Continuation of Payroll Processing: SAGE and ADP Sync

Learn how to efficiently process payroll, manage payroll deductions, and sync data between SAGE and ADP. Follow best practices for record-keeping, trial compute, and file management to ensure accurate payroll processing.

In this guide, we'll learn how to finalize payroll processing by preparing and syncing payroll data between SAGE and ADP. This includes verifying payroll records, handling payroll deductions, checking leave benefits, and using the ADP to SAGE sync tool. We will also cover how to prepare files for upload and ensure all data is accurate before processing payroll.

Let's get started

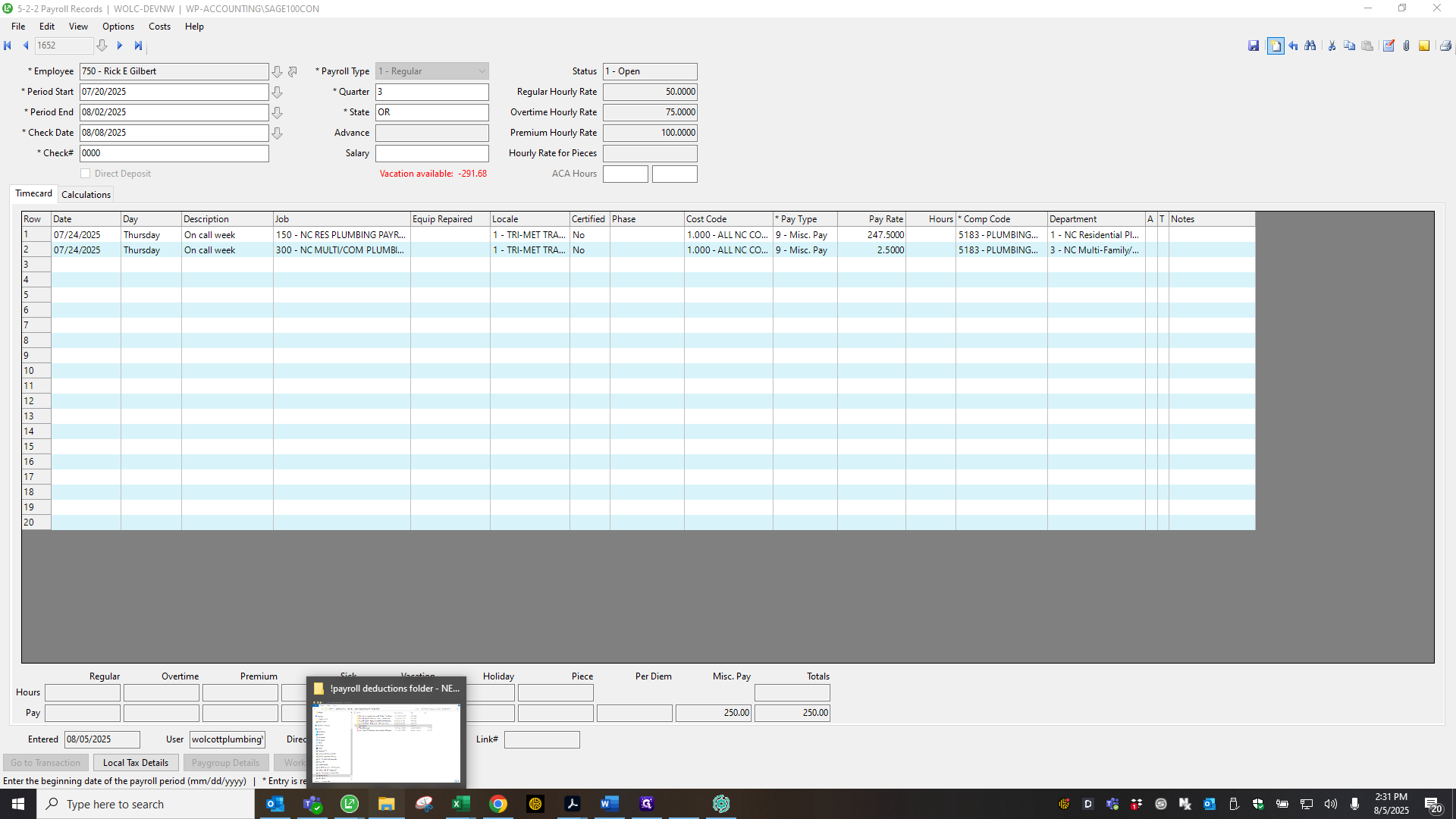

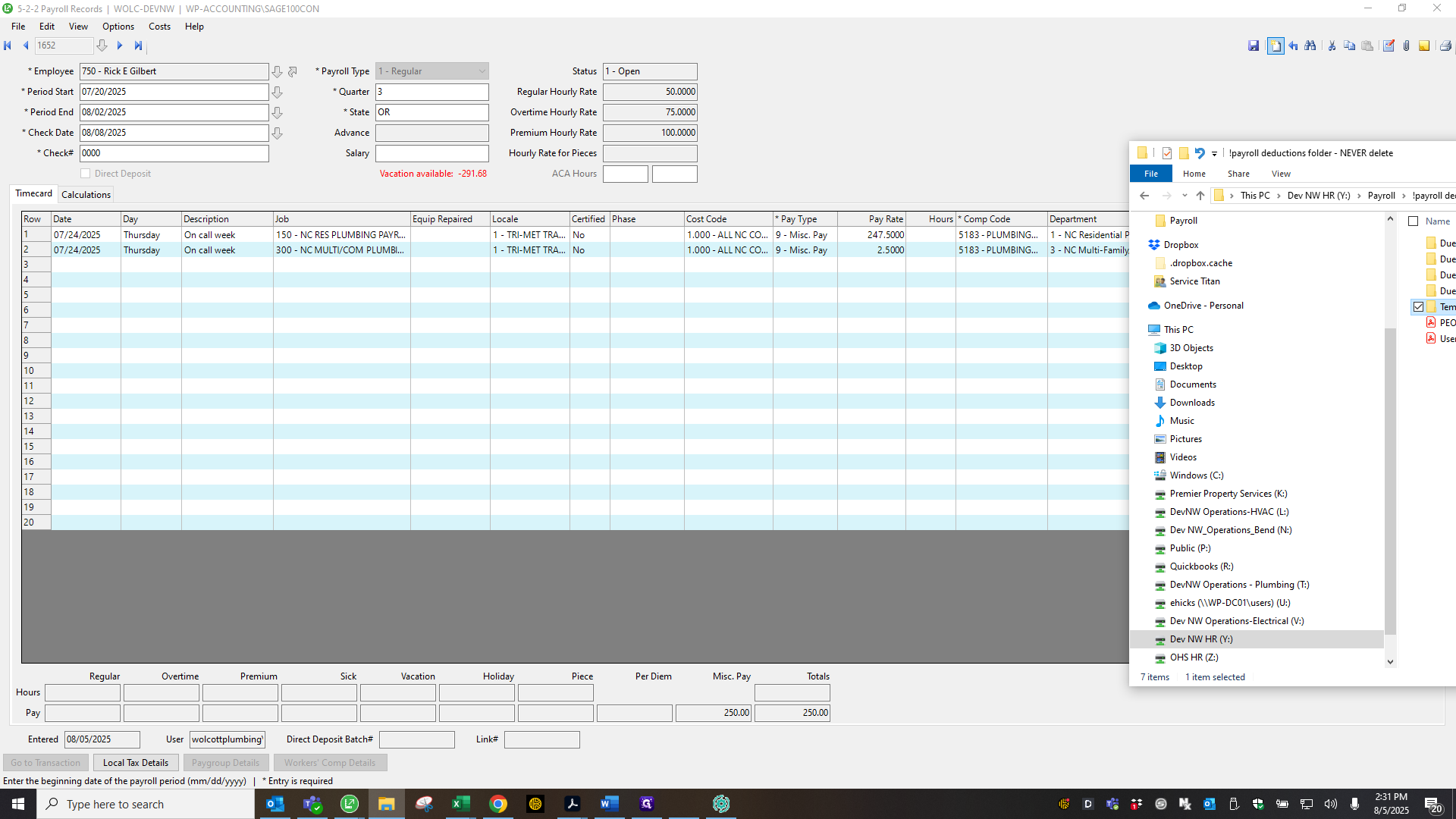

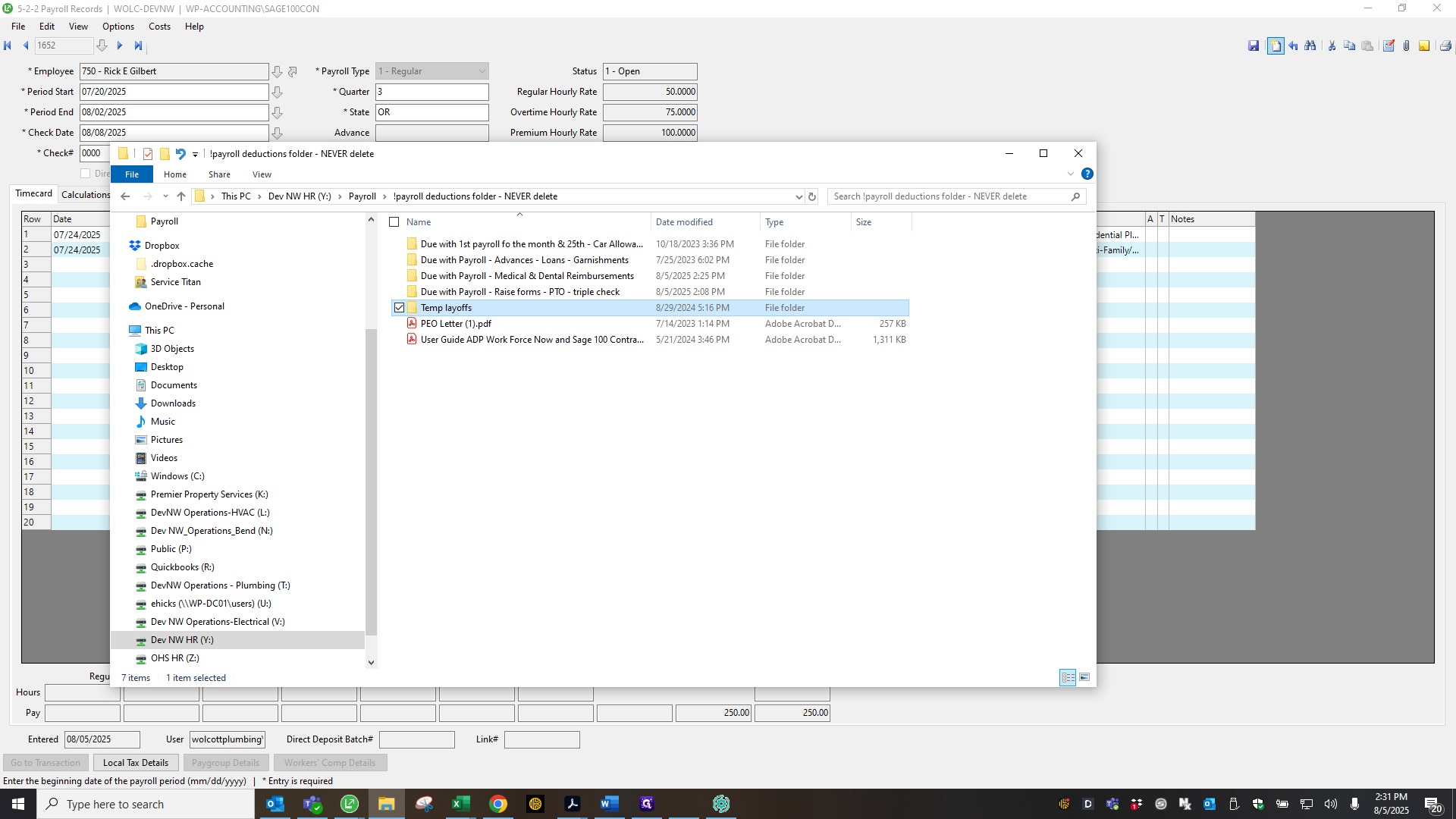

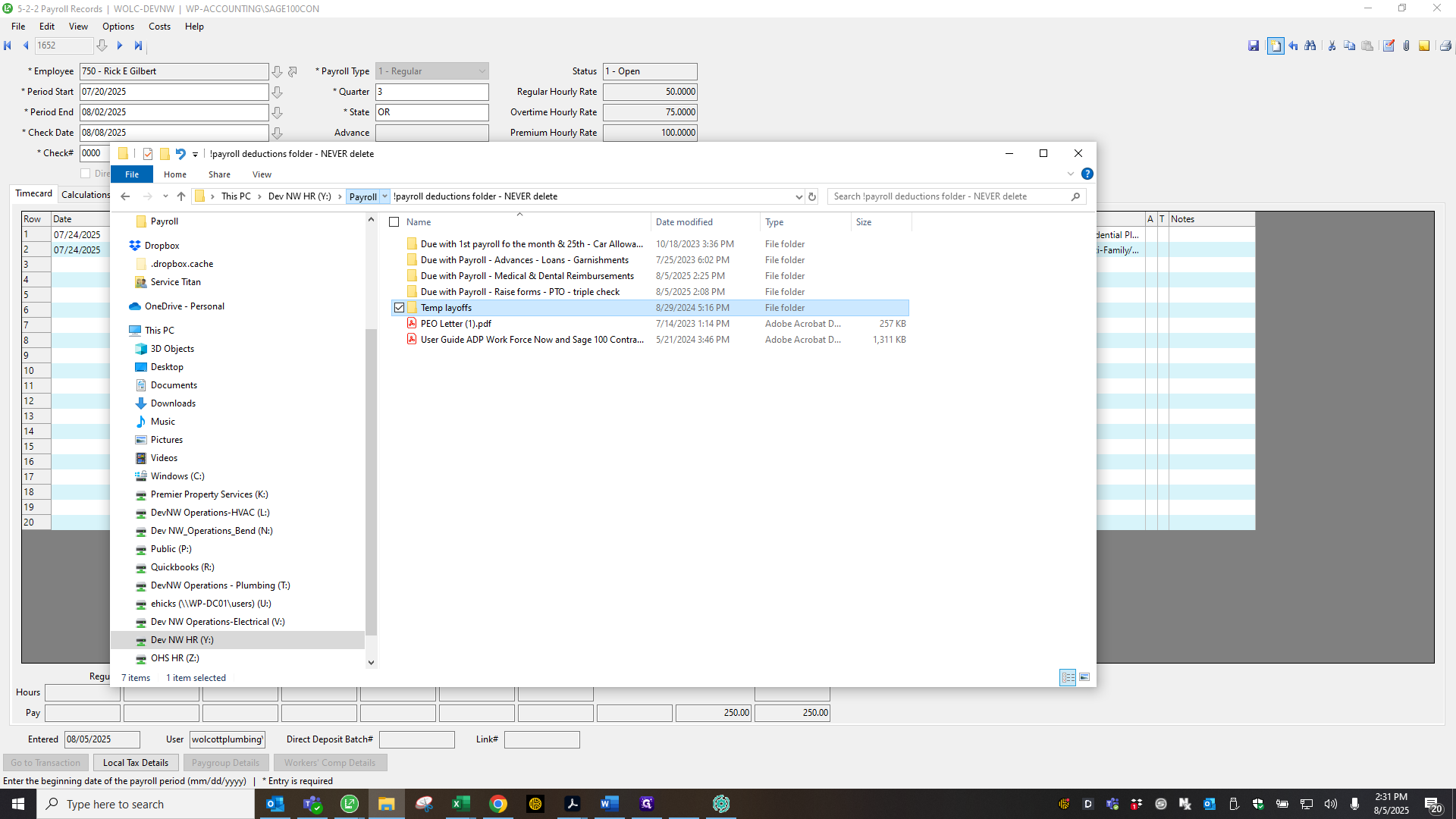

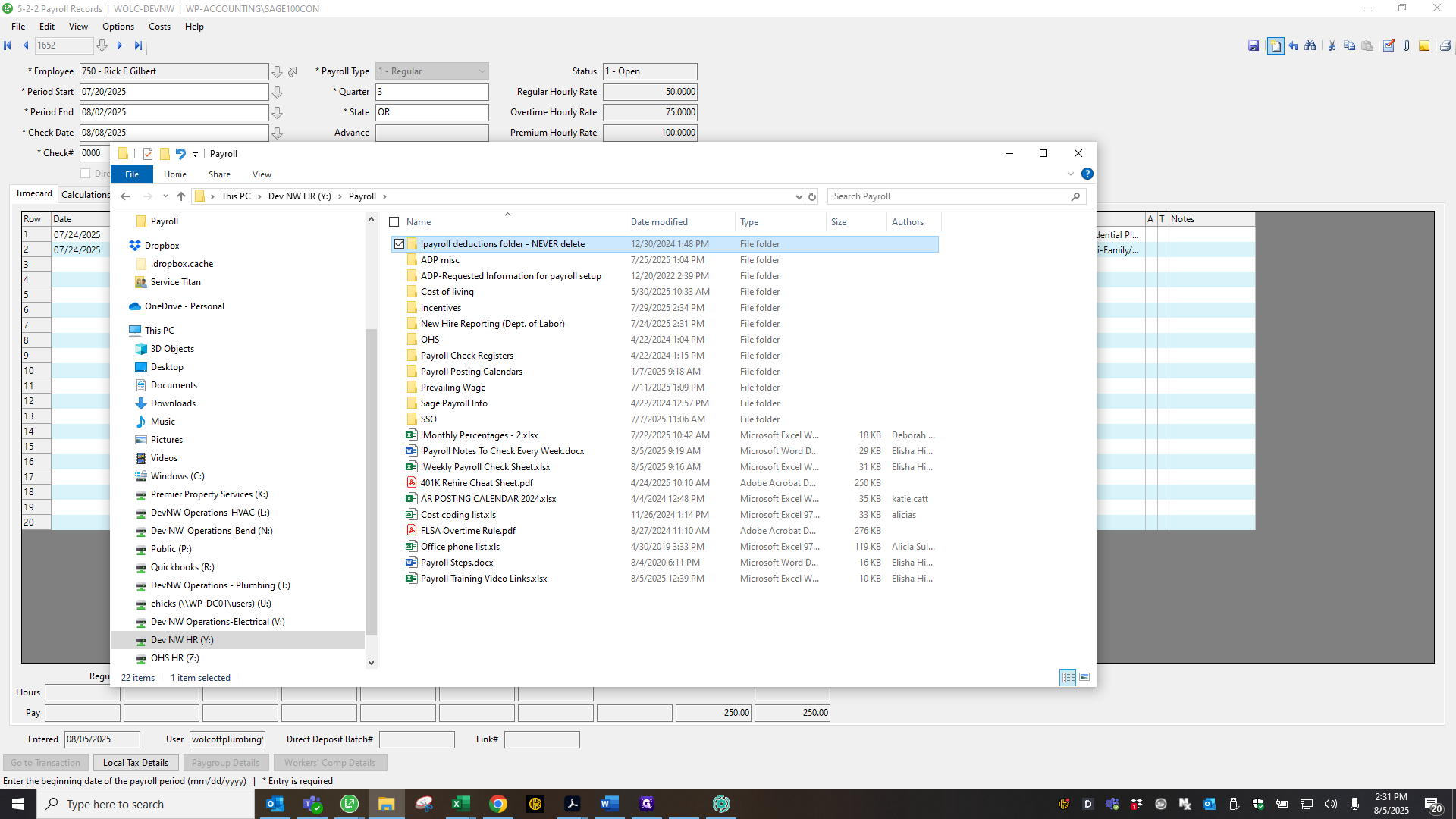

