How to Sync Payroll Records Between Sage and ADP Using The Bridge and Review Records to match to ADP

Learn step-by-step how to import and reconcile payroll records from ADP into Sage using GetPayroll. Ensure accurate payroll data, handle deductions, and resolve common syncing issues.

In this guide, we'll learn how to sync payroll records between Sage and ADP using the GetPayroll bridge. This process helps ensure that payroll data is accurate and matches across both systems. We will also cover how to verify and adjust payroll details for each employee to resolve any differences.

Let's get started

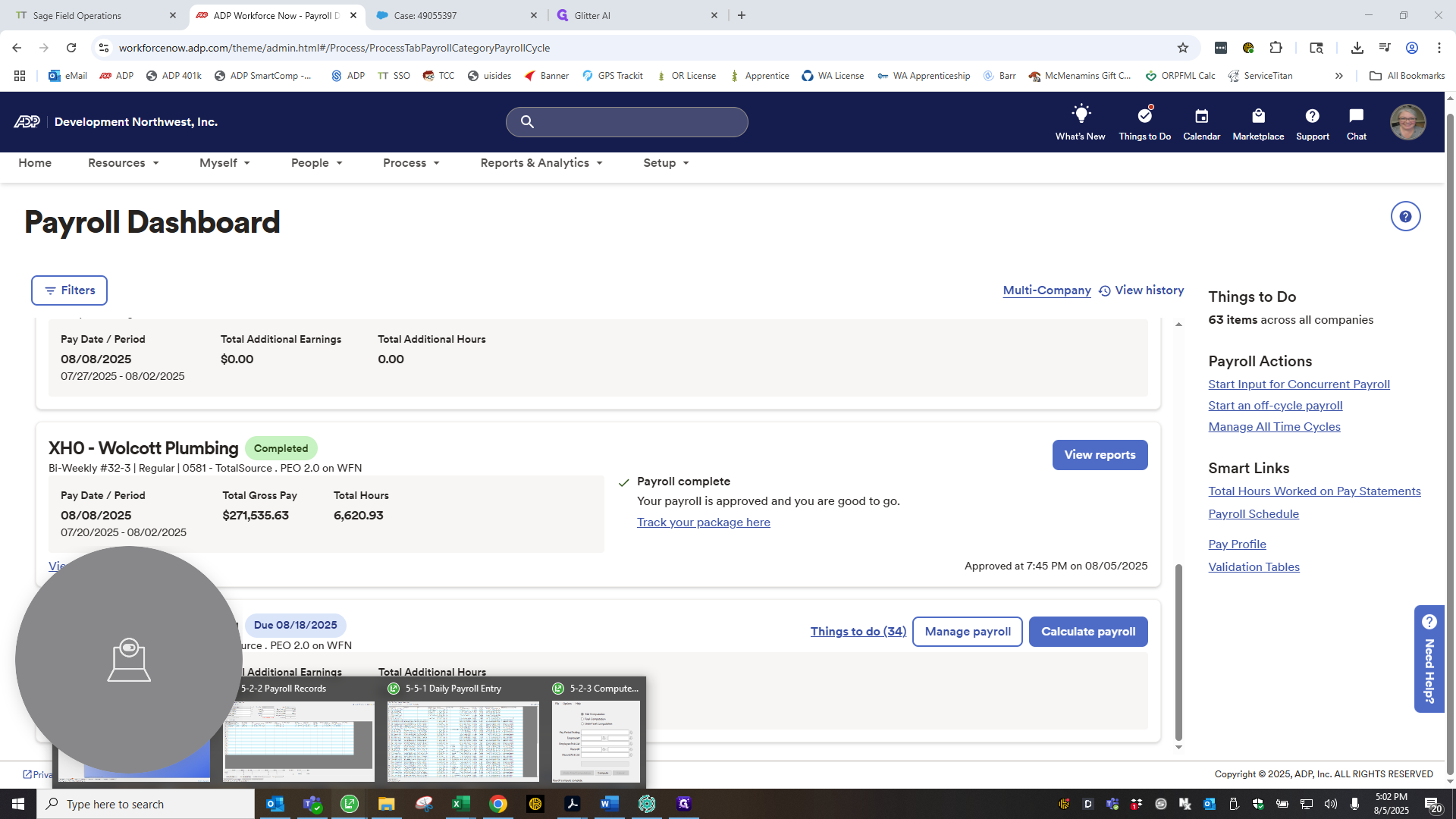

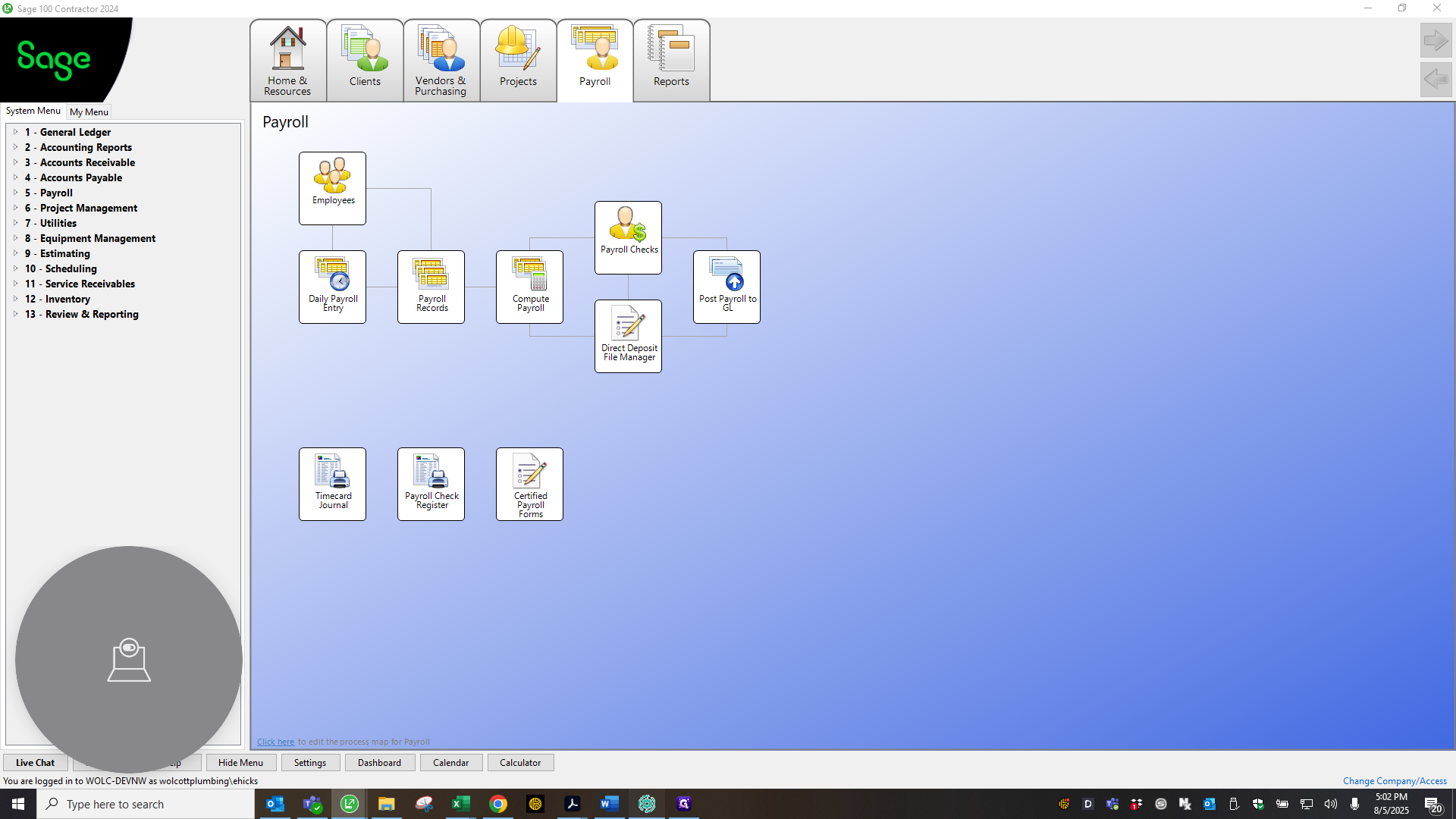

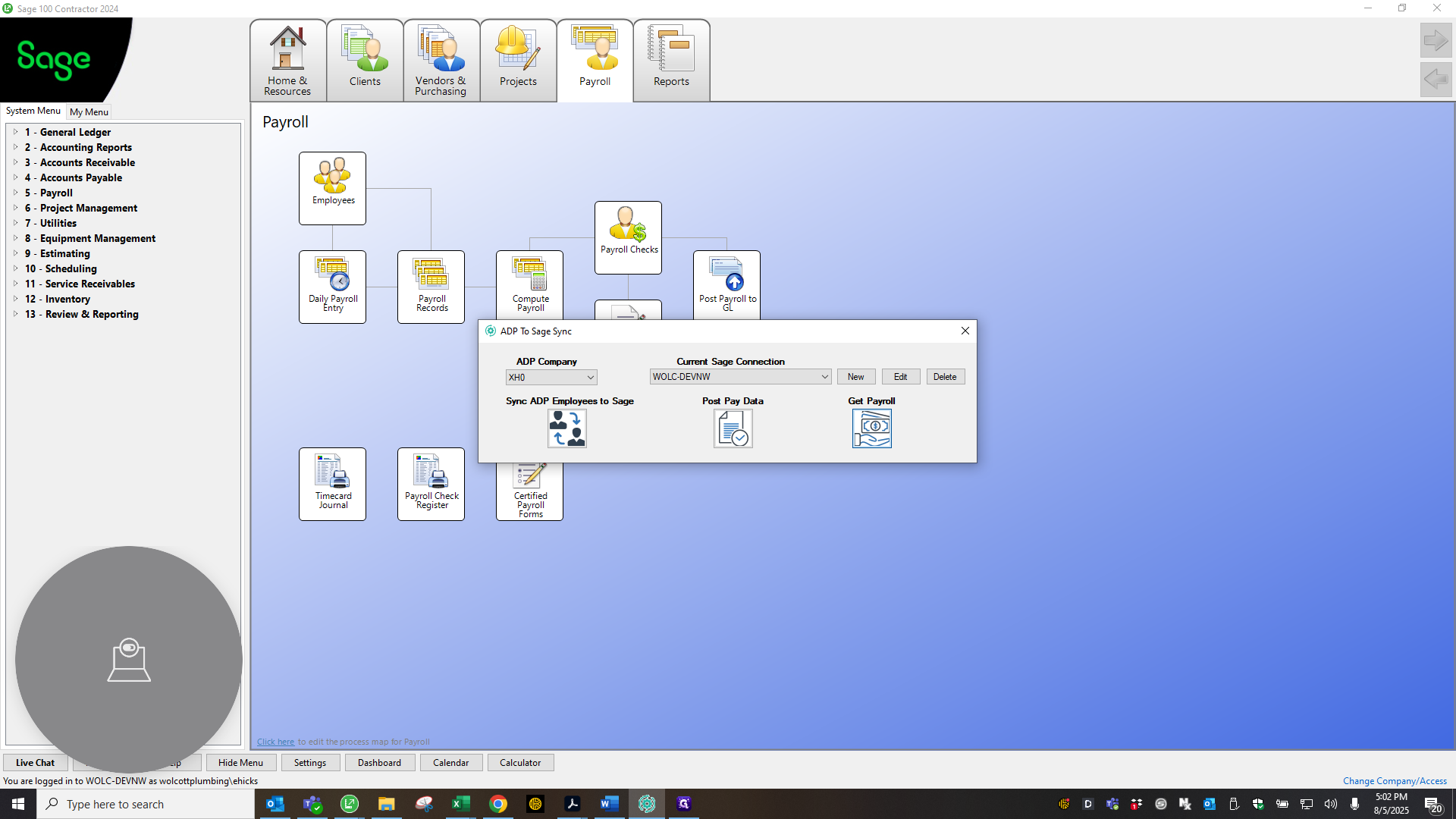

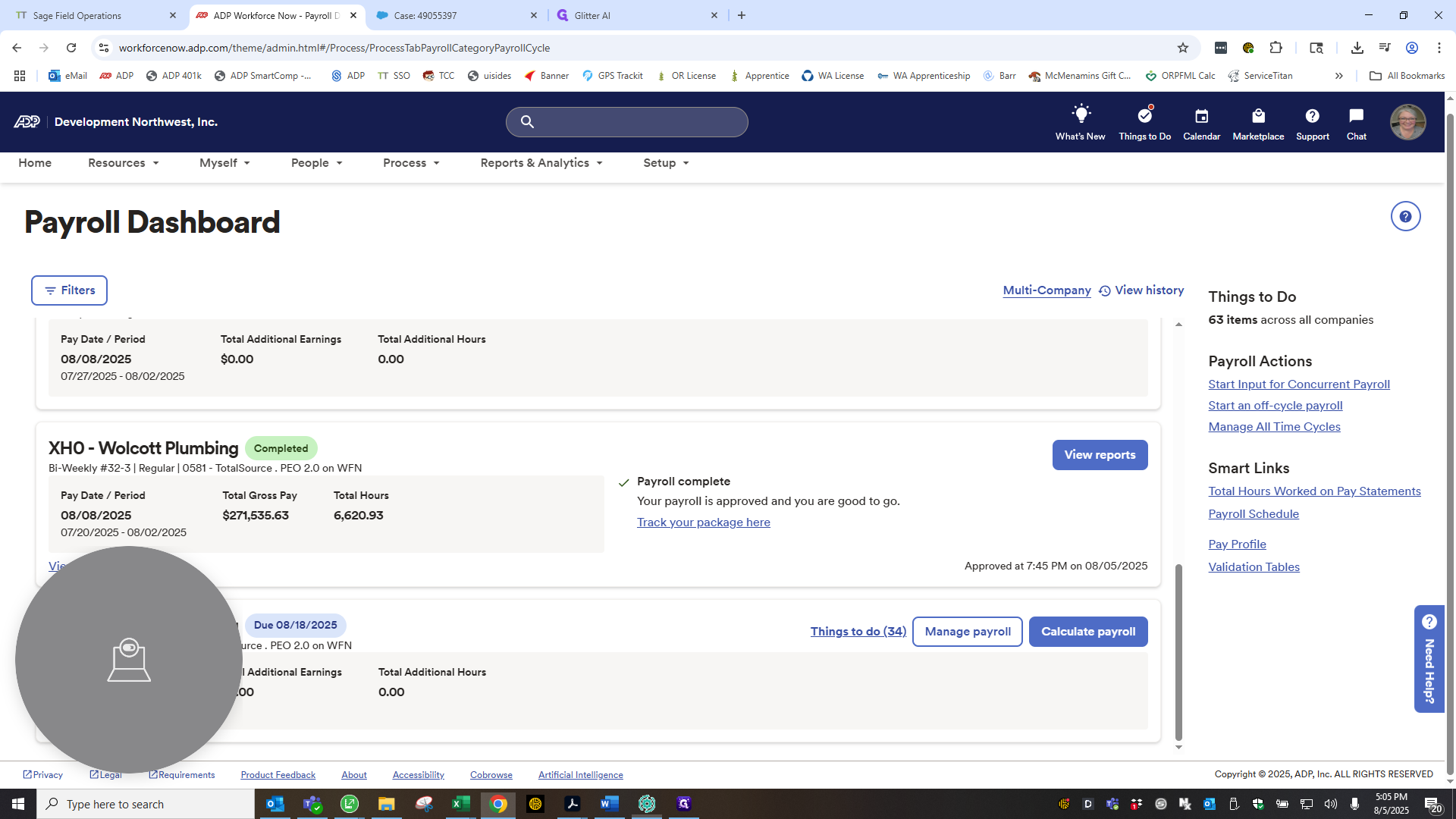

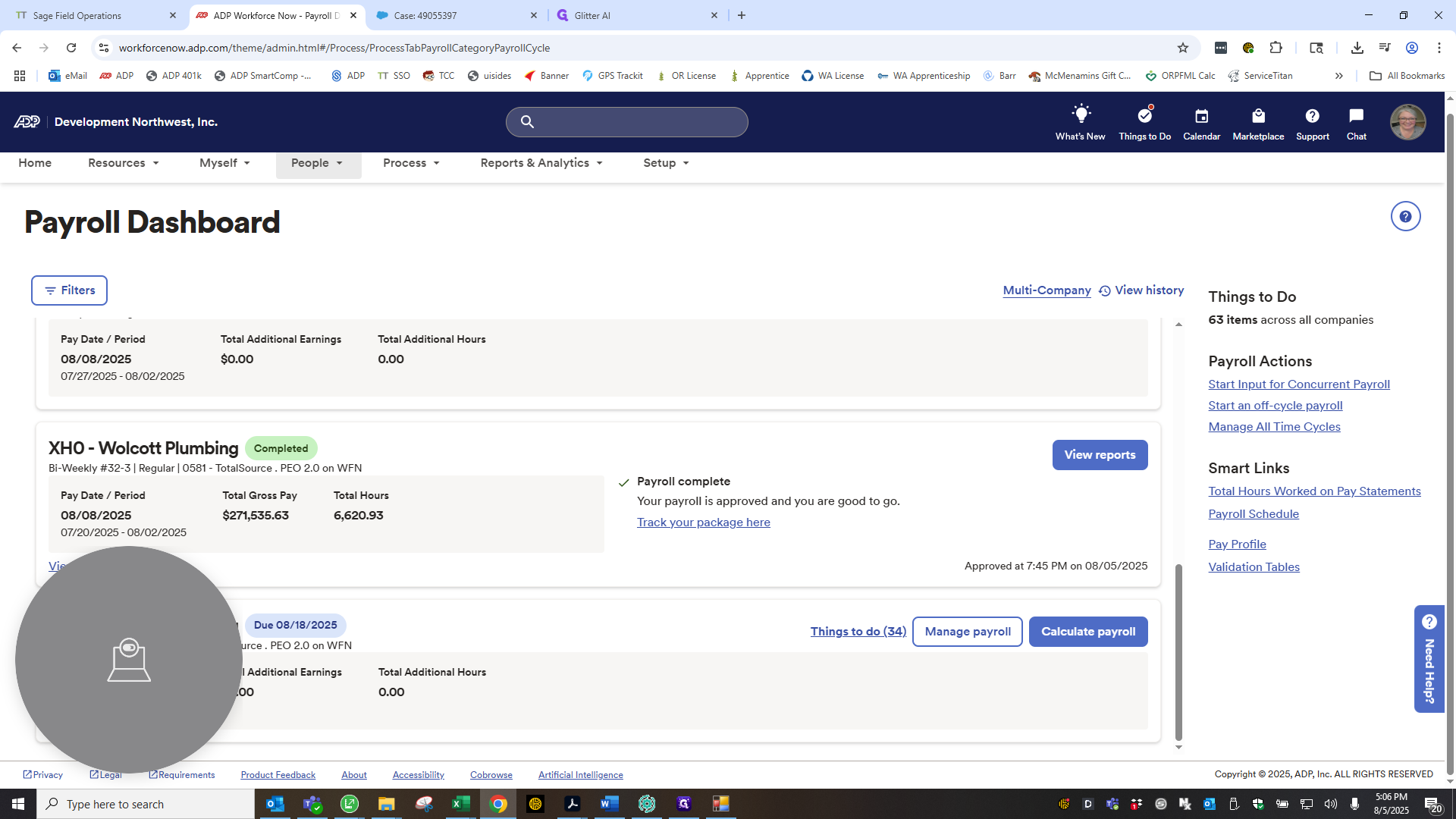

Okay. Now that payroll has been completed for HX0 for Old Hot, we can return to Sage and open the bridge to GetPayroll.

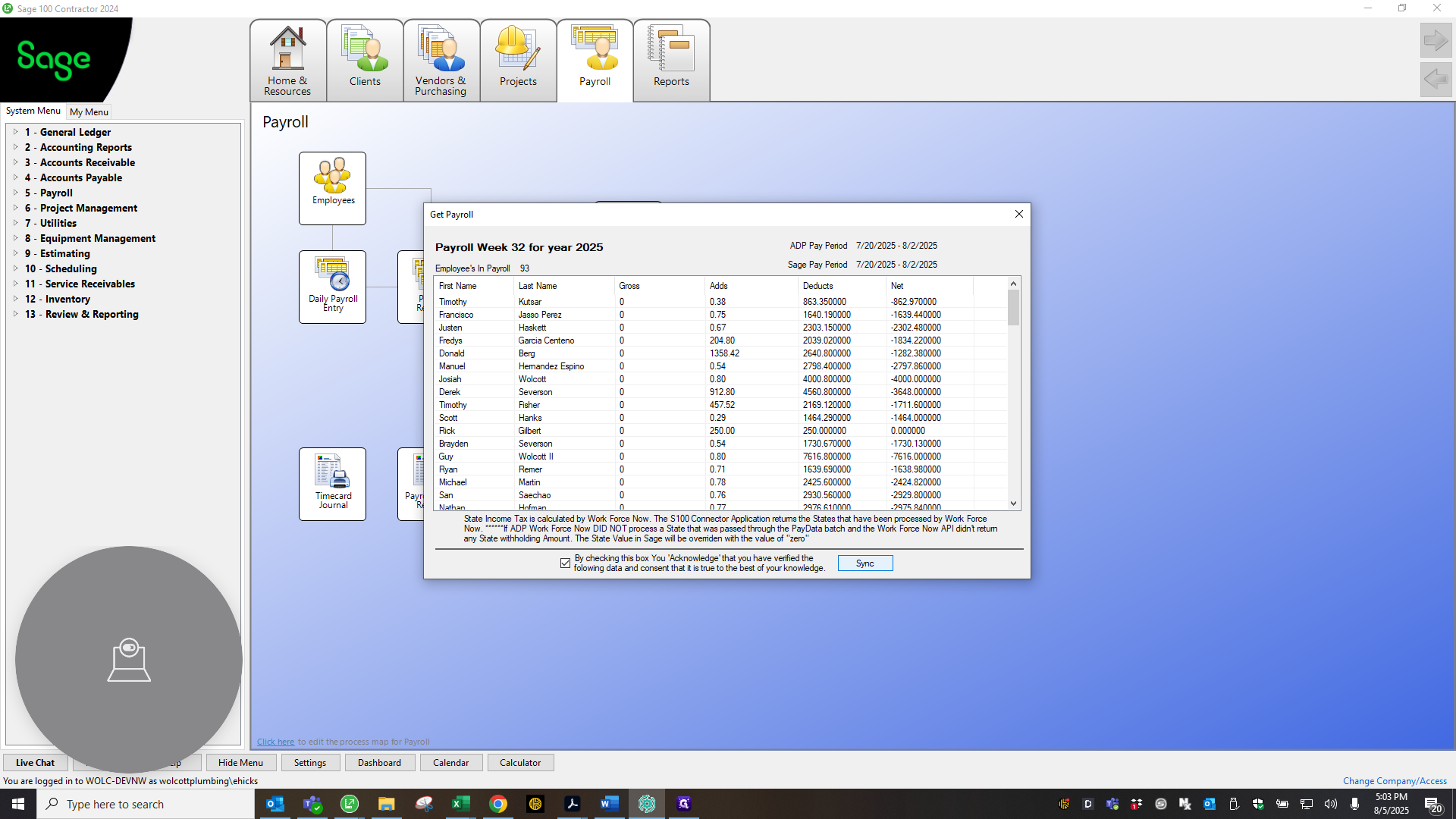

This will begin communication with ADP to import all payroll records into Sage.

