Negotiating the purchase or sale of Loans on the Capstack Technologies Platform: A Step-by-Step Guide

Learn how to negotiate a whole loan purchase or sale on the Capstack Technologies platform, featuring an example of a detailed negotiation between OptimumBank and Bankwell Bank.

In this guide, we'll learn how to conduct a negotiation on the Capstack Technologies platform. We will show the process from the perspective of both the buyer and the seller, focusing on how documents and comments are shared, offers are made, and bids are submitted. This guide will demonstrate the efficiency and transparency of direct negotiations highlighting the tools available for communication and document exchange. By the end, you'll understand how to navigate a negotiation, modify bids and offers, and move to finalize a transaction using the Capstack Technologies platform.

Let's get started

This demo will demonstrate a typical negotiation on the Capstack Technologies platform. We've already discussed how to load loans for sale, find loans to purchase, and request more information, and enter a negotiation in previous tutorials. We will begin at the start of a negotiation, where the selling bank posts documents and comments on the platform for the potential buyer, along with an initial offer price for the loan package.

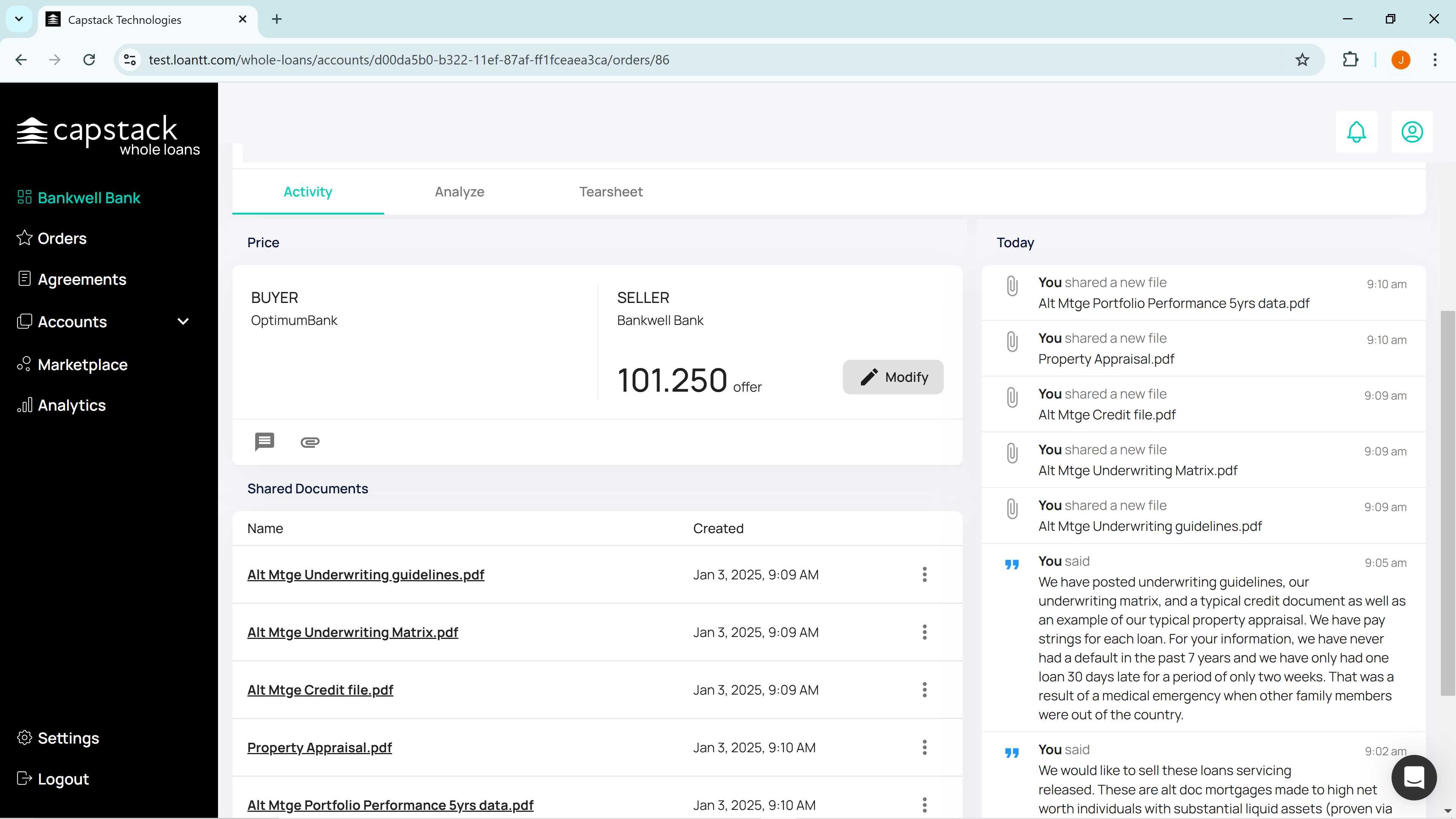

OptimumBank is a potential buyer, and Bankwell Bank is a potential seller. Bankwell Bank has offered these loans at a dollar price of 101.25.

They have also made several comments that are visible in the right hand column.

They have their underwriting guidelines, an underwriting matrix, a credit file, a property appraisal, and a mortgage portfolio performance with five years of data.

Bankwell has offered these loans at a price of 101.25.

They can modify the price by clicking on "modify." At this stage, we'll return to the buyer, OptimumBank.

