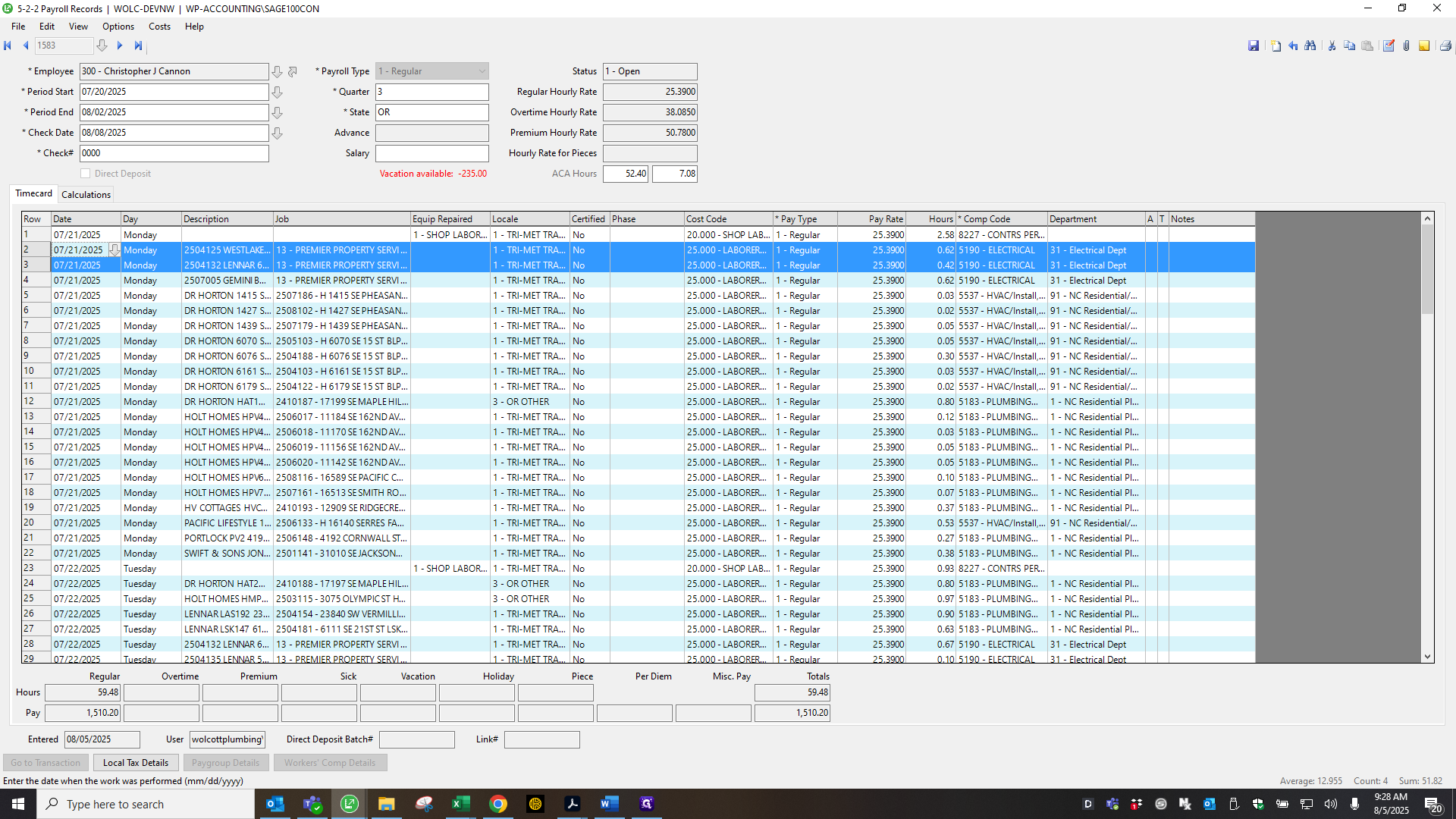

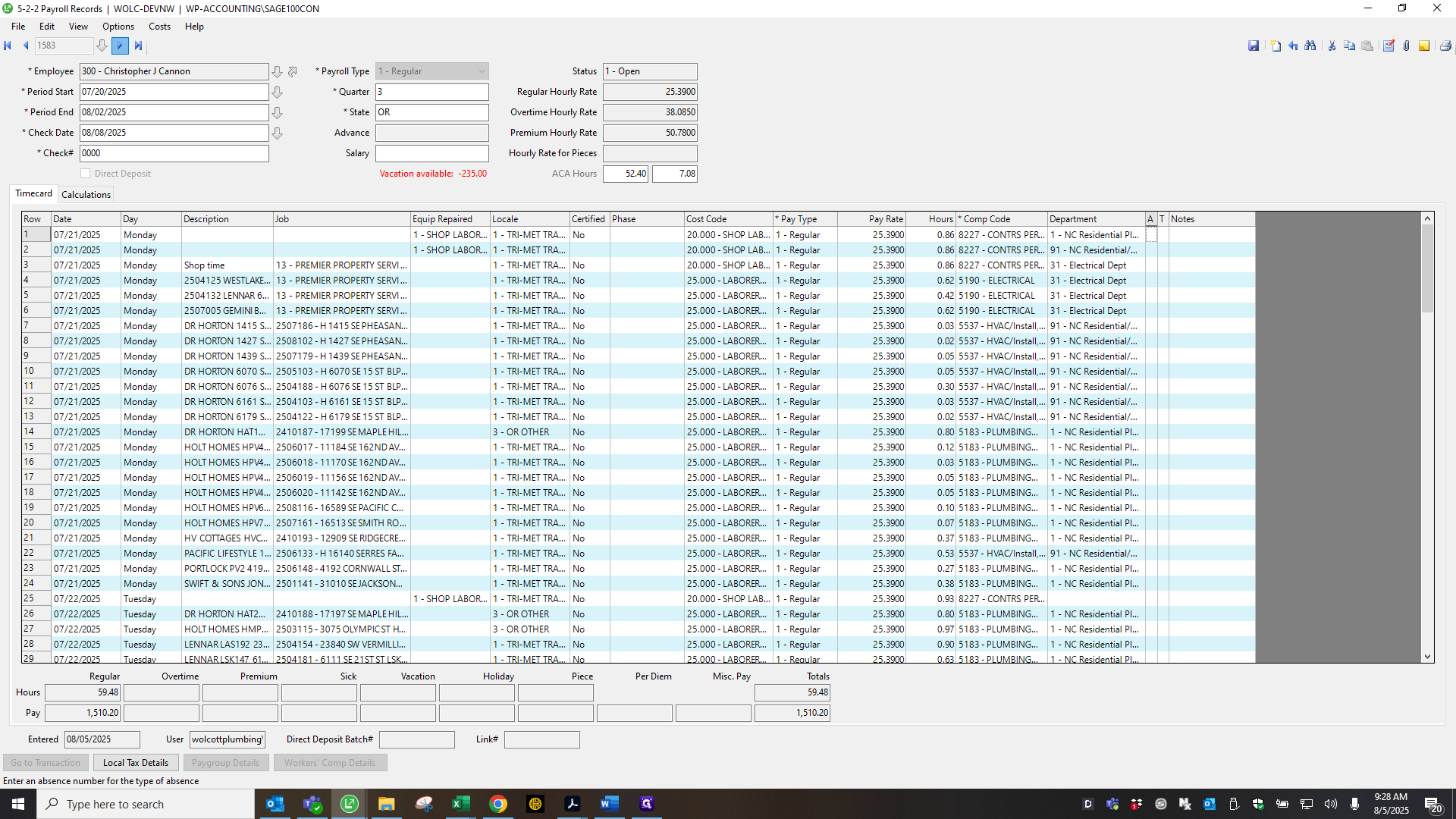

I always make sure the overtime is accurate and justified. Go to the next one. Same thing here. Here, you can see he has 80 regular hours and PTO, which is correct. I want to show you what happens if I go to a driver. Let's choose Chris Cannon.

We divide their shop time evenly among all the delivery departments they have worked in. To do that, simply follow these steps. 258 is divided among three departments. Update the comp code for department 91. Here, you'll do shop time, as this is for Premier.

Job number is 13. Six, 827, 31. Then I come back up here and subtract those two. That then goes to Department One. I do this for each driver and for every day on their payroll.

It takes time.