When a Member Uses More Than Their Allotted Nights

Explore the nuances of member reservations, discounts, and tax implications for bookings beyond allotted time.

In this guide, we'll learn how to handle reservations that exceed a member's allotted time and the implications for billing and taxation. When a member books beyond their member time, the reservation is treated as a regular guest booking, subject to taxation, and eligible for a 10% courtesy discount. This guide aims to clarify the process and ensure accurate financial transactions for such uncommon situations.

Let's get started

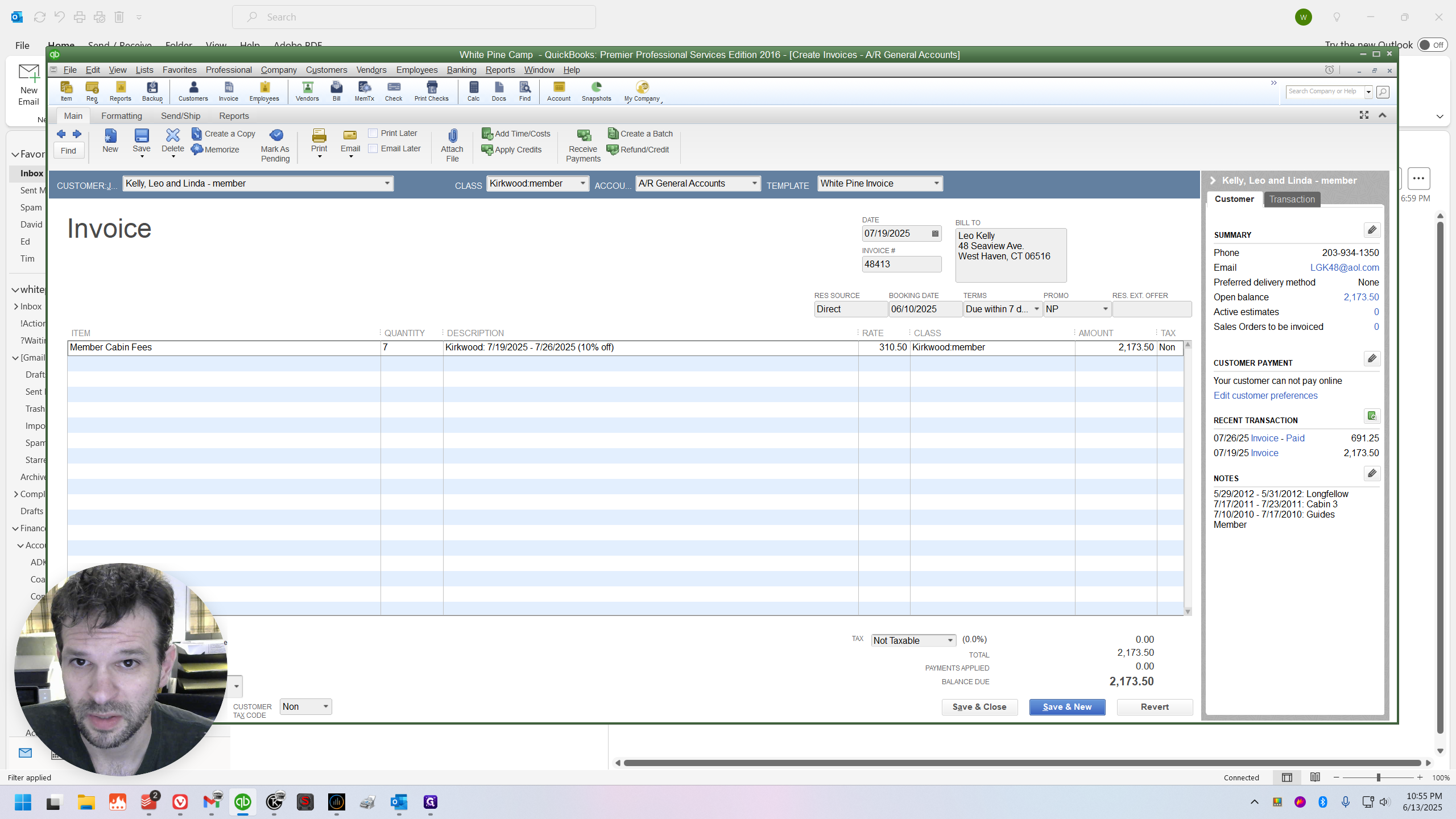

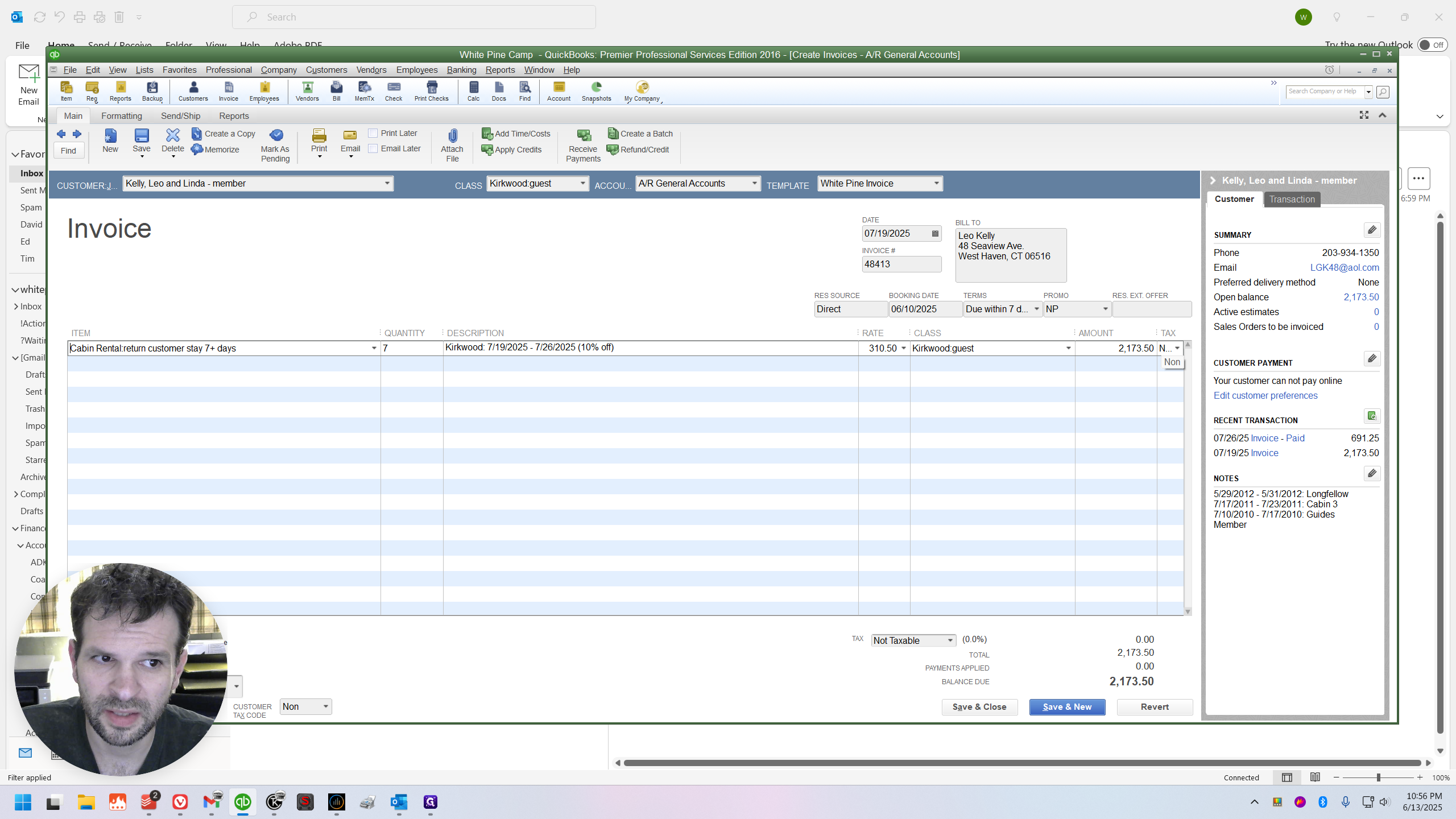

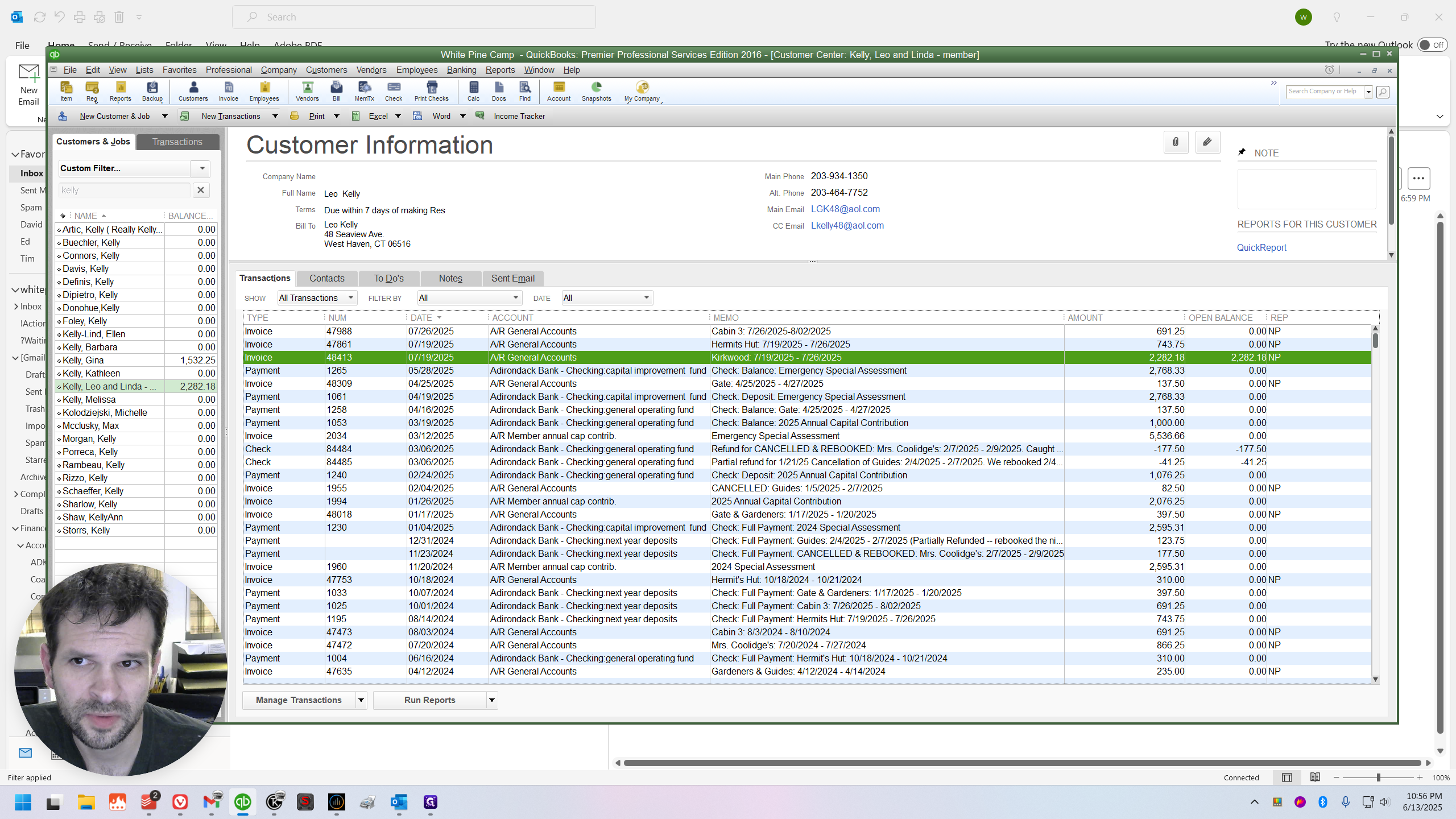

I just received the check for Leo Kelly's reservation and am reviewing it for the first time. I wanted to point out a couple of things.

It's uncommon for a member to book beyond their allotted time. Frankly, this is something I've never thought to mention because of its rarity. So I'm not complaining at all. I just wanted to clarify these things for everyone's knowledge.

When a member books time without using their share, they get 10% off, but the 10% discount does not come from their share. It's simply a courtesy to the members. It's more like a friends and family discount.

Thusly, if they book something outside their share, it is taxable. This is the key issue that needs to change on the invoice I'm working with tonight. Since it's Leo, I've considered how to handle this. I decided to make it taxable and inform him of the mistake. He can pay the tax when he's here. He won't care about it at all, so that's not a problem.

