How to Execute Trades in SECT: A Step-by-Step Guide

Learn how to execute trades in SECT using WallachBeth or Interactive Brokers. This guide covers everything from closing positions to rolling options and viewing trade confirmations.

In this guide, we'll learn how to execute trades using Interactive Brokers' Trader Workstation. This process involves signing in with the thematic account, selecting positions to close or roll, and setting the appropriate limit prices and algorithms. We'll also cover how to review and confirm trades through Interactive Brokers Online. This guide aims to help you efficiently manage your trades and ensure accurate reporting.

Let's get started

For options in the SECT, we have two choices. First, you can call or email WallachBeth to send them the trades, and they will execute them for us. The second option is to execute the trades ourselves through Interactive Brokers using the trader workstation.

You want to sign in using the thematic account. Ensure everything in the username is lowercase.

username: thematic415

password: Mainmgt1

To close a position, simply find the position you are trading.

It will populate in the top left here. You can see that we're buying and the quantity. All you have to do is select the limit price you want to use. I prefer to use this interactive adaptive algorithm.

Additionally, ensure the adaptive algorithm is set to urgent.

This ensures we execute trades quickly, especially in less liquid markets.

Alternatively, if you want to roll a position, select it and choose "roll."

It will populate this version of the option chain. As with the regular option chain, you can change the expiration dates and the strike prices you want to see on the screen.

In this instance, let's say we're looking for the December regular 235 strikes.

That will add it to the chain. Remember, we are trading calls, so you'll come to the left and select the position we are rolling to.

You will see the final position in the "Roll Builder" at the bottom of the page. The top row will be the position we're buying to close. The second will be the position we are rolling to

If you chose the wrong expiration or strike price you can remove the position in the "Roll Builder"

From there you are free to select the correct position

IBKR prices their rolls as (-) for a credit and (+) for a debit

You can chose a limit price by selecting from the "BID MID ASK" region

Or you can choose your own limit price

If you're looking at a credit, it will be quoted as a negative price.If you're looking at a debit roll (we are paying), it will always be quoted with a positive price.

You can hit submit.

