Step 2 - Setting Up UBOs and Managing Assets and Liabilities

A comprehensive guide on setting up unique beneficiary owners (UBOs), adding assets and liabilities, and understanding the metrics of asset appreciation and indirect liquidity.

Next, we'll learn how to efficiently manage the details of UBOs (unique beneficiary owners) and assets within an estate planning tool. By following simple steps, you can accurately input UBO information, such as family members, trusts & companies, and tailor the level of detail based on client preferences. Subsequently, we'll delve into adding assets such as financial (equities) or non-financial (real estate), specifying the economic and legal exposure, and determining asset appreciation rates and liquidity metrics. This comprehensive approach ensures a thorough representation of assets and liabilities, catering to varying client needs. Let's get started.

1. Adding UBOs and Managing Details

Once the profile details are set up, we will add the list of UBOs, which are the unique beneficiary owners. This list includes all individuals who own or represent holdings of assets within your estate. To begin, click the Add button and enter a name.

Add as many UBOs as required. It is first recommended to create the primary client as a UBO. Example if, the client account is "Tom Joris" the first UBO would be "Tom Joris". This is important for asset allocation ownership per UBO on the Asset & Liability identity card details.

The list of UBOs can be specific, like the exact name of the beneficial owner, or as vague as needed for client anonymity. Next, we will add the list of assets and liabilities. Let's begin by clicking to add an asset.

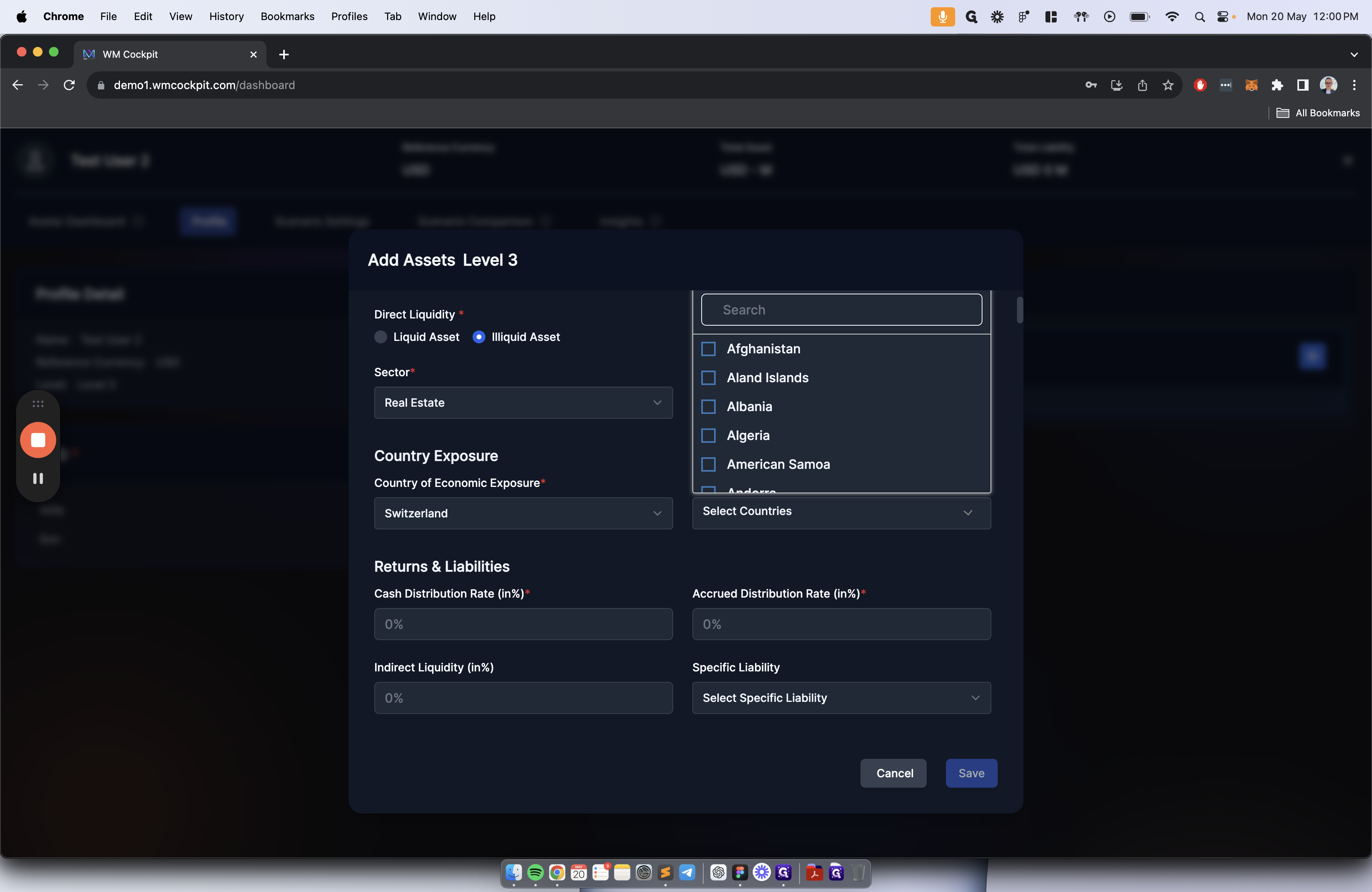

And now, we have the asset identity card, containing all the essential information for adding a specific asset, which we will use later. Let's add a non-financial asset such as a ski chalet in this example.