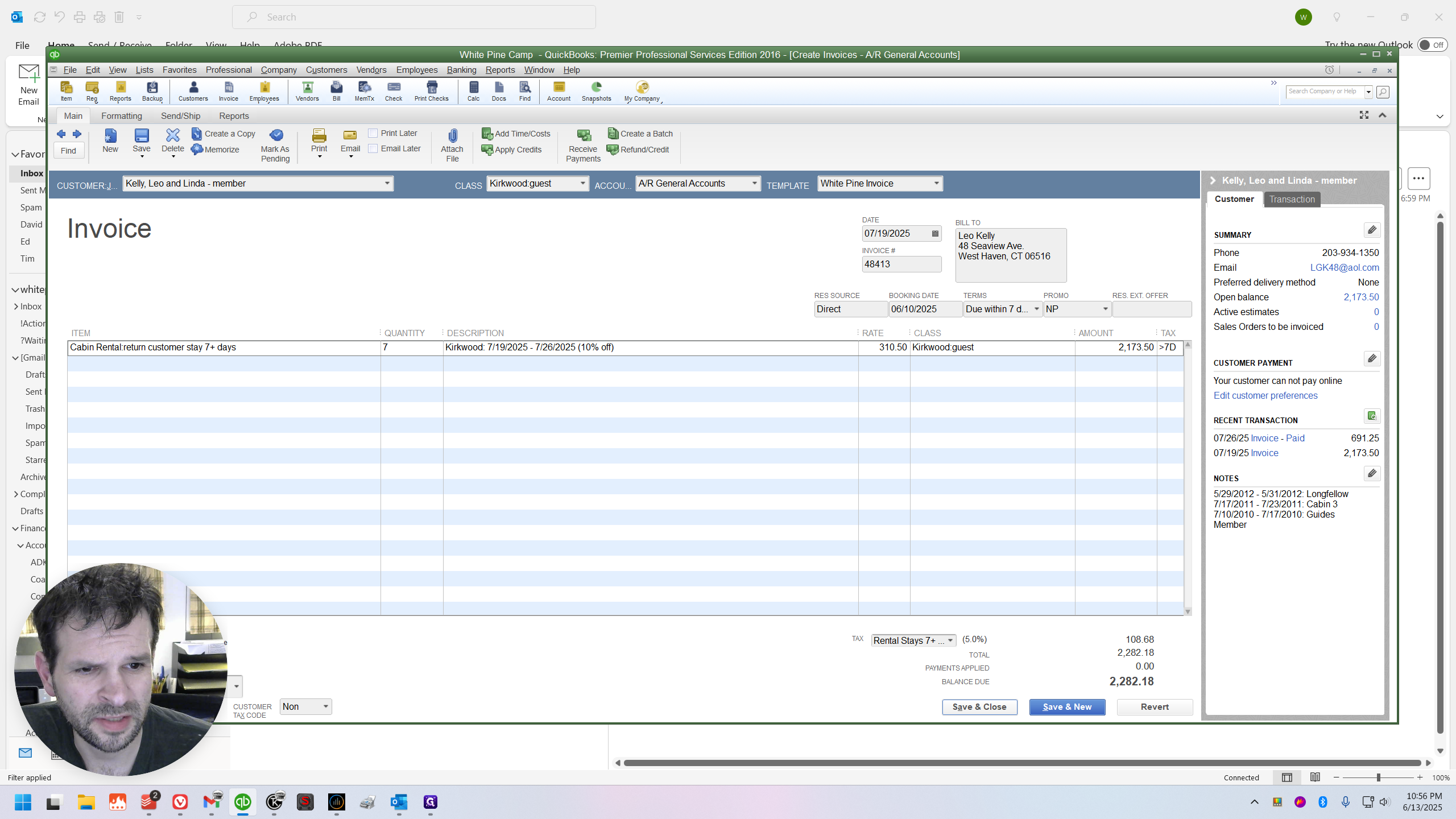

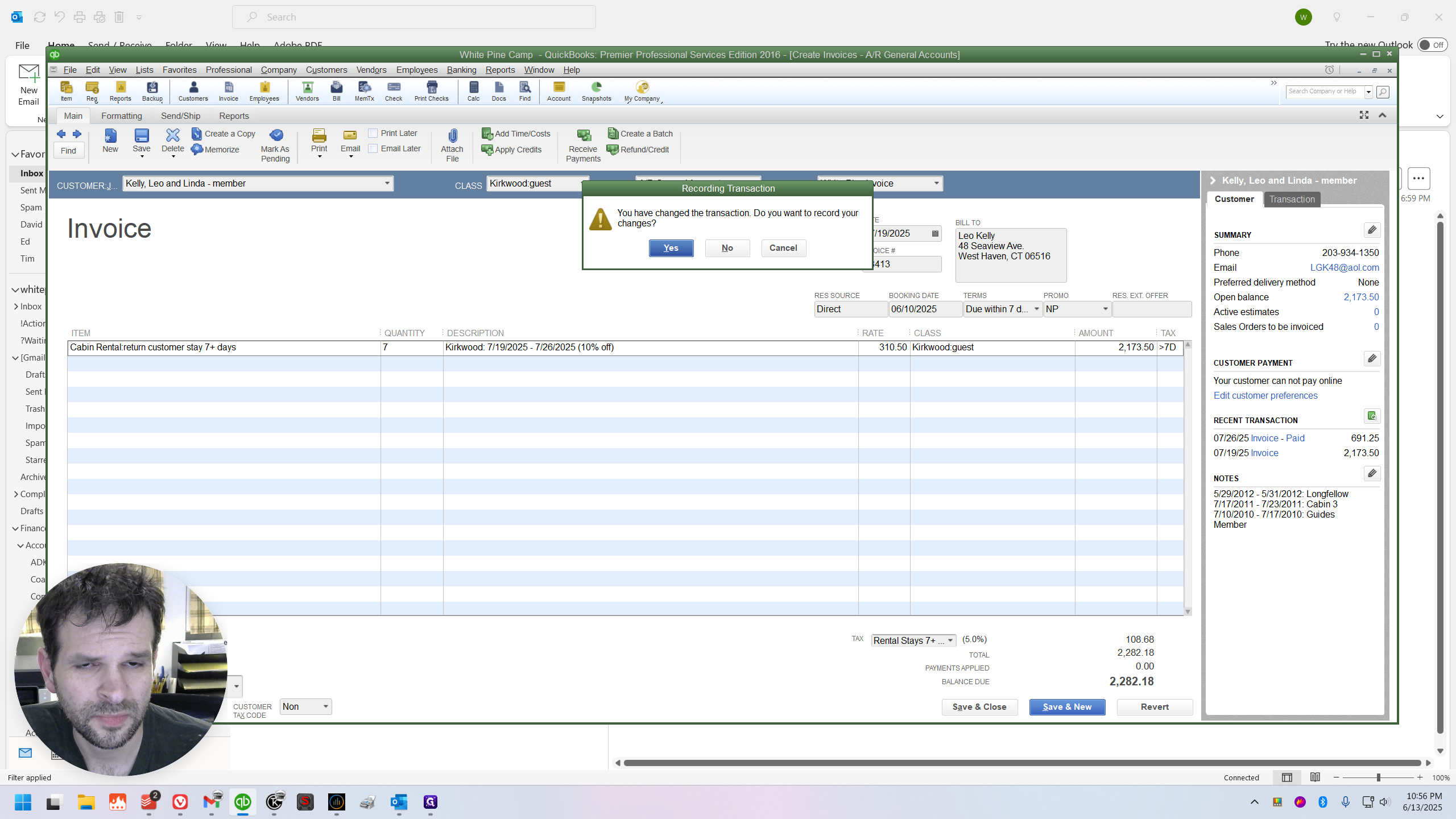

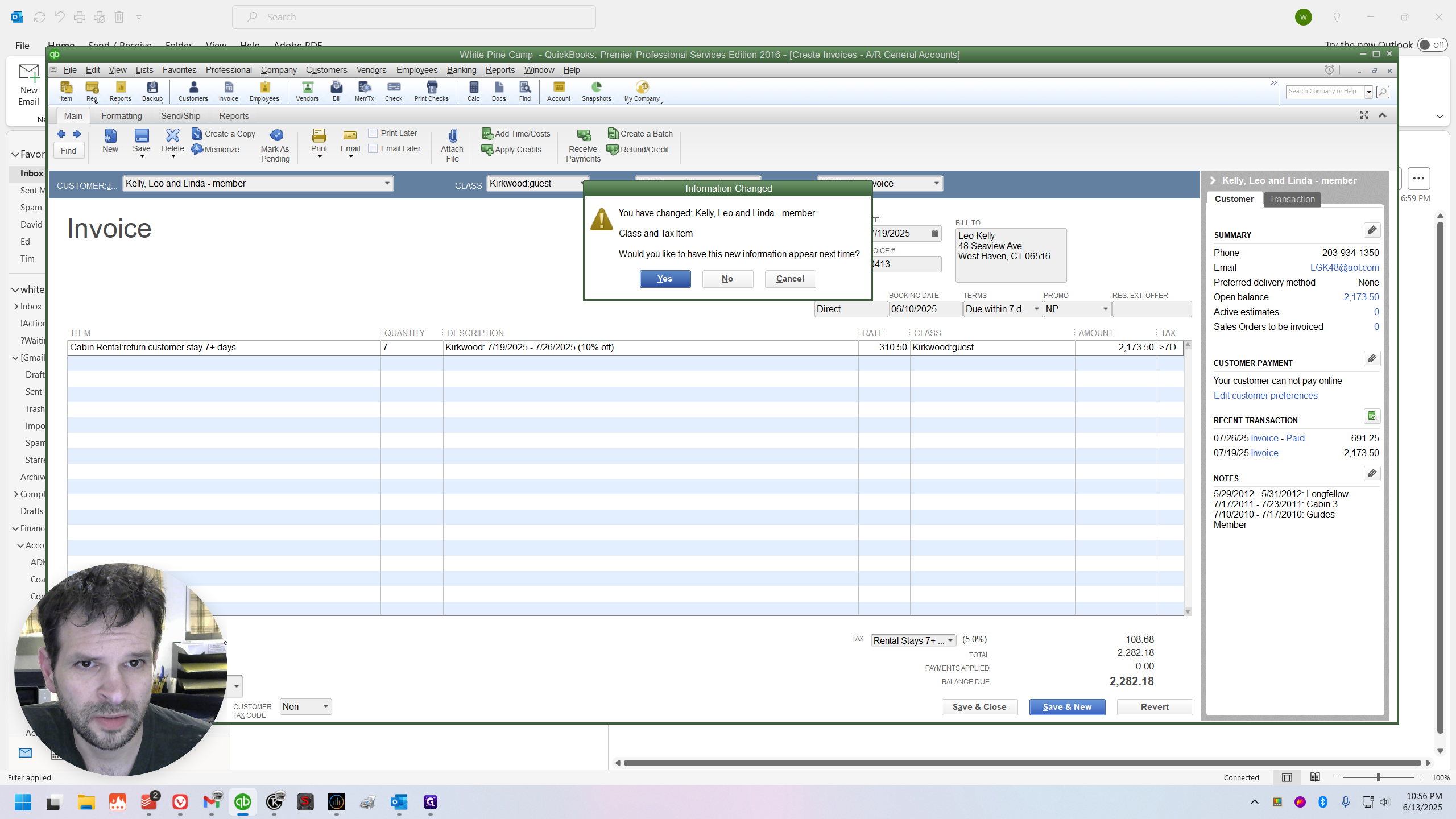

Adjusting the Invoice to Fix the Mistakes

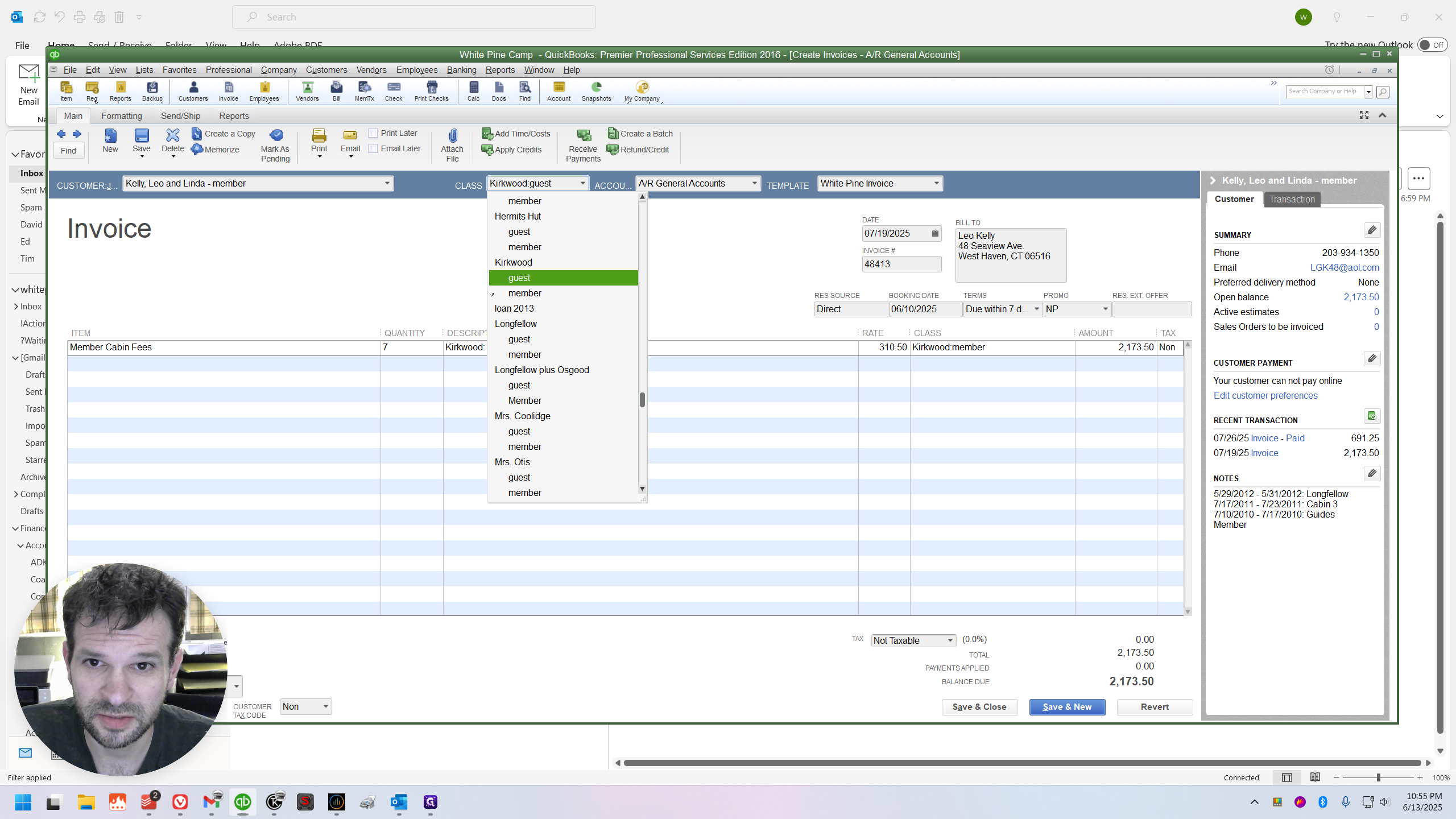