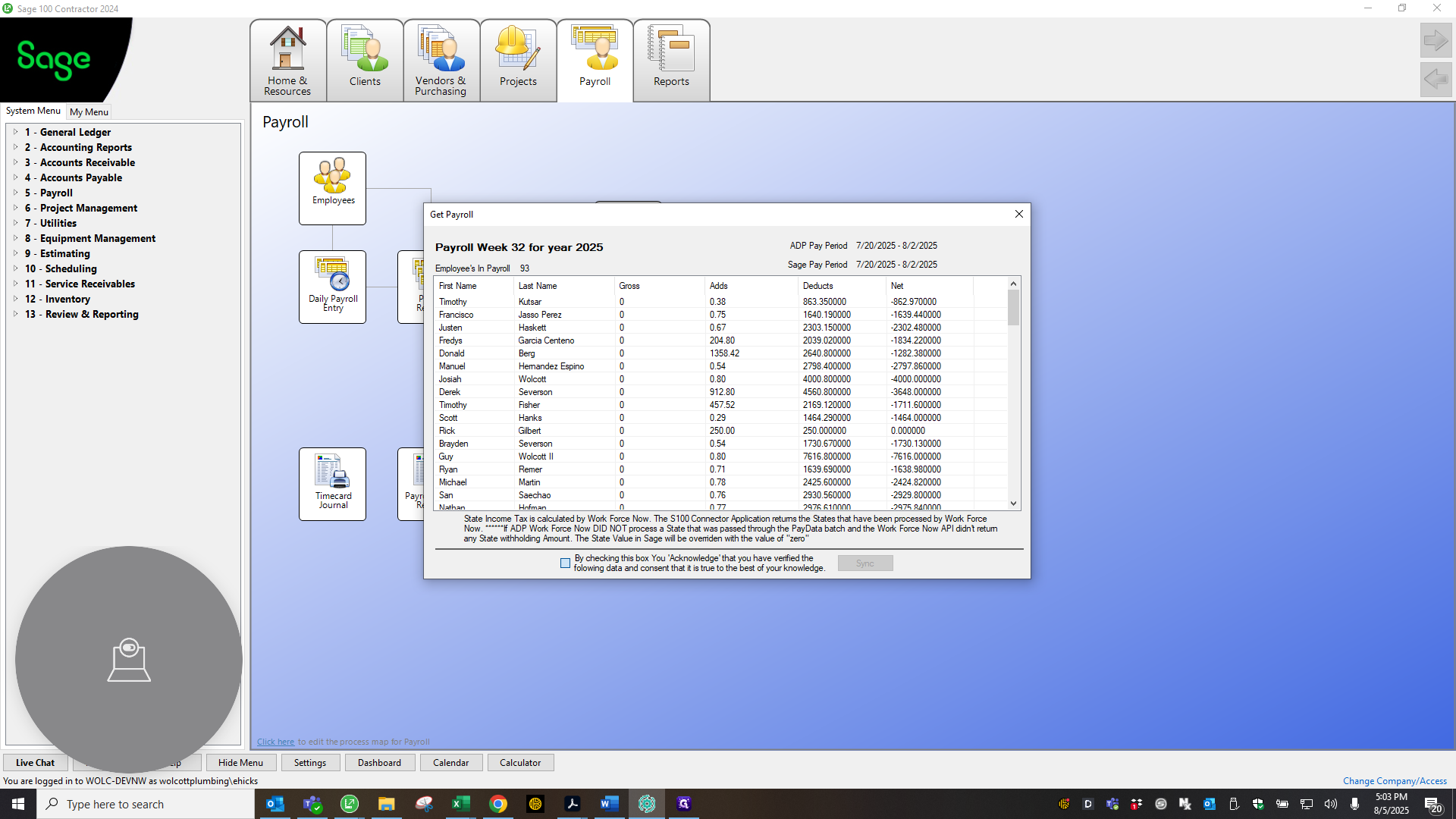

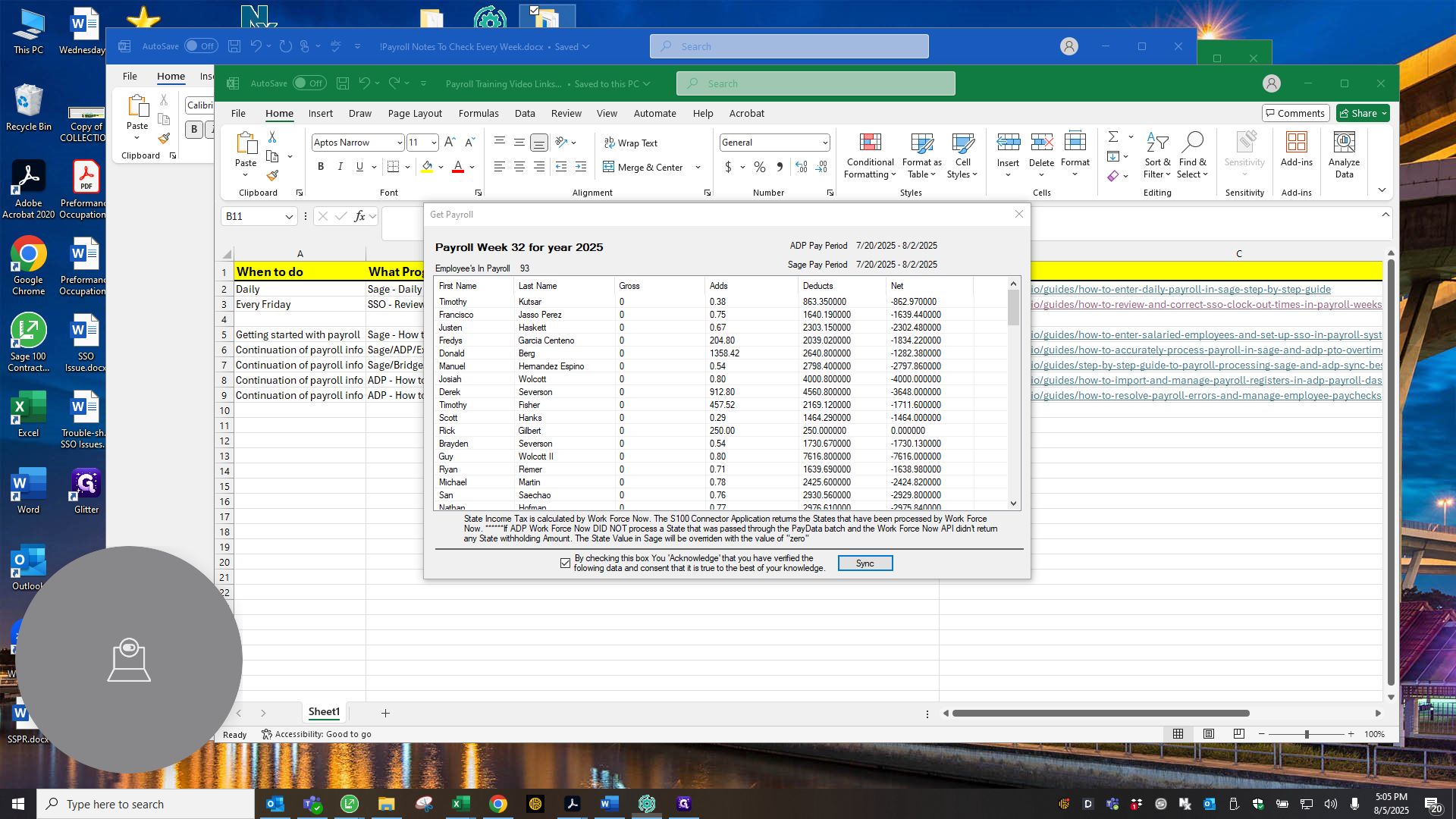

It only takes a second. Payroll—what is it? Excuse me, Employees and Payroll 93. Let me click this box below, since that number is correct.

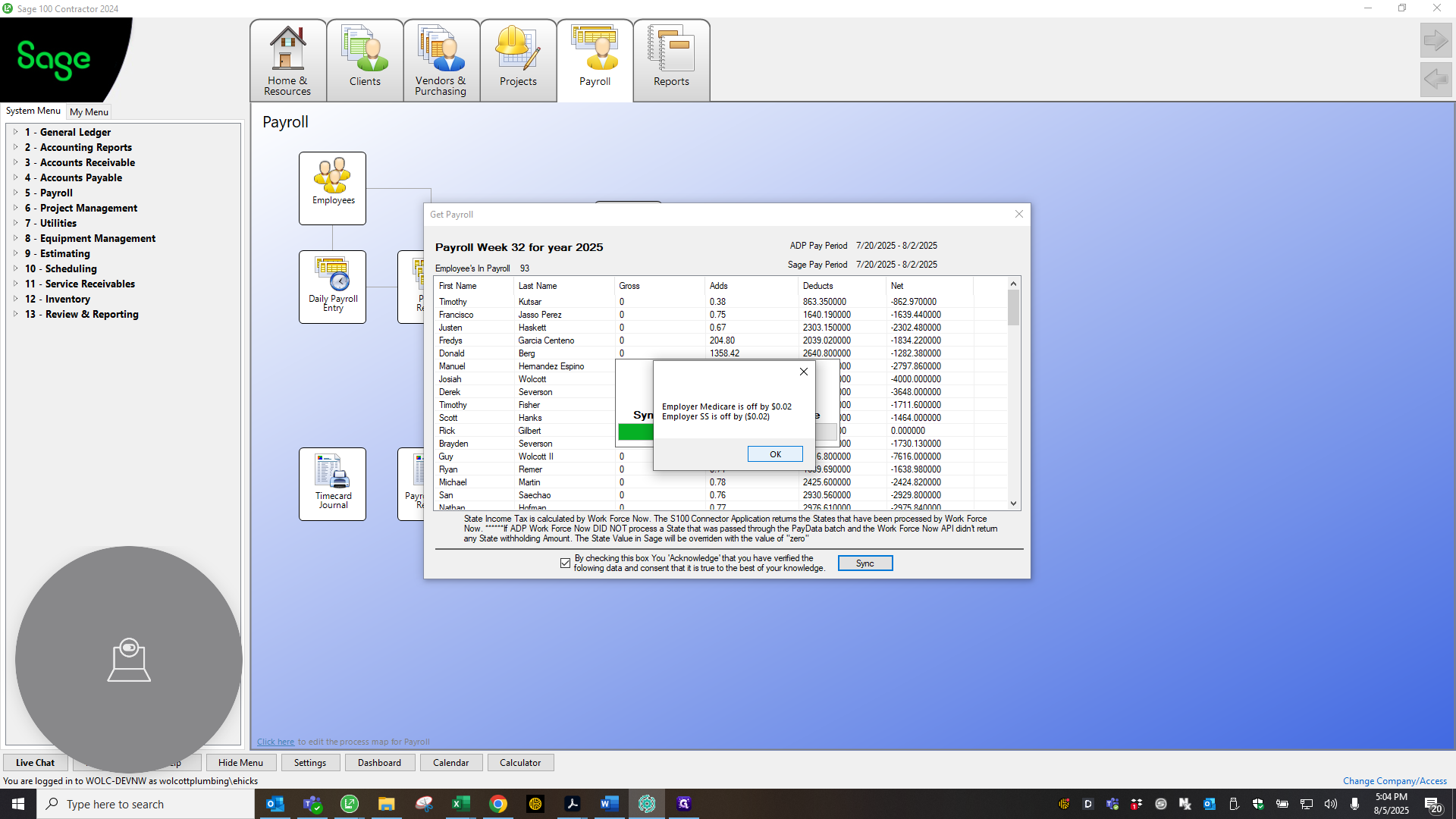

Click Sync.

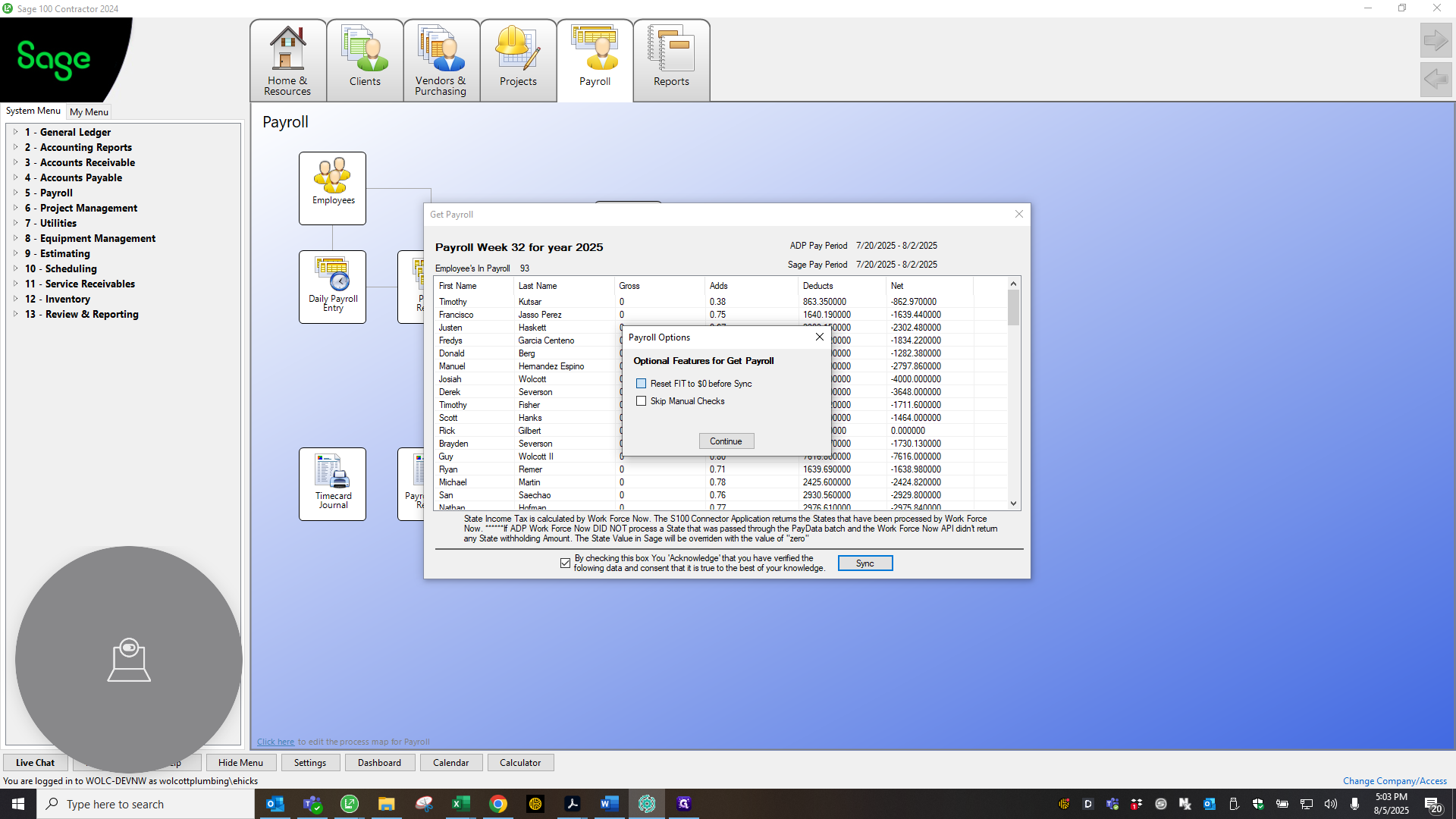

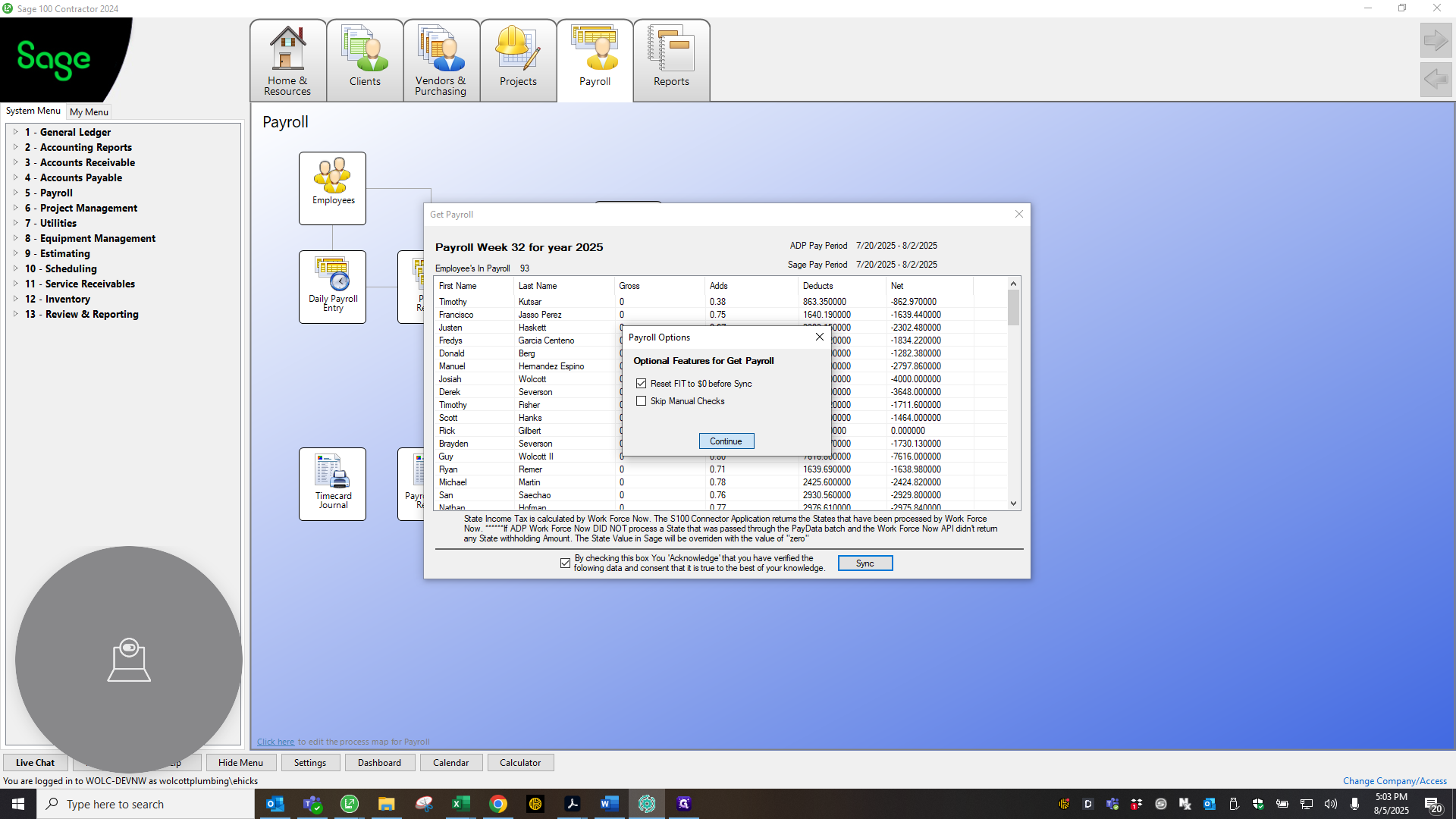

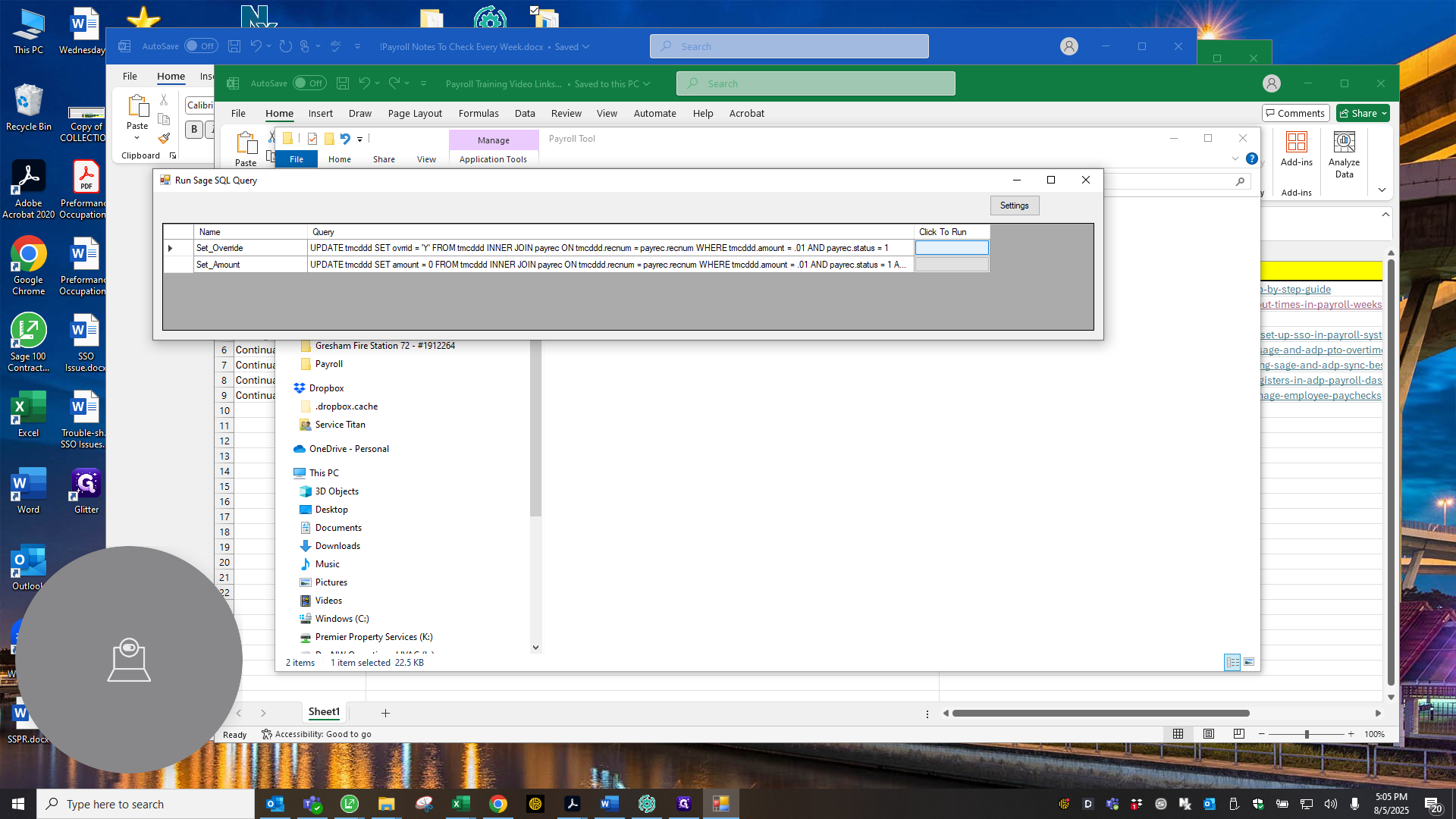

Click the first box to reset. If anyone has federal income set to zero, this will ensure it stays at zero, as Sage may try to overwrite it.

