Understanding the Invoicing Process

Explore the detailed invoicing process for joint ventures, including contract management, invoice creation, and submission guidelines.

In this guide, we'll learn how to navigate and manage invoicing processes. The focus will be on accessing and organizing invoicing folders, understanding the structure of invoice files, and the steps involved in creating and updating invoices. We'll also cover how to track invoicing due dates and maintain records of contract billing. This guide aims to provide a clear understanding of the invoicing workflow, including the use of specific file naming conventions and the submission of invoices to the government's wide area workflow system.

Let's get started

First, go to the Invoicing folder. You can find it under Programs and Operations Management, then Invoicing.

Under the Invoicing folders, there are several layers. For the Peerless JV, all individual contracts are included here.

These are not SierTeK contracts. They are the joint ventures' copies of the contracts. These are the joint ventures' invoices to the government, not our invoices to the JV. The same applies to Q-Tech's invoices.

I keep records of the Q-Tech operations invoices that CDO enters into the system on behalf of the joint venture. Casetrack does not currently have an invoice process because there are no employees on contract.

Generally, each invoice folder, when they are our invoices, contains at least these two files. The Invoicing file and the Form 1035 file.

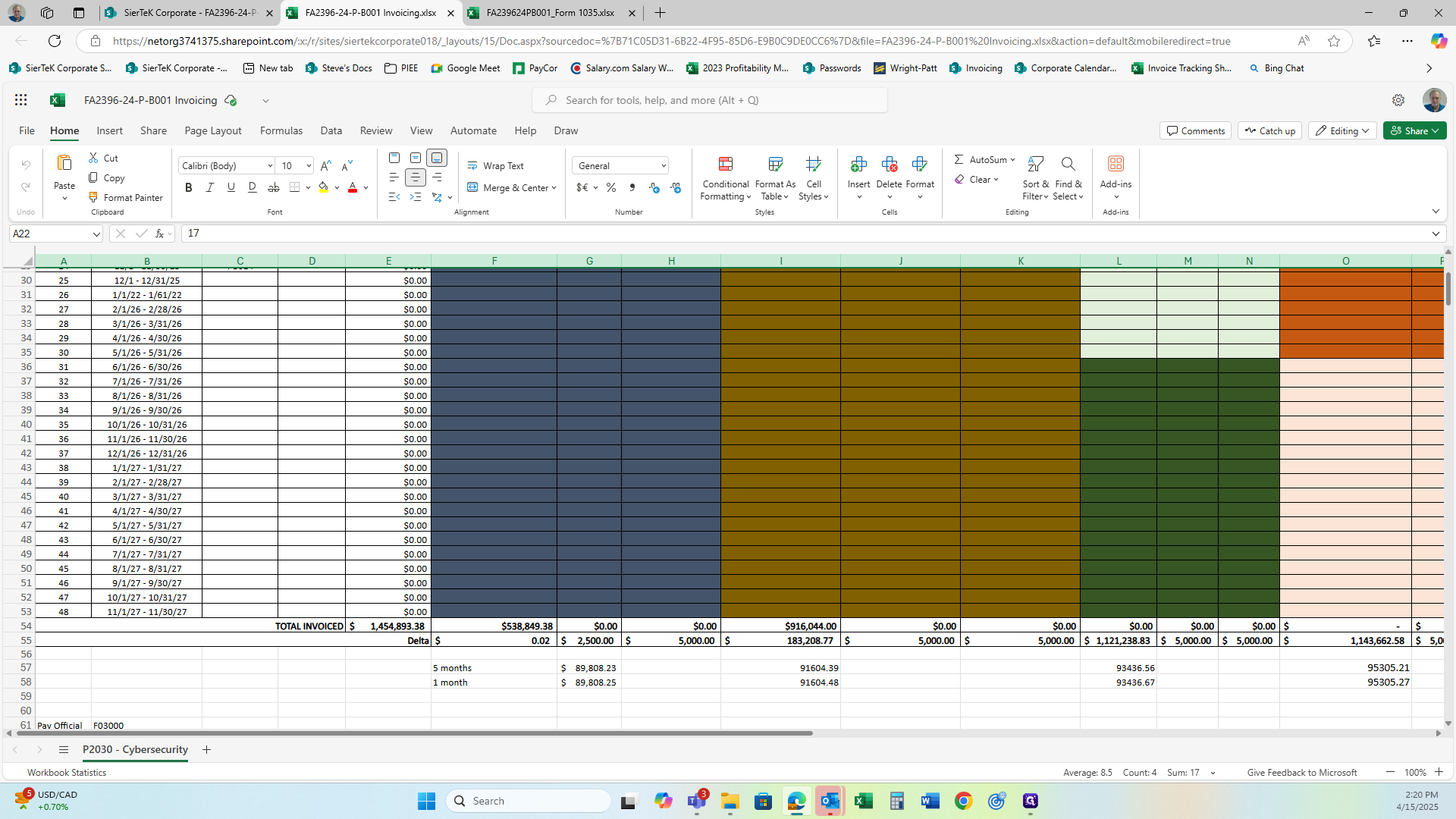

The invoice file is exactly what it sounds like. It contains every invoice entered into the system for each CLIN and each option available (Labor, Travel, etc.).

At the top, you'll find the ceiling for that CLIN and the current amount funded for it.

There are invoicing instructions at the bottom. This section contains the information we use to input data into the government's wide area workflow system.

The 1035 is the invoice sent to the government.