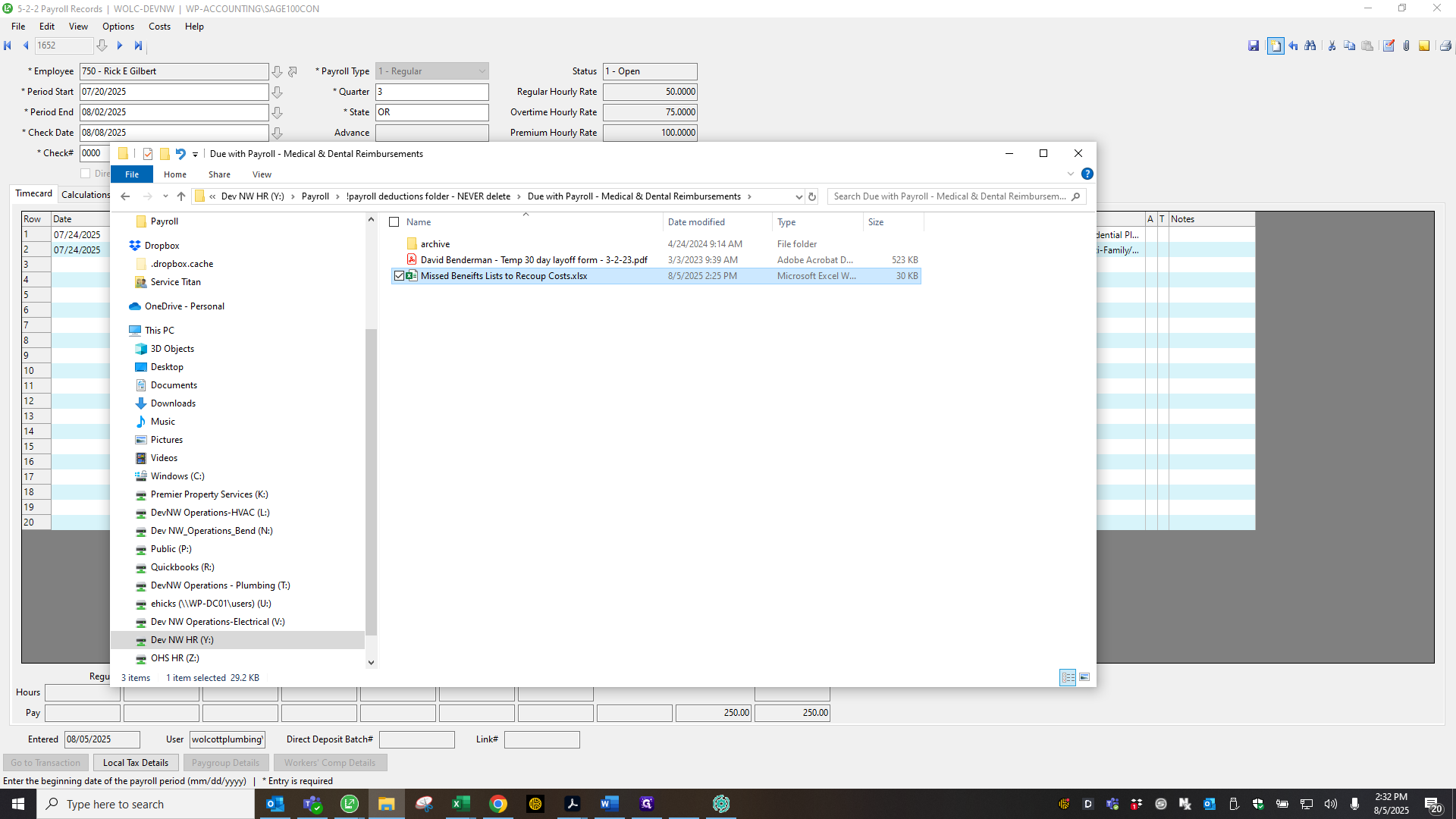

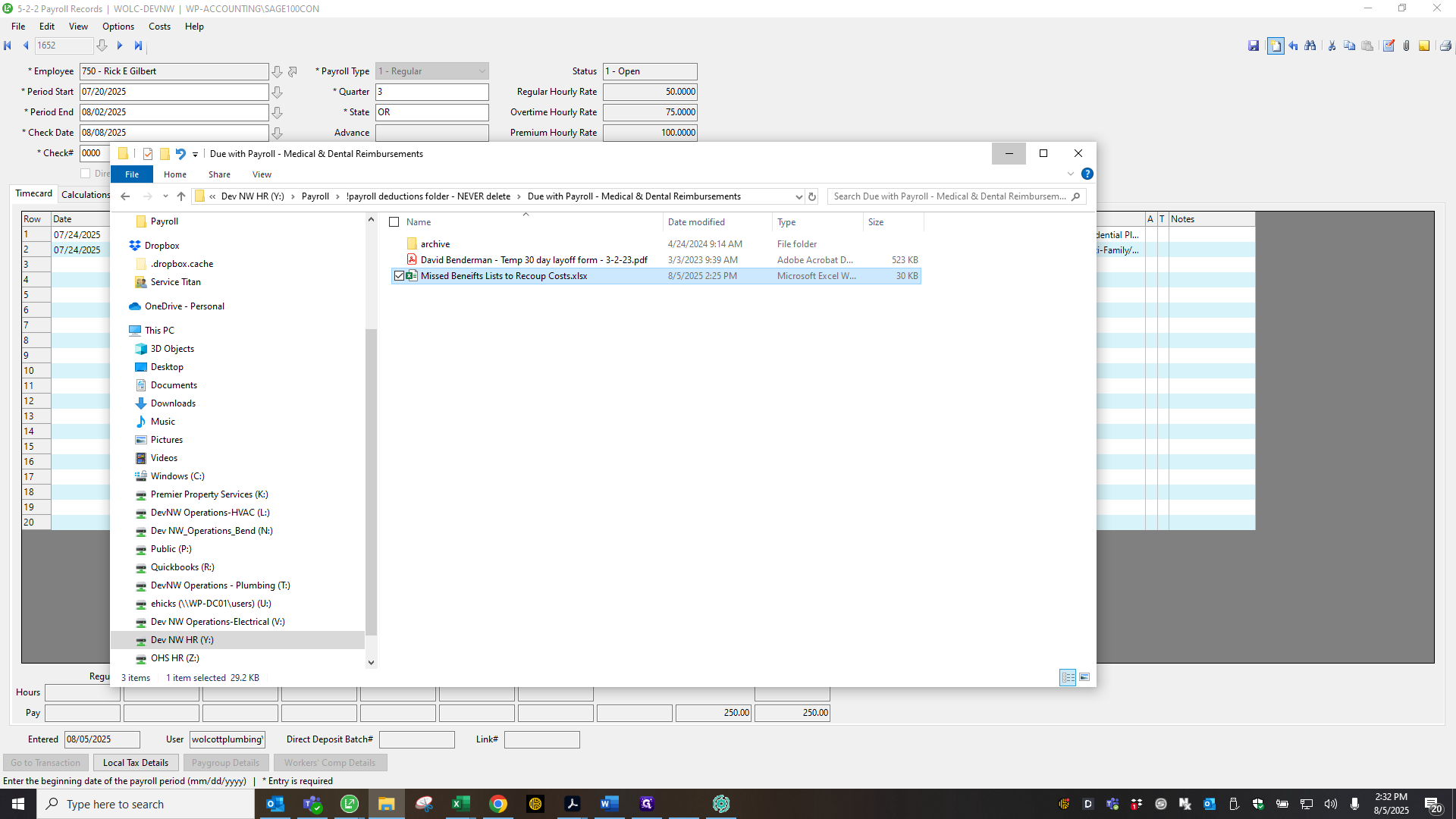

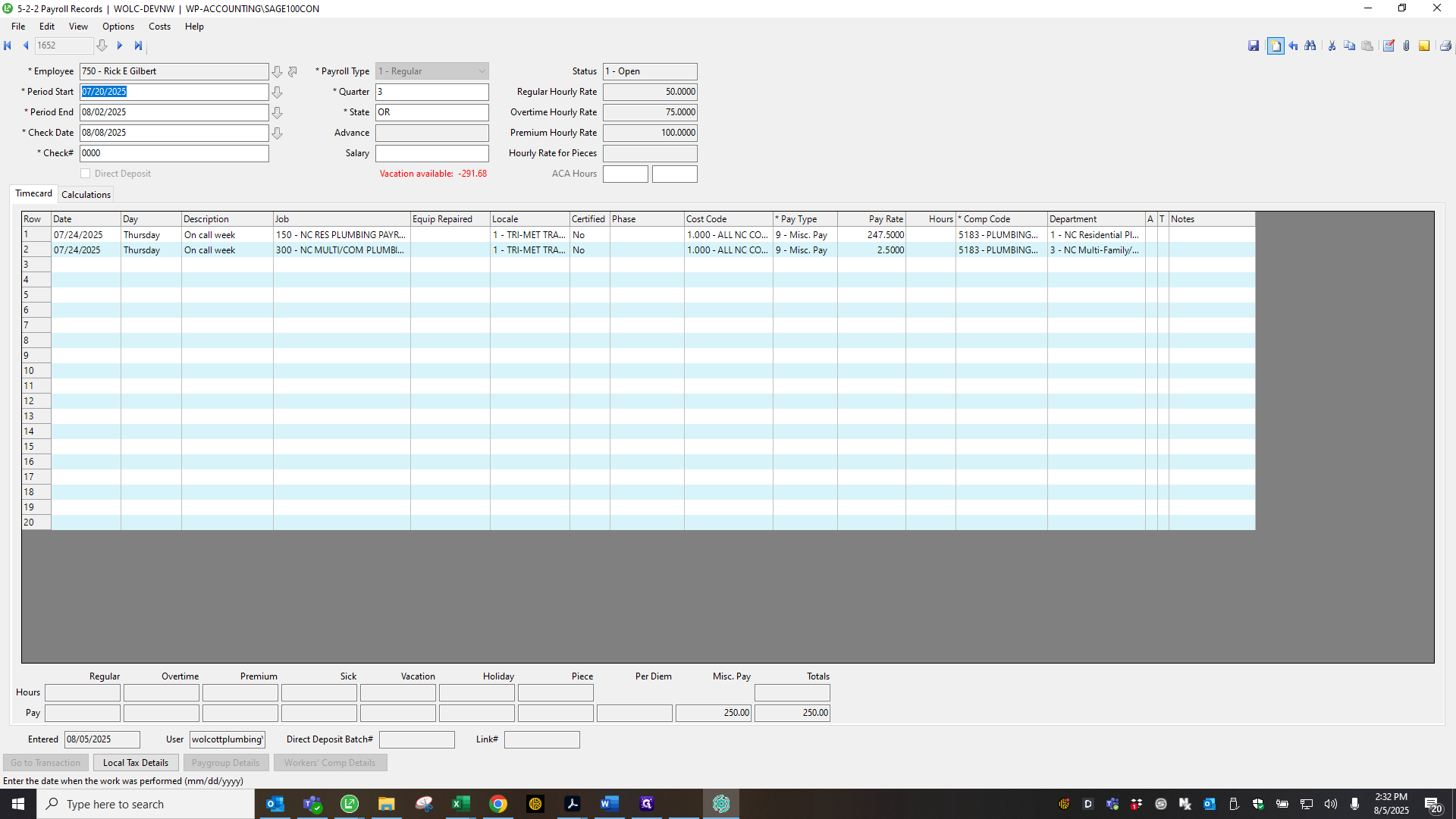

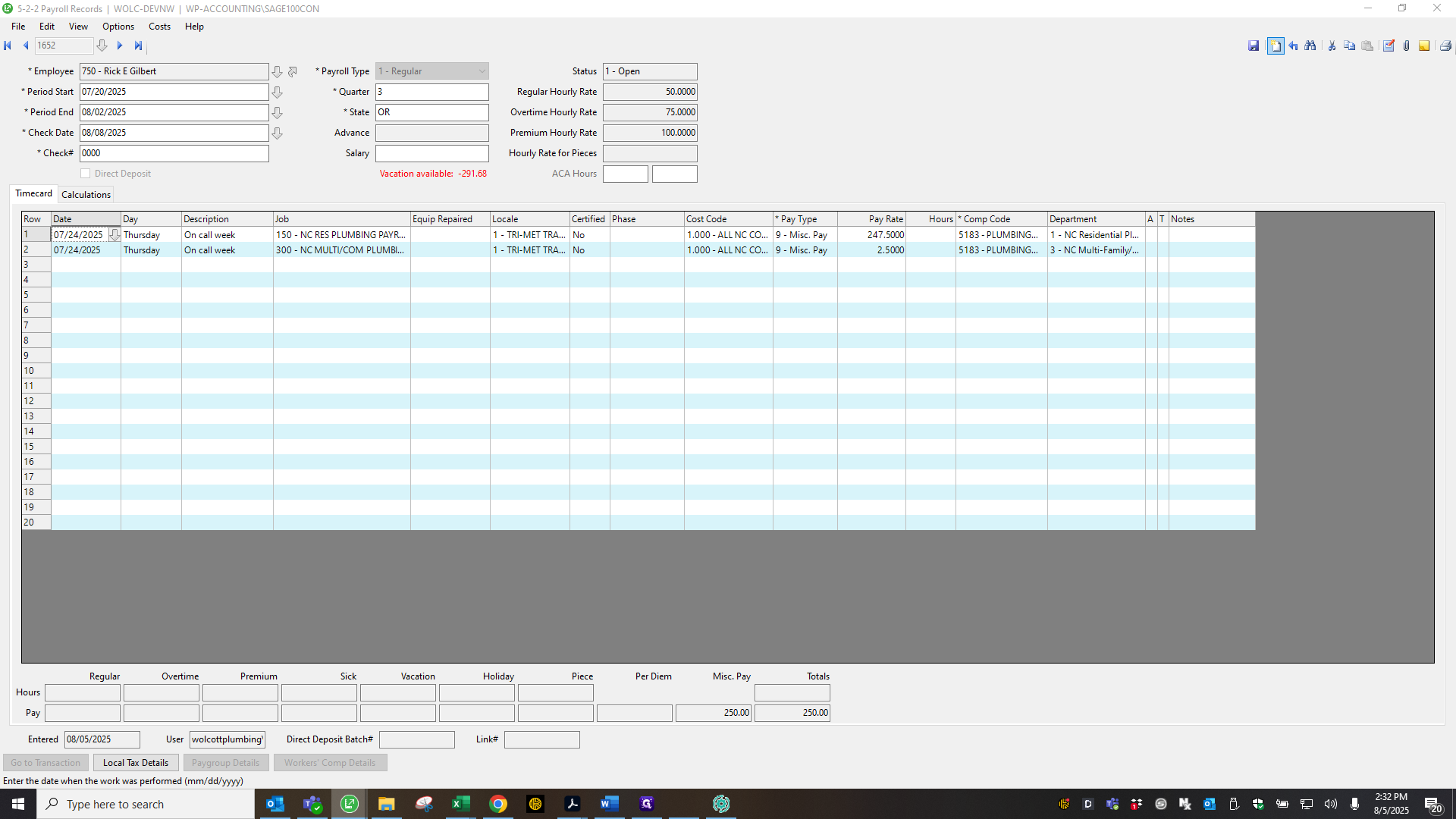

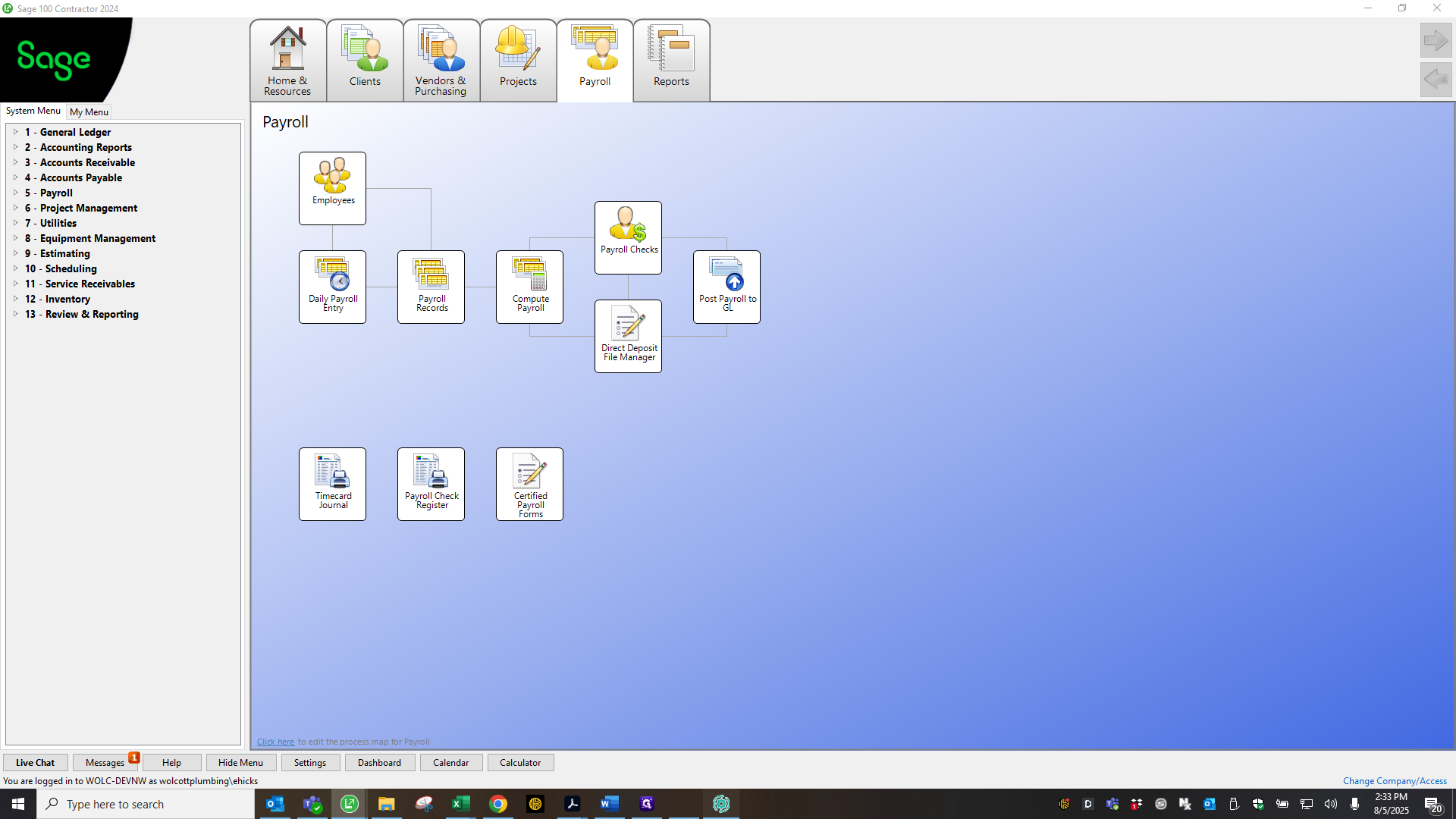

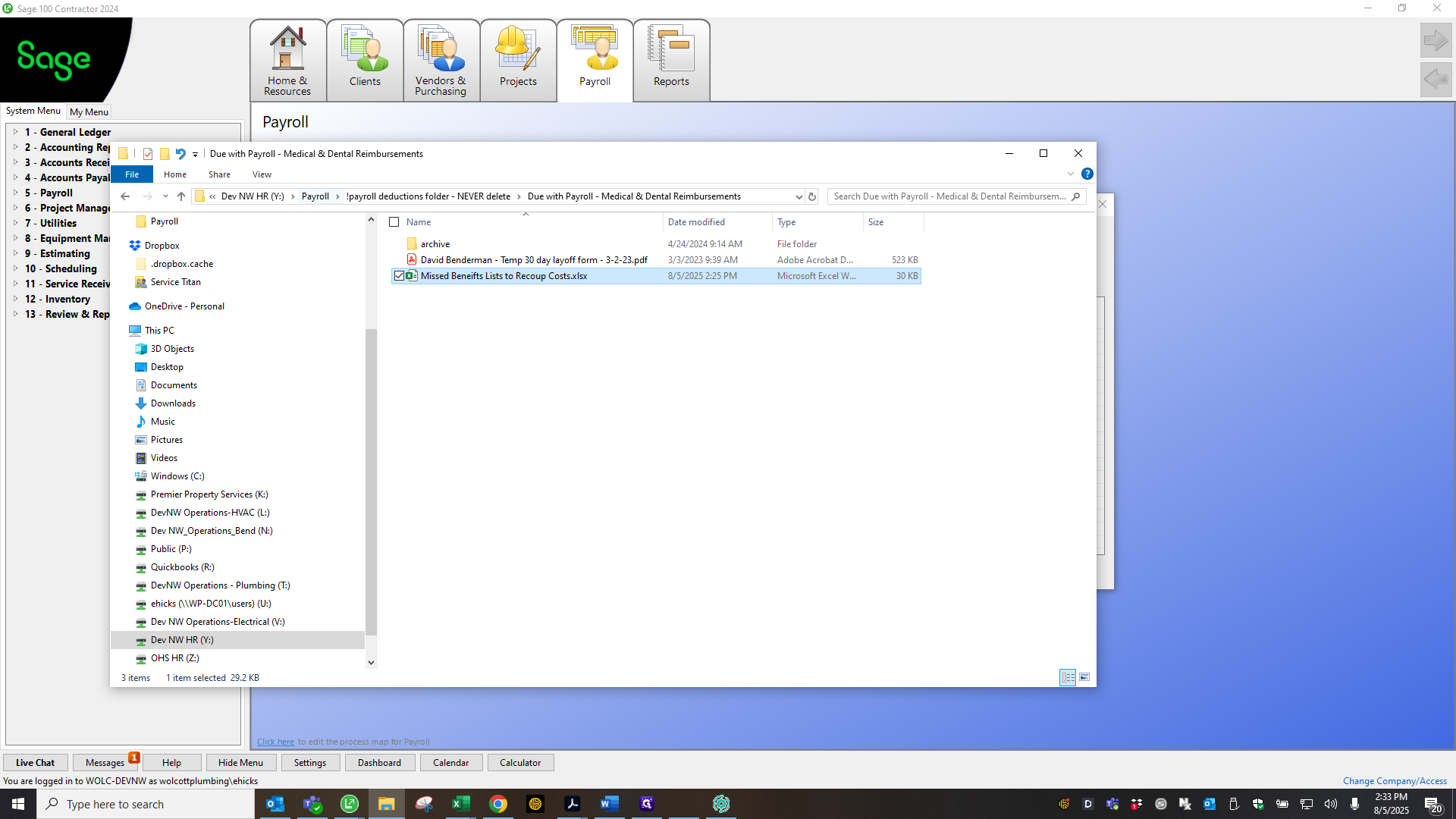

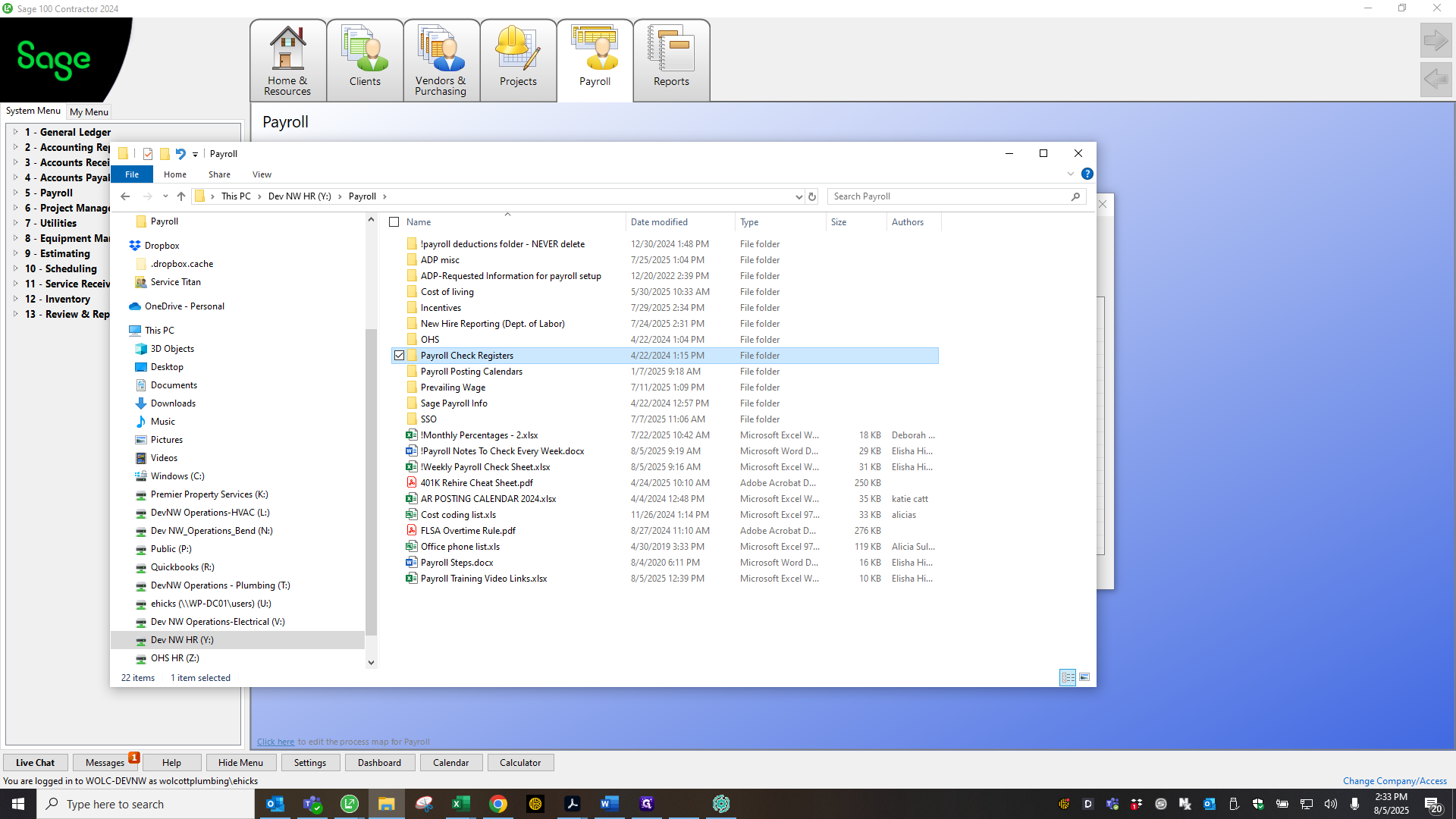

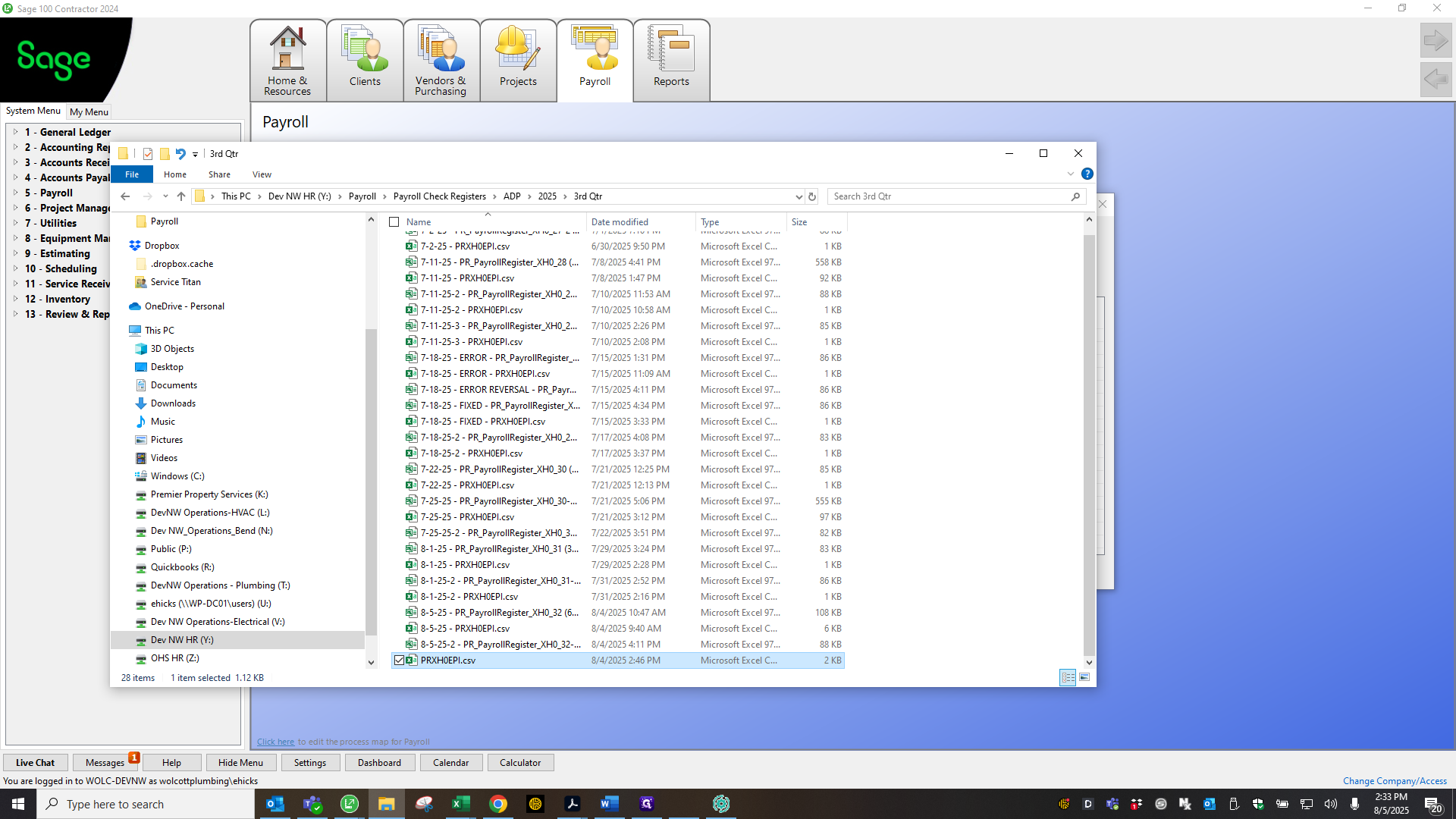

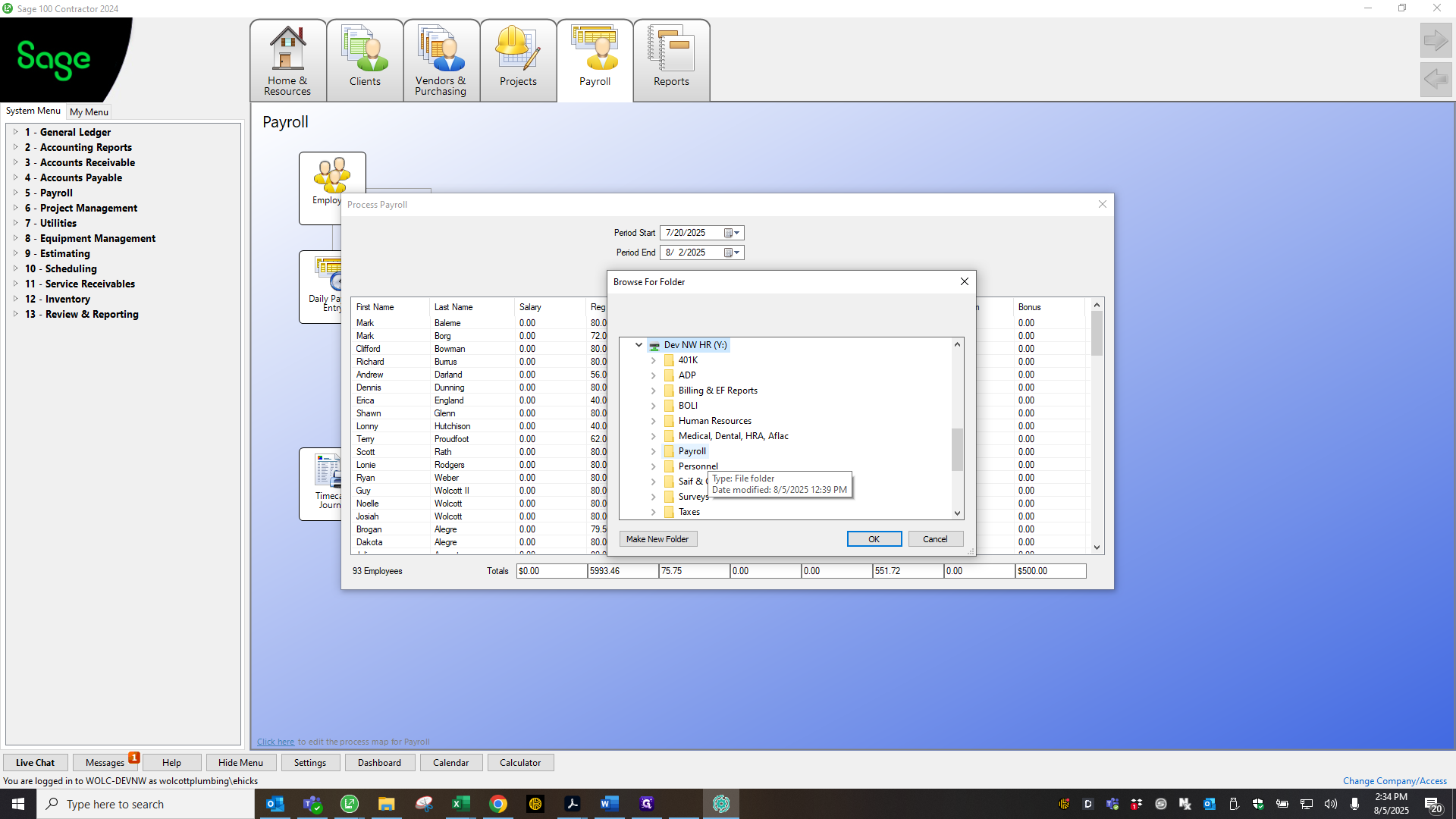

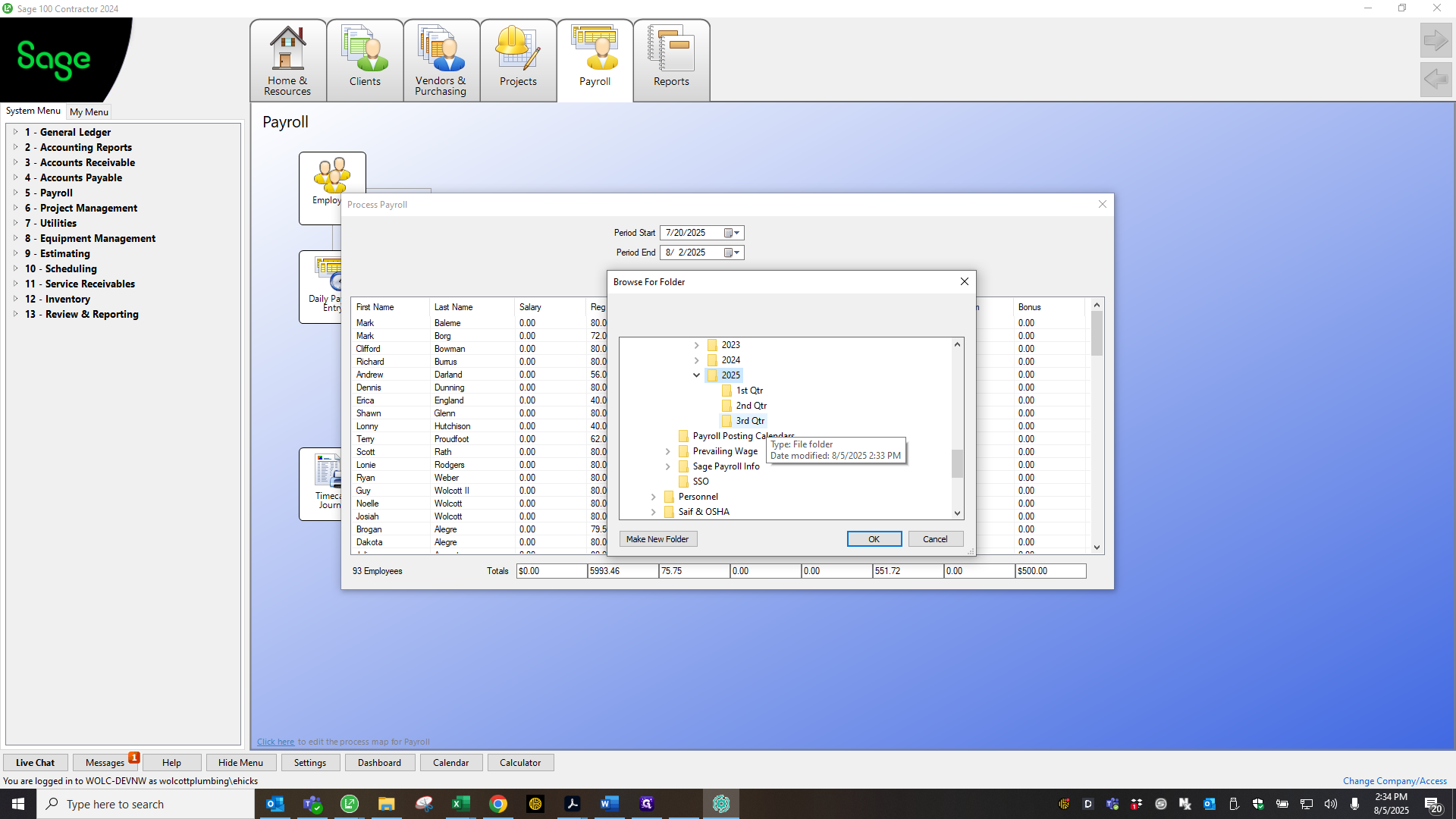

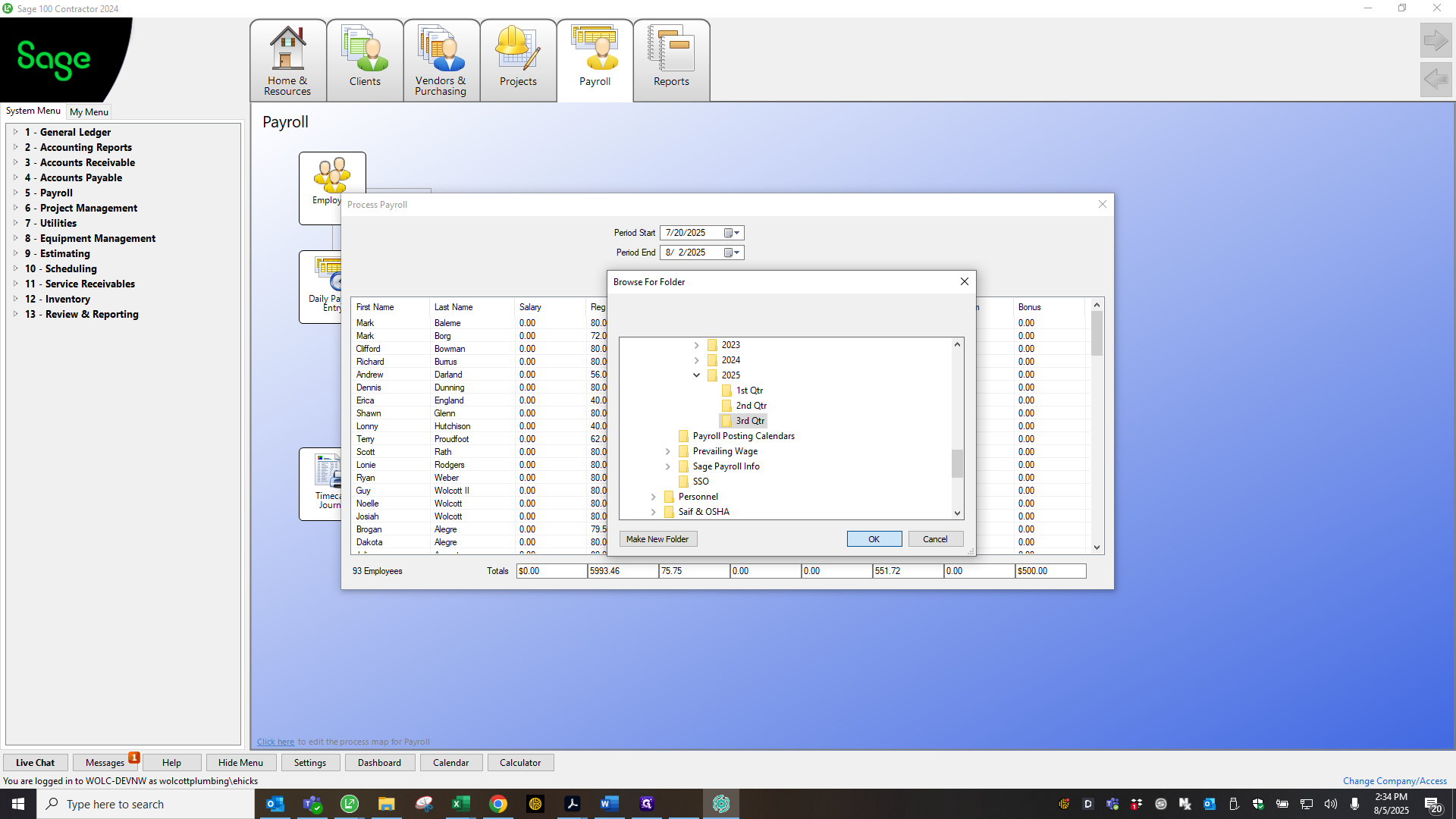

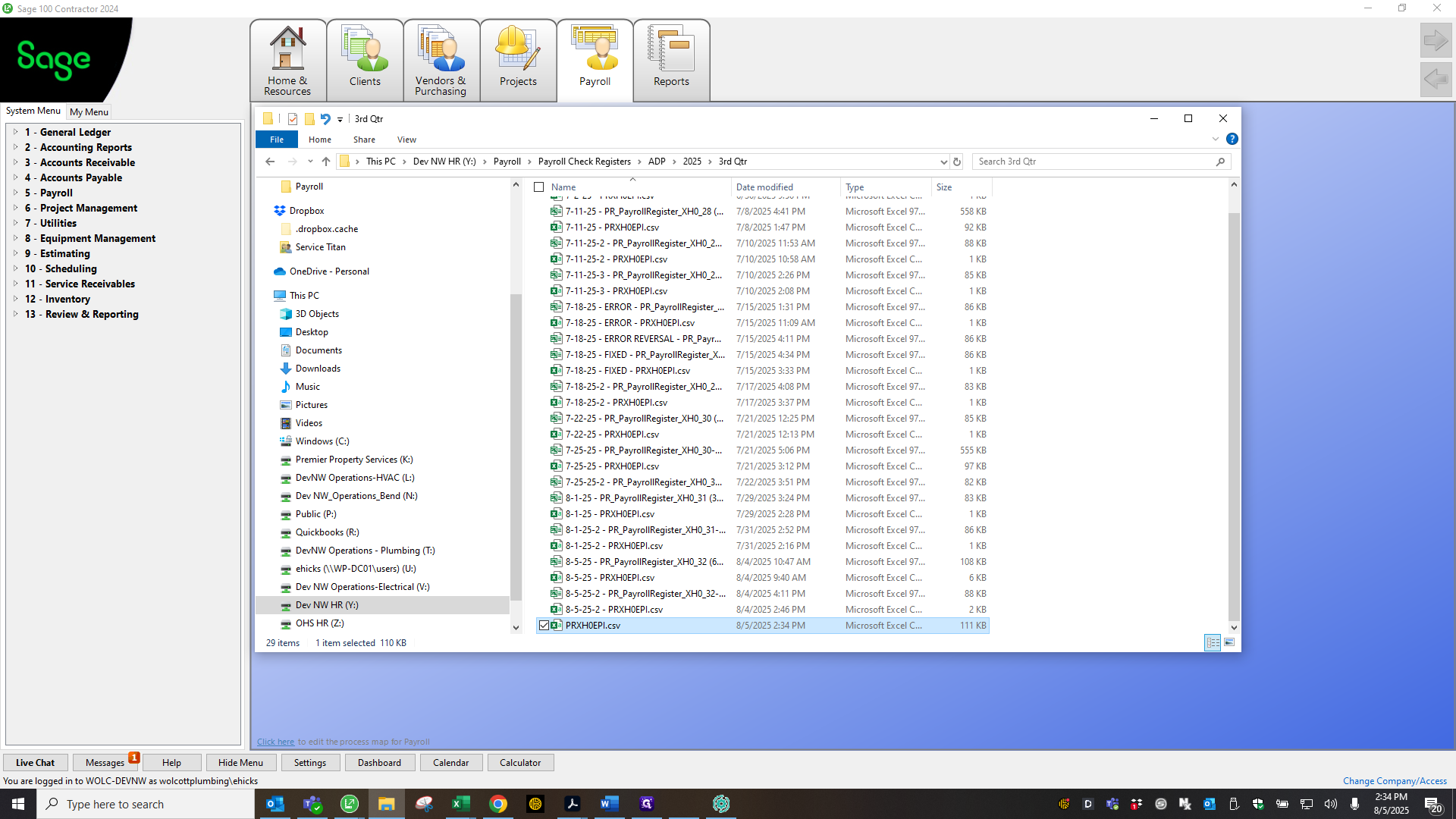

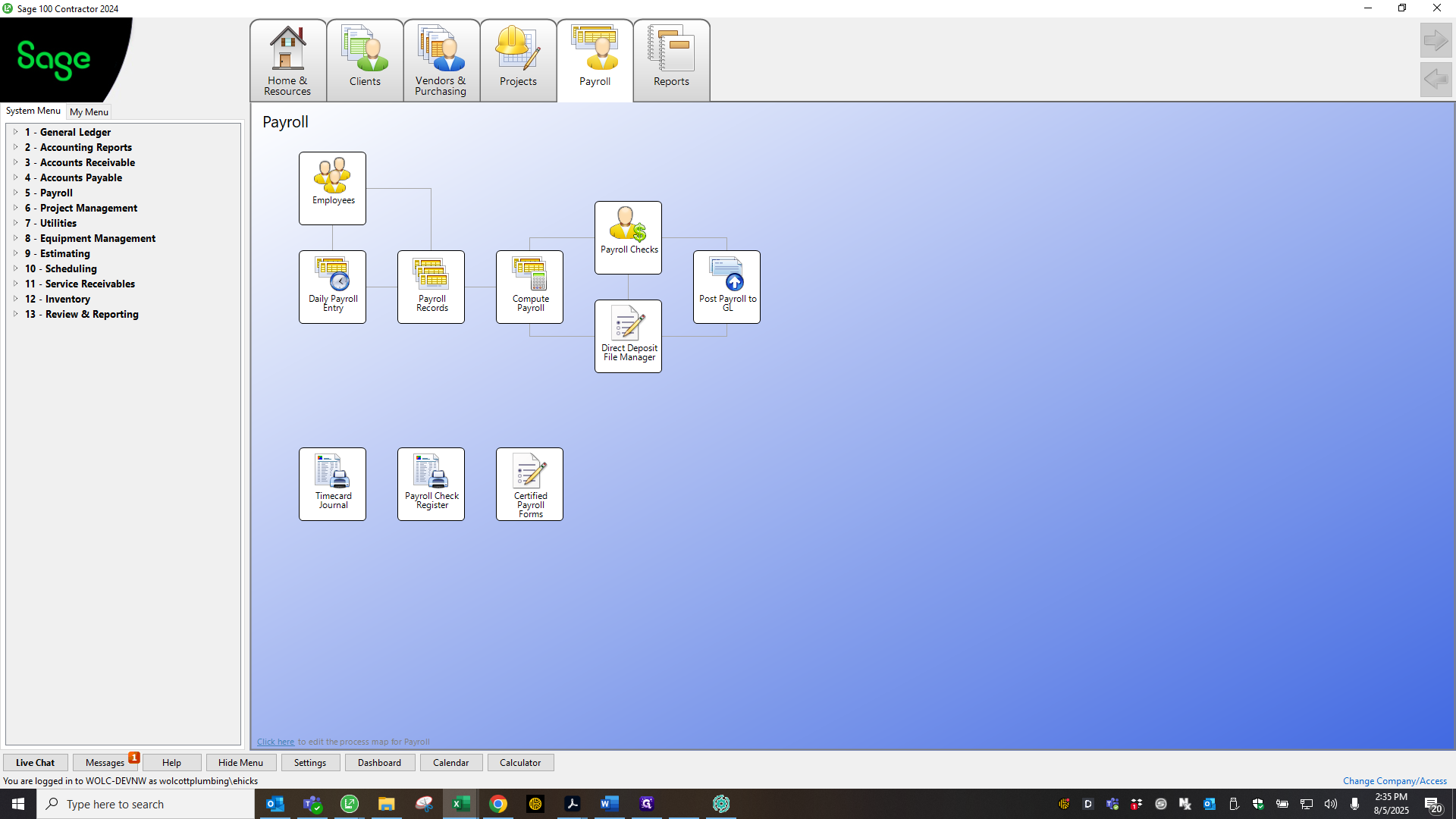

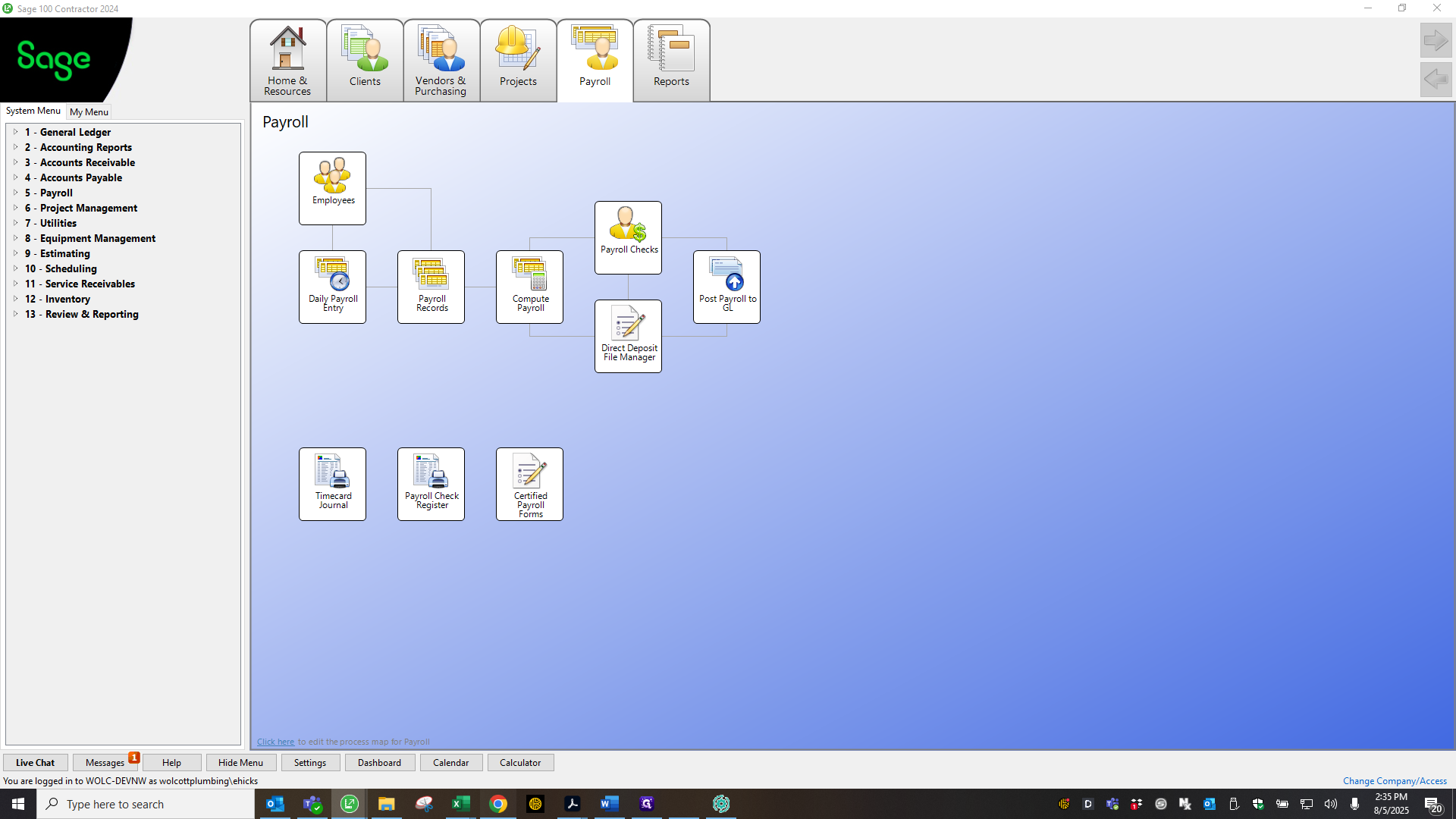

Hello. We are continuing with payroll processes. After reviewing and cleaning all the records, and making any necessary fixes, I also have a folder under payroll.

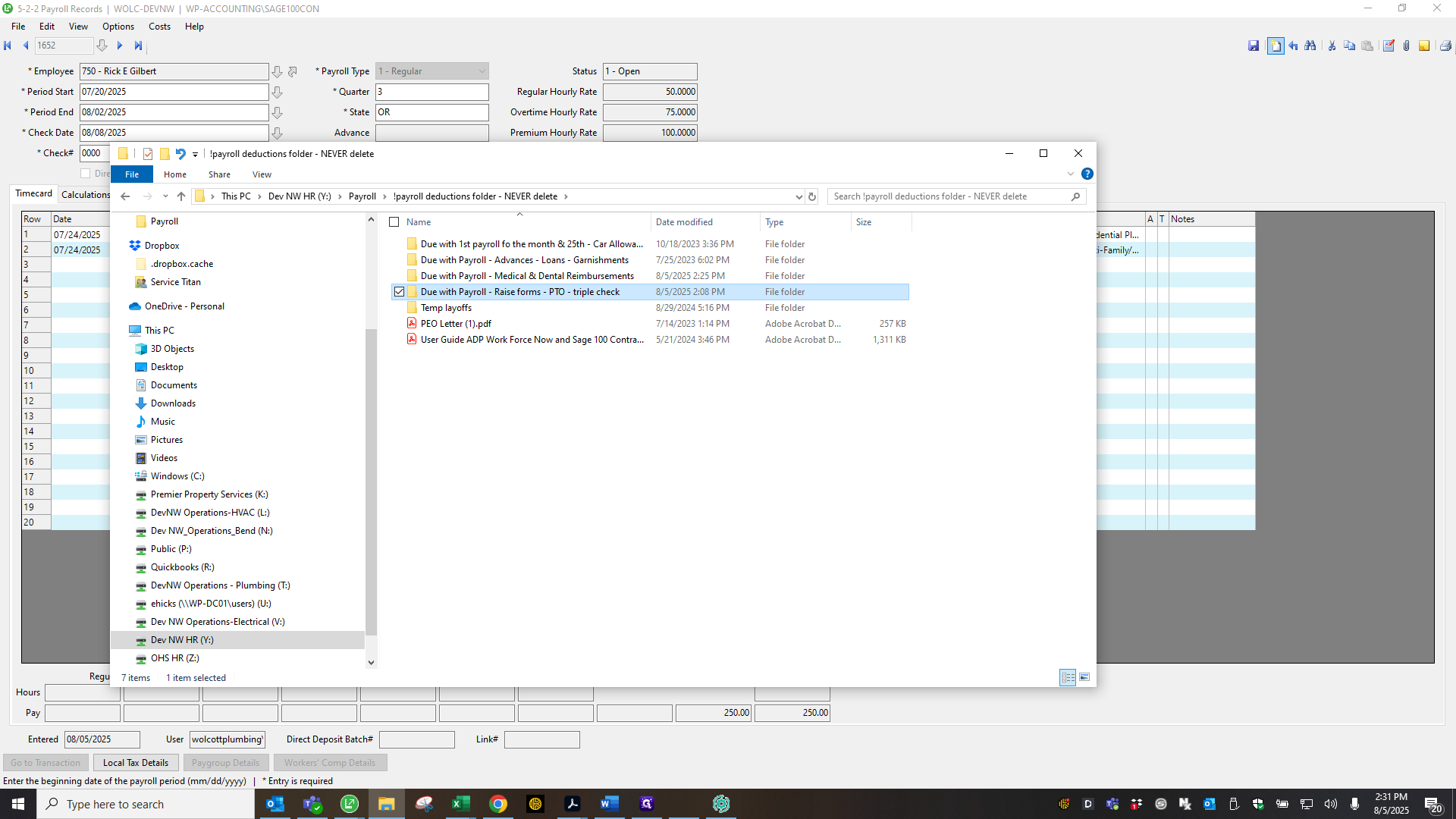

Never delete the payroll deductions folder.