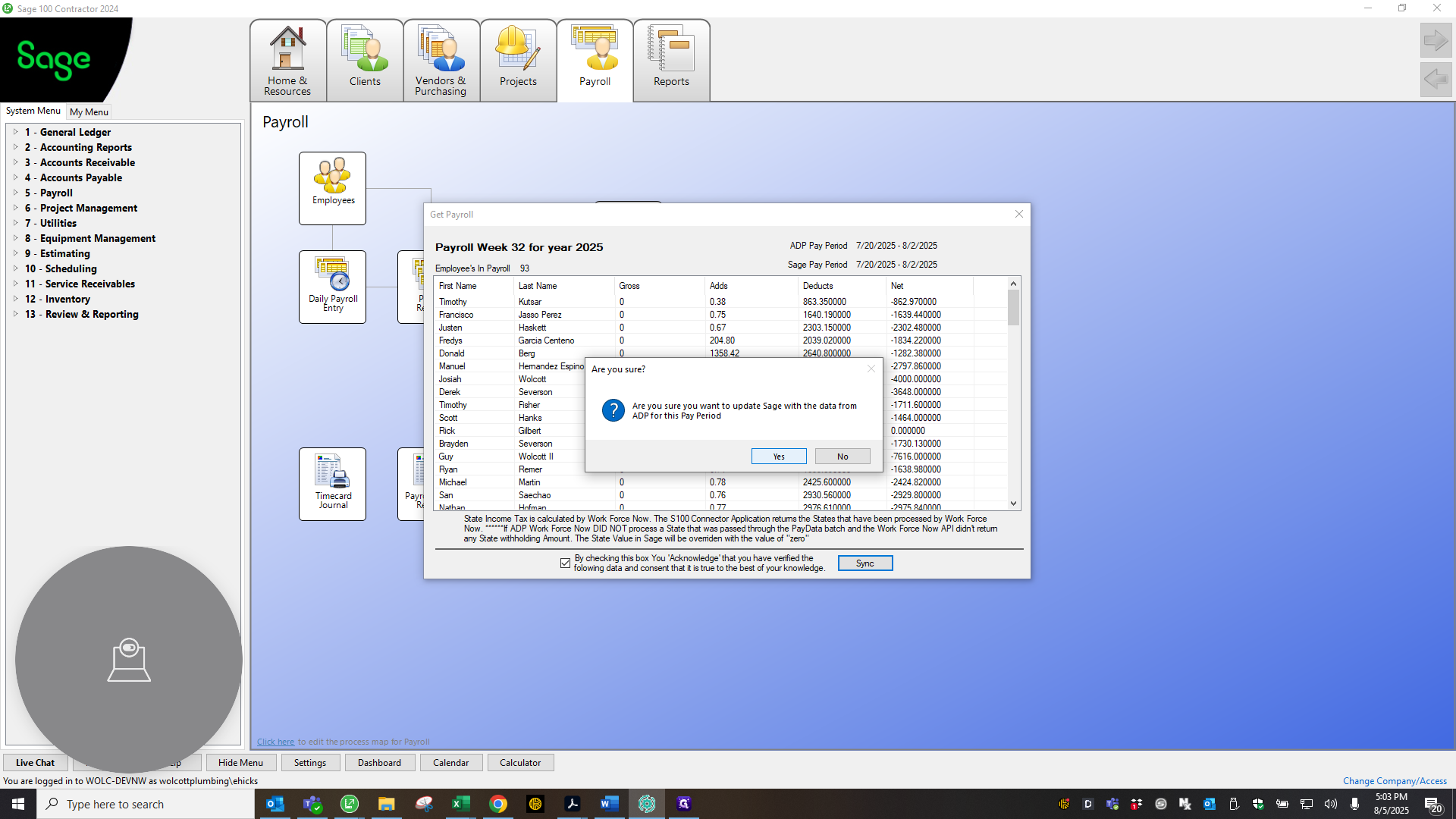

Click that, then click Continue, and select Yes.

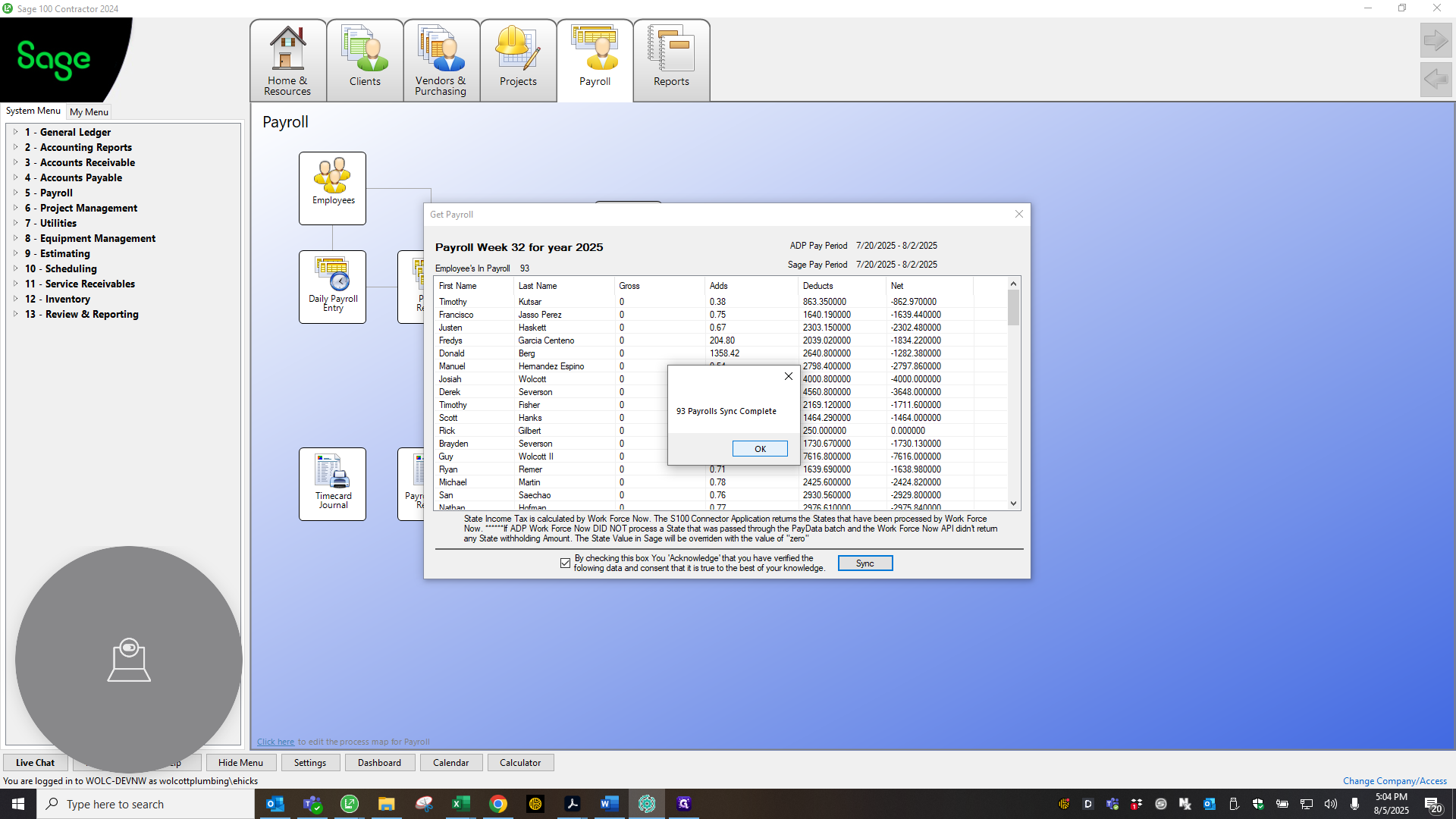

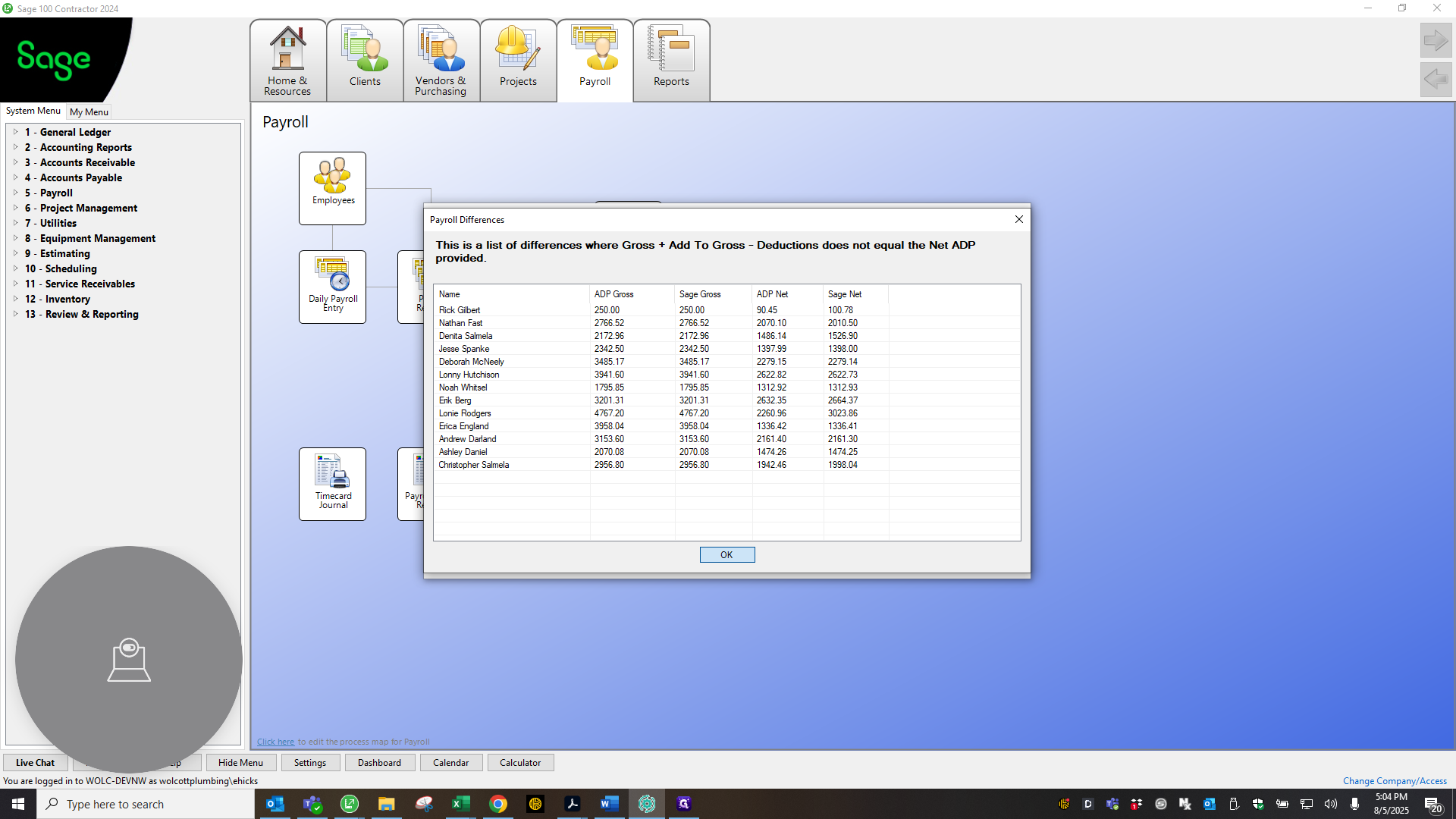

This part only takes a moment. Okay. It finishes syncing and then notifies you that Medicare and Social Security are off by 100 pennies. Just click OK, then click OK again. This shows that the balance or Net Pay in Sage is different from what is in ADP.