The government form number for an invoice is 1035. This is what I use for the invoice. When creating an invoice, since most are fixed price, I duplicate the last sheet and rename it with the current number.

Example.

New Voucher Number: PB001-017

Invoice Date: 5/10/2025

Invoice Number: PB001-017

Billing Period: 4/1/2025-4/30/2025

Next, I go to the cumulative amount column and copy that number and paste it into the previously billed column as a number. It is currently a formula that adds this to the current amount.

Then print this to a PDF file.

I go to the Download folder, find the file, and rename it to DB001, followed by the last five digits of the contract number, the invoice number, and an underscore. The underscore is used to separate these elements, as it is the only character allowed for uploads.

To ensure the WAWF doesn't reject it, avoid using dashes or similar characters. Use the underscore character instead. (ex. ContractNumber_InvoiceNumber_Date)

You'll go into the wide area workflow. I would then update this sheet so that the $91,000 is included. This way, it's in the total, and we can see our residual amount.

Next, we will once again, go to the Corporate SharePoint Home, but this time we'll focus on the accounting folder.

There are two spreadsheets that will need to be updated here. First, is "Invoicing Due Dates."

The Invoicing Due Dates section is where we track when an invoice is created. We would record the date and we processed the invoice to confirm it's done and know when it was completed.

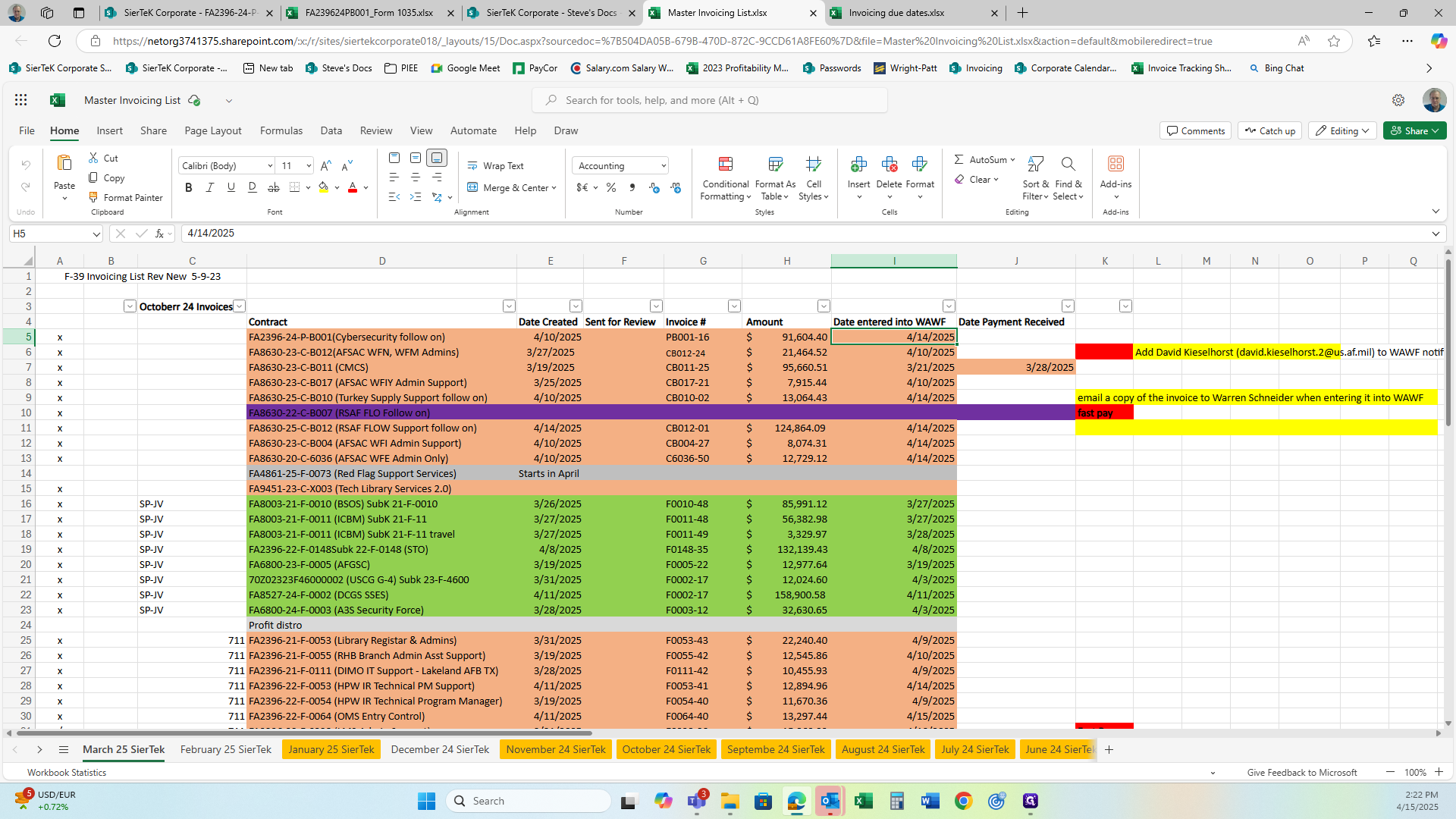

The next folder is the Master Invoicing List and this information is reported on weekly in our corporate staff meetings.

This file is where all the information about each contract we're billing is tracked.

The contract number, the invoice creation date, the invoice number, the invoice amount, the date it was entered into WAWFE, and the payment receipt date is all tracked here.

At the bottom, you'll find the total sum, which is the dollar amount of all the invoices created.