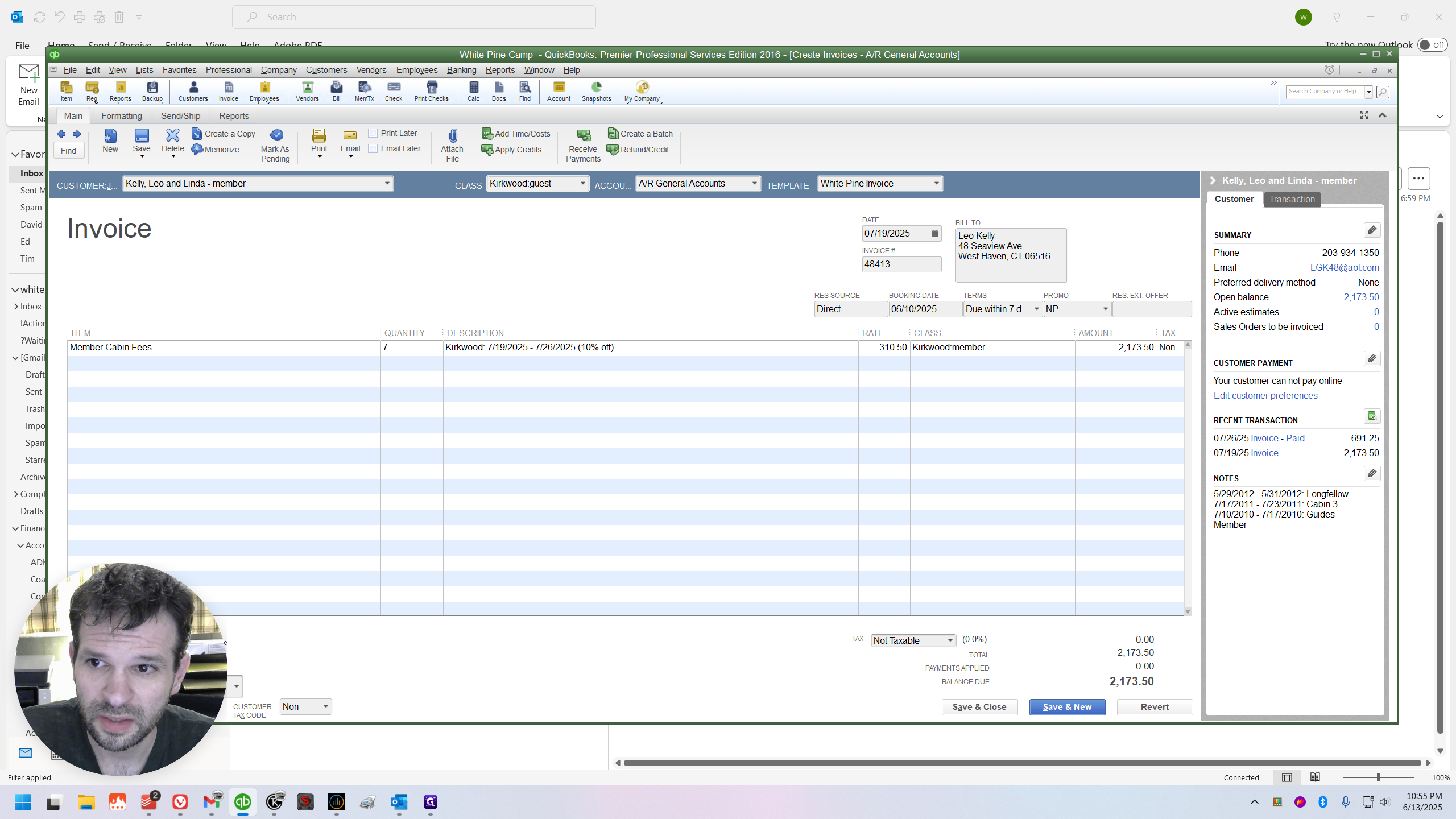

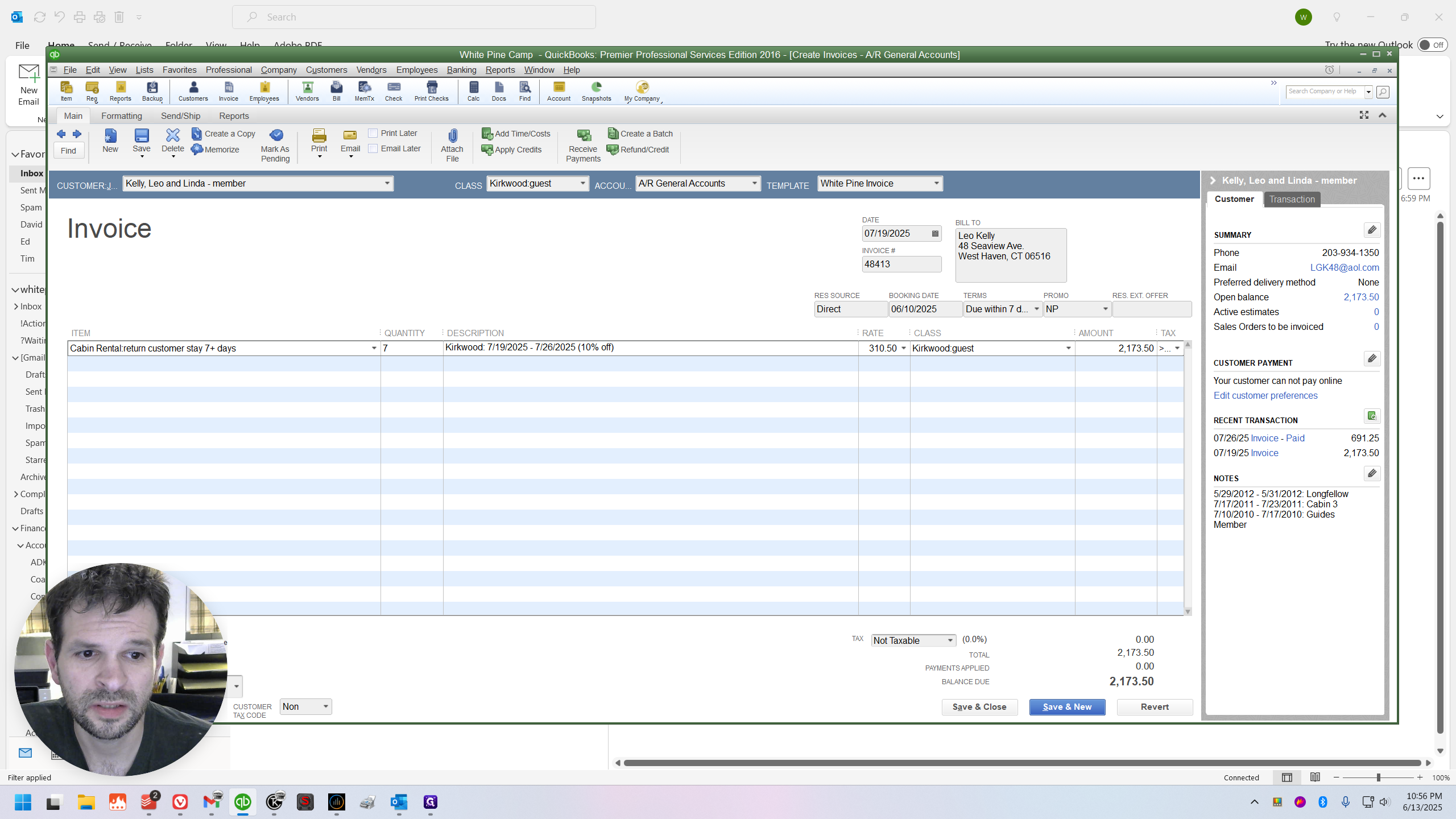

First, when making a reservation that exceeds their member time, it doesn't count as a member stay. The class needs to change to "guest"