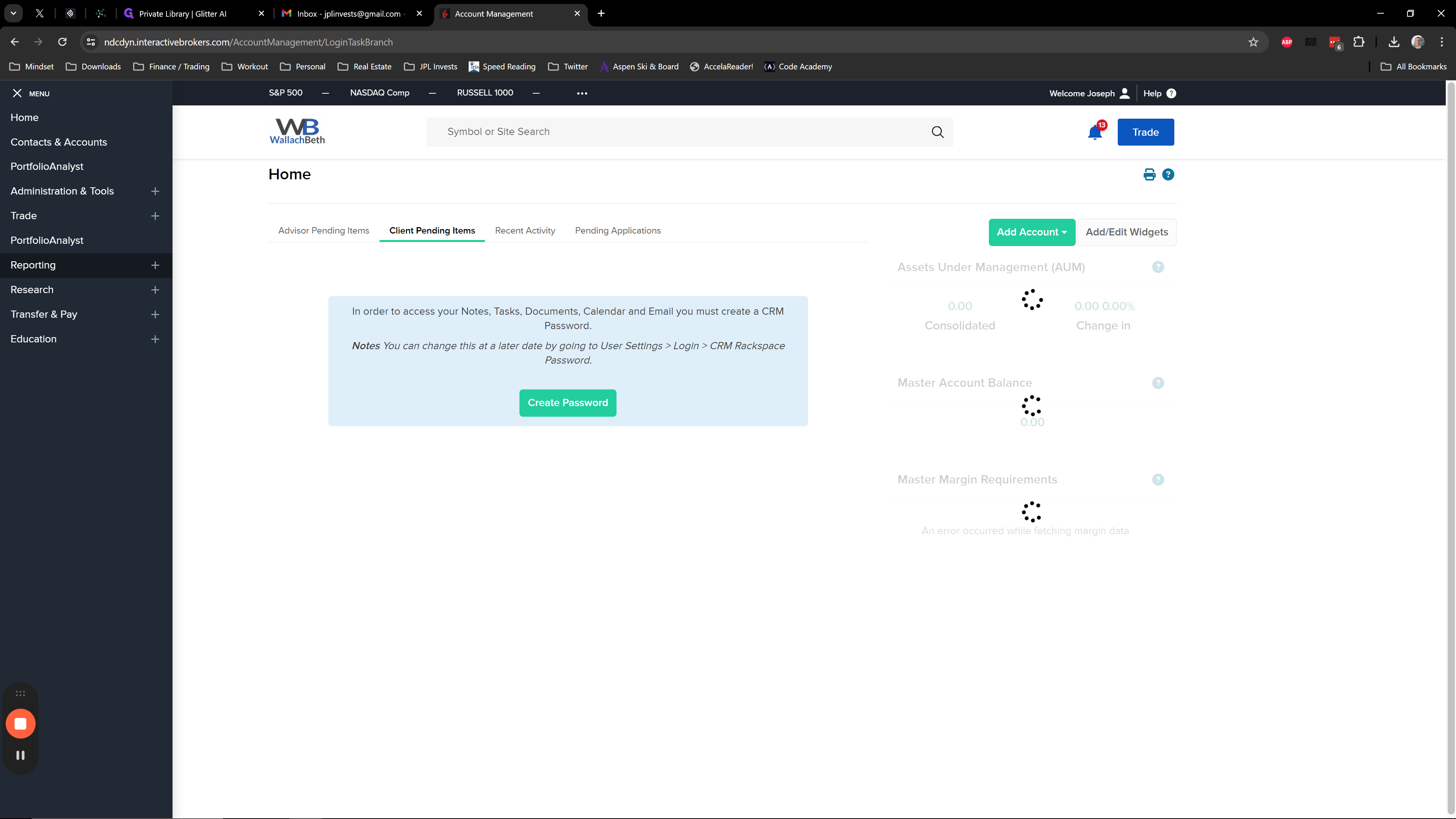

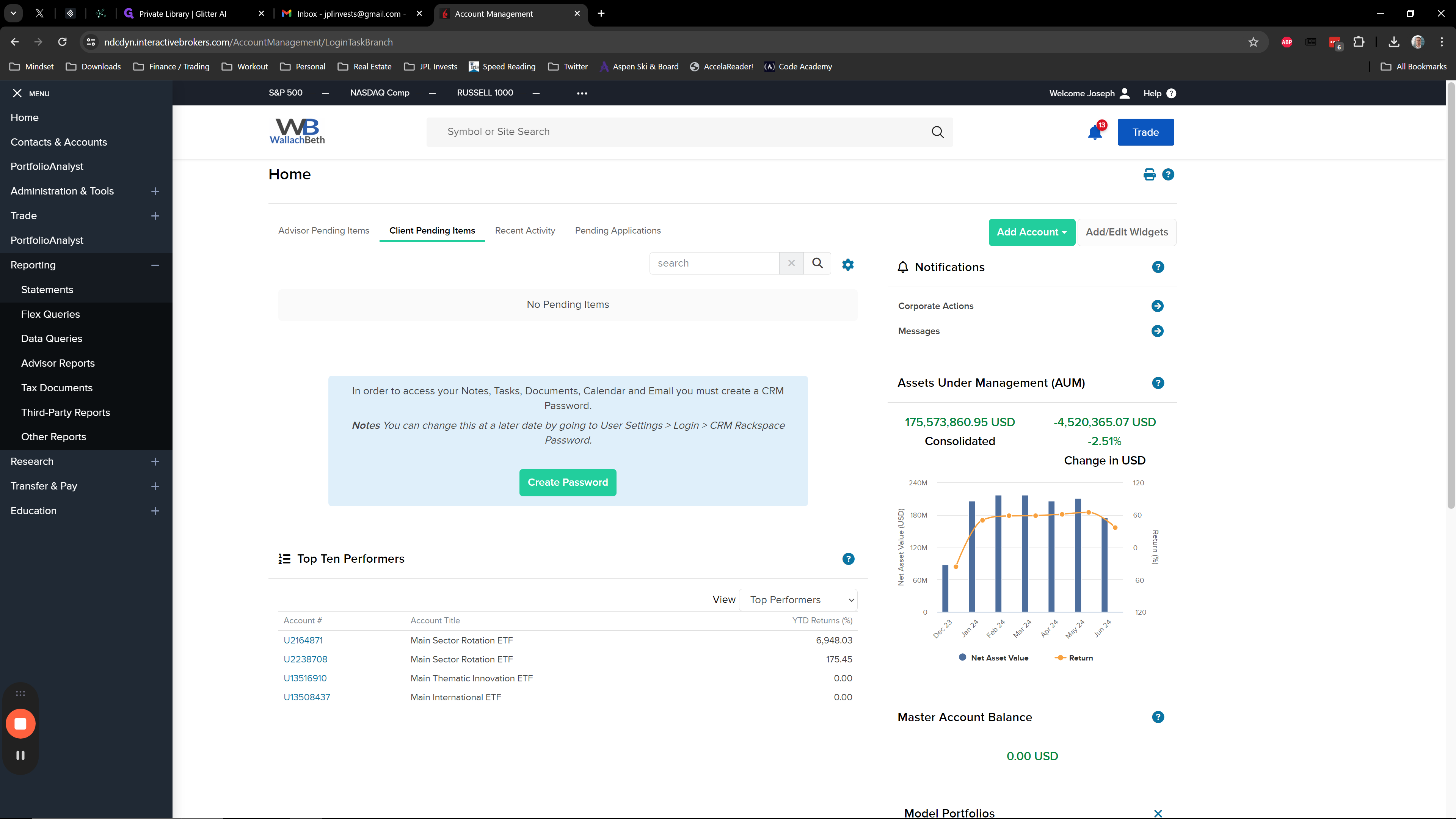

Once the options are executed, you'll see them in the order status. From there, go to Interactive Brokers website ibkr.com.

Log in using the same username and password.