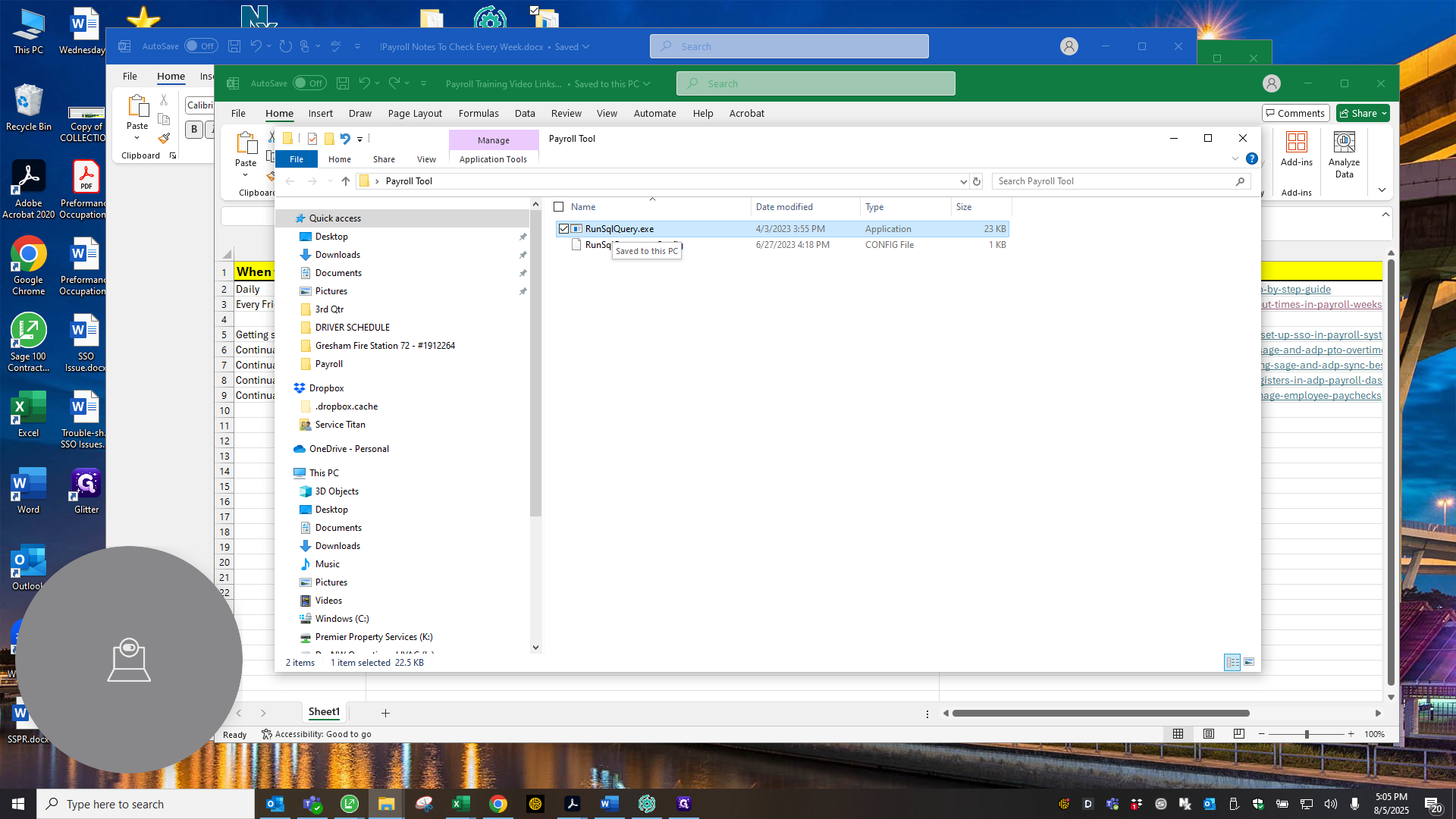

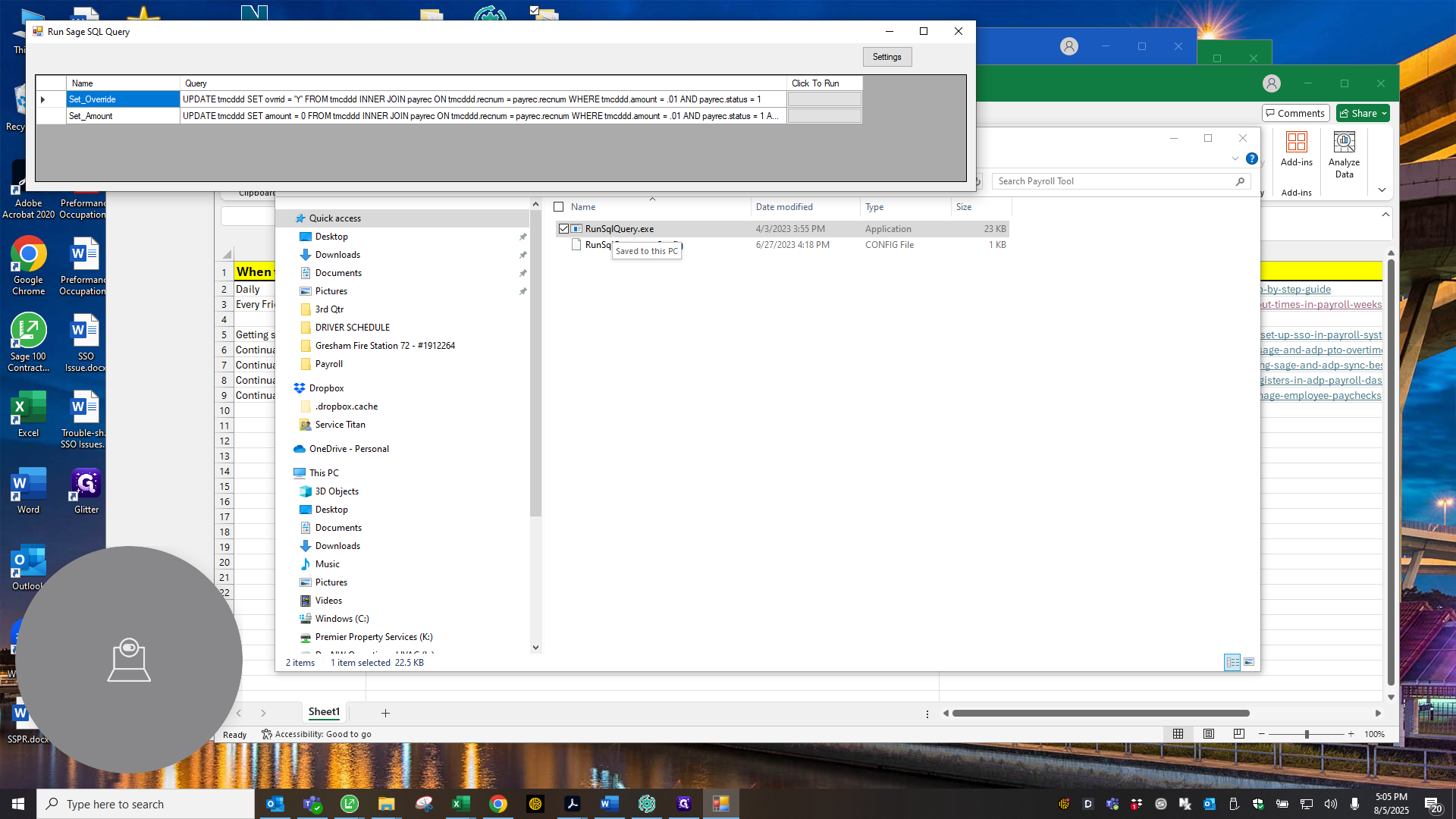

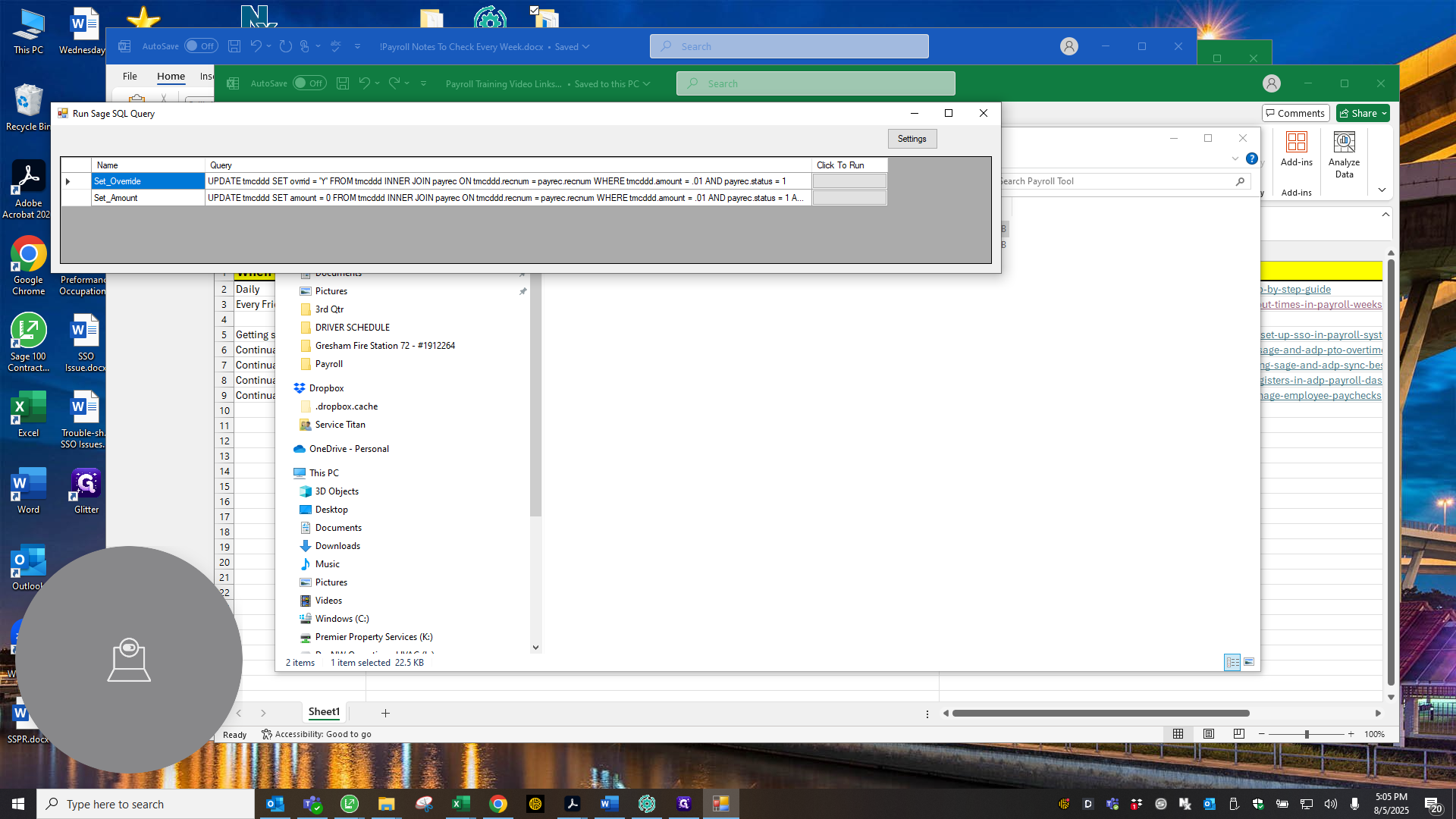

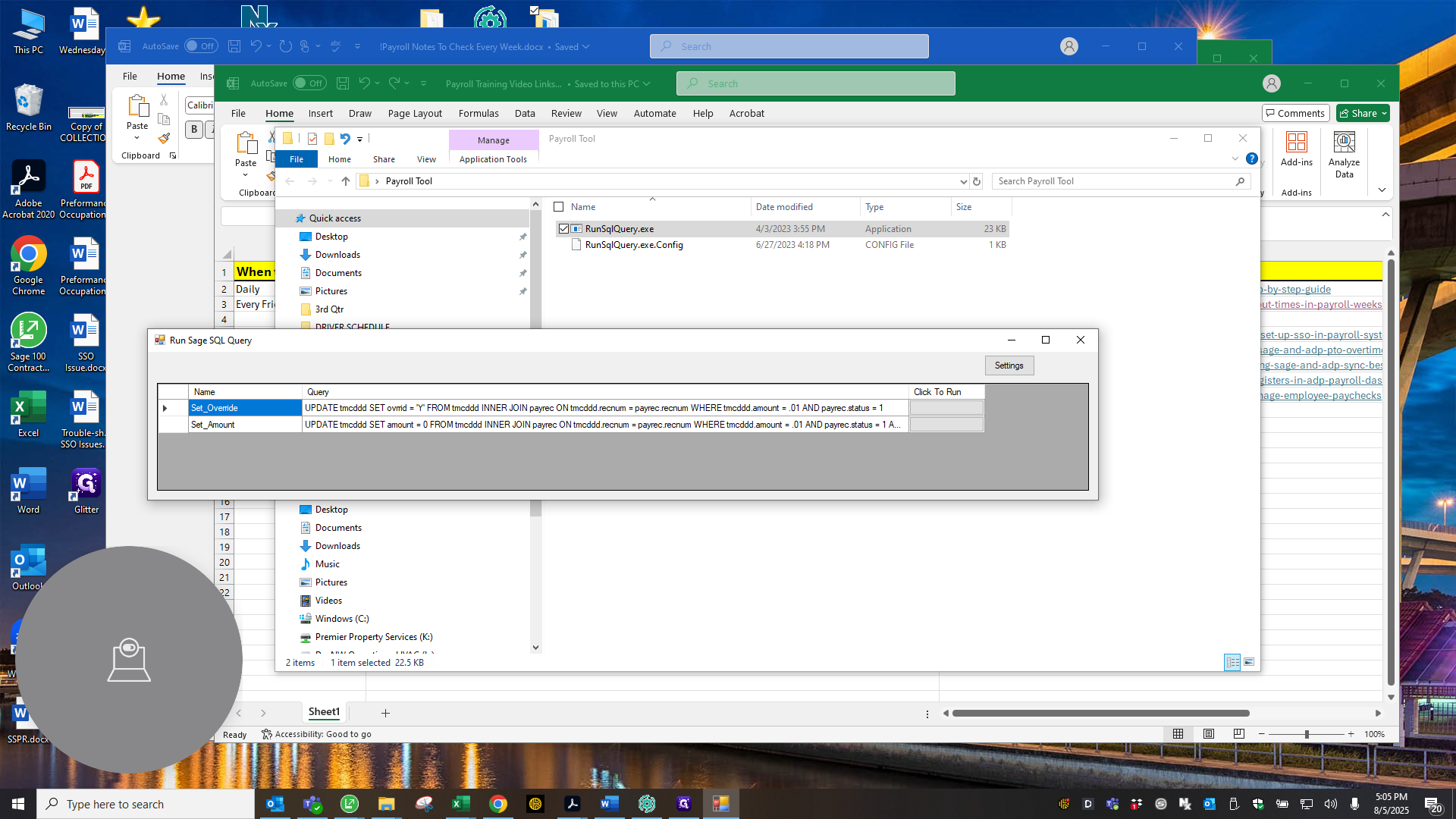

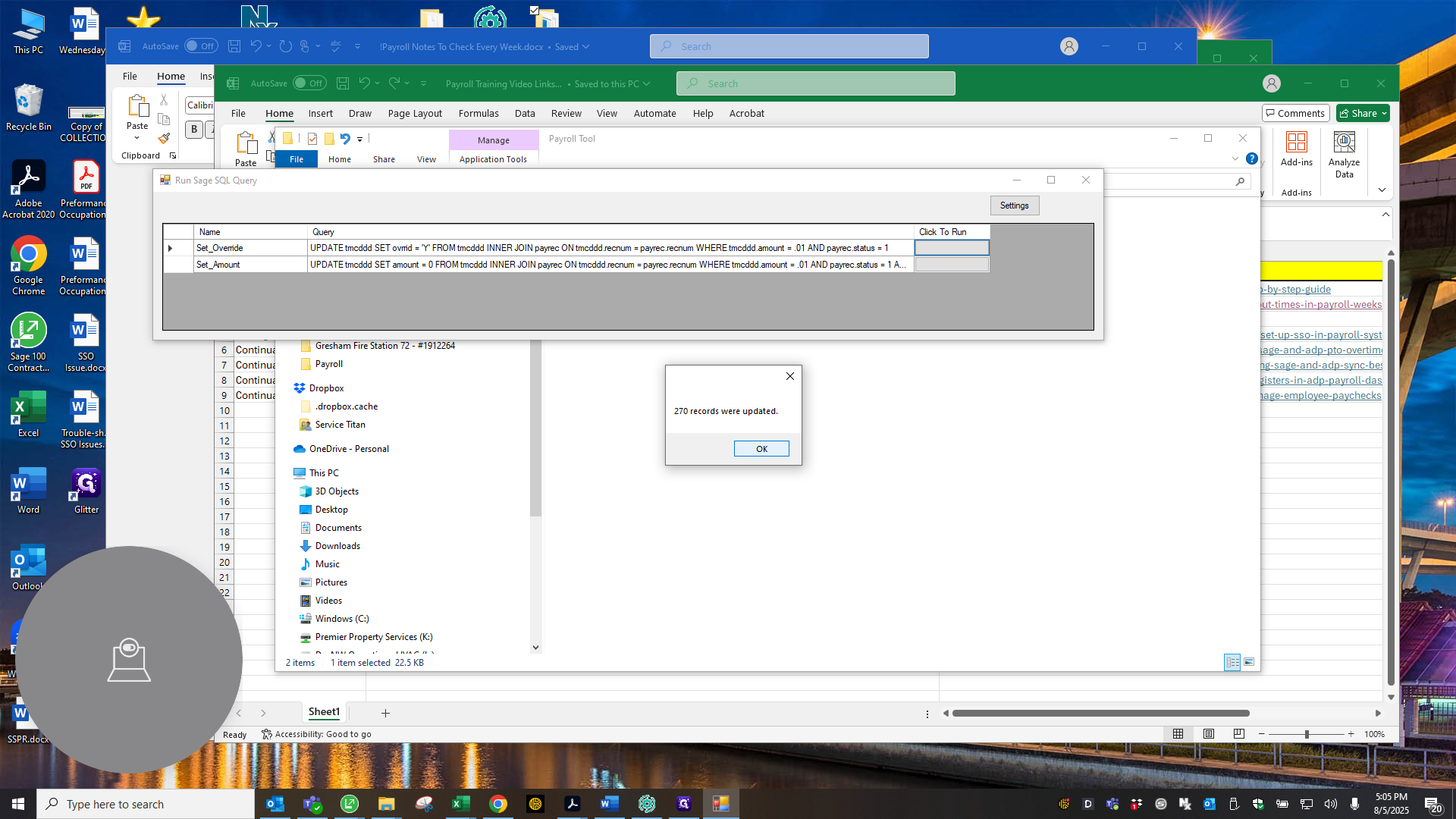

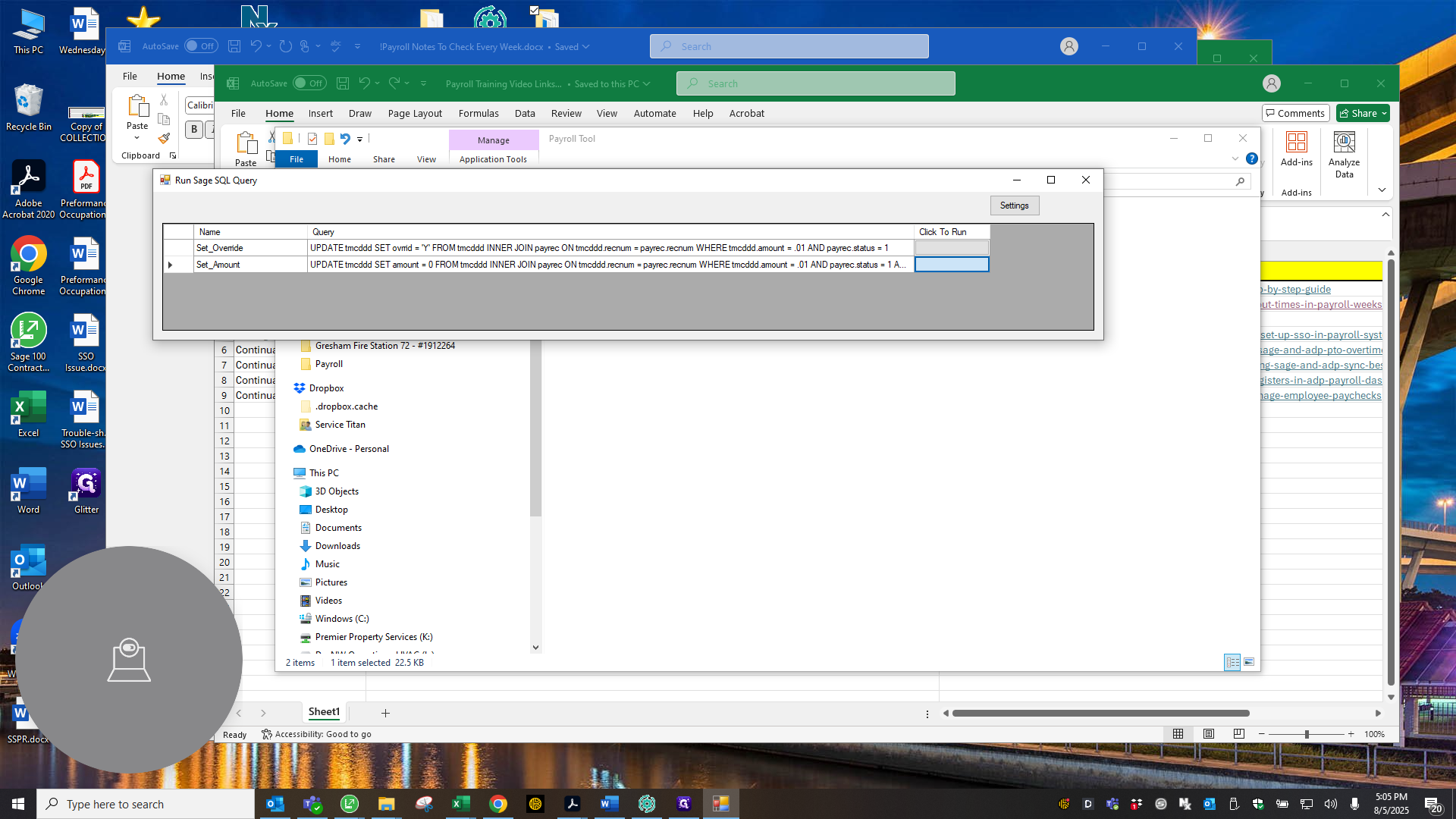

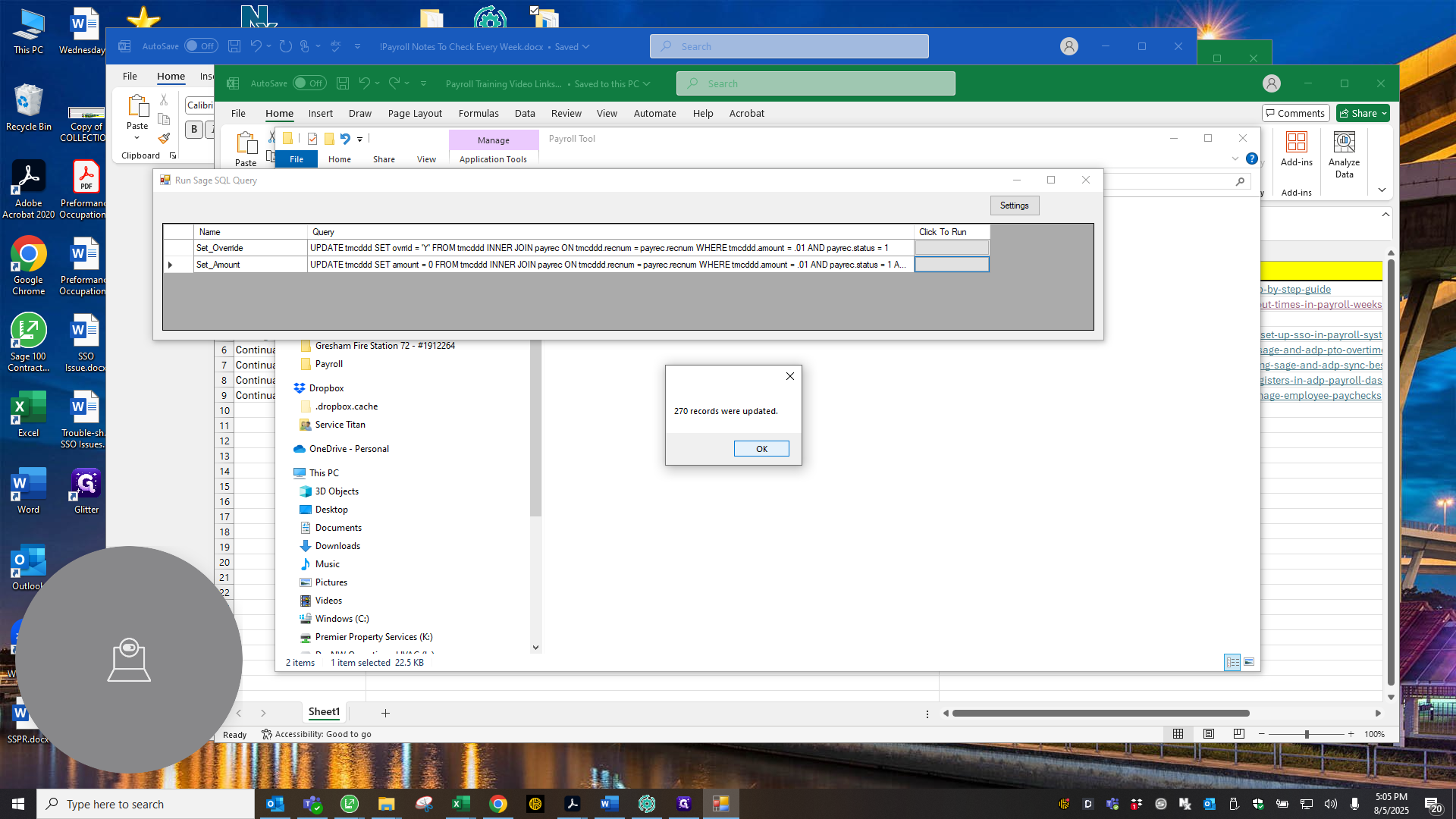

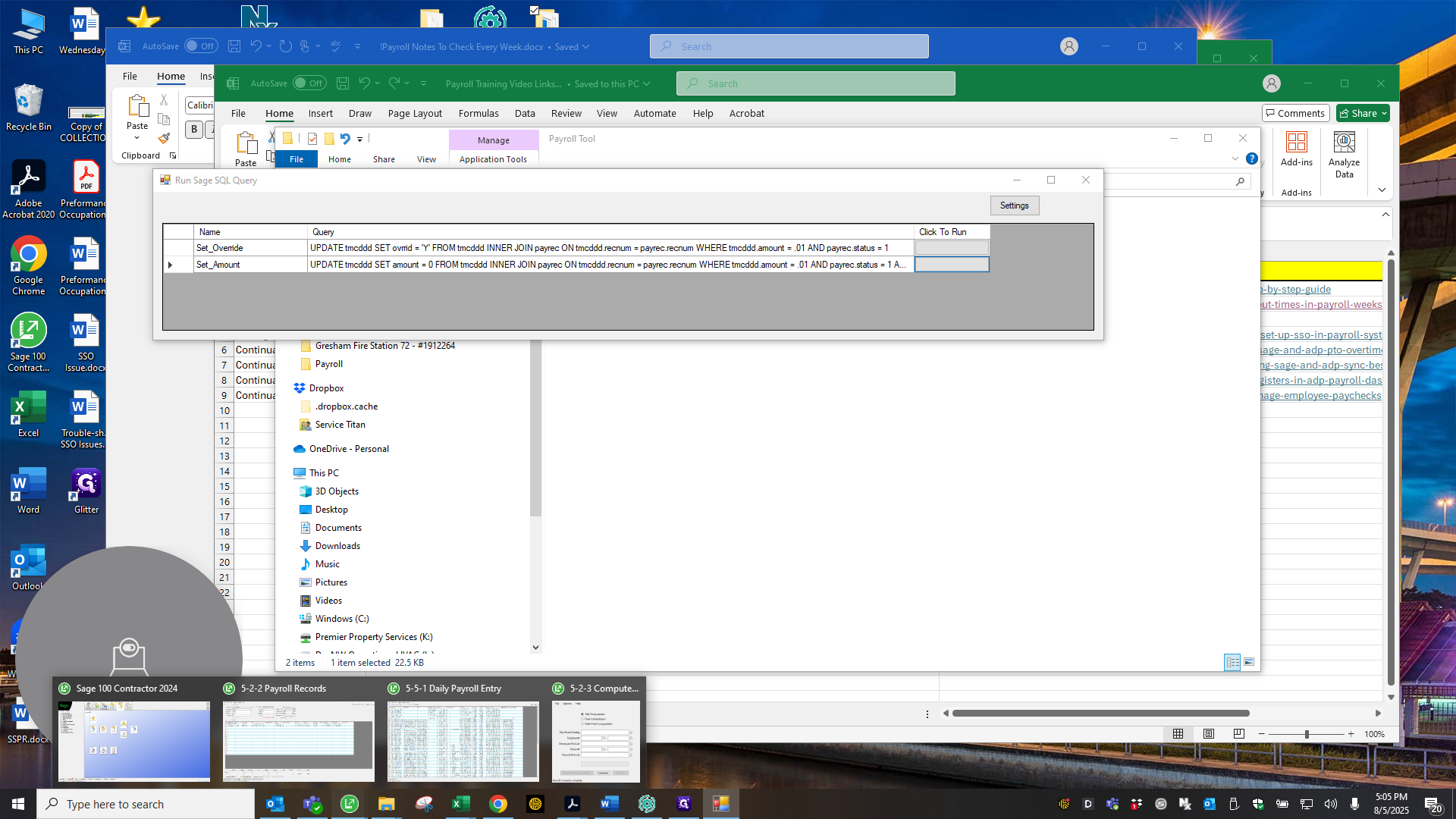

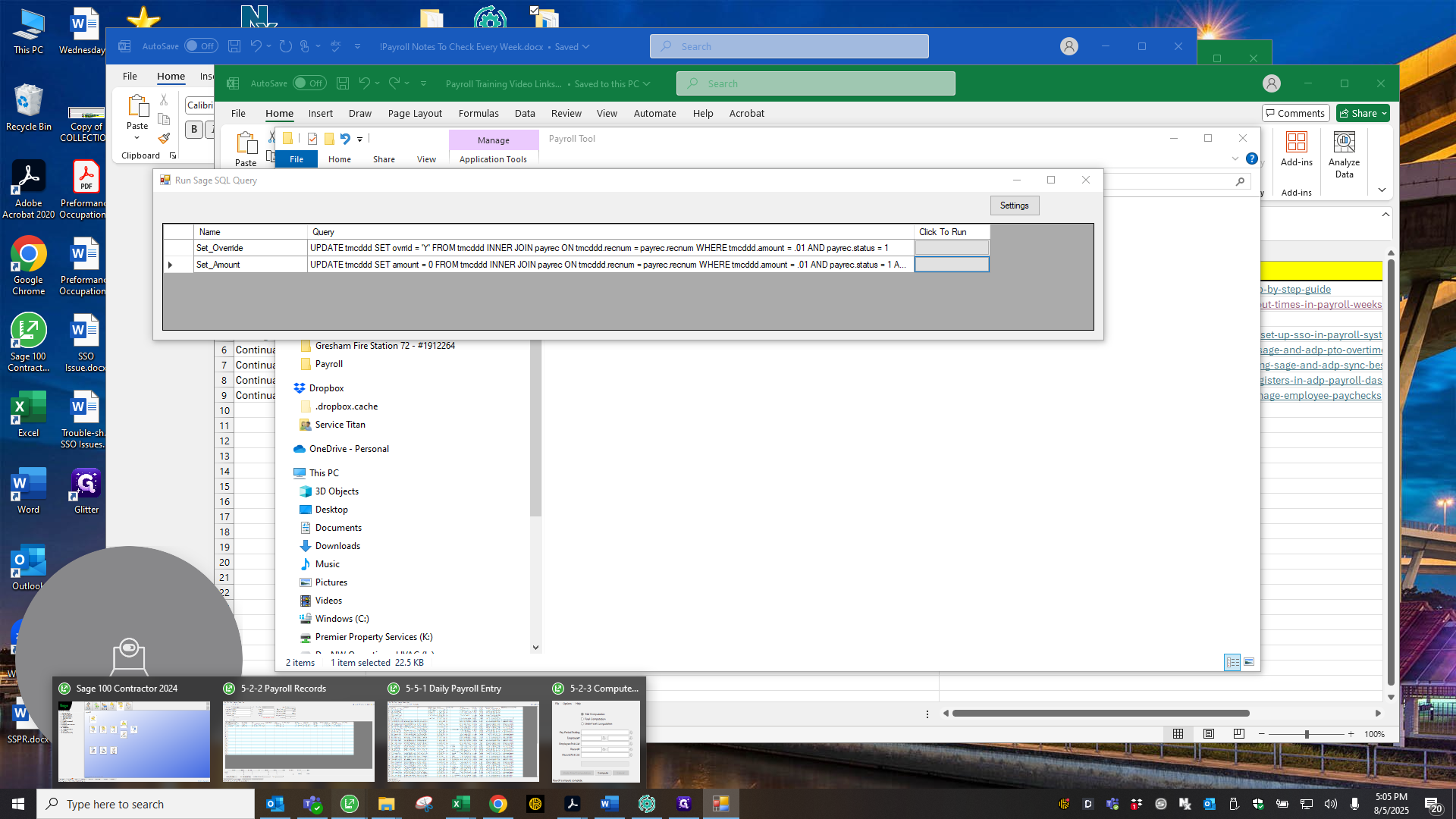

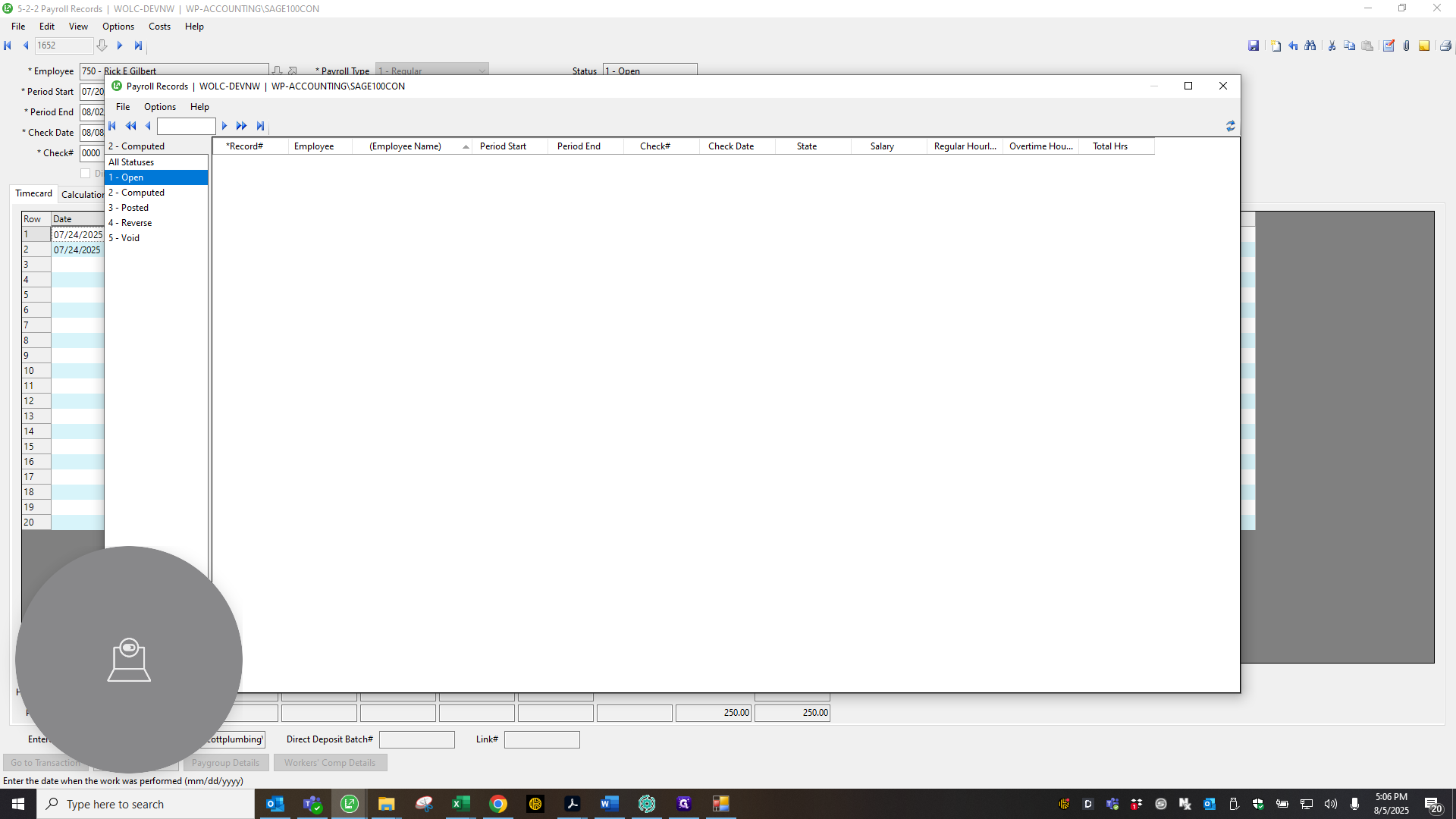

Just click OK. Now we will return to the payroll records. Sorry, we need to go to the payroll folder that John set up for us with Sage. I'll install that on Deborah's computer as well. Open the folder and click "Run Query." When the box appears, select both options.