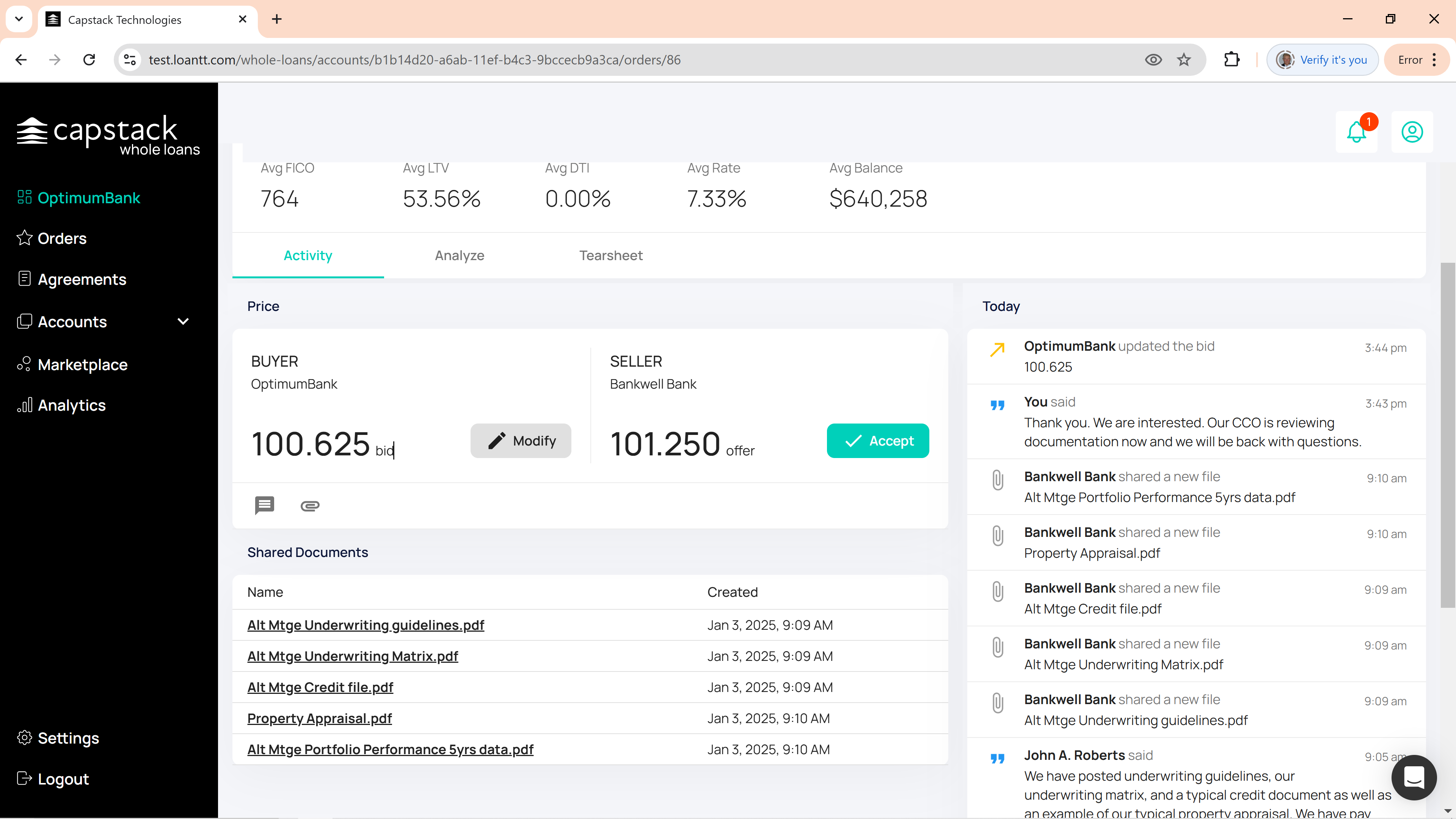

They see the 101.25 offer.

Their chief credit officer for example, can now review these documents. You can also see all the comments posted by Bankwell Bank.

OptimumBank's chief credit officer or another reviewer will examine these documents and may ask questions. It's easy to do this using our message function. Click on "Post Message" and type your message.

Then begin typing your message: "Thank you, we're interested. Our chief credit officer is reviewing the documentation now, and we will get back to you with any questions."

All keystrokes are permanently recorded during any negotiation. This process is much faster and more efficient than sending emails back and forth where file size limits may prevent emails from going through. We can handle files up to 100 MB on the system, making it easy to post documents, ask questions, and provide answers. After reviewing the files, Optimum Bank is interested in purchasing these loans. They click "Submit Bid,"

Now we have a two-way market between OptimumBank and Bankwell Bank, with a 100.625 bid versus a 101.25 offer. It's important to understand that Optimum Bank and Bankwell Bank are negotiating directly with each other openly and transparently. This is a private negotiation that no one else sees or hears about.

There's no middleman creating inefficiencies in the market. There is complete transparency. Both parties have signed our "Terms of Service". They would not have been able to negotiate otherwise. The system requires signing the terms of service before entering negotiations. This agreement acts as a multilateral NDA, protecting all counterparties and Capstack Technologies.