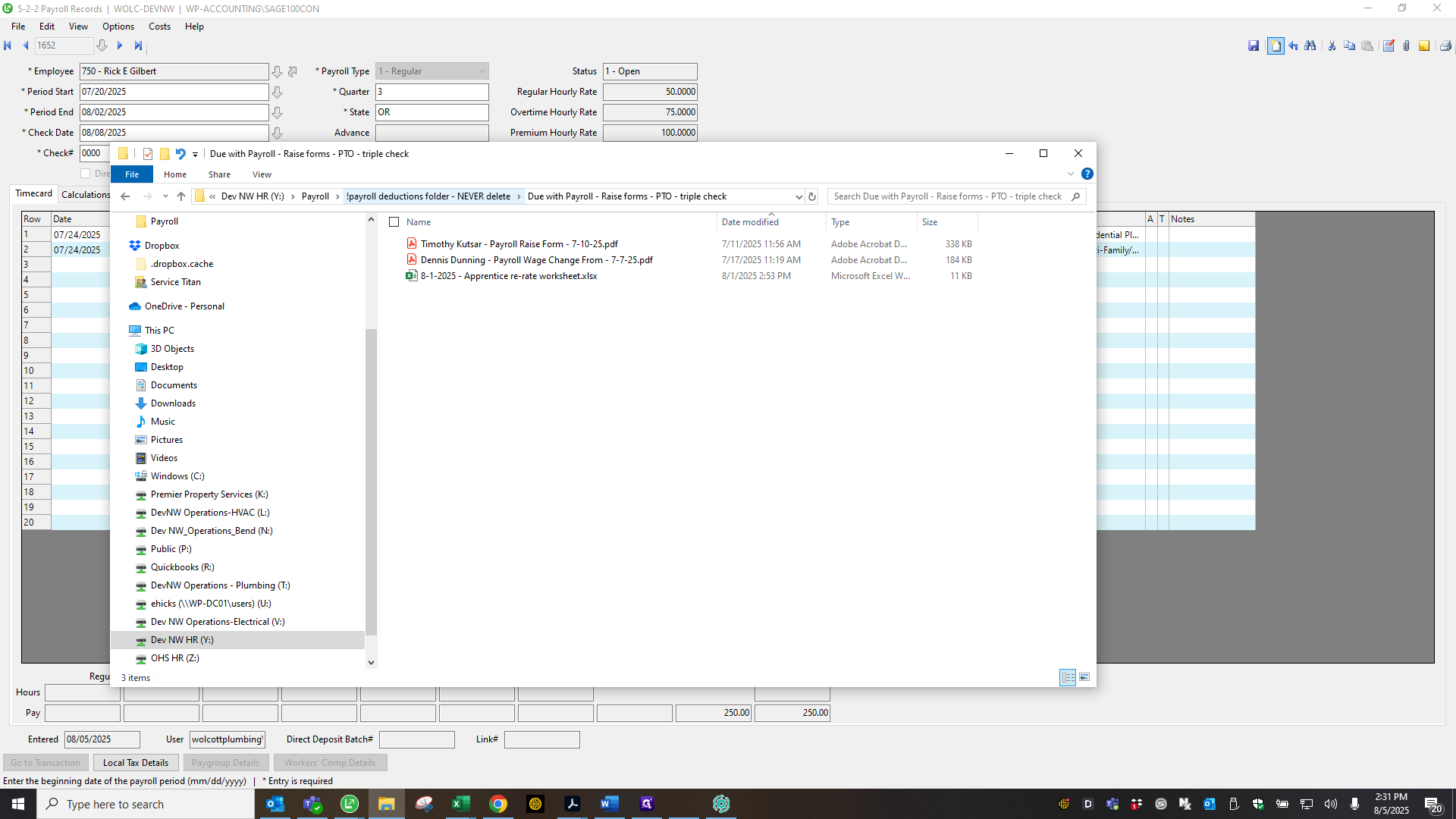

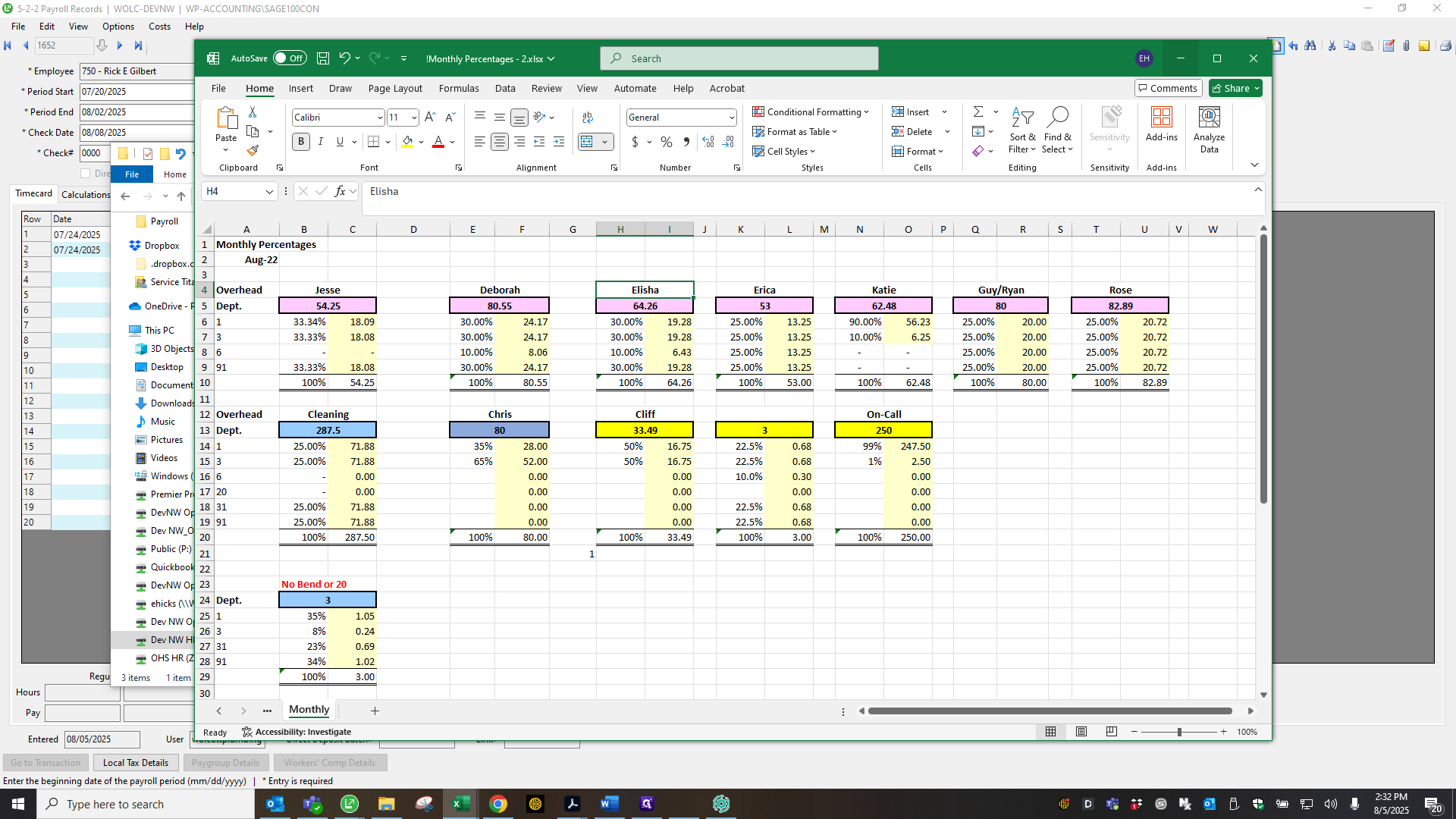

I triple-check any raises to ensure they are correctly entered into SAGE and make adjustments as needed. I do this every payroll by reviewing that folder.

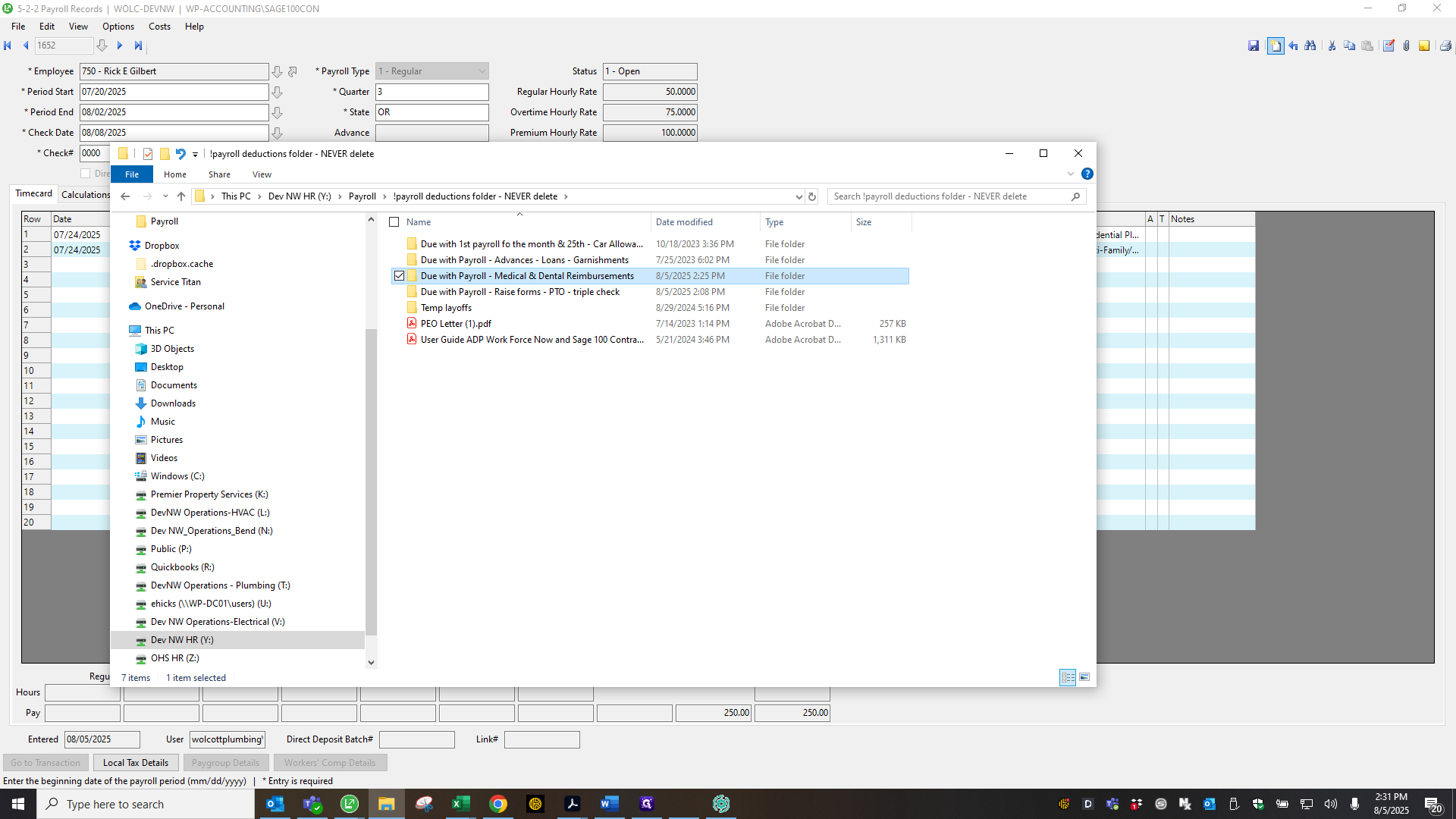

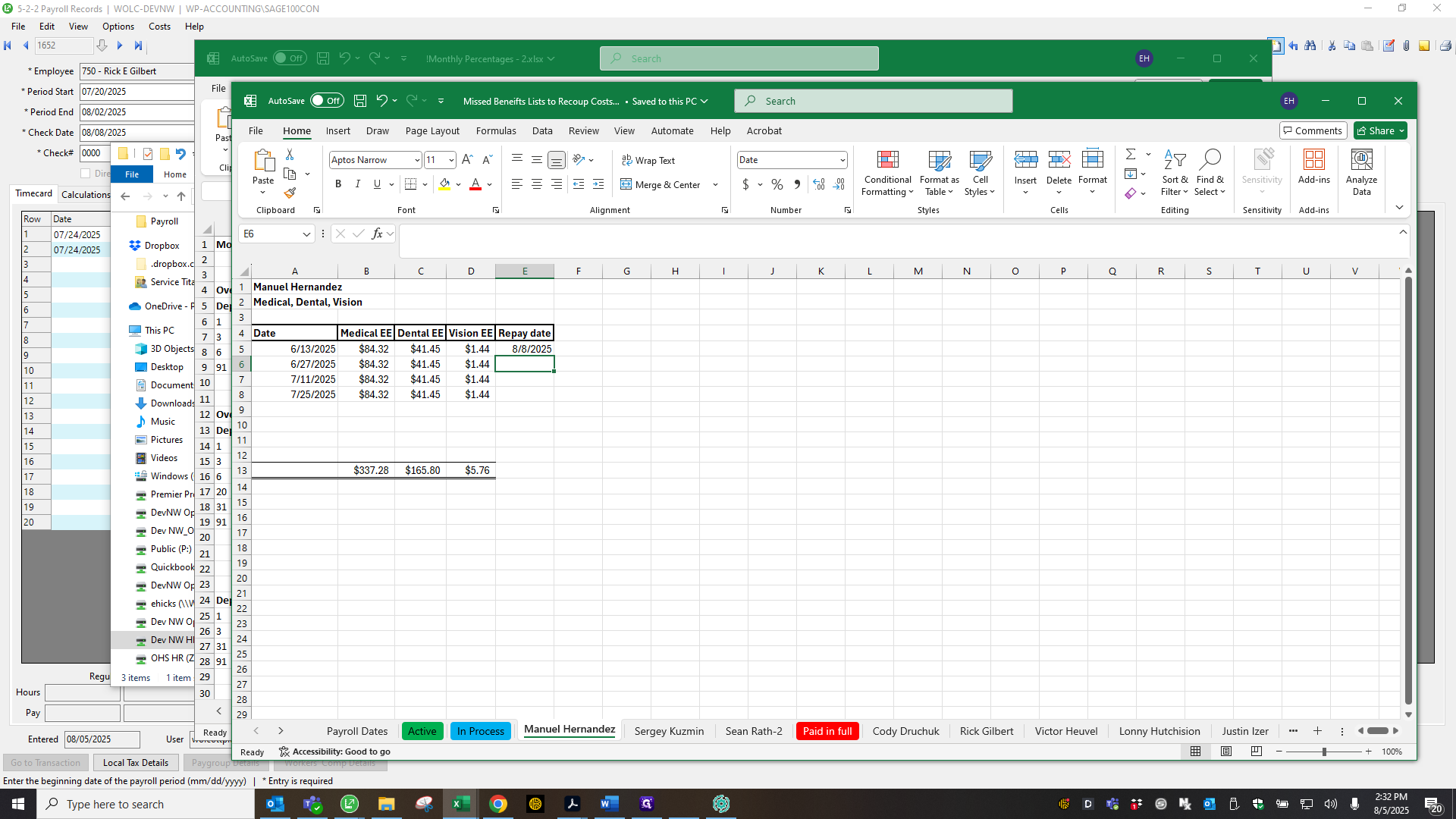

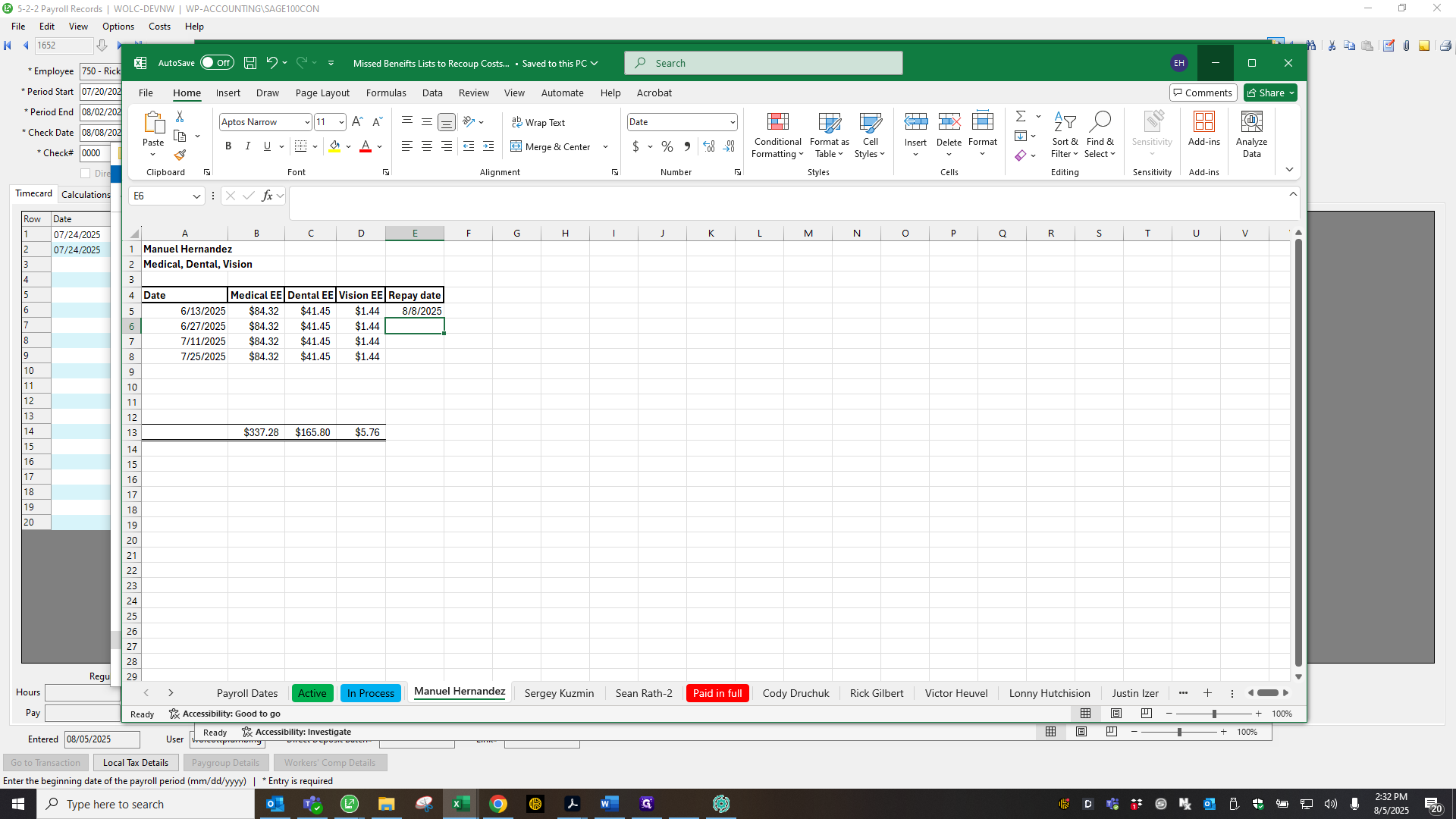

Also, check every payroll in this folder for employees who have been on leave.

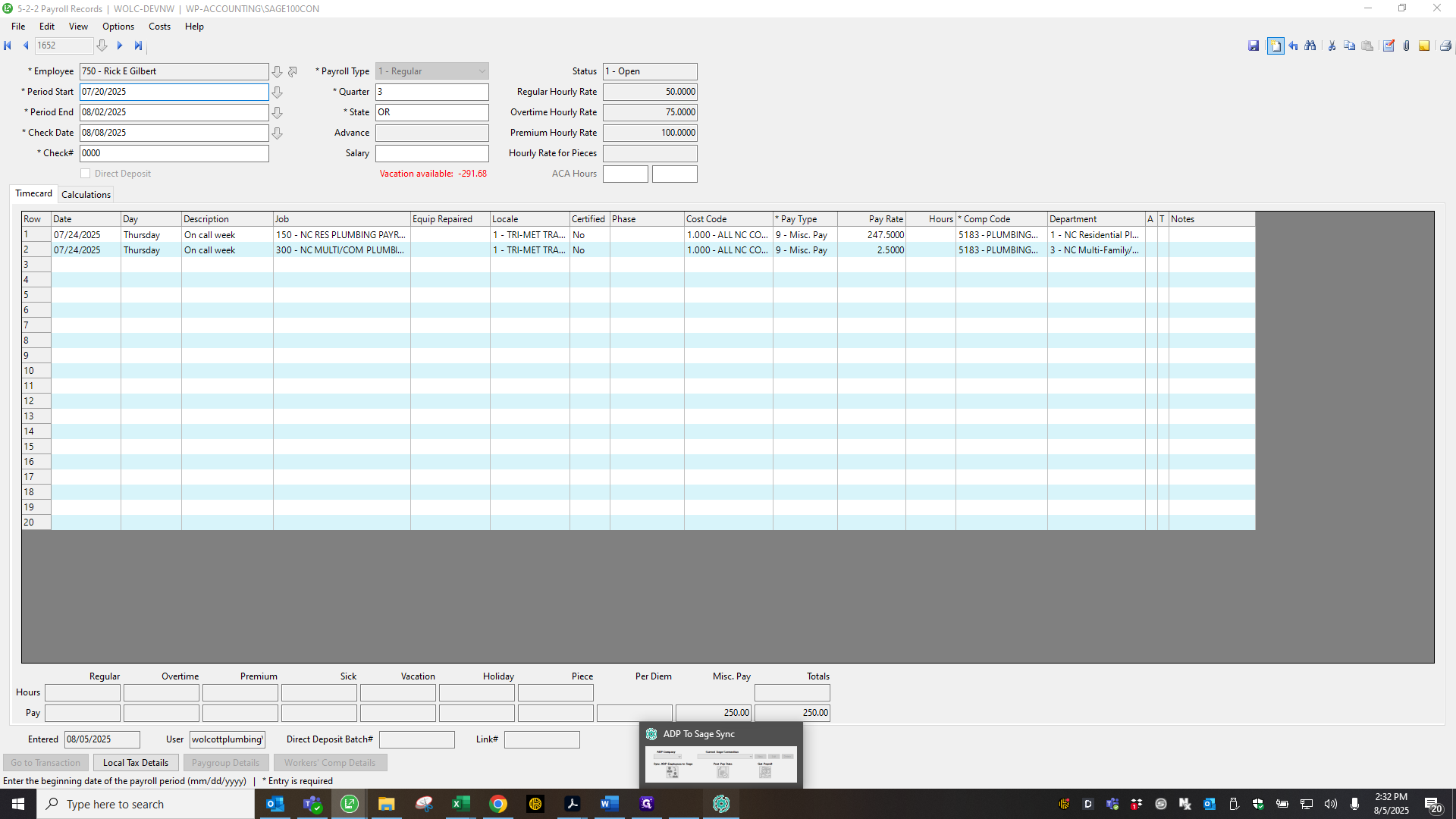

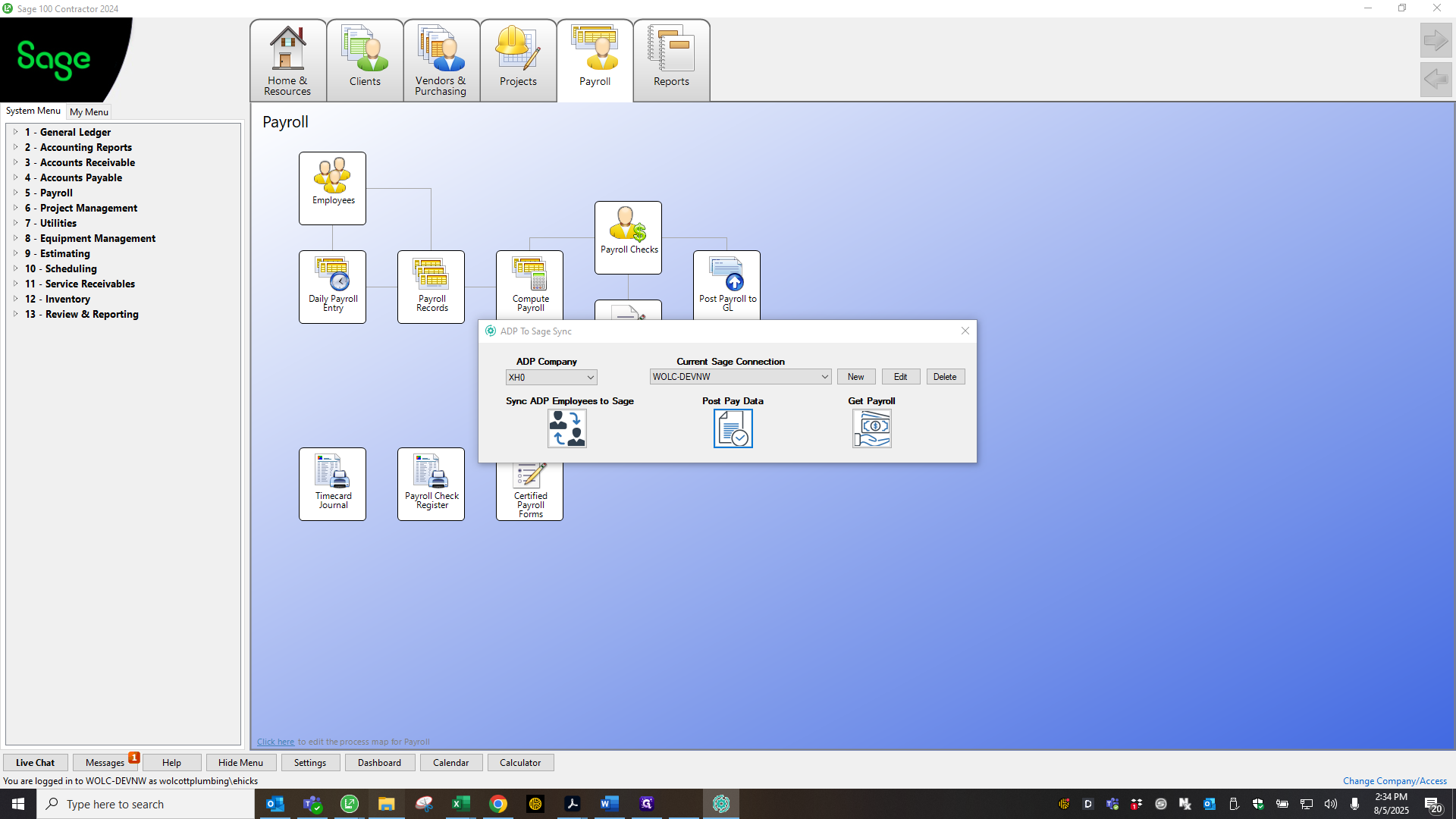

I keep track of their benefits to recover those costs. After everything is set up, open the ADP to SAGE sync program.

We need to install this on Deborah's computer. Oops. Sorry, let me go back.

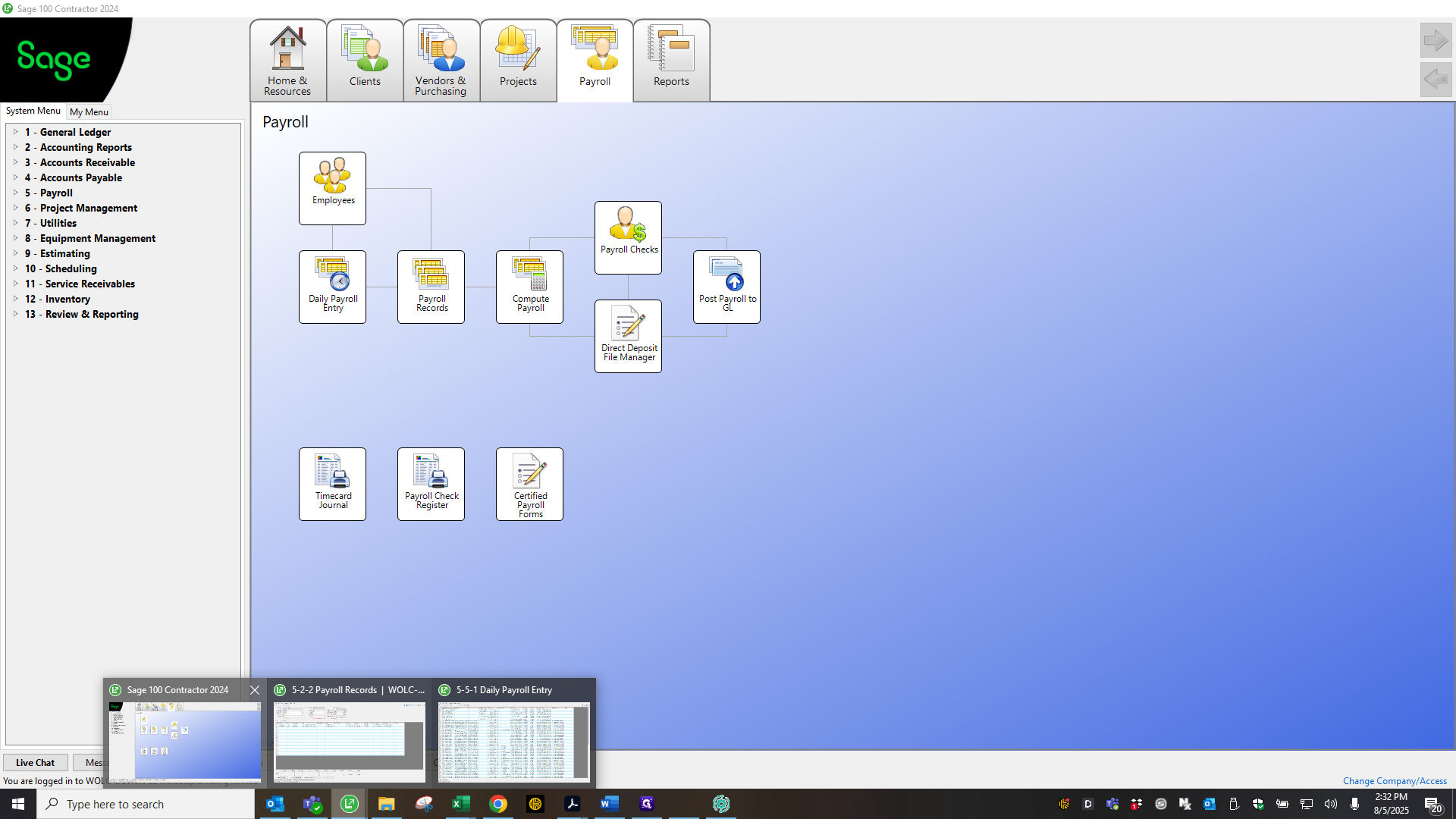

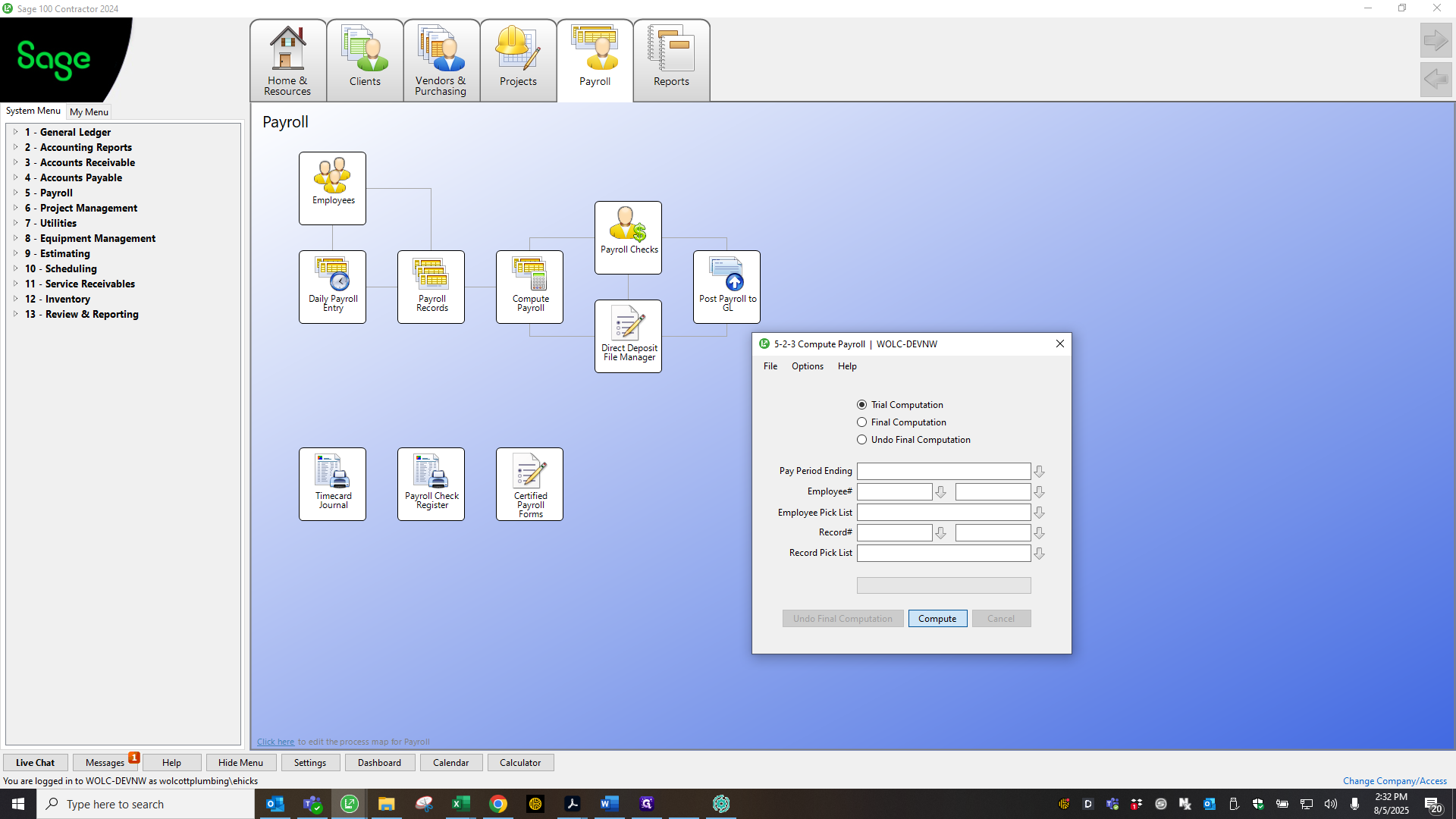

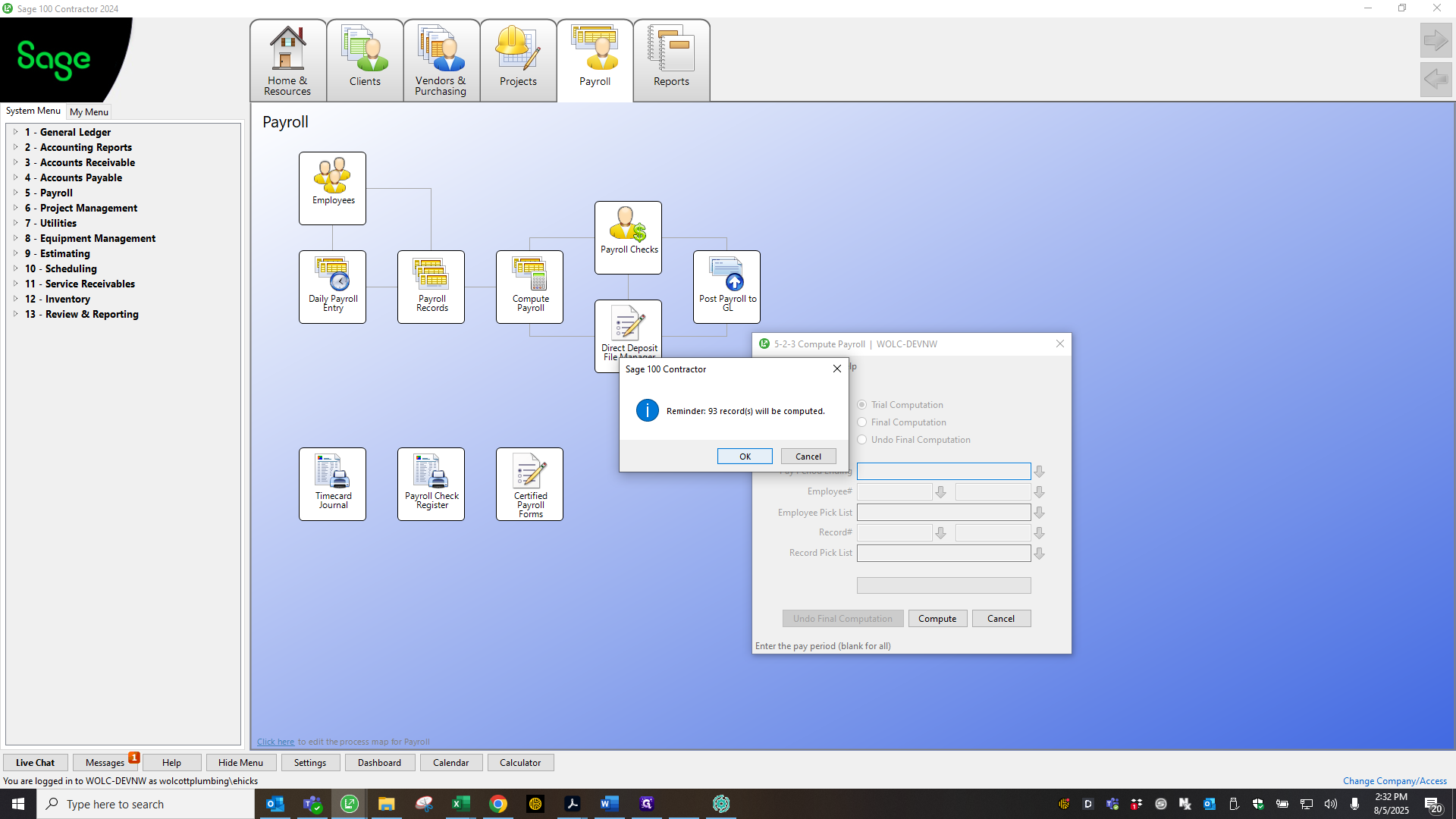

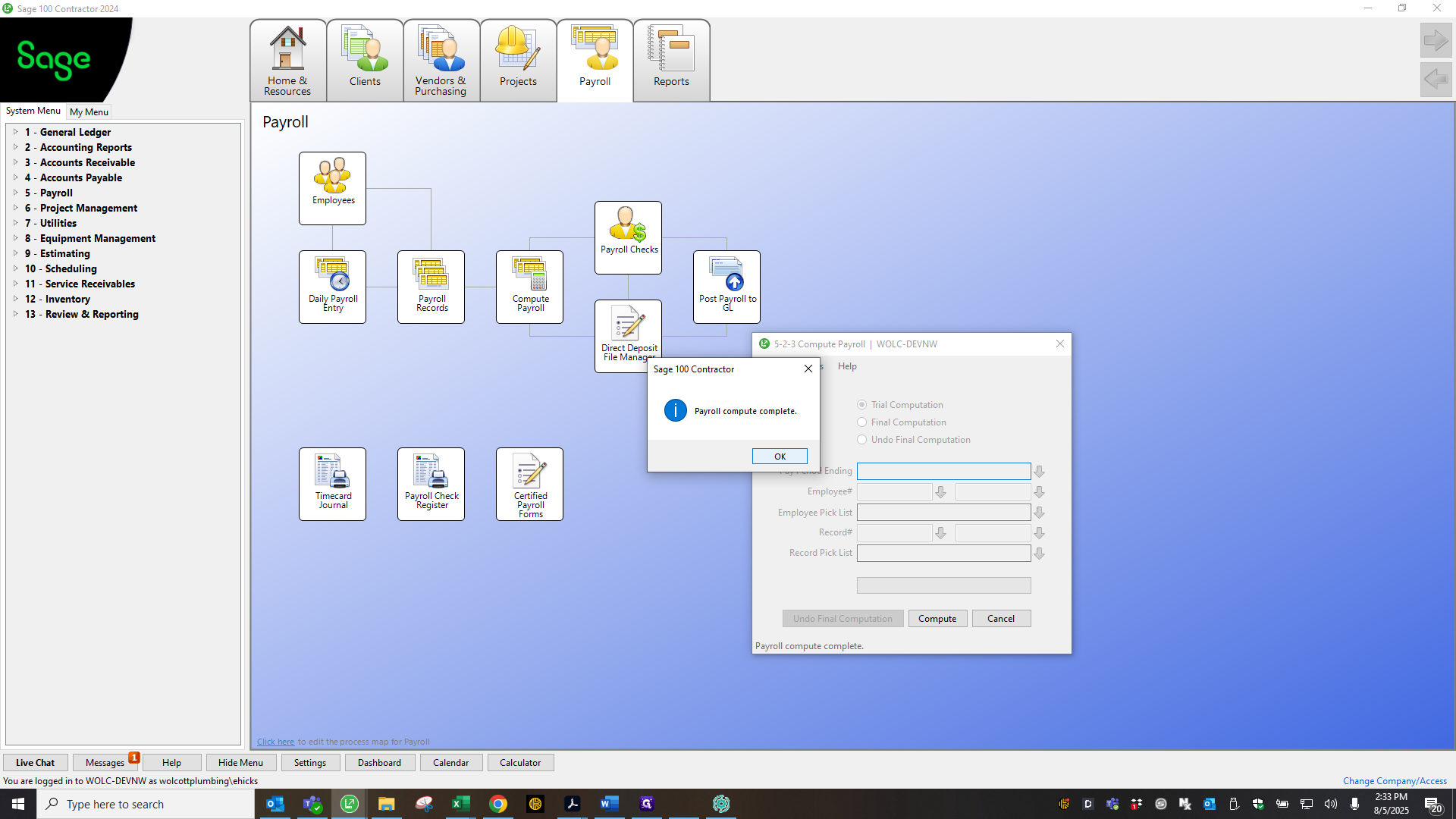

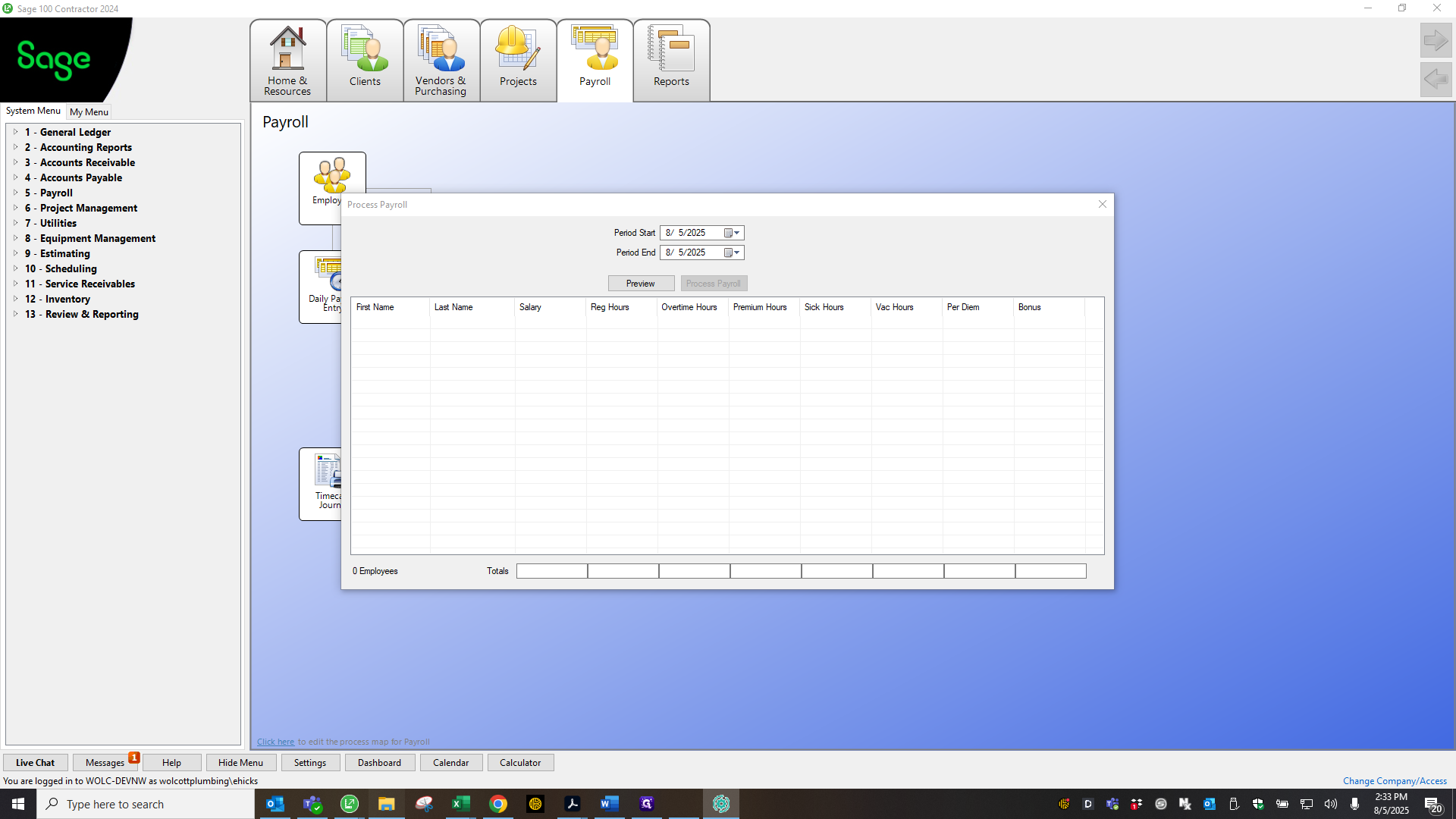

After you've finished squaring up, be sure to trial compute everything.