It updates all the zeros or pennies in Sage that appear because nothing was imported from ADP. It automatically resets those values, so we don't have to do it manually.

Alright.

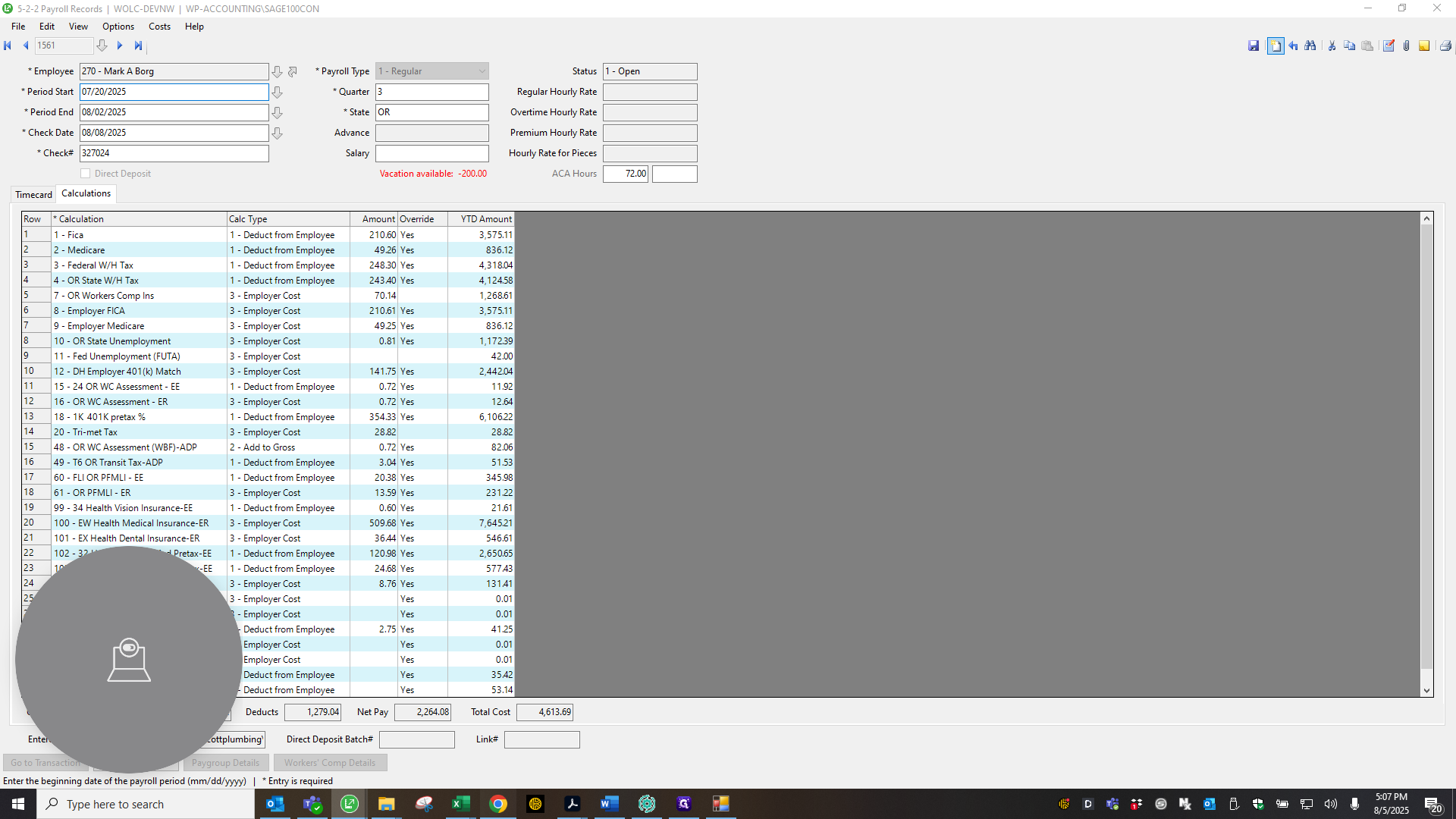

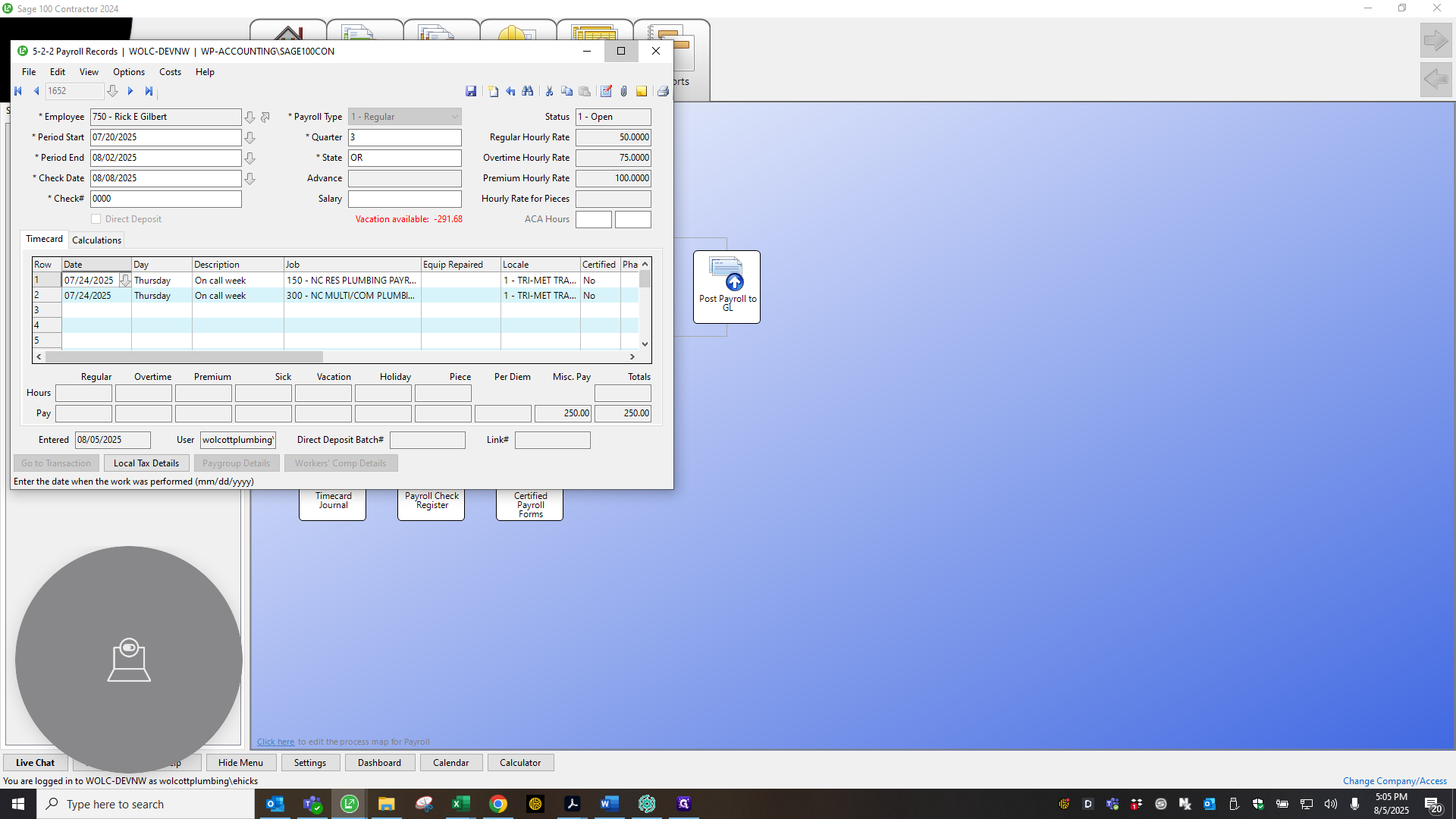

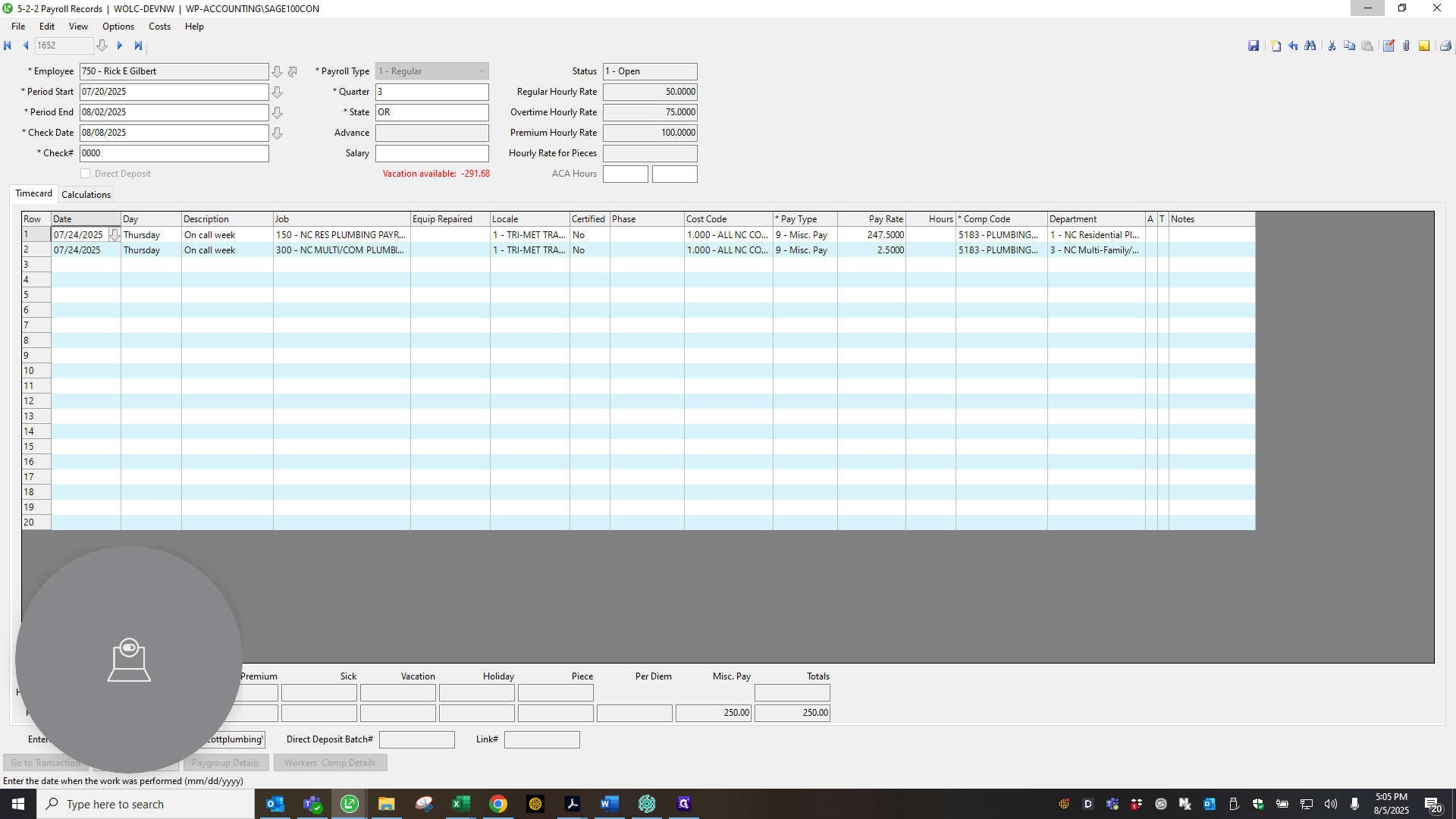

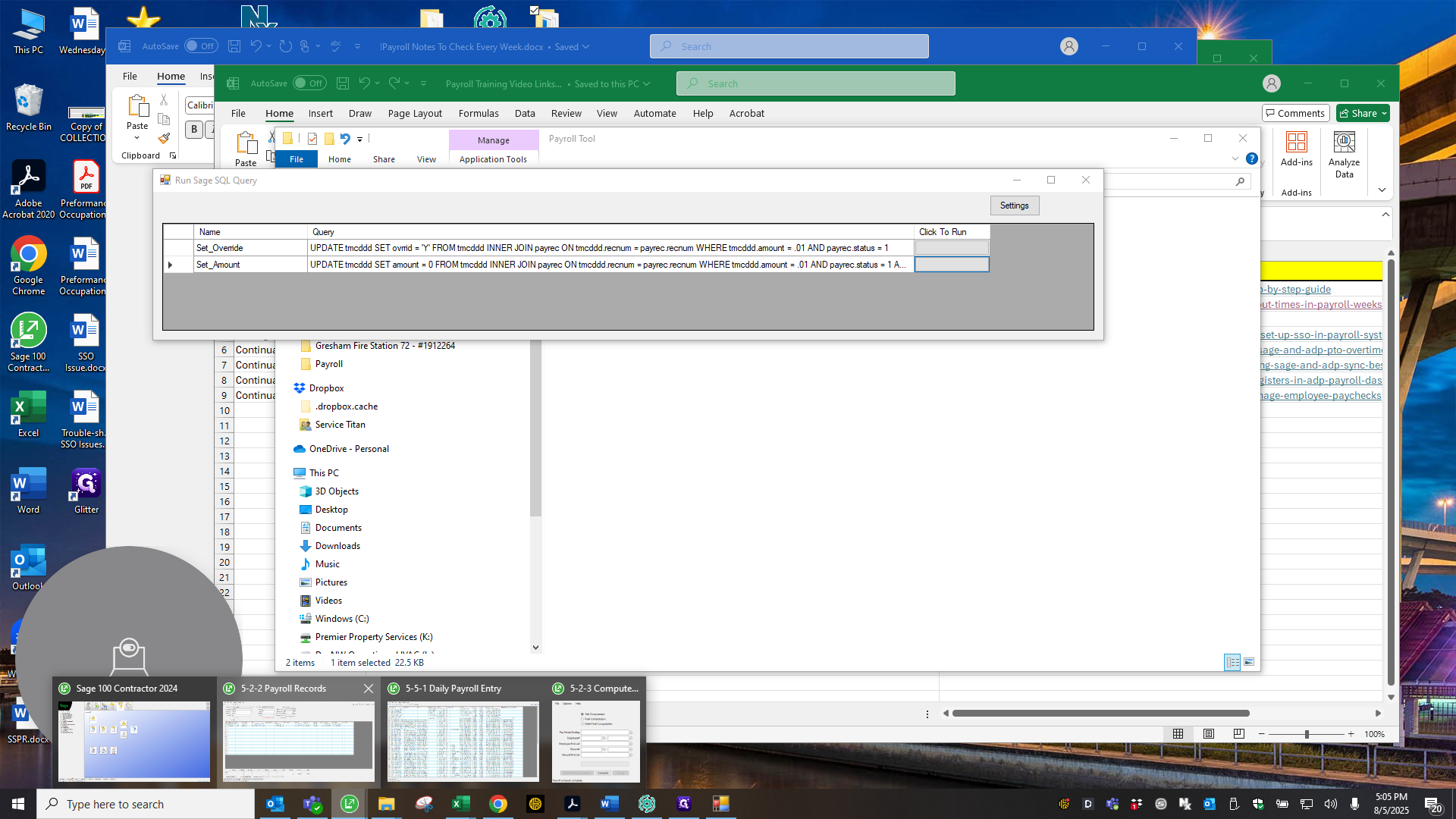

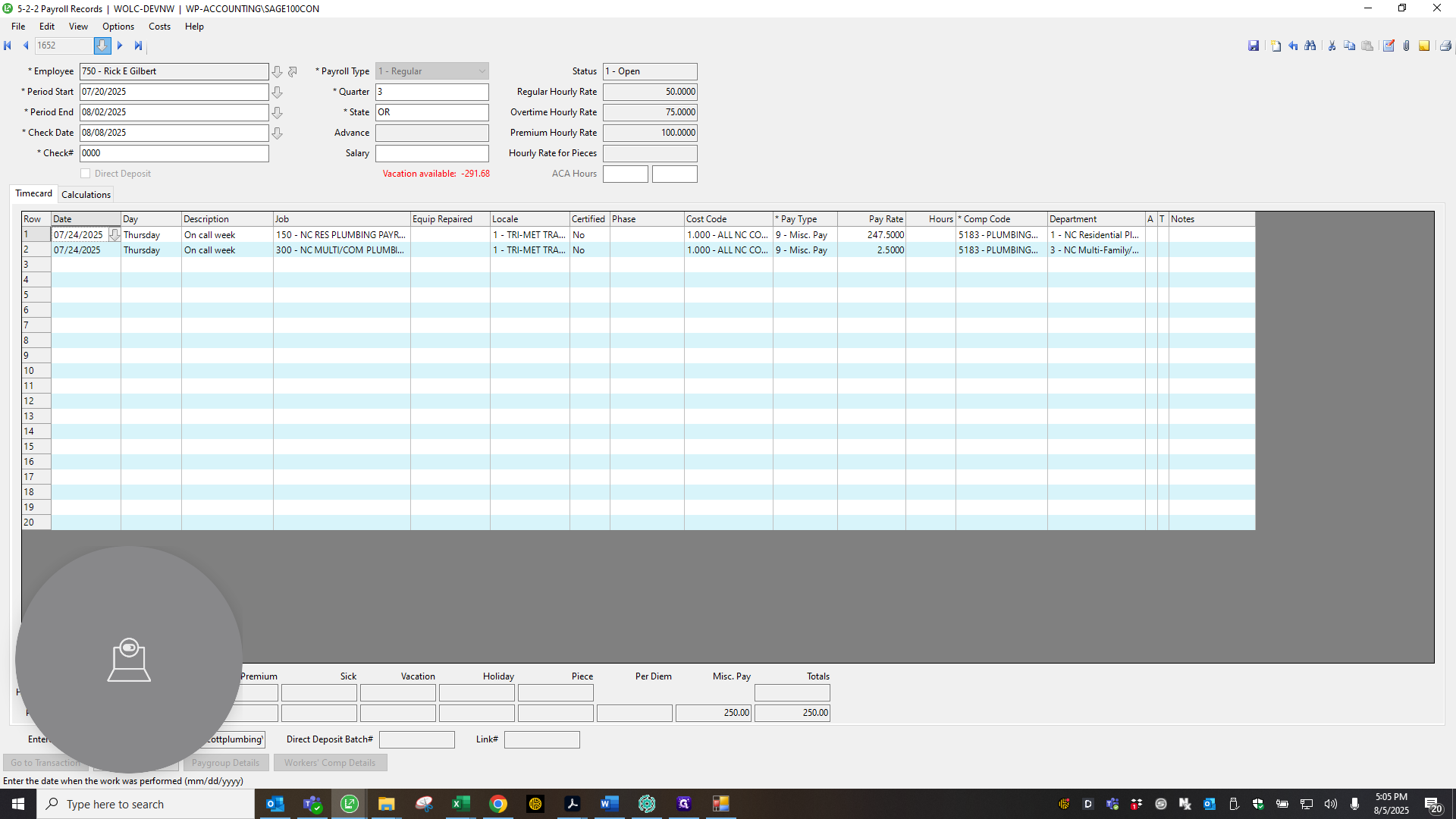

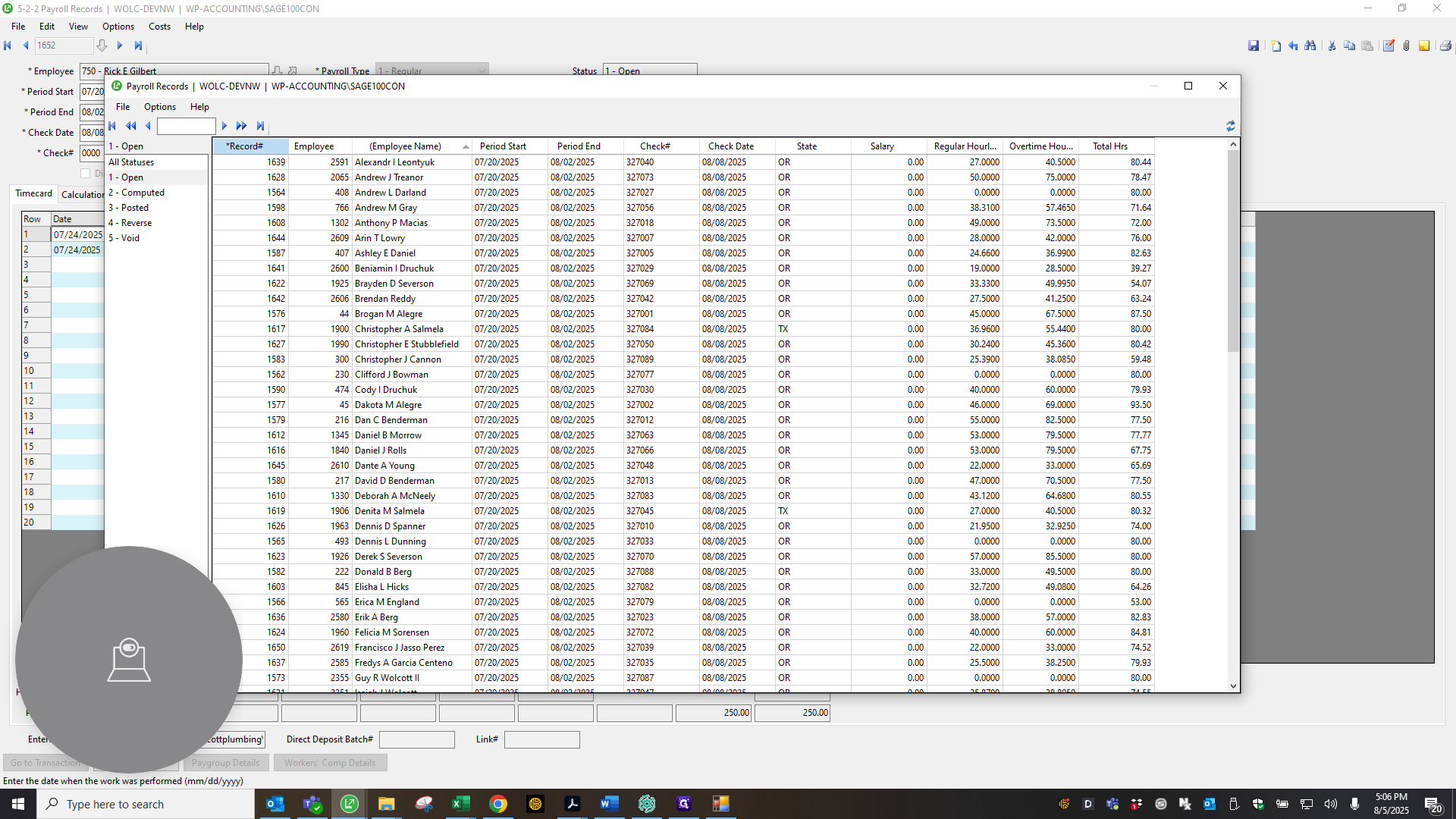