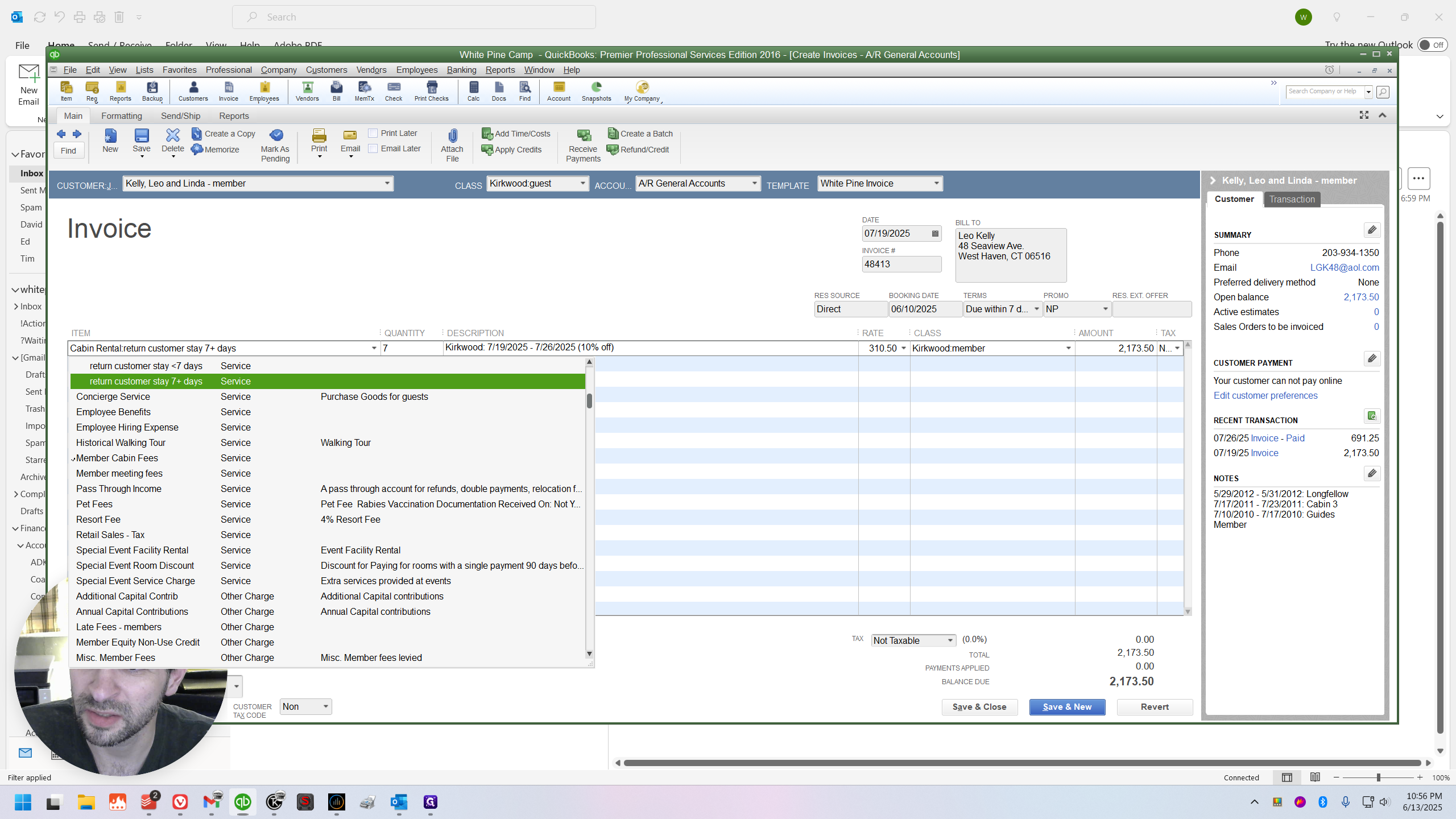

This would also change to a guest-related item down here.