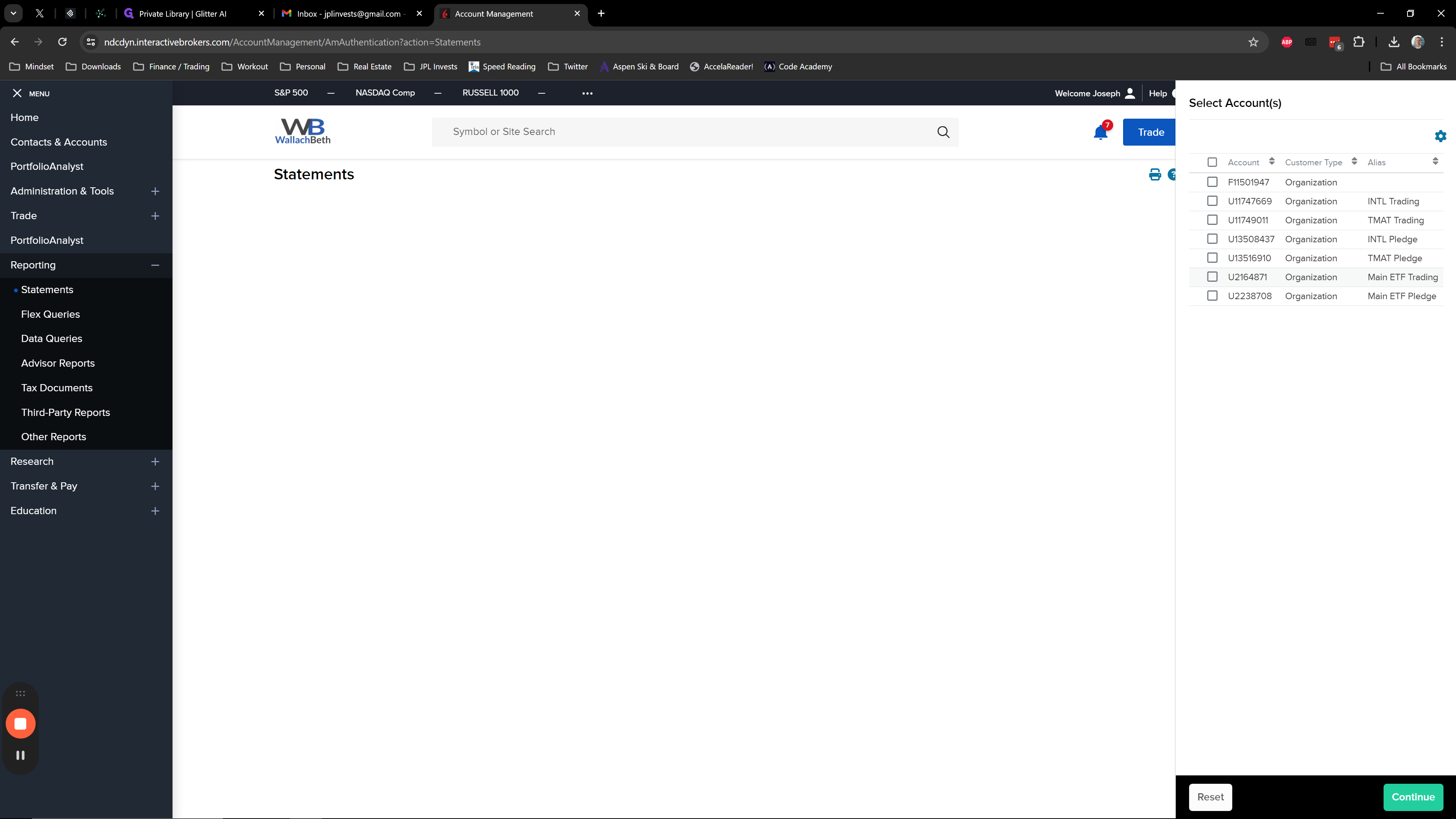

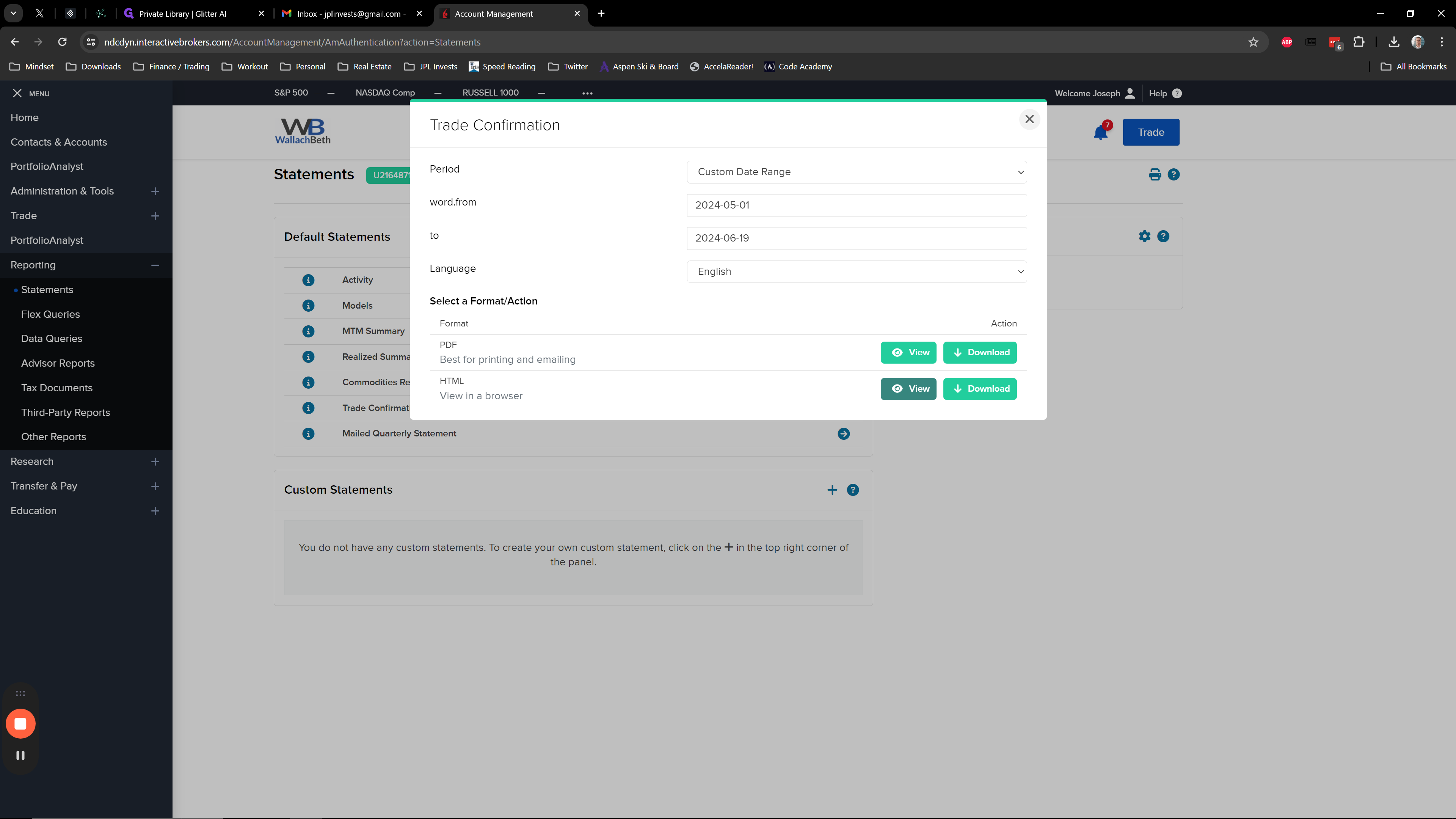

Go to Reporting and select Statements.