If trial compute has not been completed and you process payroll to ADP and try to sync it back, it will not work. You can fix it by doing a trial compute and syncing again. I usually make sure to do this beforehand.

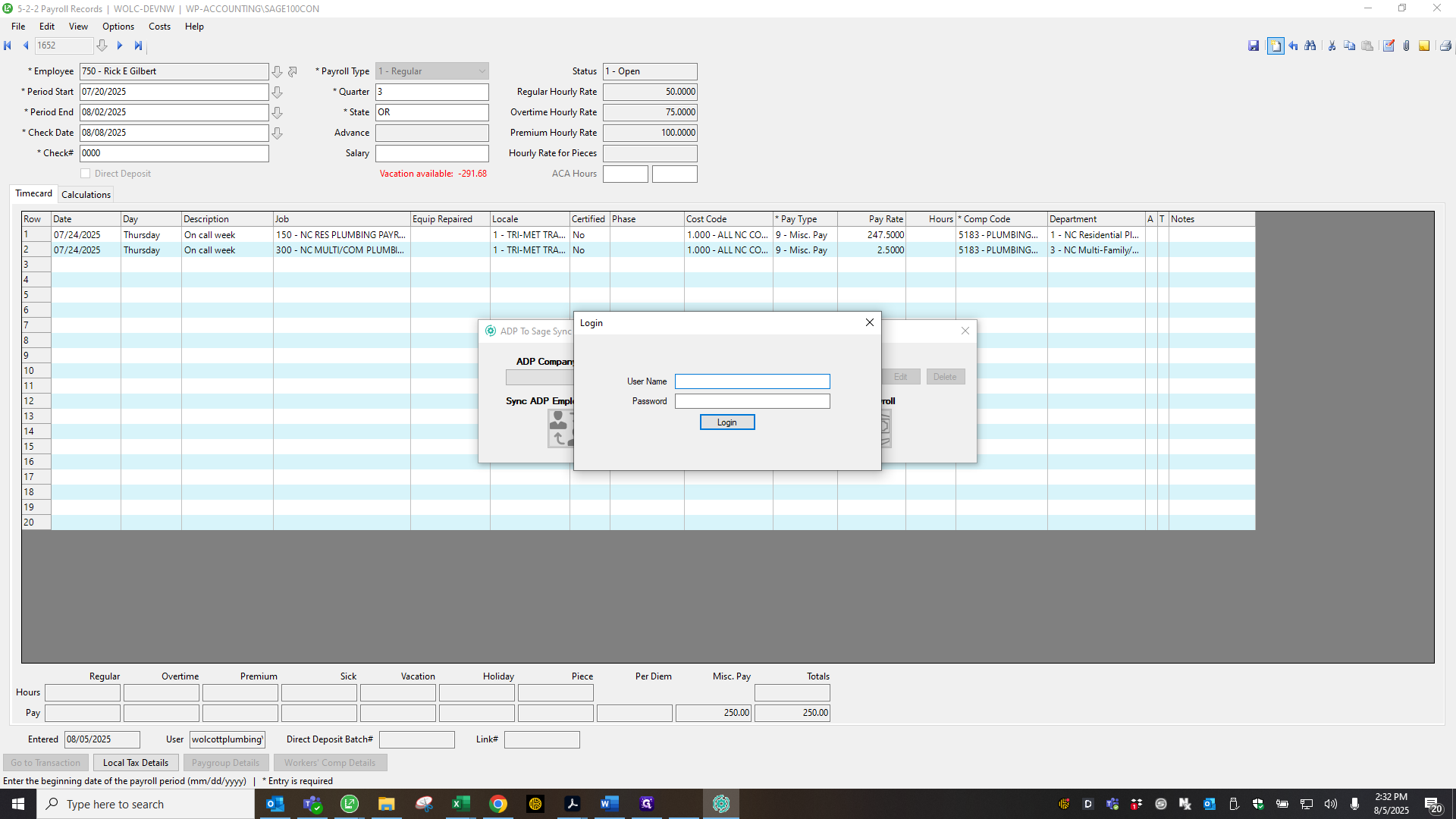

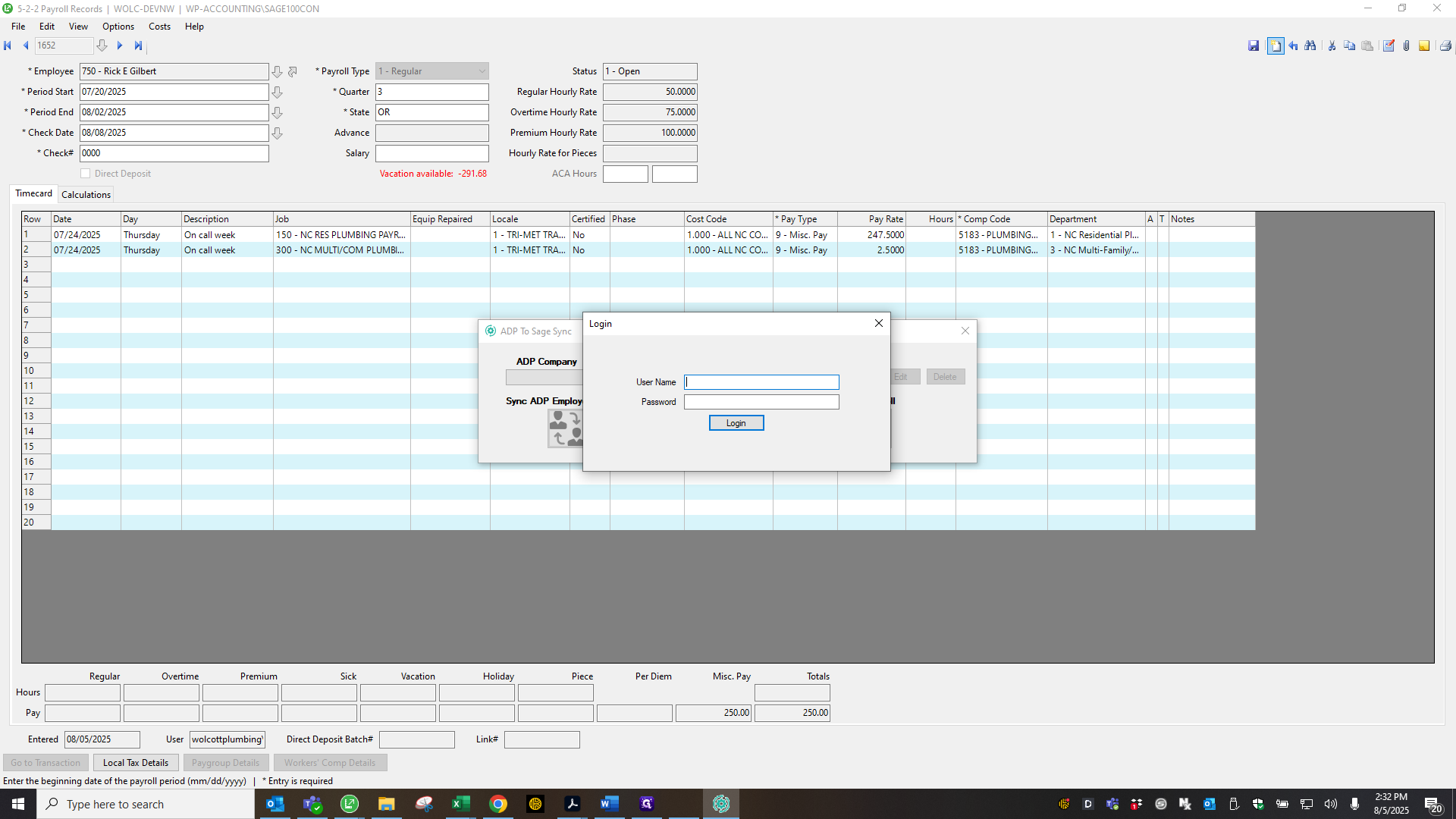

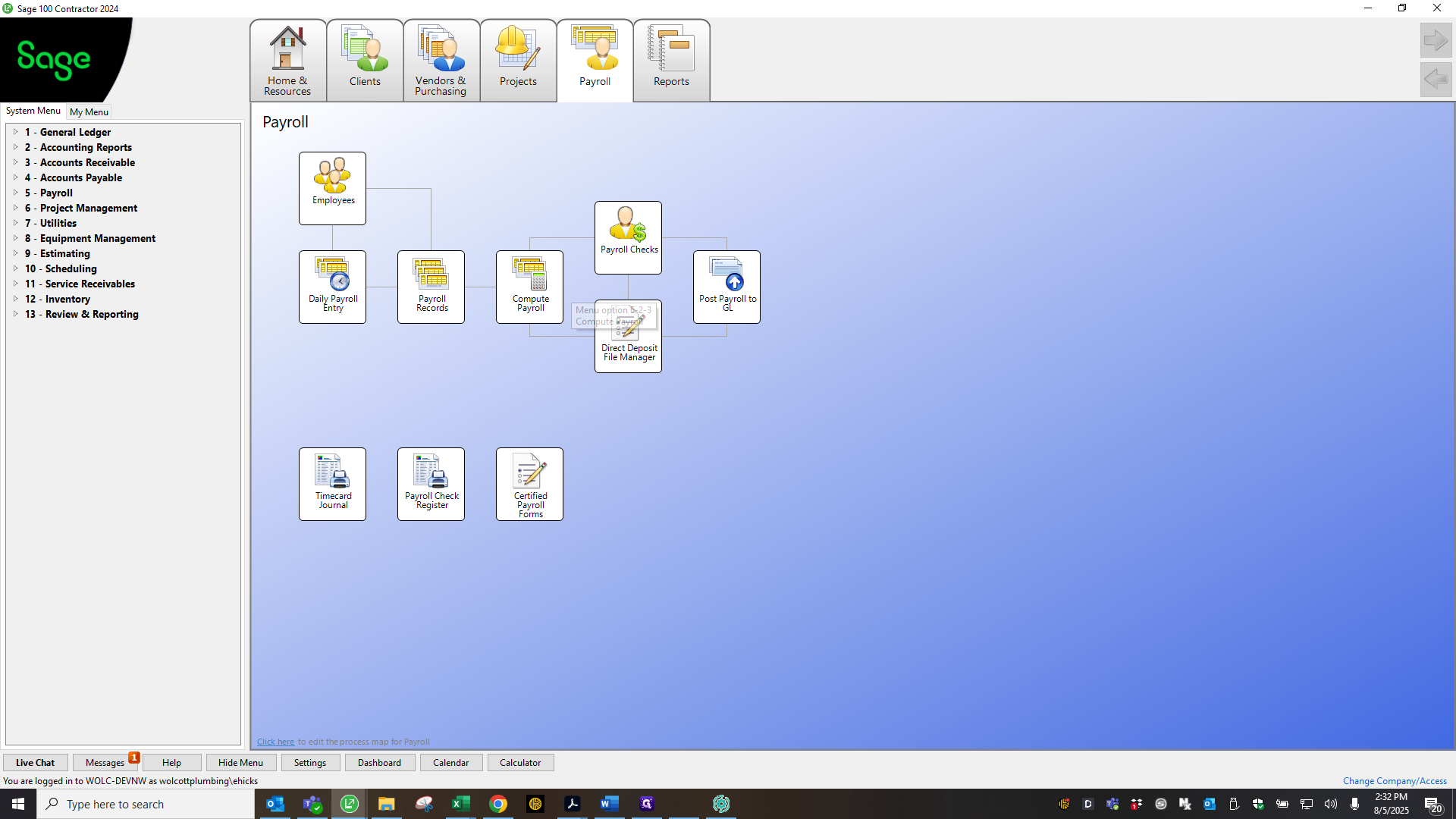

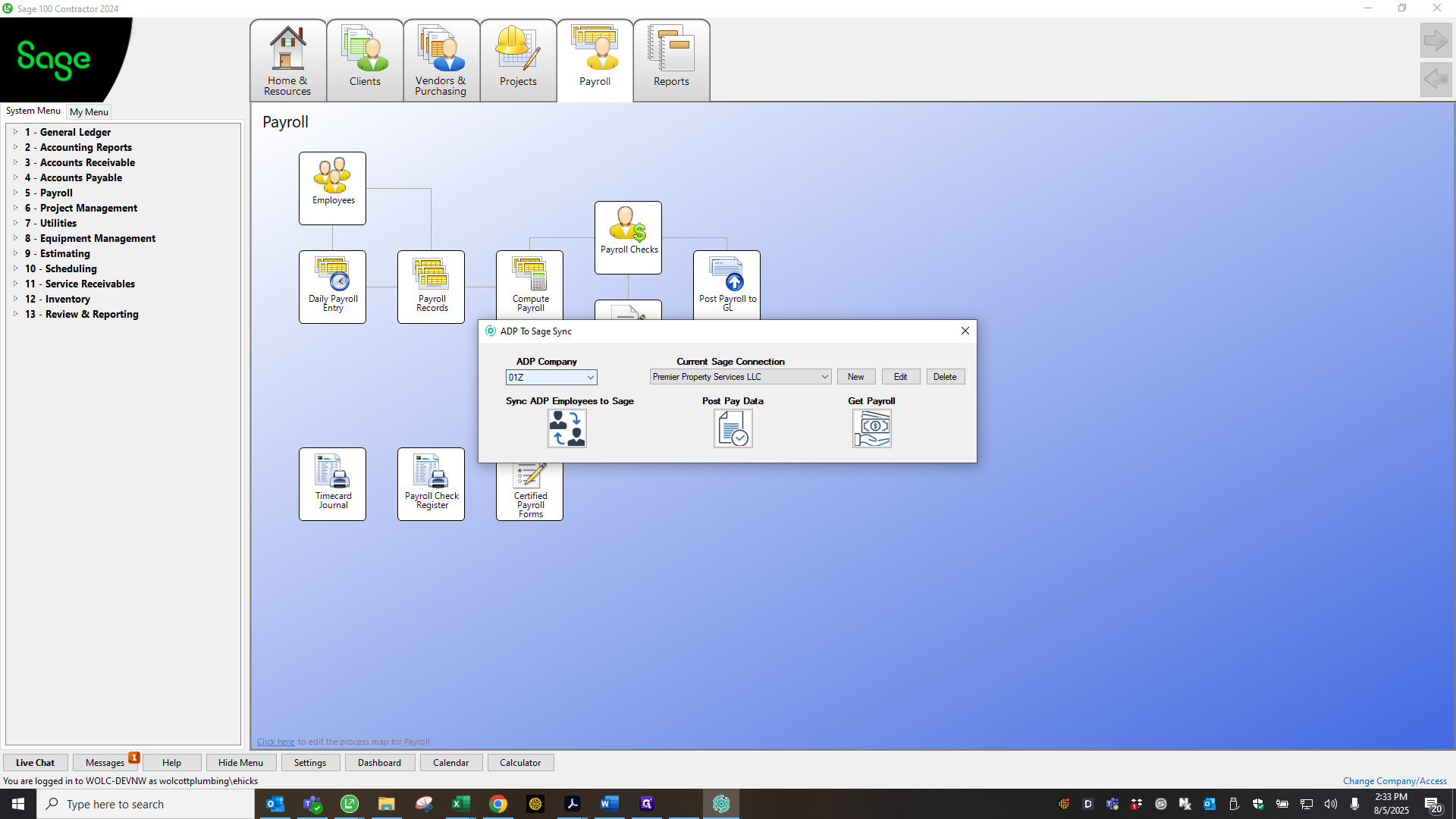

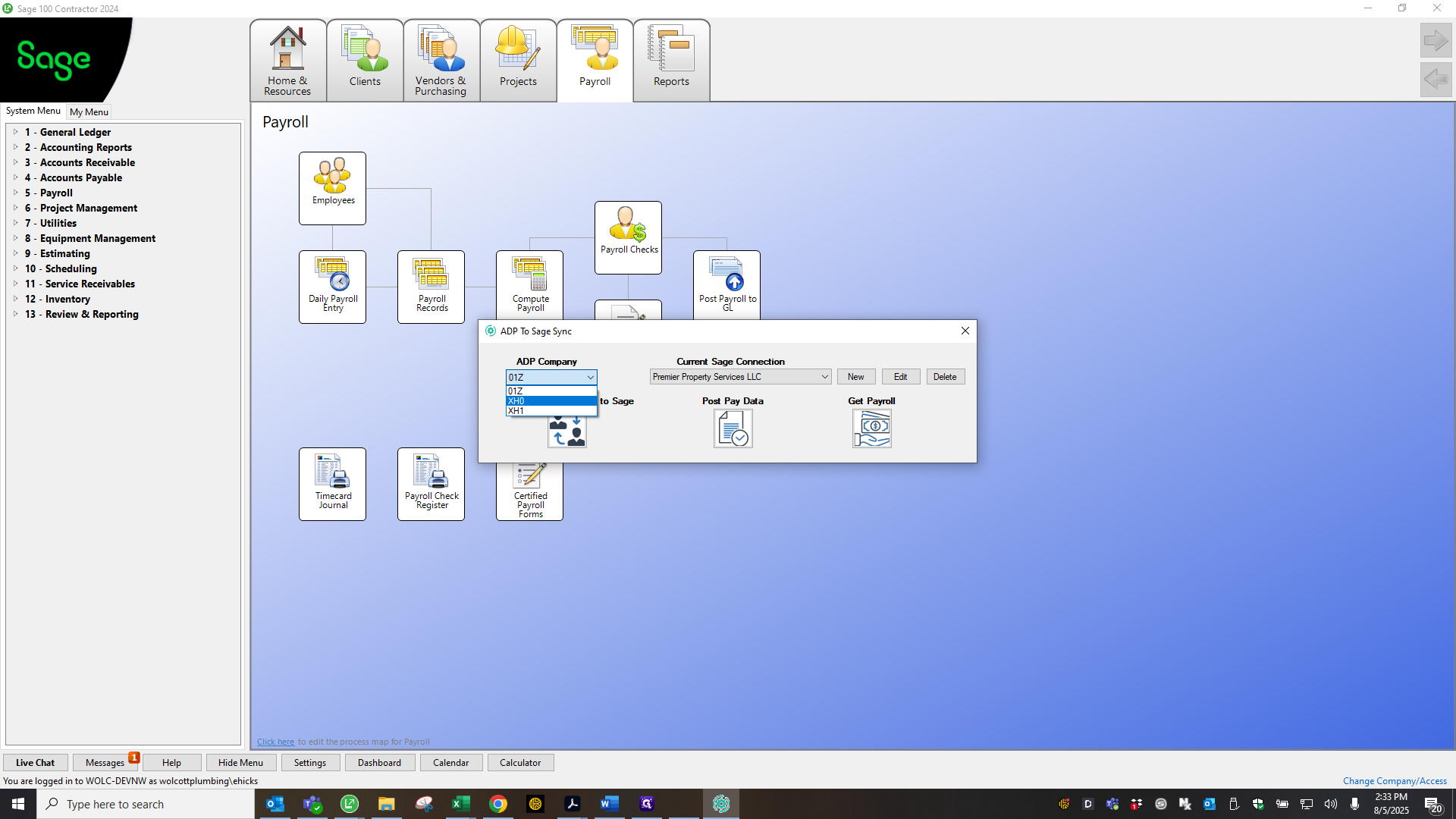

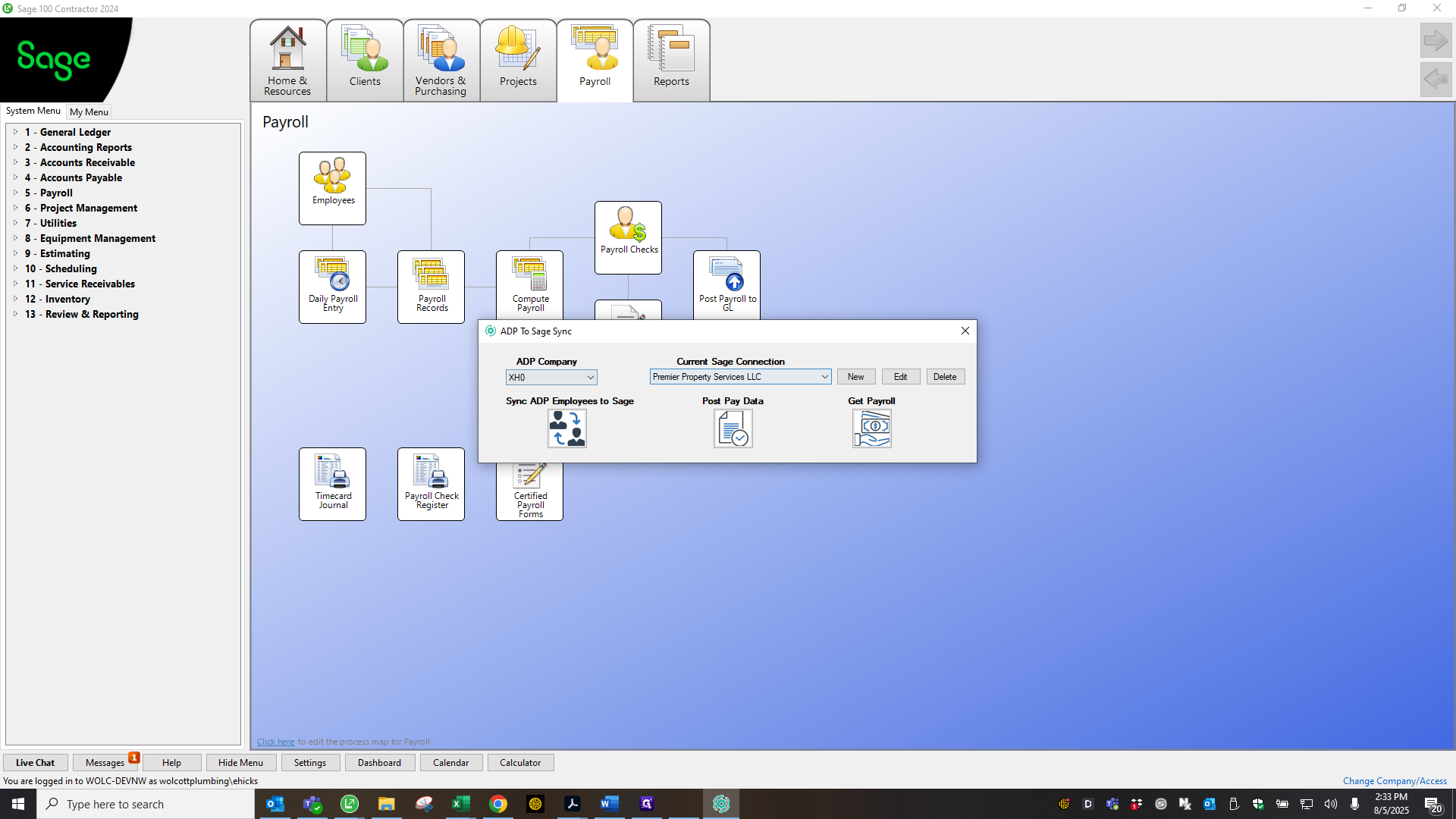

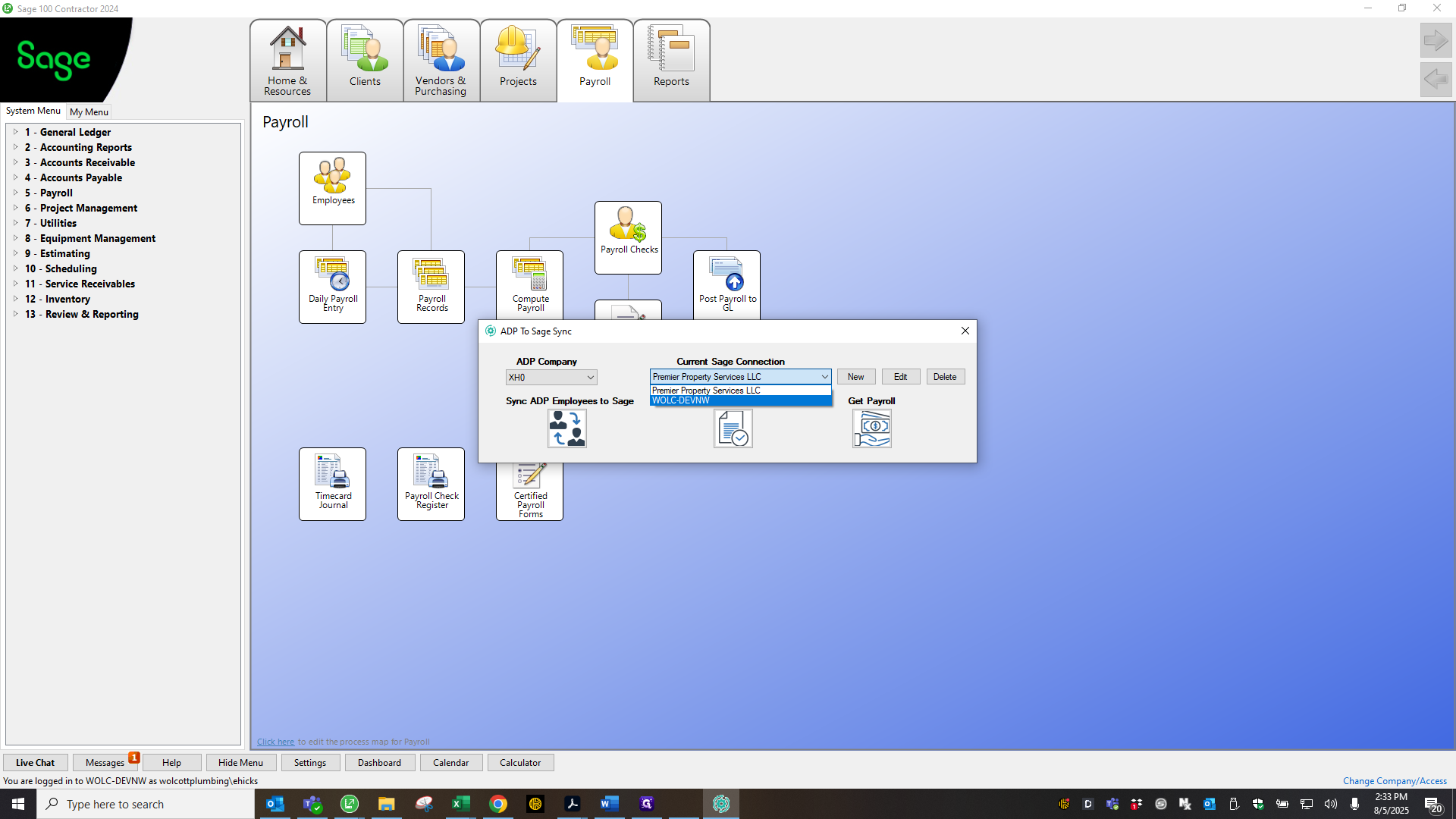

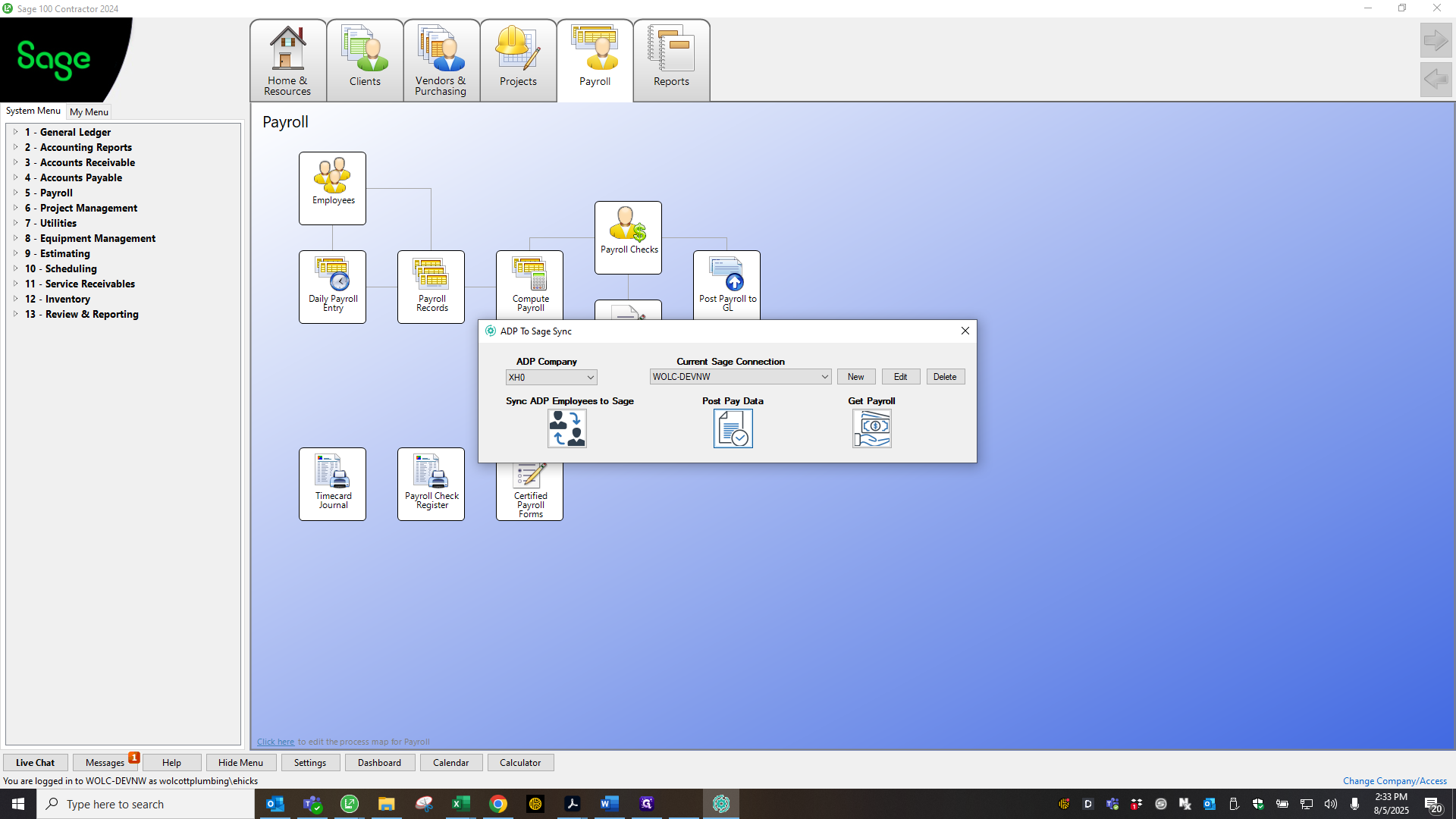

When you log into ADP SAGE Sync or the bridge...

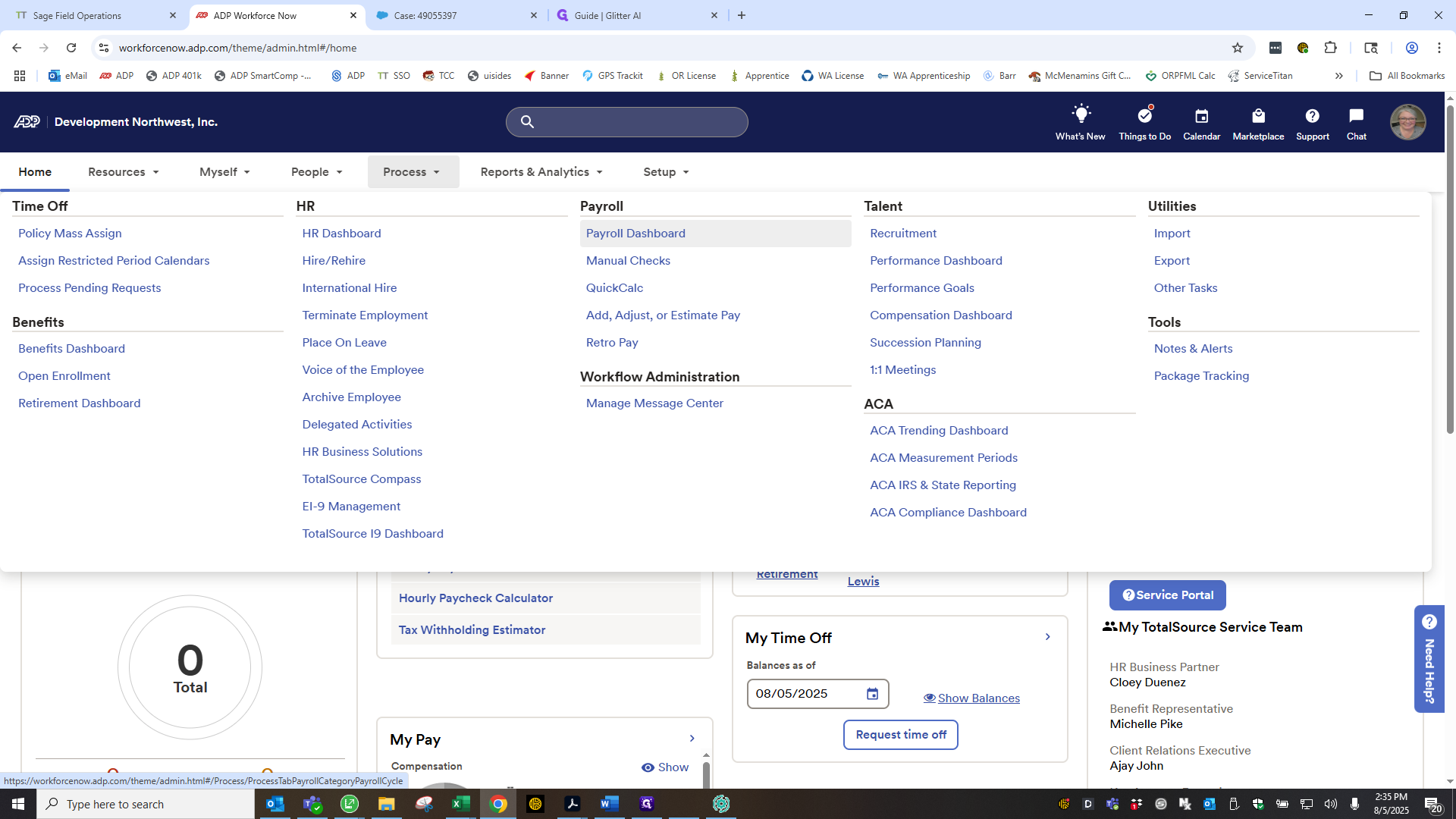

Select your company code and company, then choose post pay data.

Actually, I'm going to go here to make sure that...

