Simplifying Loan Servicing and Payment Records

Learn how to simplify loan servicing and payment records by breaking down principal and interest payments, and understanding participation percentages for originating and participating banks.

In this guide, I suggest how to streamline loan servicing and payment records to enhance functionality and client usability. The focus will be on simplifying the process by consolidating borrower payment information and clearly detailing the retained amounts by originating and participating institutions. I show how we might present a summary of loan details, including principal and interest payments, servicing fees, and outstanding balances. This approach aims to reduce the need for our clients to use a calculator and transfer amounts to the appropirate fields in the servicing module. The aim is to make the servicing module more efficient and easier to use for our clients.

Let's get started

We may need to make some changes to our servicing or payment records to simplify them for our clients. Currently, we only request the total borrower payment instead of separating it into principal and interest payments.

We need the retained percent of the loan balance for the originating institution. However, we currently do not display the percentage of participation kept by the originating institution, nor do we show the percentage of the participation participated out to the participant(s)

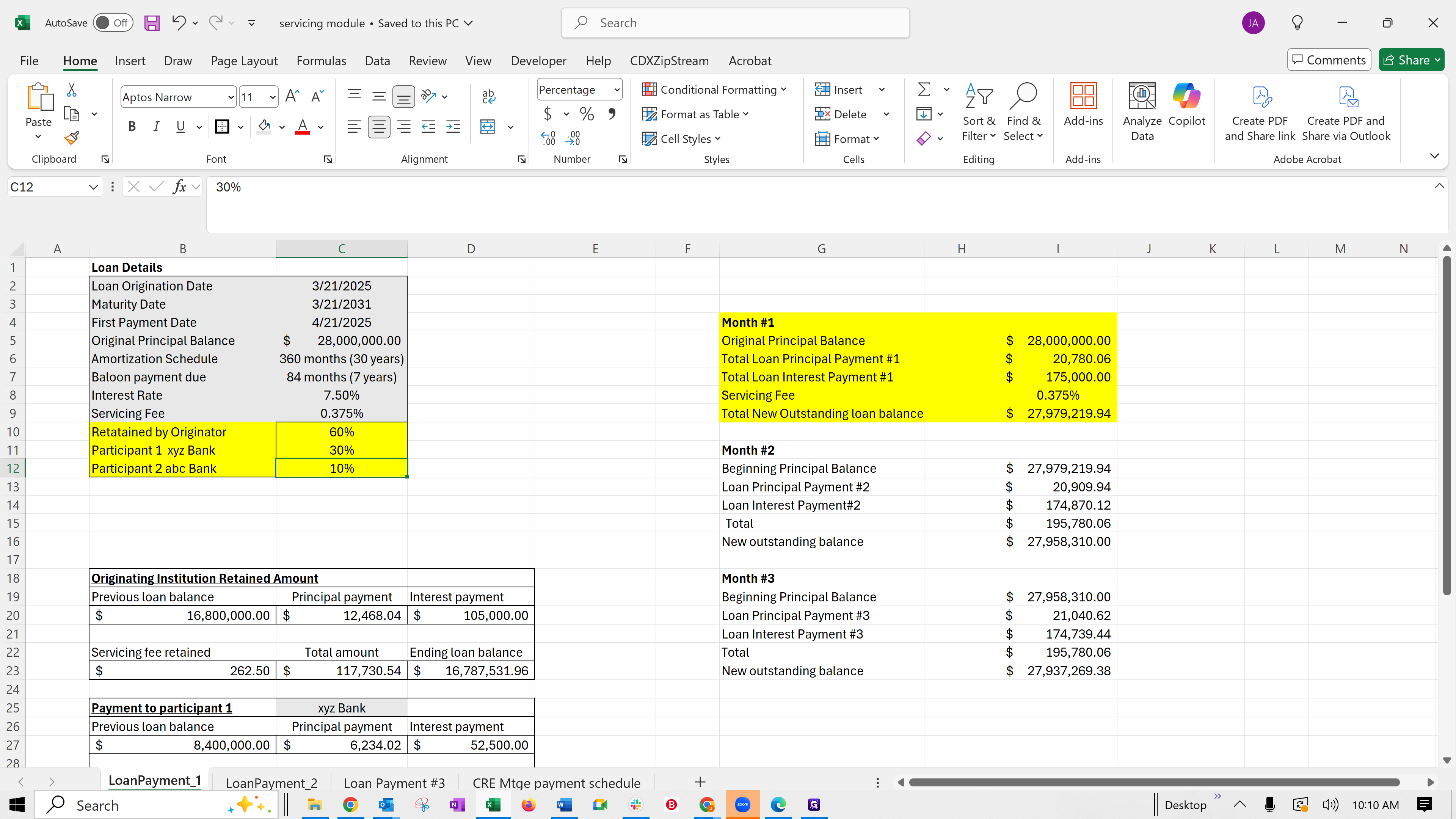

I suggest using a user friendly format with a brief summary of the loan details. In this case, I have included two participants, xyz Bank and abc Bank. xyz Bank has a 30% participation and abc Bank has a 10% participation while the originating bank keeps 60% of the loan.

The originator retains 60%. Participant one, XYZ Bank, retains 30%. Participant two, ABC Bank, retains 10%.

Here, we have the original principal balance. I've also shown the original principal payment, the interest payment, the servicing fee, and the new outstanding balance after the principal payment.

Next, I calculate the actual 60% participation of the principal payment for the institution.

The originating bank keeps 60% of the principal payment and 60% of the interest payment. The retained servicing fee is also calculated. This process is straightforward, eliminating the need for the client to make calculations.

I have done the same for each participant, showing the servicing fee, the total amount they receive, and their percentage of the ending loan balance. This is also done for participant two.

The total ending balance is the sum of all ending balances.

I have created two additional tabs.

Loan payment 2 follows the same process, and loan payment 3 also uses the same process.

For convenience, I've shown you the actual payment schedule for the life of the loan on this tab.

I will send you this Excel spreadsheet. Hopefully, it will be beneficial and make our servicing module easier for our clients to use. Thank you.