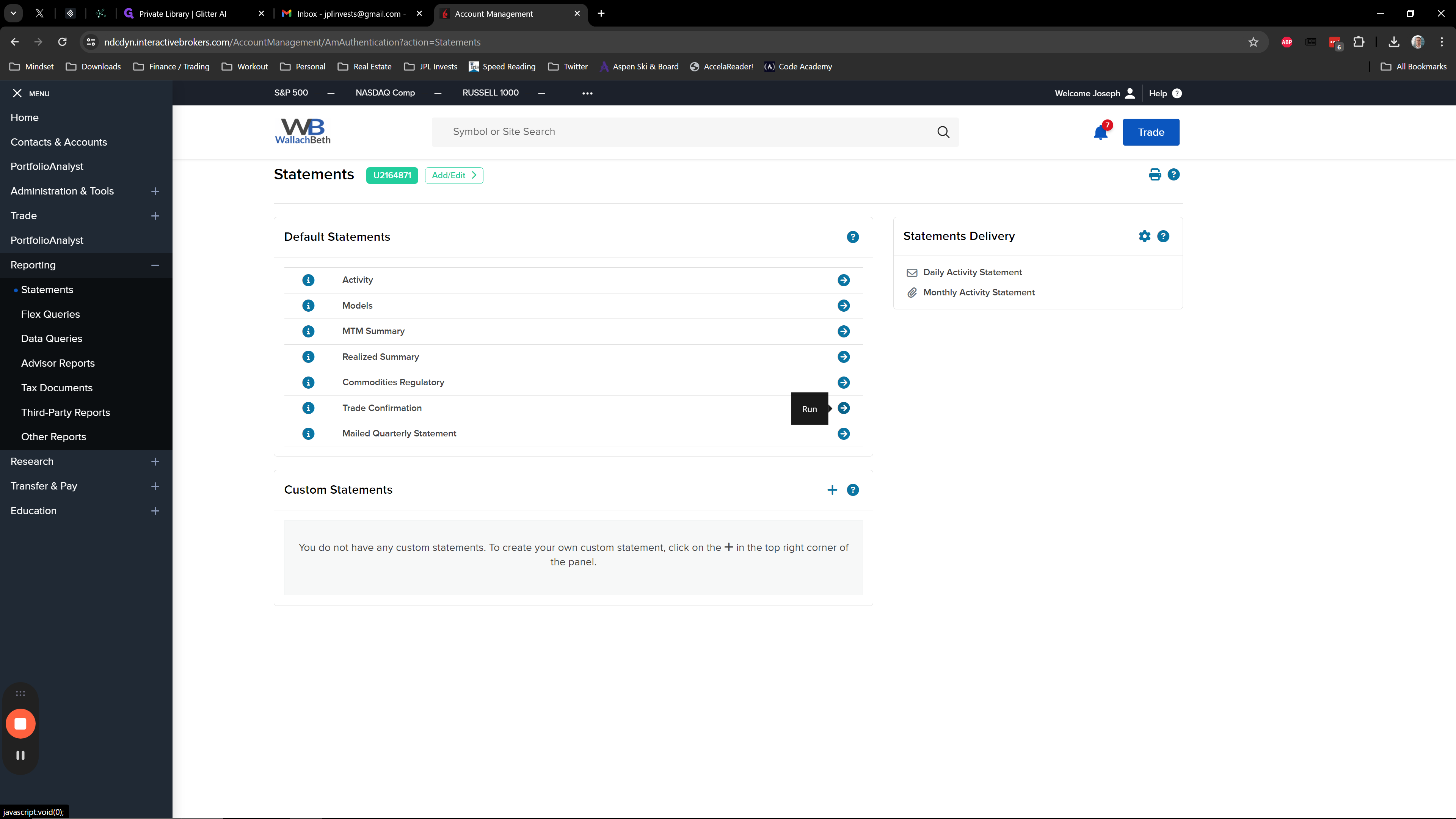

Select the account. Currently, we are only using the SECT trading account, which ends in 871 and is labelled ETF trading.