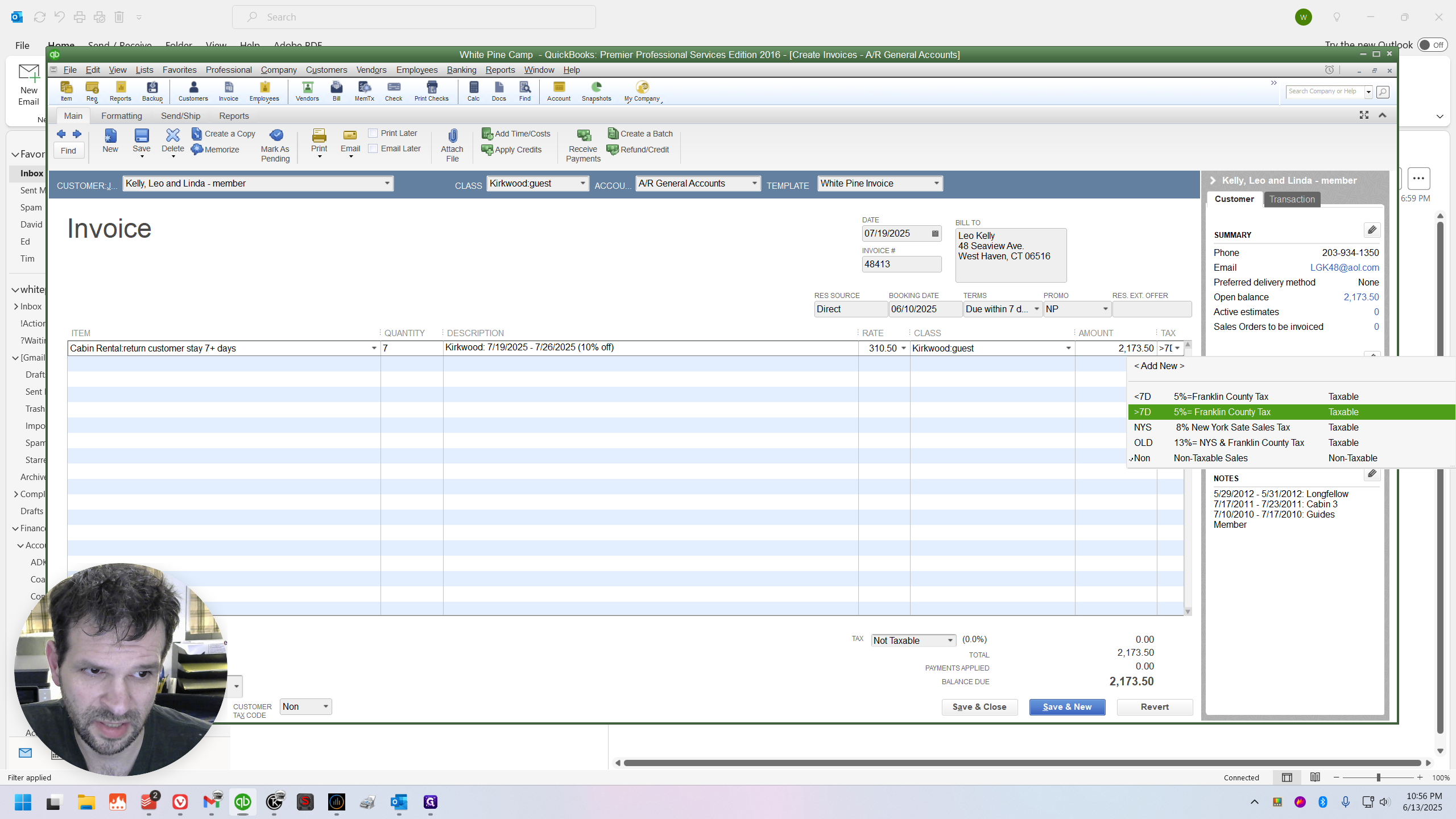

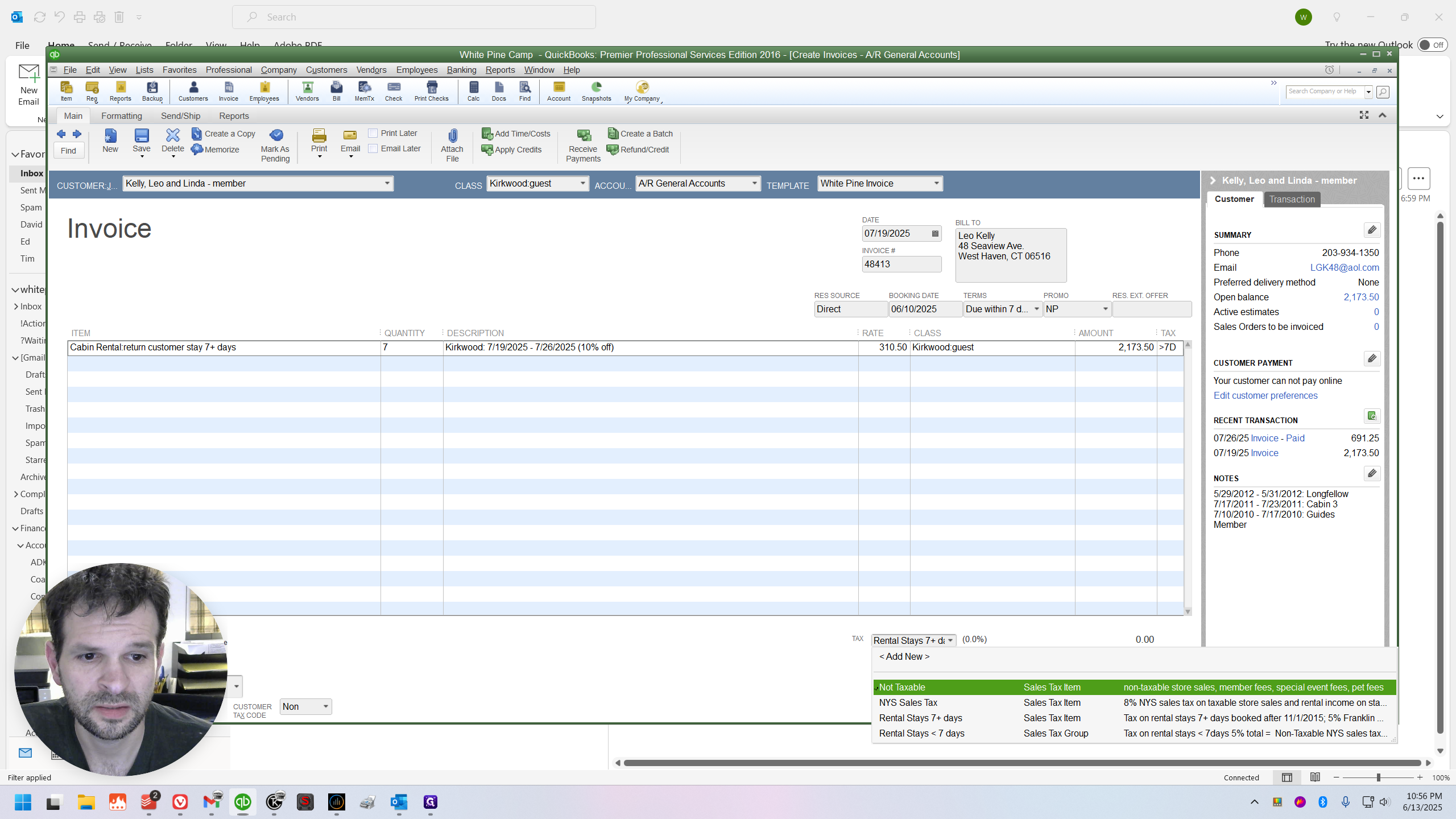

This should be set to taxable.

This will be set to taxable as well.

There we go. Now it's fixed.