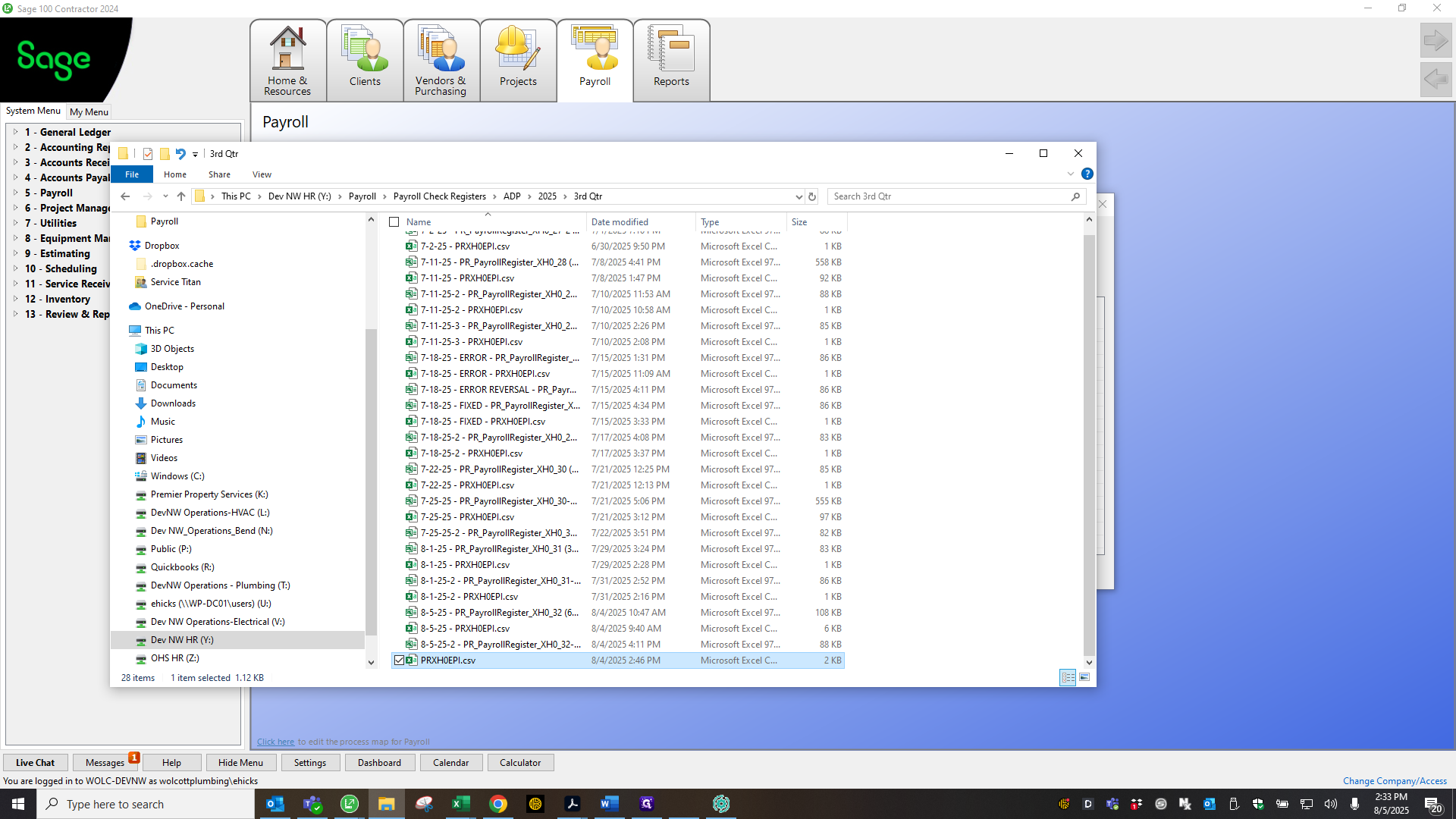

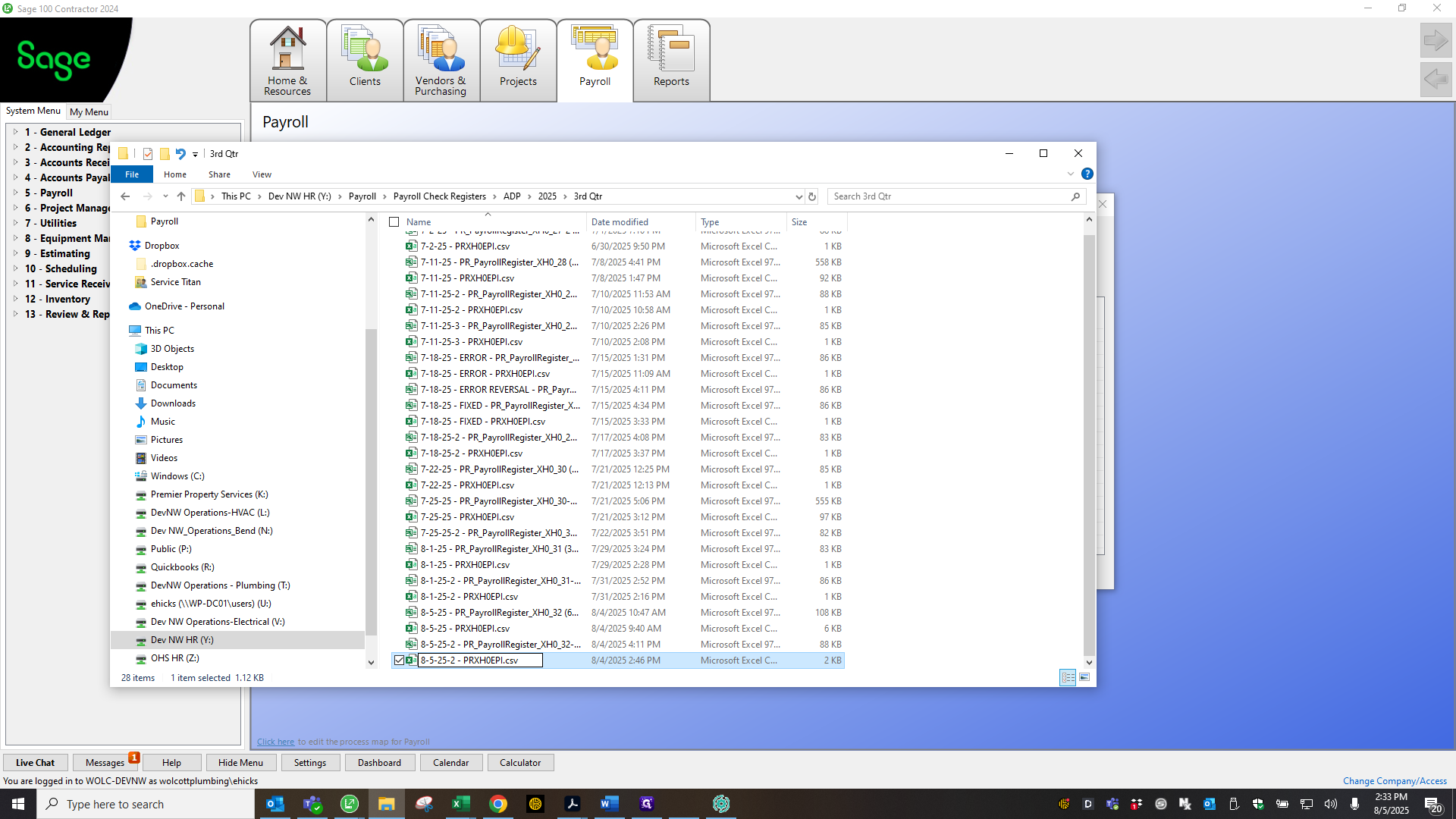

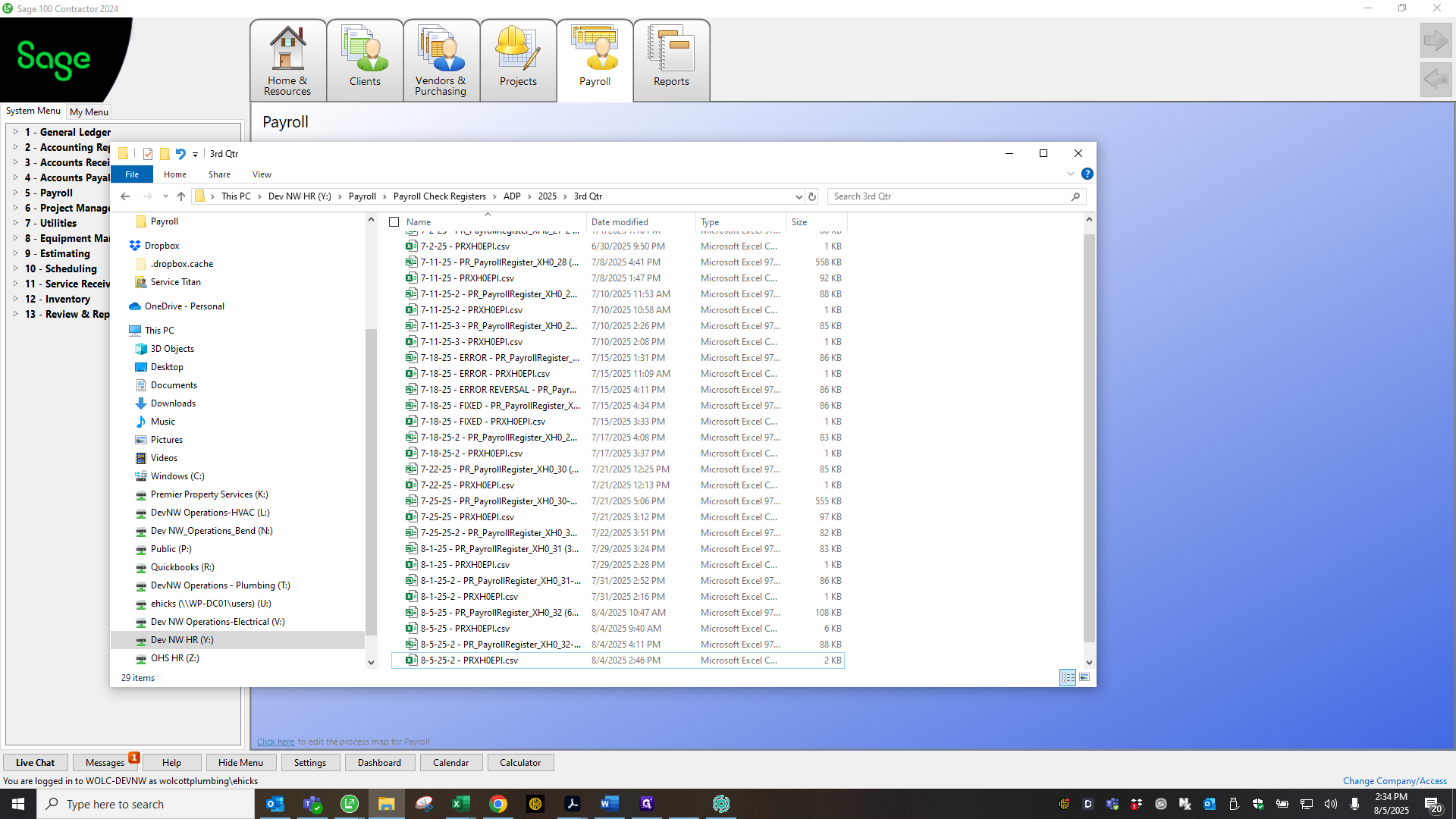

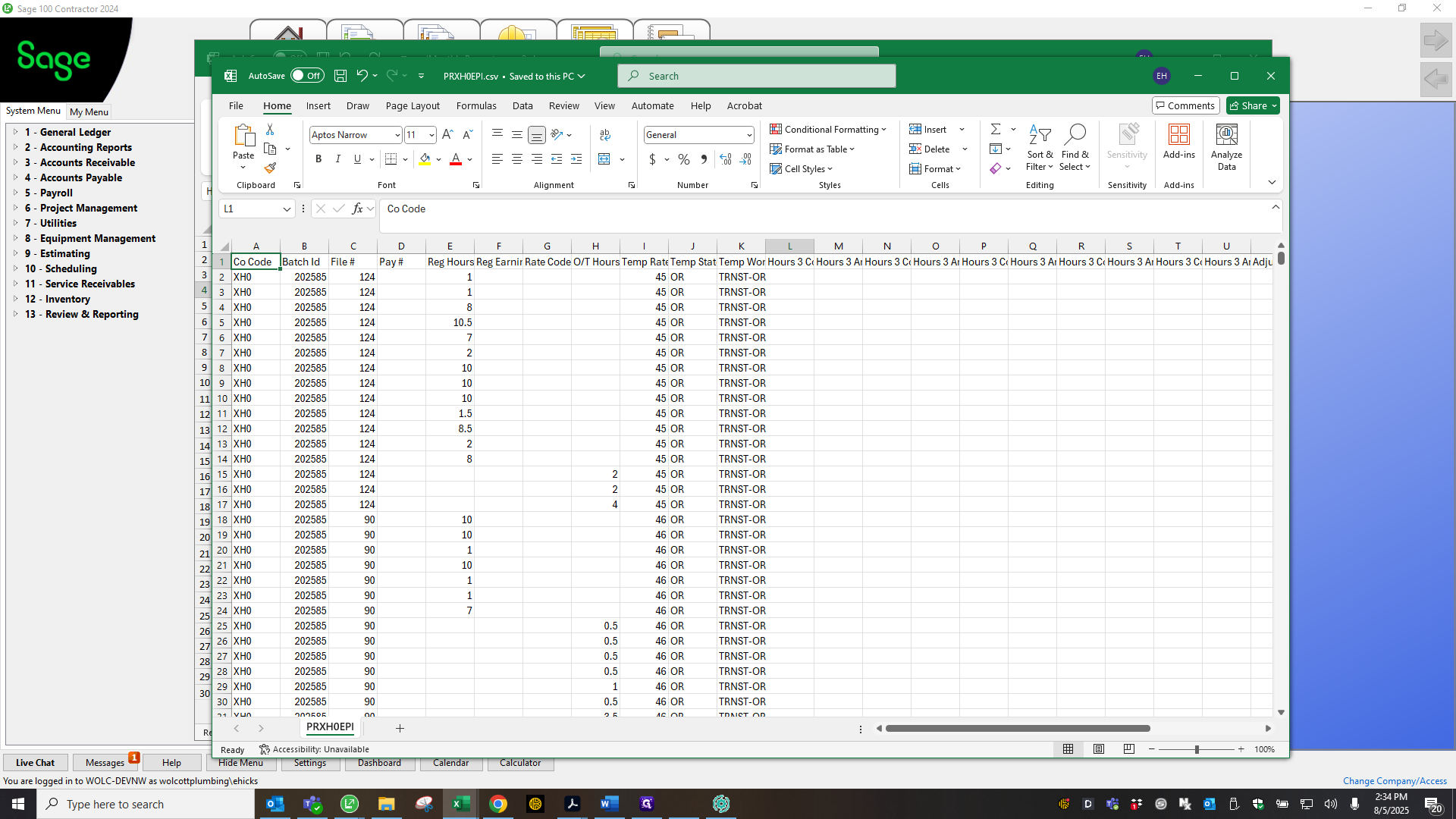

You cannot change a file name.

You need to save it as it loads. I did this one yesterday.