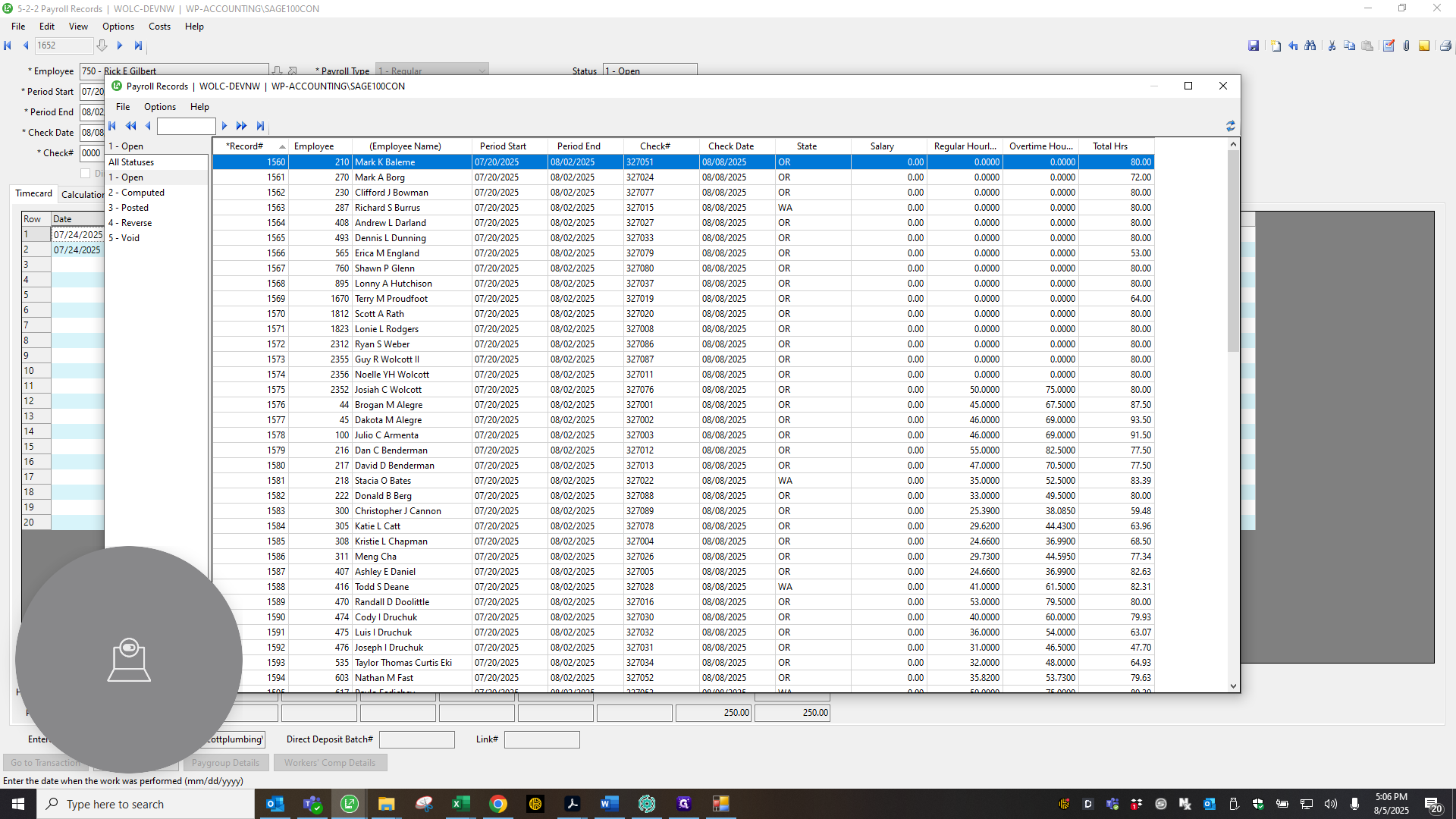

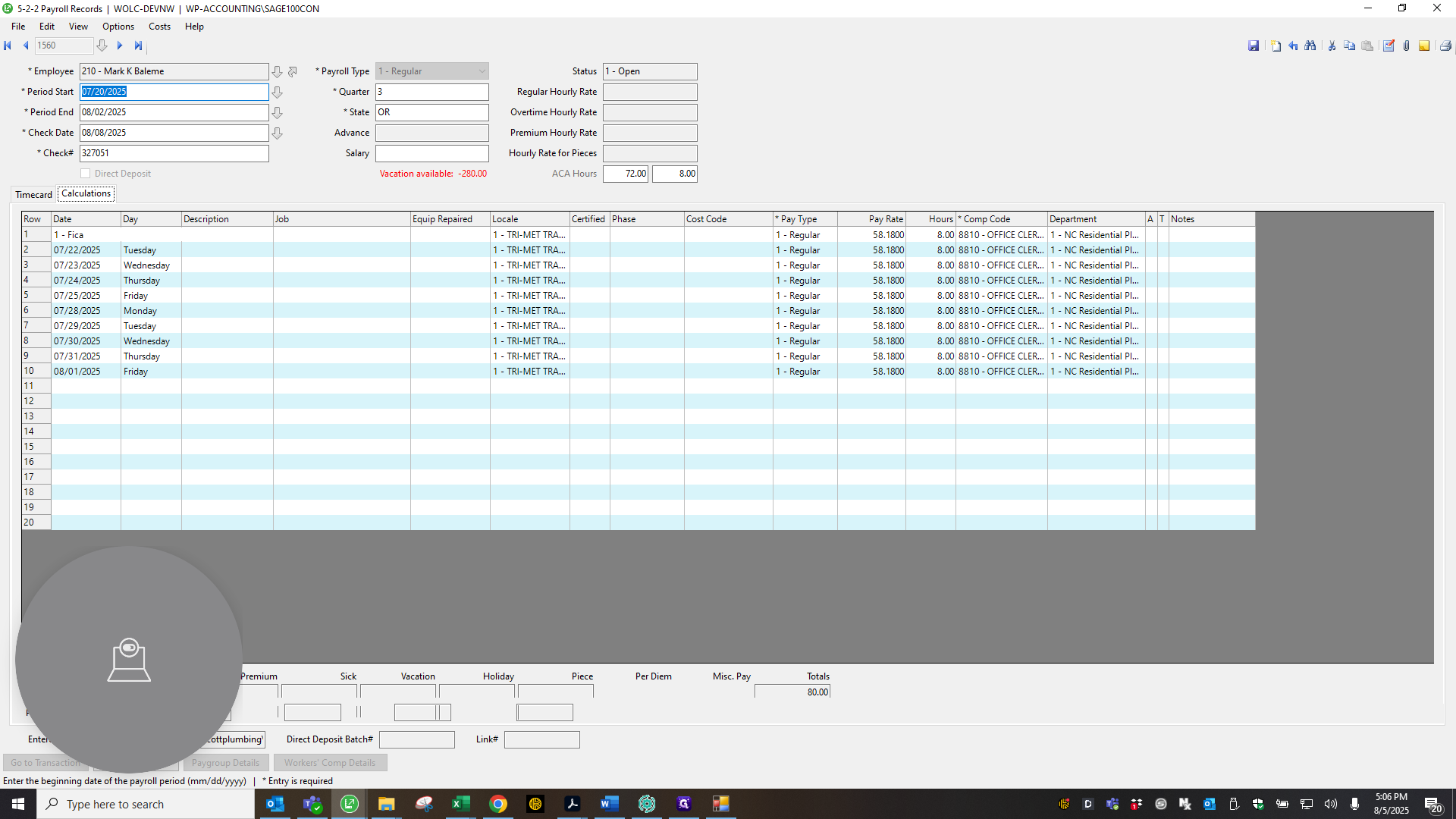

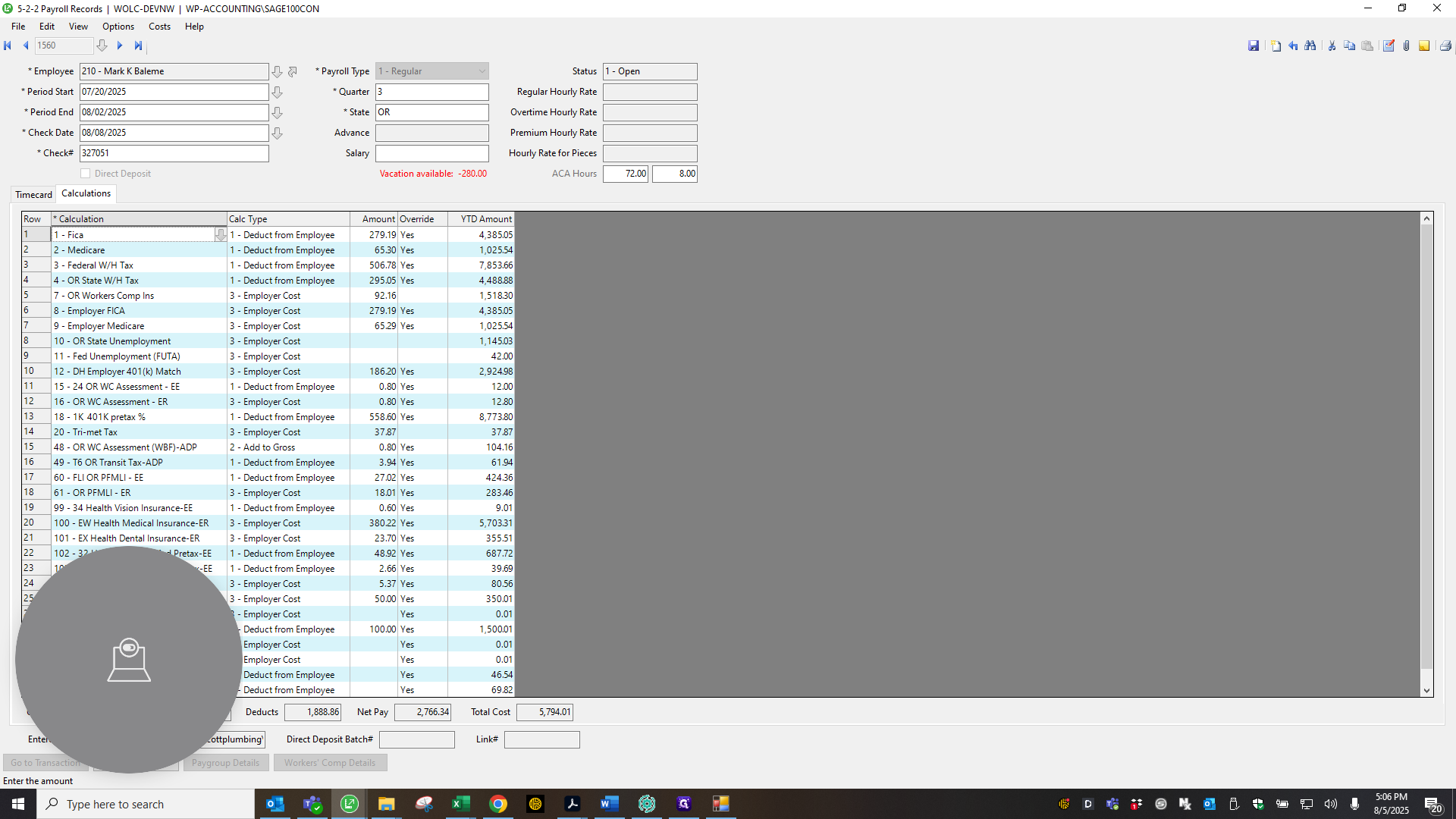

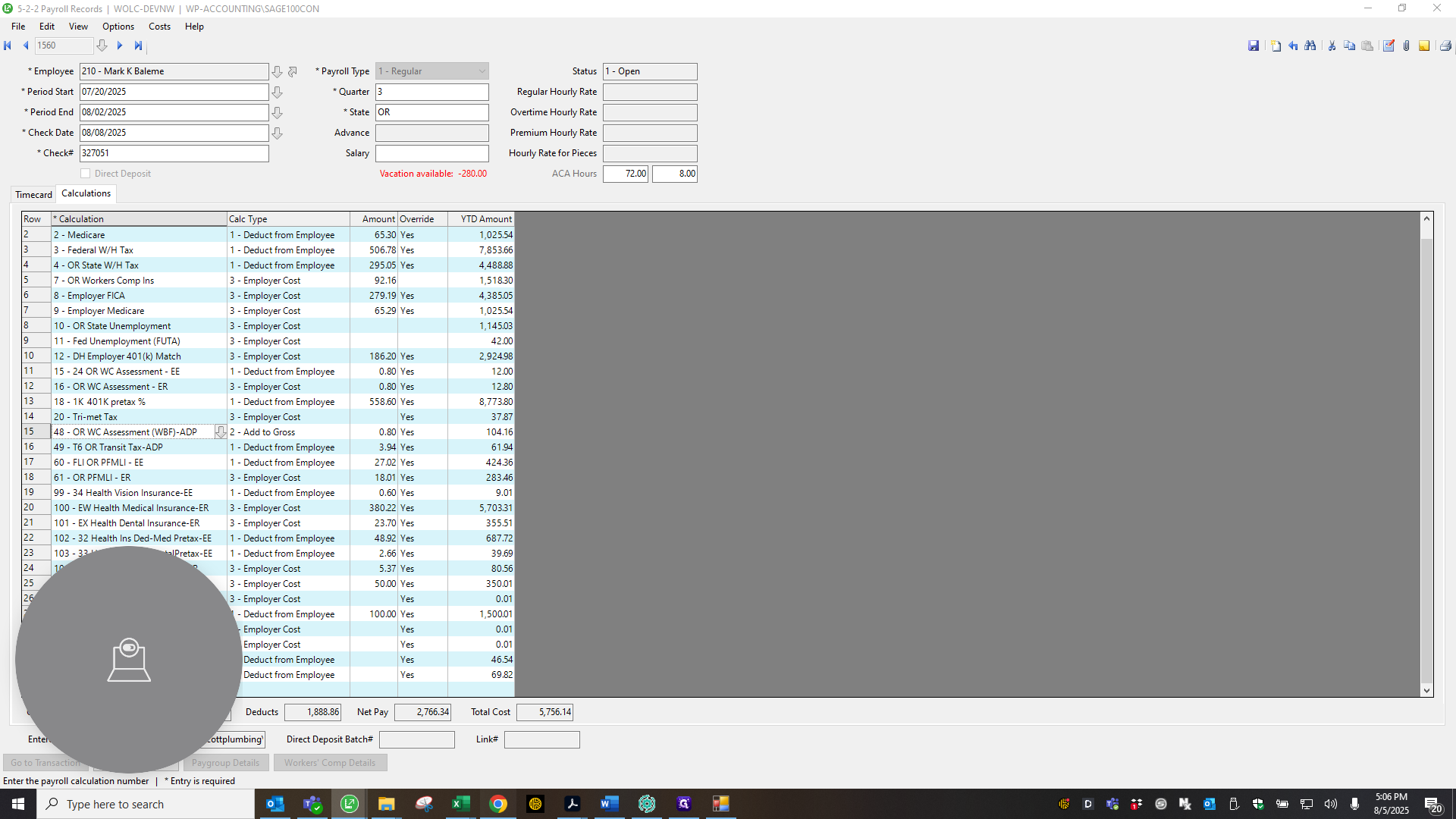

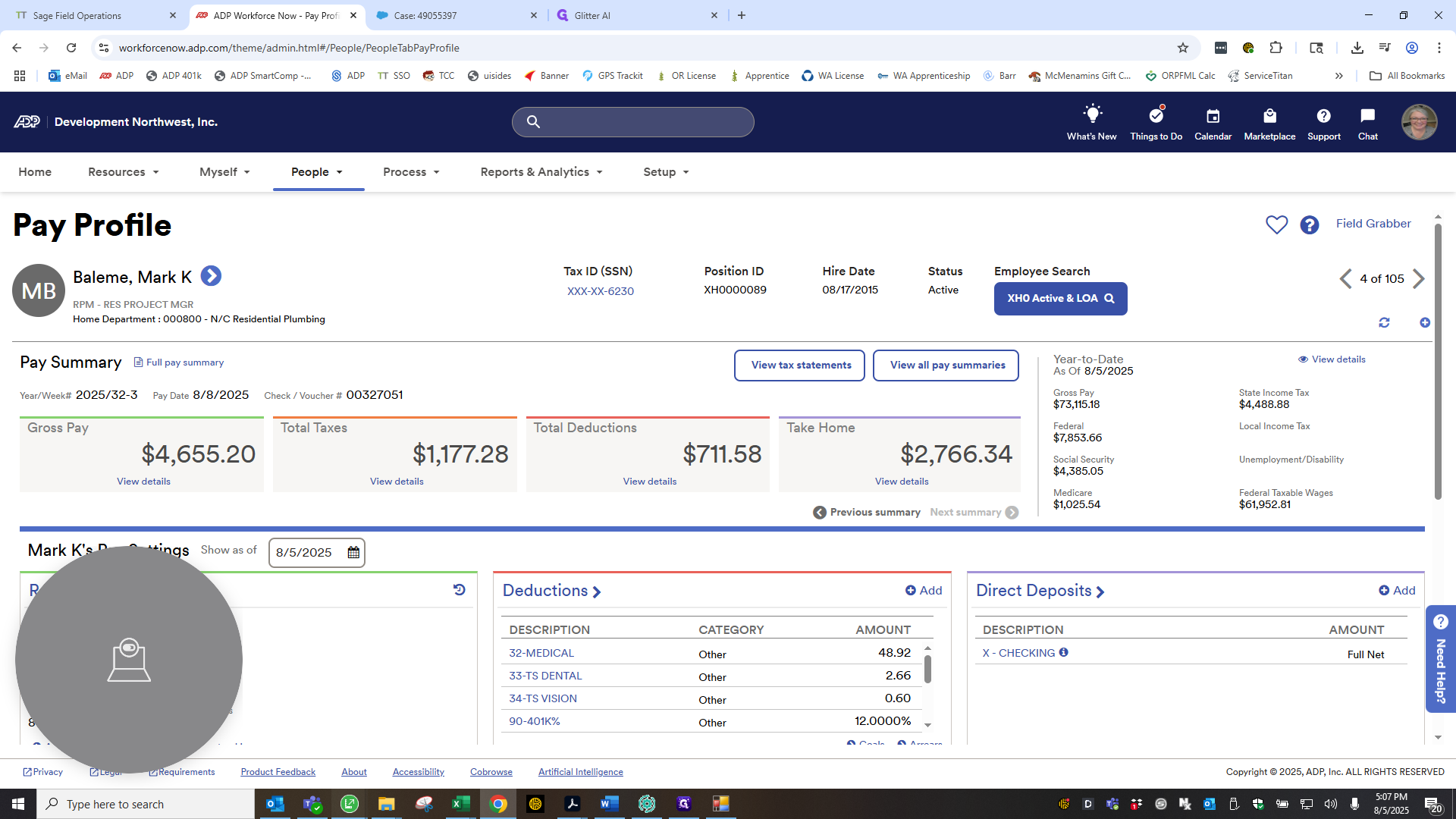

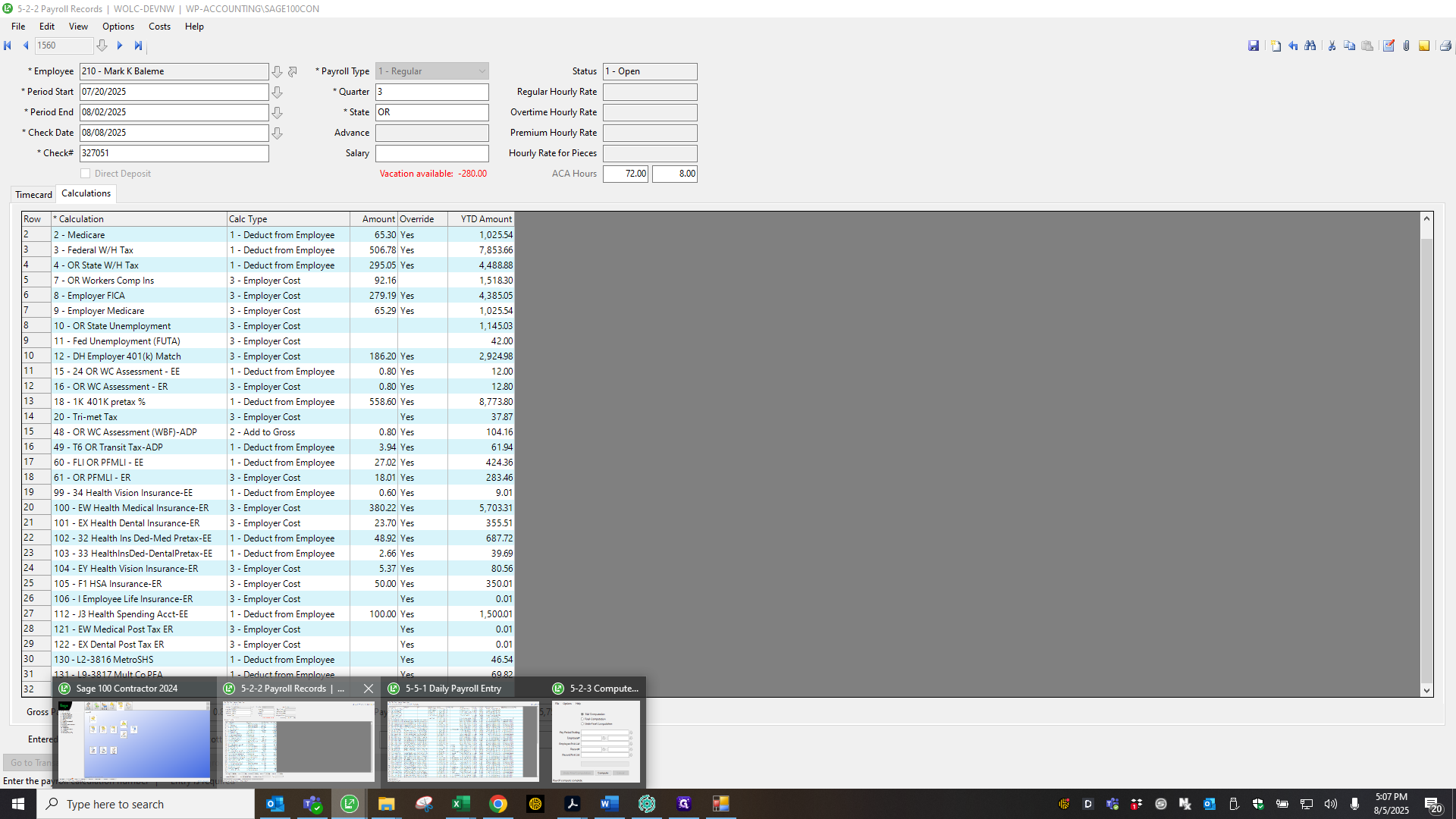

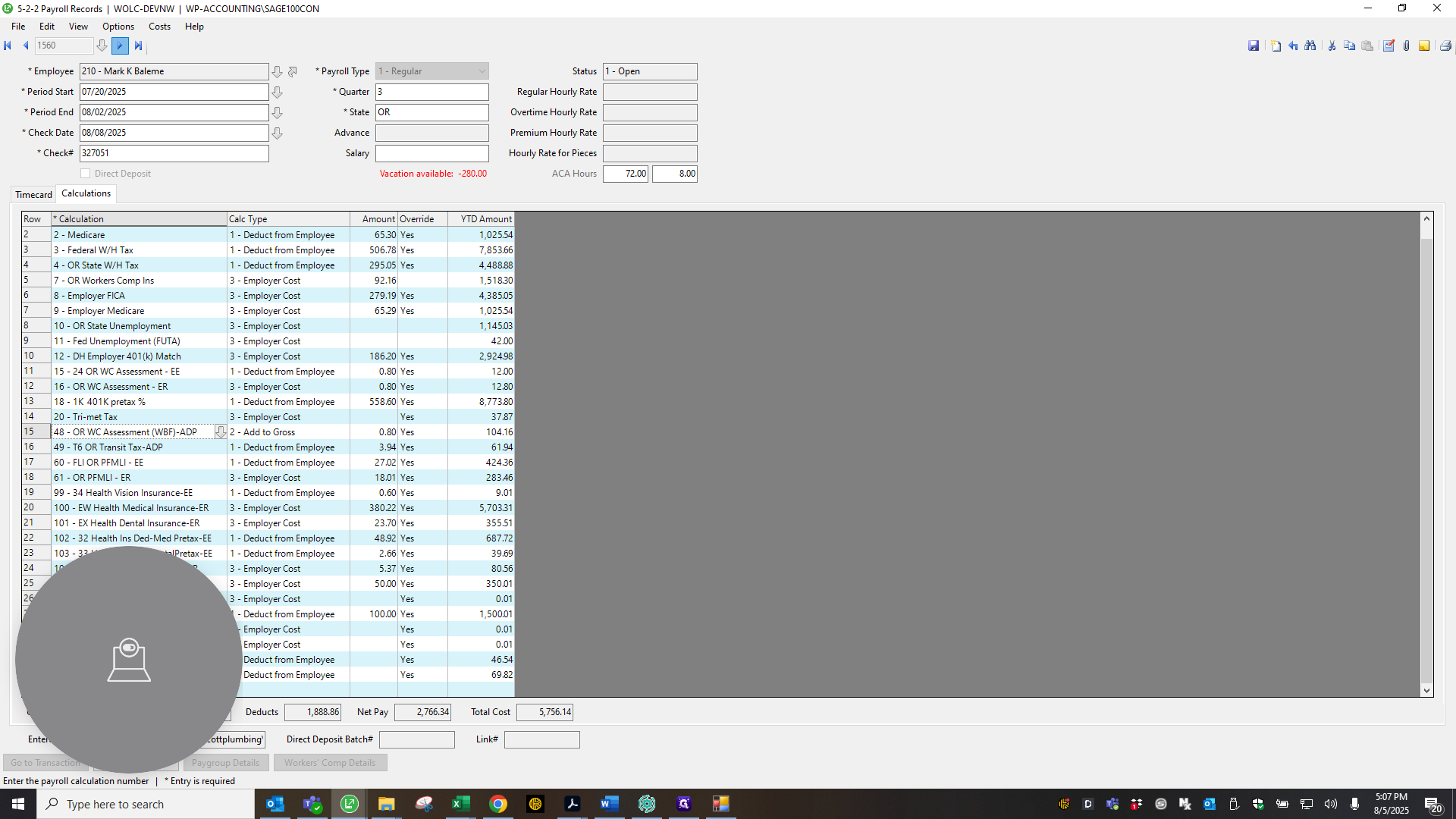

Let's start at the beginning of our records for this payroll. I'll start again with Mark. You'll see that ADP imported everything.