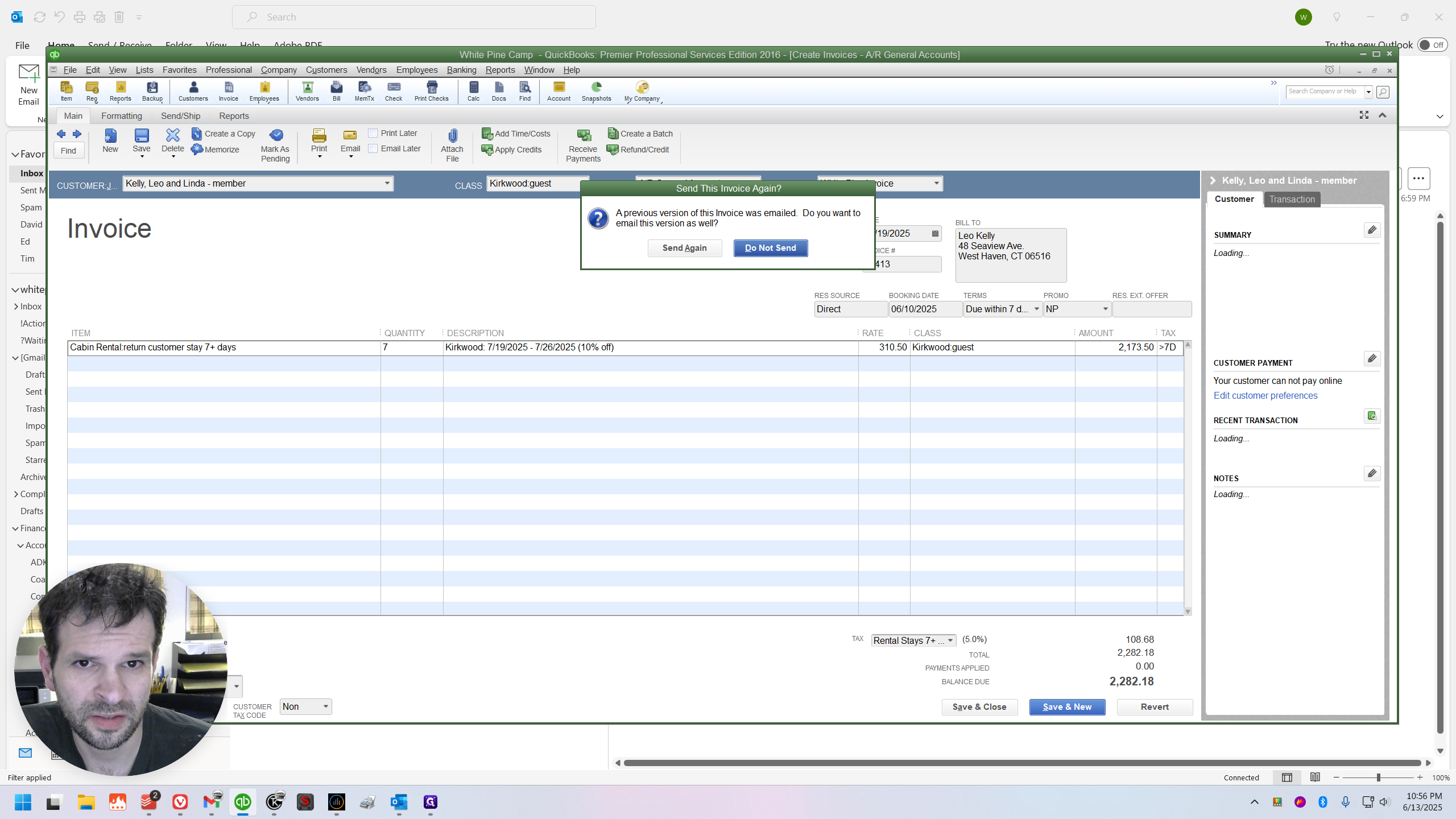

Receiving the Check

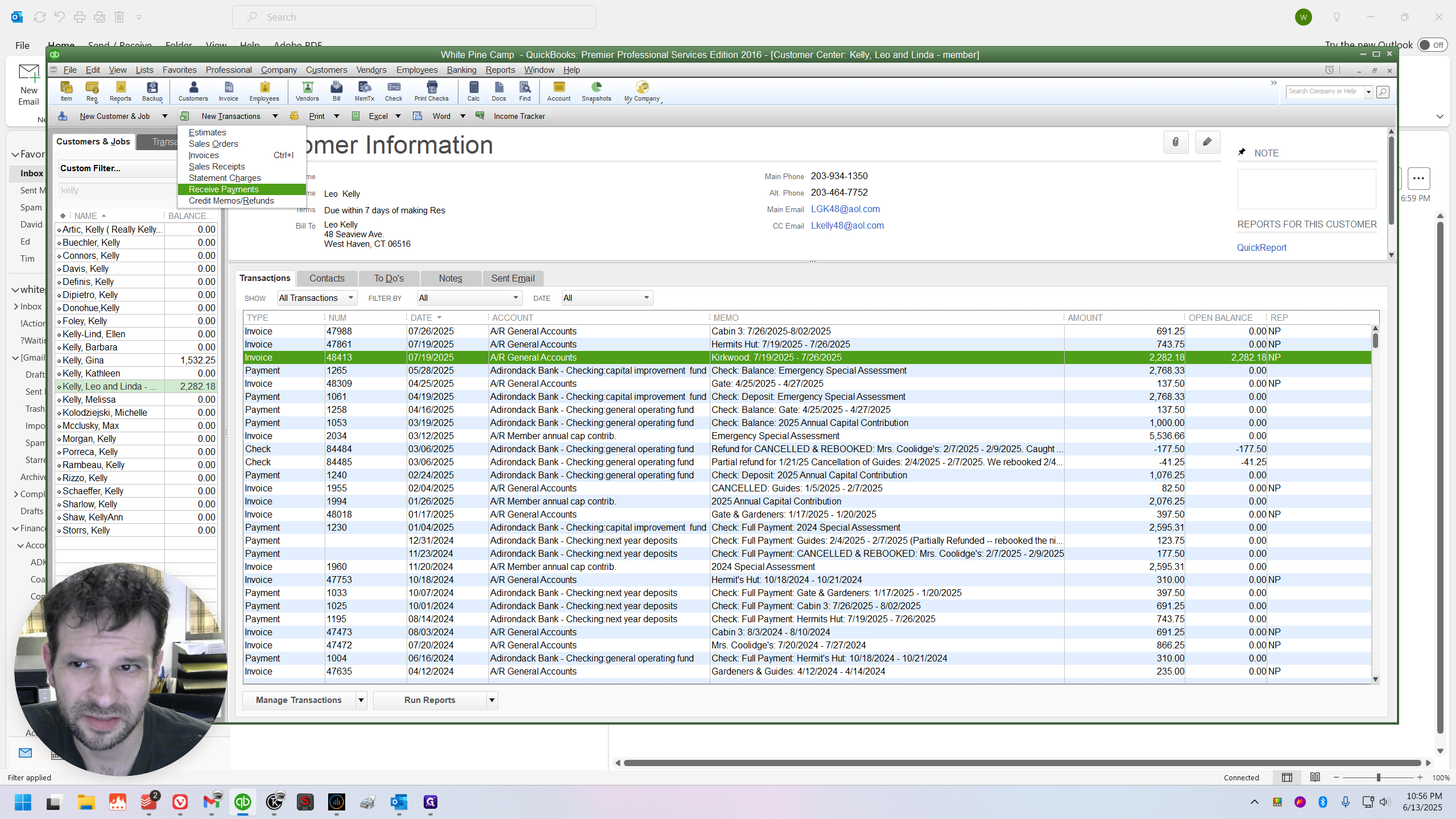

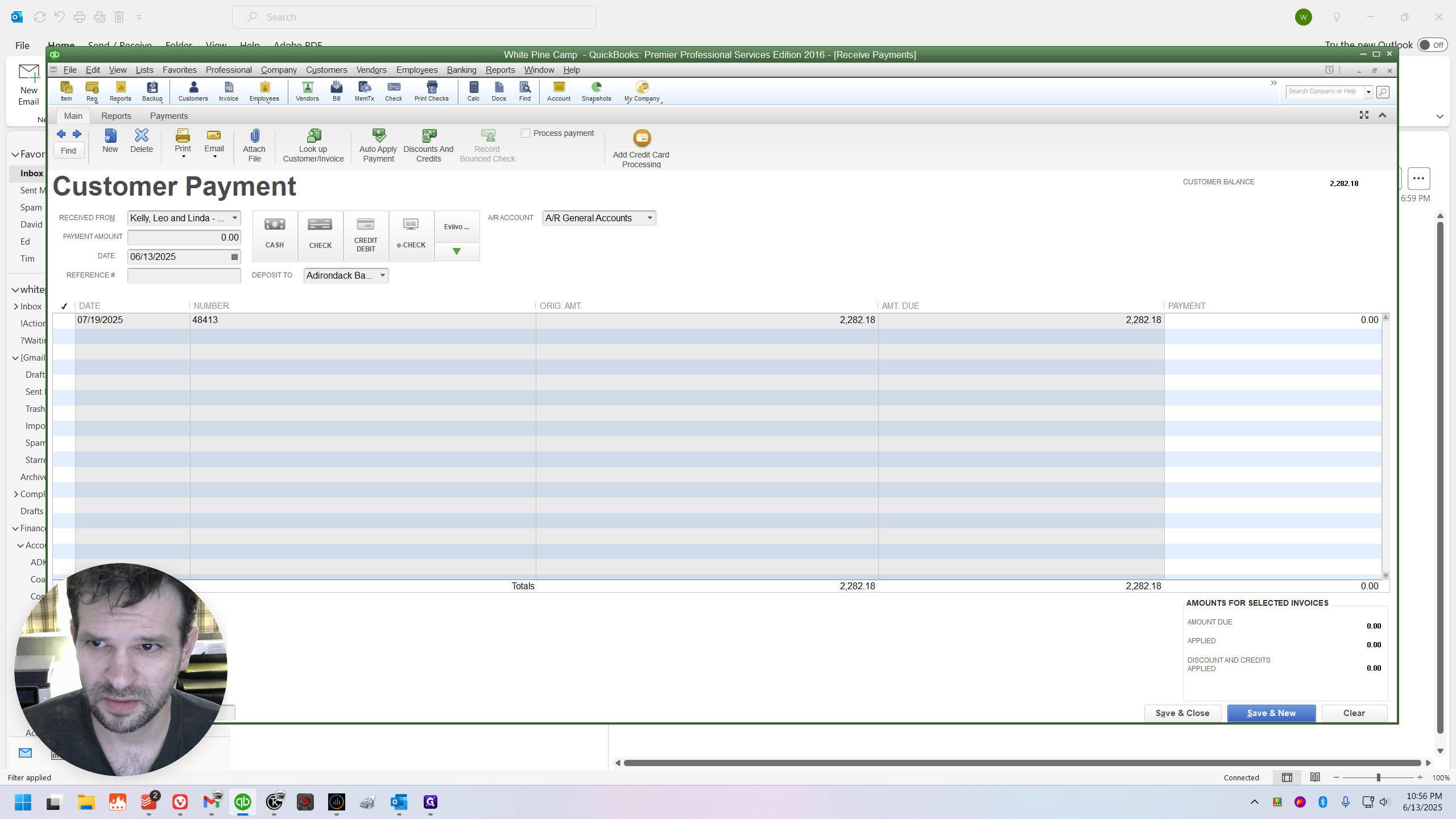

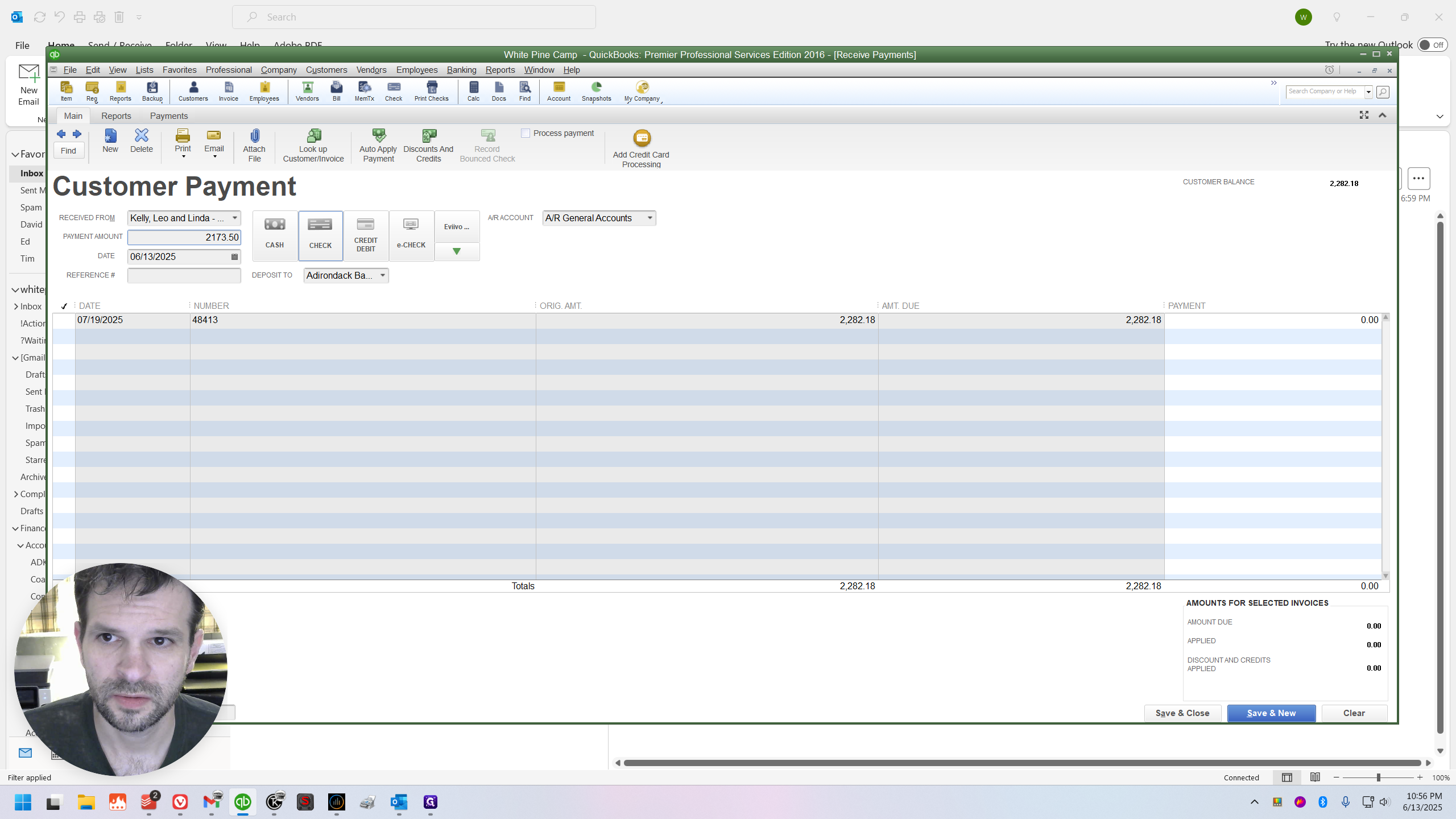

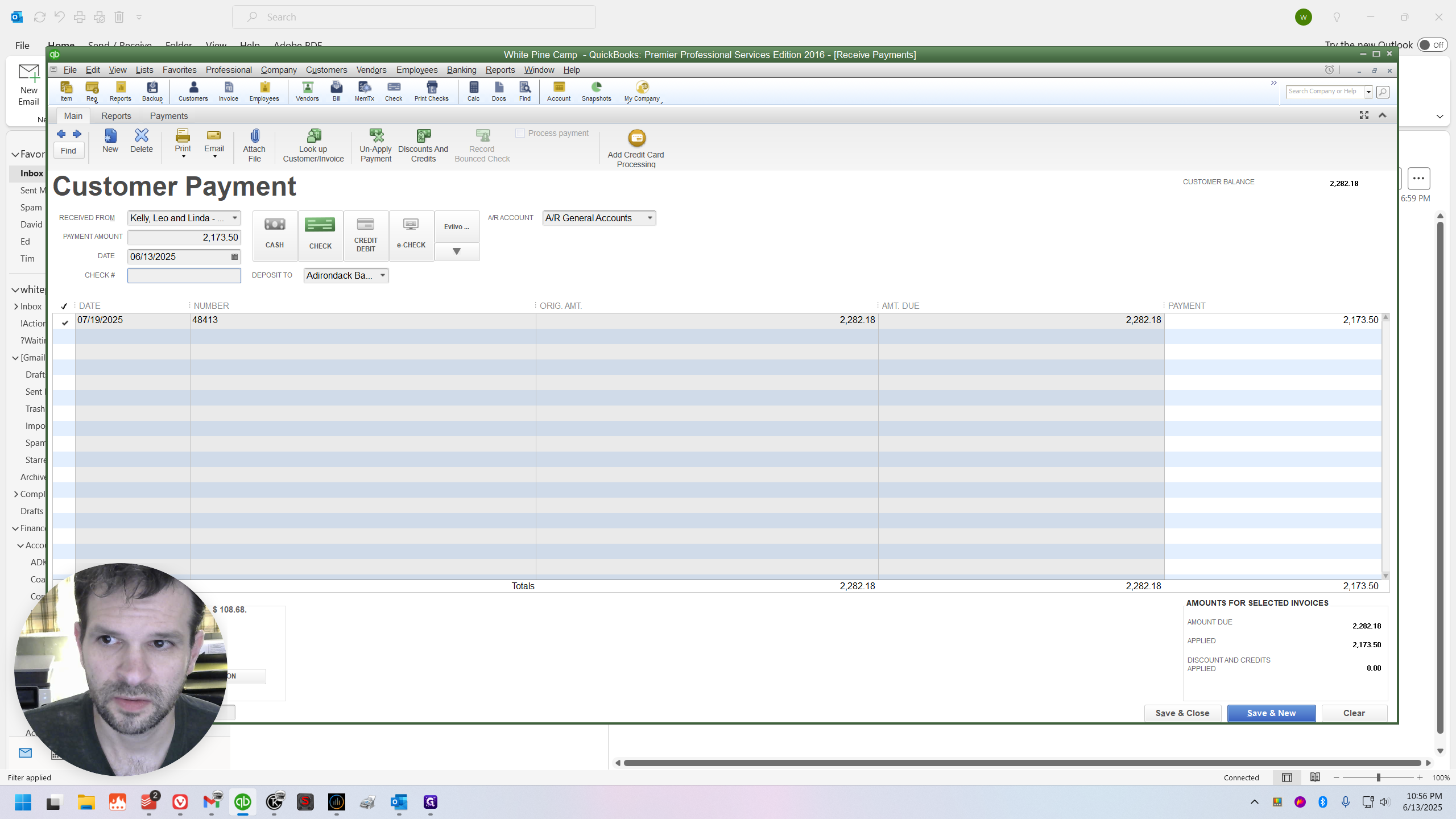