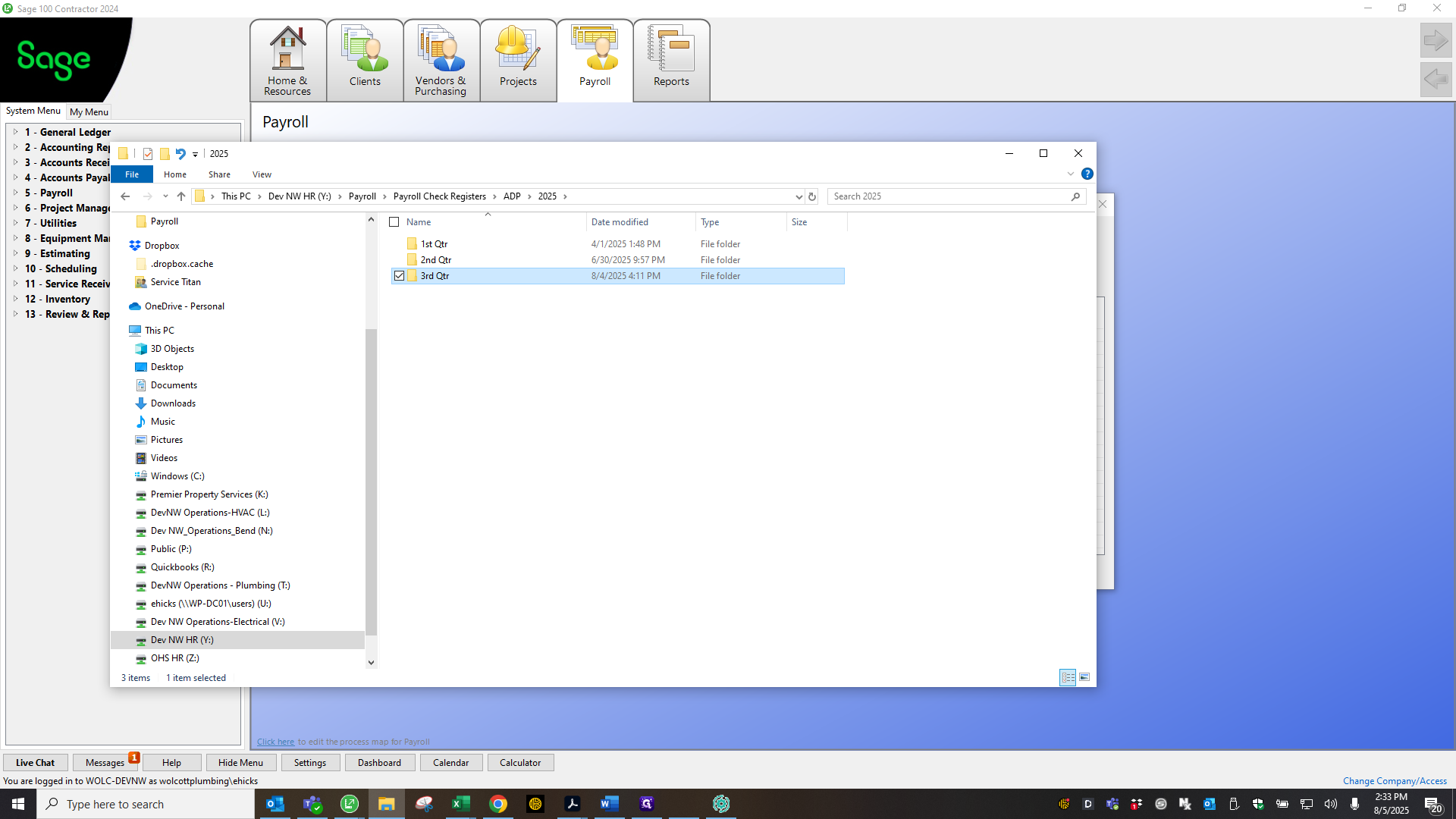

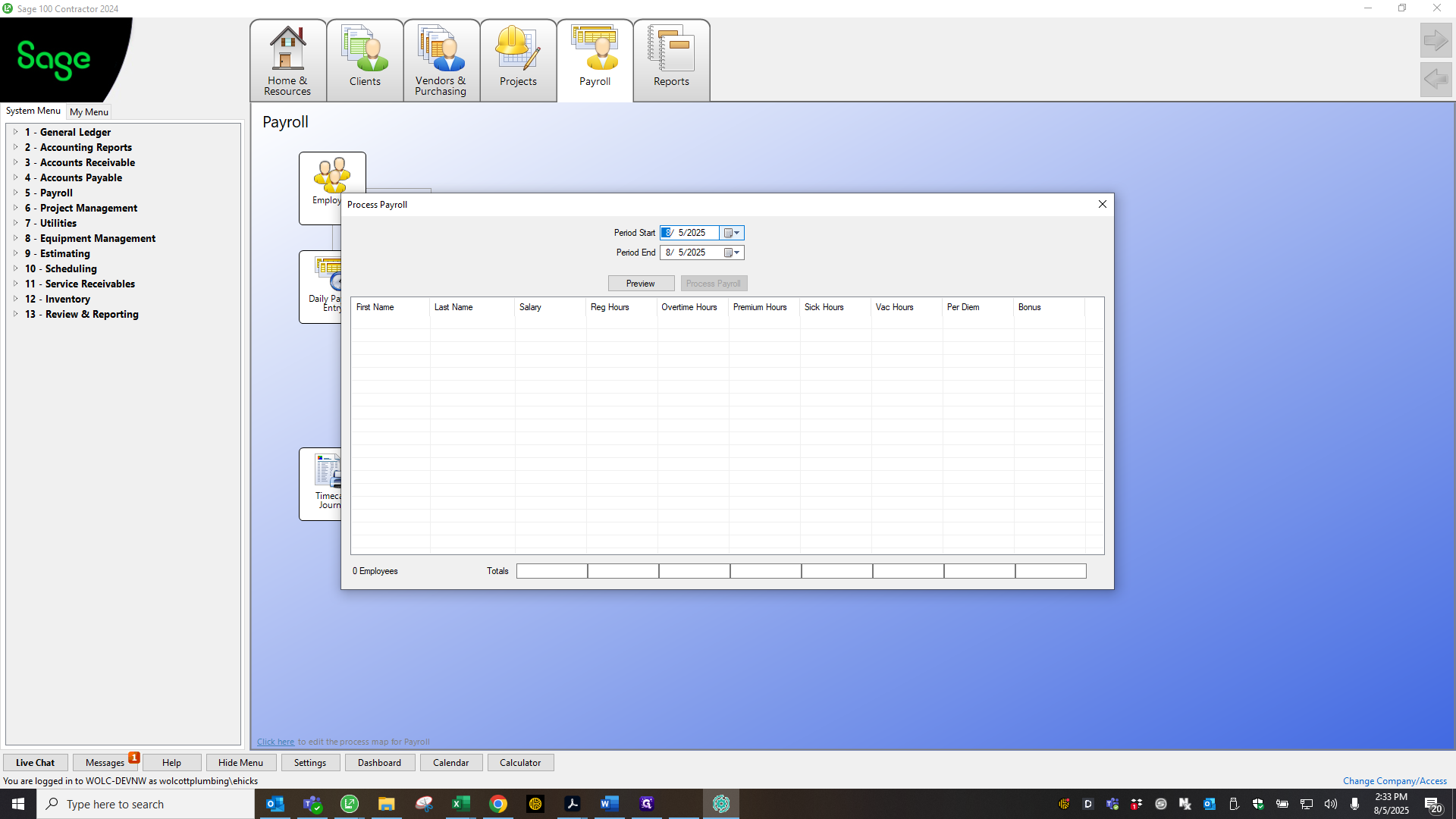

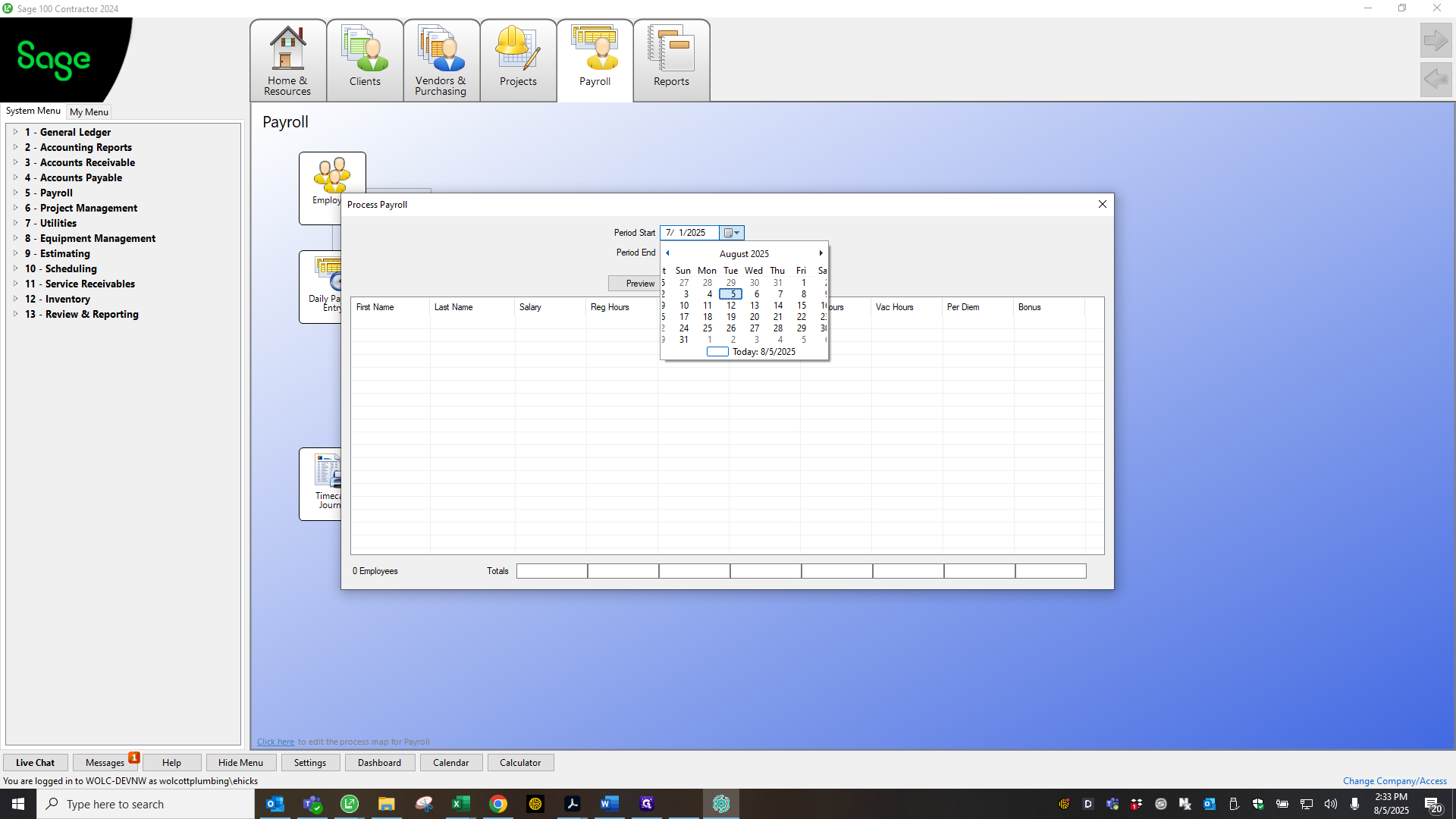

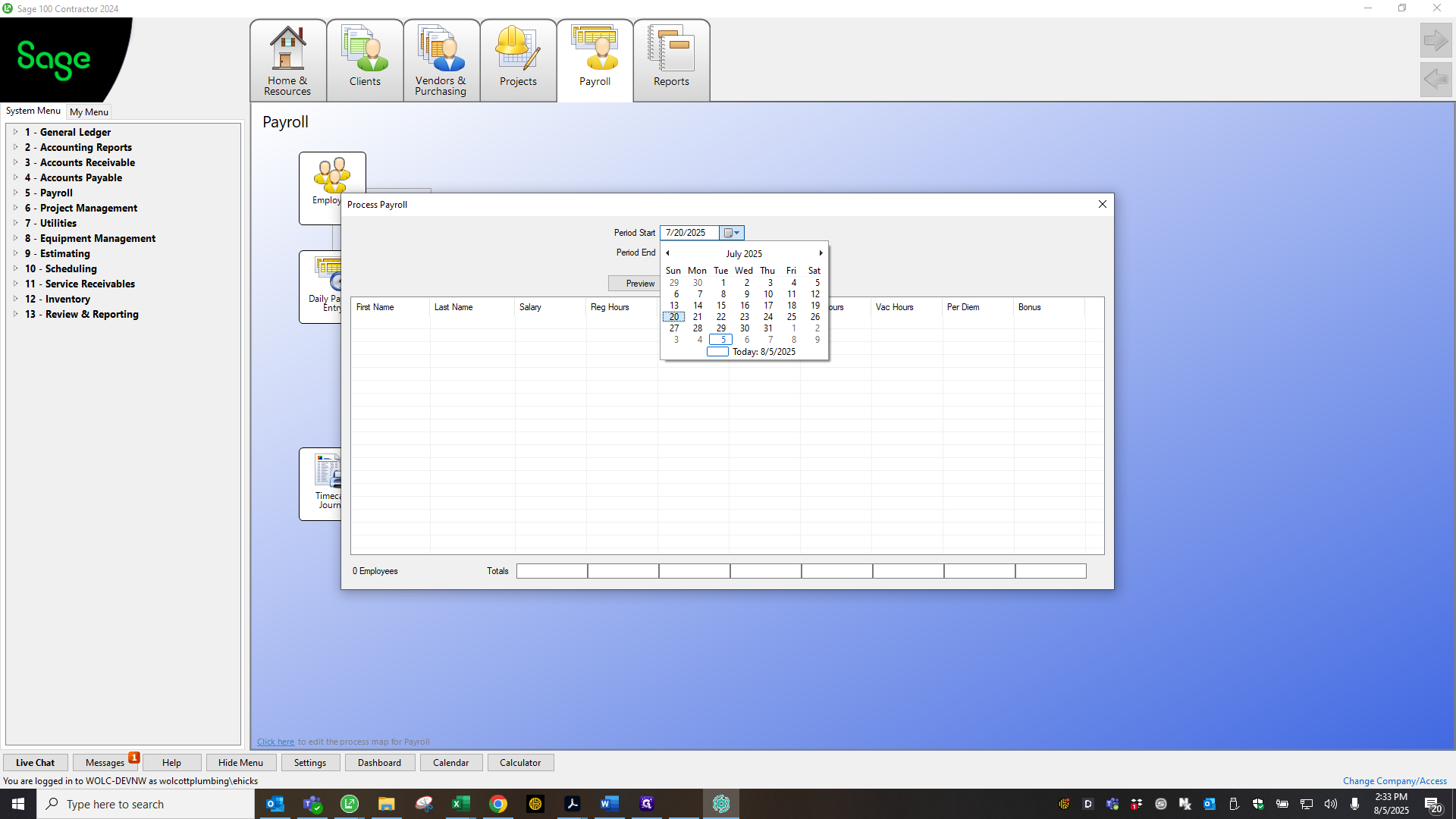

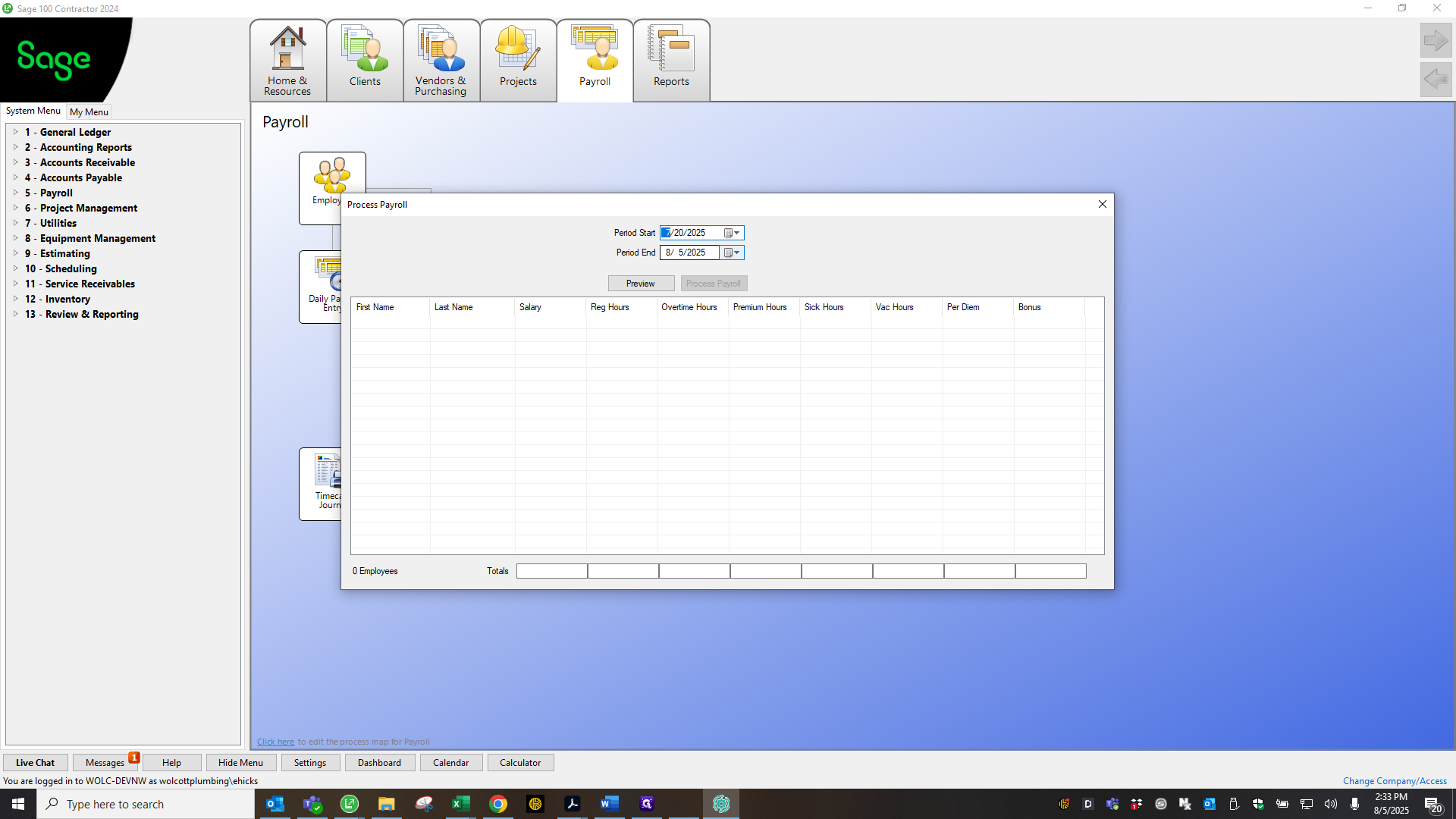

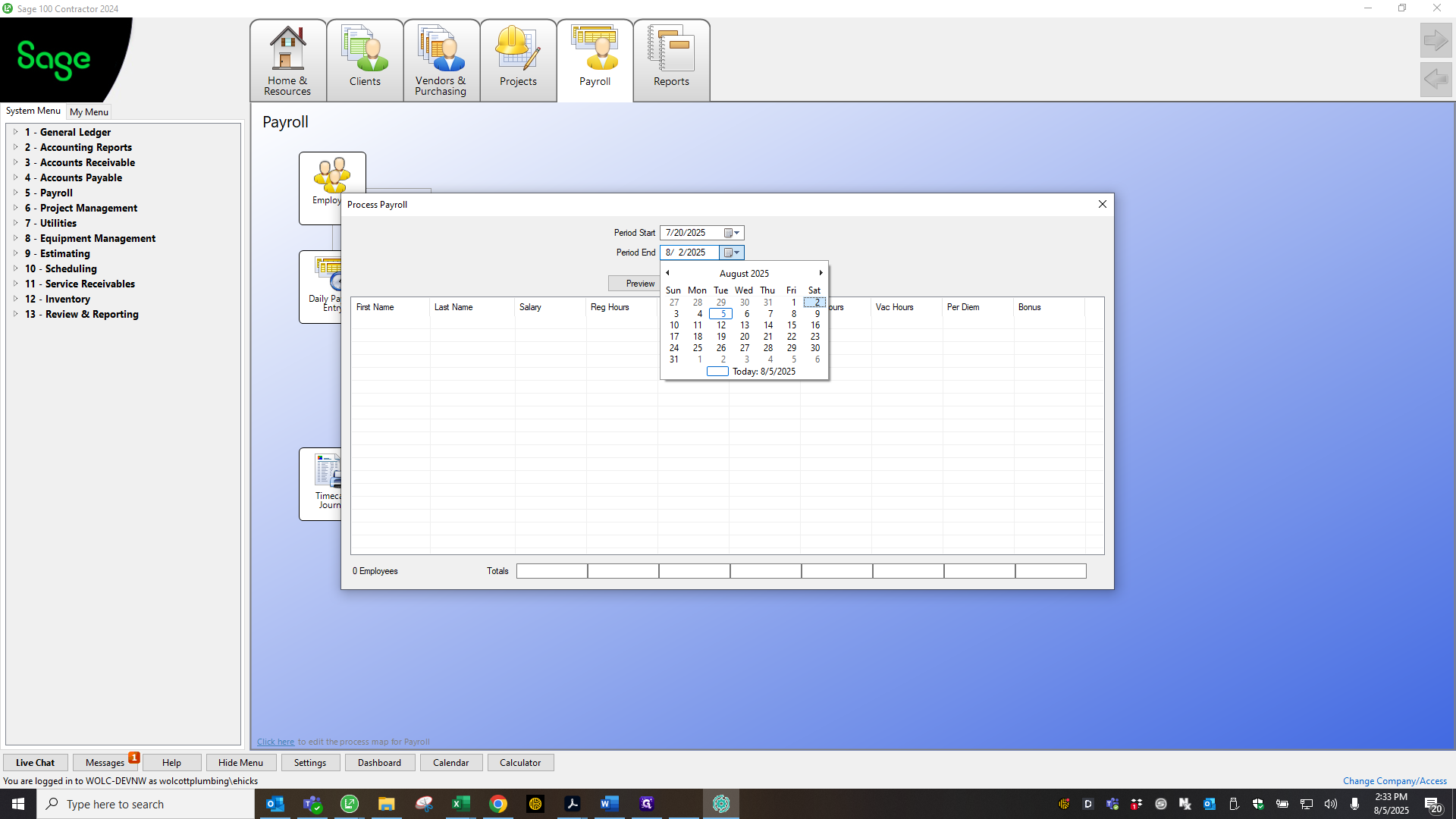

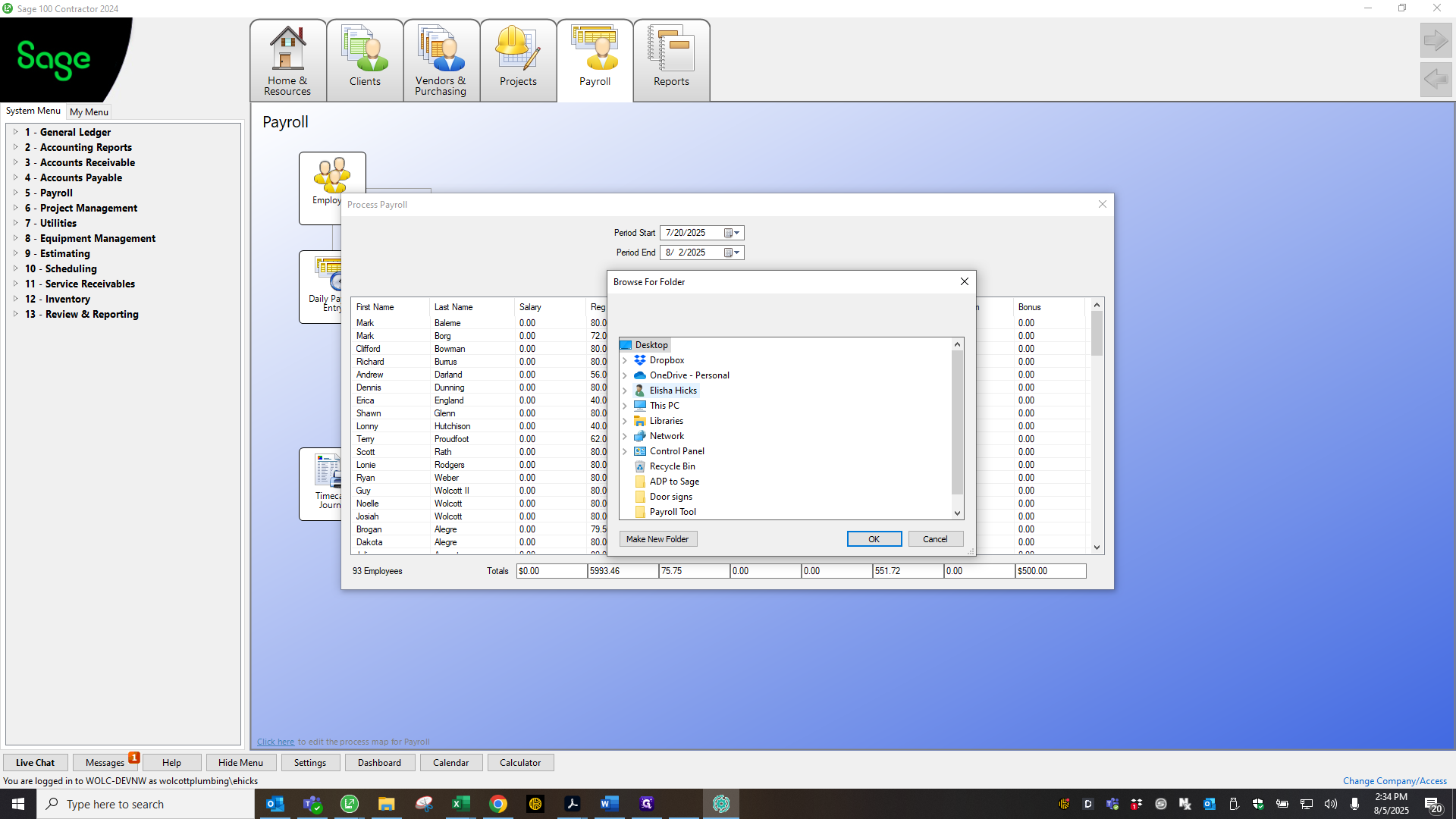

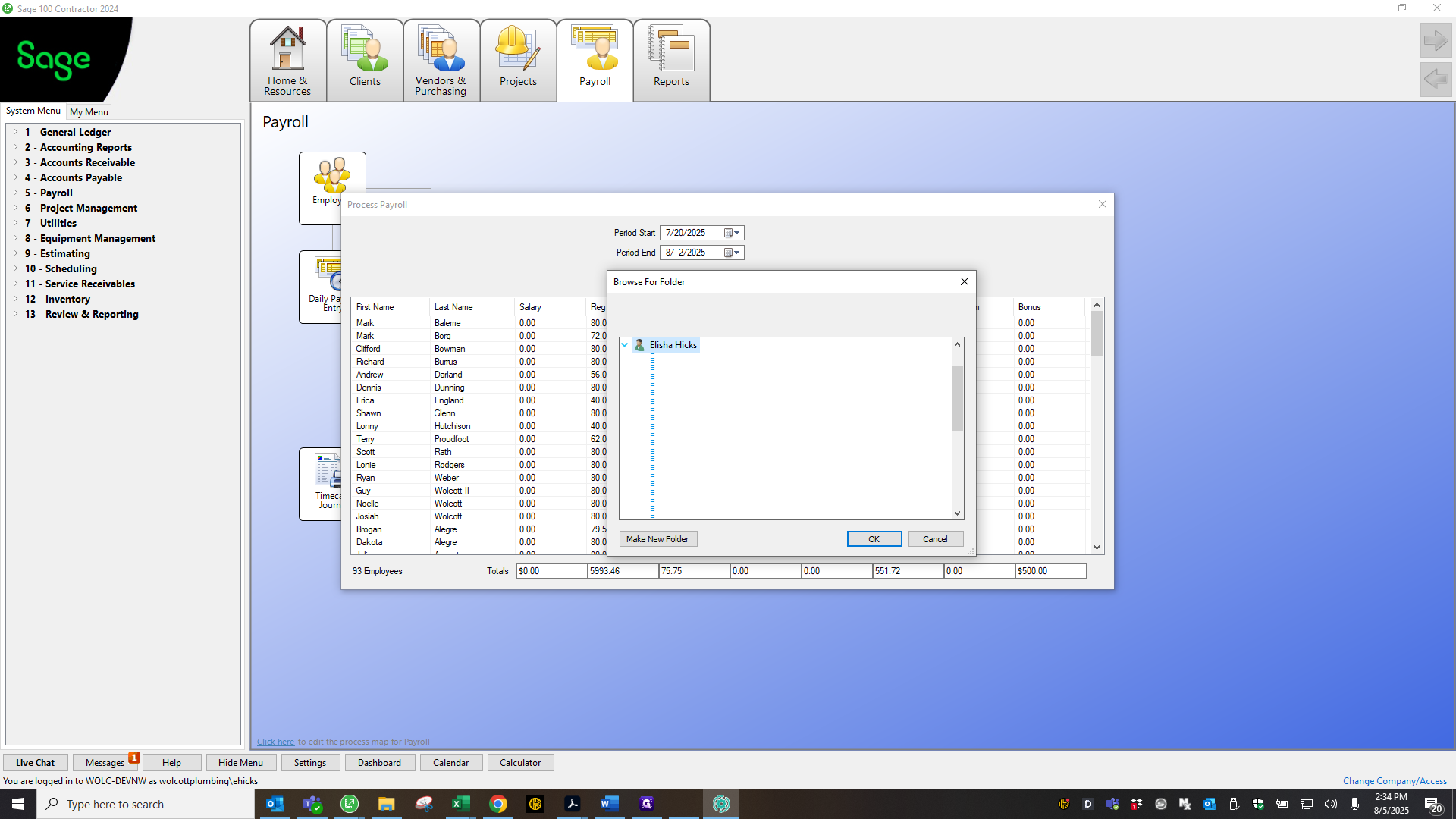

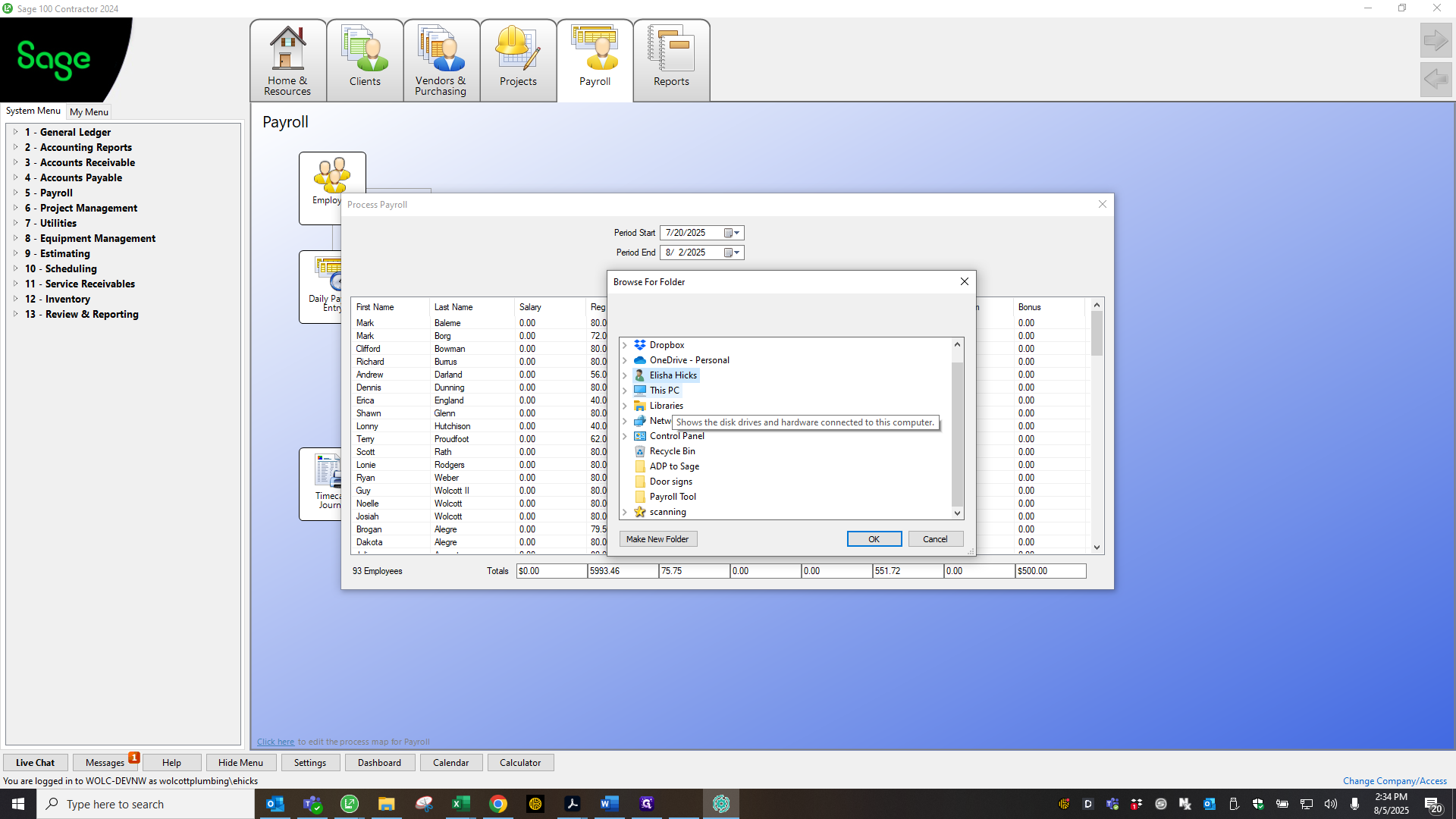

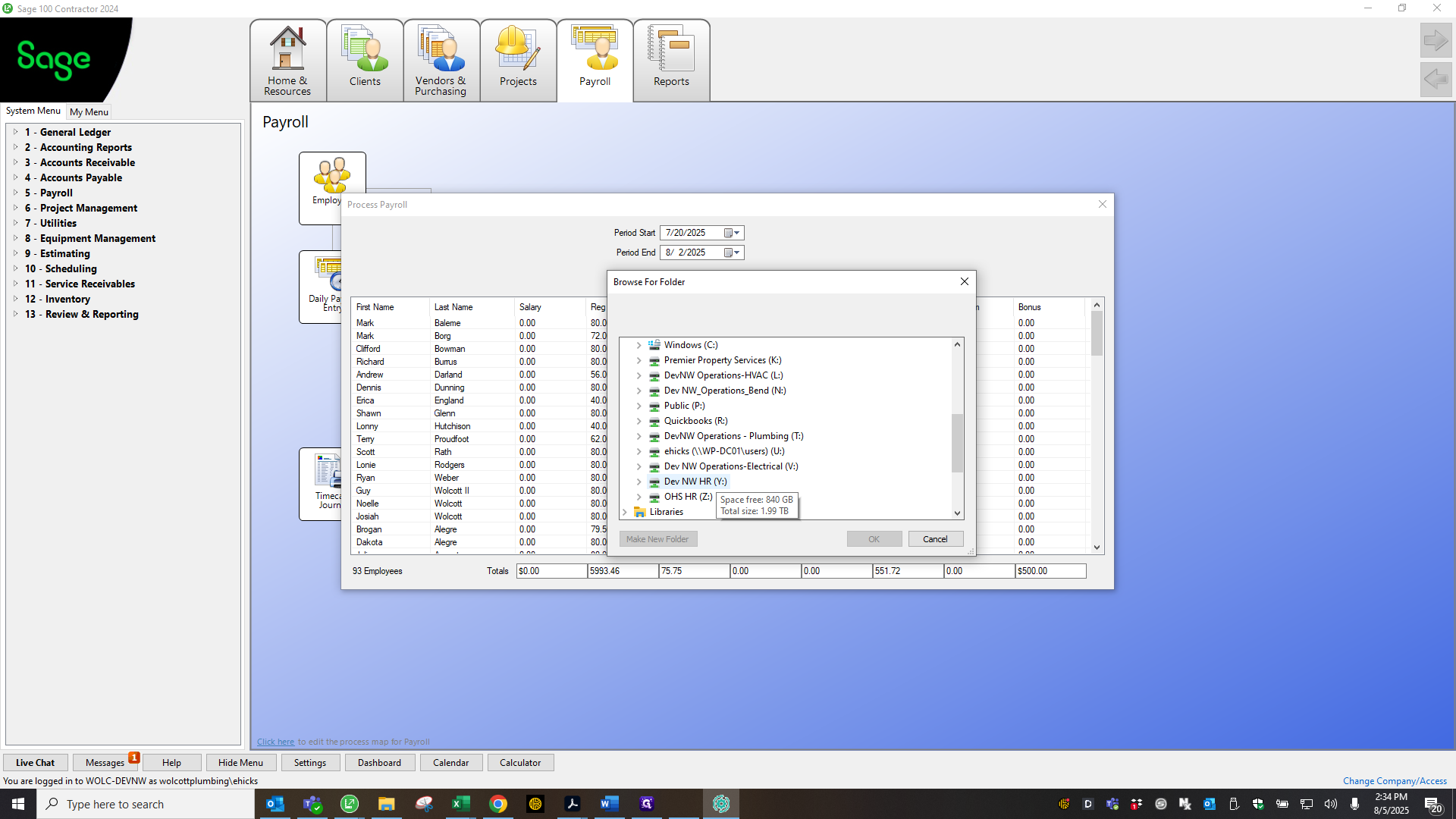

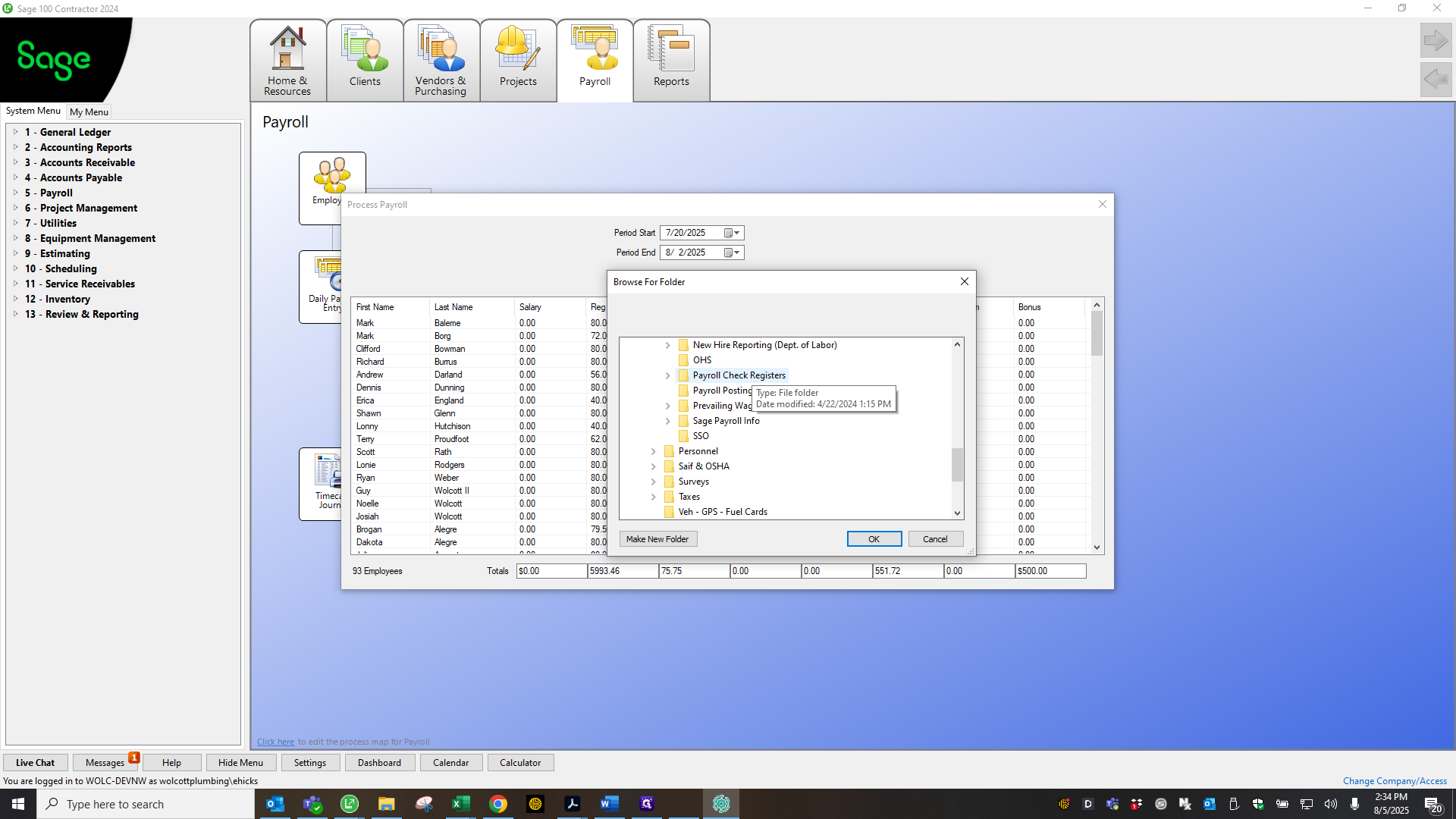

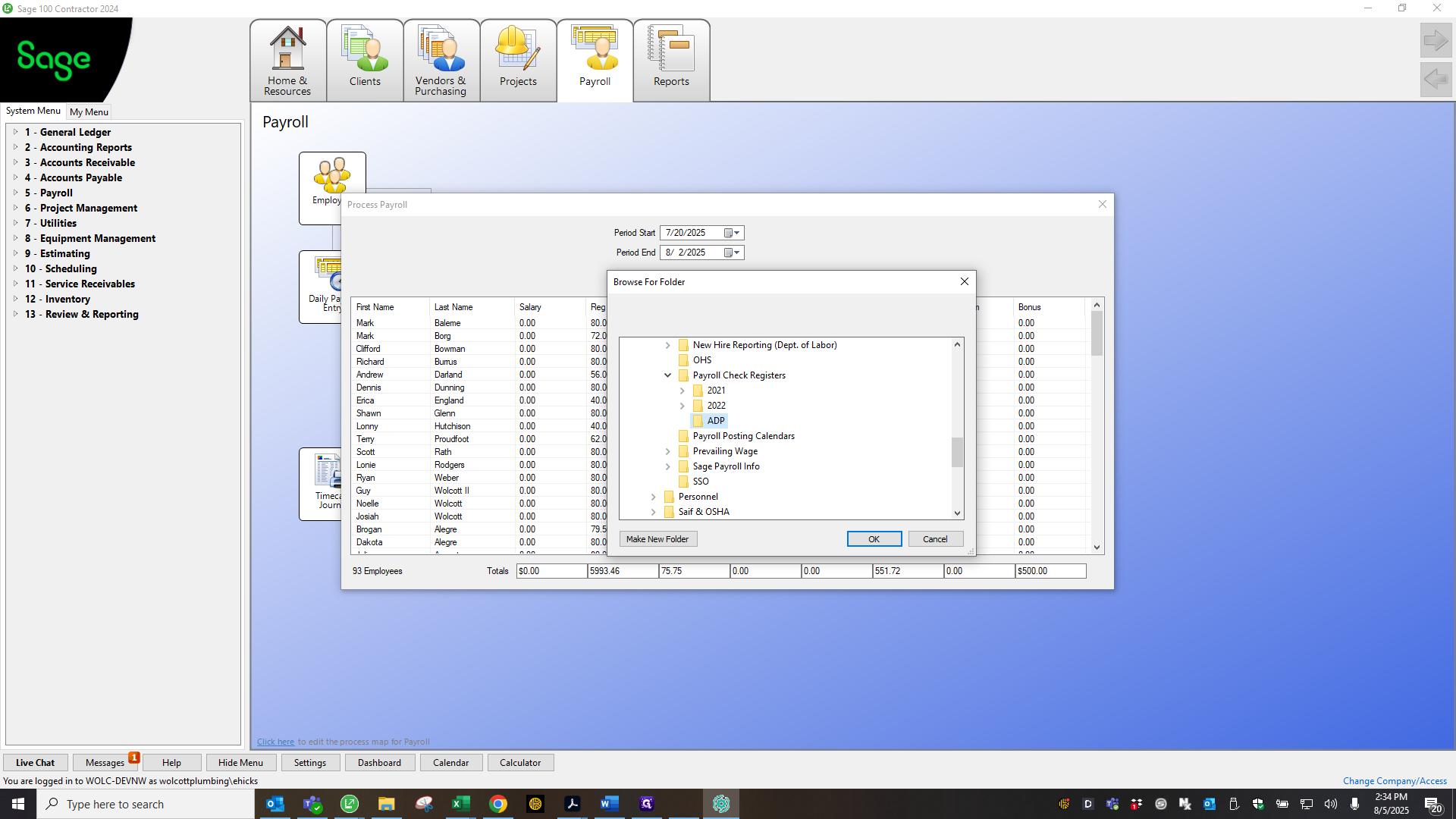

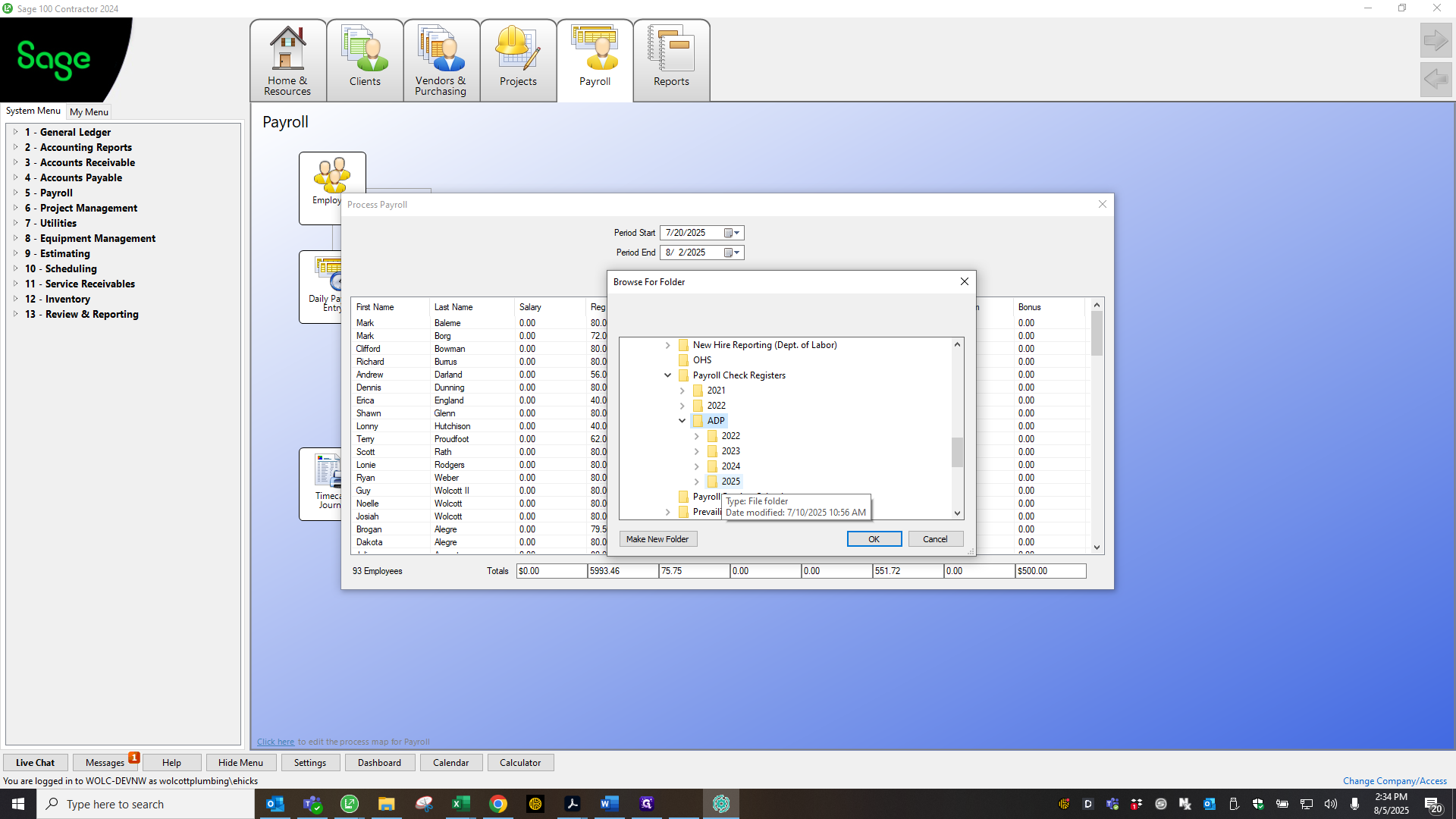

I need to add the date to prevent overwriting and to keep a copy. Choose your payroll period dates.

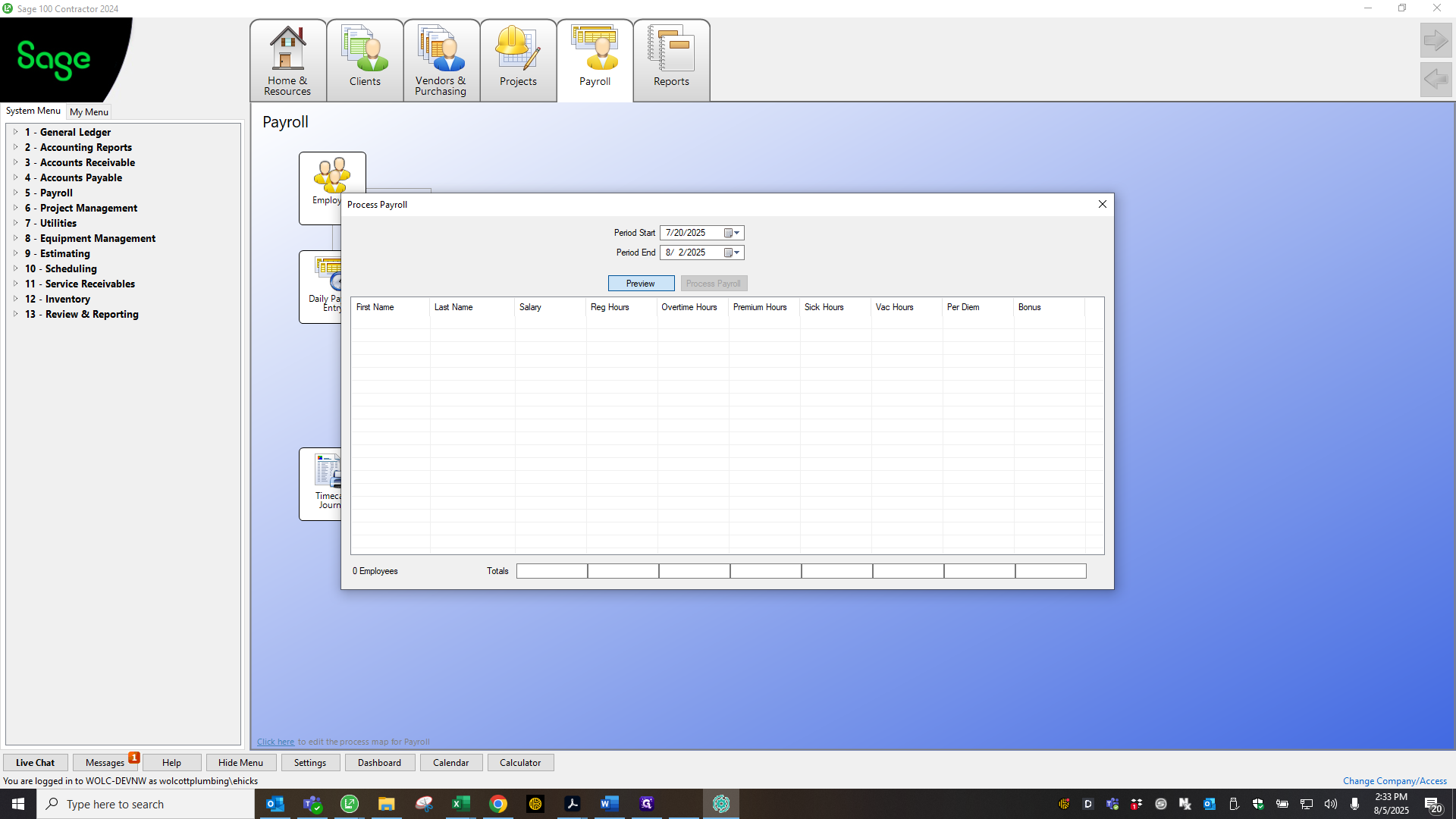

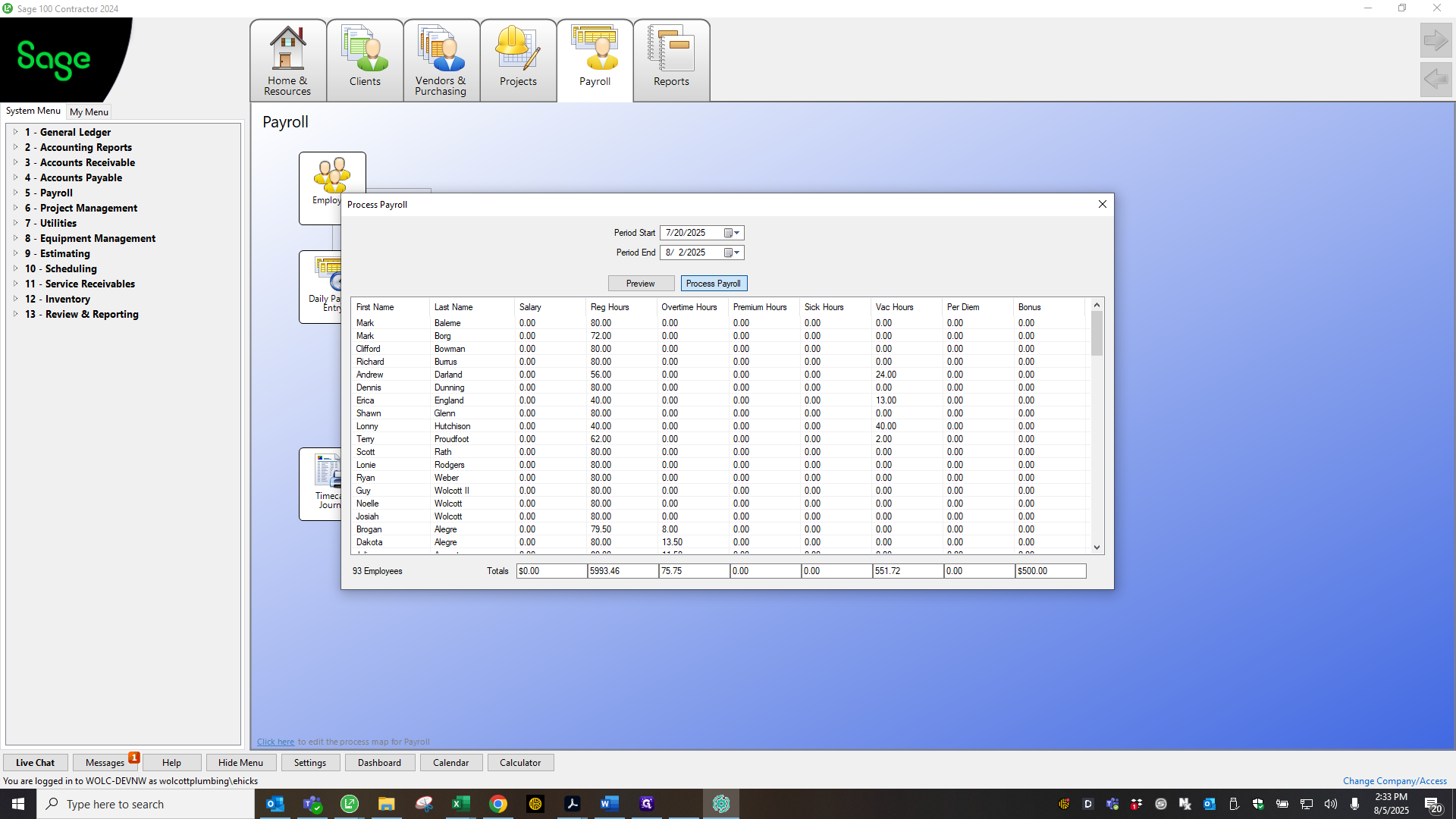

Come here and start the process.

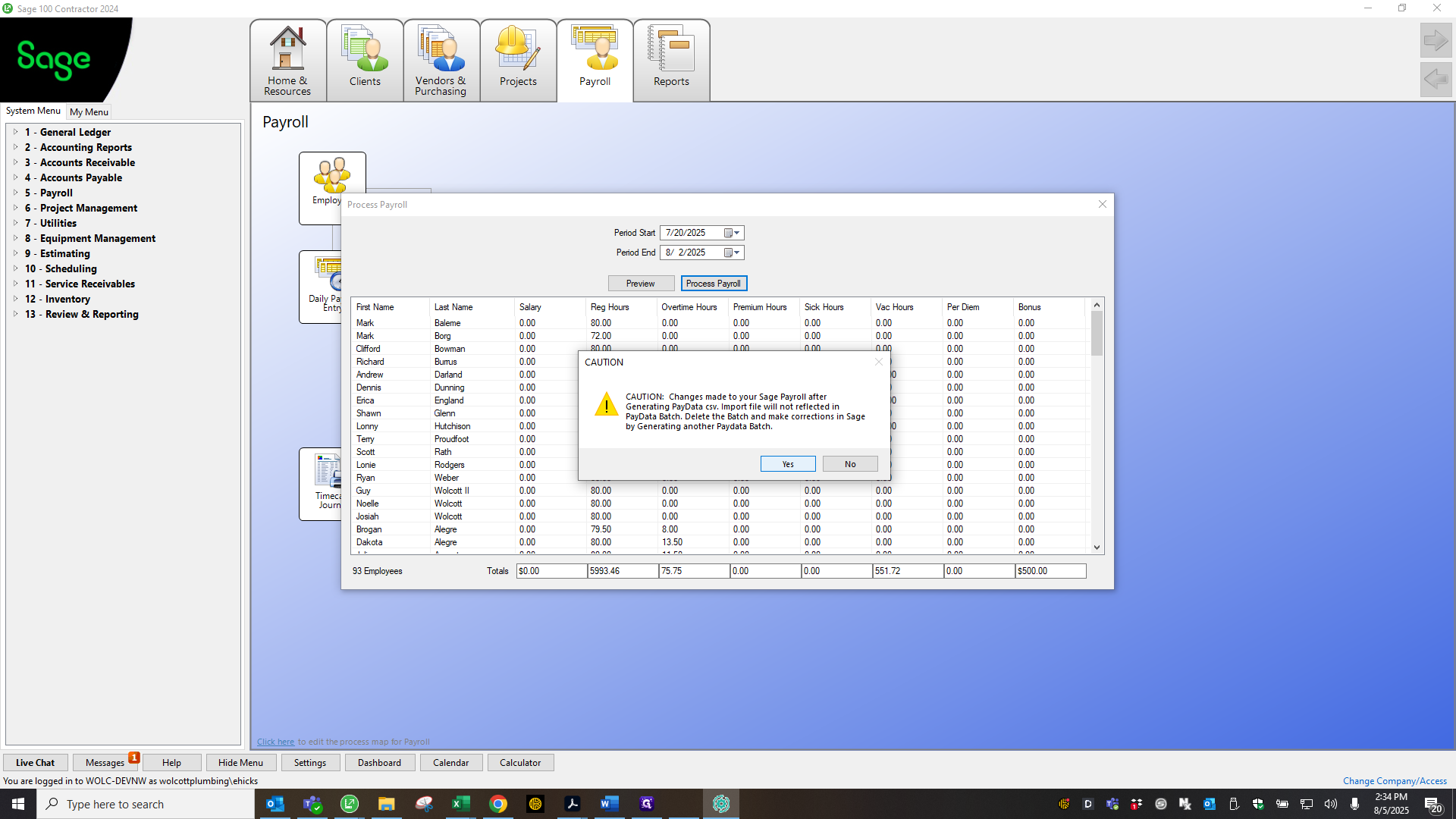

Yes.

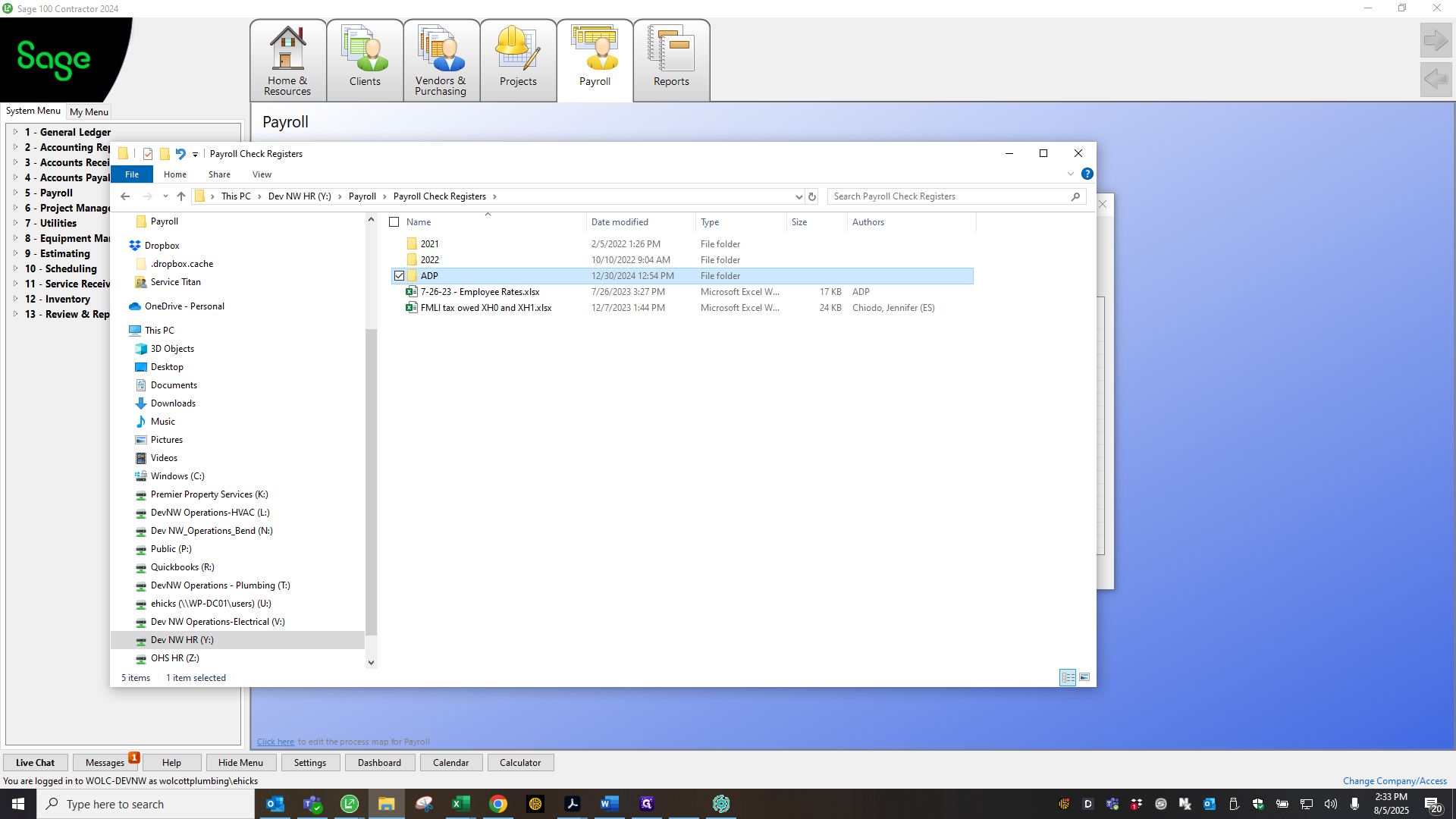

Save it to the payroll checks folder.