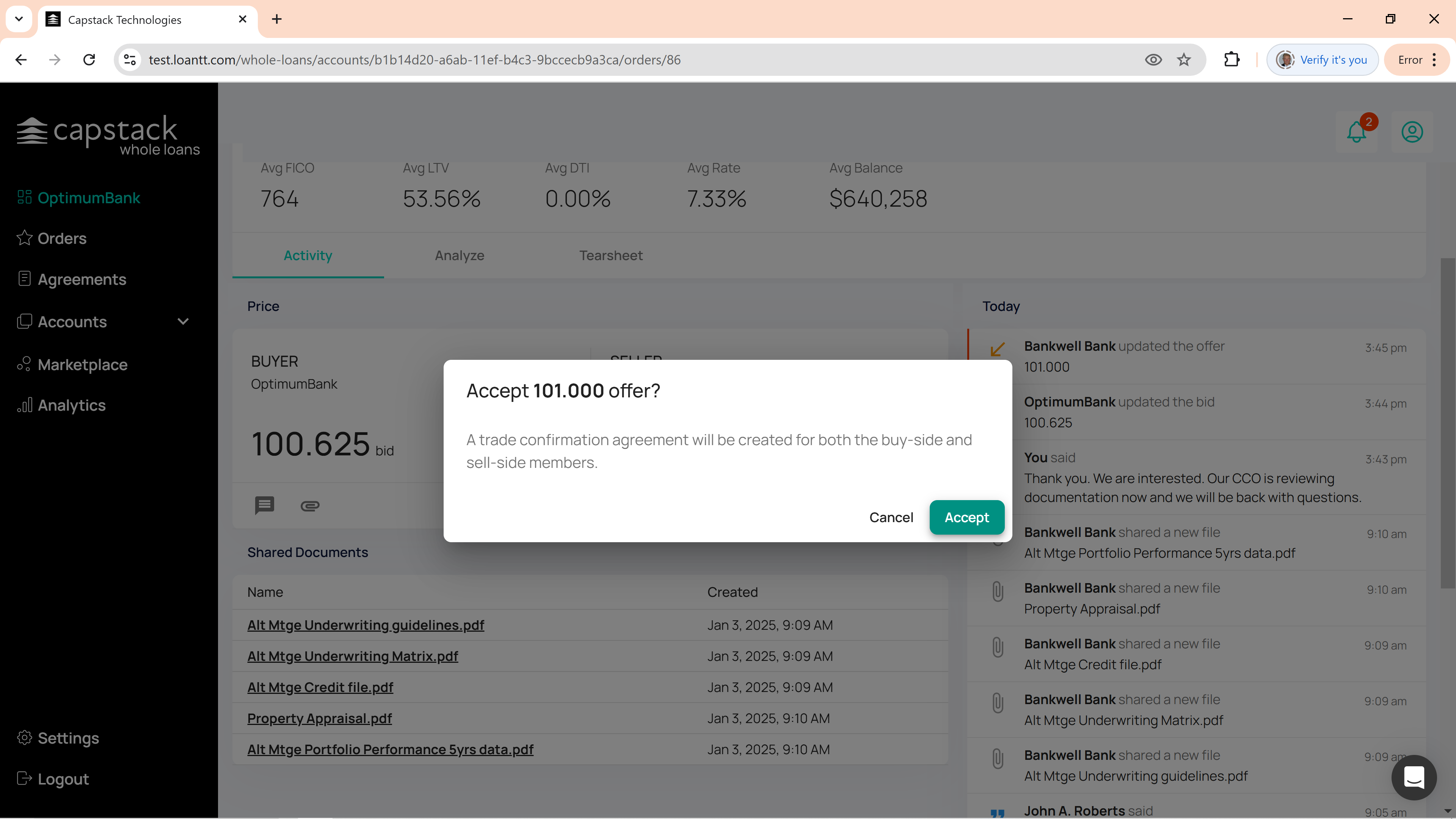

We can return to Bankwell Bank, and they might, for example, lower their price to, say, 101 and submit that.

Now we have 100.625 bidding at 101, so we're getting really close.

We're just three-eighths of a point away from a trade taking place.

Optimum Bank might change their bid or decide to buy the loans at 101. They would click "accept" twice. At this stage, we generate the LOI and the trade confirmation, which are sent via DocuSign to both counterparties and to us at Capstack. That's how you negotiate on the Capstack Technologies platform.

At this stage the LOI or Trade Confirmation is sent to both counterparties as well as to Capstack Technologies via docusign. As you know, "done" in a whole loan trade means done subject to due diligence.

The amazing thing here is that using the Capstack Technologies platform, the due diligence process actually becomes a confirmation process rather than an exploratory process. The hard work has already been done; files reviewed, performance confirmed and questions asked and answered. The process is efficient and transparent.

Once the due diligence is complete, the master purchase agreement is executed, money and assets change hands, and that is where we collect our 25 bps transaction fee to both counterparties.

Often first time buyers may say, " The seller always pays the transaction fee", and that is true in the broker world. But, more often than not, the seller may have sold at 99 and the buyer may have paid 101. The buyer is much better off paying 25 bps for an all in price of 99.25 than paying 101.

We would be happy to provide a full demo on request. Please call or email with any questions.