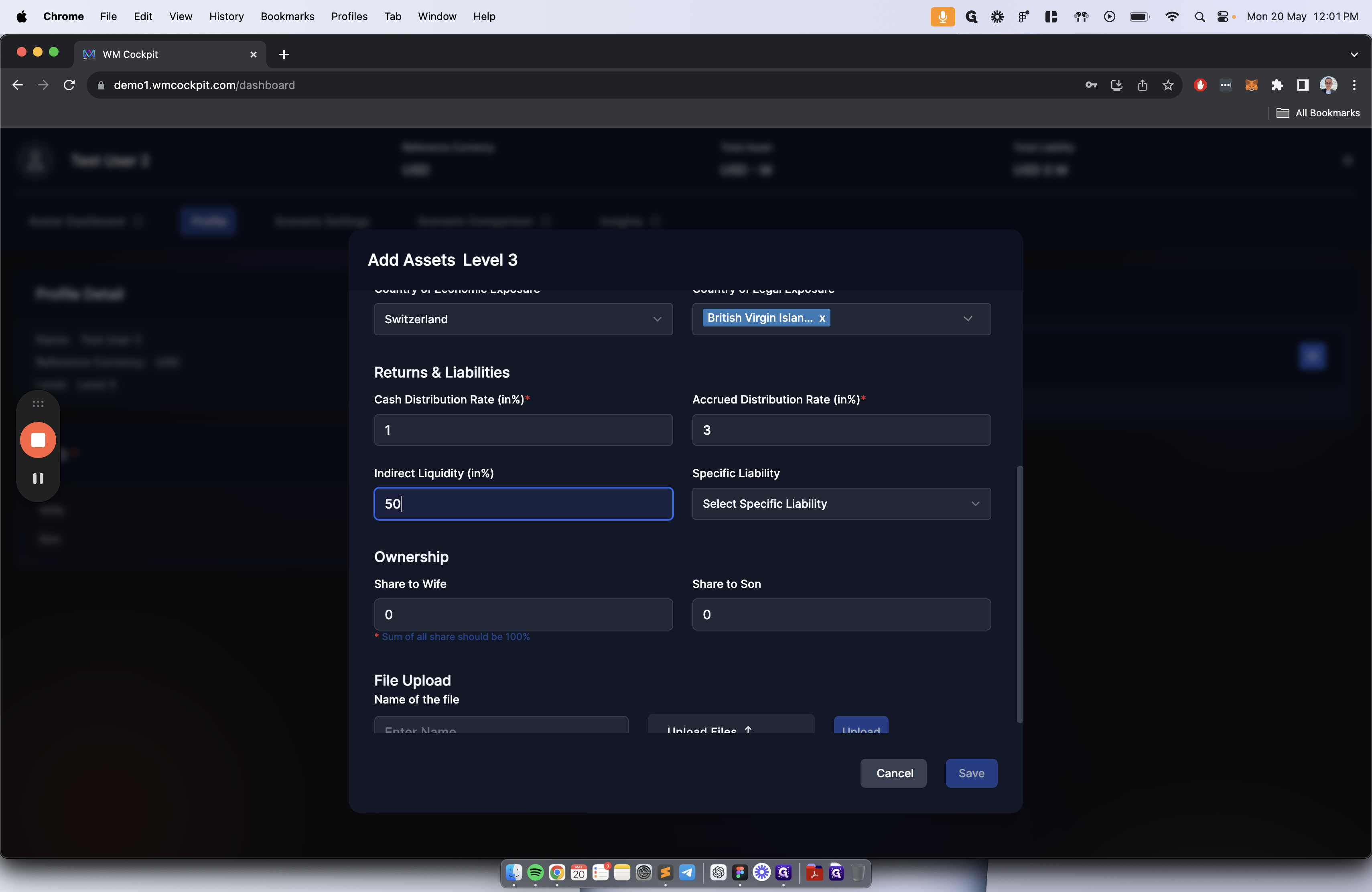

We will then select the country of legal exposure. Is this country held through a trust, through a charitable organization, or through a company registered in a different country? In this case, this asset is held through a British Virgin Islands Trust.

In this case, based on the data we have, we assume that this asset will appreciate by 3% year-over-year.

Indirect liquidity % of an asset like a house refers to the ease and speed with which the asset can be converted into cash or cash equivalents through alternative means other than a straightforward sale. For example, a home equity loan or line of credit. These financial products allow homeowners to borrow against the equity they have built up in their home. Later, this helps identify the clients potential liquidity profile.

Note: Indirect Liquidity (in%) not available if the "Direct Liquidity" is set to "Liquid Asset"

Selecting a Specific Liability

Next to the "Asset" column input section, there is a "Liability" section which can also be populated. This could include, mortgages on properties, margin loans on stock portfolios or any form of leveraged lending. The details are filled out the same with 1 difference - > "Cost of Dept %". In a mortgage context, the "Cost of debt %" typically refers to the interest rate that the borrower agrees to pay on the mortgage loan. It represents the effective cost to the borrower for utilizing the loaned funds and is crucial for calculating the overall expense of the debt over its term.

If you have a Liability related to an asset, you can assign this specific liability in this section.

Finally, File Uploads. If you have notary deeds, portfolio PDFs, Insurance documents or more, you can add these to the asset identity card for future reference and file storage purposes.

"

Click "Save" to complete the process

Repeat the process for all assets that you want to track. This can be as granular or as anonymous as you seem fit.