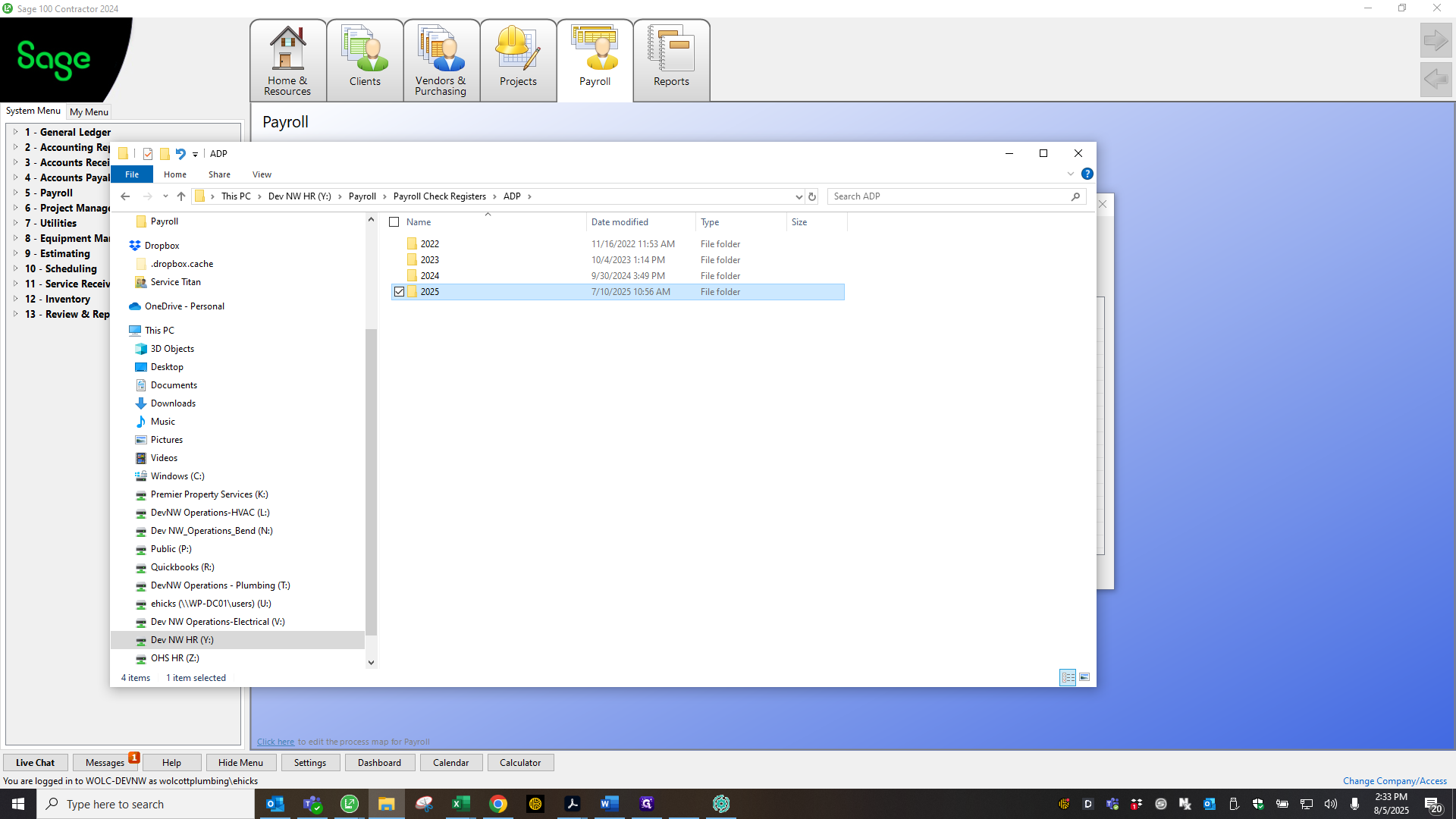

Check that the source time is in the correct year and quarter.

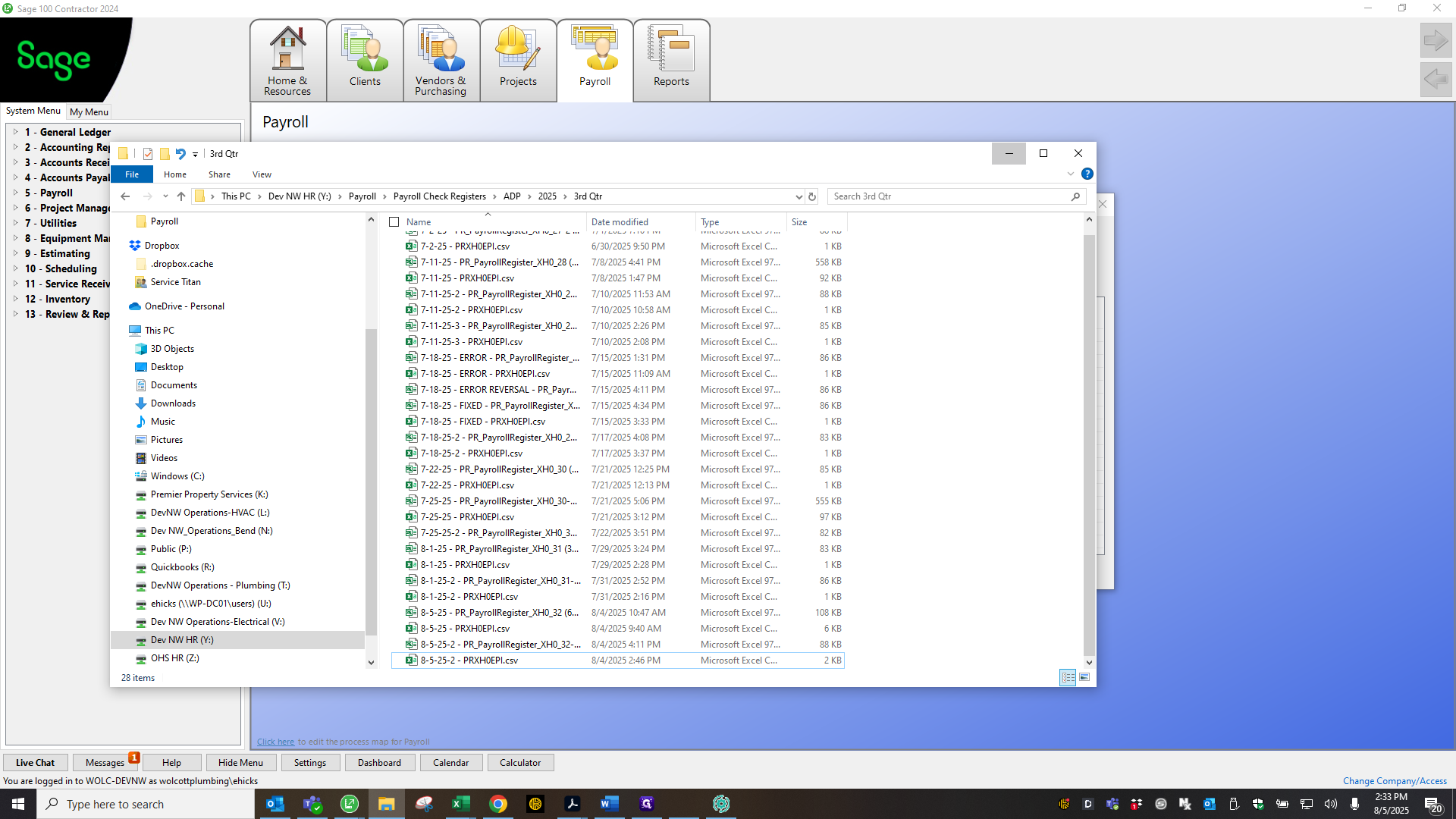

Okay, it's saved. Now, return to that folder and open it again.

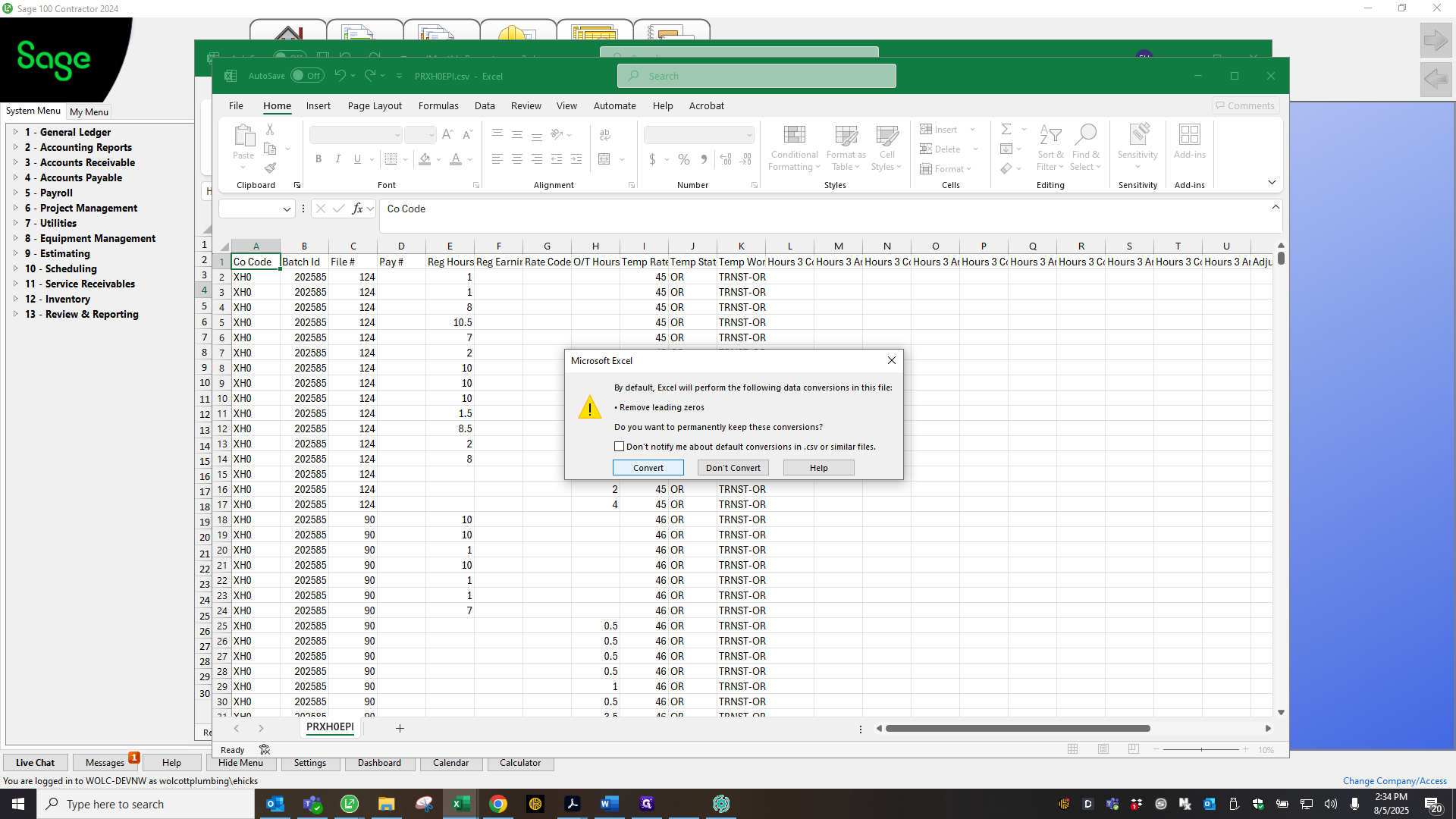

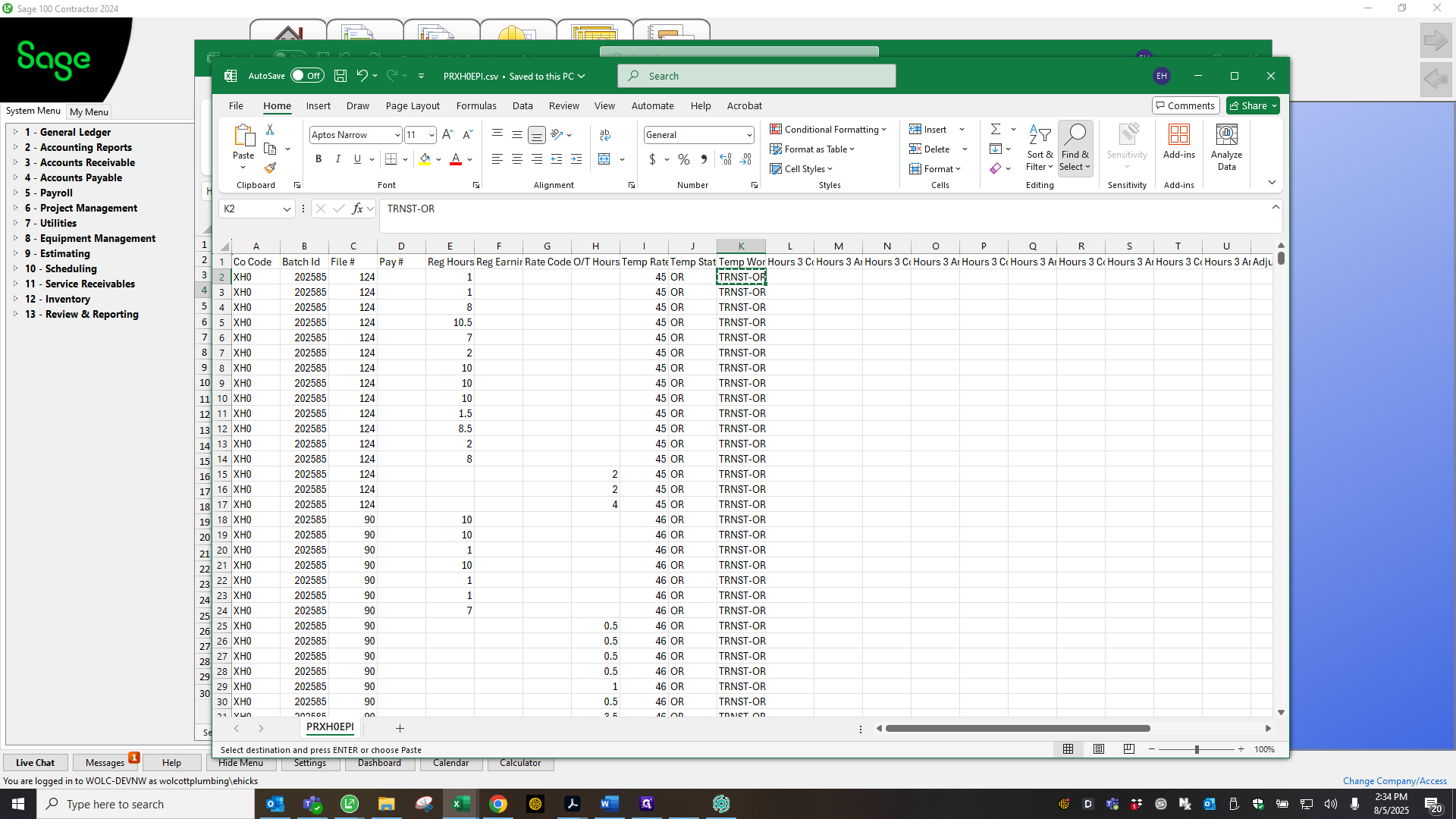

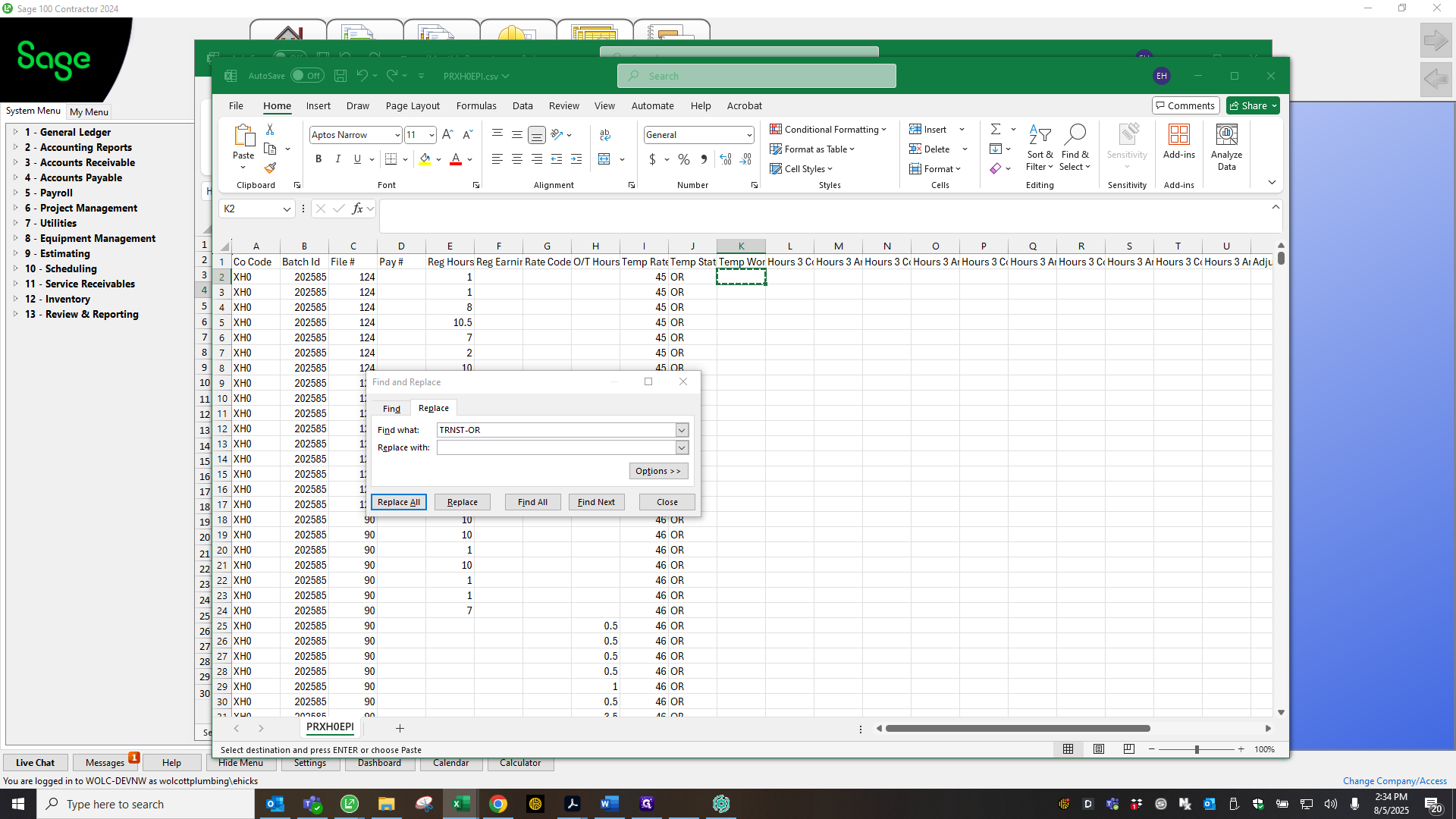

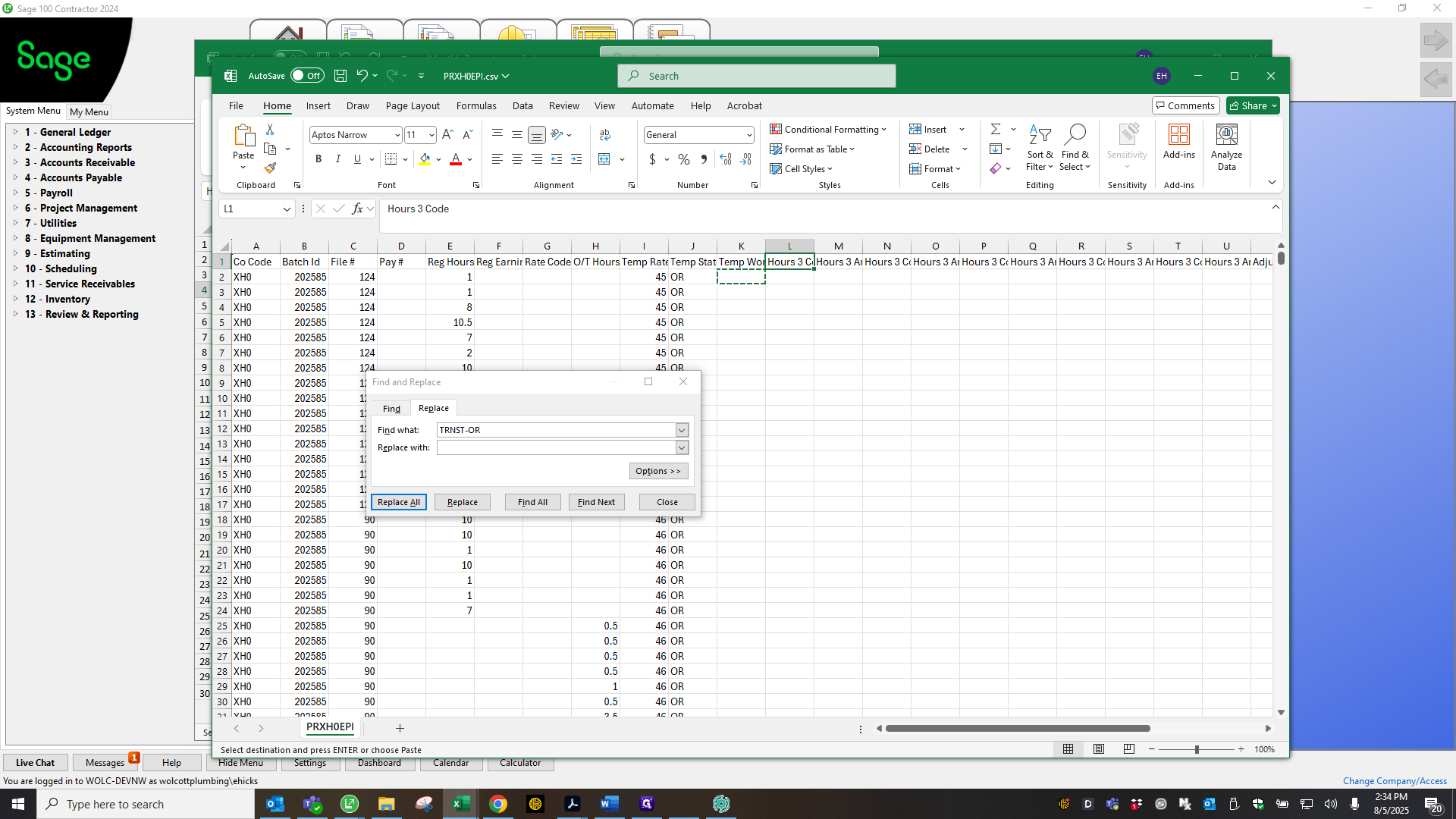

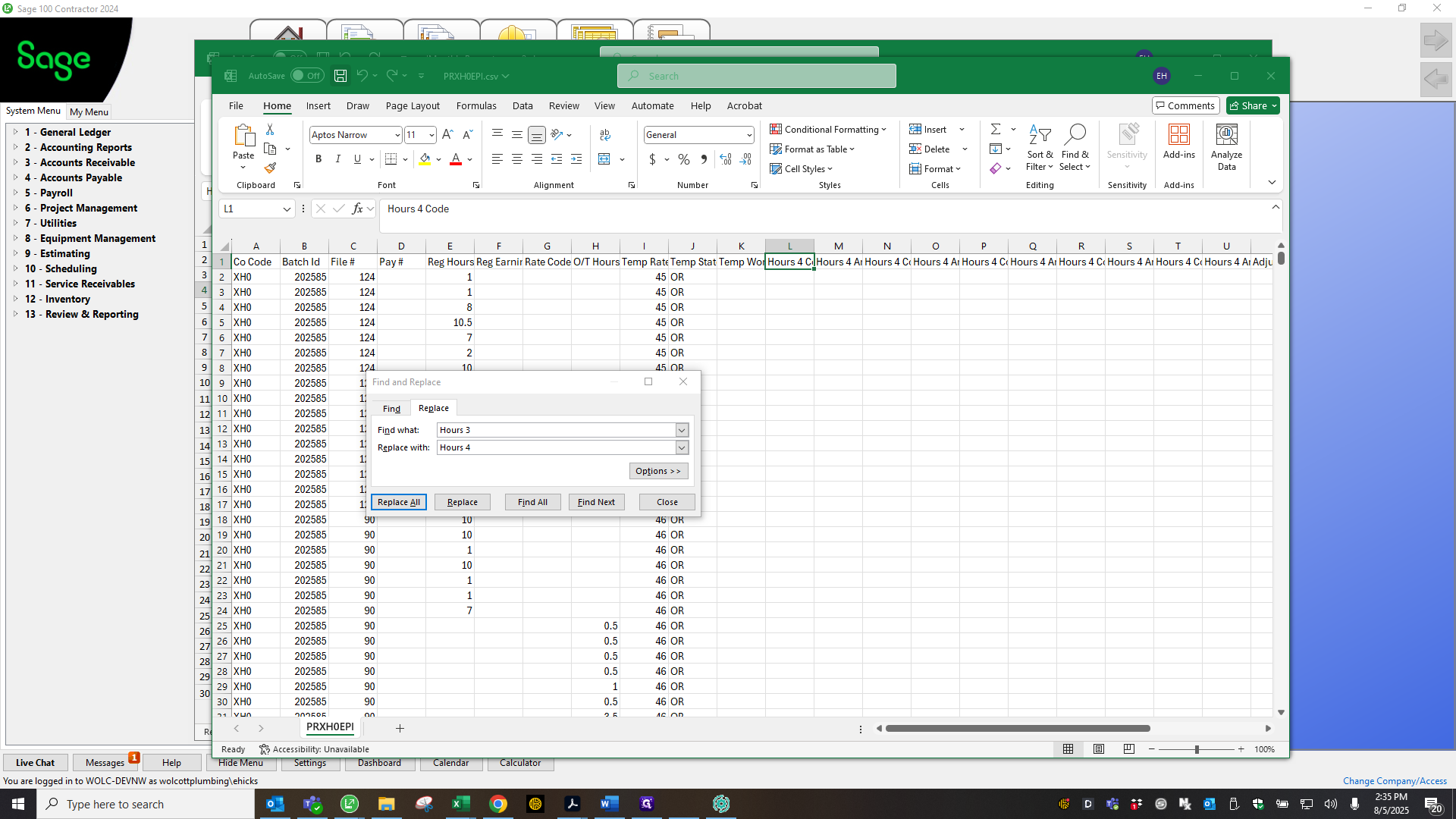

You need to make changes to this file before uploading it. Click "Convert," then remove all of these.

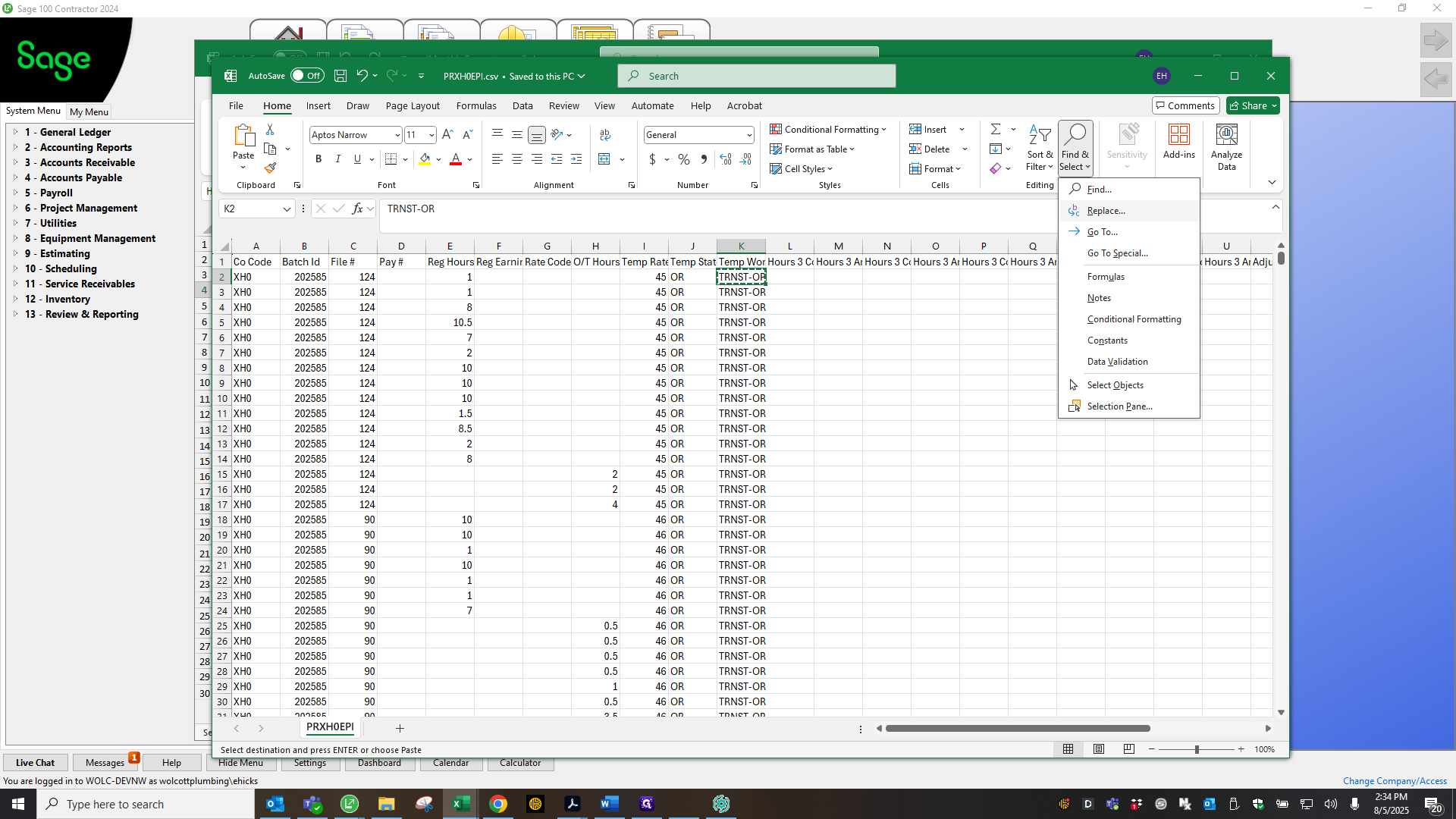

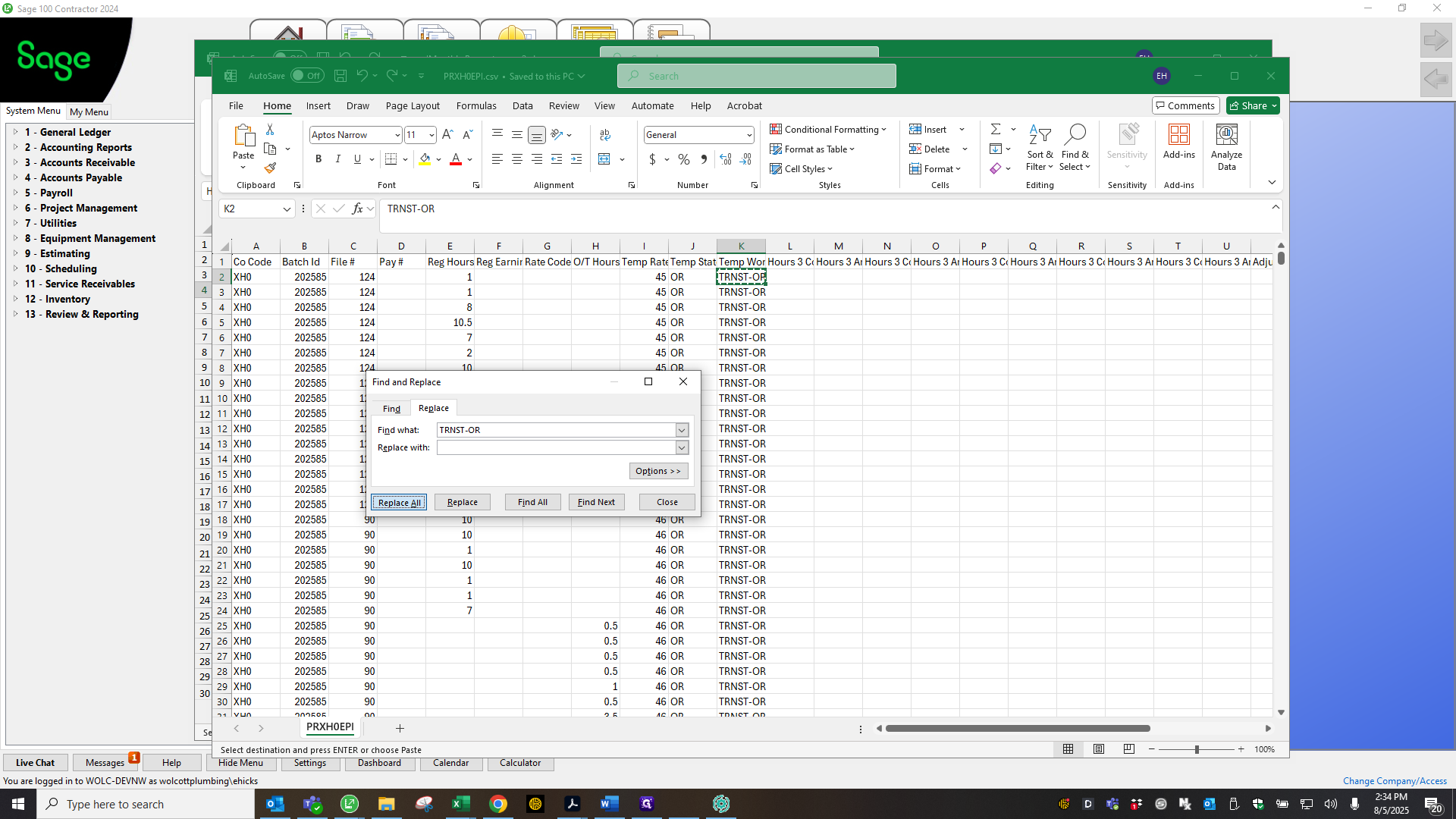

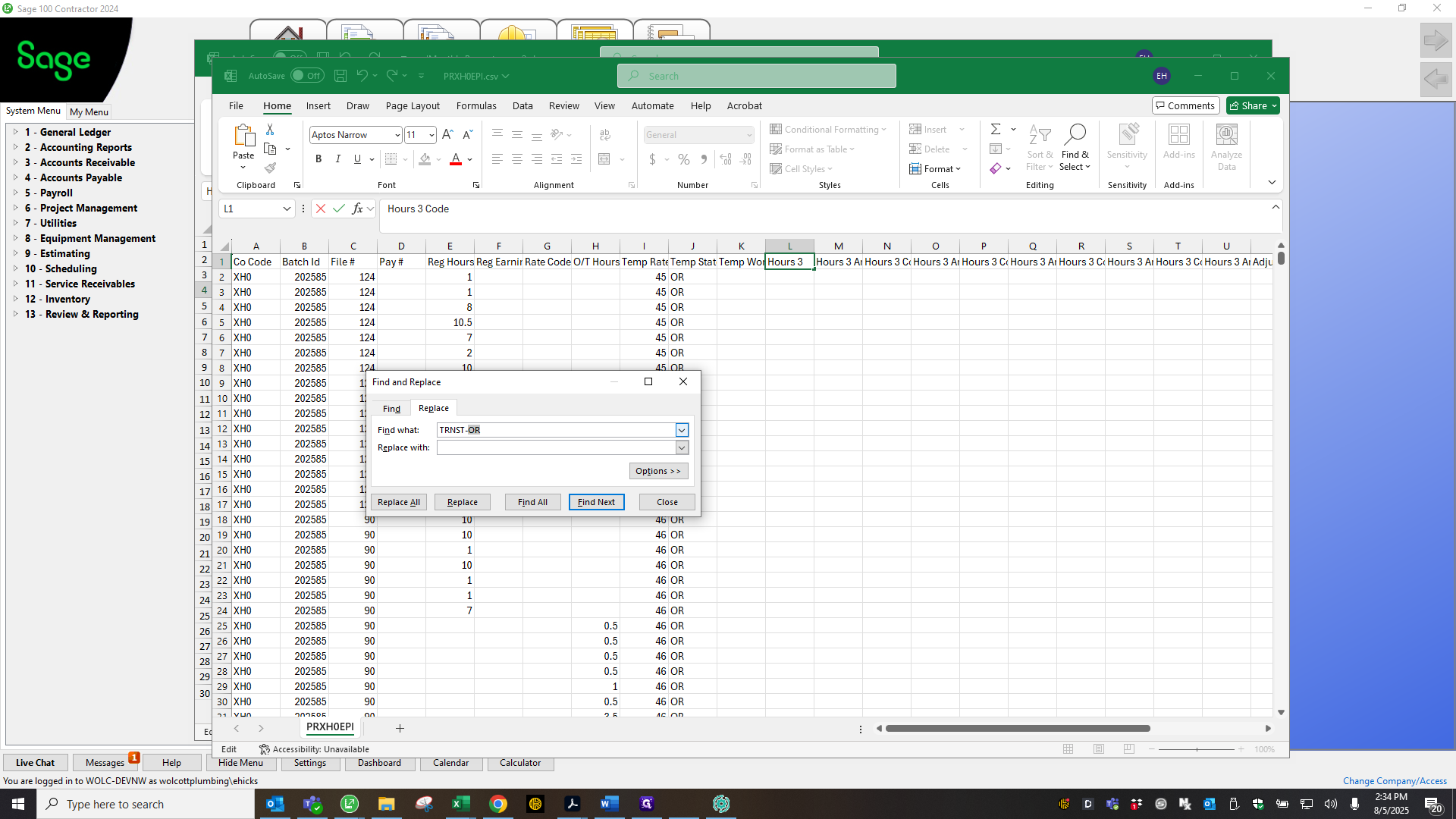

Copy the text, use find and replace, enter what you want to find, and replace it with nothing.