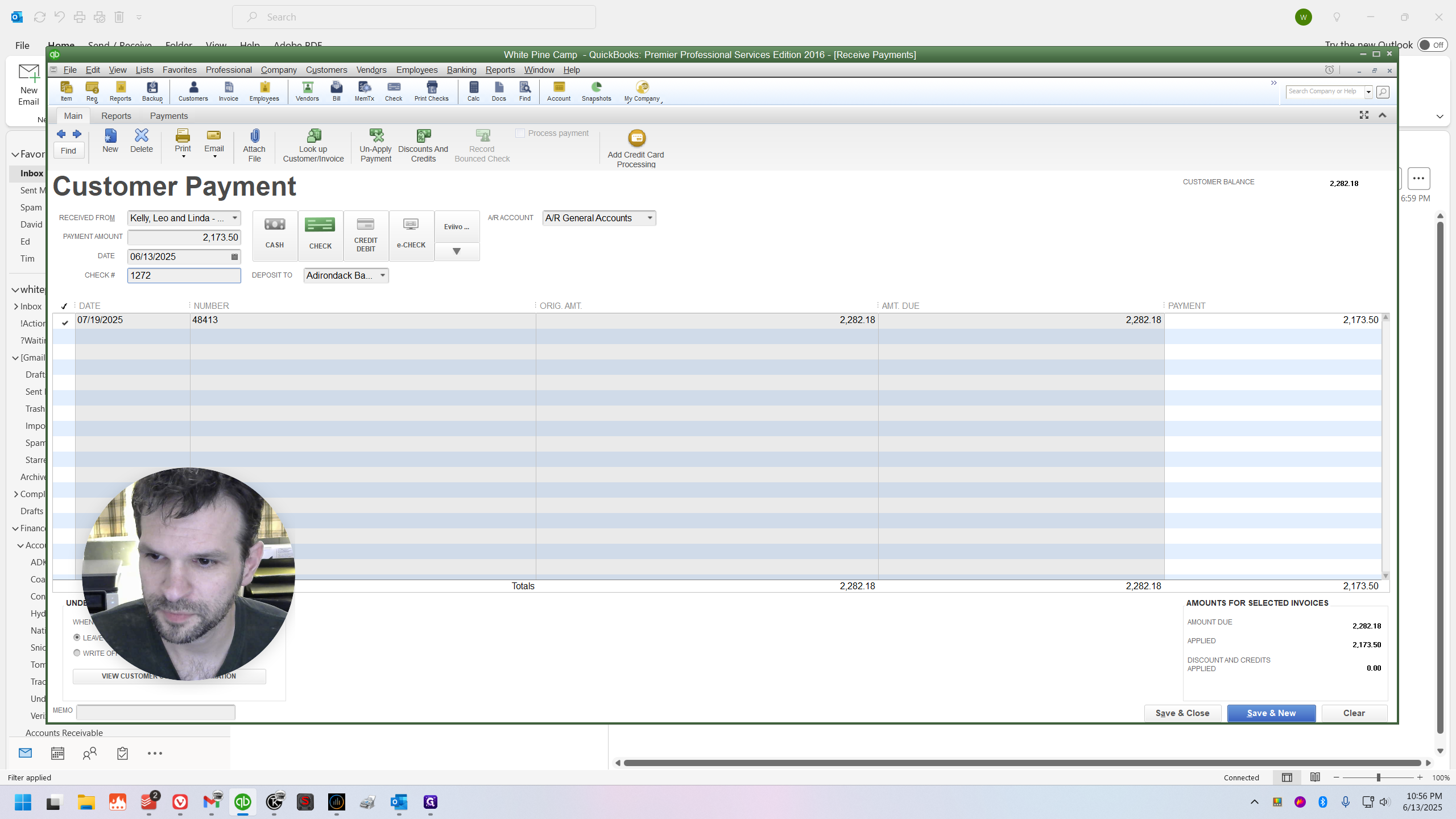

I might as well continue and show you receiving the check.

Navigate to Transactions, then select Receive Payments.

I'll still call it a balance, even though technically it wasn't.

Long and Short of it

Member's out of time, eh?

Member bookings that exceed the member benefit time allotment will receive a 10% discount. However, they will be taxed and processed as if they were regular guest bookings. Avoid using the member benefit or member cabin fees item, etc.