You need to do this one by hand.

We think it's somewhere in Sage, but we can't get it to zero out, so we always have to do that.

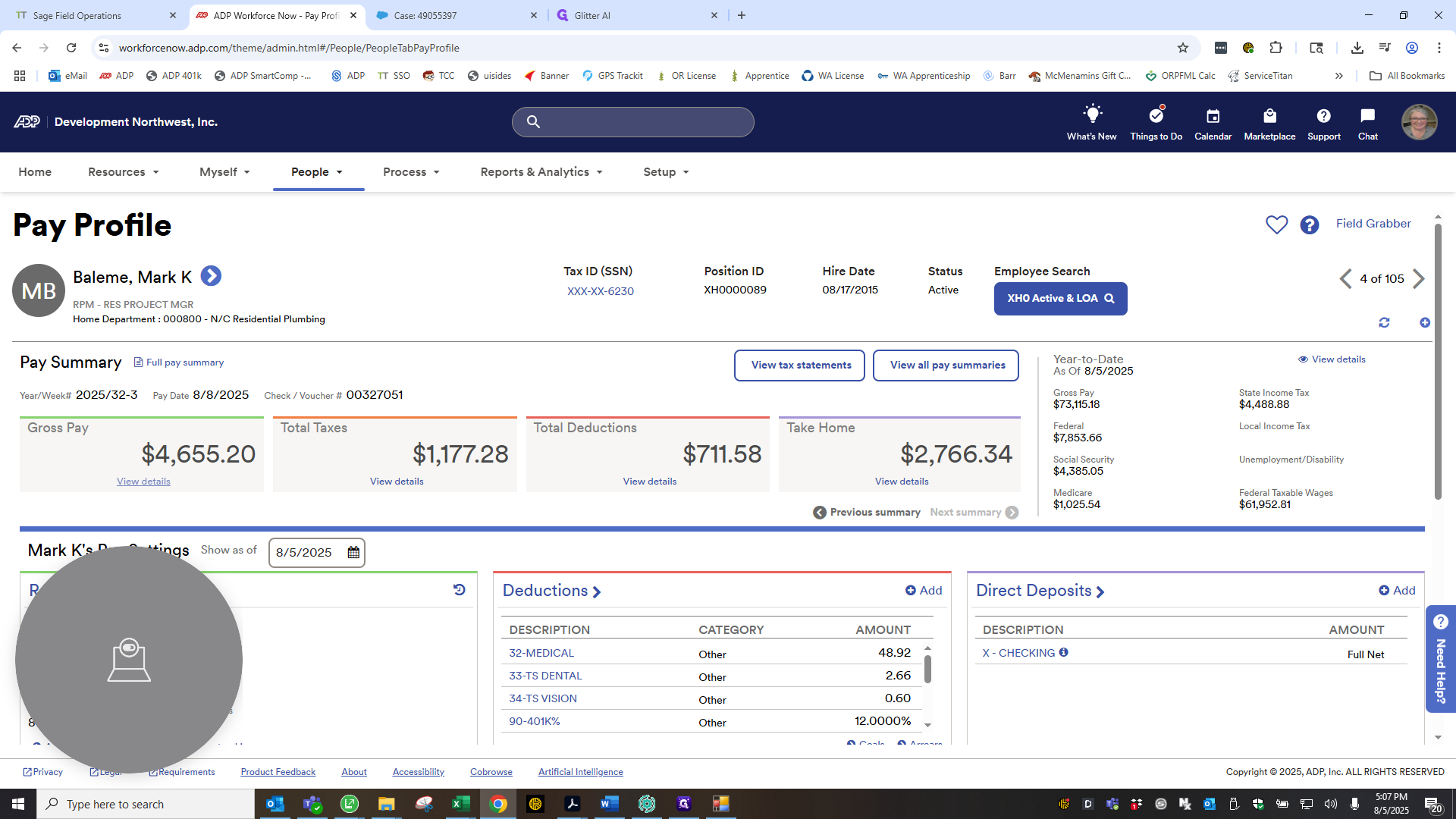

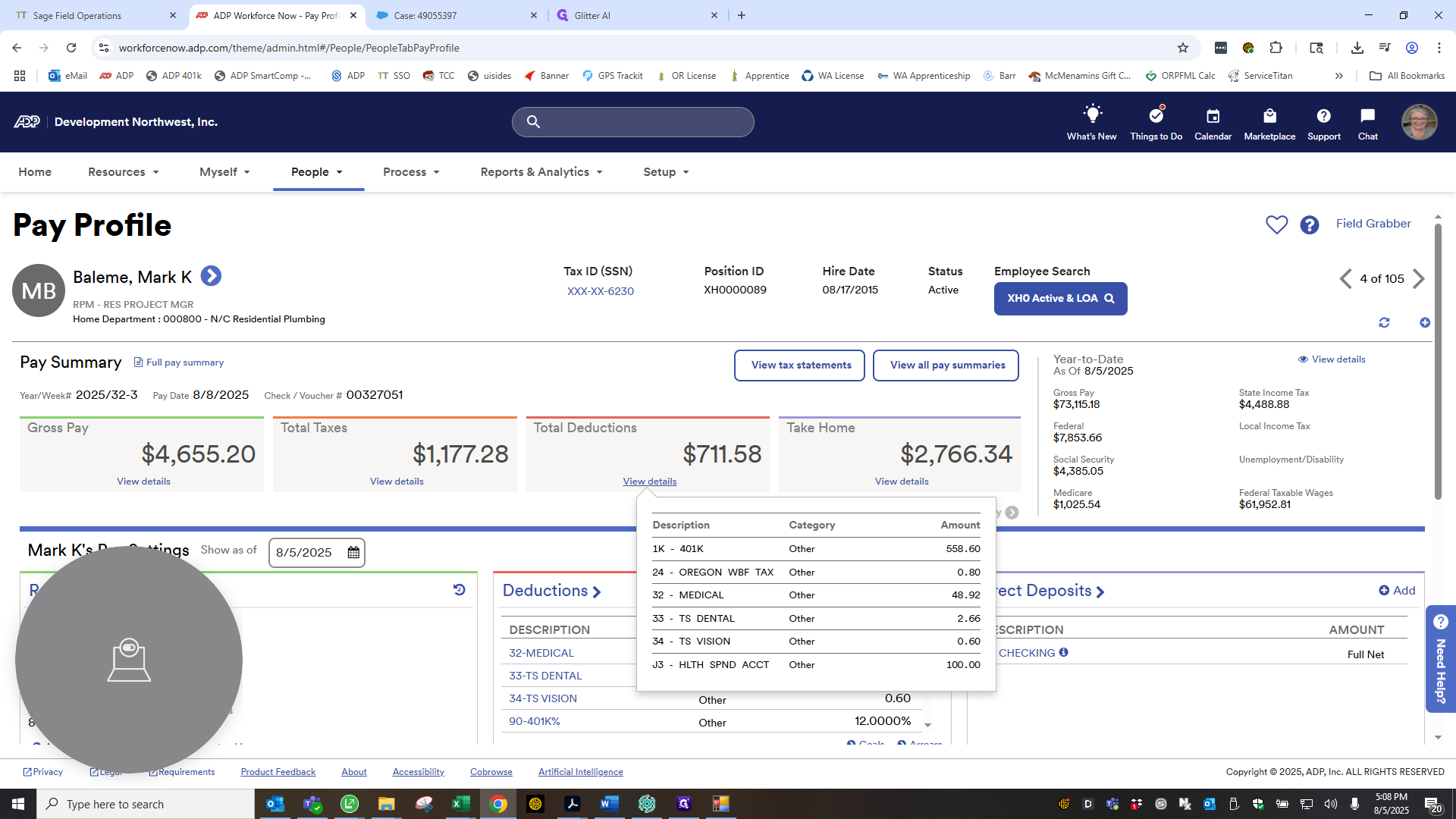

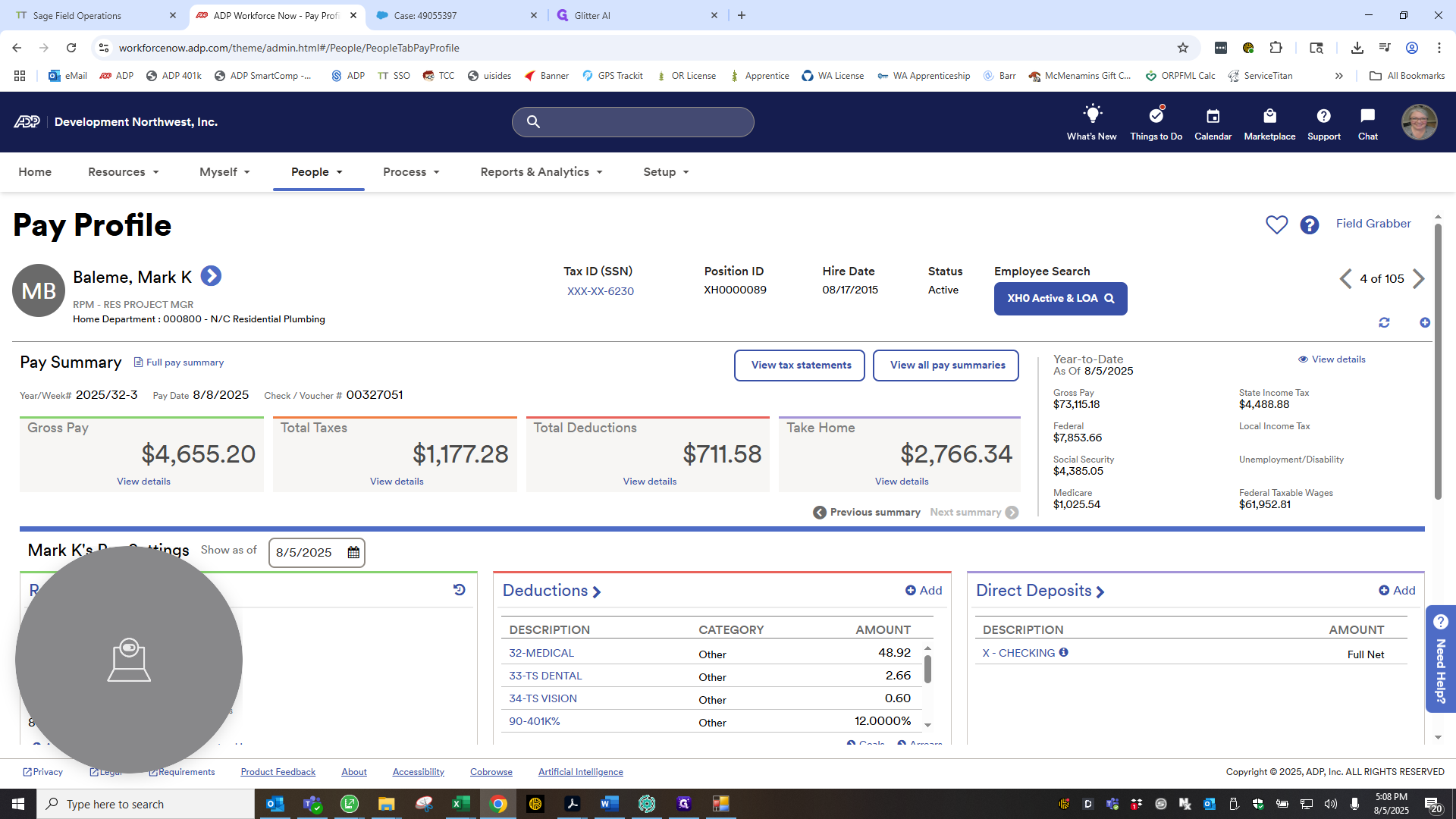

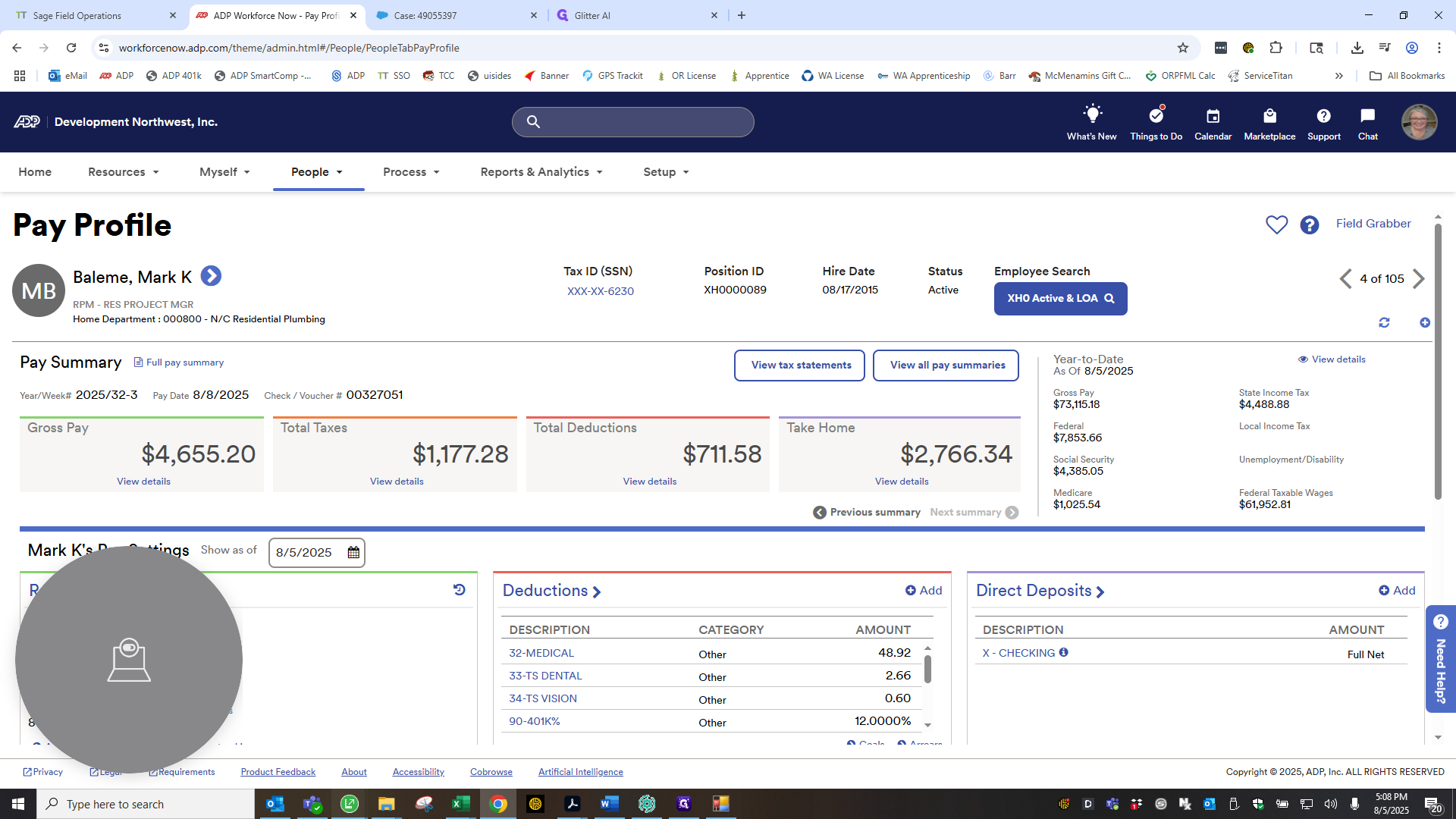

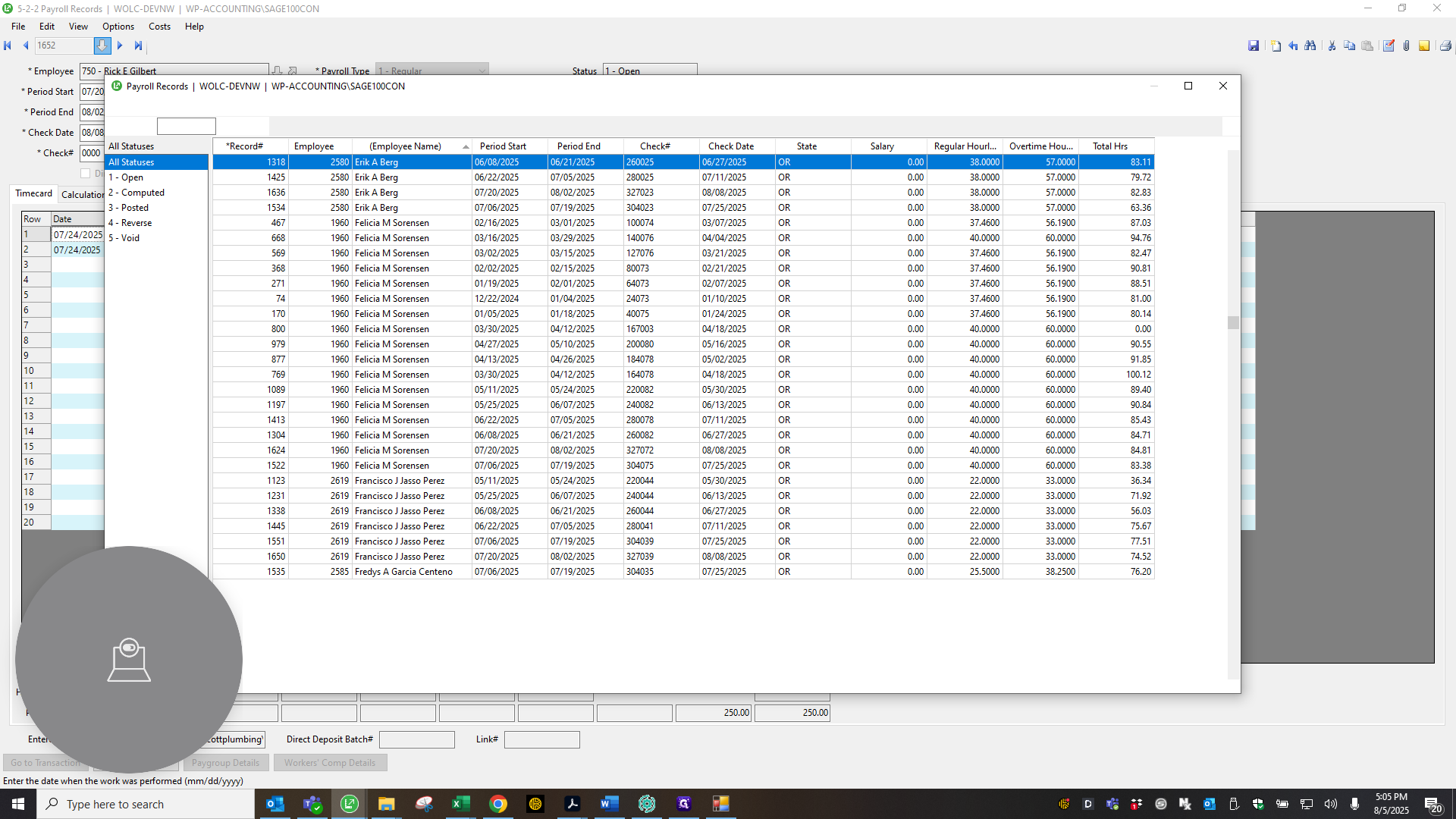

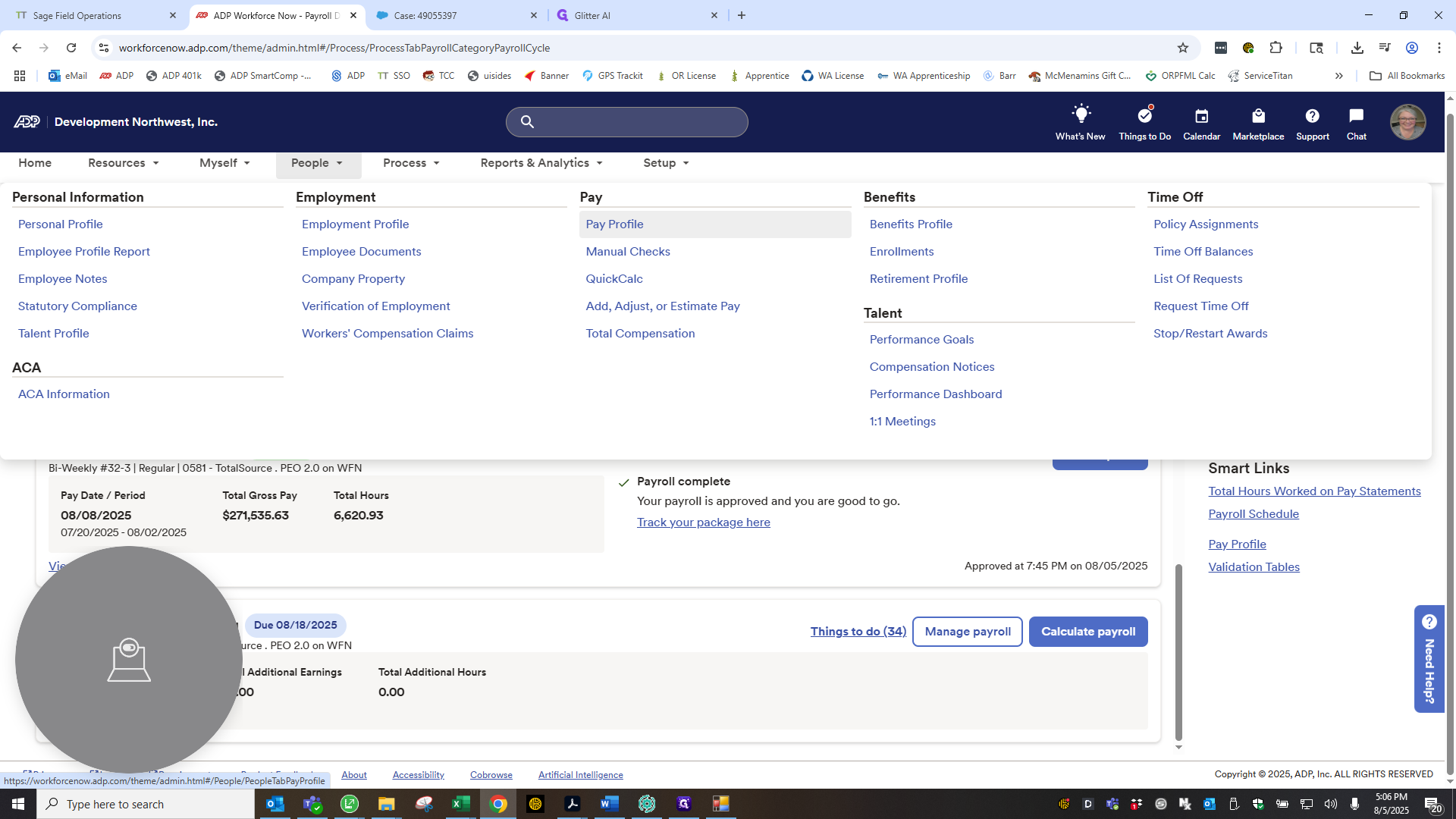

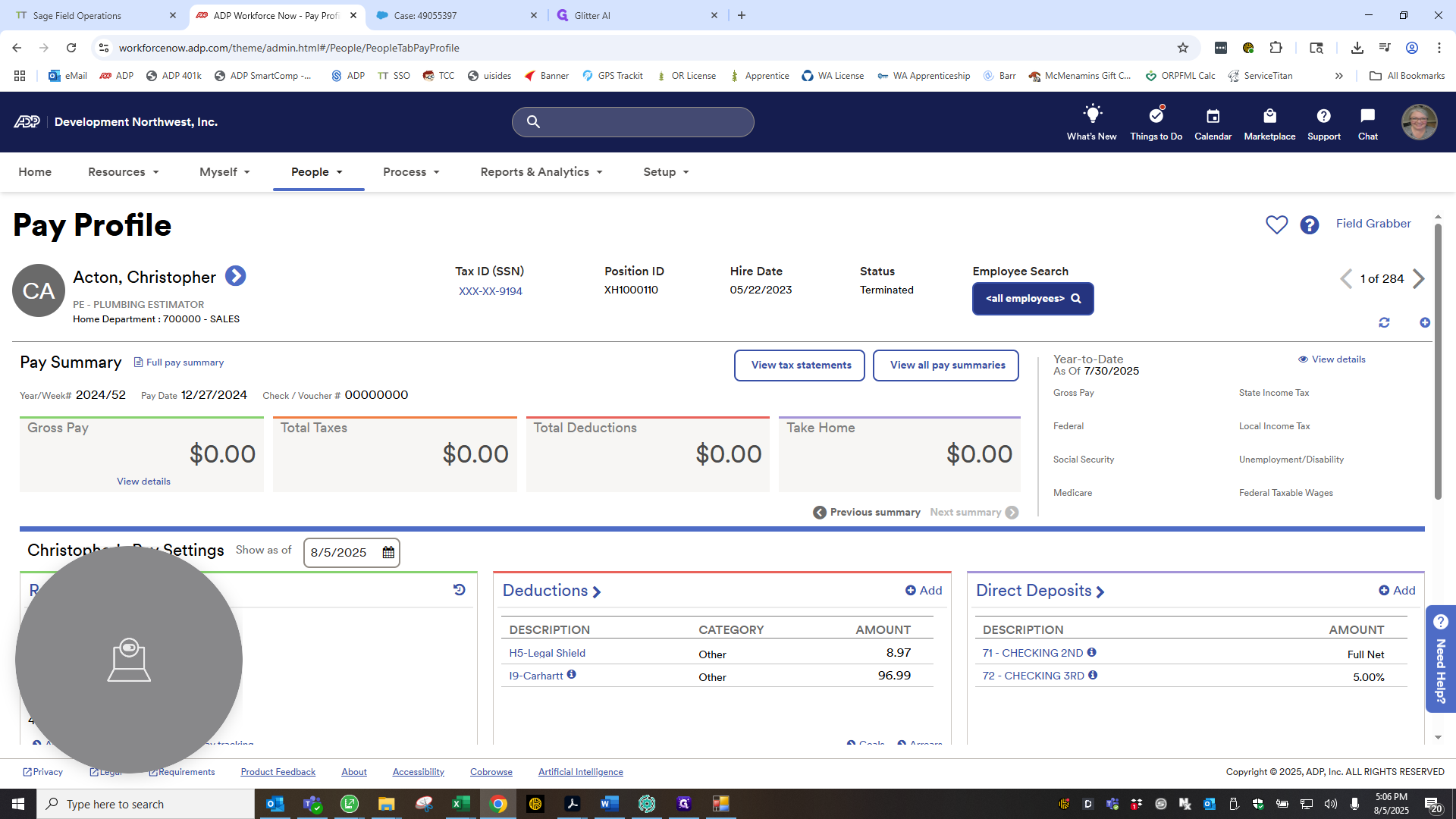

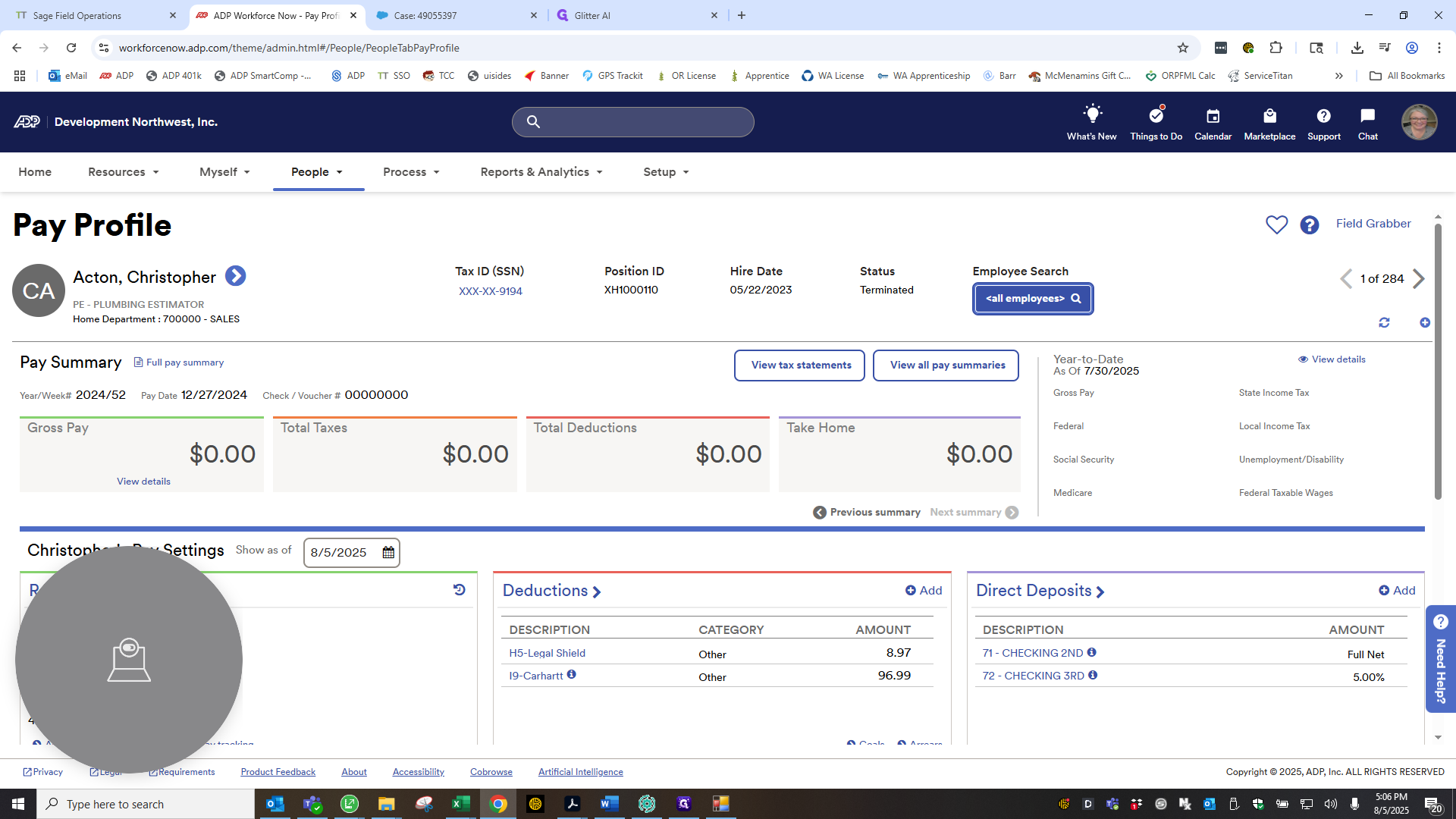

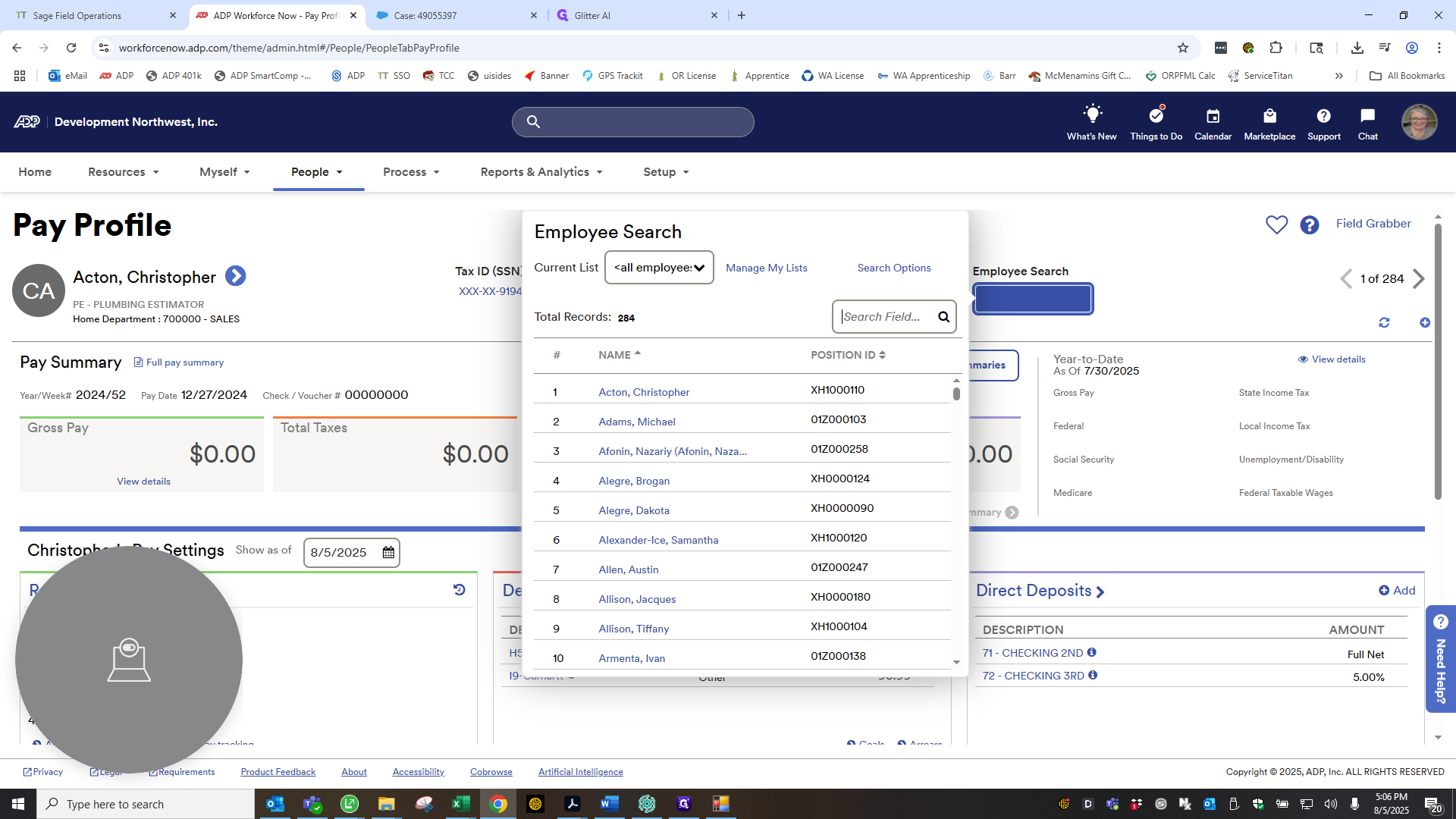

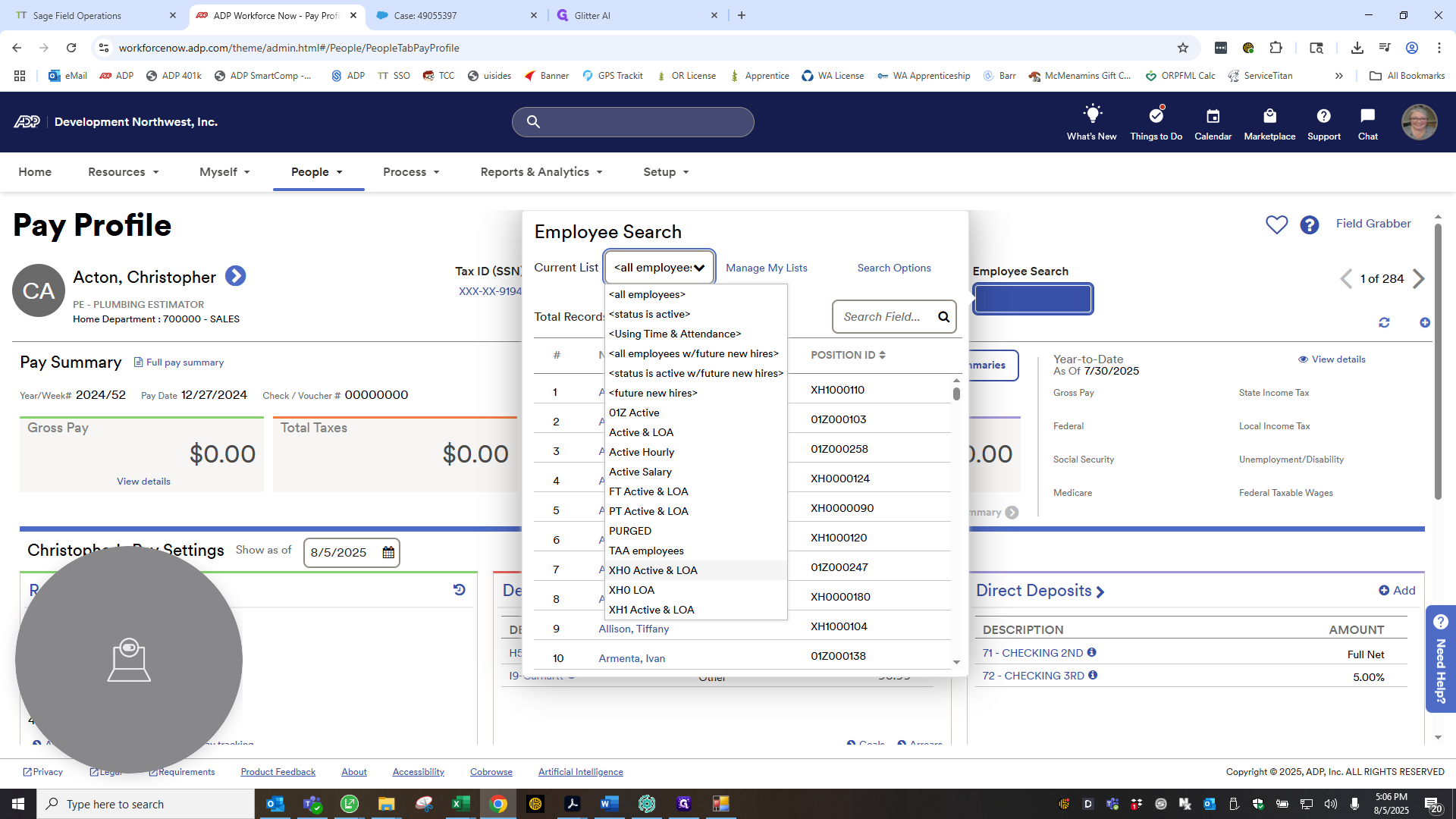

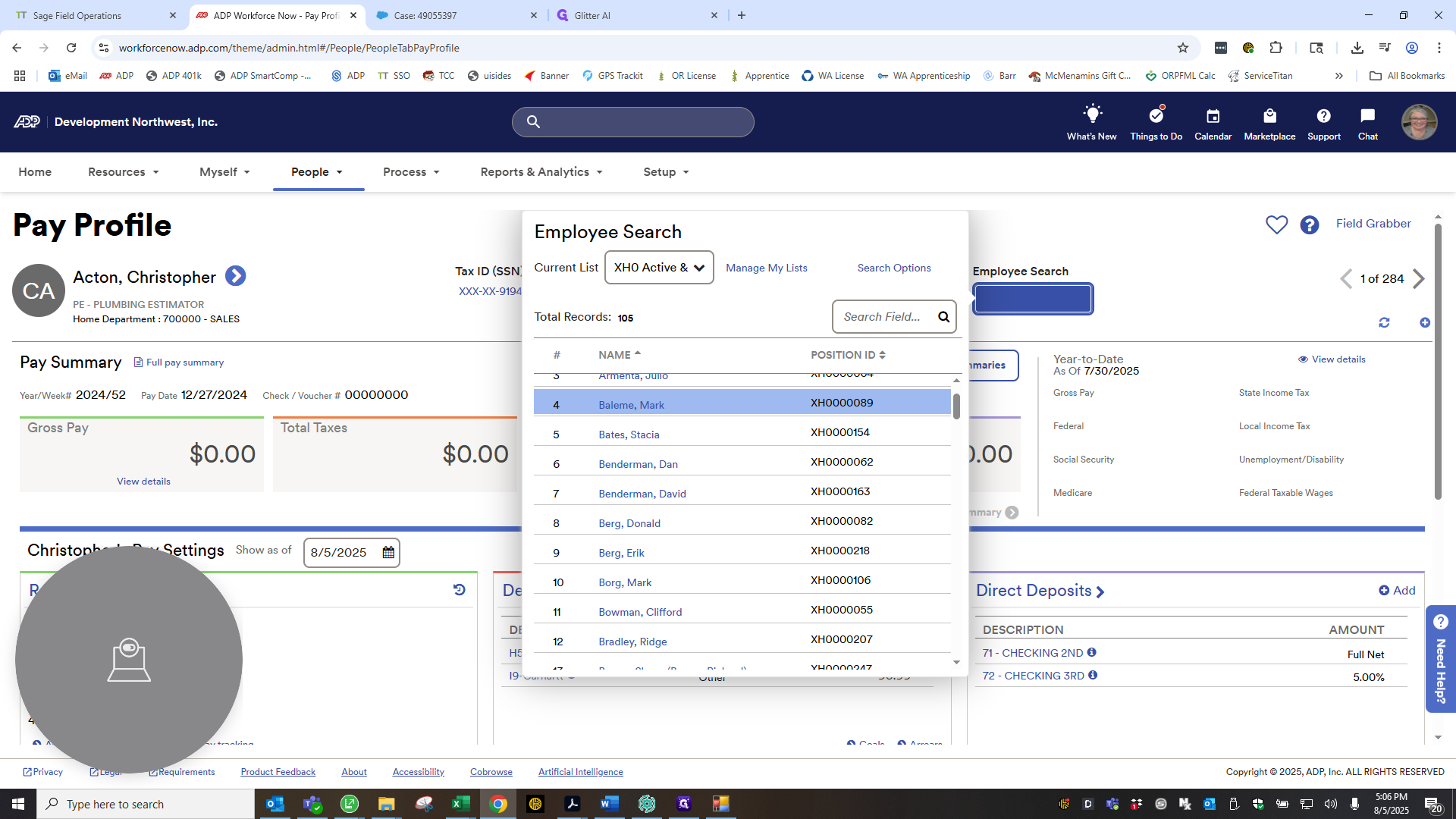

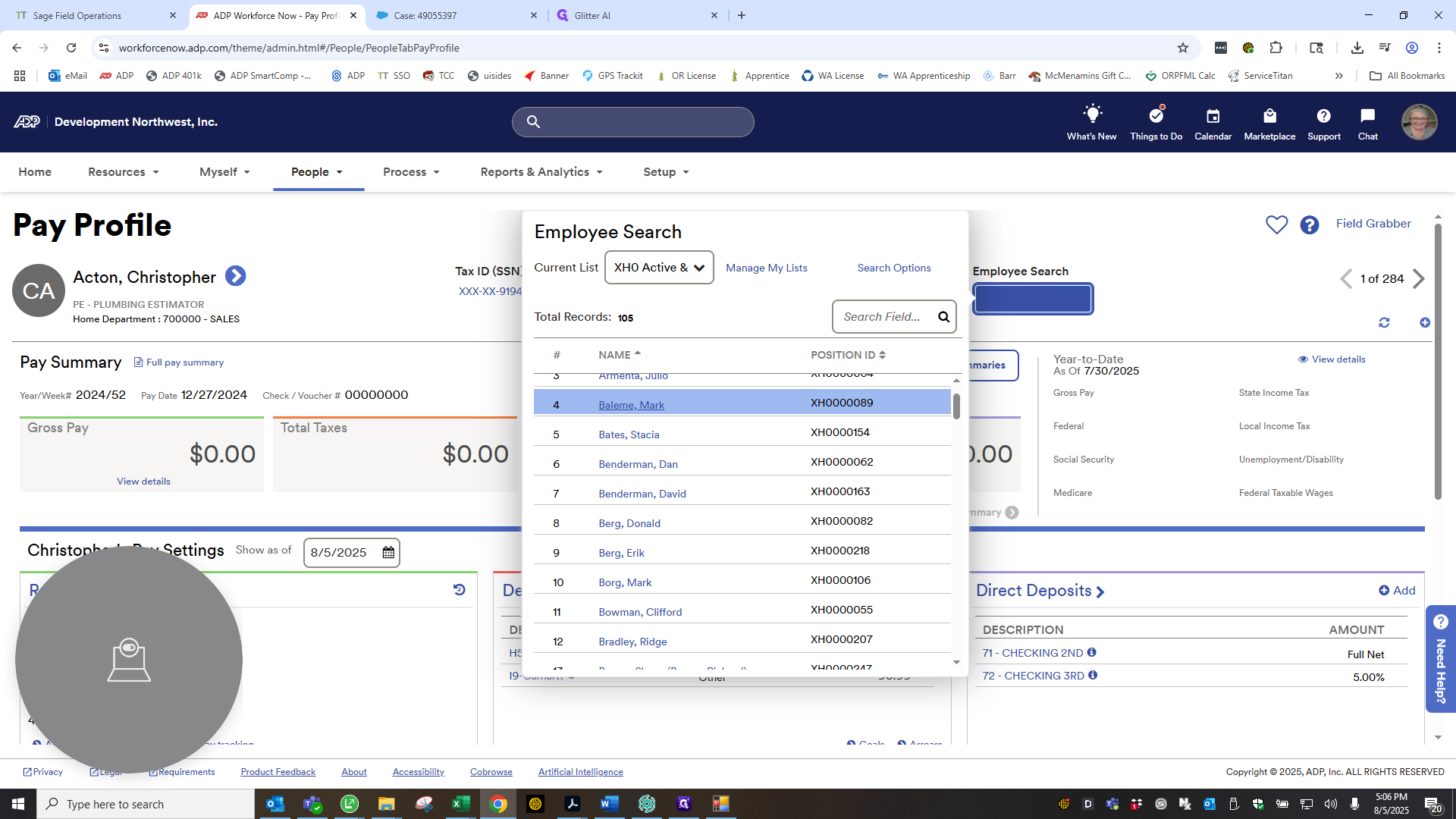

Next, go to ADP and select the list for HX0, active. Find Mark's name and verify that his payroll matches the net amount from Sage to ADP.

It does, so let me move on to the next point.

Go down the line and have everyone verify G1. Clear current attacks, check AP, and ensure the net matches for each person.

If the net doesn't match, check the section showing regular pay, overtime, holiday, or vacation. Make sure these figures match those in Sage.

You can also check here to see if anything is incorrect. Look under deductions to see if anything is missing or needs to be added to Sage.

New deductions may appear or disappear, such as child support or changes in 401K contributions. Home is used to ensure the nets match and the correct codes are entered into the employee's deduction calculations.

After completing those steps, we match the payroll registers from Sage to ADP.

Thank you.