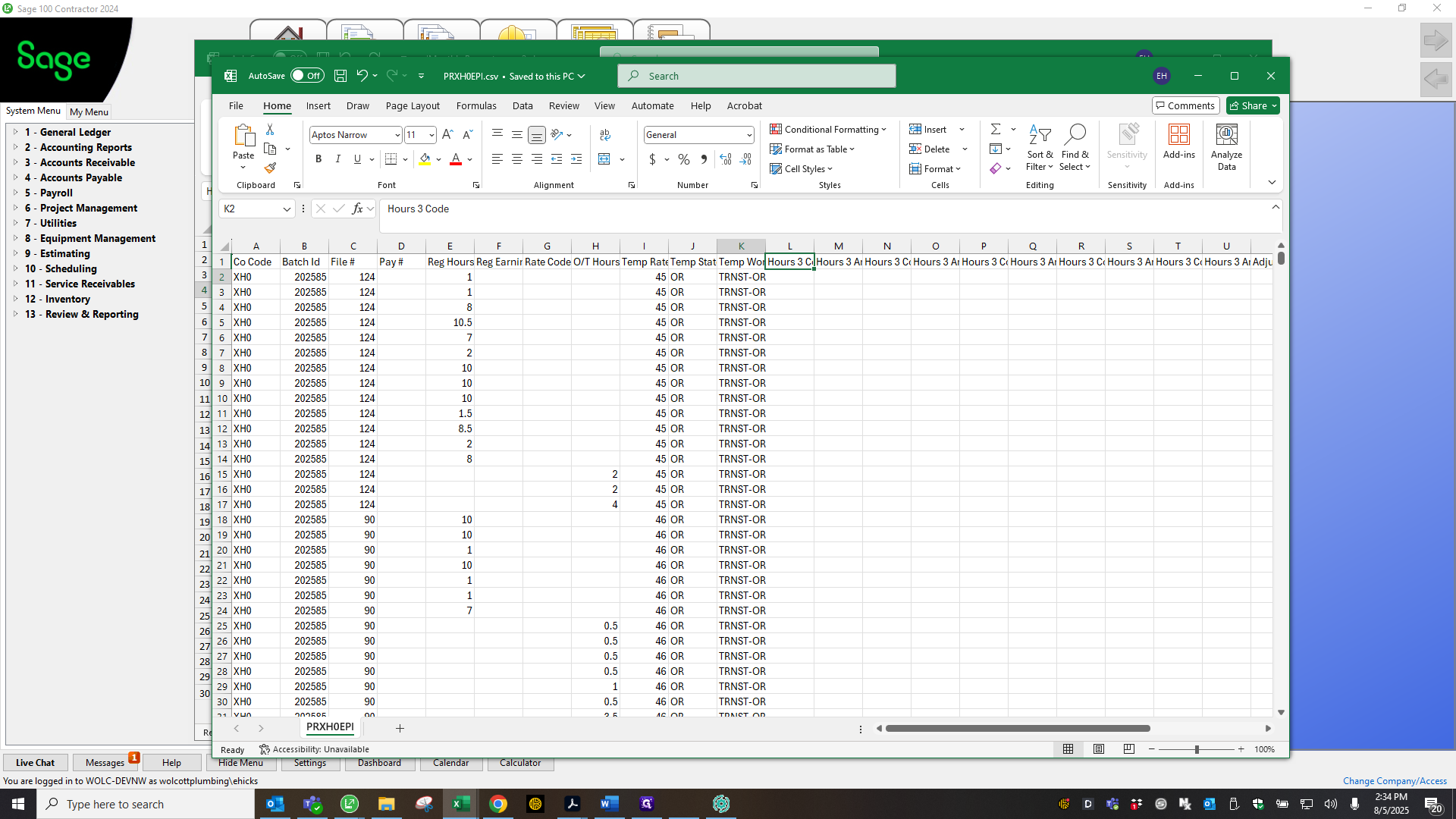

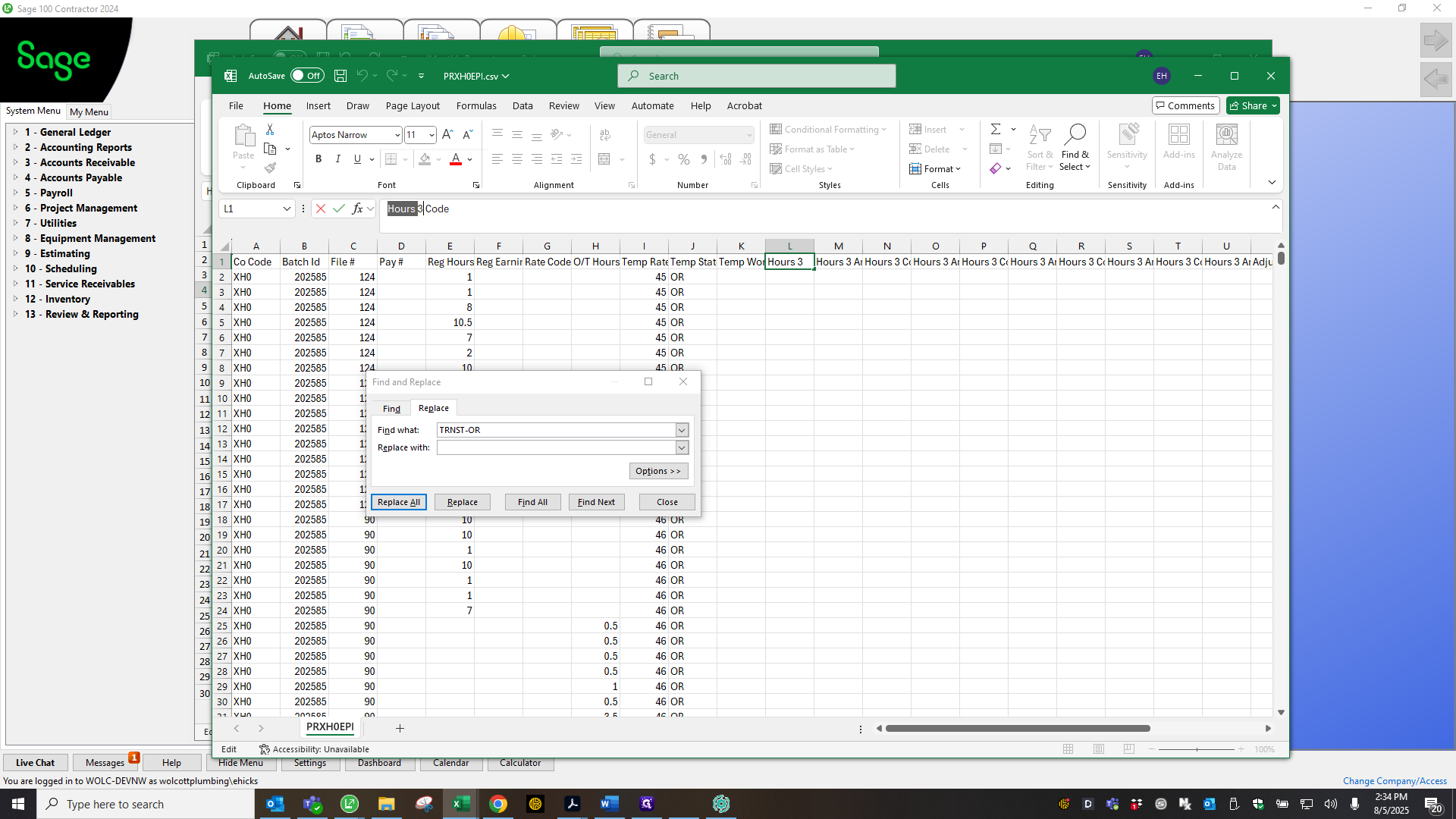

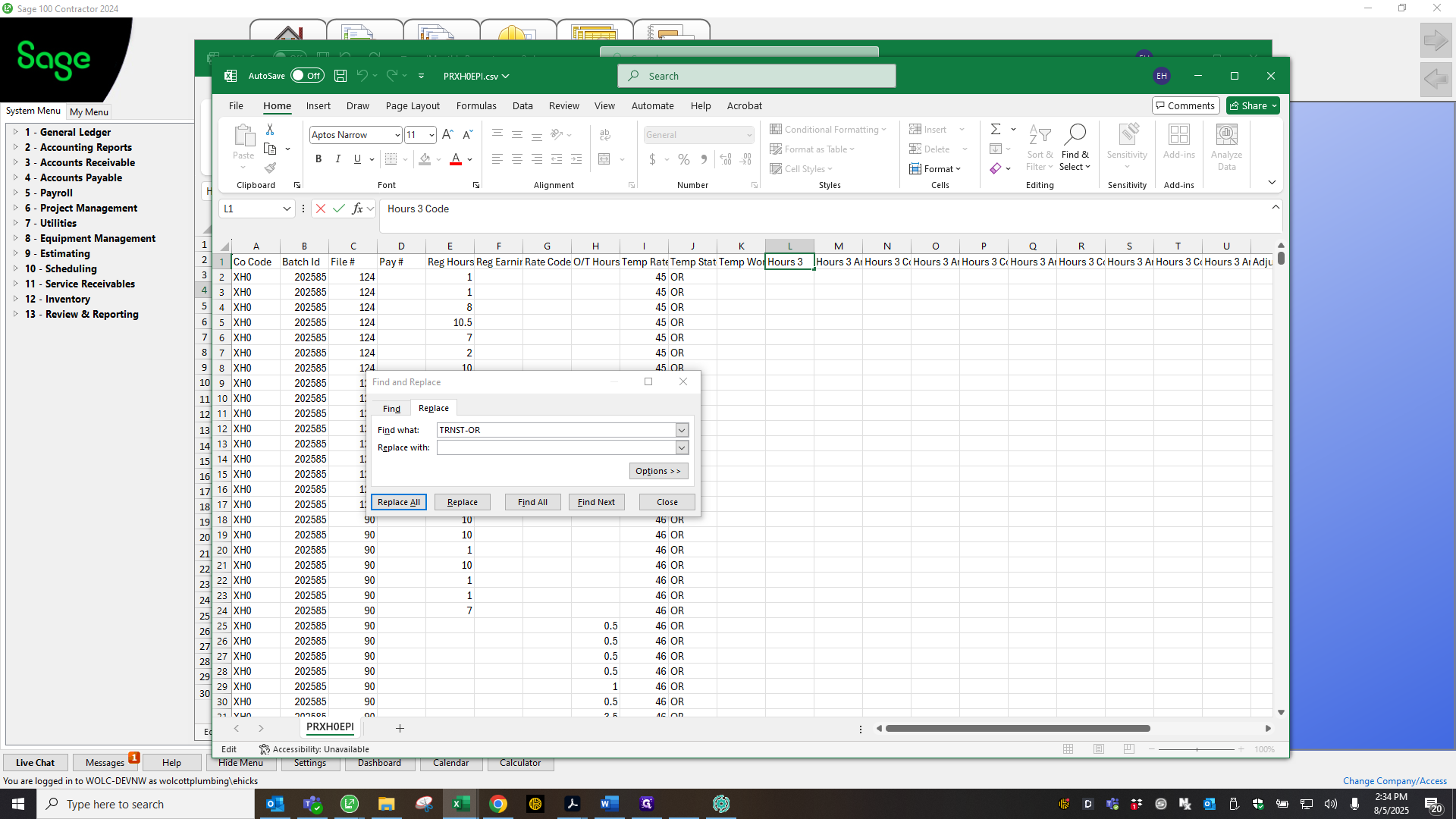

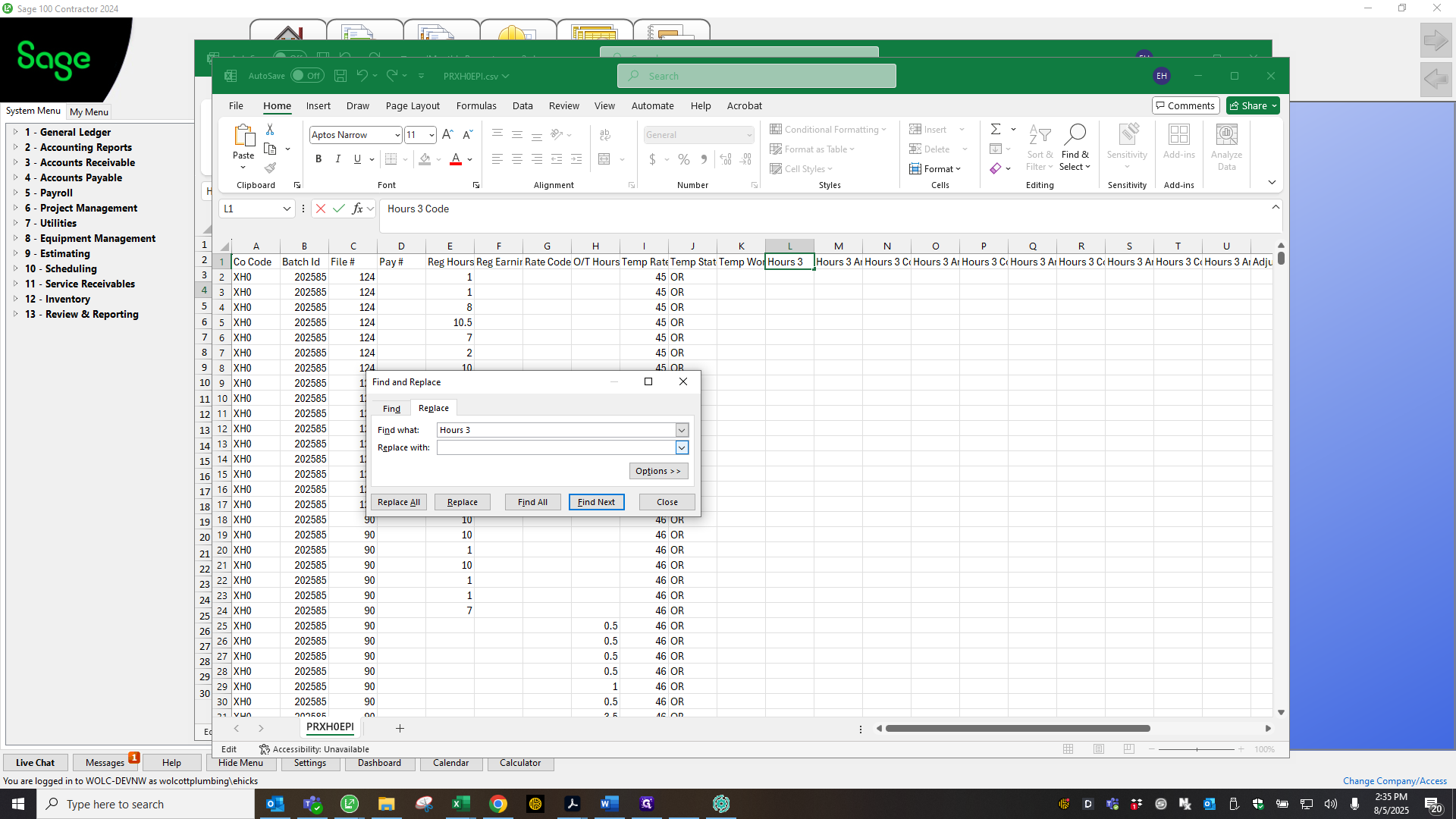

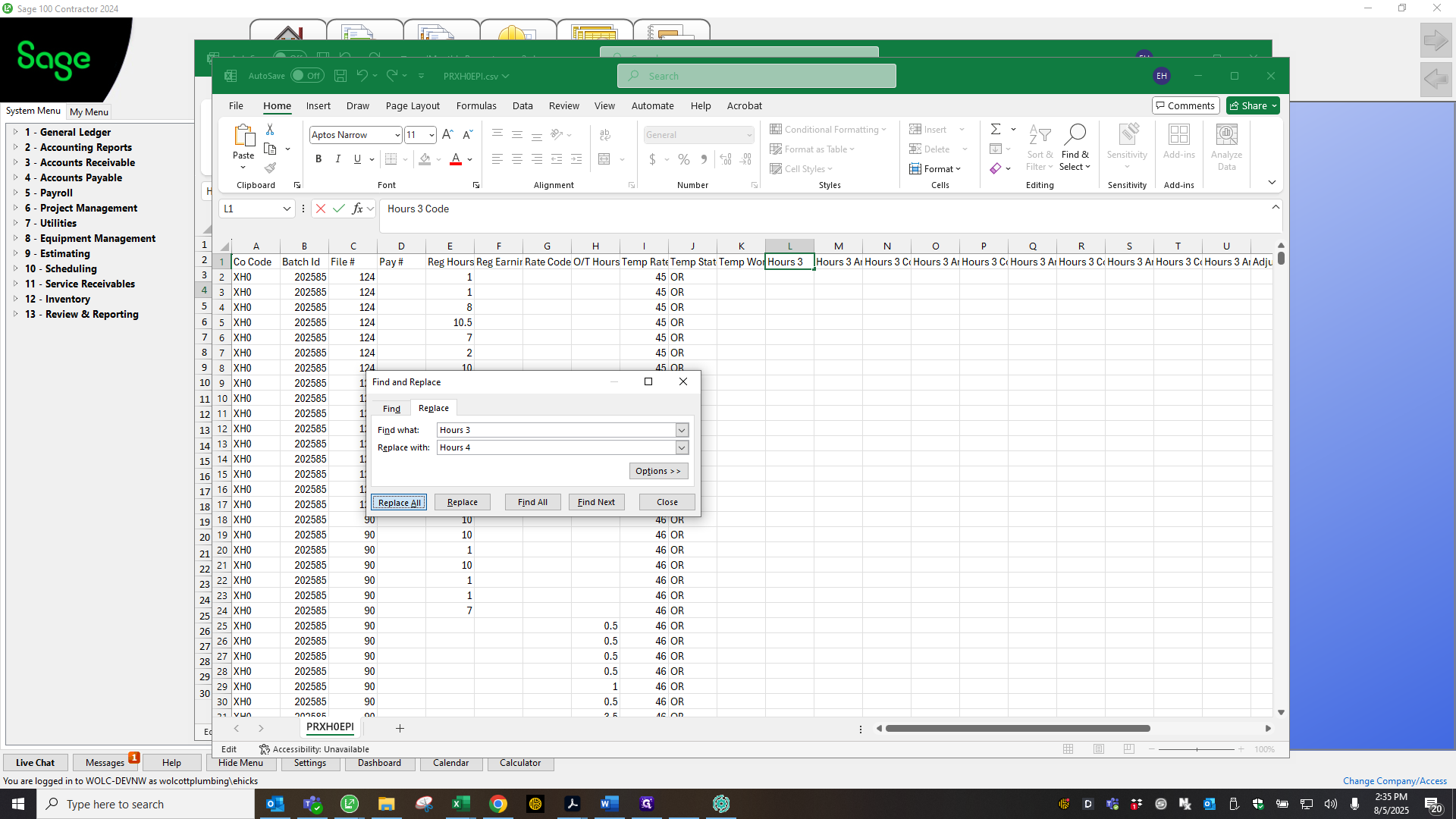

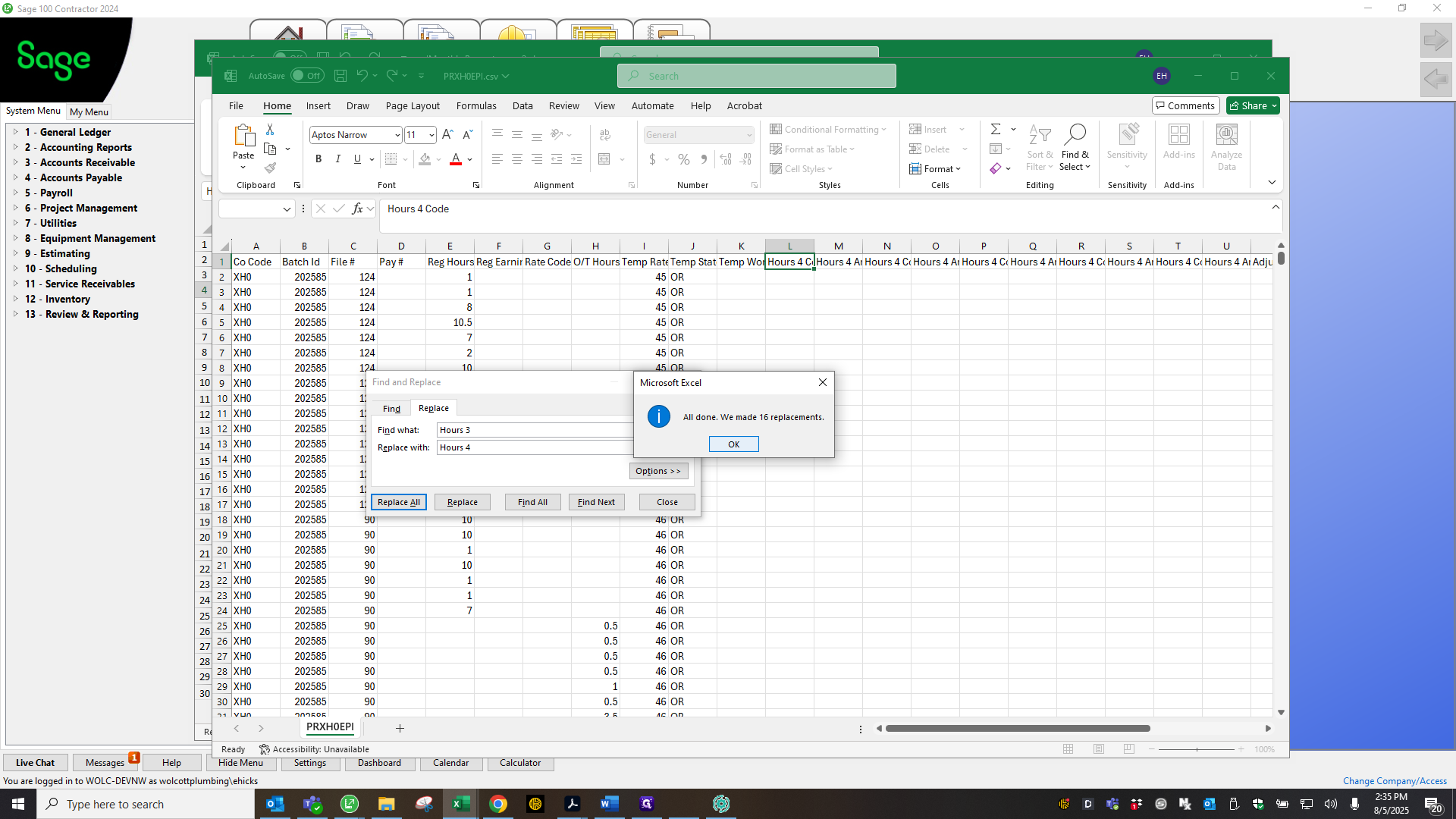

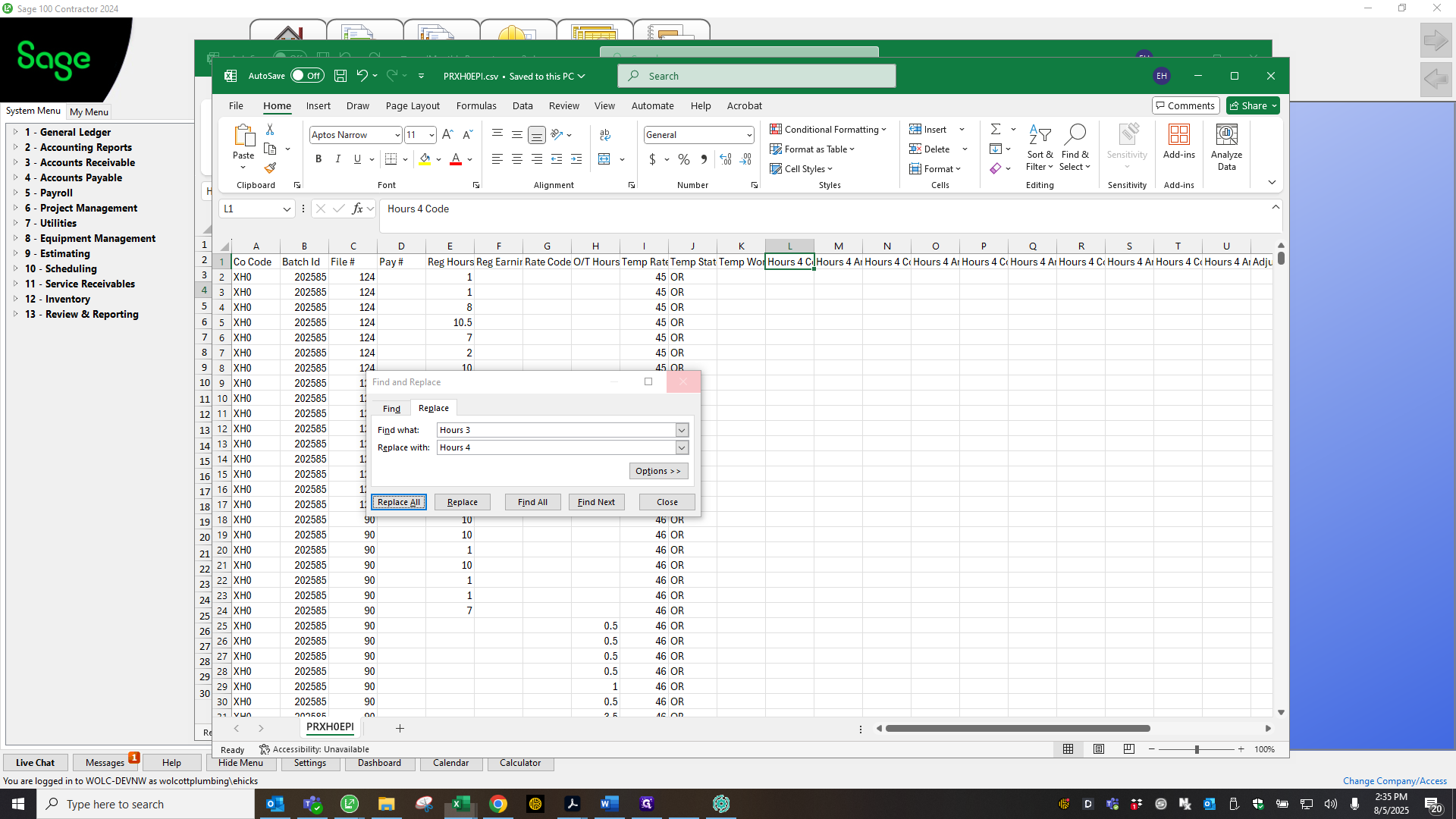

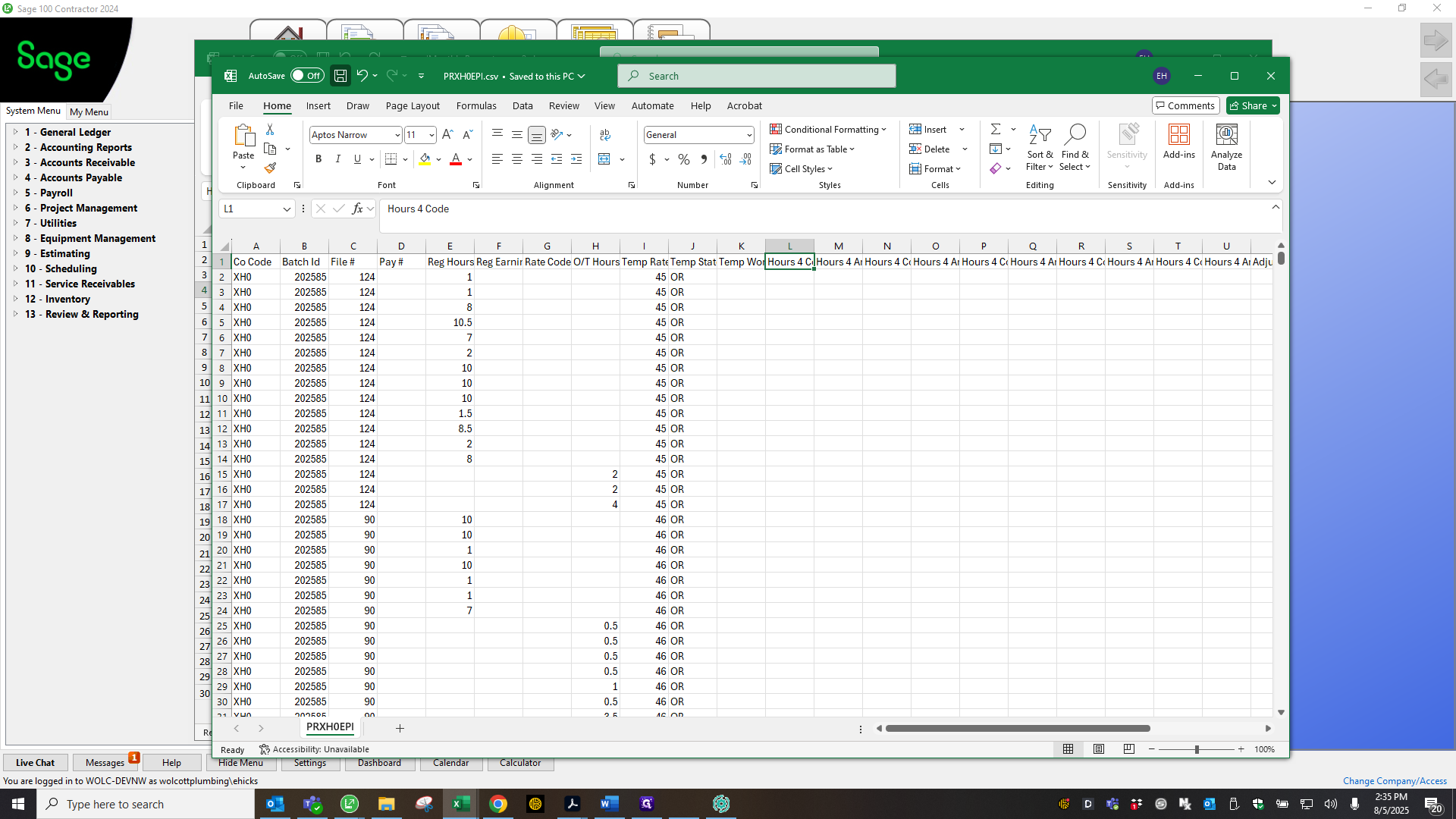

Also, update this section: change "hours three, cost and fee" to "hours four."

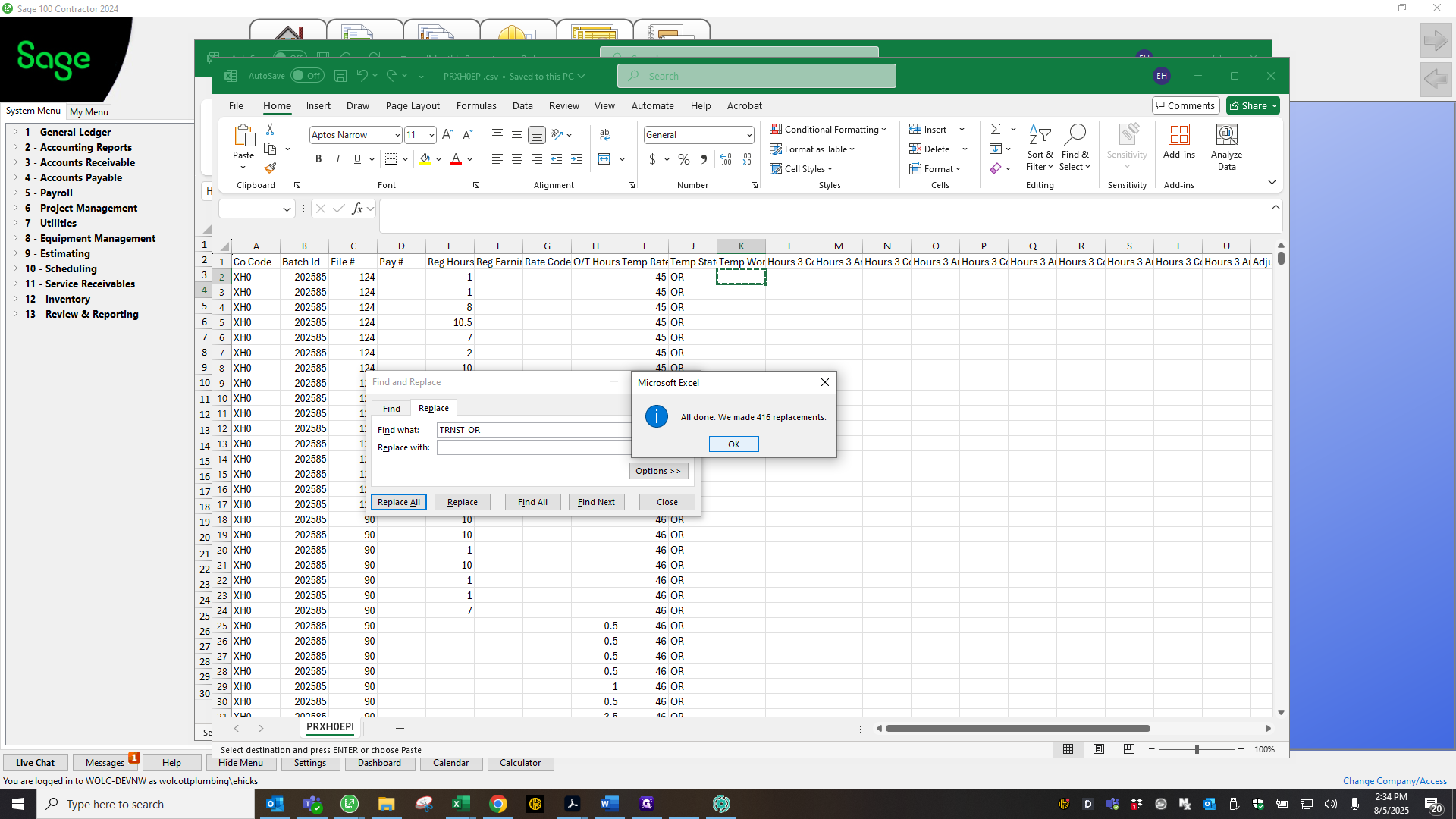

To do this, use the find and replace feature, then select "replace all."

""

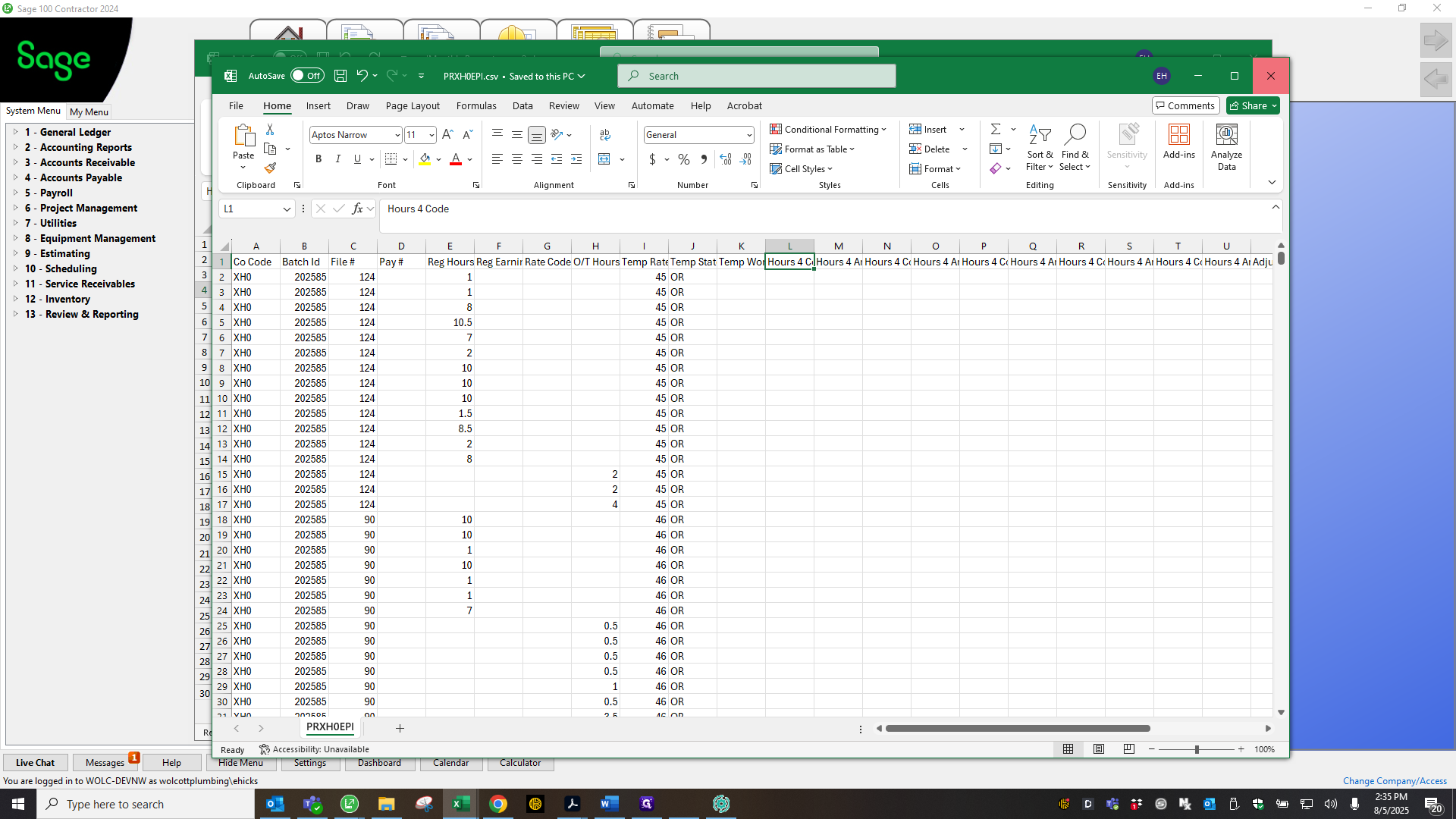

Save.

Save again.

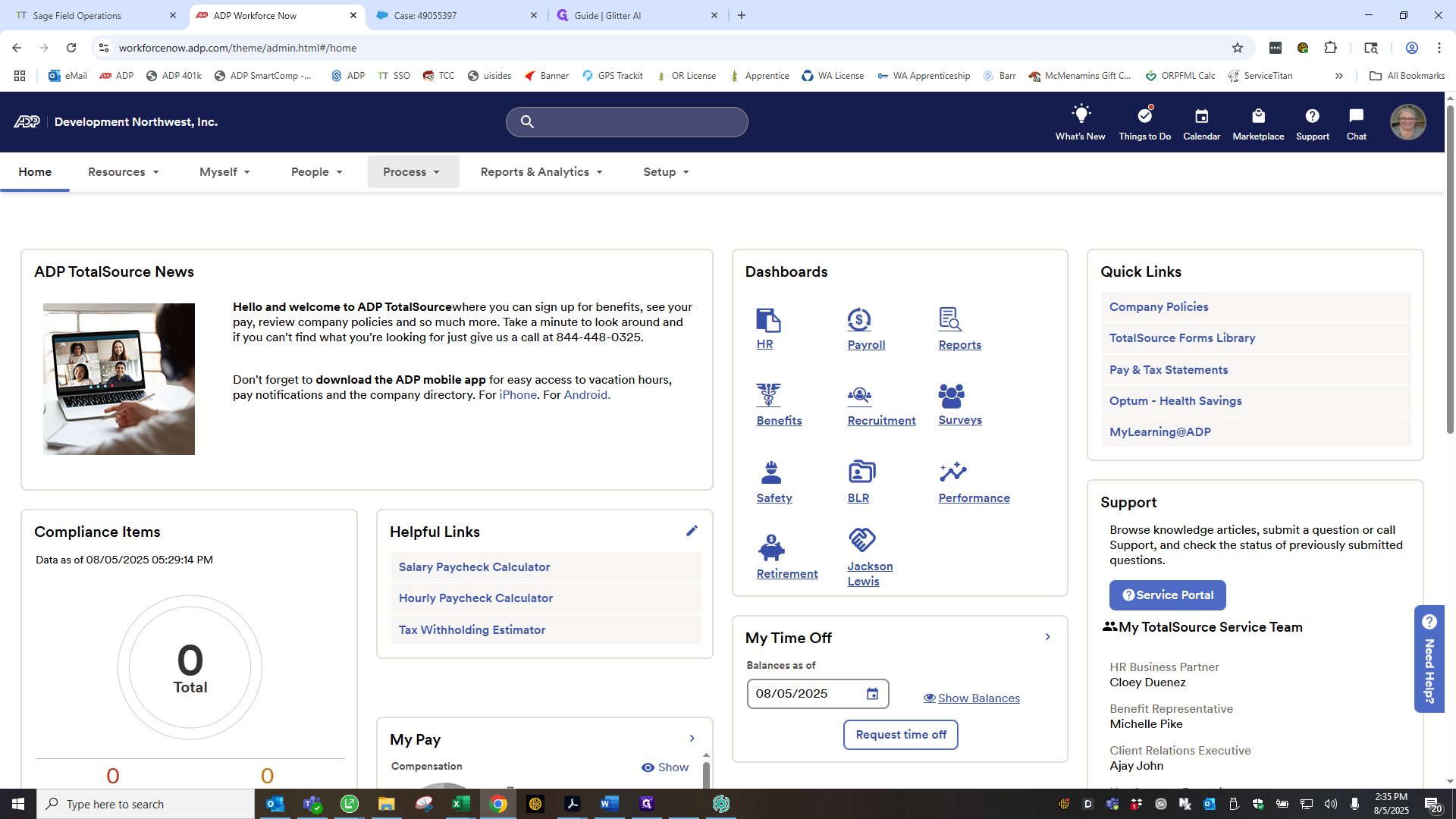

Okay. Close that, then go to the ADP Process Payroll dashboard.

I'm running out of time on this video, so I'll start another one to show how to upload the file to ADP and what steps to take with the worksheet in ADP for payroll.