How to Manage and Hide Fuel Invoices Efficiently

LOL - AI names these articles, and this is the funniest title I've ever seen it make! I'm not changing it - it's too funny - but of course, we're talking about Hyde Fuel, rather than hiding fuel invoices :)

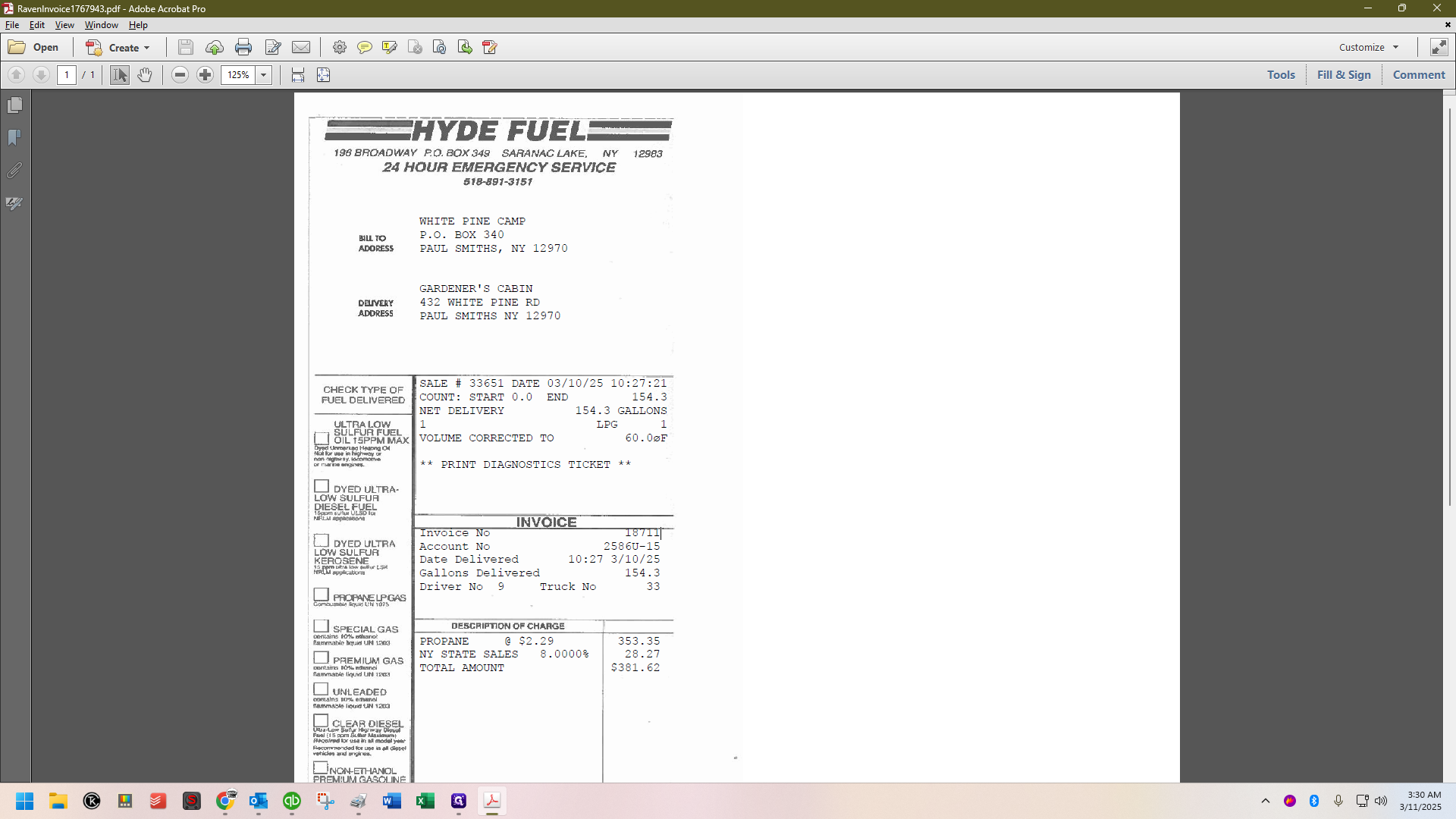

In this guide, we'll learn how to manage and process fuel invoices, specifically those labeled as "Raven Invoice," which often arrive via email or physical mail. These invoices can be confusing due to their unusual naming, but they are legitimate and can be opened safely. We'll explore how to handle these invoices using QuickBooks, focusing on identifying the correct vendor and ensuring the invoice details are accurately recorded. This process includes verifying delivery dates, invoice numbers, and amounts to maintain accurate financial records.

Let's get started

I'll quickly show you how to hide a fuel invoice. (LOL!!!! Again - AI transcribes my recording into an article - way too funny to correct this!)

These often arrive via email and sometimes physically in the mail. The email will typically have a strange and indescribable invoice name. I have no idea why they call their invoices "Raven Invoice," but they do, and it's not a hack.

You can open this.

I typically print a copy.

While that's printing, I'll access their vendor accounts. First, open QuickBooks and then go to the Vendor Center.

When you look at the invoice, you can determine if it's for propane or gas in several ways.

Notice that it is 2586U. In QuickBooks, there are two different vendors, and one of them is 2586U Propane.

I noticed this invoice is for Gardeners. I'll double-click on one of the recent Gardeners invoices and then click "Create a Copy."

It will notify me that a duplicate has been created, and I'll click OK.

I will know it worked correctly because the date will now default to the current date, which is 3/11.

Now, I'll review the invoice to see how it's marked as 3/10.

This is the date the propane was delivered.

Date the invoice to match the delivery date, 3/10.

Next, check the invoice number.

You can copy and paste it, which I often do because they don't know how to create an invoice properly. As a result, the numbers often get cut off.

I can tell that's a 1-8-7-1-1, but sometimes I genuinely can't see what it's trying to say. Anyway, just put that invoice number in front of "Gardeners" as the reference number on the bill.

Remove the amount in QuickBooks. Then, check the invoice to see the total amount listed.

Copy it over to QB.

Then in the description, replace "number of gallons" with the actual number of gallons delivered.

Then, highlight the entire description, copy it, and paste it onto the check image above. Then, save and close.

That's how to hide your fuel invoices, folks!