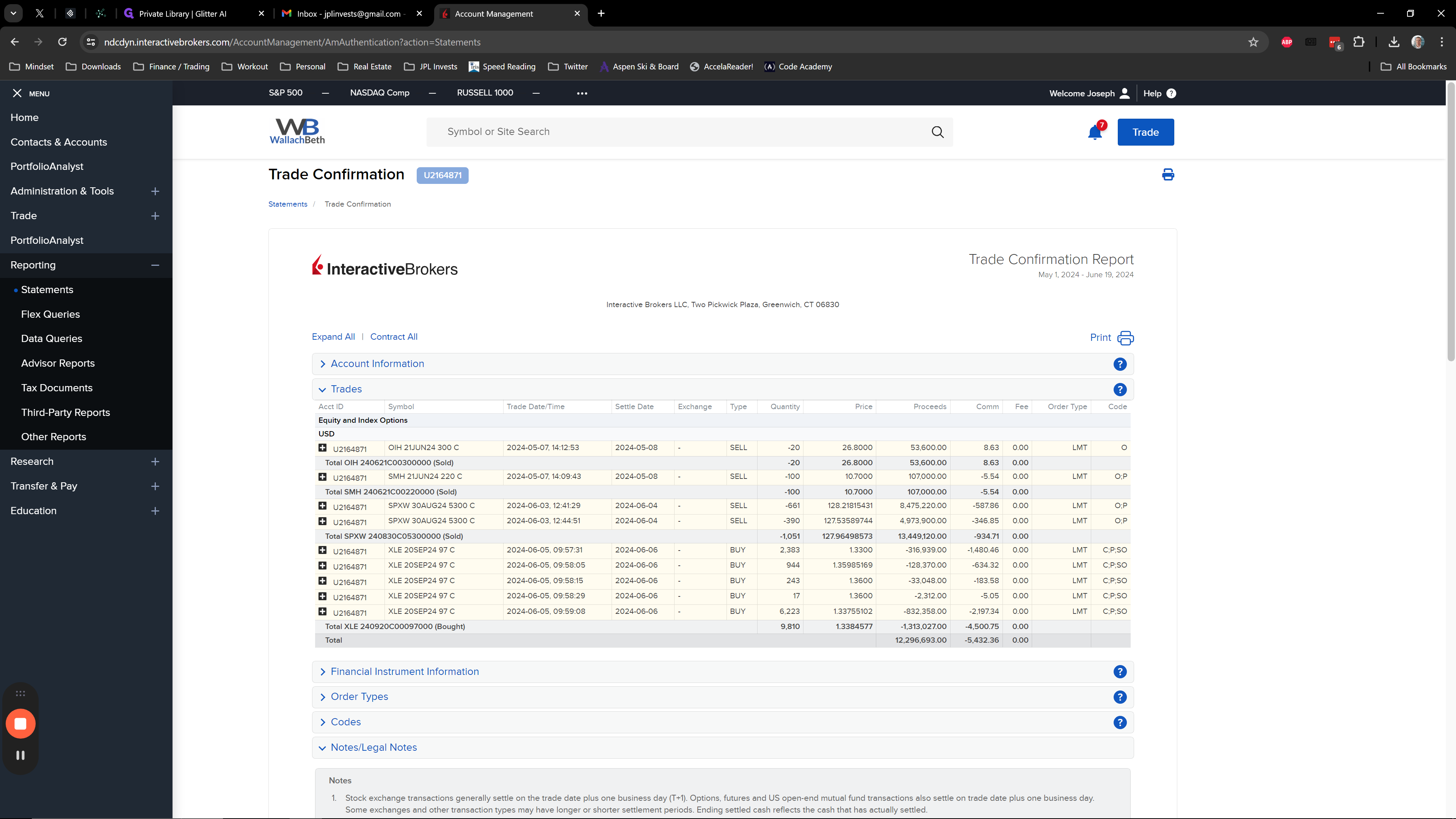

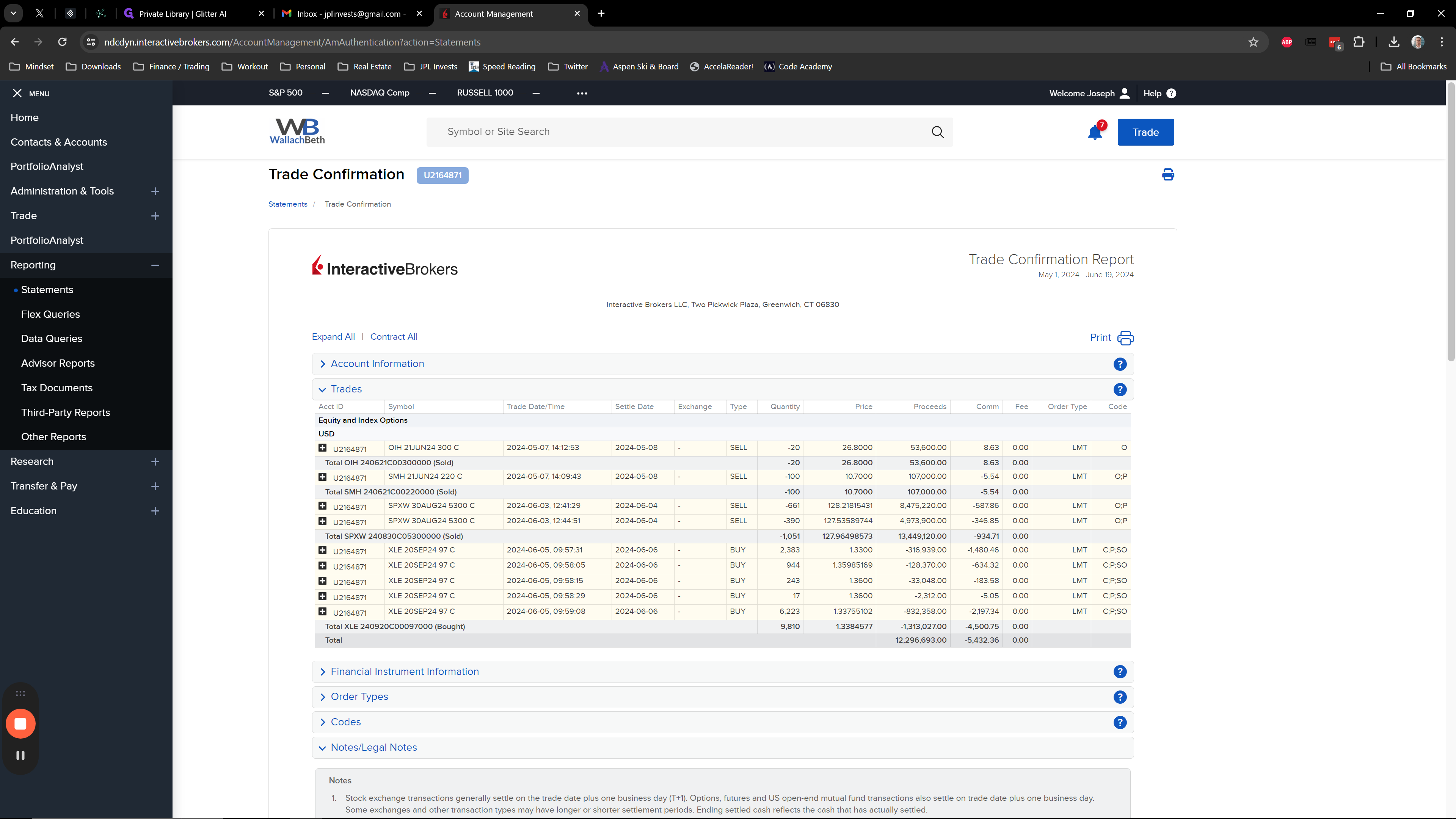

You come in here and run the trade confirmation for that day.

I usually view it as HTML.

Once it's run, you can see your consolidated trade at the bottom. This includes the price, proceeds, and commissions.

I would use this to fill out the trade template.